What it is

The term “staffing table” refers to an internal document of the enterprise that approves the structure, number of employees and salary rate in accordance with the position.

Through this document, it is possible to formulate the composition and determine the total number of the company.

Do you need a staffing table for an individual entrepreneur? The law does not oblige entrepreneurs to develop this document, but its presence facilitates the maintenance of personnel records and accounting documentation related to payroll.

The staffing schedule of an individual entrepreneur must include the following information:

- a complete list of professions and positions;

- breakdown of the list by structural divisions;

- an indication of the salary, all available allowances and the full salary of each position;

- a list of staff positions indicating the number of positions occupied.

Another reason why an individual entrepreneur should have a staffing table is the need to hire workers based on the number of staffing units. Proper maintenance of internal documentation allows you to track staffing levels, including employees working at 0.5 rate.

What form should you use to draw up the staffing table - unified or your own?

The law does not regulate who should draw up the ShR. This is usually done by a personnel officer and an accountant. If the functions of these specialists are performed by an individual entrepreneur himself, the development and approval of the document falls on his shoulders.

Despite the lack of direct indication whether the staffing table for an individual entrepreneur is mandatory or not, it is better not to neglect the preparation of the document.

To understand how to correctly fill out the “staffing” on the simplified tax system for individual entrepreneurs, let’s figure out which employees an individual entrepreneur can hire, because it is their positions that will form the basis of the current staffing table for 2020.

The staffing table is an internal document by which an individual entrepreneur approves the structure, number of his full-time employees and their wages in accordance with their position.

Source: klinikabiz.ru

Importance of the document

Guided by the resolution of the State Statistics Committee establishing unified forms of primary documentation (the staffing schedule of individual entrepreneurs on UTII is one of these), it is necessary to draw up all papers in accordance with the approved recommendations.

At the same time, the country’s legislation does not contain a clear requirement as to whether an individual entrepreneur should have a staffing table. The Labor Code of the Russian Federation establishes only the concept of an employee’s labor function, which involves the latter performing professional duties on the basis of internal documentation.

Despite the lack of direct indication whether the staffing table for an individual entrepreneur is mandatory or not, it is better not to neglect the preparation of the document. Moreover, if the entrepreneur has employees who work under an employment contract.

The staffing schedule for an individual entrepreneur with employees, a sample of which can be found on the Internet, allows you to:

- carry out staff reduction or dismissal of employees (Article 81 of the Labor Code of the Russian Federation);

- provide extracts from the document, often requested by tax or other inspection authorities supervising compliance with the law. Working on a simplified basis does not relieve the individual entrepreneur from liability in the absence of a staffing table;

- avoid penalties. For entrepreneurs working on the simplified tax system or special tax system, drawing up a document in accordance with all the rules will allow them to avoid fines for its absence. The exception is the staffing schedule for individual entrepreneurs without employees. Exemption from liability occurs due to the requirements of the said resolution.

The question of whether an individual entrepreneur should have a staffing table usually arises when organizing the labor functions of an employee in accordance with his position. When an employee performs work duties under a separate agreement and calculates wages without reference to salary, such a document is not required.

On video: Refund of overpaid tax, registration of employees as individual entrepreneurs, company cars

Document approval

The schedule must be approved by the head of the organization (CEO), in this case an individual entrepreneur. To do this, he needs to sign a mandatory order.

An administrative document usually comes into force from the date of approval. At the same time, there is no need to introduce it to employees under signature. Unless, of course, such an action is specified in the collective agreement.

Staffing form

It is allowed to independently develop the document form, but most often it is recommended to use the approved T-3 form. It is not dogmatic and can be supplemented as necessary by commercial entities to reflect all the information required in the document.

A sample staffing schedule for an individual entrepreneur for a year can be downloaded from specialized websites that offer various documents. The unified form, which can be downloaded free of charge in Excel format, contains all the necessary fields, including the names of positions, structural divisions, rank of profession, number of rates and the amount of the tariff salary with allowances, if any. Below are several free options ready for download:

It is advisable to download these examples of staffing schedules for individual entrepreneurs on UTII - this will avoid headaches when developing the document yourself.

