The services of recruitment agencies are needed both by ordinary citizens who want to find a job, and by organizations that need qualified personnel. HR specialists carefully check potential employees and employers, so cooperation with them minimizes possible risks. Such services are quite in demand, and some entrepreneurs decide to take advantage of this by opening their own recruitment agency.

Current legislation obliges business owners, when registering with the tax service, to indicate in the application the OKVED encoding, consisting of at least 4 characters. You can select one code, or you can specify several. The number of specified encodings is not limited, but only one of them will be the main code.

In 2020, the OKVED code “Personnel Recruitment” should be taken from the current edition of the OKVED2 classifier (another name ˗ OK 029-2014 (NACE Rev. 2), approved by Order of Rosstandart dated January 31, 2014 No. 14-st).

These encodings are suitable for both organizations and individual entrepreneurs.

Read also: Changing OKVED codes: step-by-step instructions

How to determine the OKVED code “Personnel Recruitment” in 2020

When selecting a code:

- In the OKVED2 directory we look for section “N”.

- Next we move on to class 78.

- In groups 78.1, 78.2, 78.3 we select the most suitable OKVED for personnel selection.

The following activities are grouped in class 78:

- maintaining a list of current vacancies;

- posting applications from job seekers;

- personnel search;

- selection of candidates;

- activities of casting agencies;

- work of employment agencies online;

- providing enterprises with hired labor on a contract basis;

- other activities.

This class does not include the activities of theatrical and artistic agencies involved in personnel selection. The code for this type of activity is 74.90.

OKVED: cleaning services in the updated classifier

With the expansion of functions, other codes corresponding to the focus are also introduced. The procedure for selecting a code using the new unified classifier has been simplified, the device is much clearer. Sections are divided into classes, then into subclasses and types. Entrepreneurship in the field of cleaning services covers a variety of activities. During the registration procedure, the company is required to indicate OKVED codes.

Cleaning an office building To facilitate the choice of a variety of types of cleaning practices, a new classifier of a single type, OKVED-2, has been developed.

It is more accessible and easier to understand than the previous one.

It contains sections, specialized classes, subclasses, and types.

"Outsourcing": OKVED

Outsourcing as a separate line of business emerged largely thanks to the work of recruitment agencies. This type of activity involves the transfer by an organization of certain functions of economic activity to another company or individual on the basis of an agreement. Outsourcing can be complete or partial.

The selection of code for outsourcing (OKVED) is carried out as follows:

- We look for section “M” in the OKVED2 directory;

- in class 69 we select the appropriate code.

In class 69 the following activities are grouped:

- representing the interests of organizations and individual entrepreneurs in courts;

- providing legal advice;

- activities of state notaries;

- provision of services in the field of accounting;

- tax consulting;

- conducting a financial audit.

When selecting the OKVED “Outsourcing” code, you should also pay attention to the following encodings:

- 70.22 – consulting on commercial activities;

- 66.19.4 – provision of advice on financial intermediation;

- 82.99 – provision of other support services for business, not included in other groups;

- 96.0 – provision of other personal services.

Entrepreneurs should be prepared for the fact that deliberately specifying OKVED encodings that do not correspond to actual activities may result in administrative penalties under Art. 14.25 Code of Administrative Offenses of the Russian Federation. The fine will be 5 thousand rubles. And if a business owner indicates codes from the OKVED1 directory, which are no longer valid, he will be denied registration.

Read also: Is it possible to carry out activities without OKVED

OKVED cleaning services 2020

all types of clothing (including fur) and textile products produced using mechanical equipment, manually or by machines - automatic machines that operate when coins (tokens) are inserted, both for the population and for industrial/commercial enterprises. — Collection of linen for washing, as well as its delivery after washing.

— Cleaning of carpets, curtains, curtains, draperies. — Dyeing of clothing and other textile products. — Rental of linen by laundries, work clothes and other similar products. — Repair, as well as minor alterations of clothing or other textile products, if this is done in connection with cleaning. Entrepreneurial activities are registered by law using OKVED codes (All-Russian Classifier of Types of Economic Activities).

