Certificate of northern allowance: sample

Regions in which northern allowances are applied may change their category or be completely excluded from the list of regions of the Far North and equivalent areas (approved by Resolution of the USSR Council of Ministers of January 3, 1983 No. 12), so it is important to monitor changes in legislation in this area. For example, among the latest changes are two districts of the Tyumen region, Berezovsky and Beloyarsky, which were transferred to the regions of the Far North by Decree of the Government of the Russian Federation dated March 3, 2012 No. 170.

We recommend reading: Return tiles to the store

What is the amount of allowances?

The bonus can be provided in the amount of 30 to 100% . Its volume can be influenced by various factors - from working conditions to the location of the activity, as well as the length of work experience.

At the same time, it is important to monitor changes in legislation, since regions can not only change the coefficients, but also be generally excluded/added from the list of regions with difficult conditions.

For example, in 2012, the Tyumen region was classified as a region with difficult northern conditions.

To calculate the appropriate discount for an employee, you need to rely on the Instructions approved by Order of the Ministry of Labor of the RSFSR of 1990 No. 2 and Resolution of the Council of Ministers of the RSFSR of 12990 No. 58.

Calculation of the northern bonus for young specialists :

- for the first six months in the amount of 10%;

- then there is an increase of 10% every 6 months;

- the increase occurs up to 60%;

- then 20% will be added annually.

Military personnel who serve in territories with difficult climatic conditions are also entitled to a bonus:

- territory of category 1 – receiving 10% for every six months up to 100%;

- 2 – 10% every six months up to 60%, and then annually by 10% up to 80%;

- 3 – increase by 10% annually to 50%;

- 4 – receiving 10% in the first year and increasing every 2 years by 10%, but only up to 30%.

An accelerated accrual process occurs if the young specialist has been a resident of the region for at least a year.

What does the form of a certificate of northern allowances look like and where can I get it?

Article 10 of the Law of the Russian Federation dated February 19, 1993 N 4520-1 (as amended on July 24, 2009) “On state guarantees and compensation for persons working and living in the regions of the Far North and equivalent areas” provides for the following: the size of the regional coefficient and the procedure its application for calculating the wages of employees of organizations located in the regions of the Far North and equivalent areas, as well as the fixed basic amount of the insurance part of the old-age labor pension, the fixed basic amount of the labor pension for disability and labor pension in the event of the loss of a breadwinner, state pensions pension provision, benefits, scholarships and compensation for persons living in the Far North and equivalent areas are established by the Government of the Russian Federation.

We recommend reading: If I Have Temporary Registration in the Chernobyl Zone Are There Any Benefits??

Features of accrual in TOP

In 2014 an amendment regarding the status of individual territories, so regions appeared with the status of priority development areas - territories of advanced development, where entrepreneurs received certain benefits, including the opportunity not to pay northern bonuses, but at the same time:

- they must offer prorated benefits to employees;

- propose signing an additional agreement indicating the amount of compensation;

- at the same time, the minimum salary of an employee must correspond to the cost of living in the region.

Only if all these standards are met can the employer be exempt from paying the northern bonus.

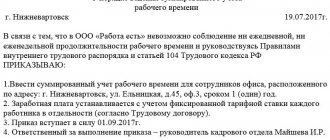

Rules and design features

Despite the absence of requirements for the execution of the document, the certificate should be generated in accordance with all office work standards: it can be compiled by hand or using a computer and then printed out on a printer; in this case, all requirements regarding the entry of details and basic data must be observed; the document should not contain errors, typos or incorrect dates, so it is very important to check everything when receiving the certificate and make timely corrections, since inaccuracy of the date or percentage of the premium can significantly affect the amount of social payments.

If the enterprise no longer exists, the “northern length of service” can be calculated according to the work book in the case of calculating, for example, a pension, and the new employer is not obliged to demand it at all.

The certificate is not issued if the employee is dismissed under the article. In this case, all interest is reset to zero, and the accrual of northern seniority will begin again at the new place of work. Form and sample document

Form and sample document

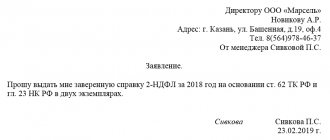

The certificate is issued at the request of the employee .

It does not have a unified form, but is drawn up in accordance with the company’s internal office rules on its letterhead with a logo.

, the following data should be included in the certificate :

- name of the employing organization;

- date of issue and serial number of the document;

- details of the employee for whom the certificate is intended;

- data regarding the period of the employee’s activity at the enterprise;

- signature of the manager and seal of the enterprise;

- information regarding the HR specialist who compiled the document.

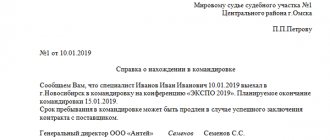

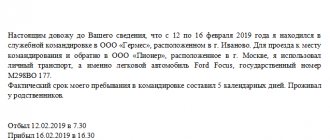

Open Joint Stock Company "Electronics"

TIN 34756328907 Address: 234890, Russian Federation, Magadan, st. Proletarskaya, 345, no. 678, tel. (0678) 6666666

REFERENCE

From 01.03.2018 No. 234/89

It is given to Stanislav Viktorovich Andreev that he actually worked at the Open Joint Stock Company "Electronics" from 01/01/2000 to 01/01/2018 as a deputy director with a salary of 60,000 rubles and a northern bonus of 100% in accordance with the law on compensation for workers of the Far North and territories equated to them.

General Director of JSC / Gavrilyuk / Gavrilyuk A. A.

Head of HR Department M. M. Anyutkina

Where do you get the certificate?

