How to reflect in the organization's accounting the payment to the spouse (heiress) of a deceased employee of the amounts of wages accrued for days worked and compensation for unused vacation accrued after the death of the employee?

At the time of payroll, the organization has information about the death of the employee. The amount of wages accrued to the employee for the time worked amounted to 42,000 rubles, compensation for unused vacation was accrued in the amount of 74,000 rubles. Payment of amounts due to the deceased employee was made at the request of his wife from the organization's cash desk.

In connection with the emergence of the right of employees to paid vacations in accordance with the legislation of the Russian Federation, the organization forms a corresponding estimated liability for accounting purposes. According to the accounting policy for profit tax purposes, the organization does not create a reserve for upcoming expenses to pay for vacations; income and expenses are accounted for on an accrual basis.

Persons who have the right to receive unpaid wages of a deceased employee

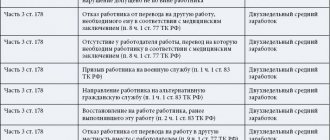

Payment of wages and equivalent income not received by the employee on the day of his death is regulated by Art. 141 of the Labor Code (LC) and Art. 1183 Civil Code of the Russian Federation. Thus, the specified payments belonging to the deceased and not received by him are subject to payment to his family members or his disabled dependents.

The legislation determines the circle of family members to whom, in accordance with Art. 2 of the Family Code includes spouse, parents and children, including adoptive parents and adopted children. The list of these persons is specified in Art. 1183 Civil Code of the Russian Federation. In particular, it establishes that the specified amounts are paid to family members who lived with the deceased citizen, and to disabled dependents - regardless of this fact. The legislation apparently proceeds from the priority (advantage) of these persons over other heirs. Although in practice there are cases when such payments are made to close relatives who did not live with the deceased.

Example The organization where a deceased employee worked was approached by her mother with a request to pay her her daughter’s wages, which she had not received on the day of her death. The daughter lived with her husband and minor children separately from her mother. The husband refused to receive payments due to his wife. After lawyers compared all the legislative acts on this issue, they came to the conclusion: based on the provisions of Art. 141 of the Labor Code of the Russian Federation, which do not provide for the cohabitation of relatives with the deceased, although this contradicts paragraph 1 of Art. 1183 of the Civil Code of the Russian Federation, an organization can give the mother of their former employee unpaid wages if she provides the relevant documents. This approach is confirmed by paragraph 68 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated May 29, 2012 No. 9 “On judicial practice in inheritance matters.”

The circle of family members of the testator who have the right to receive his unpaid wages is not limited to relatives in the ascending and descending line. In rare cases, citizens who are not relatives, but who lived and ran a common household with him, may be recognized as members of the testator's family.

Family members of a deceased relative have the right to claim unpaid wages before the expiration of the established four-month period for receiving such payments, regardless of the following characteristics:

- heirs of what order they are;

- whether they are able to work or not;

- whether they need these payments or not.

Insurance premiums

Payments and other remunerations accrued by an organization in favor of individuals within the framework of labor relations are recognized as subject to insurance contributions for compulsory pension insurance, social insurance in case of temporary disability and in connection with maternity, compulsory medical insurance, as well as compulsory social insurance from accidents at work and occupational diseases (Part 1 of Article 7 of the Federal Law of July 24, 2009 N 212-FZ "On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund" (hereinafter - Law N 212-FZ), clause 1, article 20.1 of the Federal Law of July 24, 1998 N 125-FZ “On compulsory social insurance against accidents at work and occupational diseases” (hereinafter referred to as Law N 125-FZ)).

Amounts not subject to insurance premiums are listed in Art. 9 of Law No. 212-FZ, art. 20.2 of Law No. 125-FZ. At the same time, these norms do not provide that payments made by the employer to the relatives of the deceased employee on the basis of Art. 141 of the Labor Code of the Russian Federation and clause 1 of Art. 1183 of the Civil Code of the Russian Federation, are exempt from insurance premiums.

At the same time, according to the Ministry of Labor of Russia and the Federal Social Insurance Fund of the Russian Federation, if at the time of calculating wages the organization has information about the death of an employee, wages and other payments accrued in accordance with the law in his favor (in particular, compensation for unused vacation) are not are subject to insurance premiums, since due to the death of the employee the employment contract is terminated. In addition, this person will no longer be able to obtain security for the corresponding type of insurance, i.e. the main goal of compulsory social insurance will not be realized (see paragraph 4 of the Appendix to the Letter of the Federal Social Insurance Fund of the Russian Federation dated April 14, 2015 N 02-09-11/06-5250, Letter of the Ministry of Labor of Russia dated February 20, 2013 N 17-3/292).

