Filling out section 3 of the calculation of insurance premiums

Payers submit calculations for insurance premiums to the tax authority starting from 2020. It is he who oversees payments for compulsory pension, medical and social insurance. Section 3 of the unified calculation of contributions contains personalized accounting data. In turn, the tax authorities transfer them to the Pension Fund. The correct execution of this information determines how the data will appear on the personal accounts of individuals in the fund.

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

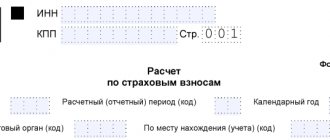

The calculation form was approved by order of the Federal Tax Service of the Russian Federation dated October 10, 2016 No. ММВ-7-11/551.

IMPORTANT! From the reporting for the 1st quarter of 2020, the calculation of insurance premiums should be completed on the form, approved. by order of the Federal Tax Service of Russia dated September 18, 2019 No. ММВ-7-11/ [email protected] Read more about the innovations in our review.

The personalized information in section 3 consists of two blocks.

The first carries information about reporting: it talks about the type of calculation (it is primary or adjustment) and the submission period, reflects the information number of each employee and the date of submission of the reports. This part of the section contains personal and passport data of employees (subsection 3.1).

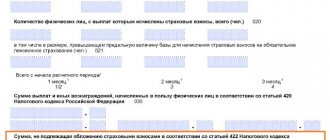

The second block consists of two subsections. The first, number 3.2.1, reflects information on accrued payments for the last three months, as well as the amount of insurance contributions for pension insurance. The second subsection, numbered 3.2.2, is filled out in case of accrual of contributions at an additional tariff. When filling out section 3 of the calculation of insurance premiums, you should pay great attention to the correct reflection of personal data.

Example of filling out section 3

Even if you make a mistake in one letter of the employee’s full name, you will need to submit an updated calculation. Let's look at how to fill out the clarification if you made a mistake in Section 3.

The Federal Tax Service suggested how to fill out the RSV for dismissed employees

In Letter dated December 5, 2018 N BS-4-11/ [email protected] , the tax service explained how to fill out the calculation of insurance premiums for dismissed employees. The situation is considered when the dismissal and the final settlement with the employee were made in different reporting periods.

Officials, with reference to clause 22.1 of the Procedure for filling out the DAM (approved by Order of the Federal Tax Service of the Russian Federation dated October 10, 2016 N ММВ-7-11 / [email protected] ), explained that information about dismissed employees must be included in Section 3 of the DAM for the reporting period including if in one of the months of this period they received remuneration:

- within the framework of labor relations;

- under civil law contracts, the subject of which is the performance of work or provision of services.

It does not matter that labor or civil relations were terminated in the previous reporting period.

The tax department does not specify how to fill out the monthly SZV-M report in such a situation. Considering that the employer is obliged to issue an extract from the SZV-M to the employee on the day of dismissal (paragraph 2, clause 4, article 11 of Federal Law No. 27-FZ of April 1, 1996), information about him should be included in the report in the month of his dismissal. The period of final settlement with the employee does not matter for the purposes of filling out the SZV-M.

In ZUP 3, in order for a dismissed employee, who was accrued benefits later than the date of his dismissal, to be included in Section 3 of the report Calculations for insurance premiums , nothing additional needs to be done. This is provided for by the report completion algorithm.

See also:

- Calculation of insurance premiums: filling in 1C 8.3 using an example

- Calculation of insurance premiums

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- The capital's tax authorities explained the procedure for reflecting benefits in the DAM in a situation where they are assigned in one month and paid in another. The company assigned temporary disability benefits to an employee in June, but...

- Have you decided to take the DAM for 2020 on paper? ─ find out what the Federal Tax Service thinks about this. The Federal Tax Service, by letter dated November 15, 2019 N BS-4-11/ [email protected] , corrected the date from which...

- Confirmation of the type of activity in the Social Insurance Fund for 2020: electronically and filling out on paper The Social Insurance Fund decided in advance to inform employers about the procedure for confirming the main type...

- A separate report on the average headcount has been canceled - the president signed the law. From 2021 there will be one less tax report...

Indicators of section 3 of the unified calculation of contributions for the GAP

Section 3 should be filled in with personalized information regarding individuals who worked during the reporting period under a civil law agreement (GPC).

The procedure for filling out Section 3 for individuals working under a GPC agreement is somewhat different from the usual.

Subscribe to our newsletter

Read us on Yandex.Zen Read us on Telegram

Social contributions for temporary disability and in connection with maternity (VNIM) are not accrued on the income of an individual performing work under a GPC agreement, except in cases where social insurance obligations are specified in the agreement. This means that the sign of a person in the insurance system on line 180 is indicated as 2.

Also, do not forget to fill out line 230 in subsection 3.2.1.

Let's consider the procedure for filling out section 3 for an employee under a civil contract.

WHAT DOCUMENTS SHOULD BE ISSUED AT THE APPLICATION OF AN EMPLOYEE

Upon a written application from the employee, you are obliged to issue certificates and copies of documents related to his work (Article 62 of the Labor Code of the Russian Federation). There is no closed list of such documents. The employee has the right to demand any documents that are related to his work and remuneration. For example, at the request of an employee, you are required to issue: