Reasons for requesting clarification from the tax office

When conducting a desk inspection, the inspector has the right to request written explanations from the organization about the identified discrepancies. Clause 3 of Article 88 of the Tax Code of the Russian Federation indicates the main reasons when it is necessary to give an explanation of what happened:

| There are errors in the report | The inspector may send a notice and ask for clarification or provide updated tax reporting. |

| In the updated declaration, the amounts are much lower than in the original document | An employee of a government agency may suspect the company of deliberately understating the tax base and will require written explanations of the changes made. |

| The income statement reflects losses | If the company’s accountant knows that the company is incurring losses, then it is better to prepare a message in advance about the factors that influenced the current situation. |

The company's management must send a reasoned response to the request within 5 days from receipt of the notification.

Job search

Tax inspector is a prestigious position. Most vacancies are closed without even appearing on employment resources. Often, applicants have to directly send their resume to the tax police or tax office. It is important to competently draw up a “business card” document and effectively reveal all your positive qualities. Naturally, the main stage of employment is a personal interview. But only a few are invited to attend. An effective and high-quality resume may well be the ticket to a personal interview.

Responsibility

No matter how much tax officials intimidate with financial sanctions, it will not be possible to hold people accountable for failure to provide explanations.

Let's find out why:

- according to Art. 126 of the Tax Code of the Russian Federation cannot be a reason for a fine when requesting clarification, since this is not a requirement to provide documents;

- Article 129.1 of the Tax Code of the Russian Federation cannot be applied, since this is not a counter-check;

- According to Article 19.4 of the Code of Administrative Offences, it is impossible to bring to administrative liability, since this article is applicable only in case of failure to appear at the inspection when called.

But, in any case, it is better to check and find out why the discrepancies appeared. Perhaps this will help to detect an accountant's mistake when drawing up the report.

Sample (example) of a ready-made resume for a Tax Inspector

Full name: Rezyumenatorov Rezyumenatorovich Date of birth: 00.00.0000 Phone number: +0(000)0000000 E-mail Marital status: single Citizenship: Russia

Education

20ХХ - 20ХХ – DonUET, Taxes and taxation Tax service specialist

Professional and work experience

20XX - present – “...”, journalist of the information portal Job responsibilities: • monitoring compliance with tax legislation • monitoring the receipt of tax and other payments to the budget • checking monetary documents, accounting books, reports, estimates, etc. • analyzing the results of audits • applying financial sanctions to violators

another skills

• knowledge of the basics of tax legislation • knowledge of all types and forms of accounting and reporting • reporting methods, principles of arbitration activities • active user of PCs and the Internet; • knowledge of English (good conversational level)

Knowledge of languages

Russian – native English – basic knowledge

key skills

Communication skills, resistance to stress, ability to learn quickly, responsibility, creative approach to work

***

Explanation of discrepancies regarding 6-NDFL

Quarterly, the accounting department submits Form 6-NDFL to the Federal Tax Service, which indicates information about income and withheld tax amounts for each employee.

What to do if tax authorities ask for clarification on inaccuracies in the report? To get started you need:

- check all indicators reflected in the form;

- check the indicated figures with other reports with which the tax office is reconciling;

- specify the amount of the transferred tax;

- if it turns out that there is no error, then you need to send a logical explanation; if an error is discovered, send a clarifying report.

If it turns out that there is an error in the personal income tax information, the company may be fined for inaccurate provision of information in the amount of 500 rubles. for each document (clause 1 of Article 126.1 of the Tax Code of the Russian Federation). The company is released from liability if the error was identified independently and corrected. Therefore, every accountant should know the rules for preparing all types of reporting in order to avoid mistakes.

Explanation of low wages

In Russia, the process of legalizing wages is underway. The rule has been established that workers for their work must receive no less than the minimum wage approved at the state level. At the same time, in the regions of the Far North or equivalent areas, wages should be calculated taking into account increasing factors.

If the inspector discovers that in the submitted calculation the workers’ wages are below the maximum value, then he has the right to demand an explanation of the discrepancies.

Reasonable reasons for this situation may be:

- due to the difficult situation of the organization, employees were transferred to part-time work, the salary was calculated based on the time actually worked;

- if the employee went on vacation, then this circumstance can be pointed out. Often employees go on vacation for a long period of time, receive vacation pay in one month, and the subsequent period remains without accruals or they are insignificant;

- There may be another situation, for example, a person got sick, issued a sick leave, and handed it over to the accounting department for payment later;

- If tax officials ask to explain the reasons for the discrepancy in wages from industry indicators, then they can write that workers receive according to the minimum wage level. But it is not possible to increase the amount, since the company is still young and production volumes are insignificant.

Any explanations must be supported by documents. In this case, you can attach orders about vacation, about switching to a shortened working day, payslips about accruals, sick leave, etc.

