Postings for the return of money and goods in the buyer’s accounting department

If significant deficiencies or defects are identified, the buyer may refuse to fulfill the terms of the contract in full and demand the supplier to return the money paid.

In such a situation, the buyer must send a written claim to the supplier to terminate the contractual relationship with a demand for a refund of the money paid.

The seller, in turn, has the right to return the goods refused by the buyer.

If the need to return the goods and money occurred after the buyer had posted material assets, then if the issue of returning the goods and money is resolved positively, entries will be made in the buyer’s accounting department to the appropriate sub-accounts, based on the claim to the seller and the invoice for the returned goods:

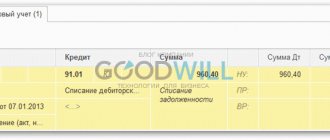

- D-t 62 invoices and K-t 90 invoices - for the amount of the returned goods,

- Invoice Dt 90 and Invoice Dt 68 - VAT is charged on the returned goods.

A refund from the supplier (seller) to the buyer’s bank account for a low-quality product (service) or a product of the wrong assortment will look like this:

- D-t 51 invoices and K-t 62 invoices - for the amount of the invoice issued by the buyer for the return of goods.

If the refund by the seller (supplier) was made directly at the buyer's (customer) cash desk, then the posting of the refund will look like a debit of 50 and a credit of 62 accounts.

Accounting account 76: balance, credit, debit, postings

In addition, the sub-accounts provided for in the Chart of Accounts are used by the organization based on the requirements of the management of the organization, including the needs of analysis, control and reporting. An organization can clarify the contents of the subaccounts shown in the Chart of Accounts, exclude and combine them, and also introduce additional subaccounts. Confirmation: count. 51, 60, 76 Instructions for the Chart of Accounts. At the same time, so that the reconciliation report with the counterparty does not reflect a “transfer” that was not in the reconciliation report, it is possible to reflect both the “transfer” and the “return” on a separate sub-account for account 76. That is, make two postings: D 76 K51 and D51 K 76 for the same amount. This answer is prepared based on the information contained in the question. If the question referred to a different situation, it is necessary to specify it, outlining it in as much detail as possible.

Refund of erroneously (excessively) paid funds

Refunds of funds transferred to the supplier by mistake are made on the basis of a letter from the customer, which indicates the payment document, its number, date and the amount paid by mistake.

The party that received the erroneous amount reconciles the calculations and deliveries. If excess money is discovered, the supplier returns it to the customer.

In the accounting department of the customer (buyer), the erroneously transferred money is reflected in account 76, the corresponding subaccount.

Posting a refund of funds erroneously transferred to the seller to the customer’s bank account will look like:

- D-t 51 accounts and K-t 76 accounts - in the amount of excessively (erroneously) transferred funds.

The return of money through the customer's cash desk is recorded as turnover on the debit of account 50 and the credit of account 76.

Consultation on accounting entries for financial returns can be obtained from organizations specializing in consulting accountants or tax authorities. Qualified employees of these organizations will answer any questions you may have regarding accounting for the company’s funds.

Refund from the supplier of the excessively transferred amount

the receipt of funds under the temporary order of a budget institution (funds that, upon the occurrence of certain conditions, are subject to return to the owner or transfer to their destination in the manner established by him - deposits, funds for storage, etc.) is reflected in the debit of account 320111510 “Receipts of funds of the institution to personal accounts with the treasury body" and credit accounts 230401730 "Increase in accounts payable for funds received for temporary disposal", 321003660 "Decrease in accounts receivable for transactions with a financial authority in cash"; the receipt of budget investments into a separate personal account of a budget institution opened in the territorial body of the Federal Treasury (financial body of a constituent entity of the Russian Federation (municipal entity) in the manner established by the legislation of the Russian Federation is reflected in the debit of account 620111510 “Receipts of funds from the institution to personal accounts in the treasury body "and the credit of account 620581660 "Reduction of accounts receivable for other income"; receipt of funds to the personal account of a budgetary institution for settlements between the head institution and separate divisions (branches) is reflected: in the debit of account 020111510 "Receipt of funds of the institution to personal accounts with the treasury authority "and the credit of account 020113610 "Retirement of funds of an institution in the treasury body in transit", the corresponding analytical accounting account of account 030404000 "Intradepartmental settlements";

receipt of subsidies for other purposes to a separate personal account of a budgetary institution opened in the territorial body of the Federal Treasury (financial body of the subject of the Russian Federation (municipal entity) in the manner established by the legislation of the Russian Federation, is reflected in the debit of account 520111510 “Receipts of funds of the institution to personal accounts in the treasury body” and the credit of account 520581660 “Reduction of accounts receivable for other income”;