Features of calculating unpaid wages

Wages are a sum of money that is considered as a means of subsistence for citizens, payable during their lifetime, but not received by them for various reasons at the time of their death. Therefore, in the event of the death of an employee, the employer is obliged to make a final calculation of his wages and all payments that are equivalent to it.

Unpaid wages include the employee's tariff rate or salary for the time actually worked, bonuses and additional payments, bonuses and rewards (if required by working conditions). If the employee was ill before his death, then it is necessary to calculate sick leave payments.

It is mandatory to calculate monetary compensation for all days of unused vacation (main and additional) on the day of his death, regardless of the period for which this vacation was not used.

The final payment is subject to all wages accrued to the deceased employee, as well as compensation for unused vacation (if any), minus the appropriate taxes, when provided for by tax legislation.

Article 137 of the Labor Code of the Russian Federation defines deductions that are not made by the employer from the wages of a deceased employee. reimbursement , deductions for the payment of alimony are also stopped, and so on.

Personal income tax (NDFL)

As a general rule, an employee’s income in the form of wages and compensation for unused vacation is subject to personal income tax taxation and forms the tax base for personal income tax (clause 6, clause 1, article 208, clause 1, article 209, clause 1, article 210, Clause 3 of Article 217 of the Tax Code of the Russian Federation). The organization paying the income is recognized as a tax agent for personal income tax and is obliged to calculate, withhold directly from the income of an individual upon their actual payment and transfer to the budget the corresponding amount of personal income tax (clauses 1, 2, 4 of Article 226 of the Tax Code of the Russian Federation).

The obligation to pay tax terminates with the death of an individual (clause 3, clause 3, article 44 of the Tax Code of the Russian Federation).

Thus, the organization does not have the obligation of a tax agent to withhold personal income tax from funds accrued to a deceased employee.

Income received from a citizen by way of inheritance is not subject to personal income tax (with the exception of remunerations paid to the heirs (legal successors) of the authors of works of science, literature, art, as well as discoveries, inventions and industrial designs) (clause 18 of article 217 of the Tax Code of the Russian Federation).

Accordingly, the organization does not have the obligation of a tax agent to withhold personal income tax from the specified income accrued to a deceased employee when it is paid to the spouse of the deceased employee. Similar explanations are given, for example, in Letters of the Ministry of Finance of Russia dated June 10, 2015 N 03-04-05/33652, Federal Tax Service of Russia dated June 18, 2014 N BS-4-11/11653.

Deadline for submitting claims for payment of unpaid wages

The deadline for family members to apply for unpaid wages to a deceased employee is determined by clause 2 of Art. 1183 Civil Code of the Russian Federation. Thus, it has been established that claims for these payments can be made within four months from the date of opening of the inheritance . On this day, according to Art. 1114 of the Civil Code of the Russian Federation, is the day of a person’s death or the day a court decision enters into legal force by which he will be declared dead. The established period differs from the period for accepting an inheritance, which is limited to six months from the date of opening of the inheritance (clause 1 of Article 1154 of the Civil Code of the Russian Federation).

However, the period of four months given to claim unpaid wages of a deceased employee is preemptive (exceptional) . That is, this is the deadline set for a person to exercise his civil rights. It cannot be qualified as a statute of limitations, therefore, if it is missed, the right of persons to receive payments from the deceased is terminated.

Basically, problems with observing the four-month period from the date of opening of the inheritance arise when several heirs simultaneously declare their claim. While they are sorting out among themselves who has more rights to receive payments, the deadline expires, and the law does not provide for a different interpretation of this fact. But there are still cases of court decisions in favor of such heirs and the terms are restored.

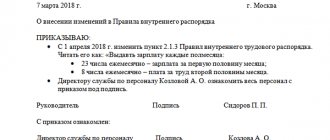

Payment terms

Important: Payment of wages, compensation for unused vacation and other mandatory accruals must be made within a week from the transfer of documents to the company confirming that the employee has died.

To receive this money, you must contact your employer before 4 months have passed since the death.

The funeral benefit provided for by Law No. 8-FZ is paid on the day all necessary documents are provided. To receive money, a citizen must contact his former employer no later than 6 months from the burial or death of the employee.

Conditions for including unpaid wages in the total inheritance estate

The absence of persons having a priority right to receive unpaid wages belonging to a deceased person is not a reason not to pay them at all . The norms of the Civil Code of the Russian Federation define two mandatory conditions under which such payments are included in the total inheritance mass and are subject to inheritance by all heirs on the grounds provided for by law:

- absence of heirs of the deceased (members of his family living with him) and his disabled dependents, who by law had a priority right to receive his settlement payments;

- failure by these persons to comply with the established four-month period for submitting requirements for their receipt.

The unpaid income of a deceased citizen is included in the inherited property in accordance with Art. 1112 of the Civil Code of the Russian Federation, which excludes which property rights and obligations of the testator are not included in the inheritance.

