Bonus for length of service in a budgetary institution: who is paid?

The procedure for determining the circle of persons who have the right to receive an allowance for budgetary experience, as well as the mechanism for calculating such an allowance, is regulated by the following legislative acts:

- Presidential Decree No. 1532 of November 19, 2017 determines the procedure for calculating work experience in a budgetary institution, and also approves the list of positions in which work is counted as “budgetary” experience;

- Government Resolution No. 583 dated August 05, 2008 approves the procedure for calculating bonuses as a mechanism for implementing the new wage system (NSWTS) for employees of budgetary institutions.

According to legislative acts, to obtain the right to a bonus, the periods during which the employee held or filled positions are taken into account:

- state civil service;

- municipal service;

- government agencies of the constituent entities of the Russian Federation;

- employees of the prosecutor's office, the Investigative Committee.

Also included in the “budget” experience:

- work in the field of education, healthcare, culture;

- military service;

- work in the Ministry of Internal Affairs and the State Fire Service, as well as institutions of the criminal correctional system.

A complete list of positions, the period of work for which is included in the “budgetary” length of service and gives the right to an increase, is contained in Presidential Decree No. 1532 of November 19, 2017.

Length of service for employees of the Ministry of Internal Affairs and military personnel

After working for two years, employees are entitled to an additional payment to their monetary remuneration.

Its size cannot exceed 40%. Such monetary incentives are possible if the labor activity in the Ministry of Internal Affairs lasts more than 25 years. In other cases, it is graduated, starting from 10% (2-5 years), adding 5% every 5 years. Exception: 25 years of experience: increase – 10%. Read about the long service bonus for military personnel.

In the video, the length of service of employees of the Ministry of Internal Affairs:

https://youtu.be/4P9rmnCpZGA

Percentage of bonus for length of service in a budgetary institution

The amount of the bonus accrued for length of service in a budgetary institution is set as a percentage of the official salary of a civil servant and depends on the length of service.

The table below shows the procedure for determining the percentage of the bonus based on the period of “budget” experience:

| No. | Work experience in a budget institution | Percentage of bonus to official salary |

| 1 | From 1 to 5 years | 10% |

| 2 | From 5 to 10 years | 15% |

| 3 | From 10 to 15 years | 20% |

| 4 | More than 15 years | 30% |

When determining the right to a bonus, the full number of years during which the citizen held positions in budgetary institutions is taken into account. For example, a civil servant with 4 years and 3 months of experience is entitled to a 10% increase, and an employee with a “budget” experience of 5 years and 2 months is entitled to a 15% increase. If the length of service in a budgetary institution is less than a year, then the civil servant is not paid a bonus.

The maximum amount of the bonus is 30% and is awarded to individuals who have at least 15 years of experience in the public sector.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Additional payment for combining positions according to the Labor Code of the Russian Federation for 2020

Remuneration Expand the list of categories Subscribe to a special free weekly newsletter to keep abreast of all changes in accounting: Join us on social media.

The legislation provides for this, as stated in the Labor Code of the Russian Federation.

networks: VAT, insurance premiums, simplified tax system 6%, simplified tax system 15%, UTII, personal income tax, penalties We send letters with the main discussions of the week > > Tax-tax May 22, 2020 Additional payment for combining positions of the Labor Code of the Russian Federation - 2020 is established for employees of all categories performing additional duties during working hours and on behalf of the employer.

Certain nuances of how additional payments can be made are discussed in our article. The obligation to pay compensation when an employee performs additional labor functions during working hours is enshrined in Art.

151 Labor Code of the Russian Federation. As follows from Art.

60.2 of the Labor Code of the Russian Federation, additional load options are possible:

How to calculate budget experience

Work experience in a budgetary institution is calculated cumulatively and consists of periods during which a citizen:

- worked in budgetary institutions;

- filled government positions at the federal and municipal levels;

- performed military duty;

- worked in the Ministry of Internal Affairs, the Ministry of Emergency Situations, institutions of the correctional system and authorities for control of the circulation of narcotic and psychotropic substances.

