All employers, being tax agents, report annually by April 30 on the income of individuals that they received from them over the past calendar year. For each employee, a certificate of income is provided to the tax office in form 2-NDFL.

An individual has the right to apply to the employer’s accounting department and receive his 2-NDFL certificate at any time and for any period not exceeding the storage period for tax documents (according to paragraph 8 of paragraph 1 of Article 23 of the Tax Code of the Russian Federation - no more than four years). How to write an application to an employer requesting the issuance of such a certificate will be discussed in this article.

Can an enterprise refuse to issue a document?

By law, an employer (even a former one) is obliged to provide a certificate to his employee upon his first request. Moreover, he must do this even if the employee asks for it orally (a written statement is needed in order to avoid all sorts of problems, delays in time, and other unpleasant phenomena).

Refusal to issue a certificate may serve as a reason to contact the labor inspectorate or even the court, as a result of which an administrative penalty in the form of a fairly large fine (for violating the legitimate interests and rights of the employee) may be imposed on the enterprise and senior officials.

The exception is those situations when an employee of an enterprise asks to issue him a certificate for the period for which the storage period for tax documents has expired (i.e. after four years).

Is a written request for a document always necessary?

Every working Russian can request and receive a document under the code 2-NDFL, without indicating the reasons why it is needed.

The rules for issuing it are set out in Article 62 of the Labor Code of the Russian Federation and Ch. 23 Tax Code of the Russian Federation.

It is provided upon the first request of the taxpayer, regardless of whether he contacted the employer orally or in writing.

However, the applicant must note that the advantages of a written application are as follows:

- the date of filing the application is indicated, which is the starting point for the three-day period for issuing the certificate;

- allows you to avoid many unpleasant moments, because the employer may deny that the employee contacted him;

- simplifies the employee’s actions when appealing a refusal to issue a certificate through other authorities.

You should always protect yourself with a written request. Although most employers issue a certificate without creating problems for employees at their first request.

And in the event of dismissal of an employee, the management administration is obliged to issue such a document on the day the employee is paid, even without his personal application.

Find out how financial assistance is reflected in the 2-NDFL certificate from our article. What to do if a new job requires a 2-NDFL certificate? Is this legal? Find out here.

How to make an application

The fact that you are on this page means that you needed to fill out an application for a 2-NDFL certificate, which you have not encountered before. Before giving you detailed information about this particular document, we will provide general information that applies to all such papers.

- Firstly, keep in mind that the law does not provide for any unified form for this application (those for commercial organizations were abolished back in 2013), so you can do it freely. But, if your company has a standard document template developed and approved in the accounting policy, draw up an act according to its type, this will save you from claims from accounting or management.

- Secondly, know that the application can be created on a regular sheet of any format convenient for you (A4 or A5 are most often used) or on company letterhead - again, when such a condition is put forward by the employer.

- The text can be written by hand (but without blots, errors, inaccuracies or edits) or typed on a computer. If you took the electronic registration route, then after you write the application, be sure to print it out - this is necessary so that you can put your signature on it. We recommend that you first check with your employer's representative whether your company accepts printed applications - sometimes organizations only consider handwritten documents.

- Make an application in two identical copies - give one of them to the employer, the second, having previously endorsed the transfer of a copy, keep it for yourself - it will come in handy in case the certificate is not issued to you at the appointed time.

Why is it needed?

A 2-NDFL certificate is required in situations where a citizen needs to document the amount of his earnings. It could be:

- When applying for a bank loan. If a citizen applies for a mortgage, the bank must require a document confirming a certain level of official earnings of the client;

- When requesting a visa to visit a foreign country. The receiving party must make sure that the citizen does not have financial problems and does not seek to stay in the country illegally;

- The document will be required when receiving tax deductions;

- When moving to a new job, if the citizen has the right to receive a tax deduction;

Important! When receiving a certificate, a citizen should ensure that it is drawn up in accordance with the provisions of regulations. If the established form is violated, part of the required information is missing from the document, or there are other inaccuracies, the certificate will be invalid.

