Acquisition of land - posting

But in order to record real estate in the form of a land plot as part of fixed assets, it is necessary to act in accordance with the requirements of accounting regulations 6/01.

It states that assets are accounted for in accounting as fixed assets in accordance with several rules:

- Land is acquired in order to be used for production needs, for performing work, providing services, for the management needs of the company;

- The operational life of the site is at least 12 months or for the period of the standard operating cycle;

- The company does not plan to engage in further resale of the asset;

- The site can organize the company's income in the future.

Based on these rules, a peculiarity arises in the accounting of a land plot when an entrepreneur plans to resell it before the expiration of 12 months. In this situation, even if before the sale the asset was used for business operations and brought profit to the organization, or was in temporary use for a certain fee from the other party, it is still not recommended to classify it as fixed assets. The best option in accounting would be to reflect it in the composition of goods.

Documentation procedure

The legislation does not provide for any special documents intended for recording land plots. The main document is the contract. In this case, you will need to prepare it in 3 copies, one of which is transferred to Rosreestr.

The transfer of land can also be carried out under an agreement, but in this case it must indicate that it is also an act of acceptance and transfer. You can choose the form for reflecting transactions with fixed assets in the company yourself, but such unified documents as OS-1, OS-6 and OS-6b can also be used.

Sometimes a company does not purchase a plot, but receives it as a contribution from the founder as a gift or in exchange for other property. In this case, an objective assessment of the land plot will be required, as well as its acceptance for registration at cadastral value . If a company leases a site, a lease agreement must be drawn up. For a long lease period, such an agreement must be registered with Rosreestr.

Expenses for the acquisition of land

Costs incurred for the purchase of land, which was accounted for as fixed assets, are regulated by paragraph 8 of accounting regulations 6/01. The initial price of an object purchased for a fee will be the price of the enterprise's actual costs for the purchase or construction and manufacturing. The exception is value added tax.

The actual expenses for the purchase, construction and manufacture of fixed assets include:

- Funds paid in accordance with the contractual relationship with the seller, in addition to this includes the amount paid for bringing the land to a condition where it can be used;

- Cash received by enterprises for construction work under a construction agreement or other contracts;

- Money paid to other companies for providing necessary information and advice relating to the purchase of fixed assets;

- Fees and duties at customs, tax payments to the state budget, which also relate to the purchase of fixed assets;

- Remunerations and other payments to third-party companies or entrepreneurs acting as intermediaries in any transactions related to fixed assets;

- Other losses that are reflected in accounting in connection with the purchase and construction of real estate on the organization’s land plot.

If we draw a conclusion from this information, it becomes clear that in almost all cases the price of a land plot will be formed from the purchase amount and the state duty for the procedure for registering property rights. Moreover, the initial price of the company’s real estate will include losses on fees for legal organizations, the amount of interest on loans, and much more.

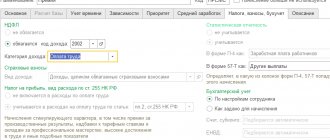

BASIC: income tax

For income tax purposes, land plots (except for lands acquired for resale and financed from investors’ funds) are classified as fixed assets (clause 1 of Article 257 of the Tax Code of the Russian Federation). At the same time, they are not recognized as depreciable property (clause 2 of Article 256 of the Tax Code of the Russian Federation).

For registration of rights to land plots, payment of a state fee is provided (subclause 22, clause 1, article 333.33 of the Tax Code of the Russian Federation).

There is no need to pay property tax on land plots, since they are not subject to this tax (clause 4 of Article 374 of the Tax Code of the Russian Federation). Owners of land plots and organizations that own them under the right of permanent (perpetual) use, as a rule, must pay land tax. For more information about this, see What property is subject to land tax. At the same time, changes in the cadastral value of a land plot do not affect its value in tax accounting. Such a change needs to be taken into account only when calculating land tax. If a land plot is acquired for the purposes of housing construction, then take into account the specifics of calculating land tax in relation to such land.

Otherwise, the calculation of taxes when purchasing (renting) land plots depends on the type of expense:

- acquisition of the right to conclude a lease agreement for a land plot that is in state (municipal) ownership;

- acquisition (rent) of land.

Accounting for land in accounting

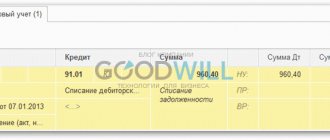

Accounting for land in accounting will largely depend on the purpose of use. The acquisition process and its further use will be reflected in different accounts. For example, the state duty on acquisition will be reflected as debit 68 credit 51, and accounting for a land plot as part of fixed assets is reflected as debit 01 credit 08.

Therefore, in order to avoid mistakes and misunderstandings with government regulatory authorities, it is best to use the services of a third-party accounting company. Then the accounting of land in accounting will take place without difficulties and with maximum benefit.

Acquisition of property

A developer can obtain ownership of a land plot by purchasing it under a purchase and sale agreement, an exchange (barter) agreement, receiving it as a contribution to the authorized (share) capital, or receiving it free of charge.

In this case, the object of the transaction can only be those land plots that have undergone state cadastral registration (Clause 1, Article 37 of the Land Code of the Russian Federation).

The owner of a land plot has the right to use it in accordance with the type of permitted use of the land plot specified in the State Real Estate Cadastre (Clause 1, Article 263 of the Civil Code of the Russian Federation, Article 37 of the Town Planning Code of the Russian Federation). Types of permitted use of land plots for capital construction are established in relation to the territorial zone.

Owners should take into account that the type of permitted use of the land plot determines the possibility of reconstructing existing buildings, as well as new construction on the land plot. It influences which buildings (buildings of what functional purpose) can be created on a given land plot. So, for example, a production workshop located on a land plot with the type of permitted use “for industrial production” cannot be reconstructed into a shopping center without changing the type of permitted use of this land plot.