Upon dismissal, an employee may ask where to get a certificate about the northern allowances and the northern coefficient. You can receive a certificate along with the rest of the employee’s “labor” documents upon dismissal. If the certificate has not been prepared, then you need to contact the employer’s manager or the head of your structural unit directly.

As a rule, such a certificate is prepared by an employee of the accounting department or human resources department. Less often, when the enterprise is large, an individual employee “sits” on northern bonuses. The certificate is signed by the person who compiled it and the head of the organization.

You are here

A certificate of northern allowances is a document displaying the amount subject to an increase in the wages of persons working and living in areas of the Far North or equivalent to them. The northern allowance is a percentage by which the employee’s income increases and is intended to compensate for additional labor costs and expenses resulting from performing work and living in areas with difficult climatic conditions.

The size of the northern allowances, as well as the list of regions of the Far North and equivalent territories are established by regulations of the Government of the Russian Federation. In addition, according to Art. 316 of the Labor Code of the Russian Federation, local governments have the right to establish additional coefficients of northern allowances at the expense of regional budgets.

A certificate of northern allowances is drawn up for the purpose of recalculating wages at the employee’s new place of work, as well as calculating a pension in the future, and is issued upon his request. The procedure according to which the length of service required to receive the northern bonus is calculated was approved by Decree of the Government of the Russian Federation dated October 7, 1993 No. 1012 and clarified by Decree of the Ministry of Labor of the Russian Federation dated May 16, 1994 No. 37.

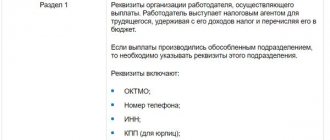

There is no unified form for a certificate of northern allowances; it is drawn up in any form by an accountant, an employee of the personnel department of an enterprise (organization) or a manager on letterhead or a standard sheet. The required details contained in the document are:

- full name of the organization;

- date of issue of the certificate and its registration number;

- last name, first name and patronymic of the person to whom the certificate is issued;

- the period of his work at this enterprise;

- the amount of wages of an employee;

- the amount of the bonus accrued to his salary;

- position, surname, first name, patronymic, signature of the person who compiled the document.

Read more Insurance premiums reporting deadlines 2018

The length of service, which is taken into account when calculating the northern bonus, according to the “Rules for maintaining and storing work books,” is calculated according to the work book in which the employer enters the entry “region of the Far North.” In cases where the work book is lost or the entry in it is made incorrectly, a certificate of northern allowances is confirmation that the employee lived and worked in difficult climatic conditions.

The Far North is characterized by difficult climatic conditions, which cannot but affect working conditions. Therefore, since Soviet times, an incentive scale for such workers has been developed, which is called the northern bonus .

When confirmation of such a privilege is required, a certificate is required, drawn up in accordance with all the rules and in accordance with the requirements of the law, containing evidence of its existence and the exact amount.

Special cases

Is a certificate issued to those fired for guilty actions?

The size of the northern bonus depends on the employee’s length of service in the Far North. The length of service is calculated based on the total number of calendar days spent in such conditions. At the same time, the length of service is summed up, despite all its breaks associated with dismissal, placement in a new job, maternity leave, etc.

The only exception is the dismissal of an employee for guilty actions, that is, “under the article.” Under such circumstances, the “northern” service is interrupted; upon employment in a new place of work, allowances will be accrued anew.

But in order to fire an employee for guilty actions, it is necessary to correctly carry out all personnel and accounting procedures. There must be a corresponding entry in the work book.

A certificate of northern allowances is not a mandatory document that must be issued upon dismissal. It confirms the employee’s overall length of service in northern conditions, and makes the work of the HR officer and accountant easier at the new place of work. They do not need to accurately calculate the length of service of a newly hired employee in order to correctly calculate the bonus. All this information is indicated in the certificate.

If an employee is fired for guilty actions, then his northern work experience is interrupted. Therefore, there is no need for this certificate.

Where can I get a certificate if the company no longer exists?

Unfortunately, the liquidation of a company is not such a rare occurrence. What should an employee do if he was fired due to the liquidation of the enterprise, and after some time he is re-employed, and they ask him for a certificate of reconciled allowances?

Firstly, the employer has no right to demand this certificate. It is not included in the list of mandatory documents and certificates that the employer must draw up and give to the employee upon dismissal. Secondly, all information about the “northern” experience can be obtained from the work book. It’s not for nothing that the entry “Far North” or “Territory equivalent to it” is made there. Based on the information received, the personnel officer can find out the size of the northern bonus.

But if such a certificate is still necessary, then you can contact the local branch of the Pension Fund of the Russian Federation, where the employer made monthly contributions. They will issue the appropriate certificate, as they have the necessary information. You can also contact the Social Insurance Fund. They also have relevant information.

Can they cancel?

In 2014, the Ministry of Finance announced the need to revise northern allowances. This caused excitement among the “northerners”. Won't bonuses be completely abolished? Why then work in such difficult climatic conditions without additional motivation?

In addition, the fears of the “northerners” regarding the abolition of surcharges are also connected with the fact that it is planned to create territories with a special status - priority development areas - ASEZ. In these zones, preferential conditions will be created for employers. In particular, they will be exempt from paying northern surcharges.

But the Labor Code of the Russian Federation says that those employers who operate in a priority development area and have “northerners” on their staff can:

- offer the employee to exchange northern bonuses for a fixed amount of monetary compensation. This is possible only with the agreement of the parties;

- sign an additional agreement to the employment contract with the employee, which will indicate the amount of compensation;

- The employee’s salary cannot be lower than the subsistence minimum established in the region.

If these standards are met, then within the ASEZ the employer may be exempt from paying the northern bonus.

Video on the topic: