Are daily allowances subject to income tax?

Art. 168 of the Labor Code of the Russian Federation states that an employer who sends a specialist on a business trip is obliged to compensate him for additional expenses associated with living away from home - to pay daily allowance. Their size is set by the company independently based on financial capabilities and ideas about fairness. It is fixed in the internal acts of the organization, for example, in a collective agreement.

Art. 217 of the Tax Code of the Russian Federation, indicates that daily allowances are not subject to personal income tax, provided that they do not exceed the following limits:

- 700 rub. – for traveling around the country;

- 2.5 thousand rubles. – for business trips abroad.

Art. 217 of the Tax Code of the Russian Federation obliges the company to withhold personal income tax from business trips in excess of the norm. To do this, the accountant acts according to the following algorithm:

- Calculates the amount of excess of paid daily allowances over the limits specified in the Tax Code of the Russian Federation.

- Determines the amount of personal income tax using the appropriate rate: 13% for residents of the Russian Federation, 30% for non-residents.

According to the provisions of the Tax Code of the Russian Federation, the accountant is obliged to calculate income tax during the month when the advance report prepared by the traveler was approved. Personal income tax is withheld from the specialist at the time of the next salary payment and is transferred to the state treasury no later than the day following this date.

Terms of withholding personal income tax from business trips

The date of receipt of income for excess daily allowance, as well as for the average salary during a business trip, is the last day of the month in which it was accrued.

For example, an employee was on a business trip from September 2 to September 8, 2020, and travel allowances were transferred on August 27. This means that on the last day of September - the 30th, he needs to calculate the salary based on the average for the time that the employee spent on a business trip and calculate personal income tax, and the excess daily allowance listed in August relates to the income of August, but it is treated as prepaid income , which is considered as such after approval of the business trip report, so personal income tax must be calculated with the next salary payment (for example, an advance for September). Personal income tax is withheld on the day the income is paid and transferred on the next business day.

Is the cost of travel subject to personal income tax?

Art. 168 prescribes that the employing company is obliged to compensate the employee for the cost of travel to the destination. In Art. 217 of the Tax Code of the Russian Federation states that income tax is not provided for the following types of expenses:

- cost of round trip tickets;

- baggage fee;

- travel to the airport (station), to the destination in the city where the specialist was sent;

- commission fees;

- payment for airport services.

Important! The only condition for exempting compensation paid to an employee from personal income tax is documentary evidence of the expenses incurred.

For example, if a specialist traveled by train, he presents a ticket to the hiring company. If the business trip involved air travel, you can attach an electronic ticket receipt and a scan of your passport with border crossing marks to the advance report. To confirm expenses for taxis and airport services, you need to save receipts.

The employer’s obligation to charge tax on travel expenses arises in a situation where the specialist was unable to document them, but compensation was paid. The accountant calculates the tax in the month when the advance report was approved and deducts it from the specialist’s next salary.

The question of whether compensation for VIP lounge services is subject to personal income tax deserves special attention. Current legislation does not contain any restrictions prohibiting the classification of this type of expense as transportation costs. In practice, questions and claims from regulatory authorities are not excluded, so it is better for the company to have an explanation why the employee needed VIP service at the airport. For example, the manager was holding negotiations there and preparing an urgent presentation. Rules regarding such costs can be specified in the enterprise's collective agreement.

Is employee travel taken into account?

Management must pay for travel if an employee is sent on a business trip. Travel tax is not provided if:

- round-trip tickets are purchased within the country;

- when carrying luggage;

- in case of payments for airport services or roads to it;

- commission fees are being paid.

To exempt yourself from personal income tax compensation, you must document your travel expenses by presenting them to the tax authority.

Are living expenses subject to personal income tax?

According to Art. 217 of the Tax Code of the Russian Federation, compensation for expenses for renting housing during a business trip is not subject to personal income tax, provided that the expenses incurred by the specialist are documented. If he rents a hotel, he will need a BSO or a check; if he rents an apartment, he will need an agreement with the owner and a paper confirming payment.

If the documents are executed incorrectly or are not submitted, the compensation is exempt from income tax within the daily limits:

- 700 rub. – for domestic Russian trips;

- 2,500 rub. – for foreigners.

The accountant includes the amount exceeding legal limits as part of the specialist’s taxable personal income tax. He calculates the tax in the month when management approved the advance report.

Example of personal income tax payments from daily allowances

Local acts of the organization set the amount of daily allowance for trips within the Russian Federation in the amount of 1000 rubles. The employee was sent to Kazan for 5 working days (from September 3 to September 7, 2020). The employee left for his destination on September 2 and arrived back on September 8. What amount of daily allowance will be paid and the amount of personal income tax.

During a business trip, daily allowance will be paid for 7 days in the amount of 7,000 rubles.

Based on the legislation, 700 rubles are not subject to personal income tax. per day of stay on a business trip, which means 4900 rubles are not taxed, the amount in excess of these norms will be subject to personal income tax - 2100 rubles.

The personal income tax amount will be:

2100 rub. * 13% = 273 rub.

Peculiarities of taxation of personal income tax on payments made abroad

If a specialist is sent to solve business problems abroad, he has a number of additional expenses that are not typical for domestic trips:

- for obtaining a visa;

- to purchase health insurance;

- consular fees;

- fee for the right to enter by car, etc.

Compensation for expenses associated with a trip abroad is exempt from taxation, provided that the expenses were actually incurred and documented. If the papers submitted to the employer are in a foreign language, they must be translated.

If checks confirming foreign expenses are denominated in foreign currency, the accountant converts them into rubles at the official exchange rate of the Central Bank of the Russian Federation, established on the last date of the month when management signed the specialist’s advance report.

Mandatory payments to employees sent on business trips are provided for in Art. 167-168 Labor Code of the Russian Federation. These transfers to specialists are reflected in the 2-NDFL certificate. There are special income codes for them:

- 2000 – for the amount of average earnings, which, according to Art. 167 of the Labor Code of the Russian Federation, is necessarily reserved for the posted worker.

- 4800 – for the amount of daily allowance paid in excess of the norms established by Art. 217 of the Tax Code of the Russian Federation, and subject to income tax.

- 4800 – for compensation for accommodation, travel and other expenses not documented by the employee.

If you find an error, please select a piece of text and press Ctrl+Enter.

When filling out the 2nd personal income tax declaration, the accountant does not understand how to reflect travel and daily expenses, and what code to indicate. This is a serious issue and requires a detailed approach. Certificate 2 of personal income tax relates to tax reporting, and any error is fraught with penalties, both for the performer and for the organization as a whole. The report with attribute 1 reflects profit that is subject to taxation, with attribute 2 - if personal income tax cannot be withheld. Let's look at the features of filling out a certificate for travel and daily expenses.

Income codes in 2-NDFL in 2018

217 Tax Code of the Russian Federation; Letter of the Ministry of Finance of Russia dated 07/05/2016 N 03-04-06/39129. Subclause 6, clause 1, art. 223 Tax Code of the Russian Federation. Clause 3 of Art. 226 Tax Code of the Russian Federation. Clause 4 of Art. 226 Tax Code of the Russian Federation. Clause 6 of Art. 226 Tax Code of the Russian Federation.

In case of dismissal, the date of receipt of income in the form of daily allowance does not change

The last day of the month is the date of receipt of income also for income in the form of wages, that is, for wages. However, the Tax Code has a special clause for her: upon dismissal, income in the form of salary is considered received on the day of dismissal. But for the daily allowance they did not make the same clause. Per diem does not apply to salary. In addition to the salary, the salary includes compensation and incentive payments, and the Labor Code classifies daily allowances not as compensation, but as guarantees. So, the norms on the date of receipt of income established by the Tax Code for wages in case of dismissal do not apply to excess daily allowances. Therefore, formally, personal income tax on excess daily allowance cannot be withheld from dismissal payments. An additional obstacle arises if the daily allowance is issued in foreign currency for a business trip abroad. In order to determine the amount of income in the form of excess daily allowance, they should be converted into rubles according to the Bank of Russia exchange rate established on the last day of the month in which the advance report was approved. And in our situation, dismissal occurs before the end of the month. And on the date of dismissal, neither the amount of taxable income nor, accordingly, the amount of personal income tax on it, will be known. And it turns out that personal income tax on the resigning employee’s excess daily allowance will need to be calculated only on the last day of the month, and at the end of the year, the Federal Tax Service must be informed about the impossibility of retaining him. ——————————— Article 129 of the Labor Code of the Russian Federation. Clause 2 of Art. 223 Tax Code of the Russian Federation. Article 129 of the Labor Code of the Russian Federation. Articles 167, 168 of the Labor Code of the Russian Federation. Clause 5 of Art. 210 Tax Code of the Russian Federation; Letters of the Ministry of Finance of Russia dated January 21, 2016 N 03-04-06/2002, dated March 21, 2016 N 03-04-06/15509.