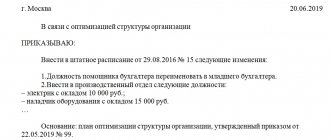

A mandatory requirement when drawing up a document this year is its approval by order of the individual entrepreneur. The staffing table is put into effect after the order is drawn up and signed by the entrepreneur. You can draw up an order approving the staffing table for individual entrepreneurs using the following example:

How to get an extract from the staffing table, why is it necessary?

We advise you to draw up a staffing table if:

- the number of your employees exceeds 3-4 people,

- the duties of employees correspond to the standard functions of a specific position, specialty or profession,

- You need to clearly structure your staff, distributing responsibilities between employees.

It is advisable to download these examples of staffing schedules for individual entrepreneurs on UTII - this will avoid headaches when developing the document yourself.

The requirement to maintain a staffing table is enshrined in Article 57 of the Labor Code of the Russian Federation. The employer is simply obliged to adopt this local act; it is precisely this norm that the legislator refers to the staffing schedule in Article 8 of the Labor Code of the Russian Federation. It turns out that maintaining a staffing table is a direct responsibility, and not the right of an individual entrepreneur. At the same time, the country’s legislation does not contain a clear requirement as to whether an individual entrepreneur should have a staffing table. The Labor Code of the Russian Federation establishes only the concept of an employee’s labor function, which involves the latter performing professional duties on the basis of internal documentation.

How to make a schedule

Is staffing required for individual entrepreneurs? It is desirable, because if an entrepreneur employs 2 or more people, then he will need to enter into an employment contract with them, which will indicate qualification requirements and salary.

How to draw up a staffing table for an individual entrepreneur? Difficulties arise with determining rates for staffing units. If an example of a staffing table for an individual entrepreneur and a sample filling can be found on websites for personnel document flow, then the need for specific work units must be determined independently. The Ministry of Labor website contains special methods and recommendations that establish an approximate plan for calculating the need for employees for each profession or position.

For example, do you need to develop a sample staffing table for an individual entrepreneur in a cafe? How do you know how many cooks, wardrobe attendants or janitors will be needed? A way to solve such a problem is to use calculation methods of labor qualimetry. They include calculation of the load on each employee, the number of operations performed, the class of working conditions, and the presence of harmful factors in the workplace.

Similar calculations can be found in old documents from the times of the Soviet Union, which still have valid status. In terms of methods, the Republic of Belarus (Belarus) compares favorably, where there are many clear and accessible documents regarding labor law and document management. The situation is similar in Kazakhstan.

Staffing schedule for an individual entrepreneur and its necessity

For the successful operation of an individual entrepreneur, does he need to draw up a staffing table?

The provision on staffing is mentioned in the Labor Code of the Russian Federation, Article 57. From this definition it follows that if an employer (individual entrepreneur) using hired labor has concluded an agreement with an employee, which defines the job functions or specialization of the employee, then he must have staffing schedule.

If an entrepreneur, in an employment contract with a hired worker, stipulates a specific area of his activity and describes his exact work, the staffing schedule for an individual entrepreneur is not necessary.

In addition, Article 57 indicates the presence of a “staffing table of the organization”; there is no wording regarding the entrepreneur. Requirements for the availability of a staffing table for an individual entrepreneur may be made by federal labor inspection bodies, defining this fact as a violation of labor legislation.

The experience of individual entrepreneurs determines the design of the staffing table if:

- the number of hired workers is more than three people;

- the job responsibilities of employees are fixed by an agreement defining his position, profession, specialty;

- A clear structuring of the staff and distribution of job responsibilities of employees is necessary.

In cases where an individual entrepreneur does not have a staffing table, but the employment contracts define what positions or specialties employees are hired for, this fact does not prevent the employee from performing his job duties. The employment contract is considered valid, despite the fact that the individual entrepreneur does not have a staffing table.

The employment of an employee by an entrepreneur for a position not included in the staffing table of his company must be considered valid in accordance with the terms of the employment contract.

If the staffing schedule of an individual entrepreneur has not been drawn up, then difficulties may arise in the process of his activities:

- there is no possibility of reducing work units, that is, the employer can reduce the staff, but in controversial cases it will not be able to document the legality of its actions.

To draw up a staffing table, an individual entrepreneur can use the UV T-3 form. But it is allowed to use its own developed form.

