Invoice

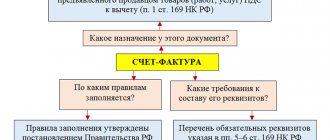

An invoice in Russia is a tax document of the established form, which is required to be drawn up by the seller or contractor.

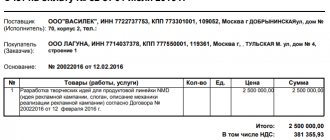

Based on received invoices in , and based on issued invoices - “Sales Book”. According to the Tax Code of the Russian Federation, only VAT taxpayers are required to provide customers with an invoice. Companies that are on the simplified tax system are not payers of this tax and do not have to prepare invoices. The invoice contains data on the name and details of the seller and buyer, the list of goods or services, their price, value, rate and amount of VAT. This list is mandatory and enshrined in the Tax Code of the Russian Federation. The invoice must also contain information about the number and date of issue of the invoice, and, if necessary, the amount of excise tax, the country of origin of the goods, and the customs declaration number.

In Russia, the purpose of an invoice is tax accounting for VAT. It imposes on the seller the obligation to transfer VAT to the budget; for the buyer it serves as the basis for presenting VAT for deduction.

“How to ensure the fulfillment of a contract and warranty obligations under 44-FZ?”

Konstantin Edelev

, expert of the State Order System

Do not sign the contract or acceptance documents until you receive security from the winner. The counterparty chooses in what form to provide contract security or guarantee obligations - provide a bank guarantee or transfer money to the customer’s account. Include the requirement to provide security in the notice or invitation to participate in the procurement, documentation and draft contract. Read how much and how participants provide contractual obligations and guarantees »

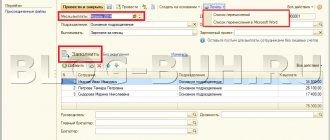

Excel for Procurement Specialists An add-in that will greatly simplify the work of a contract manager! Works without transmitting data to the Internet. Download for free to your computer!

https://youtu.be/nluFrLM_cNU

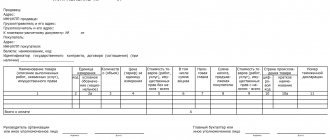

Packing list

The invoice is a primary document, which is drawn up in 2 copies and serves as proof of transfer and the basis for writing off (accepting for registration) the goods. The invoice must contain the signature and seal of the seller and buyer. It is drawn up in two copies, one of which remains with the supplier, the second with the recipient. Goskomstat has approved a unified form of consignment note (form No. TORG-12), but an organization can use its own form.

The invoice must contain the following details: name, number and date of the document, name of the supplier organization; name of the product, its quantity and cost; positions of responsible persons, their signatures and seals. If the invoice form does not correspond to the Torg-12 form, it can also be accepted for accounting by the purchasing organization.

When participating in trade operations of a third-party transport company, experts recommend abandoning the Torg-12 form and using another document - a consignment note (Bill of Lading).

Answer

It is not necessary to sign the acceptance certificate of goods if the TORG-12 consignment note is properly executed. Only primary accounting documents can serve as proof of the fact of delivery, based on the fact that any business transaction requires proper documentation (Part Article 9 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”).

It is important that the invoice contains all the fields regarding the product (otherwise it cannot be identified) and its quantity, that it is signed by the supplier and the buyer (consignee), and also has the seals of both parties (see, for example, the resolution of the Federal Antimonopoly Service of the North-Western Territory dated 03/31/14 No.).

The courts recognize as established the fact of the transfer of goods under a supply agreement, recorded in signed delivery notes, which have a link to the supply agreement (see, for example, resolutions of the Federal Antimonopoly Service ZSO dated 09/08/2009 No.).

The rationale for this position is given below in the materials of the “Lawyer System”

«

Delivery is perhaps one of the most popular contracts in business. Moreover, this type of contractual relationship most “painlessly” reacts to the absence of an agreement, both in the form of a single document signed by both parties, and in the form of documents emanating from the parties, which could be regarded as an offer and acceptance. To prove in court the fact of concluding a one-time supply transaction, primary accounting documents indicating the accomplished fact of transfer of goods by the supplier and their acceptance by the buyer are sufficient. Such judicial practice helps bona fide suppliers, but it can also benefit unscrupulous individuals. For example, the author of this article is involved in a legal dispute in which a company unexpectedly received a claim from a bank to collect a significant amount of debt arising from a supply. The bank refers to the fact that it received the right to claim this debt under a factoring agreement from another company that supplied the goods to the defendant. The defendant denies the fact of delivery, but in support of the fact that it was, the plaintiff presented invoices and other primary documents. As a result, the defendant is forced to prove that there was no delivery and could not have been, relying only on numerous shortcomings in the execution of primary documents, as well as indirect evidence that the company, which appears in the documents as a supplier, was not able to make the delivery. This dispute has not yet been completed, but preparation for it required the author to deeply analyze judicial practice on the question of what documents in similar circumstances are sufficient for the plaintiff to prove the fact of delivery, and, conversely, how the defendant can refute the fact of delivery.

Practice in such disputes is also relevant for cases where a “full” supply agreement has been signed between the parties, since debt collection in any case depends on proving the fact of actual fulfillment of obligations under the contract, namely the fact of acceptance and delivery of goods.

Documents that confirm the fact of delivery of goods

The fact of delivery (that is, transfer of goods to the buyer) is confirmed by primary accounting documents, based on the fact that any business transaction requires proper documentation (Federal Law of 06.12.11 No. 402-FZ “On Accounting”, hereinafter -). Previously, all companies were required to use unified forms of primary accounting documents, but as of January 1, 2013, there is no such requirement, and only indicates the mandatory details that must be present in the primary accounting document. Each company can now approve the form of this document itself. Nevertheless, business is accustomed to unified forms, and the development of new forms requires not only time, but also the reconfiguration of special accounting programs. In addition, it is inconvenient for turnover when the supplier and buyer use different forms of primary accounting documents. Therefore, in practice, in most cases, unified forms are still used.

The court evaluates the evidence according to its internal conviction, therefore, bona fide suppliers, when filing a claim for collection of a delivery debt and proving the fact of transfer of goods, as a rule, do not limit themselves to invoices, but present all possible documents related to the delivery, including acts of reconciliation of mutual settlements, guarantees letters, etc. (decrees, ).

Ideally, the fact of transfer of goods is accompanied by a whole set of primary documents: a consignment note (form No. TORG-12), and if the supplier also delivers the goods, then a consignment note (form No. 1-T), an act of acceptance of goods (form No. TORG-1 or in another form established by the parties to the transaction). The supplier also prepares and transfers to the buyer an invoice, which, although not a primary accounting document (it is a tax document), often appears in disputes about the reliability of the fact of delivery. But the complete set does not exist in every situation. In addition, the available documents are not always prepared properly - sometimes they lack some information, signatures, seals, etc.

The absence of some primary documents may make it difficult or even impossible for the supplier to prove in court that the delivery took place. But the general trend of arbitration practice can be characterized as follows: if there is a properly executed delivery note, then in most cases the courts will consider the delivery of goods proven. At the same time, if the buyer, despite the presence of the invoice, denies the fact of transfer of the goods and can provide any evidence that the delivery could not have taken place, then the court will most likely invite the supplier to provide additional documents confirming the delivery. The list of required evidence may depend on the terms of the supply contract itself (sometimes contracts contain references to certain types of documents used to formalize the delivery, for example, the parties agree on a special form of the acceptance certificate) or on the type of goods supplied.

The delivery note is the minimum document required to prove delivery.

In most cases, the supplier will only need one invoice to prove the fact of delivery (see, resolution of the Federal Antimonopoly Service of the East Siberian District dated 06/09/14, section No. A33-16983/2013,).

Conditions under which an invoice is sufficient.

For the invoice to work as 100% reliable evidence, it must be completed correctly. Otherwise, the court may not accept it as inadequate evidence.

It is important that the invoice contains all the fields regarding the product (otherwise it cannot be identified) and its quantity, that it is signed by the supplier and the buyer (consignee), and also has the seals of both parties (see, for example,). Of course, the signature placed on the invoice must belong to an authorized person - in particular, an employee of the buying company, whose job responsibilities include acceptance of goods (resolution of the Federal Antimonopoly Service of the Moscow District dated May 21, 2014, section No. A40-70534/13,). The right to accept goods on behalf of the company may be confirmed by a power of attorney, or these powers may be apparent from the situation. In the first case, it is important that the invoice contains the details of the power of attorney (its number and date). In addition, it would be good for the supplier to have a copy of this power of attorney, otherwise the buyer may refer to the fact that the person indicated in the invoice is unknown to him and the power of attorney was never issued to him.”

