Specifics of reflecting costs

To begin with, it should be noted that this category refers to funds allocated to establish communication between the manufacturer and the consumer. This item of costs in its content is classified as current costs. The allocation of these resources takes place annually, and their advances also occur annually.

If the head of the organization manages to increase the efficiency of these costs, then this will give him the opportunity to receive greater profits and direct it to improve the material and technical base, which will lead to an increase in the quality of goods sold and, accordingly, an increase in profits in the future.

If you try to classify the designated category of costs, you can do it as follows:

By economic content:

- material costs;

- funds allocated for remuneration of personnel;

- accrual of depreciation of fixed assets and intangible assets;

- other costs.

By industry sector:

- costs of selling retail products;

- funds allocated to ensure sales of wholesale products;

- costs of selling agricultural products.

Taking into account such a criterion as the quality of trading service, it is necessary to highlight:

- related to improving the quality of trade service;

- unrelated to him.

Example of using account 44 “Sales expenses”

Antik LLC, engaged in trading, reflected the following transactions for October 2020:

- wages - 209,000 rubles;

- insurance premiums - 62,700 rubles;

- expenses for stationery - 11,000 rubles;

- depreciation of fixed assets - 19,000 rubles;

- services of third-party organizations - 38,000 rubles;

- costs for transporting products - 42,000 rubles;

- sales revenue - RUB 849,600, incl. VAT RUB 129,600;

- cost of goods sold - 415,000 rubles;

- balance of goods in the warehouse - 113,000 rubles.

The role of 44 accounts in accounting

Position 44 in the Chart of Accounts is active and is designed to reflect information about the costs incurred by the organization in the sale of goods or services.

Thus, existing expenses are accumulated on the debit side of the account, and their disposal is accumulated on the credit side.

In enterprises engaged in commercial activities, this account records expenses such as:

- expenses for transporting goods;

- for payment;

- rental payments;

- funds allocated for the maintenance of retail premises and equipment;

- for an advertising company;

- entertainment expenses.

This account may well be actively used by non-trading organizations. In this case, the following cost items are reflected in it:

- funds allocated for loading and delivery of products;

- resources allocated for maintaining goods in warehouses;

- costs associated with product packaging;

- for an advertising company;

- commission fees and deductions.

Analytics for this account is carried out for each type and item of expenses.

1C Accounting - accounting of business transactions in detail!

subscribe to blog updates via e-mail

Hello, dear readers of the blog-buh blog. In the last two articles (this one and this one), I began to look at the features of setting up the closure of cost accounts (20, 23, 25, 26) in the 1C Enterprise Accounting program, edition 3.0. In today’s article I will talk about another cost account - 44.01 “Costs of distribution in organizations engaged in trading activities” , and of course not only about the account itself, but also about the routine operation of closing the month “Closing account 44 “Costs of distribution”” .

As part of the article, I will touch a little on the question: in what cases should account 44 be used in accounting, and we will also talk about the accounts on which the cost is reflected: 90.02 “Cost of sales” and 90.07 “Sales expenses”. Well, as per tradition, let’s consider a clear example on this topic.

Let me remind you that the site already has a number of articles that are devoted to the issue of closing a month in the 1C BUKH 3.0 program:

- Part 2: “Closing accounts 20, 23, 25, 26” transactions: detailed analysis of “Closing the month” in 1C ACCOUNTING 3.0

- Part 1: “Closing accounts 20, 23, 25, 26” transactions: detailed analysis of “Closing the month” in 1C ACCOUNTING 3.0;

- “Adjustment of item cost”;

- “Revaluation of foreign currency funds”;

- “Calculation of trade margin”;

- “Recognition of expenses for the acquisition of OS for the simplified tax system”;

- “Write-off of additional expenses for the simplified tax system”;

- “Calculation of shares of write-off of indirect expenses”;

- “Calculation of transport tax”;

- “Calculation of land tax”;

- “Calculation of property tax”;

- “Write-off of deferred expenses”;

- “Repayment of the cost of workwear and special equipment”;

- Accounting for depreciation of fixed assets;

- Exclusion of work in progress from the composition of material costs for the simplified tax system;

- Methods of depreciation of fixed assets in 1C Accounting.

A little theory

First, let's talk a little about account 44.01 “Distribution costs” . Sometimes difficulty arises (mainly among novice accountants) in determining in which account to reflect the organization’s expenses on 44 or 20 accounts. In principle, if you open the chart of accounts in the 1C program and look at the full name of account 44, it will become clear in what cases account 44.01 is applied - “Costs of distribution in organizations engaged in trading activities .”

There is also an official document “Order of the Ministry of Finance No. 94n” , which describes in some detail the purposes for which this account is intended. I will give a short excerpt:

“Account 44 “Sales Expenses” is intended to summarize information on expenses associated with the sale of products, goods, works and services . In organizations engaged in trading activities, account 44 “Sales expenses” may reflect, in particular, the following expenses (distribution costs):

- for the transportation of goods;

- for wages;

- for rent;

- for the maintenance of buildings, structures, premises and equipment;

- for storage and processing of goods;

- for advertising;

- for entertainment expenses;

- other expenses similar in purpose.”

From this we can conclude that organizations that are engaged in trading activities should reflect their expenses on account 44.01, and not on account 20. By the way, in the same order you can familiarize yourself with the purpose of the 20th accounts and many others. Let me briefly note the fact that accounts 20, 23, 25 and 26 are used to reflect costs in production organizations , i.e. where there is production.

Reflection of expenses on account 44.01

Now let's look at a small example in which a trading organization (Do It Yourself LLC) buys a large batch of goods from a supplier (Supplier LLC) and sells part of this product to its client-buyer (IP Plotnik V.M.).

So, on March 15, 300 units were purchased from the supplier . goods for a total amount of 300,000 rubles .

The supplier delivered this product and delivery costs (RUB 20,000) were reflected in a separate document “Receipt of goods and services” on account 44.01 “Distribution costs in organizations engaged in trading activities.” This expenditure also took place in the month of March.

| Next, part of the goods is sold. There is a sale of goods in the amount of 50,000 rubles. also in March. This fact is reflected in the document “Sales of goods and services. Please note that the cost of goods sold is reflected in account 90.02 “Cost of sales...” . This will be reflected in the cost of sales on the income statement. But additional expenses incurred, in this example these are delivery costs, will be debited from account 44 to account 90.07 “Sales expenses...” . |

These costs will be reported as business expenses on the income statement. We will see the postings on account 90.07 a little lower when we consider the issue of closing the month.

Regular operation of closing the month “Closing account 44 “Costs of circulation”

Let’s assume that during March there were no more expenses or receipts for this product and let’s move on to Closing the month. When closing the month of March, among other operations, the routine operation “Closing account 44 “Costs of circulation” . Let's look at the movements this document made in the accounting ledger.

A posting has been generated where we see the account 90.07, which I talked about just above. However, now I want to draw your attention to the amount of this transaction. Not the entire amount of delivery costs is debited from account 44.01 (let me remind you that delivery cost 20,000 rubles), but only part of this amount, namely 2,500 rubles. This is the amount of transportation and procurement costs (TPC) that are attributable to goods sold in March. I think it’s worth explaining the formula used to calculate this amount. The formula is as follows:

Amount of goods sold in March * (Amount of goods sold at the beginning of March + goods purchased in March) / (Amount of goods remaining at the beginning of March + Goods purchased in March)

In order to find out the indicators needed for the formula, we just need to create a balance sheet (SAS) for account 44.01 and 41.01 for March:

After we substitute all the values into the formula, it will take the following form:

| 50,000 * (0 + 20,000) / (100,000 + 300,000) = 50,000 * 0.05 = 2,500 Additionally, it is worth saying that based on the regulatory operation “ Closing account 44 “Costs of circulation”, you can generate an explanatory Certificate of calculation Transport expenses". To do this, just left-click on the “Closing account 44 …” item in the Monthly Closing service and select the appropriate line in the list that opens. |

That's all for today.

If you liked this article, you can use the social media buttons to save it to yourself! Also, don’t forget to leave your questions and comments in the comments !

Let me remind you once again that this was material from the “Closing of the Month” section, all articles of which are located here. To learn about new publications in time, you can subscribe to blog updates via e-mail.

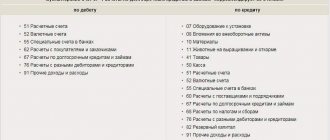

Possible accounting entries

Typical accounting entries for this position are as follows:

1) Dt 44

Kt 02 - depreciation of fixed assets used in the sale of goods and services;

2) Dt 44

Kt 10 and 60 – expenses for repairs of retail premises;

3) Dt 44

Kt 70 – wages of employees providing sales of goods;

4) Dt 44

Kt 23 – accounting for production costs in sales costs;

5) Dt 44

Kt 10 – materials used in the sale of goods, etc.

Closing account 44

The debit balance accumulated on account 44 for the month can be written off at the end of the month to the sales account, either in full or in part, depending on the choice of the organization, enshrined in the Accounting Policy for accounting purposes:

Debit account 90 “Sales” - Credit account 44

If the organization chooses to partially write off the balance of account 44, then the following expenses are subject to distribution:

| In which organizations | Allocable expenses | Distribution order |

| Industrial and other manufacturing enterprises | Packaging and transportation costs | Between individual types of products shipped monthly based on their weight, volume, production cost or other relevant indicators |

| Trade and intermediary organizations | Transportation costs | Between the goods sold and the remaining goods at the end of each month |

| Organizations procuring and processing agricultural products | Expenses for the procurement of agricultural raw materials, livestock and poultry | Installed by the organization itself |

Transportation costs refer to the costs of delivering goods or products to the organization's warehouse and other storage locations, and not of delivering them to customers. The undistributed amounts will form the debit balance of account 44 at the end of the month.

In organizations that procure and process agricultural products, when allocating sales expenses, account 44 is still reset to zero, since the amount not debited to account 90 is written off as follows:

- expenses for the procurement of agricultural raw materials: Debit of account 15 “Procurement and acquisition of material assets” - Credit of account 44;

- expenses for the procurement of livestock and poultry: Debit account 11 “Animals for growing and fattening” - Credit account 44.

“Calculations for allocated property”

The transfer of material assets between the main organization and the branch (representative office) is formalized by an act on the basis of which the transferring and receiving parties register account assignments in the transaction journals.

Examples of typical operations:

| Debit | Credit | Type of property |

| 79 | 01 | Fixed assets |

| 02 | 79 | |

| 79 | 04 | Intangible assets |

| 05 | 79 | |

| 79 | 41 | Retail goods (wholesale products are reflected in the same way, excluding the entry for reversing the markup) |

| 42 | 79 | |

| 79 | 10 | Inventory, workwear listed in the warehouse |

| 012 | Low-value items (up to RUB 40,000.00), written off as expenses in accordance with the law | |

| 07, 08 | Equipment, capital investments | |

| 20 | Unfinished products | |

| 41 | Finished products | |

| 50, 51, 52, 55 | Cash provided that a bank account is opened for an additional office | |

| 62 | Letter to debtors about changing the payment procedure - the rights to claim the debt have been transferred to the branch |

In remote divisions, transactions will be entered into account 79 “Intra-business settlements” in the same way as those carried out by centralized accounting, but debits and credits will be swapped.