How is money collected from an employee?

Art. 248 of the Labor Code of the Russian Federation determines that the costs of training a resigned employee will constitute material damage for the employer. Accordingly, this amount cannot be withheld from payments due upon dismissal.

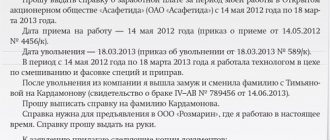

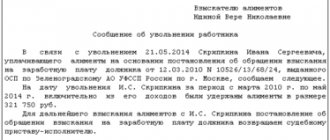

The first thing the employer must do is determine the amount to be reimbursed. This is done either based on the amount of time not worked or on the terms of the student agreement. After this, he is obliged to notify the employee by sending him a letter or handing it over for signature.

The employee can write a statement in which he authorizes the accounting department to deduct the necessary amount from the payments due to him, if it is sufficient. However, a citizen may agree to pay the required amount, but later. In this case, a repayment agreement is drawn up between the parties, which defines the payment schedule.

If within a month after receiving the notification about the need to make payments, the employee does not answer anything, and the amount to be reimbursed exceeds his average monthly earnings, then the employer collects all the necessary documents and goes to court.

An employee can be trained at the expense of the organization

In practice, a situation may arise when an enterprise employee needs to be trained. For example, an organization is going to master related types of business, and it urgently needs a person who can master a new specialty. In such a situation, it makes sense to “invest” in an employee in order to obtain subsequent returns.

In order not to lose the money spent, together with the quitting employee, they enter into a student agreement. Such an agreement regulates the relationship regarding training between employer and employee and complements the employment contract. One of the conditions of the apprenticeship agreement is the employee’s obligation to successfully complete training and work for the employer for the period established in the apprenticeship agreement (for more information, see “Concluding an apprenticeship agreement with an employee (sample 2018)”).

For your information, an apprenticeship agreement can be concluded, among other things, with a person planning to get a job. In this situation, the contract will guarantee that employment will take place. If suddenly, after receiving an education, the applicant changes his mind about concluding an employment contract with the employer, then he will have to reimburse him for the costs associated with training (for more information, see “Concluding a student agreement with the applicant (sample 2018)”).

We arrange it correctly

If an employee leaves the organization who has not completed the period established by the apprenticeship contract and does not have a valid reason for dismissal, then he must reimburse the employer for the costs associated with his training (for more information, see “Termination of the apprenticeship agreement for valid reasons”). Training costs must be compensated in an amount proportional to the time not worked by the employee (for more information, see “We compensate for the costs incurred on training an employee upon his dismissal”). Depending on how the student agreement is drawn up, two options for reimbursement of expenses are possible:

In the first case, reimbursement of expenses is made in the manner prescribed in the contract. In the second case, compensation of funds is made in accordance with the general procedure for compensation of material damage by the employee, namely (Chapter 39, Article 137-138 of the Labor Code of the Russian Federation, determination of the Constitutional Court of the Russian Federation dated July 15, 2010 No. 1005-O-O):

If you find an error, please select a piece of text and press Ctrl+Enter.

Did you like the article? Share the link with your friends:

Bypass sheet: why is it needed?

A bypass sheet is a document that is necessary to identify the presence or absence of debt to the employer for inventory items and current affairs. It serves to record the absence of mutual claims between the parties, which may prevent dismissal and final settlement with the employee.

This definition of a bypass sheet is not official, since in labor legislation there is no such term as “bypass sheet”. Nevertheless, it is quite common in the practice of interaction between an employee and an employer. Typically, bypass sheets are issued in large companies with a branched structure and a large number of divisions.

The bypass sheet upon dismissal is used for the following purposes:

- It records the fact of termination of use of corporate information resources.

- It confirms the fact of transfer of files and documents from the dismissed person to his successor.

- It serves as evidence of the dismissal’s return of the employer’s property, VHI policy, etc., transferred to him for the performance of his job duties.

The rules for filling out the work sheet are regulated by the company’s local regulations. But usually the procedure boils down to the following: the employee receives a bypass sheet before the dismissal order is issued. If the bypass sheet contains a note about the debt, then the employee should pay the employer before receiving the final payment.

The bypass sheet is transferred to the personnel department or accounting department, where it is stored for the time approved by the enterprise. Usually this period is no more than 3 years (the storage period for bypass sheets is not specified by law).

Lawyers' answers (2)

Hello! You will need to review the training agreement. In it you will find the answer to your question:

Article 249. Reimbursement of costs associated with employee training

In the event of dismissal without good reason before the expiration of the period stipulated by the employment contract or agreement on training at the expense of the employer, the employee is obliged to reimburse the costs incurred by the employer for his training, calculated in proportion to the time actually not worked after completion of training, unless otherwise provided by the employment contract or training agreement.

Hello. If you have an expiration date for your employment contract, then according to Art. 249 of the Labor Code of the Russian Federation - in case of dismissal without good reason before the expiration of the period stipulated by the employment contract or agreement on training at the expense of the employer, the employee is obliged to reimburse the employer’s costs for his training, calculated in proportion to the time actually not worked after completion of training. However, the law does not give a clear answer to the question of whether the employer can independently withhold these amounts from payments upon dismissal of an employee. In judicial practice there is no single solution on this issue. The court may refer to Art. 137 of the Labor Code of the Russian Federation, which contains a closed list of grounds for deduction from an employee’s salary. At the same time, deduction of employee training expenses upon dismissal of an employee under this article is not provided. Therefore, even if such a possibility is enshrined in the agreement between the employee and the employer, the courts may still side with the employee and declare such retention illegal. Often, the courts side with the employer and recognize the legality of withholding training costs in the event of an employee’s early dismissal for no valid reason. This conclusion is based on the requirements of Art. 259 of the Labor Code of the Russian Federation to reimburse the employer for the costs of training an employee. You need to understand that if, upon dismissal, an employee refuses to reimburse the employer’s expenses for his training, the organization, ideally, makes a full settlement with the employee, and only after that goes to court with a claim to recover payment for training. Therefore, unilateral retention of funds by the employer is not provided for by law. If you do not agree with his actions, appeal in court and the labor inspectorate, and it would be correct to warn the accounting department about the possible negative consequences of their actions for the enterprise. Good luck!

Lawyers' answers (1)

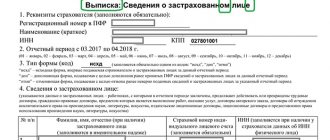

Deductions from an employee's salary are made in cases provided for by the Labor Code of the Russian Federation and other federal laws (Article 137 of the Labor Code of the Russian Federation).

Article 137. Limitation of deductions from wages

Deductions from an employee's salary are made only in cases provided for by this Code and other federal laws. Deductions from an employee’s salary to pay off his debt to the employer can be made: to reimburse an unpaid advance issued to the employee on account of wages; to repay an unspent and not returned timely advance payment issued in connection with a business trip or transfer to another job in another area, as well as in other cases; for the return of amounts overpaid to the employee due to accounting errors , as well as amounts overpaid to the employee, if the body for the consideration of individual labor disputes recognizes the employee’s guilt in failure to comply with labor standards (part three of Article 155 of this Code) or simple work (part three of Article 157 of this Code) Code); upon dismissal of an employee before the end of the working year for which he has already received annual paid leave for unworked vacation days. Deductions for these days are not made if the employee is dismissed on the grounds provided for in paragraph 8 of part one of Article 77 or paragraphs 1, 2 or 4 of part one of Article 81, paragraphs 1, 2, 5, 6 and 7 of Article 83 of this Code. In the cases provided for in paragraphs two, three and four of part two of this article, the employer has the right to decide to deduct from the employee’s salary no later than one month from the end of the period established for the return of the advance, repayment of debt or incorrectly calculated payments, and provided that if the employee does not dispute the grounds and amounts of the withholding. Wages overpaid to an employee (including in the event of incorrect application of labor legislation or other regulatory legal acts containing labor law norms) cannot be recovered from him, except in the following cases: a calculation error; if the body for consideration of individual labor disputes recognizes the employee’s guilt in failure to comply with labor standards (part three of Article 155 of this Code) or downtime (part three of Article 157 of this Code); if the wages were overpaid to the employee in connection with his unlawful actions established by the court. Article 138. Limitation on the amount of deductions from wages The total amount of all deductions for each payment of wages cannot exceed 20 percent, and in cases provided for by federal laws, 50 percent of wages due to the employee. When deducting from wages under several executive documents, the employee must, in any case, retain 50 percent of the wages. The restrictions established by this article do not apply to deductions from wages when serving correctional labor, collection of alimony for minor children, compensation for harm caused to the health of another person, compensation for harm to persons who suffered damage due to the death of the breadwinner, and compensation for damage caused by a crime. . The amount of deductions from wages in these cases cannot exceed 70 percent. Deductions from payments that are not subject to collection in accordance with federal law are not allowed.

