Just as in the case of fixed assets, the cost of an intangible asset is compensated by depreciation. Amortization of intangible assets (IIA) allows you to gradually transfer the value of assets to the cost of production.

Amortization of intangible assets is accrued monthly, the calculated deductions are written off as enterprise expenses. How the depreciation of intangible assets is accounted for, what accrual methods exist and what entries are made in accounting - let's look at these issues in more detail.

Amortization of intangible assets

First of all, it is worth noting that the calculation of depreciation of intangible assets is regulated by PBU 14/2007.

When accepting an intangible asset for accounting, it is necessary to determine the period during which the object can be used and receive economic benefits from it, that is, its useful life.

It is worth noting that there are intangible assets for which it is not possible to determine this period; depreciation is not accrued for such objects.

We begin to calculate depreciation starting from the month that follows the month in which the intangible asset was accepted for accounting.

https://youtu.be/E0Qqp5x31vw

Instructions for account 05 Amortization of intangible assets

According to the instructions for using the chart of accounts for accounting the financial and economic activities of organizations in accordance with Order No. 94n dated October 31, 2000:

Account 05 “Amortization of intangible assets” is intended to summarize information on depreciation accumulated during the use of the organization’s intangible assets (with the exception of objects for which depreciation charges are written off directly to the credit of account 04 “Intangible assets”).

The accrued amount of depreciation of intangible assets is reflected in accounting under the credit of account 05 “Amortization of intangible assets” in correspondence with the accounts of production costs (selling expenses).

Upon disposal (sale, write-off, transfer free of charge, etc.) of intangible assets, the amount of depreciation accrued on them is written off from account 05 “Amortization of intangible assets” to the credit of account 04 “Intangible assets”.

Analytical accounting for account 05 “Amortization of intangible assets” is carried out for individual objects of intangible assets. At the same time, the construction of analytical accounting should provide the ability to obtain data on the depreciation of intangible assets necessary for managing the organization and drawing up financial statements.

Amortization of intangible assets: calculation methods

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Three methods have been established for calculating depreciation of intangible assets: the straight-line method, the reducing balance method and the method of writing off value in proportion to the volume of production.

The organization independently determines for itself the most suitable accrual method.

These methods are discussed in detail in the article: methods for calculating depreciation of fixed assets.

Let us remember that the straight-line method assumes uniform depreciation over the entire useful life. That is, every month the same amount is written off to sales expenses, account 44 (for trade organizations) or to the cost of production, account 20 (for manufacturing enterprises).

This amount is determined at the beginning of the asset's use by dividing the original cost by the total period of use. The resulting amount will be the monthly depreciation deduction.

The declining balance method is where depreciation is calculated based on the asset's residual value and useful life.

When calculating monthly, the residual value of intangible assets at the beginning of the month is taken and multiplied by a coefficient that cannot be more than 3 (the organization sets it for itself), then the resulting value is divided by the useful life in months. The resulting depreciation amount is written off as expenses. Thus, every month depreciation charges will be less and less and by the end of the period of use of the intangible assets will be reduced to zero.

The last method of writing off the cost in proportion to the volume of production assumes that depreciation depends on the ratio of the volume of production that is planned to be produced over the entire service life and that actually produced per month.

With this method, monthly deductions are determined as follows: the volume of products (work) produced per month (in rubles) is multiplied by the actual cost of intangible assets and divided by the estimated volume of production for the entire period of use (in rubles).

The choice of method for calculating depreciation of intangible assets must be made after analyzing the economic feasibility of each method.

The linear method is convenient because we write off the same amount every month and do not need to constantly calculate it.

The second method is convenient if you need to write off the cost of an asset as early as possible and return the money for further investment, for example, to purchase a new intangible asset or to improve an existing one.

The chosen method must be reflected in the accounting policy of the enterprise; read about the accounting policy here.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Amortization of intangible assets: straight-line method

Source: Glavbukh magazine

When putting it on its balance sheet, an organization must determine the useful life of an intangible asset or decide that it is impossible to determine it (clause 25 of PBU 14/2007). Determine the useful life of intangible assets based on:

- the period during which the organization will own exclusive rights to the object. This period is indicated in the documents of protection (patents, certificates, etc.) or it follows from the law (for example, the exclusive rights of the database manufacturer are valid for 15 years (Article 1335 of the Civil Code of the Russian Federation));

- the period during which the organization plans to use the facility in its activities;

- the quantity of products or other physical indicator of the amount of work that the organization intends to obtain using this asset.

