- February 25, 2020

- Accounting

- Biserov Alexander

In the activities of every enterprise, sooner or later situations arise when, in one way or another, destruction of goods or materials occurs, failure of fixed assets, or even a shortage of any assets as a result of theft, natural disasters, loss and other factors. It is necessary to reflect these facts in the organization’s accounting, for which account 94 “Shortages and losses from damage to valuables”, approved by the Chart of Accounts, is used.

Reasons for shortages

As you know, accounting reflects the state of the enterprise's activities. However, unfortunately, we live in an imperfect world, and what we see “on paper” may differ from the real state of affairs. Rarely (but it also happens) an organization may actually own any assets that are not taken into account in accounting. Alas, much more often the opposite happens, and what is reflected in the accounting records, in fact, unfortunately, is in fact absent. Here is a discrepancy between accounting and real values, when real values are less and there is a shortage. There are many reasons for the shortages, here are some:

- natural loss (shrinkage occurred, food partially rotted, etc.);

- force majeure and various emergency incidents (man-made disasters, wars, revolutions, natural disasters);

- intent on the part of responsible persons;

- errors during the release or acceptance of valuables;

- errors in accounting (human factor);

- basic theft.

Account closing operations 94

Companies engaged in commercial and industrial activities have losses, shortages of cash and inventory. These accounting transactions are formed on account 94 “Shortages and losses from damage to valuables.” In our article we will consider all situations regarding the count 94.

Separate accounting for UTII and simplified tax system

Companies have the right to maintain accounting records under several tax regimes. The taxable base for each special regime is calculated separately, and therefore there is a need to maintain separate accounting.

Causes of damage to inventory items

Changes in the amount of cash and quality of inventory items are identified as a result of:

- Inventory at the enterprise;

- Upon receipt of goods from the seller;

- When checking documents.

Any shortage, loss or damage is debited to account 94. Let us list the situations in which these changes occur:

- Inconsistency in the amount of valuables in the enterprise;

- Identification of damage or missing goods upon acceptance of goods from the seller;

- Damage caused as a result of storage of inventory items (standardized and non-standardized);

- Errors found in accounting.

Attribution of damage to the debit of account 94 depends on the type of main objects:

- Actual cost, if the quantitative indicator is damaged or missing;

- Actual damage if partially damaged.

- The original cost minus depreciation, in the absence or complete damage;

- Actual damages if partially damaged.

- Actual losses, identification of the amount of actual losses.

You need to know that damage from emergency situations cannot be attributed to account 94.

https://youtu.be/IE09T1nCtH8

Account 94 for Dt interacts with the following accounts:

Accounting operations according to Kt94

Amounts recorded in the debit of account 94 are subject to write-off. The table shows the accounts to which the amounts reflected in the debit of account 94 can be written off:

Actions required to close account 94

Before closing the “Shortages and losses from damage to valuables” account, the following operations must be carried out:

- Carrying out inventory of goods and materials and cash;

- Identification of the fact of shortage, damage or loss;

- Finding out the reasons - due to the fault of the employee, natural loss, contractual losses, force majeure;

- Attributing the amount of damage to the costs of the enterprise or to the culprit employee.

Postings for debiting from account 94 are shown in the table above.

An example of accounting for cash shortages in the cash register

When conducting an inventory of cash in the cash register at the enterprise, a shortage of 3,850 rubles was identified. Damage in accounting refers to account 94, which means that the accountant makes the following accounting entries:

- Dt94 Kt50.01 – 3850 rub. – the amount is attributed to the shortage at the cash register;

- Dt73.02 Kt94 – 3850 rub. – the damage is written off if the culprit is the cashier;

- Dt70 Kt73.02 – 3850 rub. – compensation for damage from the cashier’s salary.

If the culprit of the damage cannot be determined at the cash register, then the losses are attributed to non-operating expenses by posting:

An example of accounting for damage normal and in excess of natural loss

An inventory carried out at the enterprise revealed spoilage of fruit in the amount of 1,560 rubles:

- 1000 rub. – natural losses;

- 560 rub. – damage in excess of the norm, compensated from the salary of the financially responsible person.

We create the following wiring:

- Dt94 Kt41 – 1560, damage to fruit during inspection;

- Dt44 Kt94 – 1000, damage is written off as sales costs according to the norm;

- Dt70 Kt94 – 560, the amount of damage in excess of the norm was reimbursed from the warehouseman’s salary.

If the organization has a reserve for future expenses, account 96, then the amount of damage within the limits of the natural loss rate is written off to this account. If account 96 is not provided, then the write-off of damage is attributed to the cost of production or goods (accounts 20,23,25,26,44).

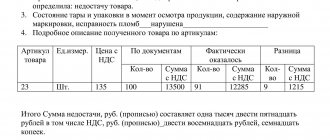

An example of accounting for shortages when accepting goods

A trade organization was brought 100 kg of cabbage for sale in the amount of 1,500, including VAT 228.81. During unloading, missing goods were found in the amount of 15 kg in the amount of 225 rubles. Payment for the goods was received in advance from the buyer to the supplier. The supplier returned the money for the shortage of goods. We formalize transactions with the buyer using the following transactions:

- Dt60 Kt51 – 1500 rub. – prepayment for goods;

- Dt41 Kt60 – 1080.51 rub. – the goods are capitalized;

- Dt94 Kt41 – 225 rub. – a shortage of cabbage is reflected;

- Dt19 Kt60 — 194.49 rub. – VAT reflected;

- Dt68 Kt19 — 194.49 rub. – VAT is presented for deduction;

- Dt73.02 Kt94 — 225 rub. – the damage is written off to the supplier;

- Dt51 Kt73.02 – 225 rub. – refund from the supplier for missing goods.

Accounting for excess materials

If during the inventory of goods surplus products are identified, they are credited to the enterprise’s balance sheet using the following entries:

- Dt10, 41 Kt91.01, basis – inventory list.

Documents recording losses from damage, shortages

Any change in the organization is recorded in primary documents. This also applies to damage, damage, shortages and other causes of damage. At the same time, a commission is created from a representative of the organization, financially responsible persons who document the quantity and quality of goods, shortages, damage, scrap, etc.

If damaged goods are discovered, the commission is TORG-15 or TORG-16. These documents are transferred to the head of the enterprise to decide on the further use of the product. If the goods are unsuitable for further use, then the accountant attributes them to account 94. The act is drawn up in 2 copies: for the accountant and the financially responsible person.

Source: https://buh-spravka.ru/buhgalterskij-uchet/buhgalterskie-provodki/zakrytie-scheta-94.html

When deficiencies are discovered

The main way is, naturally, inventory. Everyone deals with inventory in one way or another (remember the movie “Office Romance”?). The inventory is carried out once a year before summing up the results for the preparation of financial statements for the past year. You can do it more often, but not less often. For fixed assets, an inventory can be carried out every three years. But, as a rule, in practice, fixed assets are also inventoried once a year.

Inventory is also carried out during the reorganization of the enterprise, when facts of theft are revealed, after emergency incidents, when there is a change in persons bearing financial responsibility.

Also, shortages can be identified immediately at the time of acceptance of goods or materials from the supplier. The features of reflecting transactions in this case will be discussed below.

Reflecting shortages

If a shortage or any damage caused by goods and materials is identified, then, naturally, this must be written off somewhere. Previously, these losses are written off to the existing 94th account. As already stated, we indicate the shortage in the debit of this account. Entries for shortages and losses from damage to valuables based on identified facts are drawn up as follows:

| Debit | Credit |

| 94 | 10 “Materials” (according to the corresponding subaccounts), 41 "Products", 43 “Finished products” |

However, losses arise not only from damage to goods or materials, because it is possible to “mysteriously” run out of funds in the cash register or an object of fixed assets may become unusable, or even “disappear” altogether.

In these cases, in correspondence with the 94th account, the postings look like this:

In case of checking the cash register and identifying a shortage:

| Debit | Credit |

| 94 | 50 "Cashier" |

If a fixed asset is missing or has become completely unusable:

| Debit | Credit |

| 94 | 01 "Fixed assets" |

It should be noted that in the case of write-off of fixed assets, they are written off at residual value, and not at book value (which is logical, because previously accrued depreciation of written-off objects is already taken into account in the cost of finished products).

A situation may also arise when a shortage occurs when goods are received from suppliers.

If this shortage is within the limits of natural loss and is specified in the contract, then the following entries are made:

| Debit | Credit |

| 94 | 60 |

Losses in excess of the amounts previously agreed upon in the contract:

| Debit | Credit |

| 94 | 76 |

Video help “Accounting for account 94”: basic transactions, accounting

This video briefly describes accounting for account 94 “Shortages and losses from damage to valuables”, explains the basic transactions and accounting examples. The teacher of the site “Accounting and Tax Accounting for Dummies”, chief accountant N.V. Gandeva, runs the website. ⇓

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8000 books purchased |

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Write-off within the limits of natural loss norms

In the case when losses from damage to inventory items are within the limits of natural loss (shrinkage, attrition, etc.), these losses are written off to cost, that is, to production cost accounts:

| Debit | Credit |

| 20 "Main production" 23 "Additional production" 25 “General production expenses” 26 “General business expenses” | 94 |

If shortages are identified upon acceptance of inventory items from the supplier and are within the limits specified in the agreement concluded with him, then such losses are written off to the cost of the accepted goods and materials:

| Debit | Credit |

| 10 “Materials” (according to the corresponding subaccounts) 41 "Products" | 94 |

Account 94 in accounting: postings, examples, account correspondence

Every organization has valuables, be it goods, materials or fixed assets, with which unpleasant situations can happen when these values deteriorate or disappear. For such situations in accounting, account 94 “Shortages and losses from damage to valuables” is intended. It does not matter whether they are written off as expenses or reimbursed by the guilty parties.

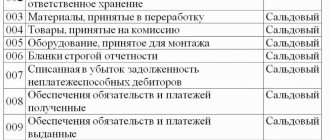

Account 94 in accounting

Account 94 of accounting is an active account “Shortages and losses from damage to valuables”, designed to reflect information on the amounts of shortages and losses from damage to material or other valuables, including funds identified during production, storage or sale. But not all shortages are attributed to 94:

Important! Account 94 “Shortages and losses from damage to property” includes all shortfalls, except losses from emergency events.

A shortage is a discrepancy between actual availability and accounting data. Let's look at the reasons for the shortages:

Shortages and losses are identified during:

- Inventory;

- Acceptance of goods from the supplier;

- Checking documents.

The debit of account 94 takes into account the cost of shortages and losses from the credit accounts, depending on the type of property.

1. Inventory assets:

- Completely damaged or missing - their actual cost is given;

- Partially damaged – actual losses.

2. Fixed assets:

- Completely damaged or missing - their residual value is given, that is, the original cost taking into account the amount of accrued depreciation;

- Partially damaged – actual damages

3. Other - according to actual losses, that is, the amount of determined losses is given.

Types of shortages and losses:

- Normalized, that is, within the limits of natural decline;

- Unstandardized, that is, in excess of the norms of natural loss.

Standardized losses and shortages

Normalized losses and shortages include natural loss during storage or transportation (shrinkage, spillage, shaking, etc.) and caused by physical and chemical properties.

The loss limit (E) is determined by the formula:

- Where T is the cost (weight) of the goods sold (dispensed);

- Where N is the rate of natural loss, %.

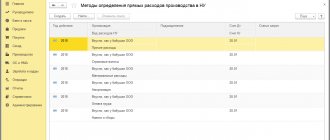

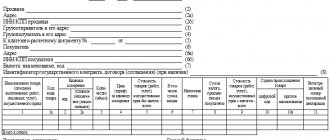

Account correspondence 94

Table 1. By debit of account 94:

Get 267 video lessons on 1C for free:

| Dt | CT | Wiring Description |

| 94 | 01 | A shortage of fixed assets has been registered |

| 94 | 03 | There is a registered shortage of property for rent |

| 94 | 07 | A shortage of equipment handed over for installation was registered |

| 94 | 08 | A shortage of investments in non-current assets was registered |

| 94 | 10 | Shortage of materials registered |

| 94 | 11 | Loss of value of forcedly slaughtered or dead animals recorded |

| 94 | 16 | The amount of deviations relating to damaged or missing inventories is attributed to shortages (using account 15) |

| 94 | 19 | The amount of VAT relating to damaged or missing inventories is included in shortages |

| 94 | 20 | A shortage detected in production was registered |

| 94 | 21 | A shortage of semi-finished products has been registered |

| 94 | 23 | A shortage detected in auxiliary production was registered |

| 94 | 29 | Shortages detected in service industries were registered |

| 94 | 41 | Shortage of goods registered |

| 94 | 42 | The reversed trade margin on disposed retail inventory items is reflected |

| 94 | 43 | A shortage of finished products has been registered |

| 94 | 44 | Selling expenses for disposed goods or finished products are allocated to shortages |

| 94 | 45 | A shortage of shipped goods or finished products has been registered |

| 94 | 50.1 | A shortage of cash was registered at the cash register (during an audit or inventory) |

| 94 | 50.2 | A shortage of monetary documents was registered at the cash desk (during an audit or inventory) |

| 94 | 60 | A shortage was registered during the acceptance of goods and materials received from suppliers |

| 94 | 71 | Accountable amounts were registered for which the accountable person did not report on time or was spent unreasonably |

| 94 | 73.2 | The amount of material damage not subject to recovery from the guilty party (employee) is included in losses and shortages |

| 94 | 76.2 | The amount of shortages and losses not subject to recovery from the guilty party (supplier) is included in losses and shortages |

Table 2. For the credit of account 94:

| Dt | CT | Wiring Description |

| 08.3 | 94 | The shortage of goods and materials intended for construction was written off (within the limits of natural loss) |

| 20 | 94 | Standardized shortages are taken into account in production |

| 23 | 94 | Standardized shortages are taken into account in auxiliary production |

| 25 | 94 | Normalized shortages are included in general production costs |

| 26 | 94 | Normalized shortages are included in general business expenses |

| 29 | 94 | Standardized shortages are taken into account in service production |

| 44 | 94 | Normalized shortages are included in sales expenses |

| 70 | 94 | Non-standardized shortfalls are reimbursed from the employee’s salary |

| 73.2 | 94 | Non-standardized shortfalls are compensated by the person at fault (not from wages) |

| 91.2 | 94 | Non-standardized shortages are written off as other expenses |

Example 1. Lack of funds

When conducting an inventory at Dandelion LLC, a shortage of RUB 5,000.00 was identified. The shortage of funds was written off to the responsible person A.A. Vasilkova.

The accountant of Dandelion LLC generated the following entries for account 94:

| date | Account Dt | Kt account | Amount, rub. | Wiring Description | A document base |

| 16.12.2016 | 94 | 50.01 | 5 000,00 | There is a shortage in accounting |

Source: https://BuhSpravka46.ru/buhgalterskiy-plan-schetov/schet-94-v-buhgalterskom-uchete-provodki-primeryi-korrespondentsiya-scheta.html

Write-off when identifying the culprit of the shortage

If the losses exceed the standard indicators established for natural loss, and also if theft has occurred and the specific culprits of “this outrage” are identified, then the cost of the shortage is withheld from the salaries of these culprits:

| Debit | Credit |

| 73-3 “Settlements with personnel for other operations” - “Settlements for compensation for material damage” | 94 |

Let's make a small deviation from the 94th account. There may be cases when an amount is recovered from the identified culprits that is greater than the accepted cost of stolen or damaged property. For example, the perpetrators must compensate for damage in the amount of the market value of goods and materials. Then it turns out that the amount of damages compensated is greater than the deficiency written off as debit to account 73 on account 94. Where should the resulting difference be put? It is written off to the credit of account 98 “Deferred income”. That is, the following transactions are made:

| Debit | Credit |

| 73-3 | 98 |

When collecting a shortage from the culprit, the amount of recovery is debited from the 98th account to other income:

| Debit | Credit |

| 98 | 91 “Other income and expenses” |

For clarity, let's give an example. Let’s say the theft of goods is detected at an actual cost of 12,000 rubles. The court ordered the culprit to compensate for damages at the market value of the goods, which is 15,000 rubles.

If a shortage is identified, the enterprise accountant makes the following entry:

| Debit | Credit | Sum |

| 94 | 41 "Products" | 12 000 |

According to the court decision, the guilty employee is obliged to compensate 15,000 rubles, which is reflected in the credit of the 73rd account:

| Credit | Sum |

| 73-3 | 15 000 |

After the court decision, from account 94 the shortage in the amount of 12,000 rubles is transferred to account 73:

| Debit | Credit | Sum |

| 73-3 | 94 | 12 000 |

Thus, our 94th account is “reset to zero”, but on the credit of the 73rd account there remains a balance of 3,000 rubles.

These 3,000 rubles are income that can be taken into account in the future, as they are collected from the culprit from his wages. And until repayment they will be accounted for in account 98:

| Debit | Credit | Sum |

| 73-3 | 98 | 3 000 |

How to close account 94 after writing off goods: methods for closing an account and completing documentation

To determine the turnover of monetary assets, the company uses additional accounts to the main ones. So, having any property in your possession, you need to report on the costs of its maintenance.

It is also necessary to provide for situations during which property may be damaged, and the subsequent purchase of new equipment to replace the broken one. Account 94 uses data not only on material assets, but also stores information about all the company’s shortcomings that could occur as a result of technical or other errors.

To determine the amount that is in shortfall, you need to take an inventory and, based on the final information, understand how much money will be spent to compensate for the shortfall.

Account 94 in accounting: postings, examples, account correspondence, new edition

Every organization has valuables, be it goods, materials or fixed assets, with which unpleasant situations can happen when these values deteriorate or disappear. For such situations in accounting, account 94 “Shortages and losses from damage to valuables” is intended. It does not matter whether they are written off as expenses or reimbursed by the guilty parties.

Write-off if the culprit is not found

But let’s return to the 94th account and consider the third option for writing it off.

In the event that the culprit has not been identified or the court has refused to recover material damage, there is nothing to be done here; the damage is written off to the financial results of the enterprise and other expenses:

| Debit | Credit |

| 91 | 94 |

A special case of this option is damage resulting from emergencies or natural disasters (war, fire, flood, hurricane, meteorite fall, etc.). Unfortunately, it will not be possible to file a claim against these “culprits.” In this case, the write-off is made immediately to the 99th “Profit and Loss” account, and the posting looks like this:

| Debit | Credit |

| 99 | 94 |

Types of natural loss

Above there were constant references to natural decline. How does it arise and how can its rate be calculated? In general, there is no strict definition of the concept of attrition in the legislation.

But we can come to the conclusion that natural loss is the loss of a mass of goods that occurs due to natural causes. More specifically, the following types of natural loss can be distinguished:

- shrinkage (when humidity changes, moisture evaporates and, as a result, the mass of raw materials decreases);

- utruska (spraying of bulk goods and materials);

- crumble (well, no need to explain here, everyone cuts bread at home);

- leakage (melting, absorption into the container, seepage from the container);

- spill (for example, when pumping from container to container);

- fight (when transporting something fragile, for example, glass containers, mirrors, ceramics, etc.).

Natural loss applies to the following types of goods:

- for food products and agricultural products;

- for medicines;

- for some types of non-food products.

The norms by which natural decline occurs are approved by the relevant industry departments. Some approved standards have existed since the times of the Soviet Union.