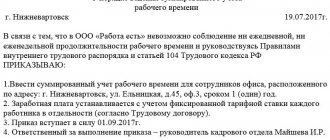

Is it necessary to issue an order?

The need to fulfill or exceed the production plan does not always fit into the framework of working hours. In this case, there is a need to organize work beyond the normal duration of the shift, but overtime work according to the Labor Code of the Russian Federation has restrictions on attracting personnel to work outside the limits of the normal working day. In addition to its own restrictions established by Article 99 of the Labor Code of the Russian Federation, involvement in such work requires additional payment for overtime hours, which is established by Article 152 of the Labor Code of the Russian Federation.

The Labor Code of the Russian Federation does not indicate that registration of overtime work requires the issuance of a separate order from the manager. The main requirement is the employee’s written consent to work beyond the norm.

An exception is the cases listed in Part 3 of Art. 99 Labor Code of the Russian Federation. The employee’s consent may not be asked if:

- there is a need to prevent an accident or natural disaster;

- engage an employee to eliminate a breakdown that interferes with the enterprise’s water supply, lighting, communications, transport and other communications;

- An emergency arose, martial law was introduced, etc.

Despite the fact that in the above cases the employee’s written consent to overtime work is not necessary, overtime must be formalized and paid for.

For payment, overtime time in the time sheet is indicated by the code “C” or “04”. The basis for paying overtime hours is the timesheet.

The following categories of employees have the right to refuse overtime work:

- disabled people;

- women raising children under three years of age;

- a parent raising a child under five years of age alone;

- citizens raising disabled children;

- employees caring for a sick relative.

Such employees must be informed in writing of the possibility of refusing overtime work. This information can be indicated in the order. Managers of organizations should be aware that it is prohibited to involve pregnant employees and minors in extracurricular work.

Overtime pay

Quite often, management invites employees to stay longer at work in order to fulfill the plan.

This is called overtime. In general, this practice does not contradict current legislative norms and the Labor Code. However, there are a number of nuances here. For example, in most cases, overtime work is possible only with the consent of the employee.

Moreover, there are categories of citizens who cannot be involved in such activities.

Overtime work is usually compensated financially, but always at an increased rate. Given the existing difficulties, this issue requires detailed and comprehensive consideration.

Involvement in work beyond established standards

First, let's look at the definition of overtime work itself. So, this term should be understood as work that an employee performs on the initiative of the employer in excess of the required working hours established by the length of the working day. This is exactly the wording given by Article 99 of the Labor Code of the Russian Federation.

Now let’s try to understand the basic principles of attracting employees to additional employment.

Who is entitled to compensation?

In general, any person involved in such activities can count on compensation for hours worked in excess of the required standard hours.

At the same time, the legislator clearly establishes the nominal number of man-hours for such processing. In particular, overtime work is allowed no more than 4 hours for two days in a row.

With a total calculation of such time - no more than 120 hours annually.

However, the length of the working day varies among employees, and this fact must be taken into account when calculating time worked. It looks like this:

- Standard working hours are 40 hours per week;

- For persons under the age of majority - 24-35 hours per week, depending on age;

- For disabled people of groups 1-2 - no more than 35 hours;

- Health workers, teachers working in the Far North - 36 hours.

It follows that any work performed in excess of the established standards is considered overtime and is paid according to the established tariffs.

Who cannot count on compensation

If you follow the letter of the law, one of the mandatory conditions for overtime work is the initiative of the employer.

In particular, the employer may ask the employee to work extra, or involve him in work in case of emergency situations, for example, to eliminate an accident.

At the same time, the law does not prohibit an employee from remaining at his workplace beyond the prescribed hours on his personal initiative.

However, in this case, the employer is not obliged to pay overtime hours, although he may somehow encourage a conscientious employee.

Who should not be left overtime?

Firstly, it is unacceptable for any employee to work overtime if the overtime limit has been reached.

For example, if for 2 days in a row a person worked 4 hours overtime, it will no longer be possible to involve him in such work on the third day. However, many employers ignore this requirement.

In such situations, the employee’s rights are violated, which gives him the right to appeal to the labor inspectorate with a complaint.

Read also: Law on architectural activities in 2019-2020

Secondly, the law clearly defines the categories of citizens who cannot be used overtime under any circumstances. These include:

- Minors;

- Pregnant;

- Single parents with dependent children under 5 years of age;

- Parents raising a disabled child.

Citizens caring for disabled relatives can stay overtime, but only on condition that they voluntarily express their consent.

Do employees need consent to work overtime?

Work exceeding approved standards at the initiative of the employer and with the consent of the employee is possible in the following situations:

- It is necessary to complete a set of activities that could not be completed during the work shift. This usually applies to cases where unfinished work may result in damage to company property, damage commercial interests, or cause harm to the health and lives of people.

- Carrying out repair work. For example, if a faulty conveyor or assembly line causes a disruption in the entire enterprise.

- With continuous work. For example, if the line cannot be stopped and the shift worker does not show up for work. In this case, the boss cannot leave the employee for the second shift, but he has time to find a replacement.

Involvement in additional work without the employee’s consent is possible in cases where we are talking about emergency and unforeseen situations that can lead to serious consequences. For example:

- Prevention of industrial accidents;

- Elimination of failures of systems responsible for people’s life support: lighting, centralized water supply, traffic;

- Elimination of emergency consequences - flood, man-made disaster, fire, etc.

How is overtime calculated?

According to the established rules, the first two hours worked overtime are compensated at one and a half times the rate, the rest - at double rate. Here it is necessary to clarify that these are minimum standards. An employer may, on his own initiative, increase overtime pay, but paying compensation below the established rates will be considered illegal.

https://youtu.be/3eCEfR9VKho

To calculate overtime pay, it is necessary to determine the employee's wage rate per hour. To do this, the monthly salary is divided by the number of hours worked.

Example

Ivanov works as a mechanic and receives a salary according to the staffing table of 50,000 rubles. He worked 168 hours per month. To calculate the hourly wage, you need 50,000:168. As a result, Ivanov’s hourly salary for the billing period is 297 rubles.

Considering that the first 2 hours worked overtime are paid at one and a half times the rate, the following formula is applied: 297 * 1.5 * 2 = 891 rubles.

Ivanov will receive this amount for the first two hours of overtime.

All subsequent hours worked in excess of the norm will be paid at double the rate - 594 rubles / hour.

Principles for calculating surcharges

As mentioned above, the minimum overtime rate is:

- The first 2 hours are paid time and a half;

- Subsequent time - double compensation.

It is from these coefficients that you need to start when calculating wages. In this case, the employer can set his own rate, securing it in a separate regulatory act for the enterprise, and certifying the document with a personal signature.

Situations where overtime work occurs on holidays or weekends deserve special attention. In this case, the employee’s work is regarded as work on a day off, and is paid in accordance with the established tariff, regardless of the length of time.

Rules for registering overtime hours

Some employers make the mistake of including a clause regarding the employee's ability to work overtime in the collective agreement. This approach directly contradicts the provisions of labor legislation.

Read also: Transportation of animals

According to established standards, each case of such employment is processed individually; there can be no generalization here. At the same time, the law does not oblige the employer to issue a separate order for the enterprise for each fact of employee overtime.

Although there must be a legal basis for engaging in labor beyond established standards. For example, the head of a structural unit must prepare a memo to the director, which sets out the reasons for attracting a certain employee to work overtime. This may be the need to complete work or the absence of a shift worker during continuous production.

This right can be assigned to department heads by a clause in the job description.

The second mandatory point is the employee’s written consent to stay overtime. The only exception to this rule is emergency situations provided for in paragraph 3 of Article 99 of the Labor Code of the Russian Federation. Moreover, if citizens of preferential categories are involved in overtime work, they must be warned about the possibility of refusing to perform such work. You can notify the employee orally or in writing.

In the time sheet, excess employment of personnel is indicated by the digital code 04 or the letter “C”. In this case, the document usually provides two columns for standard and overtime time.

What to do with weekends and national holidays

In such cases, separate accounting of overtime does not apply. There is a standard tariff rate for remuneration of enterprise personnel on weekends. According to labor legislation, work on holidays and weekends is paid at double the rate, regardless of the length of working hours.

Options for receiving compensation

If an employee stays overtime, company management can compensate for this time in two ways. The first is a cash payment in one and a half or double amounts. The second is the provision of additional days of rest.