Sample application for provision of certificate 2-NDFL

Here we come to the most important part of our article - an example. It must be said that this document, although quite simple, has some nuances that are worth emphasizing. Using our recommendations and based on the sample presented below, you can easily create the application you need.

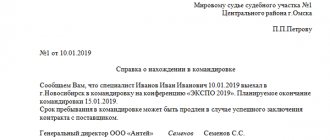

First, a “header” is drawn up in the document:

- full name of the organization you work for;

- position and full name of the director (or other employee in whose name you are supposed to write such statements);

- your position, the name of the department to which you are assigned and your full name;

- detailed passport data (as necessary);

- your phone number (for communication).

Then, below, in the middle of the line, write the word “Statement.” After this, you can proceed to the actual request for a certificate. Here you need to indicate:

- for what period do you need the document and how many copies are needed;

- it is advisable to refer to the legal norm that states the employer’s obligation to provide such certificates - in this case, this is Article 62 of the Labor Code of the Russian Federation;

- It is not necessary to enter the destination of the certificate - the absence of such information is not a reason for the employer to refuse to issue the document.

If you have any additional papers that you want to add to your application, please indicate their details in the form as a separate item.

Finally, sign and date the application.

Deadline for issuing the certificate

Tax legislation does not establish a clear deadline for issuing a 2-NDFL certificate. However, lawyers usually refer to Article 62 of the Labor Code of the Russian Federation, which establishes the employer’s obligation to issue, at the employee’s request, any documents relating to his work within 3 working days. A tax certificate certainly falls into this category. The Ministry of Finance of the Russian Federation adheres to the same position, as reflected in letter No. 03-04-05/36096 dated June 21, 2016.

Violation of this deadline may entail liability for officials of the organization under Article 5.27 of the Code of Administrative Offenses of the Russian Federation.

The problem with obtaining a 2-NDFL certificate can only arise in a small organization where there is a shortage of accountants. In other cases, the employee will receive the required document without problems or delays.

Great article 0

What to do if the company is liquidated

Another rather problematic situation cannot be excluded when, at the time of applying for a certificate, the enterprise is no longer functioning (liquidated) and information about it is excluded from the Unified State Register of Legal Entities. There are several ways to obtain a 2-NDFL certificate in such a situation.

So, if a new employer requires a certificate, he sends a request to the Pension Fund branch and the local Federal Tax Service explaining the reasons for this need. A certificate may be required for the correct application of standard deductions or the calculation of vacation and sick pay, when information about deductions made by the previous employer is indispensable.

In response to this request, information will be provided on income and deductions from it for a specific individual for the requested period. Also, the insured person himself can independently send a request to the Pension Fund of the Russian Federation in the form approved by Order of the Ministry of Health and Social Development dated January 24, 2011 No. 21n.

In addition, an individual can independently obtain the necessary information about accrued and paid personal income tax through his personal account on the website of the Federal Tax Service of Russia.

If there is a delay in payment of wages

Due to the fact that in accordance with paragraph 4 of Art. 226 of the Tax Code of the Russian Federation, accrued personal income tax cannot be withheld until the employee’s salary is paid; there are particular difficulties with entering data related to accrued but not yet paid income into the 2-NDFL certificate.

According to the tax authorities, voiced in the letter of the Federal Tax Service dated October 7, 2013 No. BS-4-11 / [email protected] , if income for the previous tax period at the time of drawing up the certificate (upon request or within a limited period - until April 1) has not yet been paid, then they, as well as the withholding of taxes from them in 2-NDFL, should not be reflected. True, according to the letter of the law, the date of actual receipt of income in the form of wages is the last day of the month for which this income was accrued (clause 2 of Article 223 of the Tax Code of the Russian Federation).

Results

A certificate in form 2-NDFL is generated by the tax agent paying income to individuals for each individual who received income subject to personal income tax. As mandatory reporting, such certificates are submitted to the Federal Tax Service in the year following the reporting year:

- until March 1 – in relation to those persons from whose income it was not possible to withhold tax;

- until April 1 of the year - for individuals from whose income tax is withheld.

However, most often such certificates are created by employers at the request of the employee. The number of copies of the certificate issued to the employee, as well as the number of requests for this document, is not limited in any way. This means that the tax agent must satisfy every application received from the employee for the issuance of 2-NDFL.

The employer is given 3 days to prepare the documents requested by the employee - this period is prescribed in the Labor Code of the Russian Federation and can be used in relation to the issuance of a certificate of income. The certificate can be issued on a form available in any accounting program. It is also available for download on all accounting portals (including ours). In addition, you can download a program for filling out this form on the tax service website.

To receive the certificate as quickly as possible, the employee should make a written request and submit it to the employer. An employee needs a 2-NDFL certificate quite often, so the accounting department of any tax agent should worry about correct tax accounting and timely correction of identified errors.

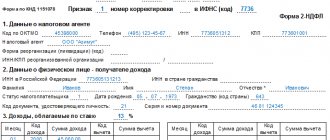

From 01/01/2019, certificate forms for the Federal Tax Service and for the employee are different.

How to write and sample

There is no legally established form for applying for a 2-NDFL certificate. The document is written by hand or using printing technology. It should reflect the following information:

- Name of the organization, its address;

- The official to whom the application is submitted (company director or chief accountant) indicating the position, surname and initials;

- Position, surname and initials of the employee, structural unit (department, workshop, service, etc.);

- Request for the issuance of a 2-NDFL certificate;

- A legal norm under which the employer is obligated to issue a certificate. This is Article 62 of the Labor Code of the Russian Federation and paragraph 3 of Article 230 of the Tax Code of the Russian Federation;

- The period that must be included in the certificate;

- Number of copies of the document;

- Employee's signature, surname and initials, date of application.

On the application, the head of the company or another authorized person (chief accountant) puts a resolution on issuing a certificate. Such an inscription is an order for accounting employees to begin processing the document.

A different procedure applies for military personnel. These persons should contact the financial support department of the relevant military district. If a citizen does not have the opportunity to submit an application on his own, this can be done via mail.

Filling out the application

The second page of the report is a monthly transcript of data from sections No. 2 and No. 3.

In the header of the document, again indicate the TIN and KPP of the reporting institution. Page number is 002.

Then re-enter information about the certificate number, reporting period and tax rate.

Then start filling out the fields. First, indicate the month: January - 01, February - 02, March 1 03 and so on. Then enter the income code and the amount received in the corresponding month. Below, enter the deduction code, if one was provided, and indicate the amount 1 in what amount.

Enter information separately for each month in which income payments were made.

The application must now be signed and dated by the tax agent or his representative. The report is ready.

You can find detailed instructions for filling out the new 2-NDFL certificate form submitted to the Federal Tax Service on this page.

In what cases is a certificate needed?

The demand for the document under code 2-NDFL is quite high, because

it confirms the receipt of official income by an individual. Most often, a certificate is asked to provide in the following cases:

- when receiving credit finance from banking institutions;

- for a mortgage (when drawing up an agreement to borrow funds for the purchase of residential premises);

- during employment at a new enterprise;

- when applying for a tax deduction in the following circumstances: payment for studies; acquisition of living space; receiving paid treatment; other expenses.

For all organizations, there are the following grounds for issuing such a certificate for a taxpayer:

| Where is it served? | Legal basis | Procedure for providing a certificate |

| To the tax authorities for each citizen who received profit during the past tax period | Reporting standards are set out in clause 2 of Article 230 of the Tax Code of the Russian Federation | The maximum filing deadline is March 31 (inclusive) of the following year following the end of the reporting period. |

| It is provided to the tax service for those persons from whose income personal income tax was not withheld | According to the text set out in paragraph 5 of Article 226 of the Tax Code of the Russian Federation. | Within a month from the date of occurrence of obligations |

| To the taxpayer at his request | Personal written or oral request from an employee (including former employees) | The document must be issued within 3 working days from the date of receipt of the application |

Where can an unemployed person or a pensioner get a certificate?

An unemployed person can receive a certificate of income received in the form of unemployment benefits at the employment center. All you have to do is submit an application and then pick up the completed certificate. But this will not be Form 2-NDFL. If an individual has not worked for more than three years and is not registered with the employment center, then there is simply nowhere for him to get a certificate of income, because officially there was none.

If a non-working person had income from other sources, it is necessary to report them by indicating in the 3-NDFL declaration. In addition, you will need to calculate the tax yourself and transfer it to the budget. In this case, evidence of income received and taxes paid on it will be a copy of the tax return.

Pensioners receiving payments from non-state pension funds can request 2-NDFL from the local branch of their fund. But disabled citizens who receive state pensions will not be able to obtain such a certificate from the Pension Fund of the Russian Federation, since such pensions are not subject to personal income tax.

Registration procedure

For those who do not know how to write an application for 2-NDFL, there are simple rules. First of all, you need to remember that it is served in any form. And to be sure that the company (IP) will receive it, it is better to use the service of sending it by registered mail with acknowledgment of receipt.

Keep in mind that the sample query assumes the following data is available:

- about the applicant and his passport;

- postal address;

- telephone number for contact;

- signatures with the date under the text of the application.

Employer's liability for non-delivery

Legislative acts oblige employers to issue a certificate upon request to workers who receive payments from them for their work. He needs to do this in any case, regardless of whether the employee asks orally or in writing.

For refusal to issue a document, the manager faces an administrative fine with an impressive amount:

- for responsible persons from 1–5 thousand rubles;

- if the individual entrepreneur refuses, then his fine will be equal to the first point;

- in relation to a legal entity, the amount of the penalty will be from 30–50 thousand rubles.

Violation by the administration of the organization of the deadline set by law for issuing a certificate or refusal to provide a document may result in punishment.

Responsibility towards the administration of the enterprise for such actions is indicated in Article 5.27 of the Code of Administrative Offenses of the Russian Federation.

In this case, the basis for the punishment will be stated as a violation of the legitimate interests and rights of the worker.

Note! If an employee asks to issue a certificate for previous years that exceed the period for storing tax documents, then the employer has the right to refuse and will not be punished for this.

In other cases, the refusal can be appealed to the following authorities:

- labor inspection;

- the prosecutor's office;

- judicial authorities.

Getting a certificate is not at all difficult. To do this, you should select a suitable sample application from the examples given above, draw up the document on your behalf and submit it to the employer.

The administration of the enterprise has no right to refuse to provide such information.

In this case, the law is on the side of the workers and if management evades fulfilling its duties, then severe punishment can be applied to it due to appeal of such actions.

Therefore, certificates are often provided within 3 working days, as indicated in the order in which they are issued.

https://youtu.be/7EHDwfUKgZQ

The procedure by which the employer issues certificates to employees in form 2-NDFL is standard. As a rule, to obtain a certificate, employees have to write an application addressed to the head of the company. The period within which the employer must prepare the certificate is 3 working days. The employer has no right to refuse to provide such a document. In addition, an employee can request a 2-NDFL certificate both while working for the current employer and after dismissal. In the article we will consider the procedure for issuing a 2-NDFL certificate, and also provide a sample application for issuing a 2-NDFL certificate.

Legislative innovations

Section 1 “Data about the tax agent.” If the company was liquidated, then the legal successor who has information about the predecessor company may also answer to the individual.

- The individual’s address may not be indicated in the new certificate form.

- The successor company must write its details, and not its predecessor.

- Investment tax deductions may no longer be reflected in section 4 of the relevant document.

- The barcode on the form changes.

If an employee needs a certificate confirming his income for the current calendar year, then the employer must provide information from January to the last month when he applied for the document.