Author of the article: Elena Petrenko Last modified: January 2020 10598

According to Art. 140 of the Labor Code of the Russian Federation, the responsibilities of employers include full settlement with employees upon termination of employment contracts on the last working day. If compensation upon dismissal is not paid , citizens can appeal to the State Labor Safety Inspectorate or the court. To do this, it is important to know the features of drawing up and submitting an application, as well as the step-by-step algorithm of actions.

When is monetary compensation paid for unused vacation?

Compensation for unused vacation upon dismissal must be paid to the employee on the day of dismissal.

Cash compensation in lieu of vacation time that exceeds 28 calendar days is usually paid along with wages for the corresponding month. In this case, payment of monetary compensation, which is associated with the dismissal of an employee, is carried out at the request of the employee.

The application can be written either printed or handwritten. If the application is written by hand, then it is drawn up exclusively in A4 format with a blue pen. Any other color ink is not acceptable.

The application must provide the following information:

Title of the request. Indicate that this is a statement.

To whom is it addressed? Indicate the last name, first name, patronymic and position of the manager (this could be: general director, head of department, president, etc.)

Organization. Indicate the name of the organization.

From whom. Here you must indicate the position of the employee and his last name, first name, patronymic.

Text. The test should include a request for payment of compensation for unused vacations. In this paragraph, you must indicate the number of days for which the payment should be accrued and refer to Article 126 of the Labor Code of the Russian Federation.

Date and signature of the employee with transcript.

If additional days of vacation subject to payment have been accumulated over several years, then the application should indicate all days indicating the previous years in which the days of unused vacation fell.

How is non-vacation paid upon dismissal in 2020?

Upon dismissal, the employee is paid compensation for vacation days not taken during the entire period of work (Article 127 of the Labor Code of the Russian Federation). In this case, we are talking not only about basic, but also about additional paid leave. Payment for unused vacation upon dismissal is made regardless of the reason for termination of the employment relationship - compensation is due even if the employee is fired as a result of guilty actions (for example, for absenteeism).

To calculate compensation payments due upon dismissal for unused vacation days, you must first find out how many days of legal rest the employee has that were not used. To do this, you will need to determine the vacation period, which gives the right to use the vacation days prescribed in accordance with the employment contract and the law.

What is included in vacation time

When calculating the length of service that grants the right to leave, you must adhere to the rules established by Art. 121 TK. This experience includes:

- actual period of work;

- the time of absence from the workplace when the employee retains his position, including the period of vacation and rest on weekends;

- the period of forced absence from work if there was an illegal dismissal, and the employee was subsequently reinstated;

- the period of inadmissibility to work if the employee was suspended due to failure to undergo a mandatory medical examination through no fault of his own;

- the period of being on leave without pay for a total length of no more than 14 calendar days for the entire year (counted from the date of employment).

This is important to know: How many days in advance is a vacation order made?

The length of service giving the right to paid leave cannot include:

- time spent on leave without pay exceeding 14 days;

- period of absence from work without good reason;

- time spent on maternity leave (except for the period when, during parental leave, the employee worked part-time/week - on the basis of Part 3 of Article 93 of the Labor Code).

The procedure for reflecting compensation for unused vacation in personnel documents

If the organization paid the employee, at his request, compensation for part of his unused vacation, then this fact is reflected in the employee’s personal card.

In the employee’s personal card in form N T-2, approved by Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 N 1, in section VIII “Vacation” the following is indicated:

§ in column 4 “Number of calendar days of vacation” - the number of days replaced by compensation;

§ in columns 5-6 “Start date” and “End date” - a comment that vacation days have been replaced by compensation;

§ in column 7 “Grounds” - an order (with details) to replace vacation with compensation.

In the vacation schedule in form N T-7, approved by Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 N 1, in column 10 “Note” it should be noted that part of the vacation was replaced by monetary compensation indicating a specific number of days.

The details of the order to replace vacation with compensation are also reflected here.

Calculation of compensation for unused vacation

To determine the amount of compensation for unused vacation both in relation to days of rest exceeding standard vacation and upon dismissal, it is necessary to calculate the employee’s average salary for 1 day.

The employee’s income that was received by him in the 12 months preceding the payment of compensation is taken as the basis.

