Are there errors in accruals?

Pensioners and disabled people belong to socially vulnerable categories of the population. The social security of such persons is guaranteed by the state. Recalculation and revision of pensions is a frequent occurrence, and no one is immune from incorrect calculations.

Mostly, such errors are associated with the human factor, but this is not the only reason. There may also be malfunctions in the software used to perform calculations. That is why the question arises as to whether it is possible to verify the correctness of pension calculation.

The pension that Russians receive after the recent reform consists of two parts: insurance and funded. Since this system is relatively new, not all of its features are clear, so sometimes doubts arise about the correctness of its calculation.

If a pensioner is not sure that the amount of his pension payments is determined correctly, he has the opportunity to request adjustments if errors are discovered.

https://youtu.be/wBDa8jFsvmA

View contributions to the Pension Fund via the Internet on the government services portal

In order to obtain information on the insurance pension account for citizens of the Russian Federation, you can use the electronic portal of government services. Also here, citizens whose insurer is the Pension Fund can obtain information about the status of their savings account.

On the portal in your personal account, you need to enter the electronic services section, select the Pension Fund column - ILS status in the OPS system, determine what form of notification you need to order, and receive the service. After this, a report will be generated within a few minutes.

Before using this method of obtaining information about the status of your pension account, you will need to register on the portal.

Where to check

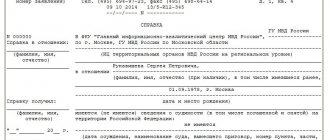

First of all, you should figure out where to check the correctness of pension calculation. If a pensioner has any doubts whether he is receiving the correctly calculated amount, he will have to contact the Russian Pension Fund directly. The application should indicate a request to re-check the correctness of the calculations made for the amount of pension payments and submit it to the Pension Fund branch, in accordance with the pensioner’s registered address.

Within five days from the date on which the application was accepted, where a citizen asks to check the correctness of the calculation of the old-age pension, Pension Fund employees are obliged to clarify whether the pension was calculated correctly and notify the applicant about the results of the check. If it turns out that the amount of payments was indeed calculated with errors, then, in accordance with current legislation, it will be adjusted automatically.

How to check savings through NPF

The question often arises: is it possible to find out on the Internet about pension contributions to non-state pension funds?

If you are a client of a non-state pension fund, then you will not be able to find out about contributions through the website of government services or the Pension Fund of the Russian Federation. In this case, you will have to either send a request to the organization’s office, presenting your passport and SNILS, or use the website of the non-state pension fund with which you signed an agreement.

As a rule, all NPFs have websites. Therefore, it is enough to go through the registration procedure on it and then find out about the accumulated amounts in your personal account. And information on transfers to a non-state pension fund should be provided upon request by the accounting department of the enterprise where you work.

Brief verification instructions

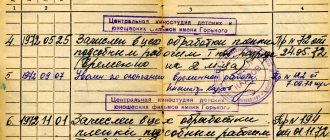

In addition to contacting the Pension Fund, it is advisable to know how to check the correctness of pension calculations yourself. To do this, you will need: a work book and a calculator, a certificate of the amount of average monthly earnings for 5 consecutive years, or for the period from the beginning to the end of the year.

Now it's time to do some math:

- First you need to find out the size of the experience coefficient. The basis is 55%. For women, this coefficient is established for twenty years of work experience, for men - for 25 years of work. Every year, if a person continues to work, the length of service coefficient increases by 1% (but not more than 20%).

- The average income for one month is calculated. This can be done by dividing the amount of income for five consecutive years by the number of months in five years (sixty).

- Information will be required on the average monthly salary established in the Russian Federation for the period that was accepted in the calculations in paragraph 2.

- The average salary in the Russian Federation, which was calculated in the third quarter of 2001 and approved by the government of the country as the basis for calculating pension payments, is 1,671 rubles.

- The ratio of the number obtained in point 2 to the figure in point 3 is calculated. If we are not talking about residents of the Far North, then the ratio of 1.2 or less must be taken into account.

- The estimated amount of payments will be: the length of service coefficient (from clause 1), multiplied by the number from clause 5 and by 1,671 from clause 4.

- Pension capital is calculated. To do this, perform the following actions:

- from the value obtained in paragraph 6, you need to subtract 450 rubles (the basic part of the pension as of January 1, 2002);

- what happens is multiplied by the estimated period during which the old-age benefit is planned to be paid (for example, from January 1, 2010 it will be 192 months).

- The amount obtained in paragraph 7 must be indexed by multiplying by the increasing factor corresponding to the year. It can be clarified, including on electronic portals, which contain information on how to check the correctness of the old-age pension calculation.

- The part of the benefit, called the insurance part, will be equal to the result of dividing the pension capital by the approximate period during which the benefit will be paid.

- The result of dividing the total value of insurance contributions on the date of assignment of benefits by the same period that was used for calculations in paragraph 9 is added.

- To the result obtained in paragraph 10, you need to add the amount of basic payment established by the government from the insurance fund. This is the required pension amount.

By comparing the calculation results with the pension amount assigned by the Pension Fund, you can understand whether you should apply for recalculation. By carefully studying the instructions on how to check the correctness of pension calculations, you can independently find out whether the Pension Fund is right.

Rules for using the pension calculator on the Pension Fund website when checking pension savings

The pension calculator is very easy to use, and everyone can understand how it works. This service has been successfully operating since 2020. The new pension system is based on a system that operates on the principle: the more you work, the more you will receive later. The work of the pension calculator is based on it.

It also takes into account the time spent on military service and maternity leave, that is, payments will also be accrued on them. The service includes the principle that the longer a person does not receive a pension and accumulates work experience, the larger the amount of future pension payments he can count on.

To predict the size of your future pension, you will need to go to the website of the “Pension Fund of the Russian Federation”: https://www.pfrf.ru. On the main page of the site you will be asked to familiarize yourself with the latest news and changes in laws relating to pensioners, and at the end of the page you can see a clickable button: “Pension calculator”.

The service visitor does not need to register, confirm his identity or waste time on other formalities. Anyone can calculate their pension savings.

The procedure itself takes no more than five minutes. On the downloaded page, you must enter your year of birth, gender, the number of years spent serving in the army or maternity leave, as well as indicate how many more years you plan to work and the amount of your monthly salary.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

In addition, if the user plans to retire later than the legal age, this also needs to be recorded in the calculator. There is a special column for this.

You will also need to provide additional information such as:

- How many years do you plan to care for disabled relatives (disabled people or elderly people over 80 years old) without working?

- In what form do you carry out your labor activity (self-employed or hired worker; combination of hired labor and independent work).

After entering all the data, the user will see the size of his future pension, the number of individual pension coefficients and total work experience. It will also be possible to obtain detailed information regarding all the nuances and algorithm for forming pension savings.

Payment according to age

To understand how to check the correctness of pension calculation, it is important to know about all the current changes in this matter. Thus, 2015 is noteworthy in that from this date it is planned to gradually increase the minimum value of the total length of service that will be required to calculate the old-age pension benefit. Previously it was five years. Starting from the date of introduction of the changes, over the next ten years, 1 will be added every year, and by 2025, the minimum that needs to be worked will be fifteen years.

If the total number of years worked for calculating an old-age pension is not enough, then it is possible to apply for a social pension. Starting from 2025, it will have to be paid to women who have reached the age of 60, and men from the age of 65.

How to check pension contributions using e-government

Citizens have been able to interact with authorities digitally since 2009. It was then that, by Resolution No. 721, the Government of the Russian Federation introduced appropriate amendments to the Federal Target Program “Electronic Russia”.

So, to get your statement, follow these steps:

- Log in to the government services portal.

- Select “Notice on the status of a personal account in the Pension Fund of Russia” and click on the “Get class=”aligncenter” width=”1000″ height=”560″[/img]

- Wait a few seconds for the download to complete.

- On the result page (just below your personal data), click on the “Save notification” link. It is possible to send the document by email.

The system will warn you that the extract has no legal force. All you have to do is click on the “Save” button again.

Disability pension: useful information

According to statistics, almost 50% of all enterprises whose work is related to industry belong to the harmful category. Early completion of work and retirement are a kind of compensation for people who are constantly exposed to risks. That is why the question of how to check the correctness of the calculation of the disability pension is relevant.

But first of all, you should find out what conditions are considered harmful or dangerous:

- increased humidity levels;

- low degree of illumination;

- high degree of environmental pollution (gases, dust, etc.);

- increased noise level;

- labor obligations associated with the use of or being in close proximity to harmful or toxic substances (for example, in the chemical industry).

Before checking the correctness of pension calculation, it is important to know some of its features. In order to retire ahead of schedule, the total length of service of a representative of the fairer sex must be at least twenty years, of which at least 10 years the potential pensioner must be a worker in hazardous production. For men, the minimum total work experience is 25 years, of which work in conditions recognized as harmful must be twelve and a half years or more.

At the same time, there are two lists of hazardous professions. For representatives of professions that can be found in list No. 1, retirement age will come another five years earlier.

List No. 1 is quite small; it includes people whose work activity was directly related to underground work, work in hot shops or production in hazardous conditions.

List No. 2 is much wider, it includes: employees of educational and medical institutions, workers in the food and light industries, employed in mining and transport work.

How much to weigh in... points?

First, let’s look at what the calculation of the insurance pension is based on according to the current rules. The latest significant changes in this area were introduced by the Law of December 28, 2013 No. 400-FZ “On Insurance Pensions”.

This regulatory document introduced a new concept - individual pension coefficients (IPC). But they are not often called that way. Both in everyday life and in official explanations, another name has “taken root” - pension points.

In general, the formula for calculating the insurance pension is as follows:

P = FV + IPK x C , where:

- PV is a fixed payment. Its size is prescribed by law and is indexed annually. For 2020, the size of the PV is set = 4,982.90 rubles. (Clause 1 of Article 16 of Law No. 400-FZ);

- C is the cost of the coefficient (point) in rubles. It is also determined by law and is subject to regular indexation. In 2020, one pension point “costs” 81.49 rubles.

Thus, a pensioner who retires in 2018 and “scores,” for example, 100 points, can count on a payment in the amount

P = 4,982.9 + 100 x 81.49 = 13,131.9 rub.

It would seem easy. What then is the confusion that was mentioned at the beginning of the article?

The main question here is the number of points. Where did the number 100 in the example come from? What exactly is a pension point? More on this in the next section.

Recommendations for applying for a disability pension

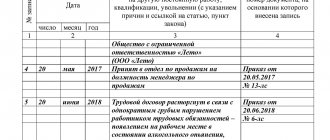

To apply for a disability pension, it is enough to contact the Pension Fund branch, which is located at your place of residence, with the following documents:

- passport;

- a document confirming that the person worked in conditions that give the right to early retirement;

- certificate of salary;

- men will also need a military ID.

The basis for calculating pension payments will be: the amount of contributions to the Pension Fund and length of service. The provision of additional benefits, as well as the lists of hazardous industries, are reviewed and supplemented regularly.

It is necessary to pay attention to the fact that the list of people entitled to early retirement now also includes people of art (for example, actors), as well as those who earned work experience in enterprises of the Far North.

How to find out pension contributions according to SNILS?

Contributions to the Pension Fund are made by the employer. Until 2013, all citizens received a document with a report on pension savings, so no one had any questions about checking SNILS for pension savings. From 2013, such letters will only be sent to those who have written a corresponding application.

How to check SNILS by number?

You can check your SNILS by number at any branch of the Pension Fund by making the appropriate request and presenting, in addition to your SNILS, your passport.

How to check SNILS via the Internet?

To check pension savings according to SNILS via the Internet, just go to the government services website and select.

Here you need to order an extended statement of the Pension Fund account. Within a few minutes, your request will be completed and you will receive a corresponding statement, which you can print or view later in your Personal Account.

If you are a client of a non-state Pension Fund, you can request information about the status of your pension account on their official website.

On the official website of the Pension Fund of the Russian Federation there is a corresponding explanation that SNILS cannot be checked via the Internet. This information is classified as confidential, and only the Pension Fund can give it to you in person.

But today there are online resources that allow you to check your SNILS number online. For example, using the link: https://mosgorcredit.com/inde /poisk_strakhovogo_nomera_individualnogo_licevogo_scheta_snils/0-62 you can use the SNILS number to find out who it belongs to. To do this, you just need to enter the number in the line.

It’s easy to check your pension savings using your SNILS number. You have two legal ways: when you contact the Pension Fund and by making a request on the government services portal. Both of these options are free, and you can quickly get complete information about the status of your retirement account.

Since 2020, all contributions to the compulsory pension insurance system are made to the Federal Tax Service, since from this period all administrative functions for accounting for insurance premiums are in the department of the tax service.

Contributions to the pension provision of citizens of the Russian Federation are made by employers, citizens themselves and co-financed by the state. Pension savings are also invested and bring additional income to their owners, which is distributed to individual accounts of clients of non-state pension funds (NPFs) and managers - this is VEB.

In connection with the innovations for policyholders in 2020, the question has become urgent: has the procedure for checking contributions to the pension fund according to SNILS changed?

Until 2013, the Pension Fund sent letters to all citizens of the Russian Federation at their registered address. The letters contained detailed information about the status of the citizen’s individual personal account for the entire period of his stay in the pension insurance system and current changes for the reporting period.

Since 2013, the mailing of letters was canceled due to low demand from the population, that is, low efficiency and high costs for its implementation.

At the current time, there are several ways to check contributions to the pension fund using SNILS. To do this, you can contact the OPFR providing the insurance certificate of the insured person and a Russian passport. And also, due to the automation of many processes in the extra-budgetary fund, citizens have the opportunity to view contributions to the Pension Fund via the Internet.

On the Internet, you can check your individual personal account in the pension insurance system in several ways, which depend on what type of pension you need to clarify information about - insurance or savings, and who is the insurer of pension savings - NPF or Pension Fund. If funds are invested through a management company (private or public), then the insurer is the Pension Fund; otherwise, the NPF.

Depending on this, you can check contributions to the Pension Fund according to SNILS through the government services portal, on the website of the Pension Fund or NPF.

A little about social benefits

To understand how to check the correctness of the old-age pension calculation, you should know that a pensioner may be accrued a social supplement from the federal or regional budget.

To do this, the following conditions must be met:

- a pensioner should not work;

- the pension amount is less than the minimum subsistence level established for the region where the pensioner lives.

In this case, the amount of additional payment and the pension itself is equal to the subsistence minimum.

If the latter in a certain region is higher than that established generally in the country, then a regional surcharge may be charged.

Check contributions to the Pension Fund via the Internet on the Pension Fund website

In addition to the government services portal, insured persons can obtain information about their formed pension rights for insurance pensions and pension savings, the insurer of which is the Pension Fund of the Russian Federation, on ]]>the official website of the extra-budgetary fund]]>. To do this, you will need to register in the electronic service “Citizen’s Personal Account” through the Unified Identification and Authentication System (USIA). Then in the “formation of pension rights” section you can obtain information about your individual pension account.

If one of the two above methods is used, the citizen receives information about the payers of insurance premiums, the amount of contributions received for the entire period, the amount of contributions for the reporting period and the final indicator of pension rights. And also, the percentage of profitability from investing pension savings, if the Pension Fund is the insurer for them.