The employer is not allowed to deduct training expenses from wages without the employee’s consent , since Art. 137 of the Labor Code of the Russian Federation contains a closed list of restrictions on deductions from wages.

the employer must obtain consent to deduct training expenses from the final calculation. If the employee refuses, the employer may go to court.

The stated opinion is confirmed by judicial practice - the Appeal ruling of the Murmansk Regional Court dated April 15, 2015 in case No. 33-1111-2015.

Should the employer have entered into an additional agreement on compulsory work by such an employee?

Appendix No. 2. Sheet of conversation with a serviceman proposed for dismissal from military service

VIDEO ON THE TOPIC: Serviceman’s report, review deadlines, how to submit it correctly.

Appendix no. The Moscow Exchange will allow individuals to participate in foreign exchange trading. The insurance community is losing participants. Mortgage borrowers are in no hurry to go on vacation. In October, the Russian car market demonstrated downward dynamics. Main Documents Experts. In October, the Russian car market demonstrated downward dynamics Today in Transport. Elimination of trade tariffs will reduce the risk of recession Today in Financial Markets. The system of fast payments will launch a subscription service Today in Economics. The draft law on recognizing individuals as foreign agents will be adopted by the end of the year. Today in Law.

The specter of an end to the trade war has caused confusion in global markets Today in Financial Markets. Mortgage borrowers are in no hurry to go on vacation on November 7 in Mortgage. The Moscow Exchange will allow individuals to trade in foreign exchange on November 7 in the Financial Markets. The Ministry of Construction explained that the program for the overhaul of dilapidated houses will not increase the amount of rent on November 7 in Residential Real Estate. Brexit: UK will never get a trade deal with US on its own terms November 7 in Financial Markets.

Roskomnadzor introduces responsibility for the acquisition of personal data on November 7 in Law. Popular documents. Agroindustrial complex of the Russian Federation. RF IC. PEC of the Russian Federation. Police Law. Weapon Law. Law on Advertising. Subscribe by letter.

If a discharged serviceman does not agree with the decision of the commander regarding the calculation of length of service, such serviceman has the right to appeal this decision in accordance with the established procedure. The legal service unit can provide some assistance in resolving a controversial situation and reducing the possible delay in dismissal in connection with this by providing advice, providing information on current regulations, and preparing a legal opinion on a controversial issue. Secondly, before a serviceman serving under a contract is nominated for discharge from military service, an individual conversation is held with this serviceman, as a rule, by the commander of a military unit.

This forum is currently viewed by: Google , Google Adsense and 31 guests. Forum for legal mutual assistance of military personnel voensud. Search Advanced search. Forums: Topics: Users:. As I understand, nowhere, not a single law, does it indicate that the conversation sheet is drawn up repeatedly: once every three months, once every six months, once a week, etc. I am always happy to study, but I don’t always like it when learn.

Tuition deduction upon dismissal

Quote (Wishenka): Good evening! The employee passed certification in July 2010. at the expense of the employer. Worked until February 2011 - 7 months, then absenteeism, no-shows, etc. resignation letter of one's own free will. To labor. the contract has additional an agreement that in the event of dismissal, the employee must reimburse the costs incurred by the employer for training. The period that the employee was supposed to work was July 2012. 1. Is it necessary to write to the employee a statement that he agrees to deduct the amount of training costs from his salary and compensation for unused vacation? Or is it enough extra? agreements? 2. How to correctly reflect household accounting. operation in case the amount is returned by the employee?

The question was asked in the wrong topic, but... it was not moved, I will answer.

There is no need to write an application; an additional agreement is sufficient.

Financial newspaper. Regional issue", 2008, N 50

SALARY: DETENTIONS AND ACCRUALS

Deduction for reimbursement of expenses associated with paying for employee training

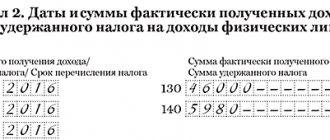

According to Art. 249 of the Labor Code of the Russian Federation, in the event of dismissal without good reason before the expiration of the period stipulated by the employment contract or agreement on training at the expense of the employer, is obliged to reimburse the costs incurred by the employer for his training, calculated in proportion to the time actually not worked after completion of training, unless otherwise provided an employment contract or training agreement. In order for the employer to be able to count on reimbursement of expenses incurred, it is necessary: a) to conclude an agreement with the employee sent to study for the purpose of professional training, retraining or advanced training (Articles 196, 197 of the Labor Code of the Russian Federation); b) include in the contract a condition on the employee’s obligation to reimburse the employer for expenses incurred by him in the event of termination of the employment contract earlier than the established period. If there is no such condition in the contract, the employer does not have the right to make this type of deduction. The condition according to which the employee is obliged to undergo training at the expense of the employer and work for a specified period after graduation can be included in the employment contract both at the time of its conclusion, and later (if appropriate circumstances arise) by signing an additional agreement. In this case, we are not talking about concluding a fixed-term employment contract or changing the duration of its validity: the condition about the need to work out the established period is included in the contract concluded for an indefinite period. In practice, the period of compulsory service is usually two to three years. The employee must reimburse the expenses incurred by the employer only if the employment contract is terminated without valid reasons. Since the Labor Code of the Russian Federation does not divide the reasons for termination of an employment contract into respectful and disrespectful, it is advisable to indicate in the employment contract exactly in which cases the employee may be exempt from reimbursement to the employer of amounts paid for the training period. Variants of the terms of contracts concluded by employers with employees sent to study at the expense of the employer are possible. The employer has the right to demand reimbursement of all types of costs incurred when sending an employee for training, which include direct payment for training, the cost of travel to the place of study and back, a scholarship paid by the employer during the period of study, etc. T. Panchenko Auditor Signed for publication on 10.12 .2008

As for the second question. Ask it in another topic. According to forum rules, one question per topic.

See also:

- Income tax when working under a patent How to reimburse personal income tax to a foreigner? If a foreign citizen works under a patent, then the employer withholds 13% of his salary to pay personal income tax (NDFL). However, not only the employer pays the tax, but […]

- Rules for citizens' appeals in court Electronic appeals of citizens to courts of general jurisdiction The procedure for citizens to appeal to courts of general jurisdiction, received in electronic form, and their consideration, is regulated by the Regulations on the procedure for consideration by courts of general jurisdiction […]

- Interdepartmental interaction with guardianship authorities Interdepartmental interaction in solving social and pedagogical problems of a child in an educational organization In his practical activities, a social teacher performs the main functions: protective, preventive, […]

- Taxes in 2020 for individuals Income tax for individuals 2020 in Russia: changes and personal income tax rates One of the most popular taxes in the Russian Federation is the income tax for individuals, which affects absolutely all working citizens. It is not surprising that […]

- When Raskolnikov committed a crime Why did Raskolnikov decide to commit a crime? Raskolnikov's personality is outstanding. He has the makings of a clear mind, a strong character and a noble heart. At an early age, Rodion Raskolnikov was a sensitive child, compassionate and [...]