The length of service is determined on the basis of entries in the work book, as well as other documents that can confirm the period of work in government agencies (for example, copies of employment contracts).

To acquire the right to a bonus, the length of service of a public sector employee must not be continuous. If a citizen left public office, worked for some time in a production or commercial organization, and then returned to public service, then the period of his “budgetary” service is calculated as a continuation of the previously existing government service.

How much will public sector salaries increase in 2020?

Not a day without instructions × Not a day without instructions

- Services:

Public sector salaries are the current amount of monetary remuneration for public sector specialists. Let's figure out what the salary increase for public sector employees will be in 2020. The changes will affect employees:

- federal government agencies;

- federal government, budgetary and autonomous institutions;

- civilian personnel of military units, as well as institutions and divisions of federal executive authorities, where military and equivalent service is provided.

“On the adoption of measures by federal government bodies, federal government

Additional allowances for state employees

In addition to bonuses for length of service, public sector employees also have the right to receive additional payment in the amount of 60% to 200% of the official salary.

In particular, the salaries of civil servants who have access to state secrets are calculated taking into account additional payments from 5% to 75%. Employees of the Investigative Committee, bodies of the Ministry of Internal Affairs, civil servants of federal and municipal authorities, as well as the Presidential Administration, have the right to an additional payment of 10% to 20% for work related to the protection of state secrets.

It is worthwhile to dwell specifically on the incentive payments assigned to healthcare workers. Additional payments to doctors are assigned taking into account the length of service in the medical institution, as well as depending on the nature of the work performed:

- Emergency doctors are entitled to an additional payment of 30% of their salary for the first 3 years of work. In subsequent years, the amount of additional payment increases by 25% (for every 2 years of continuous work). The maximum amount of additional payment is 80% of the official salary. These incentive payments are assigned both to doctors at ambulance stations who provide emergency care to patients, but also to paramedical and junior medical staff (nurses, orderlies) who evacuate patients.

- Leper colony workers . Each year of work in anti-leprosy institutions gives the doctor the right to an additional payment of 10%. For continuous work in a medical institution, the amount of surcharge increases annually by 10% until a maximum of 100% (for doctors and nurses) or 80% (for other medical personnel) is reached.

Within the framework of the NSOT, a program of incentive payments to employees in the educational sector has been introduced. According to Government Decree No. 583 of 08/05/2008, teachers’ salaries are paid taking into account the following allowance:

- for qualifications;

- for the level of education;

- for having an academic degree;

- for work experience in educational institutions.

The amount of bonuses for teachers for length of service is not fixed in the Russian Federation and is established by local legislative acts in the regions. For example, the authorities of the Oryol region established the following amounts of bonuses for teachers for length of service:

- 5% – up to 3 years of experience;

- 10% – experience from 3 to 15 years;

- 15% – experience from 15 to 20 years;

- 20% – experience over 20 years.

As we can see, in the Oryol region even beginning teachers without experience receive a 5% bonus. At the same time, in the Komi Republic, a 5% bonus is assigned to teachers with at least 1 year of experience. If you have less length of service, no bonus is paid.

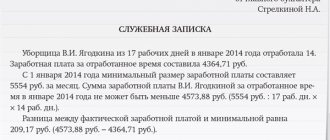

Procedure for calculating additional payments

To calculate the amount of the bonus for length of service, you need to multiply the salary assigned to the specialist by the percentage indicated by the current legislation or internal regulations of the enterprise. The resulting amount is added to the salary and given to the employee “in hand” minus income tax (13%). The employer must charge and pay insurance premiums from her.

Longevity bonuses do not exclude other salary bonuses, for example:

- for special conditions of civil service;

- northern or regional coefficients;

- additional payments for working with information that is a state secret;

- bonuses;

- cash incentives;

- financial assistance, etc.

To determine the amount of bonuses for length of service, it is necessary to sum up the entire length of service of a specialist, even if there were long breaks in his work activity. Payments begin to be made when the minimum length of service is reached (for civil servants - 1 year) and stop after the order to dismiss the employee is issued.

