What are questionable transactions?

Any banking operation, transaction or transaction that is contrary to the law or gives the impression of being deliberately unprofitable for the client is called questionable. With the help of such orders given to the bank, a citizen or company tries to withdraw money from the territory of the Russian Federation or avoid taxation.

However, it is not only illogical transactions or long chains of transfers of funds that can cause doubt. Even the most ordinary and everyday transactions are subject to increased attention from the bank if their amount exceeds 600 thousand rubles or the equivalent in foreign currency. This limit is established in Federal Law No. 115 of 08/07/2001.

Bank employees are required not only to identify dubious or unusual, from the point of view of accounting entries, transactions, but also to classify them. At the same time, experts analyze:

- client connections of a citizen or company that comes under suspicion;

- place of registration of the client or his counterparty;

- territory of the transaction.

All employees of banks and other financial organizations are provided with a list of countries that are under special control. As well as a list of companies and individuals suspected of participating in money laundering or promoting terrorism.

On what grounds is the operation considered doubtful?

All non-cash transactions in the Russian Federation take place with the participation of a bank or credit institutions that have received a license from the Central Bank. Not every transaction goes through a “live” specialist. Some of the transactions that are questionable are monitored by specialized embedded systems. But if the operation takes place with the participation of an employee, then he may not pay attention to some behavioral features. As well as other characteristics of the transaction that raise doubts, for example:

- the client refuses to provide accompanying or explanatory documents for the transaction without explanation;

- the owner of large account balances shows excessive haste when submitting documents for cash withdrawal;

- the client simultaneously gives several payment orders for the transfer of large amounts to different recipients - individuals or unknown final recipients within the country or outside the state;

- the account holder neglects offers from the bank that are beneficial to him and makes frequent adjustments to the schemes for transferring his own funds;

- only transit transactions pass through the current account without a clear purpose of payment and logical justification;

- large sums of money are received in one or more currencies from individuals, and then within a short time they are withdrawn from the account or transferred to third parties;

- clients ask to make payments according to a logically contradictory scheme compared to similar banking transactions;

- money goes to the accounts of foreign counterparties, but no goods are received from them, there are no supporting customs documents;

- a company or individual conducts complex instructions to carry out a standard operation, and only according to the only possible scheme, rejecting all proposed alternatives;

- the client’s refusal to provide bank employees with complete information about his counterparty, the recipient of funds;

- the discrepancy between the type of activity of the company and the operations that it conducts through its current accounts;

- involving too many intermediaries to participate in the traditional transfer of funds between the sender and the recipient.

These signs may lead to increased control being applied to the movement of funds in such a client's account. The situation will worsen if the situations become periodic or occur in combination.

Changes 2018-2020

Last year and this year, the Law was amended several times. In 2018 briefly:

- Non-state pension funds were included in the list of organizations that can legally conduct transactions with funds. But they can do this only within the framework of their main activities;

- a new concept of “financing terrorism and financing the proliferation of weapons of mass destruction” was introduced;

- a new article was introduced. 7.5, which sets out the measures taken to counter the financing of the proliferation of weapons of mass destruction;

- Art. was introduced. 10.2, which talks about international cooperation in this area;

- in Art. 7 introduced the obligation of banks to enter into bank deposit agreements only upon presentation of documents confirming the opening of a bearer deposit;

- Changes were also made to other articles in accordance with the current situation in the country.

In March of this year, the 57th latest edition of the law came into force. The changes made affect organizations that are part of a banking group or a banking holding company, as well as lawyers, notaries and others who provide legal and accounting services. All of them, having a corresponding order from their client, carry out transactions with funds, sometimes quite large sums.

For organizations that are part of banking associations or holdings, these changes are exclusively positive. There are several negative points regarding the rest. In particular, they can now also take measures to block their client’s account. These amendments came into force 18 days after they were submitted for discussion. Lawyers, notaries and others did not have time to prepare for them, which led to inconvenience for them.

