Costs for landscaping – basic concepts and legislative regulation

The concept of “territory improvement” refers to a number of measures for landscaping, lighting, installation of coverings, placement of monumental art objects and small architectural forms in order to improve the aesthetic, functional, environmental and sanitary condition of the site in the immediate vicinity of the enterprise.

Below is a list of the main types of work on landscaping areas adjacent to buildings and structures of enterprises:

- installation of garden furniture and small architectural forms, as well as their repair and painting;

- laying roads and sidewalks, as well as their repair;

- creation of pedestrian paths and bicycle paths, their repair;

- parking equipment;

- organization of sports and playgrounds;

- landscaping of territories (planting plants, caring for previously planted plants - fertilizing trees and pruning them, seasonal trimming of bushes, cutting out shoots, removing weeds, weeding flower beds and lawns, mowing grass, removing dried trees);

- repair and painting of fences, railings, buildings (balconies, doors, windows, plinths, facades);

- Periodically clearing areas of debris.

Recommendations for the preparation of rules for landscaping territories were approved by Order of the Ministry of Construction of the Russian Federation dated April 13, 2017 No. 711/pr. Depending on where the institution is located, different procedures apply regarding landscaping:

- As follows from the text of clause 1.1 of Art. 17 of Federal Law No. 131-FZ, in cities of federal significance, the approval of rules and the organization of improvement are carried out in accordance with the laws of cities of federal significance.

- In municipalities, the procedure and frequency of improvement activities are prescribed in municipal legal acts that are subject to federal laws and other regulations.

Important!

The accountant must remember that, according to Instructions No. 65n, in order to pay for the costs of landscaping and reflecting them in accounting, the costs are allocated to the corresponding subarticles of Art. 220 “Payment for work and services” and Art. group 300 “Receipt of non-financial assets” (depending on the economic content of the costs incurred by the enterprise).

Landscaping: what expenses can be taken into account when calculating income tax

Chelyabinsk companies will have to take care of the condition of the territory adjacent to their office, industrial or commercial buildings - this is what the leadership of the regional center believes. In other words, organizations must independently create external landscaping objects: flower beds, lawns, parking lots, fences, etc.

At the same time, the legality of reducing taxable income for expenses associated with the creation of such objects raises many disputes between tax authorities and taxpayers.

Let's consider several situations in which external landscaping objects can be created, and analyze the legality of reflecting the costs of such improvement in tax accounting.

The concept of external improvement objects

The current legislation does not have a definition of the concept of “land improvement”, therefore, in practice, taxpayers and tax authorities are guided by its generally accepted meaning, given in the explanations of the Ministry of Finance of the Russian Federation. Thus, in a letter from the Ministry of Finance of the Russian Federation dated December 4, 2008.

No. 03-03-06/4/94, expenses for external improvement objects are understood as expenses not related to the commercial activities of the organization and aimed at creating a comfortable space, equipped from a practical and aesthetic point of view, on the territory of the organization.

They do not relate directly to any industrial buildings and structures and may include the following costs:

- for the construction of paths, benches, lawns, planting trees and shrubs;

- for the construction of a fence on a land plot;

- for the construction of parking areas;

- for the installation of street lights, etc.

Currently, there is no clear position on accounting for expenses aimed at creating external improvement facilities. The order in which they are taken into account depends on the situation in which the object is created. Let's look at individual situations in more detail.

Situation No. 1. The obligation to create external improvement objects is provided for in regulations

Sometimes the creation of external improvement facilities is mandatory due to regulatory legal acts of the Russian Federation, as well as regulatory technical documents in the field of industrial safety. In this case, according to officials, the costs incurred by the organization are economically justified and are taken into account in expenses when calculating income tax (letter of the Ministry of Finance of the Russian Federation dated June 19, 2008 No. 03-03-06/1/362).

A similar position was expressed in the resolution of the Federal Antimonopoly Service of the Moscow District dated January 26, 2009 No. KA-A40/13294-08 in case No. A40-3912/08-129-16. In this decision, the court proceeded from the fact that the requirements for landscaping and landscaping the territory are provided for in regulations and are necessary for the commissioning of real estate and registration of ownership rights to them. Other arbitration courts adhere to the same position (see.

, for example, resolutions of the FAS Volga-Vyatka District dated October 22, 2008 No. A28-1630/2008-43/29, FAS Moscow District dated April 10, 2008 No. KA-A40/2263-08). Thus, if expenses improvements are carried out by the organization in accordance with the requirements of the law, then they are taken into account for the purpose of calculating the organization’s income tax.

Situation No. 2.

Creation of facilities on the territory of sanatoriums, health centers, hotels, holiday homes, amusement parks

For these organizations, it is especially important to have a large number of phytozones and external improvement objects on their territory, such as decorative pools, fountains, paths, flower beds, gazebos, etc. Obviously, the arrangement of such objects is directly related to the activities of the organizations. The more attractive the territory, the greater the chance for the company to increase the number of clients and provide them with quality services. Employees of the financial department believe that the costs of landscaping the territory for sanatoriums, health centers, hotels, holiday homes, amusement parks, etc. are most directly related to the generation of income and can be taken into account when calculating income tax (letters of the Ministry of Finance of the Russian Federation dated July 7, 2009 No. 03-03-06/1/443, dated December 4, 2008 No. 03-03-06/4 /94). Note that the courts take a similar position. Thus, in decisions of the FAS Moscow District dated April 4, 2006 No. KA-A40/2276-06-2, FAS Ural District dated June 26, 2008 No. F09-4500/08-S3, the courts came to the conclusion that the expenses incurred by organizations for improvement correspond to the conditions established in clause 1 of Article 252 of the Tax Code of the Russian Federation and are legally included in expenses that reduce taxable profit. Accordingly, in this case, the reflection in tax accounting of expenses for the creation of external improvement objects is also legal.

Expenses for landscaping – acquisition of small architectural forms

Small architectural forms are any artificial elements of a landscape gardening composition, a complete list of which is given in clause 3.11 of SNiP III-10-75 “Landscaping of territories”. These include canopies, equipment for arranging children's playgrounds, pavilions, kiosks, sculptures from living plants, arches, benches, trellises, pergolas, rotundas, gazebos. Typically, objects of small architectural forms correspond to the characteristics of fixed assets and are recognized as such based on the instructions of Instruction No. 157n.

Important!

At the landscape design stage, or when choosing and paying for small architectural forms, you should be guided by catalogs of certified products.

When registering small architectural forms acquired by an enterprise, an accountant should remember two points:

- Material assets in the form of MAF are reflected in the corresponding analytical accounts. 0 101 00 000 “Fixed assets” (if LFA meets the criteria for classifying values as fixed assets).

- Expenses for the purchase or production of small architectural forms are carried out according to Article 310 “Increase in the cost of fixed assets” of KOSGU and according to KVR 244 “Other purchase of goods, works and services”.

Expenses for landscaping – construction and repair of road surfaces

Landscaping in terms of road surface construction means the following activities:

- repair of outdated and worn coatings;

- replacement of previously installed surfaces of platforms and paths (for example, laying asphalt, paving slabs, slag, crushed stone, etc.);

- creating coatings from scratch.

Types of road surfaces

Before considering the intricacies of accounting in relation to landscaping, you should understand what types of road surfaces are distinguished for landscaping purposes:

- Soft (not capital) - these include coatings made from artificial and natural bulk materials (such as crumb rubber, sand, expanded clay, crushed stone, granite seedings), which are in their natural state, in the form of dry mixtures, compacted mixtures or reinforced with binders materials.

- Solid (capital) - these include prefabricated or monolithic structures made of natural stone, asphalt concrete, cement concrete and similar materials.

Acceptance of improvement objects for registration

Important!

Fixed assets are accepted for accounting by decision of the current commission for the receipt and disposal of assets based on the results of work on the improvement of the territory. When making a decision, you should focus on the purpose of the covering object, taking into account the instructions of SNiP III-10-75 “Improvement of territories”, Instruction No. 157n and SNiP “Highways”. Based on the results of the consideration of the case, the commission draws up a supporting document - an act (primary accounting document).

Inventory assets of fixed assets must be accepted for accounting in accordance with OKOF requirements for grouping fixed assets (this is stated in paragraph 45 of Instruction No. 157n). OKOF obliges objects such as platforms and paths to be classified as fixed assets - such objects should be classified as “Other structures”, which includes fixed assets that are not included in other groups. Today, a new OKOF code is used - 220.41.20.20.90012 (previously 12 0001090).

If territory improvement activities mean repairs or reconstruction of a previously created facility, the costs of these works are included in the costs of the current financial year. Such expenses will be reflected in account 0 401 20 200 “Expenses of the current financial year” (on the corresponding analytical accounting account).

Paths and platforms and other improvement objects created “from scratch” must be taken into account as part of fixed assets; from January 1, 2020, an account 0 101 02 000 “Non-residential premises” (previously – 0 101 03 000 “Structures”) is opened for this purpose. If several objects were erected at once with the same useful life and the same functional purpose, they should be considered as a complex with one inventory number. This does not apply to objects that have an independent function (for example, if one of the sites was built for the purpose of organizing parking spaces on it).

The complex is tied to the plot of land on which it is located. In the inventory card for accounting for non-financial assets, the accountant must reflect information about all objects included in the complex separately.

Important!

At the enterprise, it is advisable to consolidate the features of accounting for improvement objects as part of the formation of accounting policies.

Reflection of expenses for road surfaces in accounting

The costs of carrying out activities for laying paths and installing platforms must be reflected in CWR 244 “Other procurement of goods, works, services.” Depending on the situation, the following standards are taken into account:

- Art. 340 “Increase in the cost of inventories” of KOSGU (if construction materials for laying paths or constructing platforms were purchased under separate contracts);

- Art. 225 “Work, services for property maintenance” of KOSGU (if the activities were carried out by the enterprise in order to improve the functional characteristics of previously constructed objects or for the purpose of their restoration);

- Art. 310 “Increase in the value of fixed assets” of KOSGU (if, as a result of work, new structures are taken into account).

An example of reflecting the costs of laying paths in accounting

Let's say an enterprise has signed an agreement with a contractor, according to which he undertakes to carry out construction work on the arrangement of a new site, which will serve as a parking lot. It is planned to lay asphalt concrete pavement. The cost of the work amounted to 380 thousand rubles, while the company paid the contractor an advance in the amount of 25% of the total cost of laying the coating. Payment is made from targeted funds allocated for these purposes from the budget in the form of a subsidy.