To determine the average daily income of an employee, the income for the year must be divided by 12, and the resulting figure, in turn, divided by 29.3.

Thus, the average daily earnings of an employee = D / 12 / 29.3.

In this formula, D is the employee’s annual salary, 12 is the number of months in the year, and 29.3 is the value established in the regulation, which is the average number of days in each month of the year.

After determining the average daily earnings, all that remains is to multiply the resulting amount by the number of days of unclaimed vacation, and the result will be the amount of compensation for unused vacation payable to the employee.

How are payments for unused vacation time calculated?

The employer is obliged to pay, upon dismissal of an employee at his own request, payment for time worked, as well as compensation for unused vacation. If everything is obvious with payment for time worked, then compensation for vacation pay for unused rest days needs to be dealt with in more detail.

So, according to Art. 114 of the Labor Code of the Russian Federation, during the vacation the employee retains his average salary . Accordingly, upon termination of an employment relationship, compensation for unused vacation is calculated based on the employee’s average salary.

Articles on the topic (click to view)

- Fine for late payment of vacation pay

- What to do with unused vacation

- What to do if your employer does not pay vacation pay

- How long after employment is vacation allowed?

- Is maternity leave taken into account when calculating pensions?

- Accounting for compensation for unused vacation

- Dismissal while on maternity leave

In accordance with Art. 139 of the Labor Code of the Russian Federation, when calculating average earnings, wages for the last twelve months are taken into account. The amount of payments is divided by the number of months in a year - 12, and by the average number of calendar days in a month - 29.3 (read about how to calculate compensation for leave upon dismissal if an employee worked for 11 months or less).

To correctly calculate the amount of compensation, you first need to correctly calculate the employee’s labor income. The amount includes:

- wage;

- bonuses provided for in the employment contract;

- other payments, except for sick leave, maternity leave, and business trips.

To calculate the number of unused vacation days, you need:

- Divide the number of days of annual leave by twelve months. This way we can find out how many days of vacation the employee is entitled to per month worked.

- We multiply the result by the number of months worked.

- Subtract the number of vacation days already used from the result obtained. The resulting figure is the number of days of unused vacation.

To calculate the vacation days to which an employee is entitled, the “Rules on regular and additional vacations” approved by the People's Commissariat of Labor of the USSR on April 30, 1930 are applied. They stipulate that if an employee worked less than half of the current month, then he is not included in the calculations, but if more than half or exactly half is included, he is included.

Moreover, if there are twenty-nine days in a month, fifteen days are considered half, and if there are thirty-one days, then half of such a month is sixteen days.

Thus, in order to calculate the amount of compensation for unpaid vacation upon voluntary dismissal, you must:

- Calculate the average wage per day. To do this, divide the amount of wages for the last 12 months by 12, and then divide by another 29.3.

- Calculate the number of unused vacation days. To do this, divide the required number of vacation days per year by 12 and multiply by the number of months actually worked. From the result obtained, subtract the number of days off.

- We multiply the numbers calculated in the first two paragraphs. The final value will be the amount of compensation due.

In addition to unused vacation time, an employee may have accrued unused vacation time. They appear to the employee due to:

- with overtime work;

- with going to work on holidays and weekends;

- on duty;

- with participation in donor events.

As a rule, such time off is accumulated in order to then use it to extend the next vacation.

Expert opinion

Lebedev Sergey Fedorovich

Practitioner lawyer with 7 years of experience. Specialization: civil law. Extensive experience in defense in court.

But a situation may arise when an employee decides to resign of his own free will, but the accrued time off remains. The Labor Code of the Russian Federation does not contain provisions on compensation for time off in cash upon dismissal.

In this case , it is important that the right to time off is documented. That is, if this is time off due to participation in a donor event, then it will be confirmed by a doctor’s certificate. Otherwise, you may not receive payment for time off even through the court.

Therefore, if an employee decides to resign of his own free will, it is better to use all accumulated time off before writing an application to terminate the employment relationship.

Taxation of compensation for unused vacation

Personal income tax

When paying compensation for unused vacation, the employer is required to calculate and pay personal income tax on this amount.

Since compensation for unused vacation upon dismissal must be paid to the employee on the day of dismissal, the personal income tax withheld from it must be transferred to the budget upon its actual payment, in particular, no later than the day of actual receipt of cash from the bank for payment compensation either on the day of transfer of this amount to the employee’s account or on the employee’s instructions to the accounts of third parties.