That is, for these subjects it is still not clear how to perform new duties, as well as record the fact of their fulfillment. Therefore, all newly described subjects must:

- complete training within a reasonable time, or conduct unscheduled instruction within three days. That is, by March 21, authorized employees of organizations included in banking associations and holdings had to undergo training on the new rules;

- All lawyers, notaries and others must update their internal regulations. This had to be done before April 18 of the current year. That is, they were given only a month.

If an entity participates in the “Voluntary Cooperation with Rosfinmonitoring” program, then it is recommended to:

- update your personal account in accordance with the changes received;

- undergo additional training;

- The knowledge gained will need to be used when completing the report on the results of internal control. The corresponding section is in your Personal Account.

According to many who, by occupation, are associated with Law No. 115-FZ and have relevant practice, the adopted changes are unnecessary and redundant.

List of transactions classified as questionable

The general list of transactions that are considered questionable is listed in Art. 6 Federal Law No. 115. The law is constantly updated and refined by legislators. The latest edition was adopted on August 2, 2019.

If transactions are carried out in cash , then increased interest is caused by:

- purchase and subsequent resale of foreign currency and securities;

- exchanging foreign banknotes of one denomination for banknotes of another denomination;

- issuance of funds received to bearer from accounts;

- issuing funds from the account of a legal entity in cases not provided for by law and for unclear purposes;

- repurchase or resale of a share in the authorized capital of a company by an individual for cash.

The status of doubtful will also be assigned to operations of crediting, transferring money, issuing loans or non-cash transactions with securities . This will happen if one of the participating parties is a citizen or company that is registered in a state that does not comply with the FAFT recommendations.

With regard to accounts and deposits, doubts will be raised by transactions in which:

- money is sent to another country to an anonymous account of an individual;

- funds from abroad are credited to the client’s account in a Russian bank from an unknown sender;

- crediting and debiting funds from the current account of a company, less than 3 months have passed since its registration in the state register;

- registration of a deposit for a third party with cash credited to the account;

- opening a bearer account and depositing funds into it in an amount exceeding 600,000 rubles.

real estate worth more than 3 million rubles will be considered questionable . And when working with movable property , the following transactions are under special attention:

- transferring jewelry or scrap precious metals to a pawnshop;

- receiving or providing an interest-free loan;

- provision or receipt of property on lease.

Each financial institution that conducts non-cash transactions is required to develop internal instructions for compliance with Law No. 115. And also appoint responsible persons or form a department that will monitor all transactions that raise doubts about purity and transparency.

Signs of dubious transactions (fictitious transactions) in banks

► Legal services on currency regulation ► Questionable transactions The concept of “questionable transactions”

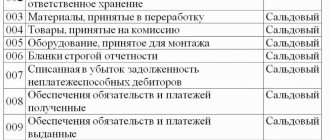

| Agency, commission, financing |

| Requirements for non-residents | Cash withdrawal | Understatement of customs value |

| Operations with bills | Securities and foreign exchange | Transfers without opening accounts |

| Customs Union, EAEU | Signs of unusual transactions | Countermeasures |

| Consultations on foreign trade activities | Foreign trade projects abroad | Accounts abroad | Foreign exchange contracts |

The concept of “doubtful transactions” and legal acts of the Central Bank with their characteristics

Extracts from the letter of the Central Bank of the Russian Federation dated September 4, 2013 No. 172-T “On priority measures in the implementation of banking supervision”:

For the purpose of qualifying transactions as suspicious transactions, the following acts of the Bank of Russia are used:

———————————

Questionable transactions

- these are transactions carried out by clients of credit institutions that are of an unusual nature and have signs of a lack of clear economic meaning and obvious legal purposes, which can be carried out to withdraw capital from the country, finance “gray” imports, transfer funds from non-cash to cash and subsequent withdrawal from taxation, as well as for financial support of corruption and other illegal purposes.

| 1 | 150-T ► | 07.08.2013 | On increasing the attention of credit institutions to individual customer transactions |

| 2 | 110-T ► | 19.06.2013 | On increasing the attention of credit institutions to individual customer transactions |

| 3 | 104-T ► | 10.06.2013 | On increasing the attention of credit institutions to individual customer transactions |

| 4 | 73-T ► | 17.04.2013 | On increasing the attention of credit institutions to individual customer transactions |

| 5 | 167-T ► | 07.12.2012 | On increasing the attention of credit institutions to individual customer transactions |

| 6 | 157-T ► | 16.11.2012 | On the implementation by authorized banks of foreign exchange control over the conduct of foreign exchange transactions by residents related to payment for goods transported across the territory of the Customs Union |

| 7 | 129-T ▼ | 16.09.2010 | On strengthening control over certain operations of legal entities |

| 8 | 83-T ► | 11.06.2010 | On the peculiarities of the work of authorized banks with waybills issued by shippers on the territory of the Republic of Belarus |

| 9 | 8-T | 23.01.2009 | In addition to the letter of the Bank of Russia dated November 1, 2008 N 137-T |

| 10 | 137-T ▼ | 01.11.2008 | On increasing the efficiency of preventing dubious transactions |

| 11 | 111-T | 03.09.2008 | On increasing the efficiency of preventing dubious transactions of clients of credit institutions |

| 12 | 80-T ▼ | 04.07.2008 | On strengthening control over certain transactions of individuals and legal entities with bills of exchange |

| 13 | 24-T | 13.03.2008 | On increasing the efficiency of preventing dubious transactions |

| 14 | 170-T ▼ | 30.10.2007 | On the specifics of accepting non-resident legal entities who are not Russian taxpayers for banking services |

| 15 | 161-T ▼ | 26.12.2005 | On strengthening efforts to prevent questionable transactions of credit institutions |

| 16 | 99-T ► | 13.07.2005 | On methodological recommendations for the development of internal control rules by credit institutions in order to combat legalization (laundering) of proceeds from crime and the financing of terrorism |

| 17 | 12-T ▼ | 21.01.2005 | Methodological recommendations for strengthening control over transactions of purchase by individuals of securities for cash and purchase and sale of cash foreign currency |

| 18 | 179-T ▼ | 24.12.2003 | On strengthening control over transactions involving the transfer of funds without opening accounts and transactions using prepaid financial products |

For the purpose of qualifying transactions as suspicious transactions, signs indicating the unusual nature of the transaction are also used, specified in the appendix to Bank of Russia Regulation No. 375-P dated March 2, 2012 “On the requirements for the rules of internal control of a credit organization in order to combat legalization (laundering)” proceeds from crime and the financing of terrorism.”

Questionable agency, commission, financing against assignment of claims

Extracts from the letter of the Central Bank of the Russian Federation dated September 16, 2010 No. 129-T “On strengthening control over certain operations of legal entities”:

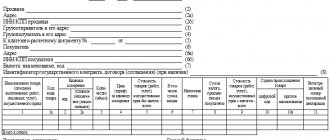

As a result of supervisory activities, the Central Bank of the Russian Federation revealed that recently the volumes of funds transferred by residents in favor of counterparties (residents and non-residents) to their accounts opened in banks outside the territory of the Russian Federation have increased in order to fulfill obligations under agency agreements, commission agreements, financing agreements for the assignment of monetary claims and agreements for the purchase and sale of goods with delivery on the territory of the Russian Federation (in bank statements such transactions are reflected using currency transaction codes 35020, 99090).

In many cases, funds are transferred by resident legal entities in favor of non-resident counterparties whose jurisdiction does not coincide with the jurisdiction of non-resident banks in which the accounts of these non-residents are opened, as well as in favor of resident counterparties to their accounts opened in banks in foreign countries. states

The characteristic features of such operations are:

1. Implementation by resident clients of credit institutions in favor of non-residents, within the framework of agency agreements (commission agreements) concluded between them, of non-cash transfers of funds in large amounts, which are proceeds from the sale by resident agents on their behalf of goods owned by non-resident principals, the delivery of which is carried out on territory of the Russian Federation (i.e. without crossing the customs border of the Russian Federation), as well as transfers of the currency of the Russian Federation between residents within the framework of similar agency agreements (commission agreements) concluded between them.

2. Carrying out, under agency agreements (commission agreements) by resident principals, transfers of funds in large amounts, which are agent remuneration for services provided on the territory of the Russian Federation, in favor of non-resident agents. The obligations of non-residents consist in providing residents - payers of funds with services for the acquisition on their own behalf, but in the interests and at the expense of a resident on the territory of the Russian Federation of goods from third parties. The amount of agency remuneration in the agency agreement (commission agreement), as a rule, is not provided for and is determined as a percentage based on the cost of the goods supplied.

3. Carrying out, under agreements of financing against the assignment of a monetary claim, transfers of funds by residents - financial agents in favor of non-residents (creditors) against the monetary claims of non-residents (creditors) to third parties - residents (debtors) under agreements concluded between them for the supply of goods on the territory of the Russian Federation .

4. Carrying out settlements and transfers between residents in the currency of the Russian Federation from accounts opened by some residents in credit institutions to the accounts of other resident counterparties opened in non-resident banks, under agreements concluded between them for the purchase and sale of goods with the supply of goods on the territory of the Russian Federation Federation.

The increasing scale of these operations suggests that their actual goals may be evasion of taxes and customs duties, withdrawal of funds from the Russian Federation, payment for “gray imports,” and laundering of proceeds of crime.

Taking into account the above, we recommend that credit institutions, when identifying such transactions, pay special attention to them and if, when implementing the rules of internal “anti-legalization” control in relation to these transactions, suspicions arise that they are related to the legalization (laundering) of proceeds from crime or financing terrorism, send information about such transactions to the authorized body in accordance with paragraph 3 of Article 7 of the Federal Law of August 7, 2001 N 115-FZ “On combating the legalization (laundering) of proceeds from crime and the financing of terrorism”...

Requirements of banks for non-residents in the Russian Federation

Extracts from the letter of the Central Bank of the Russian Federation dated October 30, 2007 No. 170-T “On the peculiarities of accepting non-resident legal entities that are not Russian taxpayers for banking services”:

The Central Bank of the Russian Federation, as a result of its supervisory activities over credit institutions, revealed that on the accounts of a number of clients of credit institutions, operations are actively carried out that are of a confusing or unusual nature, without obvious economic meaning or an obvious legal purpose, including those indicated in the letter of the Bank of Russia dated December 26, 2005 N 161-T “On strengthening efforts to prevent questionable transactions of credit institutions” (“Bulletin of the Bank of Russia” dated December 28, 2005 N 70).

The scale and ongoing nature of these operations suggest that in most cases their actual goals may be tax evasion, payment for “gray” imports, laundering proceeds from crime, and financing of terrorism. In many cases, such operations involve non-resident legal entities that have received a foreign organization code from the tax authorities, but are not Russian taxpayers, do not have a taxpayer identification number and do not submit the appropriate reports (hereinafter referred to as non-resident legal entities that are not Russian taxpayers) .

Taking into account the above, as well as difficulties in verifying the information necessary to identify non-resident legal entities that are not Russian taxpayers, in order to ensure management of the risk of loss of business reputation and legal risk, it is recommended that such persons (with the exception of foreign credit institutions) be accepted for banking services ) pay special attention to them, and also pay special attention to transactions carried out with the participation of such persons.

At the same time, the Bank of Russia recommends that credit institutions proceed from the following.

1. Before concluding a bank account agreement with non-resident legal entities that are not Russian taxpayers, in addition to the information necessary for client identification, credit institutions are recommended to obtain from non-resident legal entities that are not Russian taxpayers (with the exception of foreign credit institutions), the following information:

1) on the name and location of foreign credit organizations with which a non-resident legal entity that is not a Russian taxpayer had or has civil legal relations arising from a bank account agreement, on the nature and duration of these relations;

2) about the main counterparties, the volume and nature of transactions that are expected to be carried out using a bank account opened with a credit institution;

3) on the obligation (or lack thereof) of a non-resident legal entity that is not a Russian taxpayer to provide financial reports to the competent (authorized) government agencies at the place of its registration or activity, indicating the names of such government agencies;

4) on the provision (if there is a corresponding obligation) of a financial report for the last reporting period (indicate the government agency to which the financial report was submitted, as well as information about the publicly available source of information (if any) containing the financial report);

5) other information that the credit institution deems necessary to identify a non-resident legal entity that is not a Russian taxpayer.

2. In addition to the documents submitted when opening a bank account, it is recommended that a credit organization, before concluding a bank account agreement, request from non-resident legal entities that are not Russian taxpayers (with the exception of foreign credit organizations) letters of recommendation, drawn up in any form, Russian or foreign credit institutions with which these non-resident legal entities have civil legal relations arising from a bank account agreement. Letters of recommendation may also be requested in relation to the founders of a non-resident legal entity that is not a Russian taxpayer.

It is recommended that the conclusion of a bank account agreement with non-resident legal entities that are not Russian taxpayers be carried out in accordance with a written decision of the head of the credit institution or an authorized employee of the head office of the credit institution in a manner determined independently by the credit institution.

Providing non-resident legal entities that are not Russian taxpayers with the opportunity to send orders to carry out transactions on a bank account using an analogue of a handwritten signature, codes, passwords and other means is recommended to be carried out taking into account the letter of the Bank of Russia dated April 27, 2007 N 60-T " On the peculiarities of servicing clients by credit institutions using technology for remote access to the client’s bank account (including Internet banking).”

Signs of dubious cash withdrawal transactions

Extracts from the letter of the Central Bank of the Russian Federation dated December 26, 2005 No. 161-T “On strengthening efforts to prevent dubious transactions of credit institutions”:

The Bank of Russia draws the attention of territorial institutions to the need to be guided in their work on supervision of the activities of credit institutions by the task of not only assessing their current financial situation, but also assessing their exposure to legal risk and the risk of loss of business reputation. Such risks may arise in connection with the performance of questionable transactions by credit institutions, both on their own behalf and in their own interest, and on behalf of clients. These transactions, as a rule, attract the attention of tax and law enforcement agencies, which may make various claims against credit institutions regarding questionable transactions.

…

Questionable transactions carried out by credit institutions on behalf of clients may include transactions specified in letters of the Bank of Russia dated January 21, 2005 No. 12-T, dated January 26, 2005 No. 17-T, as well as the following types of transactions.

1. Systematic withdrawal by clients of credit institutions (legal entities or individual entrepreneurs) of large amounts of cash from their bank accounts (deposits). In this case, special attention should be paid to clients of credit institutions who have a high (80% or more) ratio of the volume of cash withdrawn to the turnover on their accounts.

2. Regular crediting of large sums of funds from third parties (except for loans) to bank accounts (deposits, deposits) of individuals with subsequent withdrawal of these funds in cash or with their subsequent transfer to bank accounts (deposits, deposits) of third parties in within a few days.

3. Implementation by residents - clients of credit institutions of non-cash transfers of funds in large amounts in favor of non-residents (especially in cases where the jurisdiction of the non-resident counterparty under the agreement does not coincide with the jurisdiction of the non-resident bank in which the account of the non-resident counterparty is opened):

- under agreements on the import of works, services and results of intellectual activity (especially advisory, marketing, computer, advertising services), under which settlements are carried out without simultaneous payment of value added tax, as well as under reinsurance agreements;

— on transactions of purchase and sale of securities (especially bills of exchange of Russian organizations, as well as shares of Russian issuers not traded on the organized securities market). In this case, special attention must be paid to clients of credit institutions whose transactions with securities are mainly one-sided in nature (purchases from non-residents);

— under contracts for the supply of goods purchased from non-residents on the territory of the Russian Federation, as well as for the supply of goods purchased by residents outside the Russian Federation and not crossing the customs border.

4. Conducting operations related to illegal reimbursement of value added tax when exporting goods, when export proceeds received in favor of the client are returned to non-residents during the same business day as part of the fulfillment of other obligations.

5. Carrying out other transactions that do not have an obvious economic meaning (are confusing or unusual in nature), or do not correspond to the nature (main type) of the client’s activity or his ability to carry out transactions in the declared volumes, or have signs of fictitious transactions.

Signs of dubious transactions with understatement of customs value

Extracts from the letter of the Central Bank of the Russian Federation dated November 1, 2008 No. 137-T “On increasing the efficiency of work to prevent dubious transactions” (as amended by the letter of the Central Bank of the Russian Federation dated January 23, 2009 No. 8- T):

The Central Bank of the Russian Federation, as a result of the implementation of supervisory activities over credit institutions, as well as information interaction between the Bank of Russia and the Federal Customs Service of Russia, revealed that in 2008 the number of passports of transactions issued under foreign trade agreements (contracts) providing for the import of goods into the customs territory of the Russian Federation increased significantly. Federations (hereinafter referred to as transaction passports), for which the value of goods reflected by authorized banks (hereinafter referred to as credit institutions) in the bank control statements ... supporting documents, in particular, customs declarations, including cargo customs declarations, significantly exceeds similar data on the cost of imported goods, available in the information base of the Federal Customs Service of Russia.

In many cases, funds reflected by credit institutions in the banking control statements according to transaction passports were transferred by resident legal entities in favor of non-residents, registered, as a rule, in offshore zones, as well as other states, in particular, the United Kingdom of Great Britain and Northern Ireland, New Zealand and clients of banks in the Republic of Latvia, the Republic of Estonia, the Republic of Cyprus, and the Republic of Lithuania.

These transactions between residents and non-residents are characterized by the following features:

1. Payers of funds are resident legal entities with extremely small authorized capital compared to the volume of payments.

2. Transactions on the accounts of resident legal entities in credit institutions in most cases are of a transit nature and are associated with the receipt of funds in the currency of the Russian Federation from a significant number of other residents and their subsequent transfer in full (or in a significant part) (with conversion in foreign currency or without conversion into foreign currency) for one or more business days in favor of non-residents.

3. Counterparties of resident legal entities are foreign companies, the state of location of which in most cases does not coincide with the state of location of the foreign banks servicing them.

4. From accounts used for transfers of funds in favor of non-residents, taxes or other obligatory payments to the budget system of the Russian Federation are not paid or are made in extremely insignificant amounts.

The increasing scale of discrepancies between the data on the cost of goods imported into the customs territory of the Russian Federation contained in the banking control statements on transaction passports generated by credit institutions, and in the information base of the Federal Customs Service of Russia, suggests that in order to justify payments in favor of non-residents by legal entities - residents may submit non-existent (fictitious) customs declarations to credit organizations, and the actual purposes of such operations may be tax evasion, payment for “gray” imports, and laundering proceeds from crime.

Taking into account the above, we recommend that credit institutions pay special attention to the above operations, as well as customs declarations submitted by resident legal entities in accordance with clause 2.1 of Bank of Russia Regulation No. 258-P.

When identifying signs indicating the dubious nature of transactions reflected by credit institutions in the banking control statements based on transaction passports, credit institutions are recommended to contact the Federal Customs Service of Russia in order to verify the accuracy of the information contained in customs declarations. Control over transactions with bills of exchange

Extracts from the letter of the Central Bank of the Russian Federation dated July 4, 2008 No. 80-T “On strengthening control over certain transactions of individuals and legal entities with bills of exchange”:

The Central Bank of the Russian Federation, as a result of its supervisory activities, revealed that recently there has been a sharp increase in the volume of funds transferred in favor of non-residents in the course of fulfillment by Russian credit institutions of obligations on bills presented for payment, the first bill holders of which were Russian legal entities (such transactions include in the number of transactions reflected in bank statements using the currency transaction code 55050).

As practice shows, the first bill holders, within a short time after purchasing the bills, transfer them to other Russian legal entities, including those with signs “On combating the legalization (laundering) of proceeds from crime and the financing of terrorism”... Control

over the purchase of valuables for cash securities and foreign currency

Extracts from the letter of the Central Bank of the Russian Federation dated January 21, 2005 No. 12-T “Methodological recommendations for strengthening control over transactions of purchase by individuals of securities for cash and purchase and sale of cash foreign currency”:

In accordance with the Federal Law “On Combating the Legalization (Laundering) of Proceeds from Crime and the Financing of Terrorism”... (hereinafter referred to as the Federal Law), credit organizations are required to exercise internal control and send information on transactions with funds or other funds to the authorized body property subject to mandatory control, and other transactions in respect of which there are suspicions that they are carried out for the purpose of legalization (laundering) of proceeds from crime or the financing of terrorism.

…

An analysis of the practice of applying the Federal Law shows that when individuals purchase securities, as well as when buying and selling foreign currency (if the amount for which the transaction is performed is equal to or exceeds 600,000 rubles or is equal to an amount in foreign currency equivalent to 600,000 rubles, or exceeds it) schemes for conducting operations are used, the nature of which gives reason to believe that the purpose of implementing these schemes is to evade the mandatory control procedures provided for by the Federal Law. So, in particular, in order to carry out a transaction to purchase securities, an individual opens a bank account (a deposit account or an account for payments using bank cards), deposits cash into it and, using these funds, purchases securities.

In the case of a transaction with cash foreign currency, a similar scheme is used. For example, when an individual purchases foreign currency in cash, the following sequence of operations is used:

— two bank accounts (deposit accounts or accounts for payments using bank cards) are opened in a credit institution in the name of an individual: in the currency of the Russian Federation and in foreign currency;

— cash in the currency of the Russian Federation is deposited (credited) to an account opened in the currency of the Russian Federation;

— on behalf of an individual, funds in the account in the currency of the Russian Federation are written off as payment for the foreign currency purchased by him;

— purchased foreign currency is credited to an individual’s account in foreign currency and subsequently withdrawn by the individual from this account in cash.

Based on the fact that, in accordance with the Federal Law, transactions of purchase (sale) of cash foreign currency and acquisition of securities carried out for cash are subject to mandatory control (paragraphs three and four of subparagraph 1 of paragraph 1 of Article 6), if all of the above a sequence of operations is carried out over a short period of time (for example, within one or two days), the purpose of carrying out such operations may be to evade the mandatory control procedures provided for by Federal Law.

According to paragraph seven of paragraph 2 of Article 7 of the Federal Law, the identification of repeated (that is, two or more times) transactions and transactions, the nature of which gives reason to believe that the purpose of their implementation is to evade mandatory control procedures, serves as one of the grounds for documenting information.

In accordance with subclause 2.9.9 of Bank of Russia Regulation No. 262-P dated August 19, 2004 “On identification of clients and beneficiaries by credit institutions for the purpose of combating legalization (laundering) of proceeds from crime and the financing of terrorism” (“Bulletin of the Bank of Russia” dated 09/10/2004 N 54) repeated operations and transactions, the nature of which gives reason to believe that the purpose of their implementation is to evade mandatory control procedures, are assessed by credit institutions as operations of an increased degree (level) of risk of the client performing operations for the purpose of legalizing (laundering) income, obtained by criminal means, or terrorist financing.

Taking into account the above, the operations described in paragraphs three to eight of this Letter can be rightfully considered as operations in respect of which there are suspicions that they were carried out for the purpose of legalization (laundering) of proceeds from crime or the financing of terrorism and information about which in accordance with Clause 3 of Article 7 of the Federal Law are subject to referral to the authorized body.

Control over transfers without opening accounts

Extract from the letter of the Central Bank of the Russian Federation dated December 24, 2003 No. 179-T “On strengthening control over transactions involving the transfer of funds without opening accounts and transactions using prepaid financial products”:

An analysis of international practice shows that money transfer operations without opening an account, as well as operations with prepaid financial products, can be carried out by clients of credit institutions for the purpose of legalizing (laundering) proceeds from crime and financing terrorism. In this regard, we recommend that credit institutions carrying out transactions with prepaid financial products, as well as providing services for transferring funds without opening an account, strengthen control over these operations, paying special attention to operations for the regular transfer of funds by individuals without opening a bank account in cases where the amount of such transactions individually does not exceed an amount equivalent to 600,000 rubles.

