What is taken into account in account 68?

According to the Standard Chart of Accounts, the 68th is called “Calculations for taxes and fees”. It quite obviously follows from this that it is created to account for settlements with the state budget. All commercial organizations in one way or another encounter the concept of taxes. What it is? Taxes are a fixed amount that must be paid by an individual or legal entity to finance the state. A full description of each payment is contained in the Tax Code of the Russian Federation.

If everything is more or less clear with taxes, then what is meant by the concept of “collection”? This is a contribution for which an obligation arises when an individual or business needs to obtain legal services from the government or other authorities. The fee may also be established for commercial companies as a mandatory condition for conducting business activities in a certain territory.

Account 68 in accounting 2018

Paying tax payments to the budget on time and in full is the responsibility of all economic entities. We will tell you how to correctly reflect accruals and calculations for such obligations in accounting in our article.

Account 68 “Calculations for taxes and fees”

The size and frequency of tax payments are established by the current fiscal legislation. Thus, the Tax Code of the Russian Federation provides for settlements with the budgets of the federal, regional and local levels. And in addition to tax obligations, companies are often required to pay specific fees. For example, state duty or local trade tax.

According to Order of the Ministry of Finance No. 94n, account 68 should be used in accounting to reflect calculations for state taxes and fees. Note that in addition to dividing fiscal obligations by level of the recipient budget, taxes are divided into:

- Property. This type of tax is paid for the use of a specific type of property. For example, if a company operates transport, land, buildings, etc., then the company is obliged to pay the state a certain amount of funds. The size of property tax return is determined based on the volume of the tax base multiplied by the rate.

- Indirect. BUT, which are included in the cost of goods, works or services, should be classified as indirect. For example, this type of non-compliance includes value added tax, excise taxes, customs duties and duties.

- According to the result. These NUTs are calculated from the specific result of the economic activity of the subject for a certain period of time (calculation period). For example, corporate income tax. Calculation indicators for this type of non-commercial entity must coincide with declarations and other reports submitted to the Federal Tax Service.

Indicators 68 of the accounting account reflect not only the amount of accrued debt to the state, but also the amount of funds transferred to the budget system of the Russian Federation, as well as the amount of tax liabilities subject to refund or deduction.

Features of account accounting 68

This accounting account belongs to the group of active-passive ones, that is, the balance of account 68 can be not only debit, but also credit. It all depends on whose benefit the debt is: in favor of the company or the state.

Transactions should be reflected by type of tax liability. To organize this detailing in the working PS, special sub-accounts are provided for account 68:

Please note that the company is not required to enter all of the above subaccounts. It is enough to include in the accounting policy only those that are used in the business activities of the company. Most Russian organizations use only two sub-accounts: accounting account 68-01 - to reflect personal income tax transactions for each employee, and accounting account 68-02 - for settlements with the VAT budget.

The final balance of account 68 in terms of tax obligations may be different. Consequently, an expanded balance is formed for the existing subaccounts. For example, a debt on one tax is reflected in credit 68 of account, and an overpayment on another is recorded as a debit. In this case, when including accounting indicators 68 in the annual balance sheet and other financial statements, make sure that debit balances are included in the balance sheet assets, and credit balances are included in liabilities.

Typical transactions for account 68

| Operation | Debit | Credit |

| VAT | ||

| VAT charged | 90 - from the main activity 91 - from other activities 76 - for advances from creditors 62 - on advances from buyers 19 - for products and goods for own needs | 68-02 |

| VAT is accepted for deduction | 68-02 | 19 |

| Value added tax is withheld by the tax agent | 76 60 | 68-02 |

| VAT restored | 20 26 44 91 | 68-02 |

| Personal income tax | ||

| Personal income tax is withheld from staff income | 71 - from wages 73 - from other income 75 - from dividends | 68-01 |

| On the profits of organizations | ||

| NNP is accrued from the income of the reporting period | 99 | 68-04/2 |

| NNP withheld by the tax agent | 76 60 | 68-04/2 |

| For the organization's property | ||

| Accrual | 91, 26, 44 | 68-08 |

| For transport | ||

| Tax liabilities accrued | 26, 44 | 68-07 |

| To the ground | ||

| Accrual reflected | 26, 44 | 68-06 |

| State duties, fees | ||

| Fees and duties assessed | 91, 26, 44, 08 | 68-10 |

Transfer of payments, calculations of taxes and fees: account 68 is reflected in debit and at the same time accounting accounts 50 “Cash” or 51 “Settlement bank account” are credited. For example, personal income tax is listed, posting:

Dt 68-01 Kt 51.

Regarding the accounting for value added tax and the procedure for its reimbursement and deduction, determining VAT payable (account 68), accountants have a huge number of questions. For more information on how to organize reliable VAT accounting, read the article “VAT: Postings”.

Dear readers, if you see an error or typo, help us fix it! To do this, highlight the error and press the “Ctrl” and “Enter” keys simultaneously. We will learn about the inaccuracy and correct it.

ppt.ru

Tax obligations of organizations

Payments for taxes and fees can be sent to the federal, regional or local budget. It depends on the type of obligation. Federal taxes include VAT, excise taxes, and income taxes. Local and regional taxes consist mainly of amounts assessed for the use of land and property.