An individual entrepreneur unilaterally establishes all names in the staffing table (positions, professions, specialties). The exception is cases if the work performed is related to special cases: provision of benefits, restrictions. In this case, all requirements for these specialties and professions must be as specified in the qualification reference books.

Directories are considered generally accepted and there are only three directories:

- ETKS - Unified Tariff and Qualification Directory of Work and Professions of Workers;

- EKS - Unified Qualification Directory of Positions of Managers, Specialists and Employees;

- OKPDTR - All-Russian classifier of workers' professions, employee positions and tariff categories.

If an individual entrepreneur violates existing provisions and ignores the specified qualification reference books when drawing up the staffing table, labor legislation will restore the rights of hired workers in court.

A correctly completed staffing table in the column “number of staff units” should contain a digital record of an incomplete staff unit (if the company has one) in shares.

The “allowances” column containing data on allowances established for employees must be filled out in the appropriate amounts: rubles, percentages or coefficients.

The employer can summarize the results of wages (the “total” column) only after the tariff rate and allowances are brought to one expression, in one period of time.

Approval of staffing

Approval of the staffing table rests with the entrepreneur himself, which he draws up in the form of an order.

There is no seal in the order of an individual entrepreneur.

The employer has the right to change the staffing schedule at its discretion any number of times.

Useful articles:

What information does a taxi waybill for an individual entrepreneur contain? Temporary suspension of the activities of an individual entrepreneur. Seizure of the property of an individual entrepreneur, its reasons and conditions.

Share

Compilation example

Filling out the staffing table according to the sample begins with indicating the name of the individual entrepreneur or organization. The full form is indicated. If there is an abbreviated name, it is placed in parentheses. The next step is to fill in the OKPO code, the date of preparation and the validity period of the document. The header of the document also contains information about the full number of staff units, taken from the “Total” line.

The document has a tabular form containing:

- name of the structural unit indicating the code according to the hierarchy;

- listing of positions, starting with director or manager;

- number of units available;

- salary and all allowances (bonuses, regional coefficients, additional payments for working conditions);

- monthly salary calculation;

- column for notes;

- a summary row that summarizes the data by column.

Alteration

If there is a need to make any amendments, two options are used:

- The schedule is redone and re-established.

- An order for changes is signed. In this case, the reason for the adjustment is indicated (for example, personnel changes, changes in the number of labor units, salary amounts, names of structural departments, and so on).

Important! When changing the routine, it is important to comply with the deadlines correctly (especially when reducing the number of people or adjusting tariff rates). With such amendments, the document cannot be changed earlier, until 2 months have passed after the order has been drawn up and signed.

The staffing table is a standard that may not be drawn up for individual entrepreneurs if there are no hired employees or there is only one director. In other cases, a routine is necessary to properly regulate labor relations.

What to do if you have one employee

Should an individual entrepreneur maintain a staffing table if he has only one employee subordinate to him? Practice shows that the advisability of drawing up a document arises when there are more than 3 employees. At the same time, the staffing table for an individual entrepreneur with one employee is no different from the general form. It contains similar fields and columns.

Drawing up a document with one seller is usually relevant for small businesses specializing in trade. The document can be based on standardized forms or your own form. Positions can be specified by the entrepreneur at his discretion. An exception is listed or preferential professions, the full name of which must be taken from the ETKS and the EKS. This will help avoid problems with contributions to the Pension Fund or Social Insurance Fund.

Who should approve it and how?

The head of the company or individual entrepreneur is who is responsible for resolving the issue in this case. To approve a document, it is necessary to issue an order containing the relevant information. It is not necessary to stamp the staffing table; this element is used if desired by an individual entrepreneur.

Important. Even when a document is drawn up and approved, it is not considered final. It is permissible to change information in the text; there are practically no restrictions in this direction. It is not necessary to seriously justify the changes made.

Changes to the document

Deadlines for preparation and approval

The law does not set a time frame for approval. The employer decides when his company should approve the schedule. With the next positive change in personnel composition, when new personnel units are introduced, the updated list can be calmly approved at least a day before its commissioning.

