Salaries for December 2020 were paid in December. How to generate and reflect the payment in the 6-NDFL calculation? How to reflect wages in sections 1 and 2 of the 6-NDFL calculation? Let's explain with an example. If you paid your salary for December in January 2020, then another article will help you, “Examples of filling out 6-NDFL when the salary for December was issued in January 2020.”

Deadlines for paying December salaries in 2019

How to fill out 6-NDFL based on the results of 2020? This depends on whether you paid your salary in December 2020 or January 2020. If you set the deadline for paying salaries at the end of the month from the 1st to the 8th, you need to pay the salary for December on the eve of the holidays (Part 8 of Article 136 of the Labor Code). If the deadline is from the 9th to the 15th, there is no need to issue wages in advance.

For more information about this, see “ Payment dates for December salaries according to the Labor Code of the Russian Federation .”

Early payment of wages

Let's start with the main question: does the organization even have the right to pay wages ahead of schedule?

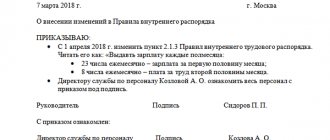

The answer to this question must be sought in the Labor Code. According to the provisions of Art. 136 of the Labor Code of the Russian Federation, wages must be paid at least every half month. In this case, the specific date of payment must be fixed in the internal labor regulations, collective or employment agreement and must not exceed 15 calendar days from the end of the period for which the salary was accrued. The legislator separately stipulated: if the salary payment day established in the organization coincides with a weekend or non-working holiday, payment should be made on the eve of this day. Calculate your salary and benefits taking into account the increase in the minimum wage from 2020 Calculate for free

That is, to answer the question about the legality of early payment of salaries for December, you need to look at the document that establishes the timing of its payment in the organization. If the established day in January is a day off, then wages must be paid on the last working day of December due to the direct instructions in Art. 136 Labor Code of the Russian Federation. Such payment is not considered early and questions about any violations of labor laws do not and cannot arise here.

If the established salary payment day in January is no longer a day off, then it can be paid in December only if the rule of Art. 136 of the Labor Code of the Russian Federation on the need to issue money to employees at least every half month. This means the following. If wages for December are paid, for example, on December 29, then in January you will have to pay an “advance” no later than the 13th, which in turn will require payment of a second “advance” no later than January 28. Otherwise, the organization will violate the rule of Art. 136 of the Labor Code of the Russian Federation and may be brought to administrative liability (Part 6 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation). That is, the desire to “knock out” the year’s results and pay employees ahead of schedule will result in additional hassle in January.

Transferring money in December, but not on the last working day, will have similar consequences if the established date for salary payment in January falls on a weekend. After all, the Labor Code of the Russian Federation has no alternative in this case, requiring that money be paid “the day before.” It turns out that only in this case will the salary be considered paid on time, and the right of workers to receive equal remuneration for their work will be respected. Accordingly, only in this case can further payments be made without calculating semi-monthly intervals.

This means that if the employer, on his own initiative, decides to pay employees not on the eve of the holidays, but earlier, he needs to additionally ensure that the employees’ right to receive equal remuneration is respected. And in January, make several “advance” payments again (for more information about advances, see “Salaries for the first half of the month: how to calculate the advance and what amounts to withhold from it”).

Salary paid 12/31/2019

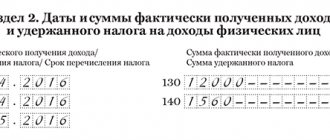

The salary paid on December 31, 2019, and the personal income tax on it, should be reflected only in section. 1 6-NDFL for 2020

In Sect. You will show these 2 amounts already in 6-NDFL for the 1st quarter of 2020. After all, the deadline for paying personal income tax in this case is 01/09/2020 - the first working day after payment of income. The fact that you transferred the tax on December 31, 2019 does not matter (Letter of the Federal Tax Service dated November 1, 2017 N GD-4-11/).

Sec. Fill out 2 6-NDFL for the 1st quarter of 2020 as follows:

- line 100 – 12/31/2019

- line 110 – 12/31/2019

- line 120 – 01/09/2020

Receiving income is an important date

The salary becomes income on the last day of the month for which it is accrued - December 31.

This follows from paragraph 2 of Article 223 of the Tax Code of the Russian Federation. Therefore, despite the fact that the salary for December was issued to employees in January 2020, from the point of view of tax legislation, the date of receipt of income is December 31, 2020. At the same time, we have already reported that the payment for December, paid in January 2020, should have been reflected in 6-NDFL for 2016.