Employees for whom the enterprise has writs of execution must be under special control of the accounting department from the first to the last day of their work. This is the only way to avoid administrative fines for violating a number of norms of the Labor and Family Codes. Current legislation requires a number of mandatory procedures to be followed when dismissing such an employee, either at his own request or at the initiative of the employer. Among them is the need to return the writ of execution to the bailiff service and notify it of the fact of dismissal. Notification will be discussed in this article.

In what cases is a notification letter written?

Most often, the presence of a writ of execution involves withholding part of the debtor’s wages in favor of the relevant recipient. At the same time, the grounds for such a penalty are unimportant. This could be alimony, debts on fines or housing and communal services, debts on previously received loans, etc. Typically, the relevant information is indicated in paragraph 7 of the special resolution, which the bailiff sends along with the writ of execution.

If there are legal grounds for such a measure, and the employer is presented with an original or a duplicate of the writ of execution (the copy does not have the force of law and is not enforceable!), then the authorities of the Federal Bailiff Service must be notified of receipt of the relevant document. Similarly, when a debtor employee is dismissed, the bailiff service must receive information about this fact. A letter form is used for this purpose. In addition, it is recommended to send a corresponding notice to the claimant, along with a copy of the dismissal order.

Who is responsible

Since if a letter to the bailiff department about the dismissal of an employee is sent untimely, we may be talking about material losses for the claimant, the law provides for administrative punishment for the employer’s failure to fulfill his duties.

Responsibility is enshrined in the Code of Administrative Offences, namely in Art. 17.14. It says that for late notification the fine for officials is from 10,000 to 20,000 rubles, for legal entities - from 30,000 to 100,000 rubles.

https://youtu.be/yhx5VsHD82o

How to write a letter to bailiffs about the dismissal of an employee

The legislation establishes the mandatory return of the writ of execution in the event of dismissal of the debtor, and notification of the Federal Bailiff Service about the fact of termination of the employment contract (Part 4 of Article 98 of the Federal Law of 02.10.2007 No. 229-FZ “On Enforcement Proceedings”), but does not regulate the form of such letters. However, according to the rules of business correspondence, it must consist of three parts: introduction, body and conclusion and contain certain information.

Cases when you can return a writ of execution to the bailiffs, and how to do it

If the debtor is dismissed during enforcement proceedings, the employer returns the decision to the bailiff to the executor within the above deadlines. Was the debtor fired earlier, even before the company received a copy of the IL? Such cases also occur - if the FSSP employees received incomplete information. Is the employer obliged to notify the bailiff in this case? Definitely!

A response to the bailiffs about the impossibility of recovery if the employee quit long ago is sent immediately. In this case, the covering letter to the bailiffs regarding dismissal must contain a copy of the decree on the basis of which the employee was dismissed.

How to return the writ of execution to the bailiffs upon dismissal if the employee quit a long time ago? Simply send all received documents back to the address from which the letter came, attaching a copy of the order.

:

Letter from the FSSP on the dismissal of an employee - debtor

Introduction

Here you need to provide the following information:

- details of the company - former employer. These include the name of the organization, its address, contact details;

- indication of the specific department of the Federal Bailiff Service - the recipient of this document. The name of a specific bailiff need not be indicated;

- if the writ of execution is issued for the collection of alimony, then it is necessary to indicate the full name and address of the collector, including his postal code;

- internal registration outgoing number;

- date of writing;

- Title of the document.

Main part

It should contain the following data:

- the reason for the drafting (in this case – dismissal);

- links to the details of the writ of execution or the outgoing number of the letter of the bailiffs containing the order to make deductions;

- last name, first name, patronymic (if any) of the dismissed employee, his former position and specialty;

- date and reason for dismissal. It is highly advisable to indicate the latter with references to the relevant articles of the Labor Code;

- whether the final payment has been made and its date. If not, then the reasons for the debt are indicated;

- the period during which the deductions were made;

- address of the debtor's new place of work. If it is unknown, then it is written that way, but the presence of such a phrase is also highly desirable;

- the last place of residence of the debtor, as indicated in the organization’s documents;

- a phrase about the return of the writ of execution to the Federal Bailiff Service.