On the other hand, if the staff, on the contrary, is being reduced, then it is better to start drawing up a reduced document early. says that management is obliged to notify employees of future dismissal 2 months in advance. This means that the reduced staff must also be developed in no less than 60 days.

Does it need to be approved every year?

Each enterprise manager independently decides for how long he will extend his regular position. In fact, approval is made before the first major additions. If no major changes were made during the current year, then there is also no reason to approve a new document next year.

For how long is it approved?

Like any planning document, it makes sense to reissue the schedule every year for more correct reporting and recording of vacancies. But at the same time, if there is no need to change it, it can work for several years in a row.

If the order approving a staff member does not have a validity period, then the document is classified as unlimited.

How often can changes be made?

Making changes to the company’s local regulations is the most important part of working with this category of documents. The document may be completely replaced, or an order may simply be issued to correct the changes. Such orders can be made an unlimited number of times.

How long before the schedule must be approved before it comes into force?

The document indicates not only the size of the workforce, but also the time when it should be put into operation. As already mentioned, if units are being reduced, then at least two months are allocated for preliminary familiarization of personnel.

How to make changes?

When divisions are opened and abolished, new positions are introduced or salaries increase, an individual entrepreneur can make appropriate changes in the ShR document. All of them must be fixed in 2 ways:

- creation of a new ShR with its subsequent approval;

- or by drawing up an order according to which amendments will be made to the paper.

In the latter case, you must indicate the reason for the adjustment:

- Changes that have taken place in the Labor Code of the Russian Federation.

- Expansion or reduction of production.

- Reorganization of the company.

- Optimization of personnel structure.

After the amendments are made, new entries are made in the documentation of the personnel department: work books, personal cards of employees. Often it is necessary to draw up an additional agreement to the TD, for example, in the event of a change in salary.

The staffing table is a necessary document for an individual entrepreneur. With its help, the employer can plan the costs of paying employees, streamline the HR department and defend their rights if a controversial situation arises with an employee due to staff reduction. There are certain paper formatting rules that must be taken into account when drawing up the SR.

If you find an error, please select a piece of text and press Ctrl+Enter.

Normative base

The staffing table is a local corporate document

, the purpose of which is to organize and manage employees and assign amounts of cash payments in accordance with positions, classes and qualifications. Legislators have not established the obligation to draw up a “staffing table” for all business entities. However, Article 57 of the Labor Code of the Russian Federation contains an unambiguous recommendation to refer to this document when drawing up an employment agreement.

The actual purpose of the document is that it provides legal protection in controversial situations if justification is required for the dismissal of an employee due to the absence of his position in the list. Thus, it automatically protects the company from litigation.

Form and sample filling

Similar articles

- Part-time work: how to register correctly

- Early termination of an employment contract due to staff reduction

- Substitution during vacation

- Sample job application form

- External part-time job: how to apply?

Simplified staffing table for individual entrepreneurs: example of filling out + form

Contents 1 Rules for registration and approval 2 How to draw up a staffing table for an individual entrepreneur in a simplified manner: example of a document 3 The procedure for filling out the T-3 form 4 The procedure for approving the staffing table 5 LLC and individual entrepreneur - who should draw up the staffing? It is worth noting that this type of document is a mandatory act; with its help, the staffing structure, composition and number of employees of the organization are drawn up. For legal entities, maintaining this form is the most important condition for entrepreneurial activity.

In the Labor Code, the staffing table is mentioned only in Article 57 as the document from which the position for the employment contract should be taken - if it is the position, and not the labor function, that is indicated there.V.

What kind of schedule is this?

In fact, the staffing table is an impersonal document. In it you show how many positions are provided in your individual entrepreneur and with what salaries. It is not clear which employees actually work from the staffing table.

For example, now for normal work in a coffee shop you need: 1 manager, 2 baristas, 2 cashiers and 1 cleaner. This is what you show in the staffing table + who has what salary with allowances.

Here's an example:

But in reality, only 1 barista Vasya and 1 cashier Masha can work for you - you are looking for the rest.

The individual entrepreneur itself is not shown in the staffing table.

And yet, the staffing table is always approved by order. Signatures are provided by the accountant, personnel officer and manager. But if you, as an individual entrepreneur, are responsible for personnel and accounting yourself, then you approve only with your signature.