Income tax

Compensation for unused vacation is accounted for as labor costs for income tax purposes on the date of accrual.

In this case, the amount of compensation for unused vacation is included in expenses, even if the organization creates a reserve for vacation payment in tax accounting;

This is important to know: Financial assistance before vacation

Single tax when applying the Simplified Taxation System

Compensation for unused vacation is taken into account as labor costs for the purposes of calculating tax under the simplified tax system with the object “income reduced by the amount of expenses” on the date of payment to the employee of compensation for unused vacation.

Insurance premiums

Compensation for unused vacation is subject to insurance premiums (including injuries) in full.

This applies to compensation for unused vacation without dismissal, and to compensation for unused vacation upon dismissal of an employee.

general information

All working people have the right to claim twenty-eight days of rest per year. They add up as follows:

Some categories of citizens are also entitled to additional rest. Its duration is determined by employment contracts.

A person does not always take the required rest completely. Therefore, at the time of dismissal, people have unused periods. Their employer includes them in the accruals.

Suppose a person got a job at a company at the beginning of January and by the end of December of the same year decided to quit. During this time he did not rest, although by law he had the right to do so after six months. It turns out that at the time of dismissal, the employer is obliged to pay him for unused vacation for 28 days. If the same employee quit after six months, he would receive 14 days of compensation. After all, for every month of work there are 2.33 days of rest.

Important! Compensation for leave is not paid upon dismissal when a person has worked at the enterprise for less than half a month or when the allotted rest has been fully used earlier. The law does not establish a specific period for using the required rest.

But when the employee pays off, the employer is obliged to pay them at the time of dismissal.

This is important to know: Is vacation available to an external part-time worker?

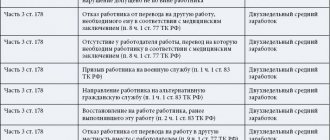

The procedure for reflecting compensation for unused vacation in accounting

The accrual of compensation for unused vacation is reflected in accounting by the following entries:

| Wiring | Operation |

| Debit account 20 (23, 25, 26, 44) – Credit account 70 | Compensation accrued for unused vacation |

| Debit account 70 – Credit account 68/NDFL | Personal income tax withheld from compensation for unused vacation |

| Debit account 20 (23, 25, 26, 44) – Credit account 69 | Insurance premiums are calculated from the amount of compensation for unused vacation |

| Debit account 70 – Credit account 50 (51) | Compensation for unused vacation was paid to the employee |

If the employer does not pay compensation for unused vacation

If the employer does not pay compensation for unused vacation, the employee can do the following:

Write a claim to the employer demanding compensation for unused vacation.

Contact the Labor Inspectorate with a statement about the violation of your labor rights. This can be done by sending an application by email, drawing up a paper application, or visiting the labor inspectorate in person. Your application will be considered within 30 days. During the consideration of the employee’s appeal, the Labor Inspectorate staff will make a request to the employer in order to find out the reason for non-payment of vacation pay and will inform the employee in writing about the results of the inspection.

Go to court. Unlike the Labor Inspectorate, the court will not be able to hold the employer accountable. But the court may order the employer to pay the entire amount of vacation pay due to the employee. In the statement of claim, the employee should indicate the violated rights and put forward a demand to recover compensation from the organization for unused vacation. After a court decision is made, on the basis of a writ of execution, the company’s accounts will be seized and the entire amount of vacation pay due to the employee will be paid by the employer.

Solving the problem through court

To recover penalties and unpaid compensation, you can apply to the district court at the place of registration of the employer. If the main office of the company is located in another city, it is allowed to file a claim at the location of the branch (Article 29 of the Code of Civil Procedure of the Russian Federation).

The step-by-step procedure looks like this:

- The plaintiff independently determines the amount of unpaid compensation and penalties - they will be needed when filling out the claims.

- A lawsuit is being filed. It indicates the period of work at the enterprise, full name. director (defendant), position of the plaintiff. The situation is described in detail: under what circumstances compensation is not paid, references to legislative norms, an indication of the manager’s refusal to pay. At the end, claims are made: to pay compensation and a penalty for it. The date of compilation and signature of the initiator is required.

