New edition of Art. 131 of the Labor Code of the Russian Federation allows residents to pay wages from a resident employer in foreign currency. The corresponding changes came into force on 02/16/2018, they were put into effect on the basis of Federal Law No. 8 of 02/05/2018. The changes will affect only a small part of employees: those who perform work duties outside of Russia.

Is it possible to pay wages in foreign currency within the country? What risks exist for the management and financial and economic service of the company in this case? Let's talk about this in more detail.

Residents working abroad

Previous version of Art. 131 of the Labor Code allowed payment of labor only in rubles. Other legislative acts of the Russian Federation contained similar norms. In December last year, changes were made to Federal Law No. 173 “On Currency Regulation...”, according to which employees of diplomatic missions and other similar services were able to receive wages in foreign currency (from 01/01/2018), but only through accounts in authorized banks outside the territory of the Russian Federation.

Changes to the Labor Code of the Russian Federation have finally resolved the problem of contradictions in legislation: employees abroad can open accounts in Russian banks and receive payment for their work in foreign currency.

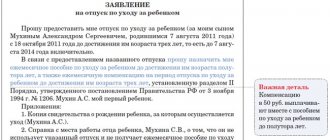

The amendments apply to the following categories of resident citizens abroad collaborating with resident organizations:

- employees of diplomatic missions, consulates;

- employees of representative offices of international organizations abroad;

- employees of representative offices of the federal executive power of the Russian Federation abroad;

- representatives of the Russian Federation to international organizations or representatives of the federal executive power of the Russian Federation to international organizations;

- employees of government agencies abroad;

- military personnel and other workers performing their duties abroad, as directed by the federal authorities;

- NGO workers abroad;

- journalists abroad, etc.

On a note! According to the new rules, workers abroad can receive not only wages, but also monetary allowance (maintenance) and any other payments provided for in labor relations. Accruals are made in accordance with employment agreements (contracts) and additional agreements thereto.

Salary in USD at the Central Bank rate?!

Jumps in the dollar and euro, inflation and talk about a possible default - all this causes citizens to distrust the ruble, which makes them start thinking seriously about salaries in foreign currency. Numerous social surveys so far indicate that there are already about 40% of those who want to, but nevertheless, almost 50% of the population want to continue to receive income in rubles, believing that they need to receive income in the currency in which a person spends. In the practice of many employers, questions often arise related in one way or another to the inclusion in the employment contract of conditions for remunerating the employee in foreign currency.

Two main practical questions have emerged regarding this issue.

Question one: Is it legal to establish in an employment contract the amount of an employee’s salary in the Russian Federation in foreign currency, as well as to make salary payments in foreign currency?

By virtue of Art. 1 of the Federal Law of December 10, 2003 No. 173-FZ “On Currency Regulation and Currency Control” (hereinafter referred to as Law No. 173-FZ), payment of wages in foreign currency is a foreign exchange transaction, i.e. an operation associated with the transfer of ownership of currency values, which include foreign currency.

Typical situations: 1. An employee, a resident of Russia, is hired by a Russian legal entity. By virtue of clause 1. Art. 9 of Law No. 173-FZ, currency transactions between residents are prohibited. The exceptions are operations directly listed in this article. 9, among which there are no transactions related to the payment of wages. Accordingly, a Russian legal entity - an employer, due to currency legislation, does not have the right to pay wages in foreign currency to an employee who is a resident of Russia. 2. A Russian legal entity, subject to a number of conditions, has the right to hire foreign workers. Accordingly, an employee of a Russian legal entity may be a non-resident of Russia for the purposes of currency regulation. Paying a salary to a non-resident employee is also a foreign exchange transaction, but due to the fact that its parties are a resident and a non-resident, different rules apply to it. Art. 6. Law No. 173-FZ provides that currency transactions between residents and non-residents are carried out without restrictions, except for cases expressly provided for in the law itself. Among the regulated transactions provided for by Law No. 173-FZ (i.e., transactions for which it is possible to establish restrictions), there is no operation to pay a non-resident employee a salary in foreign currency. From which it follows that currency legislation does not contain a ban or restrictions on the payment of wages in foreign currency by a Russian legal entity - an employer in favor of a non-Russian non-resident employee. 3. A foreign legal entity that has a branch (representative office) in the Russian Federation recruits employees who are residents of Russia to work in such a branch (representative office). From the point of view of currency legislation, the situation is identical to the second typical situation discussed above: currency transactions between residents (employees) and non-residents (employer) are carried out without restrictions, therefore, currency legislation allows payments to employees in foreign currency. 4. A foreign legal entity that has a branch (representative office) in the Russian Federation recruits employees who are non-residents of Russia to work in such a branch (representative office). There are no restrictions on settlements between non-residents in foreign currency, including those related to salary payments.

As you can see, in three of the four typical situations presented, currency legislation allows for the possibility of an employer paying wages to an employee in a foreign currency in the Russian Federation. Naturally, the rules of currency legislation can only be applied to payments in foreign currency. However, the rules do not and cannot regulate the legality of establishing the very condition on payments in foreign currency in employee employment contracts.

By virtue of Art. 11 of the Labor Code of the Russian Federation (hereinafter referred to as the Labor Code of the Russian Federation), its norms are mandatory on the territory of the Russian Federation for all employers, regardless of their organizational, legal forms and forms of ownership. On the territory of the Russian Federation, the rules established by the Labor Code of the Russian Federation apply to labor relations of foreign citizens, stateless persons, employees of international organizations and foreign legal entities.

The key norm is contained in Art. 131 of the Labor Code of the Russian Federation, which establishes that wages are paid in cash in the currency of the Russian Federation (in rubles).

It is important to note that the norm of this article of the Labor Code of the Russian Federation develops the provisions of the norm of Art. 3 Convention No. 95 of the International Labor Organization “Concerning the Protection of Wages”, adopted in Geneva on July 1, 1949, stating that wages paid in cash will be paid exclusively in legally circulated money. At the same time, the norm of Part 2 of Art. 131 of the Labor Code of the Russian Federation establishes the possibility, in accordance with a collective agreement or an employment contract at the written request of an employee, to make payment in other forms that do not contradict the legislation of the Russian Federation and international treaties of the Russian Federation.

The conditions contained in Art. 131 of the Labor Code of the Russian Federation are clear: payments in foreign currency are illegal in any of the typical situations presented above, despite the absence of prohibitions from currency legislation. It is obvious that Part 2 of Art. 131 of the Labor Code of the Russian Federation establishes the possibility of providing for other forms of remuneration, while the currency in which labor is paid is not an element of the form of payment, because From this article it follows that there are two main forms of remuneration - monetary and non-monetary forms.

However, the second question is more complex: How legal is it to establish in an employment contract the amount of an employee’s salary in the Russian Federation in a foreign currency, but pay the salary in rubles, based on the official exchange rate of the corresponding currency on the date of payment?

There is no doubt that in practice the exchange rate of the relevant currency specified in the relevant terms of the employment contract can either rise or fall against the Russian ruble under certain circumstances. However, setting salaries in foreign currency can lead to negative consequences. the Federal Service for Labor and Employment (Rostrud) has repeatedly opposed this , pointing out in its letters that this does not comply with the law, since a change in the exchange rate of the ruble against foreign currency can lead to a deterioration in the terms of remuneration of the employee (letters dated July 28. 2008 No. 1729-6-0; dated October 31, 2008 No. 5919-TZ; dated March 11, 2009 No. 1145-TZ; dated June 24, 2009 No. 1810-6-1).

Indeed, if you set the salary in foreign currency, then if its exchange rate falls, the employee’s salary will decrease, and this, in turn, will worsen his situation, which is unacceptable in accordance with Part 4 of Art. 8 Labor Code of the Russian Federation. The violation of the law in this case is seen in the fact that this method of calculating and paying wages contradicts the principle of payment for work enshrined in Part 1 of Art. 132 Labor Code of the Russian Federation. It provides that the salary of each employee depends on his qualifications, the complexity of the work performed, the quantity and quality of labor expended and is not limited to the maximum amount.

Thus, the legislator does not allow the amount of wages to depend on fluctuations in exchange rates, which in no way depend on the results, complexity and working conditions of a particular employee.

In addition, when paying wages established in foreign currency in rubles at the rate of the Central Bank of the Russian Federation, its size will inevitably fluctuate (both down and up). That is, in fact, there will be a permanent change in the terms of the employment contract regarding remuneration. But the legislator proceeds from another general rule: any adjustments to the terms of the employment contract should not be made automatically, but only by written agreement between the employee and the employer, as defined in Art. 72 Labor Code of the Russian Federation. This is seen as another violation of the law with this method of calculating and paying employees wages. Since the establishment of wages in employment contracts in foreign currency and its subsequent payment in rubles at the rate of the Central Bank of the Russian Federation is recognized as an offense, a company that practices this method of calculating and paying wages to its employees actually faces risks associated with the threat of prosecution. In particular, in this case we may be talking about the possibility of bringing the employer and his officials to administrative liability for violation of labor legislation in accordance with Art. 5.27 of the Code of the Russian Federation on Administrative Offenses (hereinafter referred to as the Code of Administrative Offenses of the Russian Federation). In Part 1 of Art. 5.27 of the Code of Administrative Offenses of the Russian Federation states that violation of labor and labor protection legislation (in this case, Article 72 and Article 132 of the Labor Code of the Russian Federation) entails a warning or the imposition of an administrative fine on officials in the amount of one thousand to five thousand rubles; for persons carrying out entrepreneurial activities without forming a legal entity - from one thousand to five thousand rubles; for legal entities - from thirty thousand to fifty thousand rubles. And part 4 art. 5.27 of the Code of Administrative Offenses of the Russian Federation provides that violation of labor and labor protection legislation by an official previously subjected to administrative punishment for a similar administrative offense entails the imposition of an administrative fine on officials in the amount of ten thousand to twenty thousand rubles or disqualification for a period of one year to three years; for persons carrying out entrepreneurial activities without forming a legal entity - from ten thousand to twenty thousand rubles; for legal entities - from fifty thousand to seventy thousand rubles.

In addition, among the possible risks, one should highlight the threat of labor disputes with employees who can (if desired) challenge this method of calculating and paying wages in court, as well as demand compensation for material damage caused by this offense on the basis of Art. 236 of the Labor Code of the Russian Federation and compensation for moral damage on the basis of Art. 237 Labor Code of the Russian Federation.

By the way, a decrease in the foreign currency exchange rate, compared to the rate on the date when the parties signed the employment contract, leads to the payment to the employee of smaller amounts in rubles compared to those previously paid. In such a situation, the unforeseen Art. 137 of the Labor Code of the Russian Federation withholding from wages. And by virtue of Part 3 of Art. 4 of the Labor Code of the Russian Federation, payment of wages not in full can be considered forced labor. It should also be pointed out that Art. 134 of the Labor Code of the Russian Federation establishes the need to ensure an increase in the level of real wages through indexation in connection with the increase in consumer prices for goods and services. State bodies, local government bodies, state and municipal institutions carry out wage indexation in the manner established by labor legislation and other regulatory legal acts containing labor law norms, other employers - in the manner established by the collective agreement, agreements, local regulations. Thus, the purpose of this norm is precisely to ensure that wages are revised and are adequate to consumer prices, which tend to rise, as the practice of recent months has shown, regardless of world currency rates.

However, a significant part of workers still considers the establishment, in an employment contract, of a salary in foreign currency with payment at the corresponding exchange rate in rubles, as a very preferable condition.

Review prepared

Residents within the country

Is it possible to calculate and pay wages in foreign currency if both the employee and the employer are residents? According to Art. 9 Federal Law No. 173, currency transactions between residents, including the payment of wages, are prohibited. Exceptions are discussed above. They do not concern the relationship between employees and resident employers within the country.

According to the legislation of the Russian Federation, resident individuals are:

- citizens of the Russian Federation;

- foreigners and stateless persons who have a residence permit in the Russian Federation (see Art. 1-6 of Federal Law No. 173).

Some employers, in an effort to retain valuable personnel of a resident company within the country, instruct the financial and economic service to establish and accrue wages and other payments related to labor relations to resident employees in foreign currency, and payments, according to labor legislation, are traditionally made in rubles They justify their position by the fact that in labor legislation there is no direct prohibition to set wages in foreign currency, and until the moment of payment of the amounts, such an operation is not a foreign exchange transaction between residents, accordingly, it does not fall under the norms of Federal Law No. 173.