When registering as an individual entrepreneur or LLC, you should use the latest version of the codes, which were updated in 2020. Cleaning services are a phenomenon in demand for offices, residential complexes, and production areas.

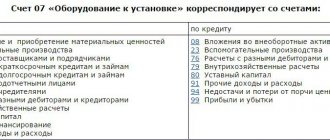

Table of OKVED codes “Personnel selection”

| Code | Decoding |

| 78 | Employment and recruitment activities This grouping includes: — activities for maintaining a list of vacancies, requests or posting applications of candidates who are not employees of the employment agency; — supplying client companies with personnel for a limited period of time and activities to support other client requests for labor resources This group also includes: — search and selection of vacancies, including the activities of theatrical recruitment agencies This group does not include: - activities of private theatrical and artistic agencies and recruitment agents, see 74.90 |

| 78.1 | Activities of recruitment agencies |

| 78.10 | Activities of recruitment agencies This grouping includes: - activities to maintain a list of employment vacancies and applications, as well as posting applications from candidates who are not employees of this employment agency This grouping includes: — personnel search, candidate selection and employment activities, including appointment; — functioning of casting agencies, for example theater agencies; — functioning of employment exchanges in “On-line” mode on the Internet information and communication network This group does not include: - activities of private theatrical and artistic agencies and recruitment agents, see 74.90 |

| 78.2 | Activities of temporary employment agencies |

| 78.20 | Activities of temporary employment agencies This grouping includes: - activities for hiring temporary labor, providing enterprises with hired labor on a contract basis, mainly for performing temporary work However, companies included in this group do not provide supervision of the workers they provide at the client’s work site. |

| 78.3 | Other personnel recruitment activities |

| 78.30 | Other personnel recruitment activities This grouping includes: — labor recruitment activities for the client’s company Companies classified in this group represent the employer in matters of labor selection, payment of taxes and other issues of financial and personnel policy, but they are not responsible for the management of employees. Typically, the workforce is selected for permanent or temporary work, and companies classified in this group provide a wide range of personnel management services This group does not include: — provision of labor selection functions together with the management of the current business, see the grouping in the relevant activities of such a company; - selection of labor for temporary replacement of employees or expansion of the client’s personnel, see 78.20 |

| 74.90 | Other professional, scientific and technical activities not included in other groups This group also includes: - the activities of agencies and agents acting on behalf of individuals and claiming a share of remuneration from the participation of their clients to act in films, play in plays and participate in other entertainment events or sports competitions, publish books, exhibit artwork, photographs, etc. on behalf of publishers, producers, etc. |

| 74.90.8 | Activities of agencies and agents acting on behalf of individuals, usually associated with the negotiation of contracts for participation in motion pictures, theatrical productions and other entertainment or sporting events, as well as the offering of books, plays, fine art, photographs and similar items publishers, producers |

The Federal Tax Service has reached the lawyers. Or a strange requirement about the relationship between OKVED 69.10 and the simplified tax system

We have not received any kind of demands from the Federal Tax Service. But no, don’t get your hopes up: the imagination of tax officials is limitless. Now they are sending out LLC demands on the simplified tax system with OKVED 69.10 “Activities in the field of law” about the illegality of using the simplified tax system.

“Your organization has indicated the main type of activity with OKVED code 69.10 “Activities in the field of law.” According to subparagraph 10 of paragraph 3 of Article 346.12 of the Tax Code of the Russian Federation, notaries engaged in private practice, lawyers who have established law offices, as well as other forms of legal entities do not have the right to apply the simplified taxation system.

1. According to what OKVED code does the organization carry out its activities?

2. Does the organization have notaries engaged in private practice or lawyers on its staff?”

Let's look at the validity of such a requirement and the general logic of such questions.

- notaries engaged in private practice,

- lawyers who have established law offices,

- as well as other forms of legal entities

What lawyers and notaries have in common is that their activities are not entrepreneurial and do not pursue the goal of making a profit.

In paragraph 2 of Art. 1 of Federal Law No. 63-FZ of May 31, 2002 “On advocacy and the legal profession in the Russian Federation” also states that advocacy is not entrepreneurial.

According to Art. 21 and 29 of Federal Law N 63-FZ, a lawyer’s office is not a legal entity; a lawyer’s chamber is a non-governmental non-profit organization and does not have the right to carry out entrepreneurial activities.

The organizational and legal form of “Limited Liability Company” itself presupposes engaging in commercial activities. The legislation does not prohibit Limited Liability Companies from engaging in commercial activities in the field of law.

Regarding the accounting of entities that do not have the right to apply the simplified tax system on the basis of paragraph 10 of Article 346.12 of the Tax Code of the Russian Federation, there are a number of provisions in the Tax Code.

Article 85 of the Tax Code of the Russian Federation defines the authorized state bodies that are obliged to report to the tax authorities information related to the registration of notaries and lawyers:

- Judicial authorities that grant powers to notaries are required to report to the tax authorities at their location about individuals appointed to the position of a notary engaged in private practice, or exempted from it, within five days from the date of issuance of the relevant order.

- Bar chambers of the constituent entities of the Russian Federation are required, no later than the 10th day of each month, to report to the tax authority at the location of the bar chamber of the constituent entity of the Russian Federation information about lawyers entered in the previous month in the register of lawyers of the constituent entity of the Russian Federation (including information about the form of lawyer chosen by them education) or excluded from the specified register, as well as about decisions taken during this month to suspend (renew) the status of a lawyer.

According to paragraph 6 of Art. 83 of the Tax Code of the Russian Federation, registration of a notary engaged in private practice is carried out by the tax authority at his place of residence on the basis of information reported by authorized bodies.

Registration of a lawyer is carried out by the tax authority at his place of residence on the basis of information reported by the bar association of a constituent entity of the Russian Federation.

According to para. 5 p. 2 art. 84 of the Tax Code of the Russian Federation, the tax authority is obliged to register (deregister) a notary engaged in private practice, a lawyer at their place of residence within five days from the date of receipt of the relevant information reported by the authorized bodies. Within the same period, the tax authority is obliged to issue or send by registered mail to a notary engaged in private practice (lawyer) - a certificate of registration with the tax authority (if the specified certificate was not previously issued) and (or) a notice of registration with the tax authority. tax authority, confirming the registration with the tax authority of an individual as a notary engaged in private practice, lawyer (notice of deregistration with the tax authority).

Changes in information about individuals who are not individual entrepreneurs, as well as about notaries engaged in private practice, and about lawyers are subject to registration by the tax authority at their place of residence.

According to paragraph 4, paragraph 5, art. 84 of the Tax Code of the Russian Federation, in cases of termination of the powers of a notary engaged in private practice, termination of the status of a lawyer, their deregistration is carried out by the tax authority on the basis of information reported by the authorized bodies.

Because in the staff of legal companies created in the form of an LLC, notaries and lawyers cannot work under an employment contract, providing legal services. This is directly prohibited by law:

- According to Article 6 of the Fundamentals of Legislation on Notaries dated February 11, 1993, “A notary has no right to: engage in entrepreneurial and other paid activities, with the exception of teaching, scientific or other creative activities”

- According to Article 2 of the Federal Law “On Advocacy and the Bar in the Russian Federation”: “A lawyer does not have the right to enter into labor relations as an employee, with the exception of scientific, teaching and other creative activities, as well as to hold government positions in the Russian Federation, government positions in the constituent entities of the Russian Federation , civil service positions and municipal positions"

This issue has been resolved. I wonder which OKVEDs are next?

Tax audits are becoming tougher. Learn to protect yourself in the Clerk's online course - Tax Audits. Defense tactics."

Watch the story about the course from its author Ivan Kuznetsov, a tax expert who previously worked in the Department of Economic Crimes.

