Types of salary debts in bankruptcy

All salary debts of a bankrupt enterprise are divided into two types:

- Current. These are debts for wages accrued after the date of initiation of bankruptcy proceedings by the arbitration court. It is considered initiated from the moment the court issues a ruling to accept the application for declaring the debtor bankrupt.

- Registered. These are salary debts incurred before the above date.

The duration and procedure for paying wages in bankruptcy depends on the type of debt.

Let us note that when we talk about salary debts, we mean not only the salary itself, but also other amounts due to the employee as remuneration: bonuses, allowances, vacation pay, as well as severance pay. Although such debts in bankruptcy have payment priority over most other debts of the enterprise, the employee may not receive his money at all, but the likelihood of receiving a salary for the current debt is higher than for the registered one.

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Determining the type of debt is simple: you need to use the online service “Card Index of Arbitration Cases”, where you can find a bankruptcy case by the name of the organization and look at the date of the relevant determination.

Bankruptcy of an enterprise at the initiative of employees

According to Art. 65 of the Civil Code of the Russian Federation, an enterprise that is declared bankrupt by a court is subject to liquidation. And for employees of such an enterprise, this means that employment relations with them will be terminated on the basis of clause 1, part 1, art. 81 of the Labor Code of the Russian Federation.

When an enterprise is liquidated, all employees are dismissed, even those who belong to the socially protected category, for example, women on maternity leave, minors, women raising children under 14 years of age, and disabled people.

Dismissed employees due to bankruptcy have the right to:

- Severance pay in the amount of one average monthly salary;

- To maintain your average monthly earnings during the period of employment, which is limited to 2 months. But this amount includes severance pay. So, in the end, the employee can receive no more than 2 average monthly earnings. Although in some situations, if an employee is registered with the employment center within 2 weeks after dismissal, the period for retaining his earnings can be extended to 3 months.

- To receive notice of upcoming dismissal 2 months in advance.

- To receive compensation in the amount of average monthly earnings for dismissal within a period of less than two months after receipt of notice.

We invite you to read: Joining a bankruptcy case as a creditor

In addition to compensation, the employee has the right to receive wages for the time worked. And here it doesn’t matter when the employee quit:

- the employee left before the bankruptcy procedure was initiated;

- or did so during bankruptcy proceedings;

- or after the company has been declared bankrupt.

If a bankrupt company owes an employee wages, then it is obliged to pay it, no matter what happens. Only the procedure for compensation may vary. The order is determined by law.

In case of bankruptcy, an organization fires all employees, because the company ceases to exist. The benefits relate rather to receiving payments and compensation. The following categories of persons can undergo bankruptcy on more favorable terms:

- women at any stage of pregnancy;

- minor workers;

- mothers raising children alone;

- people who are on maternity leave, caring for children under 1.5 and 3 years old;

- employees who are persons with disabilities.

These individuals must have several privileges:

- be informed in advance about the termination of cooperation;

- obtain an alternative position that meets professional skills;

- be the first to claim compensation for debts and all due payments.

There is one more nuance - the later employees are informed of their dismissal, the more privileges they are entitled to. Maintaining priority is in the interests of the employer himself.

Dismissed workers are most often concerned about what payment they are entitled to in case of bankruptcy. People are losing their source of income, so it’s understandable why they are interested in what payments are due in this case, because it is quite possible that they will have to live at their expense for quite a long time.

According to the law, employees of a bankrupt enterprise have the right to the following compensation:

- Severance pay. Its size depends on the average salary received by employees monthly. But the payment cannot be less than the minimum wage that is established in the region where the company is registered. It is also important whether the employee was employed full-time or part-time.

- Compensation in the form of two months' salary. It is needed so that the employee has something to live on until he finds a new job.

- Compensation for three months of being unemployed. Such assistance is not provided to everyone, but only to employees who immediately joined the labor exchange (no later than two weeks from the date of dismissal). And only if there are no vacancies matching your qualifications.