The position itself is shaky, from the point of view of interpretation of legislative norms, and instead of the expected positive effect it can lead to real financial losses for the employer. Employees of the Labor Inspectorate have repeatedly noted that calculating wages in foreign currency can negatively affect the position of the employee if the exchange rate of this currency falls rather than rises (see, for example, Letter No. 1810-6-1 of Rostrud dated 06/24/09 .).

In addition, the consequences of such a decision can be expressed in other negative aspects:

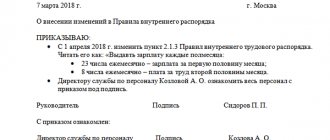

- Permanently changing the terms of an already concluded employment contract due to changes in the exchange rate without the consent of one of the parties. According to the Labor Code of the Russian Federation, this situation is a gross violation of the law (Article 72 of the Labor Code of the Russian Federation).

- The need to track the course and control changes by signing additional agreements. This is inevitable if the company does not want to break the law. These procedures significantly increase document flow and the burden on the company’s HR department. Taking into account the daily changes in the exchange rate, it is almost impossible to complete such work without omissions and violations.

- Problem when calculating a pension for an employee in the future.

Insurance premiums from non-residents

In Art. 420 of the Tax Code of the Russian Federation provides that the object of taxation with insurance premiums is payments and other remuneration in favor of individuals subject to compulsory social insurance in accordance with federal laws on specific types of compulsory social insurance. These include the laws “On compulsory pension insurance in the Russian Federation” dated December 15, 2001 No. 167-FZ, “On compulsory medical insurance in the Russian Federation” dated November 29, 2010 No. 326-FZ, “On compulsory social insurance in case of temporary disability and in connection with maternity" dated December 29, 2006 No. 255-FZ. These laws establish, in particular, a list of persons who are recognized as insured under these types of insurance.

Contributions for injuries are still regulated by the law of July 24, 1998 No. 125-FZ.

The calculation of contributions for compulsory pension and compulsory health insurance, as well as contributions for temporary disability and injury to a foreign worker depends not on his tax status (resident or non-resident), but on his legal status in Russia:

- refugee;

- received temporary asylum in the Russian Federation;

- citizen of a member state of the EAEU;

- permanently residing in the Russian Federation;

- temporarily residing in the Russian Federation;

- temporarily staying in the Russian Federation;

- highly qualified specialist.

For compulsory pension insurance of foreign workers of all listed statuses (except for highly qualified specialists), contributions are accrued from payments not exceeding RUB 1,292,000 in 2020. at a rate of 22%, and from the excess amount - at a rate of 10%. Contributions to compulsory pension provision for highly qualified specialists are not accrued (including for bonuses paid to such employees after their dismissal).

Find out whether to pay pension contributions for EAEU citizens temporarily staying in Russia here .

Contributions for compulsory temporary disability insurance for payments exceeding RUB 912,000. (in 2020) are not awarded to all specialists, regardless of status.

Contributions from payments not exceeding RUB 912,000. are accrued at a rate of 2.9% to foreigners of all statuses, except those temporarily staying in the Russian Federation. For payments to foreigners temporarily staying in Russia, contributions for temporary disability are calculated at a rate of 1.8%, and for payments in favor of temporarily staying highly qualified specialists, insurance premiums are not calculated.

Contributions for compulsory health insurance are paid at a rate of 5.1% of payments made to refugees, citizens - members of the EAEU, foreign workers permanently or temporarily residing in the Russian Federation. Contributions for this type of insurance are not paid from payments made in favor of highly qualified specialists temporarily staying in the Russian Federation.

In accordance with the law of July 24, 1998 No. 125-FZ, foreigners, along with citizens of the Russian Federation, are subject to insurance against industrial injuries. Contributions for insurance against industrial accidents are charged at the same rates as for payments to employees - citizens of the Russian Federation.

You can read more about insurance premiums for payments to foreign employees working remotely in the article “Insurance premiums are not charged for payments to “remote” foreigners .

About insurance premiums from foreigners

Resident and non-resident

The situation, from the point of view of regulation of foreign exchange transactions, is twofold. On the one hand, a non-resident foreign company can employ resident Russians in a branch or representative office on the territory of the Russian Federation. On the other hand, Russian companies that are residents also employ non-resident workers, foreign citizens. In both cases, it is possible to calculate and pay wages and similar payments in foreign currency.