When considering the tax obligations of an enterprise, it would be correct to systematize payments in the context of this economic entity. Let's group the main types of taxes and fees, data on which are entered into account 68 in accounting, according to the method of their payment:

- from the amount of sales proceeds - excise taxes, VAT, customs costs;

- write-off to the cost of products (works, services) - taxes on land, water resources, mining, on property and transport of an enterprise, gambling business;

- from net profit - corporate income tax.

In addition, account 68 is also used to pay personal income tax levied on the income of individuals (employees of the enterprise).

Depending on the tax regime under which the enterprise operates, payment rates and their total number change. For example, organizations using the simplified tax system may be exempt from paying VAT, property and profit tax, and personal income tax.

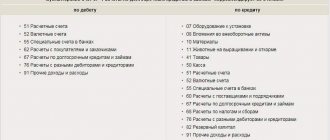

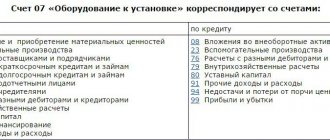

Corresponds with accounts

Account 68 can enter into transactions with the specified accounts.

From the debit of account 68 to the credit of accounts:

- Account 19 - when deducting VAT on previously acquired inventory items;

- Account 50 - such an entry can reflect the payment of various benefits to employees at the expense of the budget;

- Account 51 - when reflecting the payment of tax to the budget from the current account;

- Account 52 – when paying taxes to the budget from a foreign currency account. Considering the fact that such correspondence is directly stated in the chart of accounts, which is established by 94-N, it most likely will not occur in life, since payments to the budget must be made in rubles.

- Account 55 - when paying taxes to the budget from special bank accounts;

- Account 66 - if the repayment of tax obligations is carried out using short-term loan funds, while they themselves are transferred to the budget directly, without intermediate crediting to the organization’s account.

- Account 67 - if the repayment of tax obligations is carried out using long-term loan funds, while they themselves are transferred to the budget directly, without intermediate crediting to the organization’s account.

By crediting the account, it enters into correspondence with the debit of the following accounts:

- Account 08 - when allocating the listed fees, customs duties, and non-refundable taxes to the initial cost of capital investments;

- Account 10 – when allocating the listed fees, customs duties, and non-refundable taxes to the original cost of materials;

- Account 11 – when allocating the listed fees, customs duties, and non-refundable taxes to the initial cost of animals and young animals;

- Account 15 – when allocating the listed fees, customs duties, and non-refundable taxes to the initial cost of materials, provided that the Accounting Policy provides for accounting for the purchase of materials through account 15;

- Account 20 - when attributing the listed fees, customs duties, and non-refundable taxes to the costs of production of the main products;

- Account 23 - when attributing the listed fees, customs duties, and non-refundable taxes to the costs of auxiliary production;

- Account 26 – when attributing the listed fees, customs duties, and non-refundable taxes to general corporate expenses;

- Account 29 – when attributing the listed fees, customs duties, and non-refundable taxes to the costs of auxiliary production and farms;

- Account 41 – when allocating the listed fees, customs duties, and non-refundable taxes to the original cost of goods purchased for resale;

- Account 44 - when attributed to costs associated with the sale of finished products, listed fees, customs duties, non-refundable taxes;

- Account 51 - when returning from the budget to the current account in excess of the transferred amounts of taxes and other payments;

- Account 52 – when returning from the budget to a foreign currency account in excess of the transferred amounts of taxes and other payments. Despite the fact that such correspondence is directly spelled out in the chart of accounts, which is established by 94-N, it most likely will not occur in life, since payments to the budget must be made in rubles.

- Account 55 - when returning excessively transferred amounts of taxes and other payments to a special account;

- Account 70 - when reflecting the withholding of personal income tax from employees’ salaries;

- Account 75 - when reflecting the withholding of personal income tax from dividends accrued to the organization's employees;

- Account 90 - when calculating taxes related to the sale of products (VAT, excise taxes, duties, etc.)

- Account 91 - when calculating taxes related to the sale of other property (VAT, excise taxes, duties, etc.)

- Account 98 - when reflecting taxes related to transactions of a future period;

- Account 99 - when reflecting the accrual of income tax, as well as tax sanctions (fines, penalties).

Account characteristics

Account 68 in accounting is active-passive. At the end of the period, both a debit and a credit balance can be formed. In this case, the amounts in credit indicate the size of the enterprise’s obligations to the state, and in debit - vice versa. It turns out that any accrual occurs on credit, and write-off occurs on debit. Most often, of course, the organization has a credit ending balance on account 68.

Debit turnover indicates either the payment of taxes and fees, or the amount of VAT to be reimbursed when purchasing goods from suppliers. Credit turnover arises when obligations are formed and VAT is payable according to the invoice.

Turnover balance sheet

A balance sheet (SAS) is an accounting document that contains information about the status of accounts as of the first day of the reporting period (month, quarter or year). It also contains information about the receipts and expenditures of funds at this time, as well as the status at the end of the reporting period. SALT can be monthly, quarterly and consolidated (12 months).