- Payment for all days worked before dismissal. This should also include vacation pay, sick leave, etc. In general, all funds that the employee is entitled to, but were not transferred.

All money must be transferred to the employee on the day of dismissal. Alternatively, they can be sent to a card or handed over.

If employees of a bankrupt company did not use their vacation, they can count on compensation for the missed vacation. The company must pay all employees who have not been on vacation for at least the last 6 months.

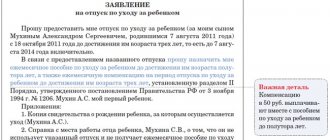

When it comes to a pregnant woman who goes on maternity leave, the money is returned to her earlier than to other employees - on the last working day before maternity leave.

There are categories of beneficiaries who, in addition to the main leave, have an additional one. It must also be included in payments. As for seasonal workers and temporary workers, they are not entitled to vacation payments at all. If you work for less than 2 months, there will be no payments.

Bankruptcy means the inability of a company to repay its debts to creditors, personnel, and government agencies. Unpaid obligations to employees may already become the main reason for initiating bankruptcy proceedings. If the enterprise is declared insolvent, the company's employees must be dismissed with the mandatory payment of all obligations.

The amount of obligations depends on the implementation by the management of the organization of the norms of current legislation, which were developed to protect the rights and interests of the workforce. At the beginning of the proceedings, the arbitration court appoints a manager who must organize the liquidation of the company and the repayment of its obligations to all creditors.

The bankruptcy procedure of a company can also be initiated by its personnel. To begin consideration of a company's bankruptcy case, an employee should prepare and submit a petition to the court. Bankruptcy in this case can begin if:

- the company's outstanding financial obligations to the employee will amount to more than 300 thousand rubles. (this amount does not include penalties and fines);

- making a legal decision to withhold the amount of debt from the enterprise;

- the organization does not fulfill its financial obligations to employees for more than 90 days.

Some managers, aware of the rights of employees, offer them to resign of their own free will in order to avoid financial costs in bankruptcy. In this situation, staff should not trust management, but rather immediately contact a lawyer specializing in labor law.

https://youtu.be/9iarJASkCF0

Repayment of current salary debt

Current salary debt is not included in the register of creditors and is accounted for separately. For the employee, this is a definite plus, since all current debts must be repaid earlier than the registered ones. However, current debts include not only wages, therefore the law determines the order of repayment of such debts.

The following will be paid first:

- bankruptcy court costs;

- activities of the arbitration manager;

- the activities of other persons who were involved by the arbitration manager to conduct the case.

Only after this will the current salary arrears be repaid. Given that the costs of filing a bankruptcy case are significant, the employee may not receive any money. This is especially true for situations where the bankrupt organization has little property, since it is through its sale that all debts are repaid.

In the situation described, it does not make sense for the employee to go to court to collect wages in bankruptcy, since his claims are already taken into account as part of current payments. The only thing that can be done is to send an official request to the arbitration manager about whether the debt to you is taken into account as part of current payments. By the way, practice shows that in most cases the current salary arrears are still paid.

If an employee learns that the manager has violated his rights (for example, by refusing to take into account the current salary debt or reducing its size), he can complain to the arbitration court hearing the case. The amount to be paid will be determined by the court.

How is the bankruptcy procedure carried out?

Bankruptcy is established in the Arbitration Court, where either the company itself can apply voluntarily (using the bankruptcy procedure as a kind of protection from creditors), or one of the creditors, demanding payment of debts in court.

A company in bankruptcy either sells off its assets to pay off debts, or, in a more optimistic version, improves its financial condition through effective external management and pays off creditors without liquidation.

Stage 1

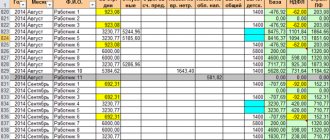

Observation. A temporary manager appointed by the court at this stage assesses existing debts and the possibilities of paying them off without losing all property. The manager refers to the company’s accounting and tax records, and also compiles a list of all creditors indicating the amount of debt (“register of claims”).

Stage 2

Financial recovery. It is possible if the interim manager suggested ways out of the crisis and found ways to pay off debts. The company continues to remain under the control of its owners, albeit with some restrictions.

Stage 3

External control. If financial recovery is not successful, then the company’s management is transferred to an arbitration manager, who can impose a temporary moratorium on debt payments. During this “deferment” period, the manager takes steps to improve the company (through the sale of illiquid divisions, reorganization of the organization, etc.).

Stage 4

Competition proceedings. Introduced if it is not possible to save the company at the previous stages. The organization is liquidated, its property is subject to sale, all proceeds are transferred to creditors according to the established priority.

How to collect registered wage debts

Wage debts accrued before the initiation of bankruptcy proceedings are included in a special register of creditors, which includes all debts, with the exception of current ones. It is usually conducted by an arbitration manager or a special registrar organization. Salary debts, like others, are included in the register by the manager or (on his recommendation) by the registrar.

Subscribe to our newsletter

Read us on Yandex.Zen Read us on Telegram

If an employee has a writ of execution or a court order to collect a registered salary debt, you need to contact the arbitration manager directly with the document. Moreover, it is advisable to do this regardless of whether the employee is sure that his requirements are in the register or not. There is no point in contacting bailiffs, since with the onset of bankruptcy, enforcement proceedings against the enterprise will be suspended.

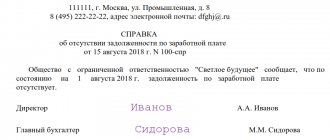

If there is no writ of execution, the employee can check whether his salary is included in the register by sending an official request to the arbitration manager for an extract from the register. The request is sent to:

- By registered mail with a description of the attachment.

- Strictly at the address of the arbitration manager indicated on the portal of the federal register of information on bankruptcy.

The specified register of information will be useful to anyone who is interested in how to collect wages in bankruptcy, since all the details of the procedure are displayed there (including information about inclusion in the register).

In the event of a dispute about the amount of debt owed to an employee, the latter will have to go to the district court, since only a court decision can confirm its amount and serve as the basis for including the disputed debt in the register.

In what order are payments made to employees?

The demands of employees dismissed from an insolvent enterprise are legal only when their relationship with the employer was sealed by an employment contract. In the case of a fixed-term contract, notices are sent three days before dismissal. For seasonal work - a week.

Seasonal workers are paid a two-week salary. If the agreement with the employer is signed for less than two months, compensation is not provided. The exception is residents of the Far North. In case of bankruptcy, local enterprises are obliged to pay them three monthly salaries.

If an employee dismissed from an insolvent enterprise immediately registered with the Employment Center, but was unable to find a job within two months, the bankrupt organization is obliged to pay him again.

For residents of the Far North, such compensation is provided within six months after dismissal.

Employees have the right to work until the final liquidation of their company, which may take more than one year.

The first to receive payments are those employees to whom the company previously incurred debt. Managers are usually given compensation last, since their salaries are higher than those of ordinary employees.

Compensation payments also include:

- 30 thousand rubles from the maximum amount of severance pay;

- vacation pay;

- penalty for late payment of wages;

- other debts of the company to the employee.

If over the last 6 months before bankruptcy, an employee’s salary was repeatedly increased, then it may be cut when benefits are paid.

As a result, when calculating compensation, the organization will proceed from the salary rate before its increase.

In the event of bankruptcy of an enterprise, it is the employees who fall into the priority group of creditors. The company, by law, must pay them first. In the second line are subordinates whose salaries were accrued even before the start of the default procedure.

Wage compensation is paid on the employee’s last working day at the enterprise.

If there is a small amount of money in the bankrupt’s account, a strict order of debt payment should be observed. Initially, debts are paid to individuals, and then, if there is a balance left, payments are made to other creditors.