Here it is necessary to clarify that in this case, overtime work is still paid, but based on the amount of a single hourly earnings. The duration of the days off provided cannot be less than the time spent on overtime work.

The procedure for compensation is achieved by mutual agreement. For example, an employer cannot refuse to accrue cash payments for overtime work, at its discretion replacing financial compensation with additional days off. Moreover, such rest days are necessarily reflected in the working time sheet and are not taken into account when calculating wages.

Payment order

De jure, financial compensation for overtime work is not compensation in its pure form.

This is a component of wages, so employees receive money for overtime on payday, along with salary, bonus payments and other monetary incentives.

Currently, wages at enterprises are paid at least 2 times a month; the employer decides which of these parts includes payment for overtime hours.

https://youtu.be/xR3vMUsOOCA

It should be noted that management may refuse to pay overtime. The reasons for this may be the following:

- The employee stayed late at work on his own initiative;

- The employee agreed to be provided with additional rest time;

- The work was carried out on a day off;

- The employee agreed to work overtime, but without completing the assigned tasks, he left the enterprise without permission.

Read also: Rights of pregnant women at work under the Labor Code

Features of taxation

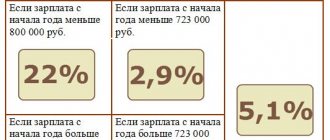

Personal income tax is levied on almost all types of income. Considering that additional payment for overtime relates to basic earnings, personal income tax is calculated on a general basis. In addition, mandatory contributions to the Pension Fund and social insurance funds are made from these amounts.

Source: https://zakonoved.su/%D0%BE%D0%BF%D0%BB%D0%B0%D1%82%D0%B0-%D1%81%D0%B2%D0%B5%D1% 80%D1%85%D1%83%D1%80%D0%BE%D1%87%D0%BD%D0%BE%D0%B9-%D1%80%D0%B0%D0%B1%D0%BE %D1%82%D1%8B.html

How much and how are overtime hours paid?

Organizational managers are often interested in how much to pay for overtime worked by an employee? For greater clarity, we have placed a table:

| Period of extracurricular work | Overtime pay |

| First 2 hours | Must be paid at least one and a half times the amount |

| Subsequent hours | At least double the size |

The amount of payment for overtime work indicated in the table is considered minimal, that is, the employer does not have the right to pay less. But the amount of payment for work above the norm can be increased by the head of the enterprise. Information about this should be indicated in the company’s local act or employment contract with the employee.

If the employee does not mind, the organization can compensate him for the time worked above the norm, not in cash, but with additional days off. The duration of the non-working period cannot be less than the time spent on work. But such overtime work is paid at a single rate.

If processing is the employee’s own initiative, then such work is not extracurricular and is not paid.

conclusions

To correctly calculate overtime hours, you need to take into account important rules:

- The calculation procedure is determined by Art. 152 Labor Code of the Russian Federation.

- Processing time is calculated from the standards regulated by law; they are directly related to the production calendar.

- When called to work beyond the established standards, the employer is obliged to make additional payment.

- Two hours of overtime are paid at one and a half times the rate, subsequent ones are subject to double payment. With a cumulative accounting of working hours of 1.5 times, only 2 hours are paid (regardless of the duration of overtime per day), the rest of the time is paid at double the rate.

- When recording working time in aggregate, overtime work time is calculated at the end of the reporting period.

- Payment for overtime is subject to income tax at the rate of thirteen percent.

What methods of recording working hours exist?

Choosing a method for recording working time is a concern for managers. Much in this matter depends on the scope of the organization. The chosen type of accounting must be specified by the director of the company in the internal regulations. The following types of accounting are distinguished:

- daily;

- Monday;

- summarized.

With summarized accounting, there may be a deviation in the duration of working hours during the day, week or month. The main requirement: at the end of the accounting period, the employee must have worked a number of hours in accordance with the approved norm.

The standard working day is 8 hours. With a five-day working week, the working time limit reaches 40 hours. But there are exceptions. If a person works a shift, his working day can last 12 hours. For some categories of employees, a shortened working day may be established. In this case, their working week is 24-36 hours. You can find out how much time a worker with a normal or reduced working day must work per month, quarter and year using the production calendar. Using a regular calculator, it will not be difficult to calculate recycling.