In the SALT for account 68, information is indicated on the balance at the beginning of the period for the debit and credit positions, the turnover of funds according to the instructions for their purpose, and then the results for D and Kt are summed up, with the subsequent withdrawal of the balance.

Features of accounting with examples and postings are presented below.

https://youtu.be/K5BVKovrYJs

Share with friends on social networks

Telegram

Analytical accounting

As can be seen from the characteristics of the enterprise’s obligations to the state, the number of taxes is enough to turn account 68 into confusion. To systematize the data, sub-accounts are created for a group of tax payments and fees: this way you can always view the necessary information.

Let's consider an example of analytical accounts for the main types of tax payments and fees from a legal entity:

- 68/01 – personal income tax;

- 68/02 – VAT;

- 68/03 – excise taxes;

- 68/04 – income tax;

- 68/05 – tax on vehicles;

- 68/06 – property tax;

- 68/07 – other fees and taxes;

- 68/08 – single tax (under the simplified tax system).

The established list of codes for subaccounts of synthetic account 68 is reflected in the accounting policy of the enterprise. The data is grouped into turnover sheets. The sum of the final results for analytical accounts should converge with the data of synthetic accounting of account 68.

ACCOUNT 68 “CALCULATIONS FOR TAXES AND FEES”

| From the editors of "Business-Info" The material refers to the Tax Code of the Republic of Belarus as amended before January 1, 2020. From January 1, 2020, the above Code, on the basis of the Law of the Republic of Belarus dated December 30, 2018 No. 159-Z, is stated in a new edition. See comments here . Regarding taxation, the material is relevant as of the date of its writing. |

Account 68 “Calculations for taxes and fees” is intended to summarize information on settlements with the budget for taxes, fees and other payments (clause 53 of the Instructions on the procedure for applying the standard chart of accounts for accounting, approved by Resolution of the Ministry of Finance of the Republic of Belarus dated June 29, 2011 No. 50 (hereinafter referred to as Instruction No. 50)).

Sub-accounts can be opened for account 68:

• 68-1 “Calculations for taxes and fees attributable to the costs of production and sales of products, goods, works, services”;

• 68-2 “Calculations for taxes and fees calculated from proceeds from the sale of products, goods, works, services”;

• 68-3 “Calculations for taxes and fees calculated from profit (income)”;

• 68-4 “Calculations for income tax”;

• 68-5 “Calculations for other payments to the budget.” This subaccount, in particular, reflects penalties and fines accrued to the budget in accordance with the law, and duties.

Analytical accounting for account 68 is carried out by type of tax. That is, if necessary, second-order subaccounts can be opened for each subaccount in the context of individual taxes, as well as other subaccounts.

The correspondence of account 68 with other accounts is established in accordance with Appendix 43 to Instruction No. 50, as well as:

• Instructions for accounting for value added tax, approved by Resolution of the Ministry of Finance of the Republic of Belarus dated June 30, 2012 No. 41 (hereinafter referred to as Instruction No. 41);

• Instructions for accounting of funds earned on republican subbotniks, approved by Resolution of the Ministry of Finance of the Republic of Belarus dated June 18, 2012 No. 38 (hereinafter referred to as Instruction No. 38);

• National Standard of Accounting and Reporting “Accounting Policies of the Organization, Changes in Accounting Estimates, Errors”, approved by Resolution of the Ministry of Finance of the Republic of Belarus dated December 10, 2013 No. 80 (hereinafter referred to as National Standard No. 80);

• Instructions on the procedure for determining the cost of a construction project in accounting, approved by Resolution of the Ministry of Architecture and Construction of the Republic of Belarus dated May 14, 2007 No. 10 (hereinafter referred to as Instruction No. 10);

• Instructions for accounting of investment real estate, approved by Resolution of the Ministry of Finance of the Republic of Belarus dated April 30, 2012 No. 25 (hereinafter referred to as Instruction No. 25);

• Instructions for accounting of state support, approved by Resolution of the Ministry of Finance of the Republic of Belarus dated October 31, 2011 No. 112 (hereinafter referred to as Instruction No. 112);

• Instructions for accounting of income and expenses, approved by Resolution of the Ministry of Finance of the Republic of Belarus dated September 30, 2011 No. 102 (hereinafter referred to as Instruction No. 102).