To summarize information on the costs of the paid acquisition of a land plot, use account 08 (sub-account 08-1 “Acquisition of land plots”) (clause 27 of the Methodological Recommendations approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n).

Otherwise, the procedure for recording the acquisition of a land plot in accounting depends on who finances the construction:

- attracted investor;

- developer who acts as an investor.

If the cost of a land plot acquired for the construction of an object is reimbursed at the expense of attracted investors (shareholders), the developer does not have the right to recognize it as an object of fixed assets, since in this case it does not comply with the conditions of paragraph 4 of PBU 6/01. Reflect the acquisition of land with the following entries:

Debit 08-1 Credit 60 – a plot of land was purchased for construction at the expense of investors (shareholders).

This procedure is established by the Instructions for the chart of accounts.

After completion of construction, the developer transfers this plot to investors or shareholders in accordance with the agreement and its cost is written off as settlements with them. For more information about this, see How to register and record the disposal of land for construction.

If the construction is financed by a developer and he is constructing an object for sale, then he also does not have the right to recognize the land plot as part of fixed assets. In this case, the site does not meet the conditions provided for in paragraph 4 of PBU 6/01. Reflect the acquisition of land with the following entries:

Debit 08-1 Credit 60 – a plot of land was purchased for construction for sale.

If the construction is financed by a developer who is building a facility for himself, then he includes the land plots received into ownership (except for lands acquired for resale) in accounting as part of fixed assets if all the necessary conditions are met (clauses 4, 5 of PBU 6/ 01). This operation is reflected by transactions:

Debit 08-1 Credit 60 – acquired land for construction;

Debit 01 Credit 08-1 – the acquired land plot is reflected as part of fixed assets.

The procedure for determining the initial cost, documentation and reflection in accounting depend on the method of obtaining ownership of land plots:

- for a fee;

- under a barter agreement;

- as a contribution to the authorized capital;

- free of charge.

At the same time, take into account the peculiarities of accounting for fixed assets that require state registration.

There are no special unified forms for registering land plots in the legislation. Therefore, use for this form No. OS-1, approved by Decree of the State Statistics Committee of Russia dated January 21, 2003 No. 7.

The peculiarity of accounting for land plots is that they are not subject to depreciation, their original cost is not repaid (paragraph 5 of clause 17 of PBU 6/01).

Accounting for land in accounting

57 of the Land Code of the Russian Federation). This procedure does not provide for compensation to the landowner organization for the amount of income tax payable upon receipt of compensation for the seizure of a land plot for state (municipal) needs.

Info

Consequently, levying income tax on the amount of compensation paid to the owner of seized property violates the principle of full compensation for losses and damages defined by the legislator for such cases. Similar conclusions are contained in the resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated June 23, 2009.

No. 2019/09, decisions of the Supreme Arbitration Court of the Russian Federation dated September 23, 2009 No. VAS-12144/09, dated July 4, 2007 No. 5047/07, resolutions of the Federal Antimonopoly Service of the Moscow District dated May 26, 2009 No. KA-A40/4352-09 -P, dated July 9, 2008

Briefly

- The purchase, sale and lease of land plots for a period of more than a year are registered in Rosreestr.

- It is permissible to register land plots using the forms of primary documents developed by the organization.

- When selling part of a plot, it is necessary to divide it, and not write off and register new objects.

- The purchase and sale of land is not subject to VAT.

- Rental of private land is subject to VAT.

- Sublease of any land is subject to VAT.

- Income tax expenses can include the costs of a plot only when it is sold.

- Otherwise, expenses for land plots of a state or municipal nature are included in income tax calculations if there are buildings on them or their construction is expected.

We suggest you familiarize yourself with Making an extension to the house, what documents are needed

How to keep accounting for land when selling and buying? key postings

Important

The site was put into operation 01-6 08 Land was made as a contribution to the authorized capital 08 75 Leased land use objects 001 - Rent for land was accrued 20, 26 76 Land was received free of charge 08 98 Payment for the acquisition of land was reflected 60, 76 51 Land tax was accrued 20, 25 , 26, 44 68 Land tax paid 68 51 If a plot of land goes to the authorized capital (MC) of an organization, make the following entries: Dt 75 Kt 80 - the founder’s debt on contribution to the CC is taken into account; Dt 08 Kt 75 - the plot was received from the founder as a contribution to the management company; Dt 01 Kt 08 - land is accounted for as an asset. Receipt of land as a gift is reflected in the following entries: Dt 08 Kt 83 - land was received from the founder, the company has no income; Dt 08 Kt 98 - land donated by third parties; Dt 08 Kt 01 - the site was put into operation; Dt 98 Kt 91 - income from land received free of charge is taken into account.

thirty). Transactions with land plots must undergo the state registration procedure (Article 131 of the Civil Code of the Russian Federation; Law dated July 21, 1997 No. 122-FZ). It is from the moment of state registration that the acquirer acquires ownership rights (Art.

https://youtu.be/tk1gxNdLWyU

25

Land Code of the Russian Federation, art. 223 of the Civil Code of the Russian Federation). To register rights to real estate, a company needs to pay a state fee of 15 thousand rubles. (Article 11 of Law No. 122-FZ, subparagraph 22, paragraph 1, Article 333.33 of the Tax Code of the Russian Federation). The amount of state duty, according to the Ministry of Finance, is included in the initial cost of the real estate property (letter dated March 27, 2009 No. 03-03-06/1/195).

Putting a plot of land on balance

https://www.youtube.com/watch?v=upload

The acquired plot of land, like other assets, must be registered. First, the cost of the plot is determined. This information is contained in the purchase and sale agreement or other documents accompanying the transaction. If the necessary data is not available, an expert assessment of the land is carried out. The plot must be distributed by type of land in hectares.

Next, a special commission is created with specialists in land issues. She draws up an act for the registration of land (form No. 111-APK). All data about the site is entered into it: area, type, location, soil fertility, balance sheet value, reasons for purchase, etc.

Dt 01-6 Kt 91 - the purchased plot of land was put on the balance sheet.

If an organization received a plot of land from the state not for ownership, but for indefinite disposal, then it is taken into account off the balance sheet. This applies to the land and under buildings transferred to budgetary organizations for operational management.

The organization bought a plot of land. How to record a purchase in accounting?

Non-produced assets” according to the title document (clause 71 of Instruction No. 157n). Before registration, the land is taken into account on the balance sheet of the account. 01 “Property in use.”

36, 37, 38 Land Code of the Russian Federation. This includes:

- The sale of land owned by the state or municipality to the owners of structures and buildings erected on the land is carried out at prices approved by the relevant authorities;

- The price of land cannot exceed its value according to the cadastre;

- Lands that have been registered with the cadastral service can be bought and sold;

- The purchase of state land or lease rights is carried out through auctions (tenders).

The purchase of land in the accounting of state employees is reflected in accordance with Art.

Land accounting at cadastral value

The value according to the state cadastre reflects the nominal price of the plot. It depends on the category of land and its location.

Land received for perpetual use is accounted for at its cadastral value. Its change is documented with an accounting certificate (f. 0504833). They can occur for the following reasons:

- Conducting a state assessment (no more than once every 3 years);

- Changes in the quantity and quality of land between the previous and subsequent cadastre assessments;

- Successful refutation of the results of establishing the cadastral value in court or a special commission.

We invite you to familiarize yourself with the Bailiffs’ Act on the impossibility of collection

Changes in the value according to the cadastre do not affect accounting. They affect tax accounting when calculating land tax.

How to reflect the sale of land in accounting

If the land is sold with a real estate object standing on it, then the new owner (buyer) of the real estate as a result of such a transaction acquires the rights to the land plot located under the building (structure, structure). At the same time, he acquires the same rights to the land as the previous owner, that is, the right of ownership or the right of use. If there are several owners, they acquire rights to a part (share) of such a land plot, taking into account the size of each person’s share in the common ownership of the property. This procedure is established by Article 35 of the Land Code of the Russian Federation and Article 552 of the Civil Code of the Russian Federation. As a general rule, the value of the property being sold includes the value of the land transferred with the property (land rights). This rule is established by paragraph 2 of Article 555 of the Civil Code of the Russian Federation.

Free urgent use

The transfer of land for free, fixed-term use is regulated by Article 24 of the Land Code of the Russian Federation.

As a rule, on this basis, land plots are transferred for the following purposes:

- for the construction of infrastructure facilities;

- for housing construction;

- for the construction of real estate at the expense of budget funds under a state (municipal) contract.

If an agreement for free, fixed-term use of a land plot is concluded for a period of one year or more, then such a transaction is subject to mandatory state registration (clause 1 of Article 164 and clause 2 of Article 609 of the Civil Code of the Russian Federation, clause 2 of Article 25 and clause 2 of Art. 26 of the Land Code of the Russian Federation). For registration of such transactions, organizations are charged a state duty of 15,000 rubles. (Subclause 22, Clause 1, Article 333.33 of the Tax Code of the Russian Federation).

Reflect and formalize the operation of obtaining land plots for free use in accounting in the same way as for any other property. For more information about this, see How to record the receipt of property for free use in accounting.

We buy and sell land plots

In tax accounting, the costs of acquiring rights to land plots are included in other expenses associated with production and sales in a special manner (clause 1 of Article 264.1 of the Tax Code of the Russian Federation). Such expenses are recognized as expenses of the reporting (tax) period in one of two ways:

- evenly over a period determined by the organization independently and should not be less than five years;

- in an amount not exceeding 30% of the tax base of the previous tax period, until the full amount of expenses is fully recognized.

Accounting when purchasing a plot If land plots are acquired for one’s own use, and not for sale or gratuitous transfer, they are accounted for as part of fixed assets (clause.

5

Attention

PBU 6/01). Objects are accepted for accounting at their original cost. It includes the cost of acquisition and expenses for registering property rights (clauses

7, 8 PBU 6/01).

Dt 1 106 03 330 Kt 1 302 21 730 380 thousand rub. — drainage costs are taken into account; Dt 1 103 01 330 Kt 1 106 03 430 2 930 thousand rub. - the site has been registered. Capital investments for land improvement are reflected in accounting accounts on the basis of acts of work performed.

Accounting for agricultural land: standard entries Accounting for agricultural land is carried out using the following account correspondence: Contents of the transaction Account correspondence Debit Credit Purchased a plot of land in ownership 08 60 State duty for registration and registration is taken into account 08 76 Services for land surveying, assessment, etc. are taken into account .

Tax accounting

Land tax

Organizations and entrepreneurs who own and use land plots indefinitely are payers of land tax (Article 388-1 of the Tax Code of the Russian Federation). The tax base is determined by the cadastral value of the site and is a fixed value. Tax rates are determined at the regional level depending on the category of land.

VAT

Land purchase and sale transactions are not subject to VAT (RF Tax Code Art. 146-2, paragraph 6). This applies to both entire plots and shares in them. At the same time, according to Art. 161 of the Tax Code of the Russian Federation, paragraph 3, paragraph. 2, municipal property is subject to VAT when it is sold. The Ministry of Finance (Letter No. 03-07-11/03 dated 13-01-10) explained that municipal and state-owned land plots, despite the above, are excluded from VAT taxation. At the same time, buildings on it are subject to VAT.

Lease of land in state ownership, municipal ownership, as well as land of constituent entities of the Russian Federation is not subject to VAT (Article 149 2 paragraphs of the Tax Code of the Russian Federation). At the same time, sublease of such lands is subject to VAT (Letter of the Ministry of Finance No. 03-07-11/436 dated 10/18/12). Under private property lease agreements, VAT is applied (Letter No. GD-3-3/2391 of the Federal Tax Service dated 06/18/15).