Conclusion

This part contains a list of attached documents (usually there are three of them - a writ of execution, a copy of the dismissal order and a certificate of the amount of deductions made), signatures of the manager and chief accountant. The entire document is certified by the seal of the organization.

Letter to representatives of the FSSP stating that the debtor resigned

In accordance with sub. 2 clause 4.1 art. 98 Federal Law of the Russian Federation “On Enforcement Proceedings”, in the event of dismissal of the debtor, the employer is obliged to send to the bailiff:

- a copy of the writ of execution with a note indicating the reason for the end of execution of the document;

- and the amount that was withheld for the entire time the employee worked in a particular organization.

Thus, the covering letter to the bailiffs is an official document that is sent to the FSSP after the termination of the employment contract with the debtor, complete with a writ of execution. An order for the dismissal of a specific employee must also be attached here.

It should be borne in mind that sending such a document is a mandatory requirement.

In case of failure to comply with the notification procedure, the employer may be fined:

- for citizens - from 2,000 to 2,500 rubles;

- for officials - director, head of the personnel department - from 15,000 to 20,000 rubles;

- for legal entities - from 50,000 to 100,000 rubles.

Such amounts are specified in Part 3 of Art. 17.14 Code of Administrative Offenses of the Russian Federation.

When is it compiled?

A covering letter to bailiffs is drawn up upon the dismissal of an employee from whose wages deductions were made on the basis of a writ of execution. It could be:

- payment of alimony;

- repayment of debt to the bank;

- compensation for damage caused to another person;

- fines;

- other types of deductions.

In this case, the main reason for sending a covering letter, including the papers attached to it, is the termination of the execution of the writ of execution. It is also worth emphasizing that the bailiffs must be notified of this event not only when the debtor is dismissed, but also in a number of other situations (for example, when transferring money in full, in connection with the filing of an application by the debtor, etc.).

How to write correctly?

The current legislation does not have any requirements or rules for writing a cover letter to bailiffs. There is also no single example of such a document.

It is drawn up in any form on A4 paper. It can be prepared on the letterhead of an organization acting as an employer.

The standard structure of a cover letter for the dismissal of a debtor is represented by the following points:

- “Head” of the document - here the details of the employing company (name, location) and information about the addressee are indicated, that is, the full name of the territorial branch of the FSSP and its address.

- Registration data - the number and date of registration of the letter in the company’s outgoing correspondence.

- Title of the document - the following wording can be used here: “Notice of dismissal of the alimony payer.”

- Content part — this section should consistently contain the following information:

- Full name of the debtor;

- the position he held in the organization;

- details of the writ of execution on the basis of which deductions from wages were made (number and date, name of the judicial authority);

- reason for dismissal;

- the day until which the deductions were made, and a note indicating the absence of uncollected debt;

- message about the return of the writ of execution.

- At the end of the document there must be signatures (of the manager and chief accountant), as well as the seal of the organization.

How to report a fired employee?

Based on the provisions of clause 4.1 of Art. 98 of the law mentioned above, the writ of execution must be sent to the bailiffs the next day after dismissal . However, in individual cases this period may change.

For example, if an employee is a payer of alimony, then the administration of the organization in which he works must notify the bailiff within 3 days of the fact of the payer’s dismissal (clause 1 of Article 111 of the RF IC). In this case, it is also necessary to inform about the new place of work of the person liable for alimony (if it is known to the former employer).

In general, a covering letter with attachments can be sent to the bailiffs in one of the following ways:

- delivered via courier;

- sent by mail (by a valuable letter with acknowledgment of delivery).

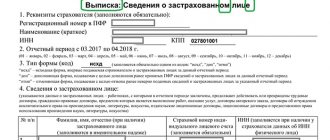

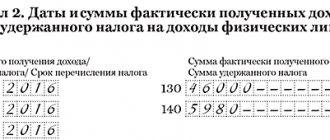

How to prepare a certificate of deductions made

The form of this document is also free, indicating the following data:

- company details

- last name, first name, patronymic (if available) and passport details of the debtor;

- details of the writ of execution;

- period for making deductions;

- payment form;

- monthly indication of income and the corresponding amount of deductions.