In the case of daily accounting, overtime or shortfalls are recorded within one day. Labor payment is calculated for each day of processing separately. And overtime (payment) is given at the end of the month.

Overtime pay: example

Let's look at a specific example of how to calculate overtime (2020). Manager Barulin V.M. worked 3 hours after hours on 03/03/2019 and 4 hours on 03/10/2019. His hourly earnings are 140 rubles. The first two hours of each overtime must be paid at one and a half times the rate. The rest of the time is double time. The amount will be:

March 3 = (140 rub. × 1.5 × 2 hours) + (140 rub. × 2 × 1 hour) = 700 rub.

March 10 = (140 rubles × 1.5 × 2 hours) + (140 rubles × 2 × 2 hours) = 980 rubles.

Barulin V.M. 1680 rubles will be credited. for extra work.

When recording working hours in aggregate, overtime work (payment) should be assessed as follows: time worked outside of normal hours is calculated based on the results of the accounting period. The first two hours of work are paid at least time and a half. The rest of the time is double time.

Calculation of additional payments for time-based payment

With a time-based wage system, calculate the additional payment for overtime work using the following formulas.

If the employee has an hourly rate:

| Additional payment for the first 2 hours of overtime work = Hourly rate × 1.5 × 2 hours |

| Additional payment for subsequent hours of overtime work | = | Hourly rate | × | 2 | × | Number of hours worked overtime (per shift, per day) | – | 2 hours |

If the employee has a daily rate:

| Additional payment for the first 2 hours of overtime work | = | Daily rate | : | Number of working hours per day | × | 1,5 | × | 2 hours |

| Additional payment for subsequent hours of overtime work | = | Daily rate | : | Number of working hours per day | × | 2 | × | Number of hours worked overtime (per shift, per day) | – | 2 hours |

If the employee has a monthly salary:

| Additional payment for the first 2 hours of overtime work | = | Salary | : | Number of working hours per month | × | 1,5 | × | 2 hours |

| Additional payment for subsequent hours of overtime work | = | Salary | : | Number of working hours per month | × | 2 | × | Number of hours worked overtime (per shift, per day) | – | 2 hours |

Advice: fix the procedure for calculating the indicator - the number of working hours per month - in order to determine the additional payment for overtime work to the salary in the internal documents of the organization (for example, in the Regulations on remuneration). The need for this is due to the fact that the legislation does not establish rules for calculating this indicator.

Indicate that the number of working hours per month is determined by dividing the salary by the average monthly number of working hours. Calculate the average monthly number of working hours using the formula:

| Average monthly working hours | = | Annual number of working hours according to the calendar | : | 12 |

In 2020, the average monthly number of working hours:

- with a 40-hour work week – 164.5 hours;

- with a 36-hour work week – 148.03 hours;

- with a 24-hour work week – 98.63 hours.

This procedure for calculating the average monthly number of hours is recommended in the letter of the Ministry of Health of Russia dated July 2, 2014 No. 16-4/2059436. If you calculate the indicator - the number of working hours per month - according to the specified formula, payment for the same amount of overtime work will not differ regardless of the number of working hours in the month.

An example of calculating additional payment to an employee for overtime work during a business trip. The employee has a time-based wage system

Alpha LLC sent its employee A.S. Kondratiev on a business trip to a separate structural unit. The organization operates on a five-day work week with two days off (Saturday, Sunday). Working hours are 40 hours per week. The duration of the trip is from July 1 to July 31, 2016. In 2020, the average monthly number of working hours for a 40-hour workweek is 164.5 hours.

By order of the head of the organization, during a business trip, Kondratyev was involved in overtime work. During the business trip, the employee worked his normal working hours, as well as overtime - 15 hours. The employee did not work on weekends (holidays). Kondratiev’s monthly salary is 30,000 rubles.

Kondratyev worked overtime on July 7 and 8 for 2 hours, on July 11 - 3 hours, on July 15 - 4 hours, on July 21 and 22 - 2 hours.

The accountant calculated the additional payment to the employee for overtime work as follows.

For overtime work on July 7: RUB 30,000. : 164.5 hours × 2 hours × 1.5 = 547.11 rub.