- Orders on extracurricular activities according to the Federal State Educational Standard Municipal educational institution secondary school No. 6 of the Tutaevsky municipal district Federal State Educational Standard Federal State Educational Standard Regulatory documents Federal level Regional level Order of the Department of Education of the Yaroslavl Region […]

- Refusal of the claim for eviction Refusal of the claim for eviction without providing another residential premises is legal, since the plaintiff is the owner of a share of the residential premises and to file a claim for eviction on the basis of mismanagement of the residential premises […]

- Rules of behavior with employees at work How to behave at work, in the office? Etiquette. Rules. The right behavior for your career. How to behave correctly at work so that you are loved, respected and promoted up the career ladder. Behavioral strategies in the office for a career. (10+) How […]

Employment contract from A to Z: terms of service after training

This teaching method is well known. Dialogue often begins with the mentor giving the student a deliberately vague task, outlining a need or problem. For example, he asks the student to look at a problem or situation or suggests to him: “You need to wash the part in a flow of single products, and not in batches.” The coach then asks what the student is offering. The answer helps the mentor determine how the student is thinking and what the mentor should offer next. This is why the initial task or problem is often vague, so that it becomes clear how the student will approach the situation.

The student provides an observation or suggestion (sometimes as a list of actions) within a one-page document. The mentor reads it. after which the document in the first cycle is often returned to the student with the sentence: “Please think about this again” or simply with the question: “Why?” This is just the first of several rounds of tossing the ball as the student's analysis and proposal become increasingly elaborate and detailed. Once the current situation has been analyzed, the target state has been defined in detail, and the mentor is satisfied with the outcome, the student moves on to planning and implementing PDCA cycles, often under the supervision of the mentor. At the same time, the student often must justify his actions to the mentor and determine in advance the expected results of the measures taken.

It is important to remember here that the mentor asks questions to the student not in order to lead the mentee to a specific decision (although this may seem to be the case), but rather to find out what and how the student thinks, how he approaches the situation. The mentor works to teach the student the improvement kata algorithm, guiding the student step by step based on reactions and responses as the process progresses. The mentor directs the student to the improvement kata, but in such a way that the student independently masters the algorithm and way of thinking that underlies the kata. The student learns by coming up with ideas independently. The best, albeit tinged with bitterness, praise for a mentor is if the student feels that he has learned and achieved the goal state on his own.

The second, more subtle element of mentor-mentee dialogues at Toyota is that while the student is responsible for implementation, the mentor is largely responsible for the results, but does not have to provide the student with ready-made solutions. This intersection of responsibilities creates a bond between them, because if the student fails, the mentor's performance will be subject to critical analysis.

If the student has not learned, then the teacher has not taught.

A common expression often used on Toyota

The student is the person working on the problem, while the mentor’s job is to keep the student “in the corridor” of the improvement kata algorithm. Of course, to guide a student in this way, the mentor must also consider the situation and often think one step ahead, but not more than one step. The mentor works to guide the student "into the corridor" of behavior prescribed by the improvement kata, but ultimately the mentor must accept the decision made by the student. If he himself leads the student to a solution, this will interfere with the development of the student’s abilities, that is, the realization of the ultimate goal of the “mentor-student” dialogue.

Although mentors at Toyota typically do not impose solutions, they can still dictate how to approach understanding a situation and developing those solutions. For example, having received information from a student on one cycle, the mentor sometimes tells him the next step.

The third element of mentor-mentee dialogue is that it is not just learning by doing: people learn by making discoveries through small mistakes. The mentor expects the student to make minor mistakes when applying the improvement kata, and it is at these moments that the mentor himself can learn the most. He will see what further coaching is required. In other words, the mentor allows the student to make small mistakes if they do not affect the customer, rather than immediately giving ready-made answers.

The mentor-mentee approach has several advantages:

§ Leaders can learn how a student thinks and thereby determine the right next step and what skills the student needs to practice to become better problem solvers. When we simply tell a person what to do, we are not taking into account their skill development needs.

§ This approach of learning by doing, from one's own mistakes, under the guidance of a mentor is more effective than when we rely on written documents, classroom training, or verbal instructions on what to do to convey organizational culture to new employees. Action learning ensures the development of specific behavioral models.

§ This approach aligns company goals with workplace behavior. It provides focus, direction and control, but allows enough freedom to help people develop their abilities. The mentor-mentee approach helps develop individual responsibility and initiative while providing overall direction.

§ Further mentoring and training provided by the mentor is determined by the needs of the student and the situation. This means that information in an organization moves both up and down. As a result, strategic decisions can be better synchronized with the actual situation at the process level.

Date added: 2016-03-25; | Copyright infringement

Recommended content:

Related information:

Search on the site: