Write-off of under-depreciated fixed assets

What is important for an accountant to remember when writing off an underdepreciated fixed asset?

The loss from write-off is accepted in both accounting and tax accounting. Moreover, at the same time. And the cost of materials remaining from liquidation in both accounts increases the income of the enterprise. When writing off, you need to be prepared for the fact that tax authorities will demand that VAT be restored from the residual value of the object. However, this can and should be argued. Let's consider this common situation. Due to moral or physical wear and tear, the organization writes off a fixed asset whose useful life has not yet expired. For clarity, we will analyze the features of accounting and taxation of this operation using a specific example.

Subtleties of accounting

In February 2004, the organization liquidated a car that was physically worn out and not used in production. The liquidation is carried out by the repair shop, the cost of the work was 3,000 rubles. The initial cost of the car according to accounting and tax records is 200,000 rubles, the amount of accrued depreciation (up to February 2004 inclusive) is 150,000 rubles.

As a result of liquidation, spare parts with a market value as of the date of liquidation of 2,000 rubles were capitalized. and scrap metal worth 800 rubles.

According to the accounting policy of the organization, income and expenses for profit tax purposes are determined using the accrual method.

To account for the movement of fixed assets, the organization uses subaccounts:

01-1 “Fixed assets in operation”;

01-2 “Disposal of fixed assets.”

The following entries were made in accounting:

– 200,000 rub. – the initial cost of the retiring vehicle is reflected;

– 150,000 rub. – depreciation accrued during operation is written off.

In accounting, income and expenses from the write-off of under-depreciated fixed assets are reflected as operating income and expenses (clause 31 of PBU 6/01 “Accounting for fixed assets”):

– 50,000 rub.

(200,000 – 150,000) – the residual value of the retired vehicle is taken into account as part of operating expenses;

– 3000 rub. – repair costs for dismantling the car are reflected (these costs are classified as operating costs, as they are associated with the disposal of fixed assets).

Materials and other property obtained during the dismantling and disposal of fixed assets are valued at market value and are included in operating income (clause 9 of PBU 5/01 “Accounting for inventories”, clause 7 of PBU 9/99 “Income of the organization” ).

Debit 10-5 “Spare parts” Credit 91-1

– 2000 rub. – spare parts suitable for use have been recorded in the warehouse.

As parts are released from the warehouse to the repair shop for vehicle repairs, the accountant will make postings. For example, spare parts worth 300 rubles were supplied:

– 300 rub. – spare parts were released from the warehouse to the repair shop.

The accountant records the scrap metal with the following entries:

– 800 rub. – scrap metal was deposited in the warehouse;

– 50,200 rub. (50,000 + 3000 – 2000 – 800) – the balance of other income and expenses is written off with the final turnover of the month.

If the retired fixed asset was previously revalued, do not forget to write off the amount of its revaluation by posting: Debit 83 Credit 84. This procedure for writing off revaluation is set out in paragraph 15 of PBU 6/01. If the item was previously discounted, no entries need to be made.

Expenses and income for income tax

What happens in tax accounting? For profit tax purposes, expenses for the liquidation of fixed assets taken out of service - the amount of underaccrued depreciation, liquidation expenses (dismantling, disassembly, removal of disassembled property) are taken into account as part of non-operating expenses (subclause 8, clause 1, article 265 of the Tax Code of the Russian Federation). A loss from the write-off of fixed assets due to moral or physical wear and tear can be recognized at a time, since a special procedure for recognizing losses is established only for the sale of fixed assets (clause 3 of Article 268 of the Tax Code of the Russian Federation).

Materials and other property obtained during the dismantling and disposal of fixed assets increase the organization’s non-operating income (clause 13 of Article 250 of the Tax Code of the Russian Federation). Tax authorities recommend valuing them at market value (section 9 of the Instructions for filling out an income tax return, approved by order of the Ministry of Taxes of Russia dated December 29, 2001 No. BG-3-02/585). The date of reflection of income is the date of drawing up the act of liquidation of depreciable property, drawn up in accordance with the accounting requirements (subclause 8, clause 4, article 271 of the Tax Code of the Russian Federation).

Thus, in the example under consideration, the accountant will take into account the amount of underaccrued depreciation (50,000 rubles) and the cost of dismantling the car (3,000 rubles) in non-operating expenses at a time in February. Then he will reflect non-operating income at the market value of materials obtained during disassembly (2000 rubles) and the cost of scrap metal (800 rubles). As materials are used, their cost will be included in expenses, reducing taxable income.

Differences according to PBU 18/02

We looked at an example in which the residual value of a fixed asset in accounting and tax accounting is the same. But it is not always the case. For example, the amounts of accrued depreciation according to accounting and tax records, and, accordingly, the loss from write-off may differ. If for this fixed asset the organization did not generate deductible temporary differences and taxable temporary differences in accordance with PBU 18/02 “Accounting for income tax calculations”, and accordingly did not reflect IT and IT, then the difference in losses will give permanent differences. When there are more expenses in accounting than in tax accounting, you need to reflect a permanent tax liability, when there are fewer expenses, a permanent tax asset.

If the amounts ONA and ONO were recorded for the retired fixed asset, use them to correct the discrepancy in losses in both types of accounting.

Disputes with VAT

Particular attention should be paid to VAT. Is it necessary or not to restore the VAT amounts accepted for deduction when putting a fixed asset into operation if it is not fully depreciated?

The position of the tax authorities on this issue is as follows: the VAT attributable to the residual value of the fixed asset must be restored, since it is no longer used for transactions subject to VAT. Moreover, the restored tax is not taken into account when determining the taxable base for income tax.

In our opinion, this is not necessary. First of all, because tax legislation does not provide for the organization’s obligation to restore and pay to the budget VAT amounts on the residual value of the property. The organization used the fixed asset for VAT-taxable transactions. She accepted the tax deduction in full legally. A further change in the use of the property does not matter. The Supreme Arbitration Court came to the same conclusion (resolution of the Supreme Arbitration Court of November 11, 2003 No. 7473/03).

Another issue is related to the deduction of VAT paid for the dismantling and disposal of fixed assets. As a general rule, VAT amounts on goods (work, services) purchased to carry out transactions subject to VAT are subject to deductions (subclause 1, clause 2, article 171 of the Tax Code of the Russian Federation). If a fixed asset is liquidated, there is no object of VAT taxation (Article 146 of the Tax Code of the Russian Federation). Therefore, the company has no grounds for deducting input VAT on dismantling and disposal services. Including it as expenses for tax purposes is also problematic. Tax authorities accept VAT in cases provided for in Article 170 of the Tax Code of the Russian Federation, but our case does not fall under this article.

Don't forget about transport tax

Please note that according to Article 357 of the Tax Code of the Russian Federation, persons to whom vehicles are registered in accordance with the legislation of the Russian Federation are recognized as payers of transport tax. Even if you liquidate a car during the tax period, you must charge tax for the months during which it was registered with the organization, including the month of deregistration (clause 3 of Article 362 of the Tax Code of the Russian Federation). The tax will have to be paid to the budget in the manner and within the time limits established by the law of the constituent entity of the Russian Federation in whose territory this car was located (clause 1 of Article 363 of the Tax Code of the Russian Federation).

Method 2. Revalue your assets at fair value.

IAS 16 allows you to use 2 models for the subsequent valuation of your fixed assets: the initial cost model and the revaluation model.

If you still plan to use the existing fixed assets in the future, their fair value will likely be greater than zero.

Revaluing an asset with a carrying amount of zero actually means that you are changing your accounting policy, and here you again need to be guided by the IAS 8 standard.

Under IAS 8, you should only change your accounting policy if:

- The change is required in accordance with IFRS. But in this case that is definitely not the case.

- This change results in financial statements providing true and more relevant information about the impact of transactions, events or conditions on a company's financial position, financial performance or cash flows.

https://www.youtube.com/watch?v=ytpolicyandsafetyru

You (and your auditors) may argue that paragraph 2 accurately reflects your situation. But is this really true?

This method definitely solves the problem of having a zero book value at the end of the current accounting period - just like the pill provides immediate relief from headaches.

Accounting policies include certain rules and standards that determine how you will present certain transactions in your financial statements—not only now, but also in the future.

It's not like a pill that provides immediate relief. It is like a cure for the cause of the disease, making you healthy for a long time so that you no longer need to take pills. But what if you take the wrong pill?

So, think about it, if you change your accounting policy from a cost model to a revaluation model, will you provide better information about your fixed assets not only now, but also in the future?

Before you answer this question to yourself, think about this too:

- To determine the fair value of your machinery, you need to apply IFRS 13 Fair Value Measurement. This is very difficult, impractical and not always feasible.

- How will you estimate the market value of used production machines?

- The revaluation model is used 99.9% of the time for buildings and land as it is easy to establish the market value of these assets on a regular basis.

- Is the problem with used production machines that are so specific that only a few companies like yours use them?

- You need to re-evaluate your technique fairly regularly. Can you estimate fair value, say, annually?

- You need to revalue the entire asset class, not individual items of fixed assets. Can you really determine fair value for all equipment? How practical is this?

If after considering all these aspects, you still want to move from a cost model to a revaluation model, then IAS 8 will make your job easier. You do not need to apply the new policy retrospectively—an assessment of prior periods is not required.

The sale price of fully depreciated property is the contract price (Article 105.3 of the Civil Code of the Russian Federation). Sold or liquidated fixed assets are deregistered (clause 76 of the Guidelines for accounting for fixed assets, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n).

When selling an asset with a residual value of 0, you need to charge VAT on the full sales amount.

Read more about the calculation of VAT on the sale of fixed assets in the article “Calculation and procedure for paying VAT on the sale (sale) of fixed assets.”

For tax purposes, proceeds from the sale of fixed assets are considered as income from sales (clause 1 of Article 249 of the Tax Code of the Russian Federation). Since the residual value of a depreciated fixed asset is 0, income from sales can only be reduced by those costs that are associated with securing a transaction for this fixed asset (clause 1 of Article 268 of the Tax Code of the Russian Federation).

Liquidation expenses for calculating income tax are included in non-operating expenses (clause 1 of Article 265 of the Tax Code of the Russian Federation) at a time in full in the period when they were actually incurred (clause 7 of Article 272 of the Tax Code of the Russian Federation).

There is no need to restore VAT (which was previously accepted for deduction) on a liquidated object with 100% depreciation (Article 170 of the Tax Code of the Russian Federation).

More about Art. 170 of the Tax Code of the Russian Federation, find out.

How to register liquidation

A fixed asset is liquidated when it is no longer suitable for further use. This usually occurs due to physical wear and tear of the object.

Before liquidating a fixed asset, it is necessary to create a commission. It should include the chief accountant and persons who are responsible for the safety of fixed assets. Representatives of inspections, which, in accordance with the law, are entrusted with the functions of registration and supervision of certain types of property, may be invited to participate in the work of the commission. This is stated in paragraph 77 of the Guidelines for accounting of fixed assets (approved by order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n).

The commission inspects the object, evaluates it in terms of suitability, possibility and efficiency of its use, and establishes the reasons for write-off. And in the case when we are talking about the unsuitability of an object due to damage caused to it, it identifies persons through whose fault the premature disposal of property occurs and makes proposals to bring these persons to responsibility established by law.

In addition, the commission must determine the possibility of using individual components, parts, and materials of the disposed facility and evaluate them based on the current market value. Subsequent control over the removal of non-ferrous and precious metals from the object written off, determination of weight and delivery to the appropriate warehouse is also within the competence of the commission.

The decision taken by the commission to write off a fixed asset item is documented in the Act on the write-off of a fixed asset item in form No. OS-4 (approved by Resolution of the State Statistics Committee of the Russian Federation dated January 21, 2003 No. 7). It contains data characterizing the object of fixed assets (date of acceptance of the object for accounting, year of manufacture or construction, time of commissioning, useful life, initial cost and amount of accrued depreciation, revaluations, repairs, reasons for disposal with their justification, condition of fixed assets). parts, details, assemblies, structural elements).

The act is drawn up in two copies. They are signed by members of the commission appointed by the head of the organization and approved by the head or his authorized person. The first copy is transferred to the accounting department, the second remains with the person responsible for the safety of fixed assets. The act is the basis for the delivery to the warehouse and sale of material assets and scrap metal remaining as a result of write-off.

Please note that the specified Act can be fully drawn up only after the completion of the liquidation of the fixed asset.

Liquidation process

Even 5 years ago, the legislation was structured in such a way that in order to liquidate OS, it was necessary to create a special commission. With the entry into force of Federal Law No. 402 in 2013, the decision to create such a commission or not falls under the exclusive competence of the head of the business entity. The reason lies in the fact that he, as the owner of the property (private business entities), is given the right to independently make the appropriate decision.

The reason for liquidation of fixed assets may be their obsolescence

If you still decide to act on commission, this is relevant for budgetary organizations, then the whole process in 2020 looks like this:

- Issuing a local order that creates a commission. The document contains a list of commission members, of whom there must be at least two (the chief accountant and the financially responsible person from among the technical specialists authorized to liquidate the facility). Additionally, external specialists who are representatives of various control and supervisory inspections may be invited.

- Members of the commission assess the condition of the assets being written off and think through possible options for restoration and repair.

- Making a decision on liquidation. This must be a balanced conclusion, supported by arguments and motives for the appropriateness of such actions (wear and tear, accident, etc.).

- Drawing up a liquidation order. The document will become valid the moment all members of the commission put their signatures on it.

- Drawing up a write-off act. Remains suitable for the future are subject to capitalization on the basis of a new specially issued invoice.

- Removing information about an object from a card or, in the absence of cards, an inventory book. This is done only after the act has been submitted to the accounting department of the institution.

Members of the commission are vested with a legally defined scope of powers, including:

- Visual examination of an object to be written off. Photographic recording is not excluded.

- Familiarization with the available documentation containing technical characteristics, as well as financial statements that address issues of its mathematical content.

- Finding out the reasons that brought the item into an unusable state, as well as identifying the persons who are guilty of this, followed by the application of liability measures.

- Preparation and certification of the write-off act by signatures.

- Determining the prospects for its further operation, for example, if repairs, modernization, etc. are carried out.