Additional measures to identify questionable transactions

In addition to identifying and putting under control transactions that are clearly questionable, bank employees pay attention to the following indirect signs:

- the amount of taxes paid and profits received from core business activities and other atypical transactions;

- timely payment of wages to employees of the enterprise or its complete absence;

- staff salaries are too low or too high compared to the company’s income;

- the total wage fund of employees, which does not reach the minimum wage, based on the average number of employees;

- there are no balances on the accounts, which is not comparable with the monthly turnover of the legal entity;

- partial transfers of social benefits if there are sufficient funds on the balance sheet;

- there is no logical relationship between the receipt of money and its expenditure;

- unjustified sharp increase in account turnover;

- receipt of payments for goods and services without charging VAT;

- absence of transactions and transactions on current accounts for the direct activity of the company.

If such signs are detected, bank employees are required to notify the internal department for combating money laundering and promoting terrorism. A video is posted on the Sberbank website, where a specialist clearly describes which operations are of increased interest. It also explains that it is necessary to clearly respond to the specialist’s requests, otherwise it may harm the business or a certain individual. Transactions will be blocked or suspended.

Regulatory document and powers of bank employees

Federal Law No. 115 of 08/07/2001 describes dubious transactions and actions of economic agents when exercising control over transactions between citizens and companies. It introduces basic concepts, signs and describes actions when identifying schemes for money laundering and promoting terrorism.

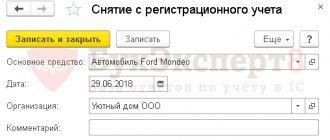

Banks are vested with certain powers in the event of a suspicious transaction being identified. They can:

- Block the operation. In this case, the bank employee is guided by the characteristics of the transaction and letter No. 17 of the Bank of the Russian Federation of 2010. It regulates the right of a financial institution to suspend a transaction.

- Suspend operations for 2 days under Federal Law No. 167 if suspicions arise about the purity and legality of the transaction.

- Terminate the banking service agreement. Such an initiative may occur if there is no movement on the accounts for more than 2 calendar years. This right is provided for in Art. 859 of the Civil Code of the Russian Federation. The client receives a notice of termination of the contract in advance.

- Block all funds in accounts. This occurs on the basis of a decision of the Interdepartmental Coordination Body, which recognized the grounds for suspicion as sufficient. In this case, the property of the organization or individual is also frozen.

In a situation where a citizen or company against which measures have been applied does not agree with the established restrictions, they can sue. The Central Bank constantly publishes signs describing suspicious transactions, to which banks should pay increased attention.

What documents do banks have the right to request as part of the identification procedure?

To understand this issue, let us recall that there are laws and there are industry instructions and recommendations. In the event that industry recommendations conflict with the norm of a legal act, priority must, of course, be given to the law.

The primary law regulating the relationship between the bank and the client is the Civil Code of the Russian Federation. In paragraph 3 of Art. 845 clearly states that the bank does not have the right to tell the client exactly how he should manage his funds, nor to control such orders, much less limit this order in any way.

Letters and orders of the Central Bank in relation to the Civil Code of the Russian Federation are of an instructional and recommendatory nature.

Reasoning in this way, we can draw the following conclusions regarding banks’ compliance with the requirements of Law No. 115-FZ:

- The bank needs to work with bank administrative documents and with the information they contain (for example, counterparty data in a payment order), and with the information that was received from the client during his identification. The bank can only ask the client for documents and information beyond this. In this case, the client retains the right to politely refuse.

- The bank cannot restrict the client’s use of his account only on the grounds that the client refused to provide documents that are not relevant to the bank to complete the transaction (but instructions, instructions, demands are necessary).

- Law No. 115-FZ does not oblige the client to present to the bank any documents at the bank’s request (for example, contracts or passport details of beneficiaries). That is, the bank must fulfill the requirements of Law No. 115-FZ regarding the collection of information about the origin of funds, beneficiaries, beneficiaries, etc. independently, on its own;

- The bank must forward all questions and suspicions that the bank has to the financial monitoring body, since only this body has the right to make legal decisions (including restrictions on account management) and carry out additional verification activities.

About the position of banks in relation to “doubtful” clients, read: “The bank has the right to sever all relations with a suspicious client .