Difference between invoice and delivery note

The following differences can be distinguished between an invoice and a delivery note:

— documents have different forms;

— an invoice has a strictly regulated form, while a delivery note has a free form;

- the delivery note is signed in two copies - by the seller and the buyer, the invoice - only by the supplier;

— these documents do not replace each other, but complement each other and are issued simultaneously upon transfer of goods;

— an invoice is issued for payment for goods and services, while an invoice is issued only upon shipment of goods, the provision of services is formalized by an act;

- unlike a delivery note, an invoice does not confirm the fact of transfer of goods to someone, but is only the basis for VAT offset;

— based on the invoice, you cannot make a claim against the supplier of the goods.

Many people who have little knowledge of accounting think that an invoice and an invoice are the same accounting document. This opinion is wrong. In fact, these documents are directly related to the creation of the same operation; the difference exists in their purpose and design.

Comparative characteristics

Enterprises and individual entrepreneurs who are VAT payers use an invoice. The need for this document lies not in the promptness of payments, but in proving the fact that the fees have been paid in full

, which in turn provides the opportunity to withhold VAT from the payer.

Distinctive features

Invoice and invoice are two different documents

.

They are created for the same purpose, but have different meanings. The differences between the documents are as follows

:

- An invoice is required for the buyer's side to pay the amount specified in the contract. To do this, it contains all the necessary details.

- The invoice reflects transactions in tax accounting. Its necessity lies in obtaining the opportunity to deduct VAT.

Presence of basic similarities

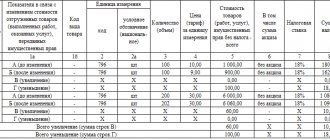

The main correspondence between an invoice and an invoice is shown in the table below:

Difference between invoice and delivery note

Consequently, the invoice is easier to prepare, as it contains less information.

Many agree that both documents have an identical appearance in relation to each other. However, the only difference they have is the presence of a special seal on the delivery note. In all other respects, these are two identical documents.

The important thing is that their main difference is in purpose

:

- An invoice

is a document for accounting reporting on VAT accounting and its deduction. - The delivery note

is proof of the transfer of ownership of a particular product.

Another reason why they should not be confused: these documents cannot replace each other or perform two functions at once. Thus, a tax invoice does not make it possible to obtain a tax deduction, and an invoice does not provide a fact confirming ownership of a particular product.

Correlation with invoice

The word invoice has two meanings

. Let's define each of them:

- An invoice (as a commercial invoice)

is a document drawn up by the seller to the buyer containing information about the provision of services, the cost and quantity of goods, information about the sender and recipient. This document is also significantly similar to an invoice. - An invoice (like an invoice)

is drawn up by the seller to the buyer, thereby documenting the amount of the goods and its delivery.

An invoice (like a commercial invoice) has little in common with an invoice. It contains expanded requirements for the buyer regarding the payment specified in the document.

When issued, an invoice (like an invoice) contains information identical to the invoice. Accordingly, it can be noted that they have practically no differences.

What is the difference between an invoice and an invoice?

Typically, the invoice is issued by an accountant. There must be a basis for this - a purchase and sale agreement or an agreement for the provision of any services. This document indicates the specific amount that the payer undertakes to transfer to a current account or pay at the cash desk of the supplier organization for a service performed or for a specific product.

If the contract stipulates a reusable service (once a month for a year or once a quarter), then this invoice can be issued once a month, once a quarter, or for the whole year at once. As a rule, the invoice is not a strict reporting form and is not recorded in the sales book. Having an account is necessary mainly for prepayment.

Certificate of acceptance and transfer of goods under 44-FZ

The act of acceptance and transfer of goods is a document that confirms the fact of transfer of goods from one person to another. The act is filled out at the stage of contract execution. This may be the acceptance of work, goods or services in full, or their individual stages. It is worth noting that the act can be drawn up both for one unit of goods and for an entire batch of goods.

Let's consider who signs the acceptance certificate for the transfer of goods. According to Law No. 44-FZ, the goods are accepted and checked for compliance with the requirements by the customer. However, by his decision, an acceptance committee of five or more people can be created. In the first case, the act is signed personally by the customer; in the second, the document must contain the signatures of all members of the commission, and it must be approved by the customer.

The act is drawn up in two copies. One remains with the customer, the second is taken by the contractor.

Do you work under 44-FZ?

A selection of special materials is ready for you »

Do you purchase according to 223-FZ?

We know that you will find it useful to watch"

The act of acceptance and transfer of documents, information or material means

It is important to understand that by signing the act, the customer agrees that the goods were supplied to him in the required quantity and proper quality, and he has no complaints. If claims are nevertheless identified, the customer can send the supplier a refusal to sign the act. The time frame within which acceptance of the goods must take place, as well as the time period within which it is necessary to send the contractor a refusal to sign the act, are specified in the contract.