Documentation of refund to the buyer

According to Article 466 of the Civil Code of the Russian Federation, the buyer has the right to return the goods if they are delivered in quantities less than those provided for in the contracts. If there are discrepancies in the assortment, the return is carried out on the basis of Article 468 of the Civil Code of the Russian Federation. If a product is found to be of inadequate quality, the customer issues a return in accordance with Article 475 of the Civil Code of the Russian Federation.

When returning goods, the buyer draws up the following documents:

- A report on identified discrepancies, drawn up in the TORG-2 form (for imported goods - TORG-3 form). This document is drawn up if, upon shipment of the goods and after payment, the customer identifies deviations in the quality or quantity of products, as well as if inconsistencies are detected in the shipping documents.

- Invoice (form TORG-12), which is used to issue a return if a product is found to be defective or the product does not comply with the approved state or contractual standard.

These documents are transferred to the supplier along with a letter of refund, on the basis of which the supplier accepts the products, and the buyer is credited with the previously made prepayment.

Refunds to the buyer: accounting with the customer and the supplier

Let's consider each wiring option.

Return postings from the supplier

Example:

For convenience, let's look at accounting for a return transaction from a supplier using an example. An agreement was concluded between Phobos LLC and Demos LLC for the supply of paint and varnish products, where Phobos is the supplier and Demos is the buyer. The products were sold at a price of 155,000 rubles. at a cost of 88,000 rubles. "Demos" made 100% payment for the goods. Due to non-compliance with the quality characteristics, Demos returned the entire consignment of goods, having issued a TORG-2 act. Upon the return of the products, Phobos credited the previously paid funds to the Demos bank account.

The following entries were made in the accounting of Phobos LLC:

| Dt | CT | Base | Sum | Document |

| 62 | 90/1 | Reflection of revenue from the sale of paint and varnish products | 155,000 rub. | Packing list |

| 90/2 | 43 | Write-off of the cost of paint and varnish products | 88,000 rub. | Costing |

| 90/3 | 68 VAT | VAT accrual on shipped goods | RUB 23,644 | Packing list |

| 51 | 62 | Payment for products has been received from Demos | 155,000 rub. | Bank statement |

| 68 VAT | 51 | VAT transfer | RUB 23,644 | Packing list |

| 10 | 60 | Accounting for returned goods as part of materials | 88,000 rub. | Statement of Discrepancies |

| 19 | 60 | Accounting for VAT on returned goods | RUB 23,644 | Statement of Discrepancies |

| 68 VAT | 16 | Acceptance of returned goods for deduction | RUB 23,644 | Statement of Discrepancies |

| 60 | 51 | LLC "Demos" returned previously paid funds | 155,000 rub. | Discrepancy report, refund letter |

| 91/2 | 60 | Recognition of other expenses (RUB 155,000 - RUB 23,644 - RUB 88,000) | RUB 43,356 | Discrepancy report, delivery note, cost calculation |

Buyer's accounting

To understand what transactions are necessary to reflect the return of funds from the buyer, consider the following example:

According to the agreement, LLC “Faza” supplies LLC “Vector” with goods and materials in the amount of 24 pieces in the amount of 64,000 rubles, VAT 9,762 rubles. Upon delivery, 4 units of goods were found to be defective and were returned to Phase. The cost of defective goods and materials was credited to Vector's account.