The document is certified by the signatures of the manager, chief accountant and the seal of the organization.

In special cases, special notes are additionally made in the document. They are necessary, firstly, if the claimant independently provided the organization with a writ of execution, and, secondly, in case of deductions made under a notary agreement

What to do if a decree has been issued regarding penalties against a dismissed employee?

If the order to collect alimony comes to a long-dismissed employee, the document should be returned to the bailiff with a covering letter.

The fact of return is recorded in writing in the registration and accounting journal. Documentary evidence of the return is also kept documented (for example, a list of the contents when sending papers by registered mail). The procedure for terminating working relationships with persons who pay alimony differs significantly from the standard procedure.

It is for this reason that the employer must familiarize himself with all the nuances and rules of this process. The main thing in such a case is to ensure that the person in charge has completed all the necessary actions. Otherwise, the likelihood of fines being assessed increases significantly. If difficulties and questions arise in practice, it is advisable to involve an experienced lawyer.

Notice deadlines

Part 4 art. 98 of the Federal Law of 02.10.2007 No. 229-FZ “On Enforcement Proceedings” does not establish clear deadlines for sending a notification, but contains only a phrase about the “immediacy” of this action. If the reason for the withholding is alimony, then part 1 of Art. 111 of the Family Code of the Russian Federation establishes a three-day period for sending a message, but says nothing about the deadline for returning the writ of execution. Therefore, it is advisable to complete all required actions no later than the working day following dismissal (excluding weekends and holidays).

A person quits his job and a foreclosure order has arrived, how to respond?

- Lawyer consultation

- Articles

In this case, there is no need to worry, because the organization and its employees will not suffer any financial losses if they send a response to the bailiff’s request in a timely manner and return all received documents. Subsequent proceedings with documents, a decision that the person does not work and the search for ways to collect the debt is already the job of the bailiffs.

But you will greatly help the investigation if in your answer you also indicate information known to you about the current or last place of employment of the debtor known to you. If an employee is still employed in this company, but for some reason does not receive wages, the executive officer should also be notified about this.

An administrative penalty for failure to prepare a response may be a monetary fine.

Read related articles:

- Dismissal at the initiative of the employer

- Dismissal for violation of labor discipline

- One day dismissal

In this situation, the current legislation does not require the employer to attach any other documents to the writ of execution. However, given that the employee resigned before the writ of execution was received by the organization, it would be advisable to attach a copy of the order to dismiss the employee.

Attention

In the book you will find instructions on personnel records management that will make your work easier; document details. You will also learn how to restore HR records after its predecessors; learn everything about the archive of personnel documents: from the formation of files to the destruction of documents.

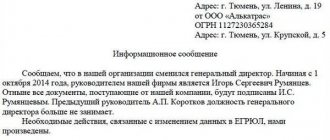

Answer to the bailiffs that the person is not working

Just recently they also answered the bailiff + attached a copy of the order to dismiss the employee for whom the request came.

I want to draw the moderator’s attention to this message, because: A notification is being sent... I’m at the best age: there is no more stupidity, there is STILL no insanity... My head is a mess, but everything is scattered and lies somehow according to feng shui... I want to draw the moderator’s attention to this message because: Notification is being sent... #9[119688] January 14, 2010, 16:53

The fact that the employee quit is the second question. And the first one indicated the organization incorrectly. In general, if you want to conduct a search with them, then write about the incorrect name of the organization, and if you want them to fall behind, then write that he was fired on that date.

But I wouldn’t attach the order. I want to draw the moderator's attention to this message because: A notification is being sent...

Procedure for receiving a writ of execution

A writ of execution is a document issued on the basis of a court decision, which, among other things, indicates what amount must be collected monthly from the employee’s earnings in payment of the debt. The paper is received by the head of the enterprise from the FSSP, or directly from the employee, after which the following procedure must be followed:

- Report that the document has been received, or return it back if the employee left the company a long time ago, accompanied by an appropriate explanatory note.

- Register in the document flow log.

- Submit to the accounting department for implementation and control of deductions.