The difference between the act of acceptance of the transfer of goods and the delivery note

The question often arises: what is the difference between an invoice and an act of acceptance and transfer of goods - are these documents interchangeable or not? These are different documents. An invoice is an accounting document required for reporting. Formalizing it is a legal requirement.

As for the transfer and acceptance certificate, everything depends on the terms of the contract. The regulatory authorities do not ask for it. But, if the act is specified in the contract, it must be filled out. If the signing of the act is not provided for in the contract, then a delivery note will suffice as an acceptance document. The form of the consignment note – TORG-12 – is approved by the state.

However, remember that the act is important for resolving controversial issues. This is not possible with a regular delivery note. After all, the act is the only paper confirming the fact of transfer of the goods, which indicates all the characteristics of the goods, possibly its defects. The act is signed by both parties and sealed. Therefore, it can provide assistance in court if, for example, the contractor is faced with an unscrupulous customer.

What data is included in the invoice?

This document is a table that indicates a specific service or product name, unit of measurement, quantity and price per unit of product. At the end the total amount is indicated. Also, the invoice must indicate the details of the service provider to whom the customer must transfer the money.

The invoice is issued by the seller or contractor upon completion of the work performed or services provided. Presentation of this document is mandatory if the company is refunding VAT (the amount must be indicated in the document), i.e. is on the general taxation system. In other situations, an invoice is usually not required. If the presence of this document is mandatory, it must be executed in the same period when the transaction was made (a service was provided, confirmed by a certificate of completion, or goods were purchased, as evidenced by the presence of a delivery note).

In fact, the accountant issues both an invoice and an invoice both when providing any services and when completing a purchase and sale agreement. The only difference is the purpose of these documents. The buyer needs an invoice in order to pay for the services provided, which are specified in the contract. It is for this purpose that the invoice contains the details for transferring the required amount of money and the services or goods for which this amount will be paid.

An invoice is needed so that the transaction performed is reflected in tax accounting, i.e. VAT must be recorded on the completed service or product that is planned to be performed under the specified transaction.

As a rule, the invoice bears the seal of the service provider (mandatory), while the invoice does not. Another difference between these documents is that the invoice must be submitted to the tax office, since this document is a strict reporting form, while an invoice does not have this function.

Sharing

Can an invoice and a delivery note be issued for the same product? SF and TN not only can, but also must be issued for the same product.

Since, as we have already discussed above, this documentation performs different functions in accounting: the invoice reflects VAT, and delivery notes for the transfer of goods (you can find out who should sign the columns “received the goods”, “received the goods” and others) .

Do the numbers for one product have to match?

There are no requirements under the Tax Code, as well as other regulations stating that the SF and TN numbers must match. The main thing is to ensure that the VAT amounts coincide in both cases. Each organization has the right to choose the order and type of numbering of its documents independently.

Which document should be drawn up first?

Can SF be discharged before TN? Since the SF confirms the VAT on the transferred goods, it cannot be written out in advance to the TN,

except in cases where the transaction agreement provides for prepayment. The invoice must be issued no later than five days after shipment of the goods.

Is it possible to combine them?

In 2013, the Federal Tax Service introduced the UTD form into circulation - a universal transfer document that contains elements of tax and accounting. It is based on the invoice base, the rest is an element of the delivery note.

Is registration with different dates acceptable?

The invoice may have different dates from the delivery note.

But you need to consider:

- The SF must be issued no later than five days after shipment of the goods, that is, TN.

- If one of the five days is a weekend, then the required date is postponed to the next working day.

There is no liability for violating this five-day deadline, however, the Ministry of Finance indicates that the buyer cannot claim a deduction for late documents.

What does the transfer acceptance act include?

The form of this document is not legally approved, but there are some requirements for its content. A sample act of acceptance of the transfer of goods under 44-FZ must include the following information:

- The header indicates the number of the application, as well as the number and date of conclusion of the agreement to which the application was drawn up;

- The name of the legal entities, the names of the people acting on their behalf, as well as the name of the documents on the basis of which they act;

- List of goods indicating for each name, quantity, price with and without VAT. Here you can also register product defects;

- Total cost of the goods;

- A footnote that all contract requirements have been met, including quality, quantity and timing, and that the customer has no complaints against the supplier;

- Signatures of both parties.

✔