For overtime work on July 8: RUB 30,000. : 164.5 hours × 2 hours × 1.5 = 547.11 rub.

For overtime work on July 11: RUB 30,000. : 164.5 hours × 2 hours × 1.5 = 547.11 rub. – additional payment for the first 2 hours of work; 30,000 rub. : 164.5 hours × 1 hour × 2 = 364.74 rubles. – additional payment for the next hour; RUB 547.11 + 364.74 rub. = 911.85 rub. – the total amount of additional payment for overtime work on July 11.

For overtime work on July 15: RUB 30,000. : 164.5 hours × 2 hours × 1.5 = 547.11 rub. – additional payment for the first 2 hours of work; 30,000 rub. : 164.5 hours × 2 hours × 2 = 729.48 rubles. – additional payment for the next 2 hours; RUB 547.11 + 729.48 rub. = 1276.59 rub. – the total amount of additional payment for overtime work on July 15.

For overtime work on July 21: RUB 30,000. : 164.5 hours × 2 hours × 1.5 = 547.11 rub.

For overtime work on July 22: RUB 30,000. : 164.5 hours × 2 hours × 1.5 = 547.11 rub.

The total amount of additional payment to the employee for overtime work during a business trip was 4,376.88 rubles. (547.11 rubles + 547.11 rubles + 911.85 rubles + 1276.59 rubles + 547.11 rubles + 547.11 rubles).

How is overtime paid on a salary basis?

In Art. 152 of the Labor Code of the Russian Federation there is no information about what amount should be taken into account. Therefore, many employers are wondering whether to take into account only salary or average income along with bonuses and allowances. When calculating overtime, managers often take double the tariff as a minimum. Incentive and compensation payments are not taken into account. Overtime work is paid inclusive of bonus payments only if the employer has established such a procedure.

If such a procedure is not established, then the cost of an hour is equal to the salary divided by the number of standard hours in the accounting month according to the production calendar. If the period of summarized accounting is more than one month, it is necessary to determine the average cost of an hour for the entire period (for example, salary income for a quarter divided by the standard time for the specified quarter). Overtime calculations must be made from the resulting cost per hour.

How to count correctly - formulas

According to labor legislation, overtime work is paid additionally:

- in the first 2 hours - at least 1.5 sizes;

- subsequent time - no less than size 2.

The indicated indicators are considered minimum.

The employer has the right to set higher payments for overtime.

However, such conditions must necessarily be stipulated in contracts or regulations on remuneration.

According to Art. 99 of the Labor Code of the Russian Federation, the organization is obliged to keep strict records of the duration of overtime work, therefore it will not be difficult to determine the number of overtime hours in the time sheet that are subject to additional payment.

We recommend reading: what to do if you are forced to work overtime?

Example

Initial data:

The standard working hours per week is 40.

Due to production needs, the employee was asked to work 3 hours overtime twice.

Calculation:

The total on the report card will be (40 + 6) = 46.

It turns out that an additional 6 hours will be paid at an increased rate.

Formula:

Os = P2 * T * 1.5 + Poch * T * 2, where

- Oc – overtime pay;

- P2 – two overtime hours;

- T – tariff per hour;

- Poch – the rest is processed time.

Important! If the employer does not make additional payments for overtime, he will be fined upon inspection.

Payment for overtime occurs at the end of a month of work together with salary. The exception is the summarized recording of working hours. With it, the calculation occurs at the end of the accounting period (it can be a month, quarter or year) - the procedure for calculating overtime with summarized accounting.

In fact, a person can work overtime in one month and take time off in another. As a result, there will be no rework at all. Accordingly, you won’t have to pay anything extra.

How to pay for overtime with a salary

Article 152 of the Labor Code of the Russian Federation does not provide information about what amount is taken into account in calculating additional payments for overtime work.

Very often, employers simply accept a double tariff as the minimum.

Bonus payments are taken into account in calculations only if provided for in employment contracts.

If such a condition is not specified, then the cost of an hour of labor based on salary is first calculated.

To do this, the salary is divided by the number of hours per month according to the norm (unless a different calculation principle is agreed upon at the enterprise).

After this, you can already calculate the additional payment for overtime hours using the formula presented above.

Example

Initial data:

Let's look at a specific example of how overtime hours are calculated and paid under the salary system.

