When drawing up an employment contract, citizens are guaranteed payment of monetary remuneration. It includes the salary under the employment agreement, various allowances and additional payments, and when applying for annual paid rest time, the amount of vacation pay.

If at the time of termination of employment at the enterprise the employee has not fully used the guaranteed vacation days, he may be paid compensation. In the material presented you can find out how compensation for unused vacation is calculated and within what time frame it should be paid.

Legislative regulation

Labor legislation guarantees to each citizen upon dismissal the payment of all amounts due for the time actually worked. If on the last day of work an employee has at least one unused vacation day, he receives the right:

- go on vacation followed by dismissal;

- receive compensation for unused vacation.

In some cases, departmental regulations may only provide for termination of work with the actual provision of remaining days of rest. This is due to the peculiarities of budget planning and financing.

Payment of vacation pay upon dismissal, as well as any other payments, must be made no later than the last day of work at the enterprise. The specified date will be indicated in the management order on the employee’s dismissal. It is this document that the accounting department will use when calculating the amount.

Compensation for vacation pay will be provided in any case of termination of employment: upon dismissal at one's own request, upon termination of the contract at the initiative of the employer, etc.

Let's consider the order in which compensation for leave upon dismissal is paid, and what information is necessary for the correct calculation.

An example of calculating compensation for unused vacation upon dismissal based on formulas

Let's try to calculate compensation for unused vacation upon dismissal using an example, and for this we will derive the SDZ and the number of “unused” days using formulas (without a calculator).

Example: Panfilov I.L. has been working at OJSC Cinema since April 10, 2014, resigning on August 15, 2020. Annually to I.L. Panfilov. There are 28 days of rest according to the calendar. During his work at OJSC Cinema, he used 20 days in October 2014, 14 days in May 2020, 28 days in July 2020, that is, a total of 62. Monthly labor payments to I.L. Panfilov. — 30,000 rubles including bonus. Let's calculate how many rest days Panfilov has left for 2014-2016:

Over a three-year period from 2014 to 2020. Panfilov I.L. Allotted 84 days for rest (3*28), he used 62 days. The number of unused days for previous periods is 22.

How many vacation days did I.L. Panfilov accumulate? for 2020, if he worked for a full 4 months (4 months and 5 days are rounded down):

Let’s say that according to the internal rules of the organization, days for compensation upon dismissal are rounded in favor of the employee. Then for 2020 Panfilov I.L. not used 10 days. The total number of days to be reimbursed is 22 + 10 = 32 days.

Let's calculate the average earnings of I.L. Panfilov. in a day. Taking into account the salary of 30,000 rubles, in 12 months he earns 360,000 rubles:

Now it’s easy to calculate the amount of compensation for 32 days:

Before his dismissal, Panfilov will receive 32,764 rubles 50 kopecks in compensation.

Calculation and payment of compensation

Since vacation pay must be paid no later than the last day of work in the company, the accounting department must make the calculation in advance. Vacation pay upon dismissal is calculated based on the following information:

- the date of dismissal, which is recorded in the order;

- the duration of annual paid leave for a given employee - the standard amount according to the Labor Code of the Russian Federation is 28 days, but for some categories of citizens this figure is significantly higher (for example, for employees in areas equated to the Far North, an additional 14 days of annual leave are required);

- the amount of the employee’s salary for the last 12 months of work at the enterprise.

When issuing a dismissal order, HR employees must indicate the number of vacation days remaining for the employee. The remaining days are calculated based on full months of work, rounded to the full number (for example, if vacation is not used for 5 months 27 days, the figure of 6 months will be used for calculation.).

With a standard duration of rest time of 28 days, the calculation of the remaining unused vacation will be: 28: 12 x 6 = 14 days of unused vacation.

It is this figure that will be indicated in the order to terminate the employment contract with the employee, and the accounting department will use it to calculate compensation.

Accrual of vacation pay upon dismissal is based on the average daily wage of the dismissed employee. For this purpose, the accounting department uses the following formula:

- Average daily salary of an employee = FROM: 12: 29.3, where:

- OT – the total amount of monetary remuneration accrued to the employee over the last 12 months of employment;

- 12 – number of calendar months in a year;

- 29.3 – average calculated value of the number of days in a month.