When there are not enough funds in the account to make payments on all debt obligations, then in order of priority, payments are sent to:

- to pay off alimony debt;

- for payment of funds in connection with damage to health;

- funds are debited from the bankrupt’s account to pay wages, remunerations, etc.;

- payment of debts to employees who work on a contract basis;

- Then payments are made to off-budget organizations.

If there are insufficient funds in the account, after the above-mentioned priority recipients of the debt, debts should be repaid with other creditors. The order of payments in bankruptcy depends on the date of receipt of certain claims from them.

https://youtu.be/QYanaVYkaT0

Deadlines for including claims in the register of creditors and receiving salary debt

Inclusion of requirements in the register is possible only before its closure. The register is closed 2 months after the publication of information about declaring an enterprise bankrupt and opening bankruptcy proceedings. At the same time, a significant amount of time often passes from the beginning of the bankruptcy procedure to this moment. However, the employee should make sure as early as possible that the debt owed to him is recorded in the register, since after closure no claims are included in it.

The chances of receiving registered salary debts are lower than the chances of receiving current ones:

- First, current debts will be paid out of turn. These include the already mentioned bankruptcy expenses, current salary payments and several other categories of payments.

- First of all, amounts will be paid to compensate for damage to the health and life of people. These are rare categories of payments for which there are usually no debts.

- Secondly, registered wage debts will be satisfied.

Thus, by the time it is the employee’s turn to satisfy the demands, there may be no more property left. Nothing can be done in such a situation.

You may have to wait a long time for any type of salary debt to be paid. All debts are satisfied within the framework of the last stage of bankruptcy - bankruptcy proceedings. It, like the previous stages of the procedure, can take more than one year, depending on the size of the company, the composition of the property and other factors.

The concept of queue

When a legal entity is declared bankrupt, it needs to establish a certain order of payments in the event of bankruptcy of the enterprise to creditors, in accordance with which it will repay the debt. The legislative text defines three categories of priority for satisfying debt payment requirements.

In accordance with the norms of law, in case of bankruptcy, the priority of repayment of debts to creditors is determined as follows:

- First of all, creditors in bankruptcy include individuals who have suffered physical or moral damage;

- then debts to the employees of the bankrupt organization are paid. For example, wages, vacation pay, benefits and other payments;

- Lastly, the bankrupt repays the debt to other creditors.

We invite you to familiarize yourself with: Rights and guarantees for an employee upon dismissal by agreement of the parties in 2020

Representatives of the third line of debt recipients have the right to establish their requirements for the bankrupt. The list of creditors' claims consists of the following:

- reimburse them for the full amount of the loan (work, services);

- compensate for the damage caused;

- pay all existing debts on wages, benefits, vacation pay, etc.;

- pay off utility debts;

- pay the costs incurred during the trial.

When does a company go bankrupt?

The bankruptcy procedure begins when the following conditions are met:

- the total amount of debt cannot be less than 100 thousand rubles;

- within three months the company did not transfer any funds to repay the existing debt;

- Due to its financial condition, the company cannot satisfy the demands of all creditors.

If management realizes that the company is not solvent, then it can independently begin the procedure for declaring the company insolvent. What happens to employees if the company goes bankrupt? All employees are dismissed using the standard layoff procedure. They can count on standard payments and severance pay.

Notice Rules

The bankruptcy process of an enterprise must be accompanied by the following actions on the part of the company’s management or external manager:

- a notice of mass layoff is sent to the employment center three months before the dismissal of workers;

- Directly hired specialists are notified of this process two months before the termination of the employment relationship, and for this purpose, written notifications are prepared by HR employees containing information about the timing and reasons for the reduction;

- such notices are drawn up in two copies, since one document remains with the employer, and the other is given to the employee;

- on the last day of work, each employee receives a work book containing information about the layoff, and is also paid due payments and compensation.

If an employee does not want to sign the notice of layoff, then a HR specialist will draw up a corresponding act.