Legal rules for paying the salary of a deceased employee

Russian legislation implies that the salary is transferred to the employee to his bank account, which is linked to the bank card, or personally into the hands of the enterprise through the cash desk of the enterprise. But after the death of an employee, the situation changes and the employer is faced with the question of what to do with the salary due to him.

Important

An incorrect payment may result in additional costs and penalties!

In the area of paying the salary of a deceased employee, all employers need to be guided by the following acts and regulations:

- Article 22 of the Russian Labor Code. It obliges the employer to pay salaries to all employees in full and on time.

- Article 83 of the Labor Code of Russia regulates situations when an employment contract ceases to be valid due to circumstances beyond the control of the parties, including due to the death of an employee.

- Article 136 of the Labor Code. It is devoted to the procedure for paying wages to the employee himself and to individuals in cases where this is provided for by law.

- Article 141 of the Labor Code. It concerns the payment of wages in the event of the death of an employee, regulates its procedure, timing, and also designates the circle of persons who can apply for the money.

These articles of the Labor Code will help the employer do everything right without violating legal norms. We will help you with this too. We will devote one of the following articles to the dismissal of a deceased employee.

Procedure for payment of unpaid wages

There are often cases when the priority right to inherit unpaid wages after a deceased citizen is held not by one, but by several heirs who lived with him, as well as, in addition to them, disabled dependents who have not yet lived with him.

The unpaid settlement amount must be paid to all applicants who contacted the employer within the period established by the Civil Code of the Russian Federation. By agreement between them, the payment is made to one of them, after which it goes to the common shared property of the heirs and is divided proportionally between them in equal parts . Otherwise, the dispute is resolved through court.

Payment procedure

Wages accrued but not paid for various reasons to an employee who has died are deposited and kept in a special account until claims for payment are made by family members of the deceased or his disabled dependents.

The employer is obliged to make such a payment within one week from the date of application and submission of the relevant documents to him (Article 141 of the Labor Code of the Russian Federation). If an employer delays payment to relatives of the estimated wages of a deceased employee, then, in accordance with Art. 236 of the Labor Code of the Russian Federation, he bears financial responsibility for such actions.

But, on the other hand, the employer is not obliged to search for family members of the former employee and find out the reason for their failure to apply for payments.

Required documents

In order to receive unpaid wages, as well as compensation for unused vacation belonging to a deceased person, members of his family who lived with him and/or disabled dependents must contact his former place of work with a package of necessary documents . It includes:

- a written application for payment of uncollected settlement amounts;

- a copy of the death certificate of a relative (breadwinner);

- a copy of a document, usually a passport, identifying the person who applied;

- documents confirming the relationship and cohabitation with the deceased person of the applicant; or confirmation of the relationship of such a person to a disabled dependent who was fully supported by the breadwinner for at least one year before his death.

Accounting

The accrual of the deceased’s “settlement” is made using standard entries Dt 20,23,44,25, etc. Kt 70. If the organization creates a reserve of expenses for upcoming vacations, then compensation for unused vacation is reflected in the posting Dt 96 Kt 70. For settlements with relatives of the dismissed person on occasion upon the death of an employee, account 76 “Settlements with various debtors and creditors” is used, since they were not and are not employees of the company: Dt 70 Kt 76. Payment and closing of settlements to relatives is reflected by posting Dt 76 Kt 50, 51.

When forming a vacation reserve (estimated liability) and paying compensation from this reserve for non-use of vacation time by the deceased, a temporary difference arises between the accounting and NU. After all, the amount of this liability was attributed according to the accounting system to expenses for ordinary activities at the time of formation. In this case, the actual amounts of costs incurred are reflected in the NU.

Deferred tax assets (repayment) arising in connection with this temporary difference should be reflected in accounting: Dt 68 Kt 09 - for the amount of income tax calculated based on the amount of compensation for unused vacation.

Results

- Wages not received by the deceased, compensation for unused vacation after the registration of the procedure for his dismissal upon death are given to his relatives or dependents. First of all, this is the spouse, parents, children, according to the RF IC.

- According to the Civil Code of the Russian Federation, only those relatives who lived with him or were financially dependent on him have the right to receive the funds of the deceased.

- Property disputes between relatives are resolved by them independently, without involving the organization where the employee worked.

- The law also does not oblige representatives of the organization where the employee worked to search for relatives of the deceased. If no one has applied for the money within 4 months or management has reasoned doubts about the recipient of the funds, the money is transferred to the bank to the account of the former employee or deposited. In the future, they are automatically included in the estate of the deceased and handed over to his legal heirs.

- Personal income tax is not taken from posthumous payments to relatives, but payments to funds are calculated. Settlements with recipients of funds are carried out through account 76 BU.