Late payment of tax, explanation from the Federal Tax Service

For such reasons, inspectors rarely request clarification; they have the right to send a demand for payment of the relevant tax after the expiration of the regulated period for payment.

What to do if the tax authorities asked to indicate the reasons for the delay in paying taxes?

| Cause | Explanation |

| Technical reason | The company's management may discover that the tax was calculated correctly, but when paying, incorrect details were indicated in the payment documents, for example, in KBK or OKTMO. In this case, you will need to write an application to clarify the payment. If it passes by the current date, and not the actual date of payment, you will have to pay a penalty for late payment. |

| There is a discrepancy between the period of accrual and payment of personal income tax | In paragraph 6. Article 226 of the Tax Code of the Russian Federation stipulates that the taxpayer must transfer the amount the next day after payment of wages. In cases where the salary is transferred on the last day of the reporting quarter, and the tax is transferred in the next period, you will need to explain the situation. But this fact is not a violation of the law. |

In these cases, financial sanctions can be avoided; the main thing is to respond to the notification in a timely manner and take measures to provide explanations.

Explanation of lack of activity

When conducting business activities, the company's management often encounters financial difficulties, which serves as a reason for suspending activities.

To avoid misunderstandings, it is recommended to immediately inform the tax authority, the Pension Fund of the Russian Federation, and social security services that for specific reasons the organization’s activities have been suspended, employees have been fired, and wages have not been accrued.

Let's find out what arguments can be written in a letter. Most often these are the following reasons:

- due to the economic crisis in the country;

- production volumes have decreased, activities have been temporarily suspended, if work is resumed, the organization undertakes to notify government authorities about this;

- The company decided to liquidate.

Suspension of a company's business activities does not relieve the taxpayer from submitting reports. Penalties are provided for late submission of even zero declaration forms.

Training and Requirements

You can master the profession of a tax inspector at higher educational institutions that offer applicants majors in economics related to taxation (“Taxes and Taxation”, etc.)

The inspector must have an excellent knowledge of the Tax Code and other related laws and regulations. To advance up the career ladder, you also need to have a number of personal qualities:

- diligence;

- determination;

- attentiveness;

- honesty;

- accuracy in details;

- psychological toughness.

The well-being of the entire state largely depends on the effectiveness of the work of the tax police and tax inspectorate. Taxes and fees represent the most important source of budget revenue. This means that the standard of living in the country and the prospects for the development of the state directly depend on the integrity of each employee of the tax system.

How to fill out an explanatory form correctly

The document is drawn up in any form, since there is no approved standard form. The explanation can be drawn up by hand or using computer technology.

When drawing up a document, you should follow the general rules:

- the name of the inspection that requested the explanation is written in the header;

- The answer can be issued on the company’s letterhead. If there is no such form, then you must indicate the full name of the company, OGRN, INN, KPP and legal address;

- the date and number of the inspection requirement for which an explanation is provided should be indicated;

- further details of the situation that require clarification are described in detail;

- It is best to document the facts that caused the discrepancies identified. For example, if an employee’s salary is less than the subsistence minimum, then a vacation order can serve as a supporting document. This will be understandable if vacation pay was accrued in one month, and the rest days were in the next period.

If, after receiving a request from the Federal Tax Service, the organization’s accountant discovers errors in the submitted reports, you must immediately submit corrective declarations.

For the convenience of our readers, we will provide a unified example that is suitable for almost any situation for sending reasonable explanations to tax authorities about identified discrepancies.

When requesting clarification about VAT discrepancies, the response should be sent only electronically. Even if the organization sends a response to the request within the prescribed period, but on paper, the information will be considered not provided.

Summarize. Whatever the request from the tax authorities, a response must be given within 5 days. This will help to identify the mistake made in a timely manner. If the reporting was submitted correctly, then it is enough to write an explanation and attach supporting documents.

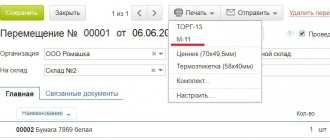

How to prepare documents before sending them to the Federal Tax Service

The Tax Code of the Russian Federation does not establish additional mandatory requirements for documents submitted at the request of the tax authority. The only requirement is certification in the prescribed manner, if necessary.

According to general practice, the number of documents requested by the tax authority often amounts to several thousand or hundreds of documents. This is a very time-consuming and usually pointless process.

Attention! Our qualified lawyers will assist you free of charge and around the clock on any issues. Find out more here.

In this regard, a rule has developed according to which hundreds of documents are not required to be certified. Documents of the same type are put into one folder, bound and numbered. Next, an inventory is compiled for this folder. On the initial sheets, the employee indicates the register of documents that are transferred to the authority.

After this, the threads of the documents on the last sheet are fastened. The official puts the seal of the organization and his signature. The last sheet should contain information about how many sheets are inserted and stapled.