To carry out the liquidation of fixed assets, the manager can, if desired, assemble a commission

If, during the work of the commission, it is determined that individual components of the object can be sold or used in other devices, units, etc., this is subject to mandatory recording in accounting reports, regardless of whether or not they will actually be used in the future . The value of such balances is assessed based on market supply. Precious and non-ferrous metals are also weighed and handed over to this commission.

Accounting

Liquidated property is subject to write-off from accounting accounts (clause 29 of PBU 6/01 “Accounting for fixed assets”). Income and expenses from write-offs are reflected in the accounting period to which they relate and are subject to credit to the profit and loss account as other income and expenses (clause 31 of PBU 6/01). This means that the residual value of the liquidated fixed asset and other expenses associated with its liquidation are reflected in the debit of account 91, subaccount “Other expenses”. The credit of account 91, subaccount “Other income” shows income from the receipt of materials received as a result of liquidation.

To account for the disposal of fixed assets, a subaccount “Retirement of fixed assets” can be opened to account 01 “Fixed Assets”. The cost of the liquidated object is transferred to the debit of this subaccount, and the amount of accumulated depreciation is transferred to the credit. In accounting entries it looks like this:

Debit 01 subaccount “Retirement of fixed assets” Credit 01 subaccount “Fixed assets in operation” – the initial cost of the object subject to liquidation is written off; Debit 02 Credit 01 subaccount “Disposal of fixed assets” - depreciation accumulated at the time of liquidation is written off; Debit 91 subaccount “Other expenses” Credit 01 subaccount “Disposal of fixed assets” – the residual value of the liquidated object is written off; Debit 10 Credit 91, subaccount “Other income” - materials received during the liquidation of the object were capitalized (at current market value).

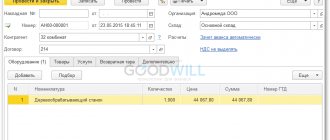

Disposal of fixed assets - how to reflect in 1C

Published 10/15/2014 20:45

Sometimes there are situations when an organization sells a fixed asset, or maybe it has to be written off due to physical/moral wear and tear or breakdown. What entries should the accountant make, and how to correctly reflect the disposal of fixed assets in 1C programs? Let's consider this situation using the example of 1C: Enterprise Accounting 8.

In our example, we will write off a fixed asset worth 100 thousand rubles due to a breakdown. This woodworking machine was registered in January 2013 and as of the end of September 2014 we see the following picture in the “Subconto Analysis” report.

Accrued depreciation is not yet equal to the original cost of the fixed assets; the residual value as of September 30, 2014 is 44,444 rubles.

Thus, when decommissioning the OS in October, we must:

— calculate depreciation for the last month of use;

— write off the initial cost to the account 01.09;

— write off the amount of depreciation accrued during the operating period also to account 01.09;

- write off the difference between the initial cost and accrued depreciation (residual value) as expenses (account 91.02).

For all these purposes, the “Write-off of fixed assets” document is intended, which is located on the “Fixed assets and intangible assets” tab.

We create a new document, indicate the reason for write-off - breakdown (you can add a new element to the directory “Reasons for write-off of OS”). Then we select the organization, write-off account - 91.02 and expense item - “Income (expenses) associated with the liquidation of fixed assets.” It is also necessary to fill out the “Location of fixed assets” field, indicating there the division in which the fixed asset is registered after acceptance for accounting. If this detail is left blank or incorrect data is specified, the program will generate an error like “Fixed asset. was not reflected in the accounting at location <>” and will not process the document.

We add the OS that should be written off to the tabular section, and the document can be processed.

When posting a document, the following account movements are generated:

— Dt 20.01 Kt 02.01 — depreciation for October

— Dt 02.01 Kt 01.09 — accrued depreciation written off

— Dt 01.09 Kt 01.01 — the initial cost of the fixed assets was written off

- Dt 91.02 Kt 01.09 - the residual value of the fixed assets is written off as expenses

If you need more information about working in 1C: Enterprise Accounting 8, then you can get our book for free using the link.

Did you like the article? Subscribe to the newsletter for new materials

Tax accounting

Tax legislation allows the residual value of the liquidated object to be attributed to non-operating expenses (subclause 8, clause 1, article 265 of the Tax Code of the Russian Federation). The basis and documentary evidence of expenses in the form of the residual value of a liquidated fixed asset, the useful life of which has not expired, will be the above-mentioned Act on the write-off of a fixed asset item (Form No. OS-4). After all, it is this document that testifies to the liquidation of the object. This position is confirmed by the Ministry of Finance (letter dated November 16, 2010 No. 03-03-06/1/726).

But this applies only to those assets for which depreciation is calculated using the straight-line method. In relation to objects depreciated in a non-linear way, decommissioning is carried out according to the rules prescribed in paragraph 13 of Article 259.2 of the Tax Code of the Russian Federation. According to the rules, the residual value of the fixed asset will not reduce the total balance of the depreciation group, that is, the object is liquidated, removed from the depreciable property, and depreciation continues to accrue. The Ministry of Finance in letter dated December 20, 2010 No. 03-03-06/2/217 also explains that the amount of underaccrued depreciation will continue to be written off as part of the total balance of the corresponding depreciation group (subgroup).

A situation is possible when liquidation is started (and the fixed asset is taken out of service) in one tax period and completed in another. The under-depreciated cost in this case is taken into account as part of non-operating expenses on the date of completion of liquidation (letter of the Ministry of Finance dated October 21, 2008 No. 03-03-06/1/592).

Despite the fact that the Tax Code of the Russian Federation contains a rule on the possibility of attributing to expenses the residual value of liquidated property, tax authorities may doubt the need for liquidation. Thus, according to the Ministry of Finance (letter dated 04/08/05 No. 03-03-01-04/2/61), expenses for the liquidation of fixed assets, including in the form of amounts of underaccrued depreciation, are justified if these fixed assets are unsuitable for further use. use, and their restoration is impossible or ineffective. Of course, if we are talking about physical wear and tear, breakdown as a result of an accident, excessive use, etc., then problems should not arise, because the property has been damaged and is therefore unsuitable for further use.

What does the accounting plan say?

The accounting plan (PBU) in paragraph 29 directly indicates the fact that assets that:

- cease to be used for the production of products, provision of services, performance of certain works;

- are no longer used to implement the management needs of the company;

- are not available based on inventory results,

must be written off from accounting, that is, a disposal procedure must be carried out.

Accounting involves reflecting double entries in accounting accounts for ongoing transactions.

They are carried out by an accountant responsible for maintaining records of fixed assets.

Postings are made only on the basis of documents.

In this case, these can be a write-off act or an act of acceptance and transfer of fixed assets.

The disposal of fixed assets, regardless of the reasons and direction of movement, in accounting is always accompanied by the following procedure:

- Opening a separate sub-account on account 01 – 01.2.

- Transferring to the debit of subaccount 01.2 the cost of the retiring fixed asset (from the credit of subaccount 01.1) - posting Dt 01.1 Kt 01.2.

- Transferring to the credit of subaccount 01.2 the depreciation accumulated during use (from the debit of account 02) - posting Dt 02 Kt 01.2.