Federal Law No. 173 (Article 9-1) provides for restrictions only if the two parties to the employment contract are residents, and Art. 6 directly speaks about the possibility of foreign exchange transactions between residents and non-residents. Exceptions under this article do not apply to labor relations and wage amounts.

Let's consider a situation in which a foreign citizen is an employee of a Russian resident company. In general, two options are possible:

- the employee has a residence permit and is a resident of the Russian Federation;

- the employee has other documents giving him the right to stay in the territory of the Russian Federation temporarily, and is a non-resident.

Legal norms prohibit the calculation and payment of wages in foreign currency to a foreigner (stateless person) permanently residing in the territory of the Russian Federation - the holder of a residence permit. At the same time, they make it possible, if this does not contradict the law, to pay the currency equivalent of wages to non-resident foreign citizens.

On a note! A residence permit can be issued to both a foreign citizen and stateless persons. The document confirms the right of its owner to reside permanently on the territory of the Russian Federation (Article 2-1 of Federal Law No. 115 “On the legal status of foreign citizens...”).

When paying wages to an employee of a resident company, in accordance with Art. 14-1 Federal Law No. 173, have the right to open foreign currency accounts in authorized banks, if this does not contradict the legislative norms discussed above. At the same time, in Art. 14-2 talks about conducting currency payments through such accounts according to the rules of the Central Bank. Regulatory authorities often conclude that it is mandatory to pay the currency equivalent of wages exclusively through banking transactions. They consider it a violation to pay the same amounts through the cash register.

Meanwhile, arbitration courts support the employer in this matter and believe that payment of wages in foreign currency to a non-resident employee through the cash desk is completely legal (Definition No. 19914/13 27-01-14 of the Supreme Arbitration Court of the Russian Federation and a number of similar documents). A non-resident employee who has not expressed a desire to receive wages through a bank account can receive it at the cash desk. There are no violations on the part of the resident employer in this case, since he is obliged to comply with the requirements of labor legislation.

How can an employee confirm his resident status?

An employee's resident status is confirmed in one of the following ways:

- There are no facts that refute the stay of a citizen in the Russian Federation for a period of more than 183 days . For example, citizen Petrov is a full-time employee of the Russian enterprise Alfa. Petrov’s place of work is Saratov. During 2020, Petrov performed official duties in accordance with the established schedule, and also stayed on vacation for a period of 28 calendar days in Crimea. Thus, we can conclude that Petrov was constantly on the territory of the Russian Federation, which means he has resident status.

- There are facts confirming the citizen’s stay in Russia for more than 183 days . Let’s say citizen Suleymanov permanently resides in Azerbaijan, while working in Russia. In 2020, Suleymanov was in Russia from 04/01/2019 to 10/01/2019 (184 days), the rest of the time he lived in his homeland, Azerbaijan. Since Suleymanov’s stay exceeds 183 calendar days during the year, he is recognized as a resident of the Russian Federation. Documentary confirmation of status are border crossing marks.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Main

Amendments to the Labor Code of the Russian Federation, adopted this year, resolve the issue of paying wages and similar amounts in foreign currency, if both the employee and the employer are residents of the Russian Federation, and the recipient is located outside the country. Now a similar operation can be carried out through an account opened in a Russian bank.

Other categories of residents and non-residents were not affected by the innovations: in labor relations under the “resident-resident” scheme in Russia, foreign currency payments are prohibited. If at least one of the parties to the labor relationship is a non-resident, problems with payments, according to the law, do not arise.

Why is salary in foreign currency prohibited?

The Federal Service for Labor and Employment outlined its position several years ago in.

Officials considered that unpredictable fluctuations in exchange rates would lead to a decrease in wages (if the exchange rate fell), and this, in turn, was an infringement of the rights of workers. Moreover, even if the employee agreed with the indication of the salary in foreign currency (or at the exchange rate in USD), having signed the corresponding condition in the employment contract.

Rules Art. 72 of the Labor Code of the Russian Federation, which allows changing the terms of employment contracts “by agreement of the parties,” according to officials, are not applicable in this case, since they contradict Art. 135 of the Labor Code of the Russian Federation, according to which wage conditions cannot be worsened.