Which individual entrepreneurs can become self-employed?

According to Law No. 422-FZ, an individual entrepreneur can be self-employed if he meets certain conditions, namely:

- he is not an employer, that is, he has not entered into employment agreements with hired personnel and performs all professional operations independently;

- his income for a calendar year does not exceed 2.4 million rubles;

- he does not carry out the activities listed in Art. 4 Laws.

In all other cases, an entrepreneur can count on the right to use this tax regime. However, to do this, he needs to familiarize himself in detail with the information on how to switch from an individual entrepreneur to self-employed and at the same time not violate the law.

Registration Features

According to the current trend and taking into account the fact that today finding employment and registering oneself as self-employed is a current experiment of the state, registration in this field of activity is an extremely simple question. This is done using the “My Tax” application. If a taxpayer has a personal account, a citizen only needs to fill out and send an application for registration. If there is no office, you will need to attach photocopies of your passport and a photograph to your application. Notification of successful registration is sent within 24 hours.

Registration of an individual entrepreneur is available in several options. It can be issued on the official website of the Federal Tax Service, during a personal visit to the tax authorities authorized to carry out registration, through MFC centers or a notarized power of attorney, which is issued to a representative.

Is it profitable for an individual entrepreneur to become self-employed?

Before addressing the question of whether an individual entrepreneur can become self-employed, you need to analyze whether this will be beneficial for entrepreneurship.

To this end, let's consider a few important points:

- for the self-employed there is a lower tax rate. For example, under the simplified tax system the tax rate is 6% or 15% (depending on the object of taxation), and for self-employment it is 4% or 6% depending on to whom the services are provided (individual or legal entity). If we consider the general taxation system, then under it the entrepreneur’s tax burden is as large as possible;

- Before July 1, 2020, all entities, including individual entrepreneurs, must switch to online cash registers. The costs associated with it are quite significant, since it is necessary not only to purchase or upgrade a cash register, but also to enter into a service agreement with the fiscal data operator. If an individual entrepreneur is registered as self-employed, then he notifies the tax service about the receipt of money through his personal account or mobile application, and also generates checks for clients there;

- the new tax regime does not provide for the submission of any reports to the Federal Tax Service, which significantly reduces the time and financial expenses of the entrepreneur.

We described the difference between self-employed and individual entrepreneurs in another article.

Individual entrepreneur as self-employed

Federal law provides for the possibility of transition to self-employed status for individual entrepreneurs. To do this, you must notify the Federal Tax Service within 30 days after registering self-employment.

Taxes for a self-employed entrepreneur will include the same interest rates as for individuals:

- 4% - when working with FL;

- 6% - on income received from legal entities.

- The remaining mandatory contributions to public funds will be abolished.

Is it possible to be an individual entrepreneur and self-employed at the same time?

Some entrepreneurs are interested in whether it is possible to be an individual entrepreneur and self-employed at the same time? Legislators answer unequivocally - no, such a situation is impossible. At the same time, we note that, for example, hired personnel are granted such a right, that is, they can have an employment relationship with the employer and additionally conduct individual professional activities.

The following way out of the situation is proposed for entrepreneurs: initially close the individual entrepreneur and then become self-employed, or change the tax regime without closing. This point is due to the fact that the Law says: individuals (including entrepreneurs) who have switched to this special regime are recognized as taxpayers.

The entrepreneur decides on his own how exactly to proceed - to close the individual entrepreneur or just change the tax system.

How to switch to self-employment - instructions

We remind you that only residents of Moscow, Moscow region, Kaluga region and Tatarstan can register as self-employed. Registration takes 15 minutes and does not require a visit to the local Federal Tax Service to provide paper documents.

The user can choose a convenient method of registering self-employment from the following:

- “My Tax” application - available for Android, iOS, WEB version.

- Taxpayer's office NPD.

- Authorized banks. The official list is presented on the Federal Tax Service website here and currently includes the following banks: Sberbank of Russia, Alfa-Bank.

Visit the Sberbank website to open an account and register self-employed status

Beware of scammers who create clone sites and gain access to personal data. Use only official sources and organizations accredited by the Federal Tax Service.

How to close an individual entrepreneur and register as a self-employed person (step-by-step instructions)?

In order for an individual entrepreneur to switch to tax for the self-employed, ceasing to operate as an entrepreneur, the following steps must be taken:

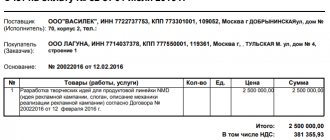

- fill out an application on form P26001 indicating your full name, INN, OGRNIP, and contact details. The entrepreneur must sign when directly transferring the document to the Federal Tax Service specialist. If documents will be submitted by Russian Post, the signature must be notarized;

- pay the state fee for closing an individual entrepreneur - 160 rubles. It is necessary to note that if in the future documents for closing are submitted through the MFC, then this point must be indicated on the receipt, otherwise the documents will not be accepted;

- submit the application and receipt to the tax authorities either in person when visiting the department, or through the Federal Tax Service website, through a third party (with the execution of a notarized power of attorney) or by Russian post;

- receive from the Federal Tax Service a record sheet from the Unified State Register of Individual Entrepreneurs, which indicates that the individual entrepreneur is closed;

- submit the necessary declarations under the appropriate tax regime, even if they are zero;

- register with the tax office as a self-employed person - when visiting the office, through your personal account or the “My Tax” application. In the first case, you need to fill out an application and also provide a passport, TIN and photograph. In other cases, there is no need to collect such a package of documents - just register an account or download the program;

- receive a notification from the tax office about registration as self-employed. It is sent to your personal account and is also displayed in the mobile application.

Individual entrepreneur and self-employment: how to combine to avoid tax claims

Let's look at these rules in more detail. So, if you want to combine individual entrepreneurs with self-employment, then you will have to comply with a number of conditions.

Refuse other special modes

An individual has the right to be an individual entrepreneur and self-employed at the same time, but he cannot combine the professional income tax (PIT) with other special tax regimes - simplified tax system, UTII and unified agricultural tax. That is, you cannot use two tax regimes at the same time.

You need to have time to refuse special regimes within a month from the day the individual entrepreneur registered as self-employed (Part 4 of Article 15 of the Federal Law of November 27, 2018 No. 422-FZ). Otherwise, the registration will not be counted. To do this, it is important to send to the tax office, with which the entrepreneur is registered, a notice of refusal of the simplified tax system, UTII or Unified Agricultural Tax in the standard form, which is given in the Order of the Federal Tax Service of the Russian Federation dated November 2, 2012 N ММВ-7-3 / [email protected] This can be done in person, by mail, through the personal account of an individual entrepreneur.

To confirm that the notification has been sent to the tax office, you can make a copy or photograph the application with a note of acceptance.

If an individual entrepreneur applies a special regime for some type of activity that is not subject to professional income tax, he must pay personal income tax on income from this activity. In this case, self-employment for all income, including income from personal property, terminates automatically.

Please note that if an individual entrepreneur uses a patent taxation system, he will be able to register as a tax payer only after the patent expires or after he notifies the tax authority of the termination of such activities.

Monitor your income

They should not exceed the limit of 2.4 million rubles. in year. This is exactly the limit specified in Federal Law No. 422-FZ of November 27, 2018 for tax on professional income. If you go beyond this limit, the tax office will certainly notify you of the termination of your self-employed status.

Therefore, “it is important to monitor the level of your income and, if it exceeds it, promptly switch to other taxation regimes in order to avoid paying personal income tax of 13% and VAT of 20%,” notes lawyer and general director of SaaS Project Izabella Atlaskirova. “If a self-employed person is late in switching to the new tax regime, he will have to pay taxes under the general tax regime until the end of the year.”

To avoid this situation, you can again choose a special regime by submitting a notification to the tax office at your place of residence using a standard form within 20 days after termination of registration as a self-employed person (Part 6, Article 15 of Federal Law No. 422-FZ of November 27, 2018).

Do not count on a decrease in income for expenses

In the “Questions to an Expert” section of Kontur.Magazine, the following questions periodically appear: how can a self-employed person deduct expenses necessary for the manufacture of products?

But if a self-employed person is engaged in the manufacture of products, then the costs of creating them do not reduce the income received from the sale of these products. According to paragraph 1 of Art. 8 of Federal Law No. 422-FZ of November 27, 2018, when citizens apply the NDP, expenses associated with conducting activities are not taken into account. Income is considered the entire amount of proceeds from sales, regardless of the amount of business development expenses and net profit. Self-employed people pay tax on this income - in the amount of 4% or 6% of revenue, depending on whether they work with individuals or legal entities.

Thus, the NAP differs from the special regime of the simplified tax system with the object “income minus expenses”.

The simplified tax system with the object “income” may be more profitable than self-employment

“Individual entrepreneurs on the simplified tax system and self-employed people cooperating with legal entities pay the same tax - 6% of income, but at the same time, for individual entrepreneurs, the tax is reduced by the amount of insurance premiums, and self-employed people pay insurance premiums in full,” notes the lawyer and general director “SAAS project” Isabella Atlaskirova. “Accordingly, an individual entrepreneur on the simplified tax system, cooperating with legal entities and other individual entrepreneurs, finds himself in a more advantageous position than a self-employed person.”

In addition to the opportunity to reduce tax under the simplified tax system, you can also save your pension using insurance contributions. In addition, the simplified tax system, unlike the NAP, allows you to earn more than 2.4 million rubles. per year and still maintain the same tax rate.

Keep separate records of income and expenses

If an individual entrepreneur, in addition to entrepreneurial activities, carries out other activities as an employee, he will have to keep separate records of income and expenses.

When receiving income from ordinary individuals, a self-employed person applies a tax rate of 4% on income. In case of receiving income from individual entrepreneurs or legal entities, but deducts 6% of the income.

It is important to pay attention to the fact that when carrying out business activities as an individual entrepreneur, it is better if all cash receipts go through the individual entrepreneur’s current account. Although the Letter of the Federal Tax Service of the Russian Federation dated June 20, 2018 No. ED-3-2/ [email protected] states that an individual entrepreneur has the right to use a personal bank card issued to him as an individual to receive funds from customers, unless the bank account agreement directly prohibits the use personal account in commercial activities. Accordingly, these incomes are taken into account for tax accounting purposes if they are produced for the purposes of entrepreneurial activity.

For self-employed individuals providing personal services, an individual’s personal account opened with a bank is used. At the same time, self-employed people can accept payments via payment systems or electronic wallets. To do this, an agreement is concluded with the payment system. Self-employed people do not need an online cash register.

Expect some privileges

In particular, when switching to self-employment, you can maintain your current account and individual entrepreneur status. But he won't be able to hire employees or resell goods that someone else made. But if he wants to do this, then he will have to switch back to the simplified tax system or another tax regime.

According to Art. 2 of the Federal Law of November 27, 2018 No. 422-FZ, individual entrepreneurs applying NAP:

- are not recognized as VAT taxpayers, with the exception of VAT payable when importing goods into the territory of the Russian Federation and other territories under its jurisdiction (including tax amounts payable upon completion of the customs procedure of the free customs zone on the territory of the SEZ in the Kaliningrad region);

- are not exempt from performing the duties of a tax agent;

- are not recognized as payers of insurance premiums for the period of application of the NAP of individual entrepreneurs specified in subparagraph. 2 p. 1 art. 419 of the Tax Code of the Russian Federation).

When is it more profitable to completely close an individual entrepreneur?

If an entrepreneur, having become self-employed, accepts payments only from individuals, he does not need a current account for entrepreneurs, as well as the individual entrepreneur status itself. In this case, he can submit a tax application to close the individual entrepreneur.

A hired employee works under an employment contract, he is also an individual entrepreneur. Can he also be self-employed?

“There are no obstacles to registering as self-employed for persons working under employment contracts and at the same time being individual entrepreneurs,” assures Isabella Atlaskirova (SaaS project). – It is important that activities as a self-employed person do not overlap with activities as an individual entrepreneur and are not carried out in the interests of the organization in which he works under an employment contract.

For example, you can simultaneously work as a manager in an organization, be the owner of a store as an individual entrepreneur, and provide accounting services as a self-employed person.

Individual entrepreneurs that do not use the labor of hired workers, are not engaged in activities prohibited for self-employed workers, and apply special tax regimes (STS, UTII or Unified Agricultural Tax), have the right to switch to paying NAP.”

How to register income after switching to self-employment?

The option for individual entrepreneurs to switch to self-employed is beneficial because you do not need to use an online cash register, but you will still have to record your income. For this purpose, it is intended to use the “My Tax” mobile application, installed both on a smartphone and on a computer or tablet. However, in Art. 14 of the Law states that information about income can be transferred to the Federal Tax Service through an operator or a credit institution.

If you plan to use a mobile application, then you just need to indicate the basic parameters of the incoming transaction. All information will be sent to the tax office online, and based on it, specialists will calculate the tax on professional income at the end of the calendar month.