Come in, register and learn. Training is completely remote, we issue a certificate.

Providing personnel - what is it?

This practice to this day makes it possible to effectively solve several problems of the organization at once in comparison with the use of full-time employees:

1. If there is no need for a full-time employee to work full time, hiring an outside specialist to perform tasks can reduce the organization’s costs. In turn, the specialist himself has the opportunity not to work at a reduced rate, but to effectively spend his working time serving several clients.

2. For an employee invited in this way, in comparison with a full-time specialist, insurance fees are not paid from his salary. Thus, outsourcing can reduce the overall tax burden on the employer.

3. Lack of regulation of labor relations. For employees on the staff of an enterprise, the employer must provide a certain set of social guarantees. Including the right to paid leave, sick leave and other methods of support.

These legal requirements do not apply to hired specialists under outsourcing agreements, which allows the customer to have a certain stability and not incur additional costs.

It is necessary to distinguish between outsourcing and outstaffing. In the first case, the customer purchases a certain package of services, without reference to a specific number of working people. In the second situation, the customer directly receives specific specialists who actually carry out permanent labor activities at his enterprise.

Since 2020, changes have been made to the Labor Code and other regulatory documents that directly prohibit outstaffing agreements and the concept of leasing personnel in general cases. This has also affected outsourcing in some aspects.

On the other hand, mechanisms for legally leasing personnel to individual business entities were also introduced, which made it possible to ensure effective protection of the rights of the workers themselves and the existence of the outstaffing system as a whole.

Which OKVED code is suitable for agency activities?

51.2 - 51.7 - retail trade through agents, see 52 - activities of insurance agents, see 67.20.1 - activities of agents engaged in real estate transactions, see 70.3 This is a general code. It is better to choose based on their specific field of activity.

— What sanctions are applicable for engaging in activities that are not timely included in the types of economic activity of the enterprise?

Basically none. The main activity code is important when paying insurance premiums. October 10, 2012, 10:13 am Was the lawyer's answer helpful? + 1 — 0 Collapse Client clarification Good, Konstantin!

Field of activity: provision of information services on the Internet and e-commerce by companies of which I act as an agent, but acting on my own behalf. 10 October 2012, 10:32

- 249 reviews

- Druzhkin MaximJurist, Moscow

- 1103responses

- 249 reviews

OKVED for intermediary services (realtors, trade and insurance agents, other agency services)

The law allows realtors, brokers, commission agents or agencies to operate in one or more types of real estate business:

- consulting;

- rent;

- information services.

- pre-sale preparation;

- purchase;

- assessment;

- sale;

Legal services are not within their competence.

In wholesale trade, the activities of agents trading on behalf and on behalf of others are widespread and are divided into individual types of products. This is possible not only directly, but also through the Internet. In the retail trade, intermediary services can be provided through commission sales agents who sell in ways permitted for this type of goods.

What is meant by intermediary services?

Before moving on to considering the OKVED code of all intermediary services, you need to have an idea of what type of business this is. If you look closely at the modern market for various services, using real estate as an example, you will notice that those people who want to buy or sell an apartment or house turn to various real estate companies for help. Their responsibilities include selecting the required property and assisting in the execution of the transaction, during which ownership will pass from one owner to another. Based on this example, we can come to the conclusion that intermediary services consist of the following:

- activities related to the search for information (real estate, insurance), which is necessary for market participants to meet their needs (taking out insurance, purchasing an apartment, etc.);

- activities related to the provision of advisory and other assistance for the full implementation of their rights by market participants (for example, support of various real estate transactions).

Despite the fact that this is a specific business, it has become widespread in our country, since the costs of organizing it are not large, and the profit received is tangible.

It is important to understand that intermediation is a business that only provides information services. It is thanks to this specificity that this type of commerce has not found wide distribution in OKVED, since such a range of services is constantly growing and changing, and the all-Russian classifier has not changed for a long time.

Okved agent for searching hotel clients

If the agreement does not establish deadlines for reporting, then the report is provided by the agent during the implementation of the order.