Let’s say an employee works a five-day shift.

In May 2020, according to the production calendar, the standard was set at 159 hours.

The employer required the employee to work overtime twice for three hours. In fact, according to his report card, he worked 165.

The salary is 25,000.

Calculation:

When calculating wages, the accountant sees the overworked time in the timesheet and makes an additional payment according to it in the following order:

- First, it determines how much a person earns per hour in salary:

25000 / 159 = 157, 23.

- Makes calculations for processing in 3 hours:

(2 * 157, 23 * 1,5 + 1 * 157,23 * 2) = 471, 69 + 314, 46 = 786, 15.

For the second day of overtime, the calculation will be identical, since the person overworked the same amount of time. It turns out that in total for overtime work a person will receive:

786, 15 * 2 = 1572, 30.

The working person will receive the amount minus personal income tax.

Payment for a shift work schedule

When working on a shift schedule, wages can be calculated based on salary or hourly rate.

If a salary system is used, then the calculation of overtime pay will be identical to the previous example.

With an hourly tariff rate, the difference in the calculations is that there is no need to additionally calculate how much an hour of an employee’s work costs.

You can immediately begin calculating processing fees.

A shift work schedule is designed for people to work in several shifts. It can be two, three or even four shifts. In this case, the norm per week must correspond to the standard - 40 hours.

Therefore, if overtime is expected, the employer must obtain the employee’s consent and pay overtime accordingly: the first two hours at one and a half times the rate, and the rest at double the rate.

Example

Initial data:

Suppose a person works at an enterprise with a 24-hour schedule in 4 shifts of 6 hours: from 6-00 to 12-00, from 12-00 to 18-00, from 18-00 to 24-00, from 24-00 to 6- 00.

The hourly rate for a worker is 170 rubles.

The person was required to work overtime on May 23 from 12.00 to 15.00 for 3 hours.

Calculation:

170 * 1,5 * 2 + 170 * 2 *1 = 525 + 340 = 865.

The accountant additionally deducts 13% income tax from the accrued amount.

How to calculate with summarized accounting of working hours

When a business cannot maintain its normal workweek, total accounting is used.

Overtime is not counted for a week, but for a period established by the management of the enterprise - a month, a quarter, a year.

A comparison with the norms is made at the end of the reporting period, at which time the calculation and payment of time worked more than the norm is made. With this accounting, you can work overtime one week and not work at all the other week (on leave).

A distinctive feature of such payment is that overtime is summed up for the entire period, only 2 hours are paid at time and a half, the rest of the time is always subject to double payment.

Example

Initial data:

Let's say a person works in a company that uses summarized time tracking. His hourly rate is 185 rubles.

The standard hours per week is 40.

With standard working hours for the 1st quarter of 2020, 446 people worked 462.

It turns out that an employed citizen worked 16 hours in excess of the norm established by law. They are subject to individual payment in accordance with the Labor Code of the Russian Federation.

Calculation:

- First 2 hours: 185 * 1.5 * 2 = 555.

- The rest of the overtime is paid as follows: 185 * 14 * 2 =5180.

The total additional payment for work beyond the allotted time is: 5180 + 555 = 5735.

A person will receive in hand the amount of 5735 - 5735 * 13% = 4989.45, since such amounts are subject to taxation.

What are the rules for paying overtime on a shift schedule?

Let's look at how overtime is paid during a shift work schedule. If a worker works in shifts, his salary can be calculated using both hourly tariff rates and on a salary basis.

In the first case, overtime is calculated as follows: the number of hours worked during a certain period is multiplied by the established rate.

If the organization uses a salary system, then every month the employee is transferred the same amount of remuneration.

How is work on weekends paid?

Payment for overtime on weekends and holidays is made in accordance with the norms of the Labor Code of the Russian Federation. Payment for going to work on a day off is regulated by Art. 153 . According to its provisions, work on a day off is paid at least double the amount. This means that the additional payment for being hired to work on weekends may be higher; the law sets a minimum bar below which it cannot fall.

Are you forced to work on your day off at your regular rate?

Contact a professional lawyer, we know how to act in such cases.