Account 68 may have a balance at the beginning and end of the reporting period:

1) debit - if there is a budget debt to the organization;

2) credit - if the organization has a debt to the budget.

| Accounting entries for account 68 | ||||

| No. | Contents of operation | Debit | Credit | Rationale |

| BY DEBIT OF ACCOUNT 68 | ||||

| 1 | The amounts of value added tax subject to deduction in accordance with the law are reflected | Clause 4 of Instruction No. 41; Part three, paragraph 21 of Instruction No. 50 | ||

| 2 | Taxes have been paid from the organization's accounts | 68 | , | Part ten, paragraph 53 of Instruction No. 50 |

| 3 | Taxes paid in cash | 68 | Appendix 43 to Instruction No. 50 | |

| 4 | An overpaid amount for one tax was sent to pay for another tax | 68 | 68 | Appendix 43 to Instruction No. 50 |

| 5 | Tax debts were repaid using debtors' funds | 68 | , | Appendix 43 to Instruction No. 50 |

| 6 | Taxes were paid using funds received from the sale of currency | 68 | Appendix 43 to Instruction No. 50 | |

| 7 | Tax paid in foreign currency purchased on the domestic foreign exchange market | 68 | (57) | Appendix 43 to Instruction No. 50 |

| 8 | Reflects the amounts of taxes from which the payer is exempt from payment with their intended use | 68 | Part one, paragraph 14 of Instruction No. 112 | |

| 9 | Reflects the receipt and use of a tax credit with a one-time or phased payment of taxes | 68 | , | Paragraph 2 p.13 of Instruction No. 112 |

| 10 | Repayment of debt to the budget is reflected through loans provided by transferring funds to the budget, bypassing the organization’s accounts | 68 | 66, 67 | Appendix 43 to Instruction No. 50 |

| 11 | The debt of the business company for taxes, fees and other payments to the budget was restructured | 68 | Part twelve, paragraph 58 of Instruction No. 50 | |

| 12 | Obligations to repay debts to the budget of the parent organization (structural unit allocated to a separate balance sheet) have been transferred | 68 | Appendix 43 to Instruction No. 50 | |

| 13 | Accepted fulfillment of the obligation to the budget from the parent organization (structural unit allocated to a separate balance sheet) | 68 | 79 | Appendix 43 to Instruction No. 50 |

| BY ACCOUNT CREDIT 68 | ||||

| Excise taxes | ||||

| 1 | Excise taxes are charged on the sale of excisable goods (products). Rationale: subclause 1.1 clause 1 of article 113 of the Tax Code of the Republic of Belarus (hereinafter referred to as the Tax Code) | 90-3 | 68 | Parts eight, nine, paragraph 70 of Instruction No. 50 |

| 2 | Excise taxes have been assessed on gratuitously transferred excisable goods (products). Rationale: Subclause 2.1 Clause 2 Article 113 Tax Code | 90-10, 91-4 | 68 | Appendix 43 to Instruction No. 50 |

| 3 | Excise taxes are accrued when the payer transfers excisable goods produced by him as a contribution (contribution) to the authorized capital of organizations, as well as a contribution under a simple partnership agreement (joint activity agreement) (as expenses for investment activities). Rationale: Subclause 2.6 Clause 2 Article 113 Tax Code | 91-4 | 68 | Appendix 43 to Instruction No. 50 |

| 4 | The amount of calculated excise taxes is included in the costs. Rationale: Clause 1 of Article 122 of the Tax Code | , , and other cost accounts | 68 | Appendix 43 to Instruction No. 50 |

| 5 | Excise duty is accrued upon transfer to a structural unit of produced excisable goods for further production of non-excisable goods. Rationale: Subclause 2.4 Clause 2 Article 113 Tax Code | 79 | 68 | Appendix 43 to Instruction No. 50 |

| For information For more details on the accounting procedure for excise taxes, see the material “Accounting for excise taxes” | ||||

| Value added tax | ||||

| 6 | VAT is calculated when paying (otherwise terminating an obligation) for goods, works, services purchased on the territory of the Republic of Belarus from foreign organizations that do not operate in the Republic of Belarus through a permanent representative office and are therefore not registered with the tax authorities of the Republic of Belarus. Rationale: Clause 1 of Article 92 of the Tax Code | 18 | 68-2 | Part three, paragraph 21 of Instruction No. 50; paragraph 5 clause 2 of Instruction No. 41 |

| 7 | The VAT payable to the republican budget when importing goods into the territory of the Republic of Belarus from the territory of member states of the Customs Union has been calculated. Rationale: Clause 2 of Article 95 of the Tax Code | 18 | 68-2 | Paragraph 3 p.2 of Instruction No. 41 |

| 8 | VAT is calculated: - on goods sold (except for fixed assets, intangible assets, profitable investments in tangible assets, investments in long-term assets, equipment for installation, building materials from the customer, developer (hereinafter referred to as investment assets)), work performed, services provided ; | 90-2 | 68-2 | Parts six, seven, paragraph 70 of Instruction No. 50; paragraph 2 subclause 3.1 clause 3 of Instruction No. 41. |

| — freely transferred goods (except for investment assets), works, and services. Rationale: Subclause 1.1 Clause 1 Article 93 Tax Code | Paragraph 3 sub-clause 3.1 clause 3 of Instruction No. 41 | |||

| 9 | VAT is calculated on goods (except for investment assets) shipped outside the Republic of Belarus if the validity of applying a value added tax rate of 0% within the time limits established by law is not confirmed. | 90-2 | 68-2 | Paragraph 4 sub-clause 3.1 clause 3 of Instruction No. 41 |

| The reversal entry is made after confirming the validity of applying a value added tax rate of 0%. Rationale: part ten, paragraph 2, article 102 of the Tax Code | 90-2 | 68-2 | ||

| 10 | VAT calculated on other income from current activities | 90-8 | 68-2 | Paragraph 5 sub-clause 3.1 clause 3 of Instruction No. 41; part sixteen clause 70 of Instruction No. 50 |

| 11 | VAT was calculated on other expenses for current activities that are subject to VAT in accordance with Article 93 of the Tax Code | 90-10 | 68-2 | Paragraph 5 sub-clause 3.1 clause 3 of Instruction No. 41 |

| 12 | VAT is calculated: - on sold investment assets. Rationale: subparagraph 1.1, paragraph 1, article 93 of the Tax Code; — freely transferred investment assets. Rationale: sub-clause 1.1.3 clause 1 of Article 93 of the Tax Code; - investment assets shipped outside the Republic of Belarus, in case of failure to confirm the validity of applying a value added tax rate of 0% within the time limits established by law. | 91-2 | 68-2 | Subclause 3.2 clause 3 of Instruction No. 41; part six, paragraph 71 of Instruction No. 50; part two, paragraph 17 of Instruction No. 25 |

| The reversal entry is made after confirming the validity of applying a value added tax rate of 0%. Rationale: part ten, paragraph 2, article 102 of the Tax Code | 91-2 | 68-2 | ||

| 13 | VAT is calculated by the lender when transferring goods to the borrower under a loan agreement in the form of things. Rationale: Subclause 1.1.9 Clause 1 Article 93 Tax Code | , | 68-2 | Subclause 3.3 clause 3 of Instruction No. 41 |

| 14 | VAT is calculated by the borrower when returning goods to the lender under a loan agreement in the form of things. Rationale: Subclause 1.1.9 Clause 1 Article 93 Tax Code | 66, 67 | 68-2 | Subclause 3.4 clause 3 of Instruction No. 41 |

| 15 | VAT is calculated in cases where revenue from the sale of goods, works, services cannot be recognized in accounting for a certain time. When recognizing in accounting revenues from the sale of goods, works, services, the amount of value added tax is written off from the credit of account 97 “Deferred expenses” to the debit of accounts 90, 91 | 68-2 | Subclause 3.5 clause 3 of Instruction No. 41 | |

| 16 | VAT calculated on other income from investment activities | 91-2 | 68-2 | Subclause 3.6 clause 3 of Instruction No. 41; part six clause 71 of Instruction No. 50 |

| 17 | VAT was calculated on other expenses for investment activities that are subject to VAT in accordance with Article 93 of the Tax Code | 91-4 | 68-2 | Subclause 3.6 clause 3 of Instruction No. 41 |

| 18 | VAT has been calculated on other disposals of goods placed under the customs procedure of duty-free trade in duty-free stores, including when there is a shortage. Rationale: subclause 1.3.21 clause 1 of article 102 of the Tax Code | 68-2 | Appendix 43 to Instruction No. 50 | |

| Income tax | ||||

| 19 | Calculated income tax during the reporting year | 68-3 | Part five, paragraph 78 of Instruction No. 50 | |

| 20 | The amount of profit received from holding republican cleanup days and subject to transfer to the budget is reflected | 99 | 68 | Point 2 of Instruction No. 38 |

| 21 | Additional income tax accrued for the current year | 99 | 68-3 | Clause 11 of National Standard No. 80 |

| 22 | Additional income tax accrued for previous tax periods (previous years) | 68-3 | Clause 12 of National Standard No. 80 | |

| 23 | Income tax on dividends accrued to Belarusian legal entities has been calculated | 75 | 68 | Part eleven, paragraph 58 of Instruction No. 50 |

| Tax on income of foreign organizations not operating in the Republic of Belarus through a permanent representative office | ||||

| 24 | The income tax of foreign organizations that do not operate in the Republic of Belarus through a permanent representative office has been calculated in accordance with Article 145-151 of the Tax Code | , 66, 67, 75, 76 | 68 | Appendix 43 to Instruction No. 50 |

| Personal income tax | ||||

| 25 | Income tax is withheld by the tax agent from the amounts accrued to employees : - wages, bonuses, benefits and other payments; — dividends and other income from participation in the authorized capital of the organization | 70 | 68-4 | Part seven, paragraph 55 of Instruction No. 50 |

| 26 | Income tax is withheld from the amount of dividends and other income from participation in the authorized capital of the organization accrued to the founders - individuals who are not employees of the organization | 75 | 68-4 | Part eleven, paragraph 58 of Instruction No. 50 |

| 27 | Income tax is withheld from income paid to the employee that is not related to wages, payment of dividends, or other income from participation in the authorized capital | 73 | 68-4 | Appendix 43 to Instruction No. 50 |

| 28 | Income tax has been calculated at the expense of the tax agent in accordance with the law on the amounts of loans and credits issued by the organization to individuals, with the exception of individual entrepreneurs (notaries, lawyers) Rationale: part three, clause 10, article 175 of the Tax Code | 73, 76 | 68-4 | Appendix 43 to Instruction No. 50 |

| 29 | Using the “red reversal” method reflects the return of the calculated amount of income tax as an individual repays a loan or credit Rationale: part three, clause 10, article 175 of the Tax Code | 73, 76 | 68-4 | Appendix 43 to Instruction No. 50 |

| 30 | The amount of withheld wages accrued for the days of republican subbotniks is reflected | 68-5 | Point 2 of Instruction No. 38 | |

| Property tax | ||||

| 31 | Real estate tax has been calculated. Rationale: Article 190 of the Tax Code | 20 and other cost accounts | 68-1 | Part eight, paragraph 53 of Instruction No. 50 |

| 32 | Real estate tax has been calculated on the value of objects: - excess construction in progress; — included in the list of unused (inefficiently used) property. Rationale: Article 190 of the Tax Code; paragraph 6, clause 6, clause 63 of Instruction No. 10 | 90-10, 91-4 90-10 | 68-1 68-1 | Appendix 43 to Instruction No. 50 |

| Land tax | ||||

| 33 | The land tax has been calculated. Rationale: Clause 1 of Article 203 of the Tax Code | 20 and other cost accounts | 68-1 | Part eight, paragraph 53 of Instruction No. 50 |

| 34 | The land tax has been calculated for the plots on which the construction of objects is carried out (with the exception of plots occupied by objects of excess construction in progress). Rationale: paragraph 5 of part three, clause 5 of Instruction No. 10 | 08 | 68-1 | Appendix 43 to Instruction No. 50 |

| 35 | The land tax has been calculated for land plots (parts of a land plot) occupied by objects of excess construction in progress: - those being built for one’s own use or for renting out; - under construction for further implementation. Rationale: paragraph 7, clause 6, clause 63 of Instruction No. 10 | 91-4 90-10 | 68 | Appendix 43 to Instruction No. 50 |

| Environmental tax | ||||

| 36 | An environmental tax has been calculated for emissions of pollutants into the air, wastewater discharges, storage, disposal of production waste, and for the import of ozone-depleting substances into the territory of the Republic of Belarus, including those contained in products. Rationale: Article 209 Tax Code | 20 and other cost accounts | 68-1 | Part eight, paragraph 53 of Instruction No. 50 |

| Tax on extraction (withdrawal) of natural resources | ||||

| 37 | The tax for the extraction (withdrawal) of natural resources has been calculated. Rationale: Article 215 of the Tax Code | 20 and other cost accounts | 68-1 | Part eight, paragraph 53 of Instruction No. 50 |

| Fees and duties | ||||

| 38 | Offshore tax has been calculated. Rationale: Article 235 of the Tax Code | 20 and other cost accounts | 68-1 | Part eight, paragraph 53 of Instruction No. 50 |

| 39 | Stamp duty has been calculated. Rationale: Article 240 Tax Code | 20 and other cost accounts | 68-1 | Part eight, paragraph 53 of Instruction No. 50 |

| 40 | The consular fee has been calculated. Rationale: Article 247 Tax Code | 20 and other cost accounts | 68-1 | Part eight, paragraph 53 of Instruction No. 50 |

| 41 | State duty has been charged. Rationale: Article 260 Tax Code | 20 and other cost accounts | 68-1 | Part eight, paragraph 53 of Instruction No. 50 |

| 42 | Patent fees have been assessed. Rationale: Article 265 of the Tax Code | 20 and other cost accounts | 68-1 | Part eight, paragraph 53 of Instruction No. 50 |

| Local taxes and fees | ||||

| 43 | Resort fee amounts accepted from individuals. Rationale: Art. 277-280 Tax Code | 50, 51 | 76 | Appendix 43 to Instruction No. 50 |

| 44 | A resort fee has been charged and must be paid to the budget. Rationale: Art. 277-280 Tax Code | 76 | 68-5 | Appendix 43 to Instruction No. 50 |

| 45 | The collection from suppliers has been calculated. Rationale: Article 284 Tax Code | 20 and other cost accounts | 68-1 | Part eight, paragraph 53 of Instruction No. 50 |

| Taxes calculated when applying special tax regimes | ||||

| 46 | The tax was calculated under the simplified taxation system. Rationale: Clause 1 of Article 288 of the Tax Code | 90-3 | 68-2 | Part nine, paragraph 70 of Instruction No. 50 |

| 47 | A single tax has been calculated for producers of agricultural products. Rationale: Clause 1 of Article 304 of the Tax Code | 90-3 | 68-2 | Part nine, paragraph 70 of Instruction No. 50 |

| 48 | The tax on gambling business has been calculated. Rationale: Article 308 of the Tax Code | 99 | 68-3 | Parts five, eight, paragraph 53 of Instruction No. 50 |

| 49 | The tax on income from lottery activities has been calculated. Rationale: Clause 1 of Article 312 of the Tax Code | 99 | 68-3 | Parts five, eight, paragraph 53 of Instruction No. 50 |

| 50 | The tax on income from electronic interactive games has been calculated. Rationale: Clause 1 of Article 316 of the Tax Code | 99 | 68-3 | Parts five, eight, paragraph 53 of Instruction No. 50 |

| 51 | The fee for carrying out activities to provide services in the field of agroecotourism has been calculated. Rationale: Article 322-324 Tax Code | 99 | 68-3 | Parts five, eight, paragraph 53 of Instruction No. 50 |

| 52 | A single tax on imputed income has been calculated. Rationale: Article 3252 Tax Code | 90-3 | 68-2 | Part nine, paragraph 70 of Instruction No. 50 |

| 53 | Interest accrued for using tax credit | 68 | Part two, paragraph 13 of Instruction No. 112 | |

| 54 | Accrued taxes, fees, payments in cases established by law for insurance payments | 68 | Appendix 43 to Instruction No. 50 | |

| 55 | The return from the budget to the current account of overpaid (collected) payments to the budget is reflected | 51 | 68 | Appendix 43 to Instruction No. 50 |

| 56 | Penalties, fines and penalties due on payments to the budget have been accrued | 90-10 | 68 | Part nine, paragraph 53 of Instruction No. 50; paragraph 15 clause 13 of Instruction No. 102 |

| 57 | Interest has been accrued for using the tax credit (except for interest attributed to the value of investment assets in accordance with the law) | 91 | 68 | Part two, paragraph 13 of Instruction No. 112 |

22.12.2015

Anna Andreeva, economist

Postings for personal income tax

Personal income tax is one of the main taxes withheld from individuals, the rate of which for the average working citizen is 13%. It is necessary to calculate the amount due to the state from the employee’s income only after deducting benefits, if any, should be applied. To collect information about personal income tax amounts from enterprise employees, accounting account 68.01 is used.

The entry describing the calculation of tax is drawn up as follows: Dt 70 Kt 68.01 for the amount of personal income tax. When transferring a payment to the budget, account 68.01 is debited: Dt 68.01 Kt 51.

Reflection of VAT amounts

68.02 an accounting account is created to account for VAT on the basis of issued and accepted invoices. Let's consider a situation: for example, an enterprise purchased materials from a supplier for a certain amount. The seller sent an invoice. What entries does the buyer make in account 68 in accounting? Postings are carried out in two stages:

- Dt 19 Kt 60 – “incoming” VAT is recorded.

- Dt 68.02 Kt 19 – the amount is written off to offset VAT payments.

If a company sells products, it becomes necessary to issue an invoice within a certain period. The operation is recorded in accounting account 68.2 with the entry: Dt 90.3 Kt 68.02.

It turns out that in the course of economic activity, the enterprise accumulates VAT for deduction in the debit of subaccount 68.02, and in the credit for payment. In total, the organization actually pays the difference between the VAT amounts issued and accepted. It should be noted that all transactions for this tax are carried out only with an invoice.

Account 68 in accounting: postings :: BusinessMan.ru

Account 68 in accounting serves to collect information about mandatory payments to the budget, deducted both at the expense of the enterprise and employees. The amount and procedure for paying tax amounts are reflected in the Tax Code of the Russian Federation, according to which calculations must be made. The accountant records all obligations to the state, which are then transferred to him at a certain period and at the same time written off from the account.

What is taken into account in account 68?

According to the Standard Chart of Accounts, the 68th is called “Calculations for taxes and fees”. It quite obviously follows from this that it is created to account for settlements with the state budget. All commercial organizations in one way or another encounter the concept of taxes. What it is? Taxes are a fixed amount that must be paid by an individual or legal entity to finance the state. A full description of each payment is contained in the Tax Code of the Russian Federation.

If everything is more or less clear with taxes, then what is meant by the concept of “collection”? This is a contribution for which an obligation arises when an individual or business needs to obtain legal services from the government or other authorities. The fee may also be established for commercial companies as a mandatory condition for conducting business activities in a certain territory.

Tax obligations of organizations

Payments for taxes and fees can be sent to the federal, regional or local budget. It depends on the type of obligation. Federal taxes include VAT, excise taxes, and income taxes. Local and regional taxes consist mainly of amounts assessed for the use of land and property.

When considering the tax obligations of an enterprise, it would be correct to systematize payments in the context of this economic entity. Let's group the main types of taxes and fees, data on which are entered into account 68 in accounting, according to the method of their payment:

- from the amount of sales proceeds - excise taxes, VAT, customs costs;

- write-off to the cost of products (works, services) - taxes on land, water resources, mining, on property and transport of an enterprise, gambling business;

- from net profit - corporate income tax.

In addition, account 68 is also used to pay personal income tax levied on the income of individuals (employees of the enterprise).

Depending on the tax regime under which the enterprise operates, payment rates and their total number change. For example, organizations using the simplified tax system may be exempt from paying VAT, property and profit tax, and personal income tax.

Account characteristics

Account 68 in accounting is active-passive. At the end of the period, both a debit and a credit balance can be formed. In this case, the amounts in credit indicate the size of the enterprise’s obligations to the state, and in debit - vice versa. It turns out that any accrual occurs on credit, and write-off occurs on debit. Most often, of course, the organization has a credit ending balance on account 68.

Debit turnover indicates either the payment of taxes and fees, or the amount of VAT to be reimbursed when purchasing goods from suppliers. Credit turnover arises when obligations are formed and VAT is payable according to the invoice.

Analytical accounting

As can be seen from the characteristics of the enterprise’s obligations to the state, the number of taxes is enough to turn account 68 into confusion. To systematize the data, sub-accounts are created for a group of tax payments and fees: this way you can always view the necessary information.

Let's consider an example of analytical accounts for the main types of tax payments and fees from a legal entity:

- 68/01 – personal income tax;

- 68/02 – VAT;

- 68/03 – excise taxes;

- 68/04 – income tax;

- 68/05 – tax on vehicles;

- 68/06 – property tax;

- 68/07 – other fees and taxes;

- 68/08 – single tax (under the simplified tax system).

The established list of codes for subaccounts of synthetic account 68 is reflected in the accounting policy of the enterprise. The data is grouped into turnover sheets. The sum of the final results for analytical accounts should converge with the data of synthetic accounting of account 68.

Postings for personal income tax

Personal income tax is one of the main taxes withheld from individuals, the rate of which for the average working citizen is 13%. It is necessary to calculate the amount due to the state from the employee’s income only after deducting benefits, if any, should be applied. To collect information about personal income tax amounts from enterprise employees, accounting account 68.01 is used.

The entry describing the calculation of tax is drawn up as follows: Dt 70 Kt 68.01 for the amount of personal income tax. When transferring a payment to the budget, account 68.01 is debited: Dt 68.01 Kt 51.

Reflection of VAT amounts

68.02 an accounting account is created to account for VAT on the basis of issued and accepted invoices. Let's consider a situation: for example, an enterprise purchased materials from a supplier for a certain amount. The seller sent an invoice. What entries does the buyer make in account 68 in accounting? Postings are carried out in two stages:

- Dt 19 Kt 60 – “incoming” VAT is recorded.

- Dt 68.02 Kt 19 – the amount is written off to offset VAT payments.

If a company sells products, it becomes necessary to issue an invoice within a certain period. The operation is recorded in accounting account 68.2 with the entry: Dt 90.3 Kt 68.02.

It turns out that in the course of economic activity, the enterprise accumulates VAT for deduction in the debit of subaccount 68.02, and in the credit for payment. In total, the organization actually pays the difference between the VAT amounts issued and accepted. It should be noted that all transactions for this tax are carried out only with an invoice.

Postings for other taxes and fees

Account 68 in accounting is used in every commercial organization, since any economic activity should bring benefits not only to the entrepreneur, but also to the state.

The table shows the most common entries for the accrual and payment of amounts to the budget: Account assignments for account 68

| Dt | CT | Characteristics of a business transaction |

| 91 | 68.06 | Tax has been assessed for the use of water resources and on the property of the enterprise |

| 20 | 68.07 | The amount of land tax payable has been taken into account |

| 99 | 68.04 | Organizational income tax accrued |

| 70 | 68.01 | The amount to be paid for personal income tax has been allocated |

| 75 | 68.07 | Tax accrued on dividends paid |

| 90 | 68.03 | The amount of excise tax on goods sold is reflected |

| 68 | 51 | The amount of obligations to the state budget has been paid |

| 68 | 66 | Tax debt paid off with a loan |

Account 68 forms one of the main articles of the enterprise's obligations. Timely tax payments and the reliability of the information reflected are the key to successful and legal activities of the company.

businessman.ru

Postings for other taxes and fees

Account 68 in accounting is used in every commercial organization, since any economic activity should bring benefits not only to the entrepreneur, but also to the state.

The table shows the most common entries for the accrual and payment of amounts to the budget: Account assignments for account 68

| Dt | CT | Characteristics of a business transaction |

| 91 | 68.06 | Tax has been assessed for the use of water resources and on the property of the enterprise |

| 20 | 68.07 | The amount of land tax payable has been taken into account |

| 99 | 68.04 | Organizational income tax accrued |

| 70 | 68.01 | The amount to be paid for personal income tax has been allocated |

| 75 | 68.07 | Tax accrued on dividends paid |

| 90 | 68.03 | The amount of excise tax on goods sold is reflected |

| 68 | 51 | The amount of obligations to the state budget has been paid |

| 68 | 66 | Tax debt paid off with a loan |

Account 68 forms one of the main articles of the enterprise's obligations. Timely tax payments and the reliability of the information reflected are the key to successful and legal activities of the company.

Reflection of debit and credit on account 68

The debit of account 68 shows the amount of taxes that were actually transferred to the budget. This also includes VAT amounts that are debited from account 19.

The credit displays accrued amounts that must be transferred to the budget. All data must strictly coincide with the results of the reports submitted to the tax office.

Account credit means all amounts contributed to the budget on the basis of reports, declarations and other calculations. These include:

- profit and loss D99;

- settlements with the founders - D75;

- sales - D90;

- settlements with personnel regarding wages - D70.

Debit to account 68 includes:

- all amounts from the value added tax account for VAT;

- funds actually contributed to the budget from the current account.

To account for all amounts, entries are made: D68 K51 and D68 K19.

Display of credit and debit