How is it calculated

Additional payments depend on the time period during which the employee performed work duties. Even if during this time he managed to quit his job several times and get a new job, this does not cancel the required financial support. The additional payment is calculated as a percentage of the official salary that was received for this period of time.

In addition to the salary, the size of the payment depends on a number of conditions . These include regional coefficients, determined on a territorial basis. They are installed separately in each subject of the Russian Federation.

In addition, the amount of additional payments also implies a bonus, if this is provided for by the Labor Code of the Russian Federation, as well as regional and federal legislation. Therefore, to calculate the amount of additional money paid, pay attention to these parameters; you should remember the need to pay income tax.

List of rules

The calculation principle in the process of determining the size of the allowance for persons working in budgetary institutions is quite simple.

- The amount of average monthly income is calculated. It is usually counted for the last 2 years of service. The total value is divided by 24 - the number of months. So, we get the average monthly income.

- The category to which the serviceman belongs and his length of service are determined. Depending on the indicator, you can find out the percentage of the monthly salary that is due for payment.

- The calculation is made by multiplying the average salary by%. The resulting amount is then added to the salary.

Example: official Sidorov has been working in a regional budget institution since 2002. Currently, the average monthly salary is 100,000 rubles. His competence includes state security. secrets.

- How much bonus can he expect in 2020?

- How are calculations performed to determine the indicator?

- What is the total amount of his monthly salary, taking into account all additional payments?

Step by step calculation:

- The amount of monthly income in this problem has already been calculated, i.e. there is no need to take income for the last 2 years and calculate the arithmetic average.

- A military personnel belongs to the category of civilian workers. As of 2018, the work experience is 20 years. This means that from this moment the size of the premium for him changes and is not 20%, as it was before, but 30%.

- We take the average salary equal to 100,000 rubles, multiply by 30%, and get a 30,000 bonus. In total, the total amount of earnings is 130,000 rubles.

Another point to take into account is that the employee’s responsibilities include state security. secrets _ Therefore, a premium of at least 10% is due. Therefore, 100,000 needs to be multiplied by 10%, you get 10,000 rubles. The total salary will thus be 140,000 rubles .

The procedure for calculating the allowance

When paying bonuses, the following rules are observed:

- Payments are calculated based on salary. Additional payments to the employee (bonuses, etc.) will not be taken into account in the calculation.

- Payments are made monthly on the day the salary is issued.

- If a person worked in several positions on a part-time basis, payments are calculated based on the basic salary.

- If, during the period of reaching a certain length of service, a person is on sick leave or on vacation, he receives all additional payments after returning to work.

- If an employee resigns, the amount of the bonus will be determined based on the actual time worked.

- The length of service of civil service representatives when calculating bonuses will be established by a commission, the participants of which are approved by the regional manager of the government agency.

To receive compensation, an employee must provide certain documents:

- Military ID (for military personnel).

- Work book (for government and budget employees).

- Certificates from the archive, extracts from orders (if there is no work book).

The convened commission decides on the calculation of the premium. The decision is drawn up in the form of a protocol, on the basis of which the manager must issue an order. The order specifies the amount of the premium. A copy of this document is attached to the employee’s personal file. Upon reaching a new level of experience, the amount of the bonus increases. That is, there is a regular increase in the employee’s salary.

The manager does not have the right not to make payments if they are due to the employee by law. However, if the increase is the initiative of the employer himself, this decision can be canceled.

As a rule, compensation is provided to employees of various types of government agencies. Allowances are extremely rarely paid in commercial organizations for a number of reasons. In particular, this is simply unprofitable for an entrepreneur. It’s rare that a company owner has a vested interest in keeping an employee in one place for several decades, and this form of bonus is designed to encourage just that.

The bonus for work experience is an additional material payment provided to citizens of the Russian Federation. But not everyone has information about the areas in which this amount is due and how settlement measures are taken to determine it.