Let's calculate the average daily earnings of an employee if he received 520,000 rubles during the year:

- average daily salary = 520,000: 12: 29.3 = 1478.95 rubles per day.

Leave compensation upon dismissal will be:

- 14 days of unused vacation x 1,478.95 rubles = 20,705.30 rubles.

https://youtu.be/3OSut2ut1IA

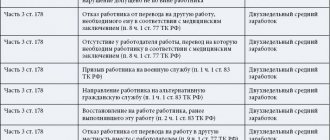

The legislative framework

Absolutely all relations between an employee and an employer are regulated by the Labor Code of the Russian Federation, according to which a citizen has the right to at least 28 days of paid leave per year, its duration may exceed the established value if there is a corresponding clause in the local regulations of the organization.

So, an employee can count on compensation for unpaid vacation in full or in part (if some of the days have already been used), in the case of:

- Termination of contractual relations by mutual consent of the parties.

- Expiration of the concluded contract.

- Termination of TD at the initiative of the employee/employer.

- Layoffs due to changes in working conditions.

- Dismissals due to violation of the conditions specified in the TD.

Paid rest becomes an employee’s right six months after the conclusion of the TD. Does this mean that an employee who quits before six months of work is not entitled to compensation? The legislation of the Russian Federation limits the right to receive such payments only for citizens who have worked for less than two weeks at a given workplace; in other cases, compensation is paid in direct proportion to the time worked.

Compensation payments are due not only to employees working at their main job full-time, but also to citizens working part-time or part-time.

Moreover, women on maternity leave can also count on compensation. This period of time is not fully included in the work experience; only the period limited by the certificate of incapacity for work is considered. It is these 140 or more days that are taken into account when calculating compensation in case of dismissal.

Examples

Ivanov V.V. worked at Kapitalstroy LLC for 3 years, 9 months and 9 days. During the entire time he worked in the organization, Ivanov was entitled to rest:

- 84 days - for 3 full years;

- 21 days - for 9 full months (days less than the accepted value are not taken into account).

Thus, the calculation of the duration of non-vacation leave will be based on 105 days.

Petrova A.V. worked at the company for 2 years, 2 months and 18 days before leaving. Since the duration of an incomplete month is more than 15 days, the calculation of vacation days will be made over 2 years and 3 months and amount to 63 days.

Nesterov V.P. leaves the company after 2 years 9 months and 13 days of work. During all this time, V.P. was on paid leave for 70 days, and his income for the year preceding his dismissal amounted to 456,876 thousand rubles. How much will the vacation compensation paid to Nesterov be? So:

- First of all, it is necessary to calculate the average daily earnings using the above formula: 456876 / 12 / 29.4 = 1295 rubles.

- Based on the specified data, we calculate the duration of rest due to the employee: 56 + 21 = 77.

- Compensation will be calculated based on 7 unused days (77 - 70).

- The amount of monetary compensation is calculated using the formula: 1295 * 7 = 9065 rubles.

Reflection in accounting

The compensation is calculated in the legally established form T-61 (calculation is possible on other forms that meet the requirements of the Accounting Law).

Compensation costs are classified as labor costs and are reflected in transactions as follows:

| Operation | Account number |

| Calculation of compensation upon dismissal | Dt 20 Kt 70 |

| Issuance of cash or transfer to the employee’s bank account | Dt 70 Kt 50.51 |

| Income tax withholding | Dt 70 Kt 68 |

| Transfer of income tax | Dt 68 Kt 51 |

| Calculation of insurance premiums | Dt 20 Kt 69 |

| Transfers of insurance premiums | Dt 69 Kt 51 |

https://youtu.be/y_vlVUVTiKo

Is it possible to replace it with monetary compensation?

Current legislation provides for the replacement of rest days with monetary compensation in the following cases:

- The duration of paid vacation is more than 4 weeks. Thus, only part of the vacation exceeding 28 days is subject to monetary compensation; the minimum value is not subject to monetary compensation.