- Filing a claim in court. To do this, you must appear in person at the government agency or send documents with a list of attachments by registered mail.

- Acceptance of materials for production. The judge is given 5 days to do this, after which a decision is made to begin the proceedings. The parties receive notices with the date of the first meeting.

- Consideration of the case in the courtroom. The employer can come in person or entrust the representation of interests to another person. If the petition for consideration in absentia is satisfied by the plaintiff or the defendant, the case is considered without their participation.

- Adjudication. The operative part is announced. After 1 month, the decision comes into force, and the plaintiff is issued a writ of execution. He has the right to keep it with him or present it to the bailiffs for forced retention of the debt if the claims are fully or partially satisfied.

Expert commentary

Platonov Alexander

Lawyer

If the court refuses to satisfy the requirements, the decision can be appealed within a month through a higher authority.

Statement of claim

Along with the claim, a passport, salary certificates, and an employment contract are provided. Copies are made of the documents, and the originals are given to the owner.

State duty

According to Art. 333.36 of the Tax Code of the Russian Federation, plaintiffs in labor disputes are exempt from paying state duty.

Application deadlines

As mentioned earlier, plaintiffs in cases of collection of payments can appeal to the courts within a year from the date when the money should have been transferred by law. If the deadline for filing a claim is missed for valid reasons, a restoration procedure is first carried out, and only after that documents are submitted to the court to consider the case.

If the employer fails to pay compensation for unused vacation upon termination of the employment contract, the employee has the right to contact the labor inspectorate or a judicial authority to resolve the dispute. In addition to the amount of compensation, the employer is charged a penalty for each day of delay at the initiative of the citizen whose rights were violated.

Administrative liability of the employer for non-payment of compensation for unused vacation

Administrative liability for violation of labor legislation is established by Article 5.27 of the Code of Administrative Offenses of the Russian Federation.

According to Article 5.27 of the Code of Administrative Offenses of the Russian Federation, violation of labor legislation entails the imposition of an administrative fine

for officials in the amount of 1000 to 5000 rubles;

for persons carrying out entrepreneurial activities without forming a legal entity - from 1000 to 5000 rubles. or administrative suspension of activities for up to 90 days;

Violation of labor legislation by an official who has previously been subjected to administrative punishment for a similar administrative offense entails disqualification for a period of 1 to 3 years.

In addition, unscheduled inspections may be carried out in relation to the employer’s activities by tax inspectors, labor inspectors and prosecutors.

Still have questions about accounting and taxes? Ask them on the “Salaries and Personnel” forum.

About granting leave

According to the rules of Art. 122 of the Labor Code of the Russian Federation, paid leave must be provided to the employee annually. A similar provision is contained in Art. 3 of ILO Convention No. 132 “On Paid Leave,” which was ratified by the Russian Federation by Federal Law No. 139-FZ of July 1, 2010 and came into force on September 6, 2011.

Employees are provided with annual leave while maintaining their place of work (position) and average earnings.

In exceptional cases, with the consent of the employee, it is allowed to transfer vacation to the next working year if the vacation was not used by him in the current year (Part 3 of Article 124 of the Labor Code of the Russian Federation).

According to Part 4 of Art. 124 of the Labor Code of the Russian Federation, failure to provide annual paid leave for two years in a row is prohibited. The employer is obliged to take into account unused days of annual paid leave when drawing up a vacation schedule. At the same time, the vacation schedule is mandatory for both the employer and the employee (Part 2 of Article 123 of the Labor Code of the Russian Federation). The employer must provide the employee with leave without his application, since leave is granted on the basis of the vacation schedule, and not on the basis of the employee’s application.

An employee submits an application regarding leave when he has the right:

- for early granting of leave;

- to choose the time of vacation;

- to extend or postpone vacation (for example, in case of illness).

In Letter No. 1921-6 dated 06/08/2007, Rostrud clarified that annual leave for previous working periods can be provided either as part of the leave schedule for the next calendar year, or by agreement between the employee and the employer. An employee can take several vacations during a calendar year. This issue is resolved by agreement between the employee and the employer or based on the vacation schedule. If an employee does not use all vacations for previous years, he has the right to receive monetary compensation for unused vacations upon dismissal.