The accountant of Vector LLC made the following entries:

| Dt | CT | Description | Sum | Document |

| 60/1 | 51 | Vector LLC paid 100% advance for the goods | 64,000 rub. | Payment order |

| 41 | 60/1 | Inventory items are registered | RUR 54,238 | Packing list |

| 19/3 | 60/1 | VAT accounting | RUB 9,762 | Packing list |

| 68 VAT | 19/3 | VAT deductible | RUB 9,762 | Invoice |

| 76/2 | 41/1 | The defective goods were returned to Faza LLC (4 units) | RUB 9,040 | Statement of Discrepancies |

| 76/2 | 68 VAT | VAT has been restored from the cost of the returned goods | RUB 1,627 | Statement of Discrepancies |

| 51 | 76/2 | A refund was received from Faza LLC for defective products | RUB 10,667 | Bank statement |

It is important to know that if a product discrepancy is identified, refunds for low-quality products are carried out only if all necessary documents are completed in full and correctly.

Accounting account 76 “settlements with various debtors and creditors”

Amounts of claims not recognized by the court are written off to “cost” accounts with entry D20,23,25,26 K76.2 or for distribution costs or commercial expenses with entry D44 K76.2, depending on the characteristics of the organization’s activities and the adopted accounting policy for accounting purposes . Payment by the debtor of the claim is reflected by entries D50,51,52 K76.2. If the claim is not fully satisfied: Example: Organization A filed a claim against the electricity supplier due to a violation of the terms of the contract in the amount of 50,000, but the court partially satisfied the claim and ordered to pay company A only 20,000. In this case, the following entries must be made in the accounting records of company A: D23 K76.02 in the amount of 30,000 - an unreimbursed claim was partially attributed to the costs of support services. D76.02 K60.01 – the supplier’s debt in the amount of 20,000 is reflected.

How to issue a refund via an online cash register: sample receipt, document flow, rules

Constituent documents, "Cash receipt order" (KO-1), 50 76-3 Receipt of cash: - from equity participation in other organizations. - on account of profits received from joint activities, Decision of participants, shareholders' meetings, "Cash receipt order order" (KO-1) 50 76-2 Receipt of the amount of claims to the organization's cash desk. »

Receipt cash order" (KO-1) 50 79 Receipt of cash from a separate division of the enterprise.

“Cash receipt order” (KO-1) 50 91-1 Sale for cash of fixed assets and other assets. “Cash receipt order” (KO-1) KKM check. 50 91-1 Reflection of positive exchange rate differences (based on changes in the ruble exchange rate against foreign currency held at the organization’s cash desk).

Accounting certificate-calculation 70 50 Issuance of wages from the cash register.

“Cash expenditure order” (KO-2), “Payroll” (T-53).

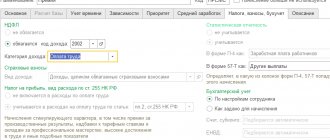

Forgiveness of an interest-free loan: we charge personal income tax According to the rules in force from 01/01/2016, when issuing an interest-free loan to an employee, personal income tax must be calculated on a monthly basis from the individual’s benefit from saving on interest.

The question arises: what to do with the already accrued tax amounts in the case when the lender forgives the borrower the entire amount of the loan issued. <... Paying tax “for that guy” - a taxpayer’s passport is not required. According to the current rules, you can pay tax not only for yourself, but also for another taxpayer (including an individual). To do this, you just need to fill out the payment form correctly. There is no need to submit any additional documents to the bank. < … Home → Accounting consultations → Accounting Current as of: September 22, 2020

In one of the consultations, we discussed general issues of synthetic and analytical accounting of cash transactions.

One of them is attached to the product report, and the other is given to the buyer and is the basis for receiving money from the cash register. 2

Next, on the check that was previously issued at the same cash desk, sign the director of the organization (deputy).

Then the check needs to be pasted on a piece of paper and handed over to the accounting department. 3

Record the amount paid for a returned customer or unused cash receipt in the cashier-operator's book.

As a result, the amount of revenue for a given day is reduced by the amount received. 4 If the goods are returned not on the day of purchase, but a day later, then the money is returned from the organization’s main cash register, but solely on the basis of a written application from the buyer, indicating his data, and upon presentation of a document that proves his identity.

Accounting entries 50-1 62, 76, 90-1 Reduced by reversing cash register revenue due to the return of money to buyers (clients) on unused cash receipts (including erroneously punched cash receipts) Accounting accounts used in the entries

- 50 — Cash deskAccount 50 “Cash desk” is intended to summarize information about the availability and flow of funds in the organization’s cash desks. Subaccount 50-1 “Cash of the organization” records the funds in the cash desk of the organization. When an organization...

- 62 — Settlements with buyers and customersAccount 62 “Settlements with buyers and customers” is intended to summarize information on settlements with buyers and customers.

Author KakSimply! Situations often arise in the business activities of an organization that sells goods for cash when a dissatisfied buyer returns the goods.

These operations must be “carried out through the cash register”, while strictly observing the procedure for preparing the primary documents.

According to the Law “On the Protection of Consumer Rights”, the buyer has the right to return the product if it suddenly does not fit in size, configuration, style or turns out to be of poor quality. Articles on the topic: Instruction 1 If the buyer, for one reason or another, is already disappointed in it on the day of purchasing the product and decides to return it, then you are obliged to accept it. Document acceptance of the goods with a return certificate in accordance with Form N KM-3, which requires the details of the cash receipt. Draw up the document in one copy and submit it to the accounting department. In addition, issue a delivery note (in two copies).

>Return of cash to the buyer using a posting check Mikhail Obukhov | Labor Law | 03/08/2018 00:20 0 Comments

Options for errors requiring a refund and their consequences

In relations between counterparties, errors in the transfer of funds are possible, associated with:

- with the wrong choice of counterparty when generating a payment order;

- indicating an incorrect payment amount;

- reflection in the purpose of payment of the details of a document that does not exist in the relationship.

Such errors can be identified by any of the parties, but will require a mandatory written expression of the initiative of the payer of funds to take actions carried out in connection with their correction.

In a number of situations, the error can be corrected by adjusting the purpose of the payment if, for example, there is a supplier-buyer relationship between the counterparties, against which an erroneously transferred amount (or a payment with an incorrectly specified purpose) may be taken into account. Correction via payment adjustment cannot be applied if there are no current engagement agreements with the payee.

Regardless of the reason for which the payment was considered to have been made without reason, it is recorded by both the payer and the recipient using the same algorithms, taking into account the fact that for these two parties the transactions when returning the erroneously transferred funds will be mirror images.

Since erroneous transfers subject to refund have no connection with the calculations performed between suppliers and buyers, VAT on them is not allocated either for payment or as deductions. However, if calculations are carried out in foreign currency, then exchange differences attributable to income/expenses may arise. The recipient of the funds, when returning them, in the purpose of payment in the payment document should reflect information that this payment is used to return the funds erroneously transferred to him, and provide a link to the details of the document in which the payer expressed a request to return the money to him.

If the error is corrected by taking into account the transferred amount as payment under another supply agreement, then it will be taken into account in the usual manner for the supplier-buyer relationship with the implementation of the necessary VAT transactions.

Posting a refund

According to current legislation, the seller of goods or service provider is obliged to provide the buyer (customer) with a product (service, work) of the quality and range specified in the contract and allowing the product or the result of the services (work) provided to be used for its intended purpose.

Postings for the return of money and goods in the buyer’s accounting department

If significant deficiencies or defects are identified, the buyer may refuse to fulfill the terms of the contract in full and demand the supplier to return the money paid.

In such a situation, the buyer must send a written claim to the supplier to terminate the contractual relationship with a demand for a refund of the money paid.

The seller, in turn, has the right to return the goods refused by the buyer.

If the need to return the goods and money occurred after the buyer had posted material assets, then if the issue of returning the goods and money is resolved positively, entries will be made in the buyer’s accounting department to the appropriate sub-accounts, based on the claim to the seller and the invoice for the returned goods:

- D-t 62 invoices and K-t 90 invoices - for the amount of the returned goods,

- Invoice Dt 90 and Invoice Dt 68 - VAT is charged on the returned goods.

A refund from the supplier (seller) to the buyer’s bank account for a low-quality product (service) or a product of the wrong assortment will look like this:

- D-t 51 invoices and K-t 62 invoices - for the amount of the invoice issued by the buyer for the return of goods.

If the refund by the seller (supplier) was made directly at the buyer's (customer) cash desk, then the posting of the refund will look like a debit of 50 and a credit of 62 accounts.

Postings for the return of money and goods in the accounting department of the supplier (seller)

The receipt of returned goods in the supplier's accounting department is carried out on the basis of an invoice issued by the buyer for the return of materials (goods):

- D-t 60 invoices and K-t 10, 41 invoices - for the amount of the returned goods,

- Invoice Dt 19 and Invoice Dt 60 - VAT is reflected on the returned goods.

A refund to the buyer’s bank account for a low-quality product or product of the wrong range from the supplier will look like this:

- D-t 60 invoices and K-t 51 invoices - for the amount of the invoice issued by the buyer for the return of goods.

If the refund to the buyer was made directly at the seller’s cash desk, then the postings will look like debit 60 and credit 50 to the account.

Refund of erroneously (excessively) paid funds

Refunds of funds transferred to the supplier by mistake are made on the basis of a letter from the customer, which indicates the payment document, its number, date and the amount paid by mistake.

The party that received the erroneous amount reconciles the calculations and deliveries. If excess money is discovered, the supplier returns it to the customer.

In the accounting department of the customer (buyer), the erroneously transferred money is reflected in account 76, the corresponding subaccount.

Posting a refund of funds erroneously transferred to the seller to the customer’s bank account will look like:

- D-t 51 accounts and K-t 76 accounts - in the amount of excessively (erroneously) transferred funds.

The return of money through the customer's cash desk is recorded as turnover on the debit of account 50 and the credit of account 76.

Consultation on accounting entries for financial returns can be obtained from organizations specializing in consulting accountants or tax authorities. Qualified employees of these organizations will answer any questions you may have regarding accounting for the company’s funds.

An erroneously transferred payment on an account should be recorded in which subaccount 76

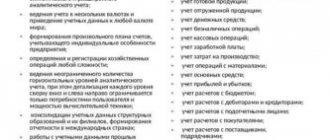

The calculated amounts of insurance payments are reflected in the credit of account 76 “Settlements with various debtors and creditors in correspondence with the accounts of production costs (selling expenses) or other sources of insurance payments. The transfer of amounts of insurance payments to insurance organizations is reflected in the debit of account 76 “Settlements with various debtors and creditors in correspondence with cash accounts. In the debit of account 76 “Settlements with various debtors and creditors”, losses due to insured events (destruction and damage to inventories, finished products and other material assets, etc.) are written off from the credit of accounts for inventory, fixed assets, etc. Accrued amounts of payments reflected in the debit of accounts 76 “Settlements with various debtors and creditors” and the credit of accounts: 90 “Sales (in terms of rent from ordinary activities). 86 “Targeted financing - in terms of targeted contributions for heating, lighting, radio, etc. When repaying debts for these amounts, an entry is made in the debit of cash accounting accounts, 70 “Settlements with personnel for wages and credit of account 76 “Settlements with different debtors and creditors."

The cost of products accepted from the population in the assessment at negotiated prices is reflected in the credit of subaccount 76-7 in correspondence with the debit of subaccount 43-5 (when accepting products grown on personal plots) and subaccount 11-8 (when accepting livestock and poultry). Subaccount 76-7 is debited in correspondence with cash accounts. On subaccount 76-8 “Calculations for leasing and rental obligations reflect the movement of rent and lease payments. This subaccount is used to record payments from the tenant, lessor, lessee and lessor. Postings for housing and communal services under account 76.05 Let's consider postings for housing and communal services between the management company and residents under subaccount 76.05 in the table: Account Dt Account Kt Transaction amount, rub. Description of the posting Document-basis 76.06.01 76.05.01 4,000 Accrued utility bills Account 76.06.01 86 1,500 Contributions for maintenance and repairs and other special purposes 76.06.01 60 5,500 Reflection of debt to the service provider Agreement, certificate of completion of work 51 76.06. 01 5 500 Receipt of payment from the tenant Bank statement 60 51 5 500 Paid to the supplier Payment order Example 3. Postings for the sale of an apartment to an employee on account 76.09 Suppose A.I. Khlebtsov is a very valuable employee of Osen LLC. Accounting 76 “settlements with various debtors and creditors Accountants. Subaccount 76-4 “Settlements for deposited amounts” takes into account settlements with employees of the organization for amounts accrued but not paid on time (due to the non-appearance of recipients).