Alternatively, it can be transferred to the customer when this contract expires. It should be noted that the report includes the presence of necessary and documented expenses that were incurred by the contractor during the implementation of the customer’s instructions. An exception may be other terms of the agreement. If the customer does not accept the submitted report, then he must notify the agent.

A period of one month is usually set for this. If, after this period, the principal has not taken steps to notify the agent regarding possible objections, then the report is considered accepted.

Attention Each enterprise or individual entrepreneur is obliged to correctly code its activities when registering for tax purposes.

These codes help tax authorities systematize your activities.

OKVED Code 68.31 - Activities of real estate agencies for a fee or on a contractual basis.

Okved 2020 real estate agency

There may be several of them, but there is only one main one! The OKVED classifier contains codes under which your activity will be required to have licensed status and you will be required to obtain the appropriate license.

Therefore, when registering your company and choosing the main type of activity, do not forget to look at the list of licensed activities. www.buxprofi.ruSet of OKVED codes - Real estate rental We invite you to use a ready-made set of OKVED codes compiled for the type of activity - Real estate rental. The set of codes is suitable for both LLC registration and individual entrepreneur registration. Codes have been updated according to the new classifier!

If necessary, in the case of a more expanded scope of activity of your company, you can independently supplement it with other codes corresponding to the type of activity of your future company.

- 68.20 Rent and management of own or leased real estate

- 68.31.4 Provision of consulting services on the rental of real estate for a fee or on a contract basis

- 68.31.12 Provision of intermediary services in the purchase and sale of non-residential real estate for a fee or on a contractual basis

- 68.31.52 Provision of intermediary services in the assessment of non-residential real estate for a fee or on a contractual basis

- 68.31.31 Provision of consulting services in the purchase and sale of residential real estate for a fee or on a contract basis

- 68.31.3 Provision of consulting services in the purchase and sale of real estate for a fee or on a contractual basis

- 68.31.5 Provision of intermediary services in the assessment of real estate for a fee or on a contractual basis

- 68.32 Management of real estate for a fee or on a contract basis

- 68.31.32 Providing consulting services for the purchase and sale of non-residential real estate for a fee or on a contractual basis

- 68.31.2 Provision of intermediary services for the rental of real estate for a fee or on a contractual basis

- 68.31.11 Provision of intermediary services in the purchase and sale of residential real estate for a fee or on a contractual basis

- 68.31.41 Provision of consulting services on the rental of residential real estate for a fee or on a contractual basis

- 68.31 Activities of real estate agencies on a fee or contract basis

- 68.32.2 Management of the operation of non-residential assets for a fee or on a contract basis

- 68.31.42 Provision of consulting services on the rental of non-residential real estate for a fee or on a contractual basis

- 68.31.21 Provision of intermediary services for the rental of residential real estate for a fee or on a contractual basis

- 68.31.1 Provision of intermediary services in the purchase and sale of real estate for a fee or on a contractual basis

- 68.20.1 Rent and management of own or leased residential real estate

- 68.32.3 Activities for technical inventory of real estate

- 68.32.1 Management of the operation of housing stock for a fee or on a contract basis

- 68.20.2 Rent and management of own or leased non-residential real estate

- 68.31.51 Provision of intermediary services in the assessment of residential real estate for a fee or on a contractual basis

- 68.31.22 Provision of intermediary services for the rental of non-residential real estate for a fee or on a contractual basis

Note To carry out your activities, you must select OKVED codes.

How much money do you need to start a business?

Opening a holiday agency does not require large initial investments. From the obligatory:

- Creation and content of your website (about 50 thousand rubles).

- Obtaining permits for doing business (up to 20 thousand).

- Rent, interior renovation and decoration of premises (up to 300 thousand).

- Purchase of necessary equipment and materials (up to 300 thousand).

The final estimate is about 700 thousand rubles, and if you approach starting a business economically, for example, working from home in the first stages, you can invest in a much smaller amount.