Ask a Question

The specific amount of the bonus can be specified in the collective agreement, internal regulations, or employment contract. Payment is made based on hours worked on a weekend (holiday). Instead of a bonus, an employee can ask management to provide him with time off; in this case, the day off worked will be paid in a single section, but the time off will not be paid.

How is overtime pay for piece workers calculated?

Citizens who work piecework are paid for each part produced. Overtime pay for piece workers depends on how many parts they produce outside of normal working hours, as well as on the length of overtime work. Cash is paid without taking into account one and a half or double premium.

Example: Kurochkina A.N. works at the factory. She works piecework. For each part made, she is paid 400 rubles. On 03/09/2019 she worked 4 hours outside of school hours, producing 5 parts during this time: 2 pcs. - for the first 2 hours and 3 pcs. — for the remaining 2 hours. Payment depends on the number of parts produced and on the time worked above the norm. Therefore the calculation is:

(400 rub. × 1.5 × 2 pcs.) + (400 rub. × 2 × 3 pcs.) = 1200 rubles + 2400 rubles = 3600 rubles.

What work is considered overtime?

The provisions of Article 99 of the Labor Code of the Russian Federation spell out the conditions under which periods worked in excess of the established standards are taken into account. They are presented:

- the initiative of the company's management has been demonstrated;

- if the activity exceeds the applicable boundaries of the working time of a particular citizen.

This means that work performed by an employee at his own request cannot be considered as overtime.

In addition, you should take into account the working hours that are established for each of the company’s employees. If the organization has decided to record the periods worked in a summarized form, then a separate indicator is provided by hours for a specific period.

If the specified standard is exceeded, the work should be considered as exceeding the standard. Legislative acts reflect restrictions on how long work activity used in excess of the norm must last.

With a five-day work week

The normal working hours of the average worker in Russia is eight hours a day, that is, 40 hours in five working days.

The legislation also considers certain categories of citizens who have the right to draw up an employment contract only for a shortened working day, which should not exceed 36 hours for the entire working week.

The production calendar determines the norms of working hours for citizens who are employed with a regular or shortened work week - this will help to find out how much total employment is for a month or year.

If an employee’s working time is recorded by day, then shortfalls or overtime will be recorded in documents within one day.

For each day of overtime, a calculation of labor wages above the norm is made, but additional payment for additional hours occurs based on the results of the entire working month.

During shift work

A shift work schedule assumes that an employee will work for two or three working days and then rest for several days. With this schedule, payment for additional hours worked is not regulated by general rules and must occur in accordance with the type of labor activity accounting adopted by the employing company.

It is worth remembering that an employee’s work on official holidays must be paid double - this is stipulated in the labor legislation of the Russian Federation. It will not be paid as overtime.

Read more about overtime pay for shift work here.

With a sliding schedule

A flexible schedule means that an employee works outside the normal work schedule. For such personnel, mandatory cumulative recording of working time should be established - this is especially true for organizations that do not have the ability to determine a clear working time for each employee.

Calculation of overtime with summarized accounting.

A sliding schedule is permitted for companies that engage in specific work or belong to a special type of activity.

In any case, regular recording of working hours may not be possible.

There are two ways to compensate for excess processing in this case:

- providing the employee with additional rest time;

- increased overtime pay;

In this case, the first two hours of additional working time of the employee should be paid one and a half times more than he usually receives. The following hours are paid at least double the amount.

During irregular working hours

In cases where an employee has irregular working hours, there is no concept of overtime.

This labor regime initially involves the involvement of an employee in work by order of the manager, and at any time.

Under abnormal working conditions, overtime can only be compensated for by additional rest time.

Comparison table between irregular hours and overtime.

Standard calculation method

In accordance with Art. 152 of the Labor Code of the Russian Federation, overtime hours worked are paid according to the scheme outlined below:

- the first two hours of overtime work - at a coefficient of not less than 1.5;

- third and further hours of overtime work - at a factor of 2 or more.

The procedure for calculating payment is established at the local level through a collective agreement, individual employment contracts and relevant orders of the head of the enterprise or organization. At the same time, the procedure established at the local level should not worsen the employee’s position in comparison with the amount of payment established by the Labor Code of the Russian Federation.