If it is impossible to determine the useful life of an intangible asset, then there is no need to charge depreciation on it (clause 23 of PBU 14/2007). Such objects are called assets with an indefinite life (clause 25 of PBU 14/2007).

Factors that interfere with determining the useful life are listed in the Explanations to the Balance Sheet and the Statement of Financial Results (clause 41 of PBU 14/2007). There is also no need to charge depreciation on intangible assets of a non-profit organization (clause

24 PBU 14/2007).

Start of depreciation

Accrue depreciation from the month following the one in which the objects were accepted for accounting as intangible assets.

In the future, depreciation should be calculated monthly, regardless of the organization’s performance. Such rules are established by paragraphs 31 and 33 of PBU 14/2007.

During the useful life of an intangible asset, depreciation is not suspended (paragraph 2, clause 31 of PBU 14/2007).

Stopping depreciation

Stop accruing depreciation from the month following the one in which the cost of the intangible asset was repaid or it was written off from accounting (clause 32 of PBU 14/2007).

Accounting for depreciation of intangible assets

Depending on the nature of the use of the intangible asset, include the depreciation accrued on it either as part of expenses for ordinary activities, or as part of other expenses, or as part of capital investments. In this case, make the following entries:

Debit 20 (23, 25, 44...) Credit 05 – depreciation has been accrued on intangible assets used in the production of goods (performance of work, provision of services) or in trading activities;

Debit 08 Credit 05 – depreciation was accrued on intangible assets used in the creation (modernization, reconstruction) of other non-current assets;

Debit 91-2 Credit 05 – depreciation has been accrued on intangible assets used in other activities (for example, on intangible assets provided for use by other persons).

It is impossible to charge amortization on the credit of account 04 “Intangible assets”, that is, reducing the initial cost of an asset from January 1, 2008. PBU 14/2007 no longer provides for this method of calculating depreciation.

Methods for calculating depreciation

In accounting, depreciation on intangible assets can be calculated:

- in a linear way;

- reducing balance method;

- by writing off the cost in proportion to the volume of products (works).

The organization must choose the method of calculating depreciation that will most accurately reflect the receipt of benefits from its use. If an organization cannot reliably determine the order in which benefits will flow, then use the straight-line method. Such rules are established by paragraph 28 of PBU 14/2007. Record your choice in your accounting policy.

Amortization of intangible assets using the straight-line method

To calculate depreciation using the straight-line method, you need to know the original cost of the intangible asset (current market value if the asset is revalued) and its useful life. The organization is obliged to use this method for depreciation of business reputation (clause 44 of PBU 14/2007)

Determine the depreciation amount for the month using the formula:

| Amortization amount per month of intangible asset (months) | = | Initial (current market) value of an intangible asset | : | Useful life of an intangible asset (months) |

The linear method of calculating depreciation of intangible assets is used in both accounting and tax accounting.

The advantage of the straight-line method of calculating depreciation is its ease of application: the cost of an intangible asset is repaid evenly over its entire useful life.

Therefore, it is used in cases where it is difficult to predict future revenues from the use of an asset (clause 28 of PBU 14/2007). In addition, using the linear method in accounting and tax accounting will allow you to avoid temporary differences.

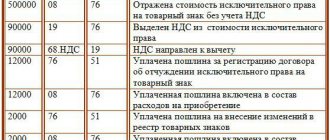

Example ZAO Alfa acquired exclusive rights to a trademark. The organization cannot predict the volume of production and sales of products in which this trademark will be used.

Therefore, it was decided to depreciate the object using the straight-line method in both accounting and tax accounting.

The initial cost of exclusive rights, formed in accounting and tax accounting, is the same and amounts to 500,000 rubles.

https://youtu.be/GVK17Umy2jY

The useful life of exclusive rights to a trademark in accounting and tax accounting is 11 years (132 months).

The amount of monthly depreciation in both accounting and tax accounting was: 500,000 rubles. : 132 months = 3788 rub.

VAT during the transition from the simplified tax system to the special tax system • Accounting in a non-profit organization • Declaration of divisional property tax • Purchase of real estate • Criteria for controlled transactions • Standard deduction for the birth of a child • Information about counterparties • Advance in EURO and payments in foreign currency • Average number of individual entrepreneurs Use employees' property

Source: https://otchetonline.ru/art/buh/45644-amortizaciya-nematerial-nyh-aktivov-lineynyy-sposob.html

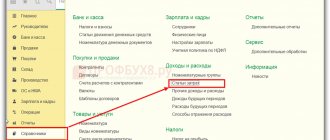

Amortization of intangible assets: entries

It is convenient to use specially created account 05 “Amortization of intangible assets” to account for deductions. On the credit of this account, depreciation is accumulated and written off to the debit of accounts 20 or 44.

Postings:

D20 (23, 25, 26) K05 – depreciation was accrued for intangible assets for a manufacturing enterprise.

D44 K05 – for a commercial enterprise.

When disposing of (writing off) an intangible asset, the depreciation accumulated over the entire period of use is written off from the debit of account 05 to the credit of account 04, after which the residual value of the object is determined, at which it will be written off. It is possible to write off the cost of an object directly from the account of this object using posting K04 D 20 (44).

Account 05 Amortization of intangible assets

Depreciation for each intangible asset must be accrued monthly, starting from the month following the month when the intangible asset was accepted for accounting and its value was reflected in account 04 “Intangible assets”.

Depreciation of intangible assets is accrued over their specified useful life. Not accrued for intangible assets with an indefinite useful life.

The amortization period for the acquired business reputation of an organization is always set equal to 20 years, but not more than the life of the organization.

Depreciation can be carried out in three ways: linear, reducing balance method, and write-off method in proportion to the volume of production (work).

Depreciation on positive goodwill is calculated using the straight-line method. Negative business reputation in full is attributed to the financial results of the organization in the form of other income.

The depreciation of intangible assets is reflected by posting:

Debit 20,23,25,26,…. Credit 05 - amortization has been accrued on an intangible asset.

Debit 08 Credit 05 - depreciation has been accrued on intangible assets used in the process of creating non-current assets: other intangible assets or fixed assets.

Debit 97 Credit 05 - depreciation has been accrued on intangible assets used in the performance of work, the costs of which are taken into account as deferred expenses.

When selling intangible assets, writing off, gratuitously transferring or transferring as a contribution to the authorized capital, the following entry is made:

Debit 05 Credit 04 - depreciation of intangible assets is written off to reduce its residual value.

open library of educational information

Concept and types of intangible assets.

Intangible assets include property that simultaneously meets the following conditions:

– does not have a material (physical) structure;

– can be separated from other property;

– intended for use in the production of products, performance of work or for the management needs of the organization;

– used for a long time (over 12 months);

– the organization does not intend to subsequently resell this property;

– capable of bringing economic benefits to the organization;

– there are documents confirming the existence of the asset itself and the organization’s exclusive rights to the results of intellectual activity (patents, certificates, etc.).

In accordance with the above conditions, the following intellectual property objects are classified as intangible assets:

– the exclusive right of the patent holder to an invention, industrial design, utility model;

– exclusive copyright for computer programs, databases;

– the author’s property right to the topology of integrated circuits (the arrangement of the elements of an integrated circuit recorded on a material medium);

– the exclusive right of the owner to the trademark and appellation of origin of goods;

– the exclusive right of the patent holder to selection achievements;

– business reputation of the organization and organizational expenses.

The business reputation of an organization is the difference between the purchase price of the organization (as an acquired property complex as a whole) and the book value of all its assets and liabilities. The object of intangible assets is a positive business reputation, which is considered as a premium to the price paid by the buyer in anticipation of future economic benefits.

Organizational expenses are the costs of advertising, preparation of documentation and other expenses of the organization during the period of its creation.

Intangible assets are used for a long time, and during this time their value is transferred evenly (monthly) to the products produced or work performed. This process is commonly called amortization of intangible assets.

Amortization of intangible assets is carried out using one of the following methods:

– linear method;

– reducing balance method;

– a method of writing off cost in proportion to the volume of products (works).

The annual amount of depreciation charges is determined:

– with the linear method – based on the initial cost of intangible assets and the depreciation rate calculated based on the useful life of this object;

– with the reducing balance method – based on the residual value of intangible assets at the beginning of the reporting year and the depreciation rate calculated based on the useful life of this object;

– when writing off the cost in proportion to the volume of products (works), depreciation charges are calculated based on the natural indicator of the volume of products (works) in the reporting period and the ratio of the initial cost of the intangible asset and the estimated volume of products (works) for the entire useful life of the intangible asset.

During the reporting year, depreciation charges on intangible assets are accrued monthly, regardless of the calculation method used, in the amount of 1/12 of the annual amount.

The useful life of intangible assets is the period during which their use generates income.

The useful life of intangible assets is determined based on:

– the validity period of the patent, certificate and other restrictions on the period of use of intellectual property;

– the expected period of use of this object, during which the organization can receive income.

The useful life of intangible assets is determined by the organization itself. If it is difficult to establish this period, it is taken as 20 years. The useful life of intangible assets cannot exceed the life of the organization.

Amortization of intangible assets – Current accounting

Amortization of intangible assets is calculated monthly regardless of the company's performance. The legislation does not provide for the possibility of suspending depreciation. It begins to be accrued from the 1st day of the month, which follows the month in which a particular object is reflected as part of intangible assets.

Intangible assets are reflected in the balance sheet at their residual value. This is the original cost minus the depreciation accrued on intangible assets. The procedure for its calculation is regulated by section IV of PBU 14/2007. Let's look at examples of calculating depreciation of intangible assets.

EXAMPLEIn February, a company acquired exclusive rights to a trademark. In March, its value was reflected as part of intangible assets on account 04 “Intangible assets”. Depreciation on the trademark begins to be calculated in April.

Depreciation is stopped on the 1st day of the month following the month in which the cost of the intangible asset was fully repaid or it was written off from the company’s balance sheet (for example, upon its sale or gratuitous transfer).

EXAMPLE A company sold exclusive rights to a computer program. The transfer of rights took place in August. Starting from September, depreciation on this intangible asset is not charged. Moreover, for August it must be accrued in full, regardless of the date when the exclusive rights to the program transferred to the buyer.

The legislation establishes three methods for calculating depreciation:

- linear;

- reducing balance;

- proportional to the volume of products produced.

The specific method of depreciation is determined as an element of accounting policy. At the same time, it can be different for different intangible assets (for example, for computer programs - linear, for trademarks - proportional to the volume of products produced).

The choice of method for determining depreciation is made based on the calculation of the expected receipt of future economic benefits. So, if it is planned to sell 1000 units of goods using a particular trademark, then depreciation on it should be calculated in proportion to the products produced.

A company must change the method of depreciation of intangible assets if the calculation of the expected receipt of future economic benefits from the use of the asset has changed significantly. Note that if it is not possible to reliably determine future economic benefits, then depreciation is calculated in only one way - linear.

When using the first two methods, the company must establish the useful life of the intangible asset. At the same time, intangible assets for which this period cannot be determined are not depreciated.

However, if at some period of time the company has the opportunity to establish the “useful” life of an asset, then it has the right to begin charging depreciation on it.

The procedure for reflecting depreciation on account 05

Depreciation amounts are credited to account 05 at certain regular intervals. Much depends on which depreciation method was chosen. In debit there are cost accounts that illustrate the volume of expenses of a production or sales nature.

When an intangible asset is disposed of, the depreciation amount that has already been formed on account 05 is written off to the credit of account 04. The final write-off is carried out at the residual value.

Account 05 analytics is always carried out for each individual asset. This is necessary so that the depreciation amount is calculated taking into account the useful life of the production unit.

The need for account 05 is due to the fact that any property has its own service life. The further you go, the less effective this or that object will be in operation. The loss of functionality is documented, gradually leading to depreciation and then write-off of the asset.