Personal experience

There are employees in Nebe who have become self-employed. We can say that the application itself works without any glitches. Although there are some overlaps. For example, sometimes client accountants ask for a certificate of registration as self-employed. Help can only be issued from the application on your computer.

Sometimes there are problems with accountants who have not understood the NAP. They start asking for some special contracts or confuse the application with other accounting programs. Be more tolerant and explain everything in detail.

In general, we can say that the experiment is interesting and, perhaps, in the near future the regime will operate throughout Russia. In any case, such conversations are already underway.

Differences between self-employed and individual entrepreneurs

The Ministry of Justice proposes the following definition of the concept “self-employed” - this is an individual who independently carries out, at his own risk, activities based on personal labor participation in providing services, performing work for individuals, aimed at systematically generating profit, not registered as an individual entrepreneur, and not having employees. The department believes that determining the legal status of the self-employed is necessary to protect the rights of this category of citizens, as well as to establish a simplified procedure for their activities and the provision of benefits.

First of all, you need to understand that the definition of self-employment can easily be confused with individual entrepreneurship, but there are still differences, even if only minor ones. The main differences between an individual entrepreneur and a self-employed citizen:

- Self-employed citizens are exempt from paying pension insurance contributions, but they will have to pay professional income tax at a rate of 4%. Whereas for individual entrepreneurs, paying insurance pension contributions and taxes is a direct responsibility.

- Individual entrepreneurs who pay contributions in good faith can count on a pension, while unregistered self-employed citizens (who do not have a main official job) are deprived of this opportunity.

- Entrepreneurs can choose the tax system and type of business activity that suits them, have the right to hire employees and are required to report on their business in the prescribed manner and in accordance with the appropriate deadlines.

- There is no obligation to use cash register equipment.

Areas in which you can work

Previously, there was information that an applicant for registration as a self-employed person must provide the following services:

- tutoring;

- supervision and care of children, sick persons, persons over 80 years of age, as well as other persons in need of constant outside care according to the conclusion of a medical organization;

- cleaning of residential premises;

- housekeeping.

However, there is now evidence that the new regime can be used for writing texts, creating websites, transporting goods, renovating apartments, doing haircuts at home, baking cakes to order, walking animals for money and anything else, if all conditions are met. This mode is also suitable for those who rent out apartments.

Taxes for self-employed and individual entrepreneurs

A self-employed citizen is the same as an individual entrepreneur who works for himself. He is in partnership with other companies or individuals, but is not employed by them as a full-time employee.

Therefore, the self-employed will be forced to report to the state for their honestly earned income.

At the moment, a single tax at the following rates: 3% for entrepreneurs working for the common population and 6% for those who cooperate with legal entities.

An individual entrepreneur pays: firstly, 32 thousand rubles per year as an insurance contribution for the formation of a pension, and secondly, the turnover tax itself, the amount of which depends on the chosen taxation system.

Income limit

- The self-employed have an income limit of 2.4 million rubles per year. But the amount of income per month does not matter - there are no separate restrictions on monthly income. You can get 10 thousand in February, nothing in March, and 300 thousand in June. As long as the income since the beginning of the year has not exceeded 2.4 million rubles, the new regime can be applied. All income above the limit will have to be taxed under other regimes. For an individual without an individual entrepreneur, this is personal income tax at a rate of 13%

- For individual entrepreneurs, the limit depends on the chosen taxation system. For example, for a simplified one - 150 million rubles per year, for a patent one - 60 million rubles.

Opportunities for scaling activities

- A self-employed person cannot hire other employees. And the number of his customers sooner or later hits the ceiling , because he simply physically cannot take more - there is not enough time. To increase his income, he needs to increase the cost of his services. However, this approach is also likely to be limited in scale.

- An individual entrepreneur can employ a large number of people - the only limitation is the taxation system. Thus, an individual entrepreneur can serve more clients, open more outlets, and thereby make more profit.

Become self-employed

If you have any questions or something doesn’t work out, leave a request and we will call you.

Recommended Posts

Can a security guard or watchman become self-employed?

Can a home pastry chef be self-employed?

Can a courier become self-employed?

Will self-employed housewives pay taxes?

Can a nanny be self-employed?

Can a massage therapist be self-employed?

Can taxi drivers become self-employed?

Can a consultant be self-employed?

Individual entrepreneur: concept, pros and cons of opening an individual entrepreneur

An individual entrepreneur is an individual endowed with all the rights and powers of legal entities. An individual entrepreneur carries out trading or production activities, makes a profit, while risking all his property (including personal property not related to work). The activities of an individual entrepreneur can be carried out simultaneously in several permitted areas.

Individual entrepreneurs are required to report to the tax authorities at the place of registration and pay taxes according to the tariffs of the chosen taxation system. They can recruit employees and enter into employment contracts, or work alone.

The advantages of working as an individual entrepreneur include:

- Individual entrepreneur status allows you to carry out commercial activities on a par with legal entities;

- Work experience and contributions to the pension fund. The income of an individual entrepreneur forms his future pension;

- The ability to choose a tax system from all suitable ones and pay tax at the lowest rate;

- There is no need to open a current account and make a seal;

- Possibility of unhindered withdrawal of earned funds;

- Low opening costs and no authorized capital.

Among the disadvantages of opening an individual entrepreneur:

- Big risks. In case of losses, the individual entrepreneur risks all his property, including apartments, cars and personal belongings;

- The obligation to make monthly contributions to extra-budgetary funds even with zero activity;

- Inability to sell the business;

- Restrictions on certain types of activities (production of medicines, alcoholic beverages, etc.);

- A ban on opening an individual entrepreneur for certain categories of citizens (military personnel, people with an open criminal record, civil servants, businessmen and individuals declared bankrupt).

Before opening an individual entrepreneur, you should weigh all the pros and cons and evaluate the feasibility of this action.

Unemployed = self-employed?

Is an unemployed person self-employed? This is another question that interests many. After all, an unemployed person, just like a self-employed person, does not work for his boss?

If you look at the definition, it will immediately become clear that an unemployed person is a person who has lost his job and is currently supported by the state. However, it is almost impossible to survive on a tiny subsidy.

But what prevents him from receiving money from the state and working for himself? Of course, one cannot but like this situation, but the joy will be short-lived. Payments from the employment service will stop after 6 to 12 months. This means he will be considered an illegal immigrant and will be subject to administrative and tax fines.

In order not to work at your own peril and risk, anyone working informally needs to register as an individual entrepreneur or as a self-employed person. But people who are content only with unemployment benefits are not considered self-employed.

What is better: self-employed or individual entrepreneur?

So, despite the general similarity of the two types of entrepreneurship, they have many differences. When choosing which is better: self-employed or individual entrepreneur , a person should decide on his goals and answer several questions for himself:

- Is the NAP valid in the region where the citizen or his clients are present?

- What is the planned turnover?

- How significant is the scope of the business?

- What is the target audience, as well as payment methods?

- What type of goods and services will be sold?

- What activities do you plan to do?

- Will additional staff be required in the foreseeable future?

- Is there any calculation made for a future pension?

- What expenses for taxes and contributions are you willing to bear?

In turn, by summing up the responses received, taking into account the difference between a self-employed person and an individual entrepreneur, one can understand which form is suitable in each specific case.

Example:

For example, a person plans to provide cosmetology and manicure services. If he does this at home on his own, then switching to NAP is optimal for him. Provided that it has already been introduced in his region. If he wants to open a beauty salon with a staff of hairdressers, cosmetologists or other employees, then he will have to register an individual entrepreneur or LLC. Because he will not be able to operate as a self-employed person with hired specialists.

When making the choice of self-employed or individual entrepreneur in a taxi , an individual also needs to decide what type of activity he is going to carry out. If he wants to develop his vehicle fleet, then this will not be possible except through an individual entrepreneur or LLC. If he plans to use his own or a rental car to collaborate with an existing fleet (for example, Yandex.Taxi), then switching to this mode as a self-employed person will be most appropriate. Provided that NAP has already been introduced in his region. However, when choosing the most profitable tax system, there are a lot of nuances that vary from case to case.

Read: Self-employed in a taxi: how to become, pros and cons.

Of course, from the point of view of financial burden and paperwork, registering as a self-employed person looks more acceptable. But only for those citizens who fit within the restrictions put forward for this category. If these conditions cannot be met, then it is impossible to apply NPA for your income.

If it is still difficult to make a choice, it is worth considering that:

- You can register for self-employment quickly without even leaving your home at any time. But later register as an individual entrepreneur, in case of expansion or need;

- Having opened an individual entrepreneur, you can just as successfully close it and remain only an NAP payer as a self-employed person;

- As an individual entrepreneur, a citizen has the right to switch to the NPA tax regime if it is already in effect in his region.