- Determination of residual value - the difference between the debit and credit of subaccount 01.2. If the result of the difference is zero, then the object is completely depreciated.

- The write-off of residual value as expenses is reflected by posting Dt 91.2 Kt 01.2.

- Accounting for associated costs associated with the disposal of fixed assets – Dt 91.2 Kt 23, 70, 69, 76, 60.

Further actions depend on the method of disposal:

- if this is a sale, then the sale price is reflected by posting Dt 62 Kt 91.1, VAT is charged on the sale price Dt 91.2 Kt 68;

- if this is a gratuitous transfer, then VAT is charged on the market price for a similar fixed asset;

- if this is a write-off, then the possibility and necessity of capitalizing parts and assemblies remaining from the disassembly and dismantling of the fixed asset is determined; the MCs are placed on receipt by posting Dt 10 Kt 91.1;

- if this is the entry of an object into the authorized capital of another organization, then the residual value of the fixed assets is transferred from the credit of account 01.2 to the debit of account 76, while this operation is considered a financial investment and is reflected by posting Dt 58 Kt 76.

After making the indicated entries on account 91, you can determine the financial result from the disposal of the fixed asset - this can be profit or loss, which is reflected in account 99.

Below is a table with transactions that are reflected when fixed assets are disposed of in various ways from the organization.

| Postings | Operation description | |

| Dt | CT | |

| 01.1 | 01.2 | The cost of the retiring fixed asset has been written off |

| 02 | 01.2 | Depreciation accruals are taken into account at the date of disposal |

| 91.2 | 01.2 | The residual value of the asset is written off |

| 91.2 | 70, 76, 60, 69, 23 | Costs associated with disposal are reflected |

| When written off due to wear and tear, breakdown | ||

| 10 | 91.1 | Parts, components, mechanisms remaining after dismantling the OS have been capitalized |

| When selling | ||

| 62 | 91.1 | The sale price of the disposed asset is reflected |

| 91.2 | 68 | VAT payable reflected |

| 91.2 | 10 (20,23,26 …), 60 | Costs associated with the sale and delivery of OS to the buyer are taken into account |

| For free transfer | ||

| 91.3 | 68 | VAT is charged on the market value of the object intended for donation |

| When contributing fixed assets to the authorized capital of another organization | ||

| 76 | 01.2 | The procedure for transferring fixed assets to the authorized capital of another organization is reflected |

| 58 | 76 | The debt on the deposit is reflected as part of financial investments |

Is it necessary to restore VAT?

The next question that arises during the liquidation of a fixed asset is related to VAT. As is known, when accepting an object for accounting, organizations deduct the “input” VAT included in the cost of the object. If at the time of liquidation the useful life of the property has not expired, that is, the original cost has not been completely transferred to expenses, then the tax authorities require the restoration of VAT from the residual value of the property. They refer to the fact that the liquidated entity ceases to participate in transactions recognized as subject to VAT taxation (and one of the conditions for the deduction is the entity’s participation in transactions subject to VAT). Similar conclusions were made by the Ministry of Finance (letters dated 07/08/09 No. 03-03-06/1/447, dated 01/29/09 No. 03-07-11/22).

But we consider this position to be incorrect. Article 170 of the Tax Code of the Russian Federation contains an exhaustive list of cases in which the corresponding tax amounts are subject to restoration. The liquidation of under-depreciated fixed assets is not indicated there. Therefore, there is no need to restore VAT. It is this argumentation that allows taxpayers to win disputes in the courts (resolutions of the FAS Volga District dated January 27, 2011 in case No. A55-7952/2010, FAS North Caucasus District dated November 3, 2010 in case No. A22-60/10/9-5, FAS Moscow District dated May 14, 2009 No. KA-A40/3703-09-2).

How to take into account the costs of liquidation of under-depreciated fixed assets in tax accounting?

Liquidation of a fixed asset occurs after the end of its useful life. However, situations may arise when it is not possible to use an under-depreciated fixed asset. For example, damage to property as a result of an emergency, moral or physical wear and tear that does not allow further use of a fixed asset in production, breakdown beyond repair, etc. All these situations oblige the taxpayer to decommission the object and write it off.

Disposal due to wear and tear

How to write off depreciated fixed assets from the balance sheet? This is perhaps the easiest case for an accountant. If the period of expected useful use completely coincides with the actual one, then the residual value is equal to zero and after drawing up a write-off act, the object ceases to be included in the assets of the enterprise.

When moral or physical wear and tear occurs earlier than planned, it is necessary to make calculations that will require data on:

- initial cost of the object (purchase price + installation + delivery);

- accumulated depreciation for the period worked (credit to the corresponding subaccount 02);

- residual value equal to the difference between the original cost and accumulated depreciation.

The last value is written off from account 01. The final result of the liquidation of property is included in the financial result.

The sequence of entries characterizing the write-off from the balance sheet of fixed assets that have become unusable due to wear and tear can be seen in the table:

The compiled entries fully show how to write off fixed assets from the balance sheet. If a positive liquidation value is formed, its value is credited to account 91.1.

Procedure for accounting for liquidation expenses

The costs of liquidating a fixed asset are accepted as part of non-operating expenses (clause 8, clause 1, article 265 of the Tax Code of the Russian Federation). Such costs include:

- dismantling costs;

- services of contractors;

- garbage removal, etc.

A one-time inclusion of dismantling costs is possible only if the facility will no longer be used (Letter of the Ministry of Finance dated December 29, 2009 No. 03-03-06/1/828). If dismantling is carried out for the purpose of moving to another location, then the amount of work must be included in the cost of the fixed asset.

To write off property, you need to create an order from the manager to liquidate the fixed asset.

When fixed assets are liquidated

A decision to write off the OS is required when:

- The service life of equipment, premises, furniture, laminate, etc. has expired, and as a result of depreciation, it is not possible to restore their properties, i.e., in fact, the book value is reduced to zero.

- There was obsolescence, which is associated with regular technical progress, the emergence of new technologies, etc., the object became ineffective or ineffective at all.

There may also be a paid or gratuitous alienation to other entities, funds or persons of fixed assets (exchange, donation, sale, etc.).

Features of the formation of residual value during complete liquidation

The residual value should be included in expenses depending on the method of calculating depreciation for the liquidated object.

- When using the linear method of calculating depreciation, the residual value of the fixed asset is written off in full at a time as non-operating expenses (paragraph 2, paragraph 8, paragraph 1, article 265 of the Tax Code of the Russian Federation). For buildings, structures and transmission devices of 8-10 depreciation groups, only the linear method of calculating depreciation is used (clause 3 of Article 259 of the Tax Code of the Russian Federation), therefore, the residual value of these objects is written off at a time in full (paragraph 2, paragraph 8, paragraph 1 Article 265 of the Tax Code of the Russian Federation).

- If the taxpayer uses the non-linear method, the fixed asset is taken out of service in the manner provided for in paragraph 13 of Art. 259.2 of the Tax Code of the Russian Federation: an object is excluded from the depreciation group on the date of its liquidation, but depreciation continues until the end of its useful life according to the previous scheme. In other words, with non-linear depreciation, the decrease in the taxable base for income tax occurs gradually through the calculation of depreciation (Letters of the Ministry of Finance of Russia dated 02/24/2014 No. 03-03-06/1/7550, dated 12/20/2010 No. 03-03-06/2/ 217).

Officials allow the depreciation bonus not to be restored, since in this case there is no fact of sale of property (Letter of the Ministry of Finance of Russia dated March 16, 2009 No. 03-03-05/37, Letter of the Federal Tax Service of Russia dated March 27, 2009 No. ШС-22-3 / [email protected ] ).

Features of the formation of residual value during partial liquidation

It is unlawful to apply the norms for writing off the residual value during the complete liquidation of property for non-operating expenses for partial liquidation, because there is no condition for decommissioning the equipment (clause 8, clause 1, article 265, clause 13, article 259.2 of the Tax Code of the Russian Federation). Therefore, it is allowed to write off the residual value of property with non-linear depreciation for partial liquidation of the object as one-time expenses (clause 20, clause 1, article 265 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of Russia dated August 19, 2011 No. 03-03-06/1/503).

Certificate of liquidation (write-off) of an asset: basic requirements

To write off property, you can use unified forms No. OS-4, OS-4a, OS-4b, or independently develop a local document (Article 9 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”) and be sure to secure the form in accounting policy of the organization. If a decision has been made to create an internal form of documents, then it is recommended to include the following sections in it (Letter of the Ministry of Finance of Russia dated October 21, 2008 No. 03-03-06/1/592):

- year of creation of the object;

- date of commissioning;

- original or replacement cost of the property;

- depreciation amount;

- number of major repairs;

- reasons for liquidation;

- the ability to use the object itself, parts or assemblies;

- Additional Information.

In the absence of the above points in the local act, the tax authorities may have justified claims.

Decommissioning of an object without dismantling

The Ministry of Finance believes that it is possible to write off the facility without dismantling it. The position of officials is as follows: write-off of property occurs as a result of disposal of the object in accordance with a correctly executed liquidation act.

It is not necessary to confirm the fact of dismantling (Letter of the Ministry of Finance of Russia dated December 8, 2009 No. 03-03-06/1/793).

Tax authorities also believe that this condition is not mandatory and the costs of write-off and the amount of remaining depreciation can be included in non-operating expenses on the basis of a liquidation act without dismantling (Letter of the Federal Tax Service of Russia for Moscow dated September 30, 2010 No. 16-15 / [email protected ] ).

The earlier position of the tax authorities differed from the explanations of the Ministry of Finance. Federal Tax Service officials said that it was impossible to liquidate the facility without dismantling it. A taxpayer who has not carried out an analysis of a written-off fixed asset does not have the right to write off liquidation expenses, depreciation and residual value as non-operating expenses (Letter of the Federal Tax Service of Russia for Moscow dated 04/07/2009 No. 16-15/033038).

Since employees of the Federal Tax Service show an ambiguous decision on this issue, it is still recommended to take into account their wishes and carry out dismantling work. If the object has been lost and it is impossible to organize work to dismantle it, it is still necessary to carry out some work to eliminate the consequences. They should be documented with primary documents. In this case, you will have every reason to legally liquidate the property.

Early write-off

What is important for an accountant to remember when writing off an underdepreciated fixed asset? The loss from write-off is accepted in both accounting and tax accounting. Moreover, at the same time. And the cost of materials remaining from liquidation in both accounts increases the income of the enterprise. When writing off, you need to be prepared for the fact that tax authorities will demand that VAT be restored from the residual value of the object. However, this can and should be argued. Let's consider this common situation. Due to moral or physical wear and tear, the organization writes off a fixed asset whose useful life has not yet expired. For clarity, we will analyze the features of accounting and taxation of this operation using a specific example.

Subtleties of accounting

In February 2004, the organization liquidated a car that was physically worn out and not used in production. The liquidation is carried out by the repair shop, the cost of the work was 3,000 rubles. The initial cost of the car according to accounting and tax records is 200,000 rubles, the amount of accrued depreciation (up to February 2004 inclusive) is 150,000 rubles.

As a result of liquidation, spare parts with a market value as of the date of liquidation of 2,000 rubles were capitalized. and scrap metal worth 800 rubles.

According to the accounting policy of the organization, income and expenses for profit tax purposes are determined using the accrual method.

To account for the movement of fixed assets, the organization uses subaccounts:

01-1 “Fixed assets in operation”;

01-2 “Disposal of fixed assets.”

The following entries were made in accounting:

Debit 01-2 Credit 01-1

– 200,000 rub. – the initial cost of the retiring vehicle is reflected;

Debit 02 Credit 01-2

– 150,000 rub. – depreciation accrued during operation is written off.

In accounting, income and expenses from the write-off of under-depreciated fixed assets are reflected as operating income and expenses (clause 31 of PBU 6/01 “Accounting for fixed assets”):

Debit 91-2 Credit 01-2

– 50,000 rub. (200,000 – 150,000) – the residual value of the retired vehicle is taken into account as part of operating expenses;

Debit 91-2 Credit 23

– 3000 rub. – repair costs for dismantling the car are reflected (these costs are classified as operating costs, as they are associated with the disposal of fixed assets).

Materials and other property obtained during the dismantling and disposal of fixed assets are valued at market value and are included in operating income (clause 9 of PBU 5/01 “Accounting for inventories”, clause 7 of PBU 9/99 “Income of the organization” ).

Debit 10-5 “Spare parts” Credit 91-1

– 2000 rub. – spare parts suitable for use have been recorded in the warehouse.

As parts are released from the warehouse to the repair shop for vehicle repairs, the accountant will make postings. For example, spare parts worth 300 rubles were supplied:

Debit 23 Credit 10-5

– 300 rub. – spare parts were released from the warehouse to the repair shop.

The accountant records the scrap metal with the following entries:

Debit 10-6 Credit 91-1

– 800 rub. – scrap metal was deposited in the warehouse;

Debit 99-9 Credit 91-9

– 50,200 rub. (50,000 + 3000 – 2000 – 800) – the balance of other income and expenses is written off with the final turnover of the month.

If the retired fixed asset was previously revalued, do not forget to write off the amount of its revaluation by posting: Debit 83 Credit 84. This procedure for writing off revaluation is set out in paragraph 15 of PBU 6/01. If the item was previously discounted, no entries need to be made.

Partial liquidation of a fixed asset

In some cases, in complex fixed assets that consist of several structurally articulated items, but are listed in accounting and tax records as a single inventory item, it becomes necessary to remove a no longer needed mechanism without its subsequent restoration. The object itself retains its functional capabilities and continues to be used in business activities. This is done through partial liquidation of the object. Often, partial liquidation of a fixed asset is also carried out in relation to real estate, when a part of a building or an extension to it that is unsuitable for further use is demolished.

Documentation Neither accounting nor tax legislation defines this concept. The Accounting Regulations “Accounting for Fixed Assets” (PBU 6/01) (approved by order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n) and the Tax Code of the Russian Federation only mention that in the event of partial liquidation of a fixed asset, the initial cost of the fixed asset item changes (p 14 PBU 6/01, paragraph 2 of Article 257 of the Tax Code of the Russian Federation).

Since regulatory legal acts on accounting and tax accounting do not contain rules regarding the partial liquidation of fixed assets, it remains to turn to the rules governing the disposal of objects.

Any disposal is preceded by a commission conclusion about the impossibility of using the fixed asset. Based on this, the process of partial liquidation of an object begins with the creation of a commission. A liquidation commission can be appointed to resolve the issue of partial liquidation of a specific fixed asset, or it can be created for a long period (usually a calendar year) and carry out its activities on an ongoing basis.

If the organization has a permanent commission that deals with determining the suitability of further use of fixed assets, the possibility and effectiveness of their restoration, then it is advisable to use it during partial liquidation.

It is advisable to include in such a commission the chief accountant or another representative of the accounting department (for example, an accountant for fixed assets), as well as the person who is responsible for the safety of this object. To participate in the work of the commission, the organization has the right to invite specialists from various inspections, which, in accordance with the legislation of the Russian Federation, are entrusted with the functions of registering and supervising certain types of property (clause 77 of the Guidelines for accounting of fixed assets, approved by order of the Ministry of Finance of Russia dated 10.13.03 No. 91n).

After inspecting the object, the commission, as in cases of normal write-off of fixed assets, determines its suitability for further use using the necessary technical documentation. At the same time, in particular (clause 77 of the guidelines): • identifies specific parts (items included in the object) that are subject to partial liquidation; • makes a decision on partial liquidation of a fixed asset; • draws up and signs an act on the partial liquidation of a fixed asset and submits this act for approval to the head of the organization.

If there are non-ferrous and precious metals in the discarded part of the object or in its individual components and parts, the commission ensures and controls their removal for subsequent transfer to refining. In addition, the commission exercises control over determining the weight (quantity) of extracted non-ferrous and precious metals, transferring them to the warehouse and processing the relevant documents.

The decision taken by the commission must be recorded in the act of partial liquidation of the fixed asset.

Since the beginning of last year, accounting has used forms of primary accounting documents approved by the head of an economic entity on the recommendation of the official entrusted with its management (Clause 4, Article 9 of the Federal Law of December 11, 2011 No. 402-FZ “On Accounting”) . These may be primary documents independently developed by an economic entity. In this case, they must contain the mandatory details given in paragraph 2 of Article 9 of Law No. 402-FZ. At the same time, organizations have the right to continue to use the forms of primary accounting documents given in the albums of unified forms.

Resolution of the State Statistics Committee of Russia dated January 21, 2003 No. 7 approved unified forms of acts on the write-off of an individual object (Form No. OS-4), vehicles (Form No. OS-4a), and a group of objects (Form No. OS-4b). An organization can add the necessary details to the unified form of the write-off act that suits it, or, using one of the specified forms as a basis, develop and approve its own form of the act.

The act is drawn up in two copies, signed by members of the liquidation commission and approved by the head of the organization or another person authorized by him. One copy of the act is transferred to the accounting department, the second remains with the person responsible for the safety of fixed assets.

An act of partial write-off (liquidation) of a fixed asset can be fully executed only after the completion of the entire procedure for the partial liquidation of this object, because, as mentioned above, the commission must exercise control over the removal of material assets, including non-ferrous ones, from the fixed assets written off as part of the object and precious metals.

Based on an act approved by the head of the organization, when using unified forms of primary documents, the accounting department makes an appropriate entry about the partial liquidation of an object in the inventory card (form No. OS-6) of this object or in the inventory book for accounting for fixed assets (form No. OS-6b) ( clause 80 of the guidelines). After approval of the act, the head of the organization issues an order for the partial liquidation of the facility.

It was stated above that as a result of partial liquidation of fixed assets, parts and materials suitable for further use often remain. These materials are accepted for accounting at their actual (market) value (clause 9 of the Accounting Regulations “Accounting for Inventories” (PBU 5/01), approved by order of the Ministry of Finance of Russia dated 06/09/01 No. 44n). In the event of partial liquidation of a real estate property, an act on the dismantling of temporary (non-title) structures is drawn up in form No. KS-9 and an act on the assessment of buildings, structures, structures and plantings subject to demolition (relocation) in form No. KS-10 (these forms are approved by a resolution of the State Statistics Committee Russia dated November 11, 1999 No. 100). When registering material assets obtained during the dismantling and dismantling of buildings and structures, you can use the act in form No. M-35 (approved by Resolution of the State Statistics Committee of Russia dated October 30, 1997 No. 71a).

Cost of the liquidated part of the object It was stated above that in the event of partial liquidation of a fixed asset, its initial value changes. The procedure for determining the specified value is not established either by regulatory legal acts of accounting or by tax legislation. Depending on the specific circumstances and types of fixed assets, you can use one of the following methods for assessing the liquidated part of the object.

You can try to determine the share of the liquidated part of a fixed asset in proportion to any physical indicator characteristic of a given object. Thus, when carrying out a partial liquidation of real estate, as a result of which its area changes, the cost of the liquidated part is quite appropriate to determine from the proportions of its areas - decommissioned and original.

The organization, based on information about the area of the property specified in the title and (or) inventory documents, calculates the share of the liquidated part in the total area of the property. Then, based on the calculated share, the initial cost of the remaining part of the fixed asset and the amount of depreciation related to this part, as well as the residual value of the liquidated part, are determined.

Example 1 An organization owns an industrial building with a total area of 900 square meters. m. Due to a fire that occurred in the building, part of the premises with an area of 72 sq. m. m was liquidated. New premises area, 828 sq.m. m (900 – 72), after registration with the BTI it is indicated in the passport of the property. The act of partial liquidation of the facility was approved by the head of the organization on January 24, 2014. The initial cost of the premises was 12,600,000 rubles, the amount of depreciation accrued by the time the work on liquidating part of the building was completed was 6,111,000 rubles. In accounting and tax accounting, depreciation on an object was calculated using the straight-line method; the useful life of the premises, established by the organization when accepting it for accounting, was 200 months (the amount of monthly accrued depreciation until the moment of partial liquidation was 63,000 rubles (12,600,000 rubles / 200 month)). The share of the liquidated part in the total area of the premises is 8% (72 sq. m: 900 sq. m x 100%). Based on this, the initial cost of the liquidated part of the premises was 1,008,000 rubles. (RUB 12,600,000 x 8%), the amount of accrued depreciation attributable to this part is RUB 488,880. (RUB 6,111,000 ? 8%). In January, on the date of approval by the head of the organization of the act of partial liquidation of the premises, the organization reduces the initial cost of the building and the depreciation accrued on it by the indicated amounts. The cost at which the building will be taken into account in accounting and tax accounting after completion of work on its partial liquidation is RUB 11,592,000. (12,600,000 – 1,008,000), the amount of accrued depreciation is RUB 5,622,120. (6,111,000 – 488,880), residual value—RUB 5,969,880. (11,592,000 – 5,622,120).

When a complex object is partially liquidated and the value of all the individual items included in its composition is known, it will not be so difficult to determine the value of the withdrawn part of the object. Information about the initial cost of the liquidated part of the fixed asset is taken from the primary documents received from the supplier when purchasing this item. If there is a partial liquidation of a complex fixed asset created by the organization independently, the initial cost of the liquidated part is determined (if possible) on the basis of the primary documents drawn up when the object was accepted for accounting.