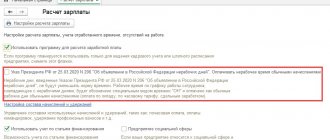

The formula for calculating overtime hours is not regulated; however, Letter No. 16-4/2059436 of the Ministry of Health of the Russian Federation contains a completely workable calculation formula.

So, in accordance with the Letter of the Ministry of Health, overtime can be calculated by performing the arithmetic operation O / (GN / 12) = PO, where:

- O is the salary size;

- GN – annual norm according to the production calendar;

- 12 – months of the calendar year;

- PO – hourly salary.

For example, take the following hypothetical conditions.

Loader A. worked 3 hours overtime. The salary of a loader is 15,000 rubles. Taking into account a 40-hour work week, loader A. worked 1970 hours during the billing period. We calculate payment for overtime work:

15,000 / (1970/12) = 91 rubles 40 kopecks cost of one standard hour. Next, we calculate the hours taking into account the coefficient:

- 91.40 × 2 × 1.5 (one and a half coefficient) = 274 rubles 20 kopecks payment for the first two overtime hours;

- 91.40 × 1 × 2 = 182 rubles 80 kopecks for the third overtime hour;

- 272.20 + 182.80 = 455 rubles payable for 3 overtime hours.

How is an employee’s overtime work recorded and processed?

The time that an employee worked overtime must be reflected in the time sheet (according to forms T-12, T-13, approved by Resolution of the State Statistics Committee of 2004 No. 1).

It is the employer's responsibility to ensure that hours of overtime work are accurately recorded. Overtime hours from the time sheet must be indicated with the digital value “04” and next to it the number of overtime hours.

For some categories of workers, there is a special procedure for attracting overtime work. In relation to these employees, the employer is obliged to :

- initially obtain the employee’s written consent;

- make sure there are no contraindications;

- inform the employee, against signature, of the possibility of refusing to perform overtime tasks.

Based on Art. 259, 264 Labor Code such employees include :

- disabled people;

- women with children under 3 years of age;

- fathers and mothers who raise children alone under the age of 5;

- workers with disabled children;

- workers who care for sick family members;

- guardians and trustees of minors.

In most cases, the employer must obtain consent from the employee to work overtime . By order of the employer, an employee without consent may be involved in overtime work on the basis of Art. 99 TK:

- to prevent a disaster or in case of a production accident;

- to eliminate the consequences of an industrial accident;

- to eliminate circumstances when centralized systems, water, heat, and gas supply systems ceased to function;

- when introducing a state of emergency or martial law in emergency cases, if this poses a threat to the population (fires, floods, etc.).

To engage in work on the specified grounds, the consent of the employee and the trade union is not required, and if he refuses to perform the work, a corresponding act is drawn up.

In other situations, involvement in overtime work is allowed in the following situations (also on the basis of Article 99 of the Labor Code):

- If it is necessary to complete work that has begun, which, due to an unexpected delay due to technical conditions, cannot be completed during the normal duration of the working day.

- When performing temporary work on the repair and restoration of mechanisms or structures in cases where their malfunction can cause the cessation of work for many employees.

- When performing work in the absence of a replacement employee, if such work does not allow breaks.

Also, for some employees, an additional stage is provided : the employer must familiarize certain categories of employees with the opportunity to refuse such work. Decisions regarding overtime work must take into account the views of the union.

After receiving consent from the employee to engage him in overtime work, the employer issues a corresponding order. This order does not have a unified format and must contain an indication of the reason for engaging the employee overtime, the start date of work, the employee’s full name, his position and details of the document with the employee’s consent to be hired to work.

If there is an amount of additional overtime pay in a collective agreement or local document, this amount must be specified in the order. The amount is determined by agreement of the parties.

If the employee has decided on the form of compensation, then this fact must be stated in the order. Such compensation may be: increased wages or additional rest time at the request of the employee under Art. 152 TK.

The employee’s order must be familiarized with a personal signature . The law does not oblige the employer to provide rest to the employee at a time that is preferable to him, but the parties usually resolve this issue by agreement.

Violation of the procedure for involving an employee in overtime work threatens the employer with liability, according to Part 1 of Art. 5.27 of the Code of Administrative Offenses (CAO).

The fine under this article is 30-50 thousand rubles, otherwise the official who committed the violation will be fined 1-5 thousand rubles.