Income tax

You can take into account the costs of purchasing land only at the time of its sale, reducing income by the amount of the purchase of land and the costs of its sale (Articles 268, 271 of the Tax Code of the Russian Federation). According to Art. 264-1 of the Tax Code of the Russian Federation, expenses for the purchase of land in state or municipal ownership, on which buildings, structures, structures are located, or which are acquired for capital construction purposes, can be recognized as income tax expenses.

Sale of land, posting in accounting

The actual transfer of the land took place in May 2015. The transfer of ownership was registered in June 2020. According to accounting and tax records, the cost of the land plot is 1,207,500 rubles. In accounting, Alpha's accountant made the following entries.

May 2020: Debit 45 subaccount “Transferred real estate” Credit 01– 1,207,500 rub. – reflects the disposal of the land plot before the transfer of ownership. June 2020: Debit 91-2 Credit 45– 1,207,500 rub.

– the cost of the land plot is reflected in other expenses; Debit 76 Credit 91-1– 1,600,000 rub. – the amount of compensation (reimbursement) for the seizure is reflected in other income. For tax accounting purposes, the organization reflected the disposal of land as an ordinary sale. In tax accounting, the taxable profit from the sale of the land plot amounted to 92,500 rubles. (RUB 1,300,000 – RUB 1,207,500). It can be obtained not only by the owner, but also by the copyright holder (user). The amount of compensation, timing of transfer of the land plot and other conditions of withdrawal are specified in an agreement with the land owner. The amount of compensation includes:

- market value of the land plot;

- the market value of real estate on this land plot;

- the amount of losses caused by the withdrawal (including lost profits).

This procedure is established by Articles 279 and 281 of the Civil Code of the Russian Federation, 56.8 and 56.9 of the Land Code of the Russian Federation. Write off the land plot from the register on the date of termination of ownership of it. When written off, reflect the book value of the land plot as part of other expenses, and the compensation received for it – as part of other income. This conclusion follows from paragraph 12 of PBU 9/99, paragraph 16 of PBU 10/99, paragraph 31 of PBU 6/01.

Article 12. Features of issuing permission to put an artificially created land plot into operation

1. The following documents are attached to the application (applications) for the issuance of permission to put an artificially created land plot into operation (hereinafter also referred to as permission to put into operation):

(as amended by Federal Law dated July 13, 2015 N 213-FZ)

(see text in previous)

1) permission to carry out work to create an artificial land plot or permission to construct a capital construction project in the case specified in Article 16 of this Federal Law;

(as amended by Federal Law dated July 13, 2015 N 213-FZ)

(see text in previous)

2) an act of acceptance of an artificial land plot (if the provision of such an act for issuing permission to put an object into operation is provided for by the Town Planning Code of the Russian Federation);

3) a document confirming the compliance of the artificial land plot with the requirements of technical regulations and signed by the person creating it;

4) a document confirming the compliance of the parameters of the artificially created land plot with the project documentation and signed by the person carrying out its creation;

5) the conclusion of the state construction supervision body on the compliance of the artificially created land plot with the requirements of technical regulations and design documentation, the conclusion of the state environmental supervision.

(edited)

Accounting areas - preparing a list

At one time, I sketched out for myself a small diagram of the accounting sections. I noticed that visualization helps to grasp the theory faster. So why not use this in our accounting teaching? Today we will “identify” some areas of accounting with you and draw a diagram. In this practical article we will solve two problems at once:

First task . We will start your thinking process. You yourself will begin to “get” the knowledge that you already have. We'll just tie them together.

Second task . You will see that the so-called specifics of an enterprise are far from what novice accountants “wind up” in their heads.

As always, let's start with the fact that we already know the names of some areas of accounting:

- site by suppliers

- plot by buyer

- loan area

- cash area - cash desk

- non-cash area - bank

Let's take, for example, any enterprise. Just look out the window or in the classifieds section of the newspaper, or just watch the advertisements on TV. You will see a lot of different business names.

Whatever these companies do, there are several main points that unite them. Let's try to highlight these moments together.

I will ask leading questions, you answer silently, and then I will write my answer and you can compare. Do you agree?

Who do we meet at companies?

Who do we encounter when we come to any company? Who do we see when, for example, we go to the checkout in a store? What if we go buy a ticket to a travel agency or call a real estate agency to find out about apartments for sale? Who are we meeting? Isn’t it with people who are representatives of the companies we contact? Do you agree?

It turns out that every enterprise, large or small, has people. No operating enterprise can carry out its activities without human participation. Such people in relation to. So, all companies have employees. Let's discuss further.

What do employees mean to a company? What does the company do in relation to its employees? Doesn't he use their time and knowledge to carry out his activities? If you agree with this, then I’m sure you’ll agree that work should be paid, right? By paying the labor of its Employees, the company incurs costs (expenses).

Of course, the amount for the work of Employees, the so-called Payroll Fund (WF) is not everything that is related to employees. With payroll, the enterprise itself also pays taxes to various funds: Social Insurance Fund, Pension Fund, Federal Compulsory Medical Insurance Fund.

These amounts are directly related to conversations about pensions, benefits, social benefits, etc. Thus, any enterprise is made up of employees. Employees mean payment for labor and payment of taxes to the state from this payment (with payroll).

Payroll and payroll taxes for an enterprise are considered costs (expenses).

You noticed that I write costs (expenses). This is a new term that I am gradually introducing into our accounting lexicon. We will leave the meaning and understanding of this term for future articles. Now it is important to note that there is such a term in accounting. Intuitively, I'm sure you understand what it means. More details to come.

Buildings as an image of enterprises

Remember one of the very first articles where I tried to represent the abstract term “enterprise” in the form of... remember? Of course the building! I said that any enterprise means either renting offices and premises, or having its own building. What does this idea tell us? What does it mean for businesses to have premises for rent or their own building? Let's try to come to an answer to these questions together.

What is rented space or own building for companies? Isn’t it the same when we live in our apartments and pay for utilities and electricity? And who rents an apartment pays rent? If you agree, then answer the following question: what do these utilities, electricity, and rent mean for your personal budget? Is it not costs? Here! The same goes for enterprises.

Enterprises either rent premises or have their own buildings. For “being” in the building, the enterprise pays rent, electricity, etc. The enterprise that owns the building pays utility bills, electricity and other payments for the maintenance of the building. Thus, it turns out that every enterprise has costs (expenses) for its “place in the sun.”

Why do companies work?

What more can we say about any enterprise, no matter what it does? Let's remember what the general purpose of any commercial enterprise is. Would you say to do something for the sake of the process itself? J no, of course. The goal is to make money. Any enterprise must take into account information about how much it earns while carrying out its activities.

I will note only one point: “how much one earns” is not money in the cash register or in the bank. We all know that selling doesn’t always mean getting money right away, don’t you agree?

And finally, I’ll say a couple more similarities. Agree that enterprises keep their premises and buildings clean, or at least strive to do so. In any case, for this, companies buy household supplies: mops, buckets, powders, etc.

The company also uses office supplies in its work: paper, pens, folders, etc.

It doesn’t matter what the company does, it uses all this: issue a salary certificate to the employee, issue an order for the enterprise, print out a payroll for the payment of wages and many, many other things that are required for the operation of the company. All this is called stationery. Such values, material assets, are taken into account in the accounting section - Materials.

Conclusion

It's time to sum up a little. Our knowledge is increasing. Our task is to slowly systematize them, find connections and put them in our heads. If you have questions about the articles, please ask them or write them down to receive answers in the following materials.

At the moment, we are preparing to draw a diagram of the accounting areas. To do this, we do not try to memorize it, as if I showed it to you right away. No.

Acquisition of land - posting

Federal Law of June 25, 2012 N 93-FZ)

(see text in previous)

2. To obtain permission to commission, it is permissible to require only the documents specified in Part 1 of this article.

3. The body that issued a permit to carry out work on the creation of an artificial land plot, within ten days from the date of receipt of the application for a commissioning permit, is obliged to verify the availability of the documents specified in part 1 of this article, the correctness of their execution and issue the applicant a permit for commissioning or refuse to issue such a permit, indicating the reasons for the refusal.

4. The grounds for refusal to issue a commissioning permit are:

1) absence of documents specified in part 1 of this article;

2) non-compliance of the artificially created land plot with the requirements established in the permit for work to create an artificial land plot;

3) discrepancy between the parameters of the artificially created land plot and the design documentation.

5. In the case specified in Part 5 of Article 10 of this Federal Law, a permit to put an artificially created land plot into operation and a capital construction project located on it is simultaneously issued.

5.1. In the case specified in Part 5 of this article, to obtain permission to put a capital construction project into operation the following is not required:

1) title documents for the land plot;

2) urban planning plan of the land plot.

(Part 5.1 introduced by Federal Law dated July 13, 2015 N 213-FZ)

6. From the date of issuance of permission to put an artificially created land plot into operation, it is also recognized as a land plot, the use and circulation of which are carried out in accordance with this Federal Law, civil legislation and land legislation.

7. The form of permission to put an artificial land plot into operation is established by the federal executive body responsible for the development and implementation of state policy and legal regulation in the field of construction.

(Part 7 introduced by Federal Law dated July 13, 2015 N 213-FZ)

Is the land plot an object of fixed assets?

First Capital Legal Center

Telephone: +7,

Is a land plot an object of fixed assets?

First of all, we will find out whether the land plot is an object of fixed assets for profit tax purposes. According to para. 1 clause 1 art. 257 of the Tax Code of the Russian Federation, fixed assets are understood as part of the property used as means of labor for the production and sale of goods (performance of work, provision of services) or for the management of an organization, with an initial cost of more than 40,000 rubles. Moreover, from the title of this article it follows that it establishes the procedure for determining the value of depreciable property . From this we can conclude that fixed assets are depreciable property. But does this apply to all fixed assets?

The concept of depreciable property is given in paragraph 1 of Art. 256 Tax Code of the Russian Federation. This includes property, results of intellectual activity and other objects of intellectual property that are owned by the taxpayer (unless otherwise provided by Chapter 25 of the Tax Code of the Russian Federation), used by him to generate income and the cost of which is repaid by calculating depreciation . Depreciable property is property with a useful life of more than 12 months and an original cost of more than 40,000 rubles.

However, by virtue of clause 2 of Art. 256 of the Tax Code of the Russian Federation, land and other environmental management objects (water, subsoil and other natural resources), along with inventories, goods, capital construction projects in progress, securities, and financial instruments of futures transactions are not subject to depreciation. Consequently, according to the author, land plots are not depreciable property. Does this mean that they should not be considered fixed assets? The answer is ambiguous due to the uncertainty in the provisions of the Tax Code. At the same time, there is an opinion among judges that land plots acquired for production purposes are classified as fixed assets that are not subject to depreciation (Resolutions of the Federal Antimonopoly Service of the North-West District dated October 16, 2012 in case No. A05-9110/2011, dated March 30, 2012 on case No. A13-1127/2011). In fact, the Presidium of the Supreme Arbitration Court of the Russian Federation insists on the same position (see Resolution No. 14231/05 of March 14, 2006).

According to paragraph 2 of Art.

Acquisition of a building and land underneath it: accounting and taxation procedures

When should we put a warehouse on the books?

The accounting procedure for fixed assets is regulated by the Accounting Regulations PBU 6/01 “Accounting for Fixed Assets” (approved by order of the Ministry of Finance of the Russian Federation dated March 30, 2001 No. 26n), Methodological Guidelines for Accounting of Fixed Assets (approved by order of the Ministry of Finance of the Russian Federation dated October 13, 2003 No. 91n), Regulations on accounting and financial reporting in the Russian Federation, pp. 41, 42, 46-54 (approved by order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n).

According to paragraphs. “a” clause 4 of PBU 6/01, an asset is accepted by the organization for accounting as fixed assets, provided that it is intended for use in the production of products, when performing work or providing services, for the management needs of the organization or for provision by the organization for a fee in temporary possession and use or temporary use.

According to clause 21 of the Methodological Guidelines for Accounting of Fixed Assets (hereinafter referred to as the Guidelines), fixed assets, depending on the rights the organization has to them, are divided into fixed assets:

— owned by an organization by right of ownership;

- those that are under the organization’s economic control or operational management;

— received by the organization for rent;

— received by the organization for free use;

— received by the organization for trust management.

According to clause 52 of the Methodological Instructions (as amended in force from 01/01/2011), real estate objects, the ownership rights to which are not registered in the manner prescribed by law, are accepted for accounting as fixed assets with allocation on a separate sub-account to the fixed assets accounting account.

According to clause 41 of the Regulations on accounting and financial reporting in the Russian Federation, hereinafter referred to as PVBU (as amended in force from 01/01/2011), unfinished capital investments include costs for the acquisition of buildings and equipment not formalized by acceptance certificates of fixed assets and other documents , other material objects of durable use.

Thus, from the norms of clause 4 of PBU 6/01, pp. 21 and 52 of the Methodological Instructions and clause 41 of the PVBU, applied in aggregate, it follows that an organization has the right to accept a real estate object for accounting as a fixed asset, provided that:

— ownership of the object has transferred to the organization;

— the object is transferred to the organization on the basis of an acceptance certificate or other document;

— the facility has been put into operation and is used for production or management needs.

As follows from the question, the purchase and sale agreement for the property was signed in May 2011. According to the agreement, ownership of the warehouse passes to the buyer on the date of signing the acceptance certificate. The transfer and acceptance certificate of the object was signed in December 2011, in the same month the buyer's ownership of the warehouse was registered in the prescribed manner.

In the accounting records of the organization (buyer), these transactions are reflected in the following entries:

Debit 60, subaccount “Advances issued” Credit 51 – on the date of payment: payment under the purchase and sale agreement was transferred;

Debit 68, subaccount “Calculations with the budget for VAT” Credit 76 “VAT on advances issued” - for the amount of VAT on the advance transferred to the buyer (this entry can only be made if there is an invoice from the seller for the advance);

Debit 08.4 Credit 60, subaccount “Settlements with suppliers and contractors” - as of the date of the transfer and acceptance certificate of the object: the acquired object is taken into account as part of unfinished capital investments, the ownership of which has transferred to the organization;

Debit 19.1 Credit 60, subaccount “Settlements with suppliers and contractors” - VAT presented by the seller in the invoice;

Debit 60, subaccount “Settlements with suppliers and contractors” Credit 60, subaccount “Advances issued” - offset of the advance issued;

Debit 76 “VAT on advances issued” Credit 68, subaccount “Calculations with the budget for VAT” - VAT on advances has been restored (only if the seller issued an invoice for the advance);

Debit 01 Credit 08.4 – fixed assets are accepted for accounting as part of fixed assets based on the manager’s order to put the facility into operation and accept it for accounting (as of the date of the manager’s order, which is drawn up in December, provided that the warehouse is ready for operation);

Debit 68, subaccount “Calculations with the budget for VAT” Credit 19.1 – tax deduction of VAT on the registered object.

According to clause 21 of PBU 6/01, the accrual of depreciation charges for an item of fixed assets begins on the first day of the month following the month in which this item was accepted for accounting .

In the situation described in the question, the accrual of depreciation for the warehouse in accounting begins in January 2012.

When should we include a warehouse as part of fixed assets in tax accounting?

According to paragraph 1 of Art. 256 of the Tax Code of the Russian Federation, depreciable property is property that is owned by the taxpayer and is used by him to generate income.

According to paragraph 11 of Art. 258 of the Tax Code of the Russian Federation, fixed assets, the rights to which are subject to state registration, are included in the corresponding depreciation group from the moment of the documented fact of filing documents for registration of these rights.

As follows from the question, the ownership of the warehouse building was transferred to the organization in December 2011, in the same month documents were submitted for state registration of this right, the warehouse was put into operation and began to be used for business activities. Therefore, for profit tax purposes, the item should be included in the appropriate depreciation group in December 2011.

According to paragraph 4 of Art. 259 of the Tax Code of the Russian Federation, depreciation calculation for depreciable property objects begins on the 1st day of the month following the month in which this object was put into operation . Accordingly, depreciation on the warehouse should be calculated for profit tax purposes starting in January 2012.

Can we take into account the costs of purchasing a land plot for income tax?

In accordance with paragraph 1 of Art. 264.1 of the Tax Code of the Russian Federation, expenses for the acquisition of rights to land plots are expenses for the acquisition of land plots from lands in state or municipal ownership on which buildings, structures, structures are located or which are acquired for the purposes of capital construction.

According to clause 5 of Federal Law No. 268-FZ of December 30, 2006, this norm applies to taxpayers who entered into agreements for the acquisition of land plots in the period from January 1, 2007 to December 31, 2011.

With regard to land purchase and sale agreements concluded in 2012, this provision does not apply.

According to paragraph 2 of Art. 256 of the Tax Code of the Russian Federation, land is not subject to depreciation. Consequently, for profit tax purposes, it is impossible to take into account the costs of acquiring land through depreciation charges.

The organization has the right to take into account the costs of acquiring a land plot for profit tax purposes only when selling this land plot on the basis of paragraph 2 of clause 1 of Art. 268 Tax Code of the Russian Federation.

How to account for land in accounting?

According to clause 5 of PBU 6/01, land plots are taken into account as part of fixed assets. On the date of concluding the contract for the sale and purchase of a land plot, the following entry should be made in the accounting records: Debit 08.1 Credit 60. The inventory value of the land plot (according to the debit of subaccount 08.1) should also include other costs associated with its acquisition, in accordance with clause 8 PBU 6/01.

After state registration of ownership of a land plot, it should be taken into account as part of fixed assets: Debit 01 Credit 08.1.

According to clause 17 of PBU 6/01, land plots are not subject to depreciation.

When should we start paying property taxes?

Taxpayers of corporate property tax are organizations that have property recognized as an object of taxation in accordance with Art. 374 of the Tax Code of the Russian Federation (clause 1 of Article 373 of the Tax Code of the Russian Federation).

Objects of taxation for Russian organizations are movable and immovable property recorded on the balance sheet as fixed assets in the manner established for accounting .

Thus, when calculating property tax, the tax base includes the residual value of fixed assets according to accounting data.

The residual value of the warehouse, which was accepted for accounting in December 2011, should be reflected in the tax return for corporate property tax for 2011 on line 140 (as of December 31) of section 2. In this case, the residual value of the warehouse in December 2011 will be equal to its original cost.

Please note that land plots are not recognized as objects of taxation by the corporate property tax (clause 1, clause 4, article 374 of the Tax Code of the Russian Federation).

Should we register for taxation in the Leninsky district at the location of the land plot and separate division (warehouse)?

Based on clause 4 of Art. 83 of the Tax Code of the Russian Federation, in order to conduct tax control, organizations and individuals are subject to registration with the tax authority at the location of the real estate they own. Land plots are classified as real estate (Clause 1, Article 130 of the Civil Code of the Russian Federation).

According to paragraph 5 of Art. 83 of the Tax Code of the Russian Federation, registration of an organization at the location of real estate is carried out on the basis of information reported by the bodies specified in Art. 85 Tax Code of the Russian Federation.

According to paragraph 4 of Art. 85 of the Tax Code of the Russian Federation, bodies carrying out state registration of rights to real estate and transactions with it are obliged to report information about real estate located on the territory under their jurisdiction and about its owners to the tax authorities at their location within 10 days from the date of corresponding registration.

Thus, the organization is subject to registration with the tax authority at the location of the land plot on the basis of information that is sent to the tax authority by the body carrying out state registration of rights to land plots. The tax authority is obliged to register a legal entity at the location of the land plot within 5 days from the date of receipt of the above information and issue or send by mail to the taxpayer a notice of its registration (clause 2 of Article 84 of the Tax Code of the Russian Federation).

The Tax Code does not provide for the taxpayer’s obligation to independently perform any actions to register for taxation at the location of the real estate.

Since the land plot is located in the Leninsky district of Krasnoyarsk, registration will be carried out by Interdistrict Inspectorate No. 24 of the Federal Tax Service of Russia for the Krasnoyarsk Territory (Krasnoyarsk, Pavlova St., 1, building 4).

According to Art. 11 of the Tax Code of the Russian Federation, a separate division of an organization is any territorially separate division from it, at the location of which stationary workplaces . Recognition of a separate division of an organization as such is carried out regardless of whether its creation is reflected or not reflected in the constituent or other organizational and administrative documents of the organization, and on the powers vested in the specified division. In this case, a workplace is considered stationary if it is created for a period of more than one month.

As follows from the question, stationary workplaces are not equipped at the location of the warehouse. In this regard, the organization does not form a separate division from the point of view of tax legislation, and there is no obligation to register it with the tax authority.

When does our obligation to pay land tax begin?

According to paragraph 1 of Art. 388 of the Tax Code of the Russian Federation, taxpayers of land tax are organizations and individuals who own land plots recognized as an object of taxation in accordance with Art. 389 of the Tax Code of the Russian Federation, on the right of ownership , on the right of permanent (perpetual) use or the right of lifelong inheritable possession.

According to paragraph 1 of Art. 389 of the Tax Code of the Russian Federation, the object of taxation is land plots located within the municipality on the territory of which the tax has been introduced.

The Ministry of Finance of the Russian Federation in a letter dated July 12, 2012 No. 03-05-06-02/47 explained that the basis for paying land tax is the presence of title documents by the taxpayer. Based on paragraph 1 of Art. 131 of the Civil Code of the Russian Federation, ownership and other real rights to immovable things, restrictions on these rights, their emergence, transfer and termination are subject to state registration in the unified state register by bodies carrying out state registration of rights to real estate and transactions with it.

State registration is the only evidence of the existence of a registered right. The obligation to pay land tax arises for an organization from the moment an entry is made in the register (letter of the Ministry of Finance of the Russian Federation dated March 15, 2010 No. 03-05-05-02/12).

Thus, the organization will become a payer of land tax from the month in which ownership of the land plot is registered.

At what rate should we pay land tax?

Tax rates for land tax are established by regulatory legal acts of representative bodies of municipalities (clause 1 of Article 394 of the Tax Code of the Russian Federation).

In Krasnoyarsk, the procedure for collecting land tax is established by the Decision of the Krasnoyarsk City Council dated July 1, 1997 No. 5-32. The land tax rate is set as a percentage of the cadastral value of the land plot. At the same time, the rate of 0.1% is established in relation to land plots:

— occupied by housing stock, housing and communal services engineering infrastructure facilities;

— intended for housing construction;

— classified as agricultural lands;

- intended for personal farming, gardening, summer cottage farming, gardening or horticulture;

- occupied by garages and parking lots.

For other land plots the rate is 1.5%.

The land plot occupied by a warehouse intended for wholesale trade is classified as other land plots.

What is the procedure for paying land tax and submitting tax reports in Krasnoyarsk?

According to clause 2.3.1 of the Decision of the Krasnoyarsk City Council dated July 1, 1997 No. 5-32, organizations pay:

- land tax no later than February 10 of the year following the expired tax period;

— advance payments no later than the last day of the month following the reporting period.

The reporting periods for land tax for organizations are the 1st quarter, 2nd quarter, 3rd quarter of the calendar year (clause 1 of Article 393 of the Tax Code of the Russian Federation).

For the tax period (calendar year), organizations submit a tax return for land tax at the location of the land plot no later than February 1 of the year following the expired tax period (Article 398 of the Tax Code of the Russian Federation). The declaration form was approved by Order of the Federal Tax Service of Russia dated October 28, 2011 No. ММВ-7-1/ [email protected]

Organizations do not provide advance tax calculations.

Thus, an organization whose land plot is located in the Leninsky district of Krasnoyarsk must submit a tax return for the tax period (calendar year) to Interdistrict Inspectorate No. 24 of the Federal Tax Service of Russia for the Krasnoyarsk Territory.

How to calculate land tax if land ownership is registered in August 2012?

The tax base for land tax is calculated in relation to each land plot and is equal to its cadastral value established as of January 1 of the year that is the tax period. For a land plot that was not formed from the beginning of the tax period, the cadastral value is determined as of the date the land plot is registered for cadastral registration. Grounds - clause 1 of Art. 391 Tax Code of the Russian Federation.

The organization determines the tax base independently on the basis of information from the state real estate cadastre about each land plot it owns (clause 3 of Article 391 of the Tax Code of the Russian Federation). A taxpayer can obtain information about the cadastral value of a land plot by contacting the territorial body of Rosreestr, which provides the specified information in the manner established by Decree of the Government of the Russian Federation of 02/07/2008 No. 52 “On the procedure for bringing the cadastral value of land plots to the attention of taxpayers.”

The procedure for calculating the amount of tax and advance payments is established by Article 396 of the Tax Code of the Russian Federation.

If an organization registers a land plot in August, then for the 3rd quarter the organization must calculate and pay an advance payment to the budget no later than October 31.

When calculating the advance payment, ¼ of the tax rate (0.375%) is applied. If the right to a land plot does not arise from the beginning of the quarter, then the advance payment is calculated taking into account the coefficient, which is defined as the ratio of the number of full calendar months of ownership of the plot to three:

— until August 15 inclusive, a coefficient of 2/3 is applied;

- after August 15 - 1/3.

For example, if the cadastral value of a land plot is 2,000,000 rubles, the advance payment will be:

a) registration until August 15 inclusive - 2,000,000 x 0.375% x 2/3 = 5,000 rubles;

b) registration after August 15 – 2,000,000 x 0.375% x 1/3 = 2,500 rubles.

The amount of tax payable to the budget no later than February 10 of the following year is calculated in a similar way. The adjustment coefficient is determined as the ratio of the number of full months of ownership of the plot in the tax period to 12. In this case, the tax calculated for the tax period is reduced by the amount of accrued advance payments.

For the example considered, the amount of tax payable to the budget will be:

a) registration until August 15 inclusive - 2,000,000 x 1.5% x 5/12 - 5,000 = 7,500 rubles;

b) registration after August 15 – 2,000,000 x 1.5% x 4/12 – 2,500 = 7,500 rubles.

How to reflect the costs of paying land tax in accounting and tax accounting?

The procedure for attributing land tax to expenses in accounting should be provided for in the accounting policy. These expenses can be included both in expenses for ordinary activities and in other expenses.

In an organization engaged in wholesale trade, expenses for ordinary activities include expenses associated with the acquisition and sale of goods (clause 5 of PBU 10/99, approved by Order of the Ministry of Finance of the Russian Federation dated May 6, 1999 No. 33n). The composition of other expenses is given in clause 11 of PBU 10/99; the list of these expenses is open.

For accounting purposes, land tax expenses are reflected on the date of accrual of advances and taxes (last day of the quarter): Debit 91.2 (or 44) Credit 68, subaccount “Settlements with the budget for land tax.”

In tax accounting, land tax expenses are reflected as part of other expenses associated with production and sales (clause 1, clause 1, article 264 of the Tax Code of the Russian Federation). These expenses for profit tax purposes are recognized on the date of accrual of taxes (advance payments) (clause 1, clause 7, article 272 of the Tax Code of the Russian Federation).

How to reflect in accounting and tax accounting the costs of connecting the warehouse to the power supply (obtaining technical specifications, purchasing panels, electric meters), which were incurred after the warehouse was put into operation?

Due to the fact that the organization acquired, under a purchase and sale agreement, a used property that was ready for use and did not require additional work, the object was legally accepted for accounting as part of fixed assets.

Expenses for the purchase of electrical appliances and services for connecting to electrical networks are included in the current expenses of a trading organization and are included in distribution costs under the item “Costs for the maintenance and operation of buildings and structures.” These expenses are reflected in accounting by the following entries:

Debit 44 Credit 10 – the cost of electrical appliances installed in the building has been written off;

Debit 44 Credit 60 (76) – reflects the fee for technological connection to electrical networks.

According to paragraph 1 of Art. 252 of the Tax Code of the Russian Federation, for profit tax purposes, documented economically justified costs are recognized, the assessment of which is expressed in monetary form. Economic justification means that the expenses were incurred as part of a business activity, the purpose of which is to generate income. According to paragraphs. 2 p. 1 art. 253 of the Tax Code of the Russian Federation, costs associated with production and sales include costs for the maintenance and operation, repair and maintenance of fixed assets and other property, as well as for maintaining them in good (up-to-date) condition.

According to paragraphs. 2 p. 1 art. 254 of the Tax Code of the Russian Federation, material costs include costs for the acquisition of materials used for production and economic needs (including maintenance, operation of fixed assets and other similar purposes).

The letter of the Ministry of Finance of the Russian Federation dated April 10, 2009 No. 03-03-05/62 states that fees for technological connections to electrical networks are taken into account for profit tax purposes as part of other expenses associated with production and sales, based on paragraphs. 49 clause 1 art. 264 Tax Code of the Russian Federation.

A similar point of view is contained in the letter of the Ministry of Finance of the Russian Federation dated 05/03/2011 No. 03-03-06/1/279 regarding the fee for ensuring the technical possibility of connecting to sewerage networks.