The Ministry of Finance suggests not to complicate things

Despite all this, the financial department issued a Letter stating that in our situation, the date of receipt of income in the form of excess daily allowance is the last day of work. The Ministry of Finance explained this with the sole requirement of the Labor Code to make a final settlement with the employee on the day of dismissal. Accordingly, with this approach, the tax agent must: - on the employee’s last day of work, calculate personal income tax from excess daily allowances. If daily allowances are issued in foreign currency, then the amount of income in rubles must be determined according to the Central Bank exchange rate established for that day; - withhold the calculated tax from the dismissal pay paid on the last day of work and transfer it to the budget no later than the next working day. This is how a Ministry of Finance specialist commented on the situation.

Withholding personal income tax from excess daily allowance upon dismissal Nikolay Nikolaevich Stelmakh, 1st class adviser to the state civil service of the Russian Federation - As a general rule, for personal income tax purposes, the date of actual receipt of income in the form of daily allowance in excess of the amounts specified in paragraph 3 of Art. 217 of the Tax Code, is the last day of the month in which the advance report is approved after the employee returns from a business trip. Consequently, on this day the tax agent is obliged to determine the amount of such income and calculate personal income tax on it. The situation when, before the end of the month in which the director approved the advance report, the employee quits and, accordingly, receives a full payment, the Tax Code is not resolved. Therefore, strictly formally, the employer-tax agent should not withhold personal income tax from excess daily allowances from dismissal payments, since on the day of dismissal the date of actual receipt of income in the form of such daily allowances has not yet arrived. This means that the employer needs to calculate the amount of personal income tax from them on the last day of the month and, at the end of the year, inform both the individual and the Federal Tax Service about the impossibility of withholding tax. Then the Federal Tax Service will have to send the individual a notification to pay such tax. After this, the individual must pay it himself. In order to eliminate this long chain and provide the individual taxpayer with more comfortable conditions for paying tax, the Ministry of Finance considered it possible to calculate tax on excess daily allowance on the last day of work and withhold its amount from dismissal payments by the tax agent - the employer. Accordingly, if the daily allowance was issued in foreign currency, then to determine the amount of income in rubles you need to take the Central Bank exchange rate for that day.

Although this approach does not correspond to the formal reading of the Tax Code, it is convenient for everyone. The employee does not have any personal income tax obligations, you do not have to send him a message about the impossibility of withholding tax, and the inspectorate does not have to send a notification and track the receipt of tax. In addition, this approach is supported by an official Letter from the Ministry of Finance. Therefore, the likelihood that the inspection will make a claim is low. ——————————— Letter of the Ministry of Finance of Russia dated December 14, 2016 N 03-04-06/74732. Article 80 of the Labor Code of the Russian Federation. Clause 5 of Art. 226 Tax Code of the Russian Federation.

Is it necessary to reflect travel allowances in personal income tax certificate 2?

When calculating travel allowances and filling out certificate 2, there are several features:

- A mandatory condition during a business trip for an employee is to maintain average earnings in accordance with the employment contract and staffing schedule. This amount is reflected in the certificate under the code 2000;

- During a business trip, the employee is paid daily allowances in excess of the norms approved by law. These amounts are reported under travel income code 4800;

- Daily allowances are not subject to personal income tax at the established rate, so there is no need to reflect them in the 2nd personal income tax declaration.

Currently, the following limit has been approved: within the Russian Federation – 700 rubles; outside the Russian Federation – 2,500 rubles.

If the financial situation of the organization allows it, and this is stipulated in the collective agreement, the enterprise reimburses employees per diem in a larger amount, the difference is recognized as income and is taxed. This is what you will need to show in the certificate.