Having information about the initial cost of an item being taken out of service, based on the accepted method of calculating depreciation for the object and the useful life that were adopted when putting the fixed asset into operation, the amount of accrued depreciation related to this item and its residual value are calculated.

Example 2 A complex fixed asset includes a structurally separate item worth RUB 1,560,000. This item is disposed of after 71 months of operation of the facility. The initial cost of the fixed asset is RUB 9,984,000; upon its commissioning, a linear depreciation method and a useful life of 96 months were established. During the operation of the fixed asset until its partial liquidation, depreciation was accrued on it in the amount of RUB 7,384,000. (RUB 9,984,000 / 96 months x 71 months). Of this, the item being liquidated accounts for 1,153,750 rubles. (RUB 1,560,000: 96 months x 71 months). Thus, the initial cost of the fixed asset after its partial liquidation will be RUB 8,424,000. (9,984,000 – 1,560,000), the amount of accrued depreciation is RUB 6,230,250. (7,384,000 – 1,153,750), residual value—RUB 2,193,750. (8,424,000 – 6,230,250). The residual value of the liquidated item is equal to 406,250 rubles. (1,560,000 – 1,153,750).

In case of partial liquidation of a fixed asset, it is possible to use the percentage method (letter of the Ministry of Finance of Russia dated August 27, 2008 No. 03-03-06/1/479). When making a decision to write off part of a fixed asset, the commission has the right to independently determine the share of the liquidated part of the object, calculated as a percentage of its total value, indicating it in the act of partial liquidation of the object. Based on the established share, the organization first calculates the initial cost and accrued depreciation amount attributable to the liquidated part of the fixed asset, and then determines the cost of the remaining part and the amount of depreciation related to this part.

Example 3 Let us slightly change the condition of example 2: if the amounts of the initial cost of the fixed asset and accrued depreciation remain unchanged, 9,984,000 and 7,384,000 rubles. The commission established the share of the liquidated part of the object in the amount of 15% of its original cost. Of the total amounts of the initial cost of the fixed asset and accrued depreciation, the liquidated part accounts for RUB 1,497,600, respectively. (RUB 9,984,000 x 15%) and RUB 1,107,600. (RUB 7,384,000 x 15%). After liquidation of part of the fixed asset, its initial cost will be RUB 8,486,400. (9,984,000 – 1,497,600), the amount of accrued depreciation is RUB 6,276,400. (7,384,000 – 1,107,600), residual value—RUB 2,210,000. (8,486,400 – 6,276,400), the residual value of the liquidated part of the object is RUB 390,000. (1,497,600 – 1,107,600).

If the value of the liquidated part of the fixed asset cannot be determined by any of the above methods, all that remains is to turn to the services of an independent appraiser. But instead of assessing the market value of the remaining or retiring part of the object, the appraiser in this case must determine the initial value of the liquidated part of the fixed asset or the share attributable to this part.

Accounting Partial liquidation, as noted above, is one of the special cases of disposal of fixed assets. Therefore, it is reflected in accounting in the general manner.

The cost of a retiring fixed asset, in our case - the cost of the liquidated part of the fixed asset, based on clause 29 of PBU 6/01, is subject to write-off from accounting. Instructions for using the Chart of Accounts for accounting the financial and economic activities of organizations (approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n) recommends using a special sub-account “Retirement of fixed assets”, opened to account 01 “Fixed Assets” when writing off the value of a fixed asset. The share of the original (replacement) cost attributable to the liquidated part of the fixed asset is written off to the debit of this subaccount in correspondence with the subaccount for accounting for fixed assets. The corresponding part of the depreciation amount accrued for the actual useful life of the object is written off to the credit of the sub-account “Disposal of fixed assets”.

It was stated above that in the event of partial liquidation of a fixed asset, an organization can receive parts, components and assemblies suitable for use, as well as other materials. According to paragraph 79 of the guidelines, they are accounted for at the current market value on the date of partial liquidation of the object. Income and expenses from the disposal of part of the object are reflected in accounting in the reporting period to which they relate. At the same time, they are subject to crediting to the profit and loss account as other income and expenses (clause 31 of PBU 6/01).

After partial liquidation, the fixed asset continues to be used, therefore, depreciation should be charged on it. Depreciation should be calculated from the 1st day of the month following the month of completion of partial liquidation until the cost of this object is fully repaid or it is written off from accounting.

The value of a fixed asset after partial liquidation changes downwards, and therefore the amount of depreciation charges also changes. By virtue of paragraph 6 of clause 20 of PBU 6/01, the organization can revise its useful life only if the technical and economic performance indicators of the facility are improved (increased) as a result of reconstruction or modernization. The possibility of changing the useful life during partial liquidation of an object is not fixed by regulatory legal acts of accounting. Since the useful life cannot be changed either upward or downward, depreciation on the remaining part of the fixed asset should be calculated from its new residual value and the remaining useful life.

Continuation of example 1 Let us clarify the condition: for dismantling the liquidated part of the production premises, 54,870 rubles were transferred to a third party, including VAT of 8,370 rubles, the market value of materials received during liquidation was 52,650 rubles. In January, on the date of approval by the head of the organization of the act of partial liquidation of the premises, the following entries are made in the organization’s accounting records: Debit 01 subaccount “Disposal of fixed assets” Credit 01 - 1,008,000 rubles. — the initial cost of the liquidated part of the building is written off; Debit 02 Credit 01 subaccount “Disposal of fixed assets” - 463,680 rubles. — the accrued amount of depreciation for the disposed part of the object is written off; Debit 91-2 Credit 01 subaccount “Disposal of fixed assets” - 544,320 rubles. (1,008,000 – 463,680) - other expenses take into account the residual value of the disposed part of the building; Debit 10 Credit 91-1 - 52,650 rubles. — inventories received during the liquidation of part of the building were taken into account; Debit 91-2 Credit 60 - 46,500 rub. (54,870 – 8370) - expenses for the liquidation of part of the fixed asset are taken into account; Debit 19 Credit 60 —?8370 rub. — the amount of VAT charged by the contractor for the services of dismantling part of the building has been allocated. The cost at which the building will be accounted for in accounting after the completion of its partial liquidation is RUB 11,592,000. (12,600,000 – 1,008,000), the amount of accrued depreciation is RUB 5,622,120. (6,111,000 – 488,880), residual value—RUB 5,969,880. (11,592,000 – 5,622,120). At the time of completion of the partial liquidation work, the building had been in use for 97 months. (RUB 6,111,000 / (RUB 12,600,000: 200 months)), its remaining service life is 103 months. (200 – 97). Based on this, the amount of depreciation in February for the facility will be 57,960 rubles. ((RUB 5,969,880: 103 months x 1 month) = (RUB 11,592,000: 200 months x 1 month)): Debit 20 Credit 02 —?57,960 rub. — depreciation has been calculated for the industrial building. This posting will be repeated monthly until August 2022 inclusive (103 months (11 + 12 + 12 + 12 + 12 + 12 + 12 + 12 + 8)).

Depreciation on the remaining part of the fixed asset continues even if, after partial liquidation, its initial cost turns out to be less than 40,000 rubles, since the object was initially taken into account as a fixed asset. It is also necessary to depreciate such an object until its cost is completely written off as expenses or until it is disposed of.

In the event of partial liquidation of a fully depreciated fixed asset, its value is adjusted in accounting in the same manner as for under-depreciated fixed assets. That is, the initial cost of a fully depreciated fixed asset is reduced by the cost of the liquidated part, and the amount of accrued depreciation charges is reduced by the amount of depreciation attributable to the liquidated part. The only peculiarity is that the amounts by which the original cost and accrued depreciation are adjusted are the same. Thus, the residual value of a partially liquidated fixed asset reflected in the accounting records will not change. After all, both before partial liquidation and after its completion, the residual value of a fully depreciated object is zero.

To be continued

IMPORTANT:

Since regulatory legal acts on accounting and tax accounting do not contain rules regarding the partial liquidation of fixed assets, it remains to turn to the rules governing the disposal of objects.

Since the beginning of last year, accounting has used forms of primary accounting documents approved by the head of an economic entity on the recommendation of the official entrusted with its management. These may be primary documents independently developed by an economic entity.

When registering material assets received during the dismantling and dismantling of buildings and structures, you can use the act in form No. M-35.

The organization first calculates the initial cost and accrued depreciation amount attributable to the liquidated part of the fixed asset, and then determines the cost of the remaining part and the amount of depreciation related to this part.

Depreciation should be calculated from the 1st day of the month following the month of completion of partial liquidation until the cost of this object is fully repaid or it is written off from accounting.

Depreciation on the remaining part of the fixed asset continues even if, after partial liquidation, its initial cost turns out to be less than 40,000 rubles, since the object was initially taken into account as a fixed asset.

Leonid IOFFE, auditor

Expenses and income for income tax

Materials and other property obtained during the dismantling and disposal of fixed assets increase the organization’s non-operating income (clause 13 of Article 250 of the Tax Code of the Russian Federation). Tax authorities recommend valuing them at market value (section 9 of the Instructions for filling out an income tax return, approved by order of the Ministry of Taxes of Russia dated December 29, 2001 No. BG-3-02/585). The date of reflection of income is the date of drawing up the act of liquidation of depreciable property, drawn up in accordance with the accounting requirements (subclause 8, clause 4, article 271 of the Tax Code of the Russian Federation).

Thus, in the example under consideration, the accountant will take into account the amount of underaccrued depreciation (50,000 rubles) and the cost of dismantling the car (3,000 rubles) in non-operating expenses at a time in February. Then he will reflect non-operating income at the market value of materials obtained during disassembly (2000 rubles) and the cost of scrap metal (800 rubles). As materials are used, their cost will be included in expenses, reducing taxable income.

Disputes with VAT

The position of the tax authorities on this issue is as follows: the VAT attributable to the residual value of the fixed asset must be restored, since it is no longer used for transactions subject to VAT. Moreover, the restored tax is not taken into account when determining the taxable base for income tax.

In our opinion, this is not necessary. First of all, because tax legislation does not provide for the organization’s obligation to restore and pay to the budget VAT amounts on the residual value of the property. The organization used the fixed asset for VAT-taxable transactions. She accepted the tax deduction in full legally. A further change in the use of the property does not matter. The Supreme Arbitration Court came to the same conclusion (resolution of the Supreme Arbitration Court of November 11, 2003 No. 7473/03).

Another issue is related to the deduction of VAT paid for the dismantling and disposal of fixed assets. As a general rule, VAT amounts on goods (work, services) purchased to carry out transactions subject to VAT are subject to deductions (subclause 1, clause 2, article 171 of the Tax Code of the Russian Federation). If a fixed asset is liquidated, there is no object of VAT taxation (Article 146 of the Tax Code of the Russian Federation). Therefore, the company has no grounds for deducting input VAT on dismantling and disposal services. Including it as expenses for tax purposes is also problematic. Tax authorities accept VAT in cases provided for in Article 170 of the Tax Code of the Russian Federation, but our case does not fall under this article.

Donation of a fully depreciated OS object

Donation of property worth over 3,000 rubles. between 2 commercial organizations is prohibited by law (Article 575 of the Civil Code of the Russian Federation).

For the nuances of gratuitous agreements between legal entities, see.

Since there is no separate procedure for determining the price of an asset with a zero book value transferred as a gift, the calculation should be made by analogy with other legal norms, in particular Art. 105.3 and 154 of the Tax Code of the Russian Federation (based on the market value of the object).

NOTE! The zero residual accounting value of an asset does not mean at all that the market value of this asset is 0. An expert assessment of the object will be required for a gratuitous transfer.

Free transfer to non-profit organizations and institutions, as well as individuals, is allowed. Wherein:

- With regard to income tax in accordance with the content of Art. 39 and 41 of the Tax Code of the Russian Federation, the transferring enterprise does not have an object of taxation (income) for income tax upon gift. At the same time, according to the norms of Art. 270 of the Tax Code of the Russian Federation, an enterprise does not have the right to take into account donation expenses for tax accounting. Thus, the transfer of fixed assets as a gift should not in any way affect income tax calculations.

- With regard to VAT, the donation of any fixed asset will be recognized as a sale for tax purposes (clause 1, article 39 and clause 1, article 146 of the Tax Code of the Russian Federation). The tax will need to be calculated and paid on the market value of the transferred asset (Clause 2 of Article 154 of the Tax Code of the Russian Federation). The amount of VAT paid on a gift should not reduce the income tax base (Clause 16, Article 270 of the Tax Code of the Russian Federation).

IMPORTANT! The donation of fixed assets is not subject to VAT if the fixed assets are transferred to state or local authorities (clause 2 of Article 146 of the Tax Code of the Russian Federation). In this case, the donor should restore the input VAT on the transferred objects. The amount of tax to be restored is determined in proportion to the residual value of the fixed assets (clause 3 of Article 170 of the Tax Code). That is, for fully depreciated fixed assets (whose residual value is 0), VAT for restoration will also be equal to 0.

https://www.youtube.com/watch?v=ytadvertiseru

In accounting, all expenses associated with the donation are taken into account as part of other expenses in the period in which the fixed asset is written off from accounting.

Primary registration

In our example, an act (2 copies) was drawn up for writing off the car (according to form No. OS-4a). The first copy, together with a document confirming the deregistration of the car with the traffic police, is transferred to the accounting department. The second copy remains with the financially responsible employee. Based on this, he delivers spare parts and materials received during liquidation to the warehouse.

The accountant makes a note on the disposal of the object on the inventory card (form No. OS-6). Inventory cards for retired objects must be stored separately for a period determined by order of the head of the organization. When liquidating a vehicle, the accounting department must have documents on the disposal of scrap or scrap (sales for scrap metal, removal to a landfill, etc.).

Spare parts suitable for further use are handed over to the warehouse with a receipt order issued in form No. M-4. The transfer of the specified spare parts from the warehouse to production (for example, to a repair shop) is formalized by a demand invoice in form No. M-11. If spare parts are sold externally, then the warehouse manager (storekeeper) draws up an invoice for the release of materials externally according to form No. M-15.

Published in “Accounting. Taxes. Right. ” No. 4/2004