- Dismissal of an employee. In such cases, absolutely all vacation days accumulated by the citizen during his work are subject to compensation.

So, monetary compensation for days not used for rest is possible only in cases where the duration of vacation due to an employee exceeds 4 weeks. It does not matter whether we are talking about extended rest time (allowed to disabled people or minors) or additional (when working in dangerous conditions, in the Far North or during irregular working hours).

The company's management has the right to replace paid vacations with cash payments, but is not obliged to do so, the only exception being the dismissal of an employee.

In some cases, even with mutual consent of the employee and the employer, reimbursement of part of the paid time off for some categories of citizens is impossible. These include:

- workers who have not reached the age of majority;

- pregnant women;

- workers who work in hazardous conditions or have an increased workload.

The last category requires more detailed consideration, since the minimum duration of additional rest is also established by law and is 7 days. It is this period that cannot be compensated; time exceeding the minimum value is subject to compensation in full.

You can find out what payments are due upon dismissal from this video.

https://youtu.be/gXAUMelo9as

Types of vacation

The Russian Federation provides for several types of vacations, differing in purpose, duration and pay. Let's look at each type in more detail.

Basic

This type of leave is legally guaranteed to absolutely all employed citizens and has a minimum duration of 28 days. For some categories of employees, based on legislative acts or local documents of the enterprise, the main paid rest can be extended and last for at least 30 calendar days.

The conditions for providing such rest imply drawing up a vacation schedule for employees of the organization, however, in some cases, rest days can be provided to an employee out of turn, with the prior consent of management.

Additional

This leave includes work in hazardous conditions, contact with hazardous substances, irregular work schedules, and imply the provision of additional rest time for the employee.

The duration of additional rest is established by the Labor Code (for categories of workers exposed to danger and additional loads listed in the code) or local acts of the organization (for employees working irregular working hours).

Other

Study leave is provided for officially employed citizens receiving secondary vocational or higher education.

Such time off can be both paid and unpaid, and is provided upon a written application from the employee and the original summons certificate provided. Their number directly depends on the duration of the training session.

Pregnant women are granted leave in connection with pregnancy and childbirth. According to the Labor Code, while at 30 weeks of pregnancy, on the basis of a sick leave, the expectant mother goes on vacation for a duration of 140 days.

This time can be extended if complications arise during labor or if two or more children are born. After the above period of time, the employee is given a period to care for a child of up to 1.5 years, which is paid at the rate of 60% of the average monthly earnings. Absence from work from 1.5 until the child reaches 3 years of age is not paid.

Leave without preserving the average monthly salary is granted at the initiative of an employee who has compelling reasons for receiving unpaid time off. The duration of such “rest” is not regulated by the state and remains at the discretion of the organization’s management, with the exception of certain categories of citizens and reasons specified by law.

Reflection in 6-NDFL, taxes and insurance premiums

Compensation for missed vacation is reflected in Form 6-NDFL as follows:

| Line numbers | Input value |

| 020 | Amount of payments for the billing period |

| 040 | Amount of income tax on accrued funds |

| 070 | Amount of income tax withheld |

| 100 | Date of actual receipt of funds |

| 110 | Income tax withholding date |

| 120 | Date by which income tax must be remitted |

| 130 | Amount to be paid (salary + compensation) |

| 140 | Amount of income tax withheld from salary and compensation |

Correct calculation of the amount of compensation is very important for determining the base and further calculation of tax and insurance payments. A feature of the transfer of income tax from compensation upon dismissal is the timing of payments - unlike wages, the withheld amounts must be transferred to the fund on the day the employee receives compensation, and the date of receipt is considered to be:

- the day on which the amount was transferred to the bank account of the resigning person;

- the day of receipt of settlement payments at the organization's cash desk;

- the day of receipt of funds at the bank's cash desk, from the organization's current account, according to a payment order.

Cash compensation for unused time off is subject to insurance contributions in full and includes transfers to health and social insurance funds and pension funds. In addition, compensation is included in the amount of income of an individual, which means it is taken into account when deducting alimony.

Documents for download (free)

- Form form No. T-61

- Sample form T-61