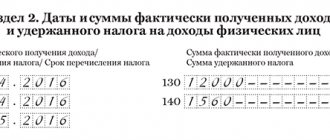

An example of reflecting daily amounts in excess of the standard (RUB 700) in section 2 of 6-NDFL

The employee reported on August 29, 2020. Will the salary for August 2020 be paid on April 5, 2020?

Personal income tax on the amount of daily allowance in excess of the limit must be withheld from the amount of wages paid (09/05/2020). Personal income tax must be transferred no later than 09/06/2020.

Section 2 of the calculation in form 6-NDFL for 9 months of 2020 must be filled out as follows:

100 – 31.08.2020

110 – 05.09.2020

120 – 06.09.2020

130 – daily allowance over the limit

140 – withheld personal income tax from daily allowances above the limit

Registration of certificate 2

To calculate personal income tax and determine the income code for travel expenses in personal income tax certificate 2, you must correctly allocate all accruals during the reporting period according to the codes used, then there will be no difficulties when filling out the report.

The third part reflects income subject to taxation, except for business trips, approved by law. For example, the daily allowance according to legislative regulations is 700 rubles. The collective agreement determines compensation in excess of daily standards in the amount of 1,100 rubles for each day.

Personal income tax certificate 2 will include 400 rubles:

- By code 4800 - indicate the amount of income of 400 rubles for each day you are on a business trip;

- Personal income tax on daily allowance is calculated similarly to any income = 400 X 13%;

- in addition, they calculate the employee’s earnings for this period in accordance with Article 167 of the Labor Code, calculate and withhold tax. The amount is reflected in the third part of the certificate using code 2000. The calculation is based on average monthly earnings.

Example of income code 4800

Let's consider an example of reflecting 4800 travel payments in excess of the established limit using the income code.

Employee Tyrnova E.S. During the year she went on business trips to Voronezh. In accordance with the law, the daily allowance is 700 rubles. The trip lasted 4 days, with a daily allowance of 1850 rubles.

Thus, the total amount of payments for a business trip was:

1850*4=7400 rub.

Let's calculate the limit not subject to personal income tax:

700*4=2800 rub.

A tax of 13% must be calculated on the remaining amount:

7400-2800=4600 rub.

4600*13%=598 rub.

Thus, in the certificate, in the income code column, “4800” is indicated and, on the contrary, the amount of travel allowances is 4600 rubles.

What else is taken into account by code 4800

This code is used to take into account other income for which a personal code has not been established.

These include:

- Daily expenses for a business traveler, executed under a work contract or employment contract, paid in excess of the approved limit;

- additional payments at the expense of the enterprise’s own funds, which are made for sick leave and maternity benefits. It is important to remember that maternity benefits are not subject to personal income tax, as well as amounts paid to care for a child under the age of one and a half years; they are not shown in the declaration.

Therefore, before sending reports to the funds, you need to carefully review the amounts falling under code 4800; the tax office checks them first.

Rules for recording daily money in a document

According to current legislation and Art. 168, a manager who sends his employee on a business trip is obliged to finance his trip - pay daily allowance. The management sets the amount of payment independently, based on its capabilities. The amount is fixed in the contract.

The law states that daily allowances are not subject to taxation in two cases:

- if the limit of 700 rubles for domestic trips within the Russian Federation is not exceeded;

- the amount paid is no more than 2,500 rubles for foreign business trips.

If travel allowances are paid in excess of the norm, the personal income tax form is withheld. The actions of the accounting department in this case are as follows:

- the excess daily allowance payment is calculated;

- the tax amount is determined based on the corresponding rate - 13% for citizens of the Russian Federation and 30% for individuals who are not residents of the country.

Features of trips abroad

When sending an employee abroad, it becomes necessary to take into account additional costs:

- obtaining a visa for an employee;

- purchasing an insurance policy;

- possible consular fees;

- the right to travel by car.

In this case, the tax agent is exempt from withholding funds. It is important to document expenses. If the form was submitted in a foreign language, it must be translated and both copies delivered to the tax authority.

If, in the case of calculation, the amount of expenses is stated in foreign currency, the accountant’s task is to recalculate it into rubles at the current exchange rate at the time the tax agent contacts the inspectorate. The calculations must be secured with the contractor’s signature and date.