- Appoint someone responsible for storing the document.

- Monthly deduct from the employee’s income the amount agreed by the court to the account of the creditor/collector.

- Return the document to the bailiffs if:

- the debtor resigned;

- the debtor died;

- the executive document has been revoked;

- the specified specified amount has been paid in full towards the debt;

- the child has reached the age of majority (in the case of the child support payer).

After this, the event is confirmed by an order, certificate or other document, and the return is recorded in the document flow log.

The employer is obliged to carry out all of the above manipulations only if he has in hand the original or a duplicate of the writ of execution. A copy of the paper in this case has no legal force.

Actions of accounting department upon dismissal of alimony payer

After the employment contract is terminated, the employee is expelled from the staff of the enterprise and receives all the payments due to him, a letter is sent to the bailiffs.

As mentioned earlier, a writ of execution is included in it. In this document, the accountant is required to indicate the amount withheld from the employee and the balance of payments to the recipient of alimony.

What are the further actions of the accountant when dismissing the alimony worker? According to legislative norms, the employee’s personal file after his dismissal is transferred to the employer’s archive. The company's accounting staff files documents such as:

- A copy of the writ of execution indicating the amount of funds withheld from the employee’s income and the total balance of alimony payments;

- A duplicate of the employer’s order to terminate the employment relationship with the employee, indicating the official date of dismissal;

- Copies of notification letters that were sent to the bailiffs and the recipient of alimony;

- A complete list of documents enclosed in the letter.

Departure procedure

To send a letter, you must first decide on the deadline. They vary and depend on the nature of the debtor’s monetary obligations. If this is a bank borrower, then the law does not establish a specific time frame. Federal Law No. 229 only indicates the need to promptly return the writ of execution to the bailiffs when dismissing an employee paying off a loan, along with a letter.

If the employee pays alimony, then the document should be sent, guided by the Family Code, which requires this to be done within three days (working days are counted). Therefore, in order to avoid problems with FSSP employees, it is advisable to notify them on the day the employment contract was terminated or on the next day.

Don’t think that meeting deadlines is an empty formality. The return of the resolution to the bailiff - executor with a letter stating that the debtor has been dismissed is required within the established framework. In other cases, the law provides for punishment. If individuals are required to pay a fine of 2,500 rubles, then for organizations its amount is already 50 to 100 thousand rubles. Cash compensation is given as of 2020.

We invite you to familiarize yourself with Article 89. The procedure for dismissal from service in internal affairs bodies and exclusion from the register of employees of internal affairs bodies ConsultantPlus

Notification of the debtor about the dismissal of the debtor

In the legislative framework of the Russian Federation there is no mention of the form of notification to the debt collector that the executor of the court decision no longer works in this organization, which means you can write a letter in a free conversational form. You need to indicate for what reasons payments from the salary of a former employee of the company will not be transferred to the account of the debtor and information known to you about the current location and employment of the debtor. You can also add formal data such as the number of the writ of execution, etc.

“Dear Petrov Petr Petrovich, the accounting department of the Organization LLC organization informs you that citizen Ivan Ivanovich Ivanov is no longer our employee, and therefore payments to repay the debt will no longer be transferred for you from the organization’s account. At the moment, we know that Ivan Ivanovich is officially employed at, where you can contact with questions that interest you.”

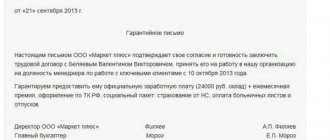

Sample letter for bailiff

Since there is no clearly established form of notification in the Russian Federation, the letter can be issued by filling out a standard application. The header of the document indicates the department to which the letter is sent and the name of the bailiff.

The main text of the application describes the fact of termination of cooperation with the debtor. The reason for dismissal and the date must be indicated. If the boss has additional information about the debtor, the necessary information can be included in the text of the notice.

Before sending an official letter, you must attach a copy of the dismissal order to the application, as well as a certificate of the financial amounts transferred by the debtor to the claimant’s account. These documents must be signed not only by the general director of the enterprise, but also by its chief accountant. If you have a company seal, you must leave an imprint on the documents.