The accountant will have to record transactions on the following accounting accounts:

| Operation | Amount (rub.) | DEBIT | CREDIT |

| Advance payment transferred to the contractor | 95.000 (380,000 x 25%) | 5 206 31 000 | 5 201 11 000 |

| The initial cost of the facility (parking) has been formed | 380000 | 5 106 11 000 | 5 302 31 000 |

| The advance payment transferred to the contractor has been credited | 95000 | 5 302 31 000 | 5 206 31 000 |

| The parking lot has been registered (after the work acceptance certificate has been issued). At the same time, capital investments are being transferred from KVFO 5 to KVFO 4. | 380000 | 5 306 04 000 4 101 12 000 | 5 106 11 000 4 304 06 000 |

| The final settlement has been made with the contractor | 285000 (380000 – 95000) | 5 302 31 000 | 5 201 11 000 |

Accounting

The procedure for reflecting improvement expenses in accounting depends on their connection with the main construction project. Namely:

- landscaping is inextricably linked with the main construction project;

- In the process of improvement, independent objects are created - objects of external improvement.

If construction is carried out at the expense of an attracted investor, then the developer transfers the results of the improvement work to him. In this case, the developer’s accounting records the expenses for improvement as follows.

If the expenses for improvement are inextricably linked with the main construction project (made before its commissioning), attribute them to the increase in expenses for the construction of the main object:

Debit 08-3 Credit 60 (10, 23, 25, 26, 69, 70, 76) - improvement costs are reflected as part of the costs of construction of the main facility.

As a rule, such improvement is mandatory by law, and without it the main construction project cannot be put into operation. Therefore, such expenses increase capital investments in the main facility (clause 8 of PBU 6/01).

Often, the improvement planned in the estimate has to be carried out after the facility has been put into operation due to the seasonal nature of the work. For example, landscaping, installation of the top covering of blind areas, building entrances and sidewalks, utility, playgrounds and sports grounds, installation of small architectural forms, as well as finishing and coloring of building facade elements can be postponed to the next spring-summer period. In this case, the developer includes the costs included in the estimate for performing such work in the cost of the property under construction by creating an estimated liability in account 96. To create a reserve for account 96, open a subaccount, for example, “Reserve for seasonal landscaping work.” Completed work will be written off against the created reserve.

Reflect these transactions in accounting with the following entries:

Debit 08 Credit 96 subaccount “Reserve for seasonal improvement work” - reflected as part of the costs of construction of the main facility, expenses for seasonal improvement work (before their implementation);

Debit 96 subaccount “Reserve for seasonal improvement work” Credit 20 (60) - actual expenses incurred for seasonal improvement work are written off against the created reserve.

In the process of improvement, independent objects (external improvement objects) can also be created. There is no definition of external improvement objects in the legislation. The Ministry of Finance of Russia, in letter dated April 2, 2007 No. 03-03-06/1/203, proposes to be guided by its generally accepted meaning in the context of use for the purposes of tax legislation. According to this letter, expenses for external improvement facilities should be understood as expenses aimed at creating a comfortable space on the territory of the organization, equipped from a practical and aesthetic point of view. Such expenses are not directly attributable to any industrial buildings and structures and are not directly related to the business activities of the organization. These include, for example, the installation of paths, benches, planting trees and shrubs, and the installation of lawns.

The developer must generate expenses for such objects separately for each external improvement object. Expenses are reflected by posting:

Debit 08-3 subaccount “Creation of an external improvement object” Credit 60 (10, 23, 25, 26, 69, 70, 76) – capital investments in the creation of an external improvement object are reflected.

After transfer by the developer, such objects are taken into account by the investor depending on the nature of their use.

If the investor uses external improvement objects in his main activity and they meet certain conditions, he takes them into account as part of fixed assets:

Debit 01 Credit 76 subaccount “Settlements with the developer” - the external improvement object is reflected in the fixed assets.

If the investor plans to rent out the received object (renting is not the main activity), then such an asset is accounted for as a profitable investment in tangible assets:

Debit 03 Credit 76 subaccount “Settlements with the developer” - reflected in the composition of profitable investments in material assets, an external improvement object.

The cost of such assets is written off as expenses through depreciation (paragraph 1, clause 17 of PBU 6/01). If the external improvement object is not depreciated in tax accounting, when these expenses are recognized in accounting, a permanent difference arises, leading to the formation of a permanent tax liability, the amount of which is reflected:

Debit 99 subaccount “Permanent tax liabilities” Credit 68 subaccount “Calculations for income tax” - reflects the permanent tax liability.

Such rules are established by paragraph 3 of PBU 18/02.

An example of how expenses for landscaping the area around a constructed building are reflected in accounting. Landscaping of the area was carried out in order to compensate for the green spaces cut down during construction. Landscaping costs are included in the costs of construction of the main facility

OJSC "Proizvodstvennaya" (investor) finances the construction of an office center intended for rental. Costs for the construction of the office center amounted to RUB 60,062,000. (including VAT - 9,162,000 rubles), which includes the cost of planting 50 trees and shrubs - 1,062,000 rubles. (including VAT – 162,000 rubles). The funds were transferred to the developer in March 2020.

In June 2020, construction of the office center was completed. In the same month, the developer began mandatory landscaping of the area.

The developer included the costs of landscaping in the costs of constructing the main facility (office center), since this type of improvement is mandatory (a legal requirement in the field of environmental protection).

In the same month, the developer transferred the constructed facility to the “Master” under a deed, and the building was put into operation.

To reflect transactions with the developer, the “Masters” accountant uses the subaccount “Settlements with the developer” opened for account 76.

In Master's accounting, operations for the construction of an office center are reflected in the following entries.

In March 2020:

Debit 76 subaccount “Settlements with the developer” Credit 51 – 60,062,000 rub. – funds were transferred to the developer for the construction of an office center.

In June 2020:

Debit 08-3 Credit 76 subaccount “Settlements with the developer” – 50,900,000 rubles. – an office center was accepted from the developer, including landscaping costs;

Debit 19 Credit 76 subaccount “Settlements with the developer” – 9,162,000 rubles. – reflected VAT presented by the developer;

Debit 68 subaccount “Calculations for VAT” Credit 19 – RUB 9,162,000. – accepted for deduction of VAT on the constructed building.

An example of how expenses for landscaping the area around a constructed building are reflected in accounting. As a result of external improvement, a separate object is created

OJSC "Proizvodstvennaya" (investor) finances the construction of an office center intended for its own needs. According to the project, landscaping of the territory includes the construction of a parking lot. The costs of building the office center amounted to RUB 59,000,000. (including VAT - 9,000,000 rubles), costs for construction of a parking lot - 1,062,000 rubles. (including VAT – 162,000 rubles). The funds were transferred to the developer in March 2015.

In June 2020, construction of the office center was completed. In the same month, the developer transferred the constructed facility to the “Master” under a deed, and the building was put into operation.

In July 2020, the developer completed the construction of the parking lot and transferred this external improvement project to “Master”. The parking lot was put into operation in the same month.

To reflect transactions with the developer, the “Masters” accountant uses the subaccount “Settlements with the developer” opened for account 60.

In Master's accounting, operations for the construction of an office center are reflected in the following entries.

In March 2020:

Debit 76 subaccount “Settlements with the developer” Credit 51 – 60,062,000 rub. – funds were transferred to the developer for the construction of an office center and landscaping of the territory.

In June 2020:

Debit 08-3 Credit 76 subaccount “Settlements with the developer” – 50,000,000 rubles. – an office center was accepted from the developer;

Debit 19 Credit 76 subaccount “Settlements with the developer” – 9,000,000 rubles. – reflected VAT presented by the developer;

Debit 01 Credit 08-3 – 50,000,000 rub. – an office center was put into operation;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 9,000,000 rubles. – accepted for deduction of VAT on the constructed building.

In July 2020:

Debit 08-3 Credit 76 subaccount “Settlements with the developer” – 900,000 rubles. – an external improvement project (parking lot) has been accepted from the developer;

Debit 19 Credit 76 subaccount “Settlements with the developer” – 162,000 rubles. – reflected VAT presented by the developer;

Debit 01 Credit 08-3 – 900,000 rub. – a parking lot was put into operation;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 162,000 rubles. – accepted for deduction of VAT on parking.

The procedure for taking into account expenses for landscaping when calculating taxes depends on the taxation system that the organization uses.

Expenses for landscaping – expenses for landscaping

Landscaping refers to a set of activities related to the creation and use of plantings. There are 2 types of landscaping depending on location:

- mobile – when plants are planted in mobile containers (pots, containers, etc.);

- stationary - when plants are planted directly into the ground without the use of mobile structures.

As a rule, landscaping activities mean the organization of green areas, groups, flower beds, lawns, hedges, wings, bosquets, trellises, lawns and plantings (bouquet, row, alley, etc.). Plantings that have already been planted need to be looked after from time to time, and such work also applies to landscaping:

- treatment with special preparations against diseases and pests, filling of hollows and wounds on tree bark;

- cutting down dead wood and trees in disrepair, pruning dry branches, cutting out broken and dry branches and twigs;

- agrotechnical measures (grass mowing, disease and pest control, drying, pruning, loosening, watering).

Payment for landscaping work

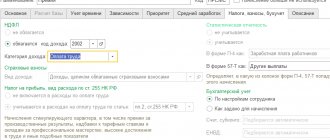

Payment for activities aimed at landscaping the territory will be regulated by various regulations, depending on the economic content of contracts with organizations specializing in planting. Payment is made in accordance with the provisions of Instructions No. 65n and is reflected according to KVR 244 in connection with:

- subarticle 226 “Other works, services” of KOSGU (if an agreement is drawn up for the provision of a range of services for the purpose of landscaping the territory, including landscaping work);

- subarticle 225 “Works, services for property maintenance” of KOSGU (if we are talking about contracts for the provision of services for the care and maintenance of perennial plantings);

- Article 340 “Increase in the cost of material reserves” of KOSGU (if seeds, seedlings, perennial plants are purchased - planting material).

Accounting for seeds, seedlings, planting material, perennial plantings

Perennial plantings are objects of plant origin that produce products more than once, and whose natural growth and restoration are controlled by the subject of accounting.

These include:

- Cultivated plantings of botanical gardens, educational institutions, research centers when used for scientific purposes.

- Hedges, plantings to strengthen the banks of rivers and sands, snow protection strips, shelterbelts, gully-beam plantings, etc.

- Decorative and landscaping plantings on the territory of legal entities, on streets and squares, in courtyards of residential buildings, in parks, gardens and public gardens.

- Fruit and berry plantings (any shrubs and trees).

An accountant needs to know about the following features of accounting for expenses for landscaping the territory of an enterprise:

- Perennial plantings (except for those planted in nurseries as planting material) must be included in the operating system and accounted for in account 0 101 07 000 “Biological resources” (previously such objects were subject to accounting in account 0 101 08 000 as part of other fixed assets ).

- Saplings, seeds and other planting materials must be included in material assets and recorded in account 0 105 06 000 “Other inventories”.

An example of reflecting landscaping expenses in accounting

The budgetary institution entered into an agreement with the nursery to carry out work on landscaping and landscaping of the site (as part of the activities to fulfill the state task). Trees were planted and flower beds were laid out under an agreement with a specialized company for 21 thousand rubles. For this purpose, planting material was purchased:

- tree seedlings – 55 thousand rubles;

- grass and flower seeds – 34 thousand rubles.

Landscaping costs were included by the accountant as general business expenses in accordance with accounting policies. The following entries were made:

| Operation | Amount (rub.) | DEBIT | CREDIT |

| Planting materials, including seedlings, are taken into account | 89000 (55000 + 34000) | 4 105 36 340 | 1 302 34 730 |

| Repayment of debt to the supplier of planting materials is reflected | 89000 | 4 302 34 830 | 4 201 11 610 |

| The sown seeds were written off | 34000 | 4 109 80 272 | 4 105 36 440 |

| The formation of the cost of perennial plants is reflected (1). Acceptance of perennial plantings for registration (2). | 55000 | (1) 4 106 31 310 (2) 4 101 37 310 | (1) 4 105 36 440 (2) 4 106 31 310 |

| Accrual of expenses for payment for landscaping work by a specialized company | 21000 | 4 109 80 226 | 4 302 26 730 |

| Payment has been made for the work performed (after the acceptance certificate has been issued) | 21000 | 4 302 26 830 | 4 201 11 610 |

Improvement of the surrounding area: cost accounting

02.04.2018

Landscaping is usually understood as a set of activities aimed at improving the operational and aesthetic characteristics of the territories of cultural institutions. What are these activities and how are the corresponding costs reflected in accounting?

Activities for landscaping

Based on clause 2 of Art. 39 of the Federal Law of January 10, 2002 No. 7-FZ “On Environmental Protection”

all legal entities operating buildings, structures, structures must carry out measures to improve the territories adjacent to them in accordance with the law.

The approval of the rules for landscaping the territory relates to issues of local importance ( clause 19, clause 1, article 14 of the Federal Law of October 6, 2003 No. 131-FZ

).

Today, their development is carried out in accordance with the Methodological Recommendations

, which provide the basic principles, approaches, quality characteristics and indicators used in the preparation of improvement rules in order to create a safe, comfortable and attractive urban environment.

The implementation of the relevant rules is the responsibility of all owners and users of property and land, regardless of their legal form and type of activity. Let us recall that the property of state (municipal) institutions belongs to them with the right of operational management, and land plots are provided to them for permanent (indefinite) use ( clause 1 of Article 296 of the Civil Code of the Russian Federation

,

pp. 2 p. 2 art. 39.9 Land Code of the Russian Federation

).

Based on the Methodological Recommendations, landscaping elements include:

– landscaping elements; – coatings; – fencing (fences); – water devices; – outdoor utility and technical equipment; – gaming and sports equipment; – lighting elements; – means of placing information and advertising structures; – small architectural forms and urban furniture; – non-permanent non-stationary structures; – elements of capital construction projects.

The main types of improvement work are:

– cleaning the area from dirt, debris, snow, ice, their removal and disposal; – landscaping (laying out lawns, flower beds, flower beds, planting seedlings); – repair of sidewalks (asphalting, laying paving slabs); – construction of various types of fencing, installation of gazebos, benches, fountains, various architectural forms, street lighting; – maintenance of elements of external improvement of buildings and structures, engineering infrastructure facilities; – arrangement of playgrounds, children’s, sports, and dance floors; – repair of monuments, obelisks, etc.

Financial support for expenses

The responsibility for improvement of the territory of municipalities falls within the competence of local government bodies. Institutions, in turn, bear the burden of improving the property and lands assigned to them.

In the first case, financial support for the implementation of work on improvement of the territory of the municipality can be provided ( letter of the Ministry of Economic Development of the Russian Federation dated March 10, 2017 No. OG-D28-2556

,

Ministry of Finance of the Russian Federation dated December 9, 2015 No. 02-01-10/71882

):

– within the limits of budget obligations (hereinafter referred to as LBO) for the relevant purposes communicated to the local government body - the customer under the municipal contract; – through a subsidy for financial support for the implementation of a municipal task, provided to an institution specially created to carry out functions for the improvement of territories, in respect of which the local government body acts as the founder.

In the second case, sources of financing expenses associated with the improvement of adjacent territories may be LBO, subsidies for the implementation of state (municipal) tasks, for the purpose of making capital investments, for other purposes, as well as the institutions’ own funds received as part of income-generating activities. It is from these sources that financial support is provided for the corresponding expenses of cultural institutions.

Accounting for landscaping expenses

The procedure for recording expenses for territory improvement will depend on the economic content of the business transaction determined by the subject of the contract (agreement). Let us highlight the main expenses that occur when improving the adjacent territory of cultural institutions.

Cleaning the area

Cleaning the surrounding area, depending on the climate season, includes the following work:

– in winter – clearing the area of ice and snow, eliminating slippery conditions; – in the spring – clearing ditches for drainage of melt water to hatches and receiving wells of the storm network; – in summer – sweeping dust and debris from the surface of coatings, caring for lawns; – in the fall – sweeping and raking leaves, clearing debris from areas where snow is supposed to be stored in winter.

As a result of such work, garbage and other waste are generated, which are subsequently removed for disposal by specialized organizations.

In accordance with Directions No. 65n

expenses of an institution within the framework of concluded contracts, the subject of which are cleaning the territory of the institution from dirt, garbage, snow, etc., as well as removal of garbage, waste and their subsequent disposal (placement, burial), are reflected according to

expense type code 244

“Other purchase of goods, works and services" and

subarticle 225

"Works, services for property maintenance" of KOSGU.

Moreover, within the framework of a separate agreement for the provision of services and work on the disposal and disposal of various types of waste, expenses are reflected under subarticle 226

“Other works, services” KOSGU.

Example 1.

An autonomous cultural institution entered into an agreement with a contractor to carry out a set of works to clear the territory of snow and ice. In March 2020, work was carried out in the amount of 15,000 rubles. Their payment was made at the expense of the subsidy allocated for the implementation of the state task, upon completion of the work (based on the certificate of completion of work).

These transactions are reflected in the accounting of the autonomous institution in accordance with Instruction No. 183n

in the following way:

| Contents of operation | Debit | Credit | Amount, rub. |

| Debt accrued to the contractor for snow removal work | 4 109 80 225 | 4 302 25 000 | 15 000 |

| Funds for work performed were transferred upon completion | 4 302 25 000 | 4 201 11 000 | 15 000 |

Landscaping

Landscaping is an element of improvement and landscape organization of the territory, ensuring the formation of an environment with the active use of plant components, as well as the maintenance of a previously created or originally existing natural environment on the territory of the institution.

When landscaping the territory, work is carried out related to:

– with planting seedlings of trees, shrubs, flowers, etc.; – with the breakdown of lawns, flower beds, flower beds; – with the care of perennial green spaces.

In accordance with Instructions No. 65n, the expenses of an institution for the purchase of seedlings of perennial plantings, as well as other planting material (seeds, seedlings, seedlings, cuttings, etc.) should be reflected according to the type of expenses code 244

“Other procurement of goods, works and services” and

Article 340

“Increase in the cost of inventories” of KOSGU.

Based on the provisions of clause 118 of Instruction No.

157n,

planting materials are accounted for on

account 0 105 36 000

“Other inventories - other movable property of the institution.”

Perennial plantings, according to OKOF OK 013-2014, belong to this type of fixed assets as cultivated resources of plant origin that repeatedly produce products (code 520.00.00.00). They are included in the tenth depreciation group with a useful life of over 30 years (see Classification of fixed assets

).

According to clause 43 of Instruction No. 157n

capital investments in perennial plantings are included by the institution in fixed assets annually in the amount of investments related to the areas accepted for operation, regardless of the completion of the entire complex of work.

Similar standards are enshrined in clause 15 of the GHS

“

Fixed assets”

.

To account for perennial plantings that have reached operational age (fruiting period), the account 0 101 07 000

“Biological resources” (

letters of the Ministry of Finance of the Russian Federation dated November 30, 2017 No. 02-07-07/79257

,

dated December 15, 2017 No. 02-07-07/84237

).

For your information:

Until 01/01/2018, perennial plantings were accounted for on

account 0 101 08 000

“Other fixed assets”.

As for expenses associated with landscaping work, according to Instructions No. 65n they are reflected according to expense type code 244

“Other procurement of goods, works, services” linked:

– with subarticle 225

“Works, services for property maintenance” - when concluding contracts for the provision of services related to the care and maintenance of perennial plantings (formation of crowns, prevention of pests, protection from pests and solar radiation);

– with subarticle 226

“Other works, services” – within the framework of contracts for the provision of a range of services for landscaping, including landscaping work (planting trees, shrubs, flowers, etc., creating grassy lawns, flower beds).

Example 2.

The budgetary institution purchased seedlings of perennial coniferous plants from the supplier for subsequent planting on its territory. The cost of one seedling was 800 rubles, a total of 10 pieces were purchased. A third-party organization was hired to plant seedlings; the cost of work under the contract is 5,500 rubles. All expenses were made from funds received from the provision of paid services. When coniferous plants reach operational age, they are taken into account as part of fixed assets.

These transactions will be reflected in the accounting of the budgetary institution on the basis of Instruction No. 174n

in the following way:

| Contents of operation | Debit | Credit | Amount, rub. |

| Seedlings accepted for accounting as part of material reserves | 2 105 36 340 | 2 302 34 730 | 8 000 |

| The debt to the seedling supplier has been repaid | 2 302 34 830 | 2 201 11 610 | 8 000 |

| Work on planting seedlings was carried out (capital investments in perennial plantings were reflected) | 2 106 31 310 | 2 302 26 730 | 5 500 |

| The debt to a third-party organization for the work performed on planting seedlings was repaid | 2 302 26 830 | 2 201 11 610 | 5 500 |

| Seedlings are written off after they are planted (capital investments in perennial plantings are reflected) | 2 106 31 310 | 2 105 36 440 | 8 000 |

| Perennial plantings are accepted as part of fixed assets when they reach operational age ((8,000 + 5,500) rub.) | 2 101 37 310* | 2 106 31 310 | 13 500 |

* At the time of writing, Instruction No. 174n has not been brought into compliance with the requirements of the GHS “Fixed Assets”. Therefore, until the adoption of appropriate amendments providing for the accounting of perennial plantings in the account 0 101 37 000

“Biological resources – other movable property of the institution”, they should be recorded in

account 0 101 38 000

“Other fixed assets – other movable property of the institution”.

Creation of new improvement facilities

As part of the improvement work, new objects can be built (purchased): gazebos, benches, fountains, fences, various architectural forms, paths, etc.

According to the GHS “Fixed Assets”, such objects from 01/01/2018 are subject to accounting as part of fixed assets in account 0 101 02 000

“Non-residential premises (buildings and structures)” at original cost, which is formed on

account 0 106 00 000

“Investments in non-financial assets” (see letters of the Ministry of Finance of the Russian Federation No. 02-07-07/79257, No. 02-07-07/84237 ).

For your information:

Until 01/01/2018, created territory improvement facilities were accounted for in

account 0 101 03 000

“Structures”.

Expenses for the construction (purchase) of relevant facilities are reflected under Article 310

“Increasing the cost of fixed assets” KOSGU. In this case, depending on the source of financial support, the following expense type codes may be used:

– 244

“Other procurement of goods, works and services”;

– 412

“Budget investments for the acquisition of real estate in state (municipal) ownership”;

– 414

“Budget investments in capital construction projects of state (municipal) property”;

– 416

“Capital investments for the acquisition of real estate by state (municipal) institutions”;

– 417

“Capital investments in the construction of real estate by state (municipal) institutions.”

Example 3.

The state-owned cultural institution entered into a contract with a contractor to carry out work on the manufacture and installation of metal fencing in the amount of 150,000 rubles. (including VAT). The terms of the agreement provide for an advance of 30%. Upon completion of the work, the fencing was taken into account as part of fixed assets.

In accordance with OKOF OK 013-2014, metal fences are assigned code 220.42.99.19.142. Based on the Classification of fixed assets, such objects belong to the sixth depreciation group - property with a useful life of over ten years to fifteen years inclusive.

The calculation of the amount of depreciation charges for the specified fixed assets is carried out in accordance with the maximum useful life established for this group ( clause 44 of Instruction No. 157n

). This means that the useful life of the metal fence is 15 years (180 months).

In budget accounting based on Instruction No. 162n

The following accounting entries must be recorded:

| Contents of operation | Debit | Credit | Amount, rub. |

| An advance was transferred to the contractor (RUB 180,000 x 30%) | 1 206 31 560 | 1 304 05 310 | 54 000 |

| The formation of the initial cost of the fence is reflected | 1 106 31 310 | 1 302 31 730 | 180 000 |

| The previously transferred advance was offset | 1 302 31 830 | 1 206 31 660 | 54 000 |

| Fencing has been accepted for accounting as part of fixed assets | 1 101 32 310* | 1 106 31 310 | 180 000 |

| The debt to the contractor has been repaid ((180,000 – 54,000) rub.) | 1 302 31 830 | 1 304 05 310 | 126 000 |

| The monthly depreciation charge is reflected throughout the entire life of the fence (RUB 180,000 / 180 months) | 1 401 20 271 | 1 104 32 410* | 1 000 |

* As of today, changes provided for by the GHS “Fixed Assets” regarding the accounting of fences on account 1,101,32,000

“Non-residential premises (buildings and structures) - other movable property of the institution”, reflections of depreciation charges on them in

account 1,104 32,000

“Depreciation of non-residential premises (buildings and structures) - other movable property of the institution” are not taken into account in the provisions of Instruction No. 162n.

Therefore, before the amendments are adopted, the erected fence must be taken into account on account 1,101,33,000

“Structures – other movable property of the institution,” and depreciation charges – on

account 1,104,33,000

“Depreciation of structures – other movable property of the institution.”

Restoring the road surface

According to Instructions No. 65n, expenses associated with carrying out work on asphalt paving of the adjacent territory, laying paving slabs (paving stones), made in order to restore the operational characteristics of the road surface, should be reflected under subarticle 225

“Costs, services for property maintenance” KOSGU.

Construction materials purchased for the installation of pavement (paving slabs, crushed stone, sand, expanded clay, etc.) under a separate agreement are recorded as part of inventories on account 0 105 34 000

“Construction materials are other movable property of the institution.”

The costs of their purchase are reflected in article 340

“Increase in the cost of inventories” of KOSGU.

At the same time, if a major repair of the coating is carried out, the costs of repair work and the purchase of building materials are allocated to expense type code 243

“Purchase of goods, works, services for the purpose of major repairs of state (municipal) property”, and for current repairs - to

expense type code 244

“Other purchase of goods, works and services”.

Example 4.

The House of Culture (a budgetary institution) entered into an agreement with a contractor for the overhaul of the asphalt pavement near the administrative building. According to the terms of the contract, the cost of the work was 150,000 rubles. (including VAT). The cost of building materials purchased under a separate contract is 80,000 rubles. (including VAT). Expenses for payment for work and construction materials were made at the expense of a targeted subsidy allocated from the regional budget. According to the accounting policy, these expenses are classified as general business expenses.

The accounting of a budgetary institution based on Instruction No. 174n reflects the following entries:

| Contents of operation | Debit | Credit | Amount, rub. |

| Construction materials accepted for accounting | 5 105 34 340 | 5 302 34 730 | 80 000 |

| The debt to the materials supplier has been repaid | 5 302 34 830 | 5 201 11 610 | 80 000 |

| Major repairs of the asphalt pavement were completed | 5 109 80 225 | 5 302 25 730 | 150 000 |

| The debt to the contractor has been repaid | 5 302 25 830 | 5 201 11 610 | 150 000 |

| Construction materials written off after completion of repairs | 5 109 80 272 | 5 105 34 440 | 80 000 |

* * *

Cultural institutions bear the burden of improving the property and lands assigned to them. Sources of financing expenses related to improvement can be both budgetary funds (LBO, subsidies) and the own funds of budgetary, autonomous institutions. The procedure for recording relevant expenses will depend on the type of work performed.

It is worth noting that with the introduction of the GHS “Fixed Assets”, the rules for accounting for some improvement objects have changed. In particular, from 01/01/2018, objects of perennial plantings should be taken into account 0 101 07 000

(previously on

the account 0 101 08 000

), and newly created objects, such as fences, gazebos, benches, fountains, etc., on the

account 0 101 02 000

(previously on

the account 0 101 03 000

).

Alekseeva M., expert of the information and reference system “Ayudar Info”

Send to a friend

Expenses for landscaping – expenses for repairs of building facades

Buildings and other structures are objects of real estate of the institution. Accordingly, the costs of updating and repairing facades are allowed to be classified as property maintenance costs. This instruction is contained in Instructions No. 65n. Expenses must be reflected by the accountant according to the type of expenses code (KVR) 244 “Other purchase of goods, works, services” and subarticle 225 “Works, services for property maintenance” of KOSGU.

Example. The budgetary institution received a subsidy to repair the facade of the building. An agreement was signed with a contractor in the amount of 450 thousand rubles with an advance payment of 25% of the total price of the agreement. The accountant will make the following entries:

| Operation | Amount (rub.) | DEBIT | CREDIT |

| Advance payment transferred to the contractor | 112500 (450000 x 25%) | 5 206 25 560 | 5 201 11 610 |

| The completed work was accepted by the institution on the basis of an act | 450 000 | 5 401 20 225 | 5 302 25 730 |

| The advance payment transferred to the contractor was taken into account | 112500 | 5 302 25 830 | 5 206 25 660 |

| The final settlement has been made with the contractor | 337500 | 5 302 25 830 | 5 201 11 610 |

Common mistakes

Error:

The company's capital investments in perennial plantings were included in the operating system in the amount of investments tied to the time of completion of the entire complex of works on the improvement of the site.

A comment:

The institution's capital investments in perennial plants must be included in fixed assets every year in the amount of investments related to the areas accepted for operation. At the same time, according to paragraph 43 of Instruction No. 157n, it does not matter when all work on the improvement of the site is completed.

Error:

After the company invested money in landscaping the territory (laying a new road surface), the value of the land plot under the structure increased.

A comment:

When constructing new territory improvement facilities or when carrying out repairs and reconstruction of previously installed facilities, expenses are not accepted as investments in a plot of land. Therefore, costs should not lead to an increase in its cost.

Directions for spending

What exactly is meant by landscaping? This is a set of measures for lighting, landscaping, and construction of new facilities. Let's consider the basic areas of improvement:

- Preparing the territory and ensuring its safety.

- Planting.

- Installation of fences.

- Construction of small objects.

- Installation of sports equipment.

- Lighting installation.

- Installation of advertising and information stands.

- Construction of non-capital facilities.

- Improving the appearance of existing buildings.

- Creation of pedestrian crossings and passages for transport.

Here are some popular jobs: paving, arranging lawns and flower beds, installing benches and lanterns, laying tiles. The exact list of works included in the improvement of the territory is not specified in the law.

Expenses in these areas of work are considered expenses for landscaping. According to the Ministry of Finance (letters No. 03-03-06/1/35, No. 03-03-06/1/443 dated July 7, 2009), expenses for traditional improvement are considered relevant expenses when determining income tax. That is, these are efforts aimed at organizing convenience on the territory of the company. The expenses in question are not related to making a profit.

Answers to common questions about how landscaping costs are accounted for

Question #1:

Is there such a thing as landscaping for sports facilities?

Answer:

Yes. It is usually understood that a sports institution carries out landscaping of the territory adjacent to the structures and buildings that it operates (which are assigned to the sports institution with the right of operational management).

Question #2:

Who is the person responsible for the improvement of the territory, and on what basis?

Answer:

The responsibility for the improvement (maintenance) of the territories adjacent to the enterprise falls on the person responsible for the operation of the building. This obligation is enshrined in paragraphs. 9 tbsp. 55.25 of the Civil Code of the Russian Federation from June 28, 2020. According to the provisions of this regulatory act, the responsible person undertakes to take part (including financial) in the maintenance of the territories adjacent to the building, in accordance with the procedure in force in the relevant municipality.