Account assets and liabilities

Return to Assets and Liabilities

First of all, you should know what an asset and a liability are. An asset is property that belongs to a legal entity. This includes fixed assets (buildings, transport, equipment, etc.), finished products, materials, financial investments and more. Liabilities are those sources through which the organization’s assets are formed. This may include trade margins, depreciation of fixed assets and intangible assets, borrowed funds and more. Please note that some accounts can be active-passive, that is, they can produce both profit and loss. Such accounts include “Settlements with suppliers”, “Tax calculations” and others.

Count 68 – active or passive?

All organizations, regardless of their status, are recognized as taxpayers. The status of settlements with the budget is reflected in account 68 “Calculations for taxes and fees”. Analysis of records gives an idea of accrued and fulfilled obligations, the presence of credit or debit taxes.

Characteristics of account 68

Based on the results of their economic activities, organizations and entrepreneurs must transfer part of their funds to the budget. The same responsibilities apply to individuals.

Tax accrual for legal entities reflects account 68 in the accounting department. Transactions for the payment of budget obligations are also formed by accounting account 68.

The records contain data on accrued and paid tax liabilities of the organization itself, reflect the status of taxes withheld from employees, and provide data on indirect taxes, including those declared for deduction.

68 account – active or passive?

Account 68 in accounting can have both a debit and a credit balance, depending on the nature of the debt. In case of overpayment of tax liabilities, the balance becomes a debit. If there is debt, on the contrary, the amount that needs to be transferred to the budget is located on credit balances.

Analytical accounting for account 68 is carried out separately for each type of tax. The final result is summed up, while for some payments the balance can take on a debit value, for others - a credit value.

Thus, account 68 belongs to the group of active-passive accounts. The balance for these entries is expanded, that is, the debit balance is reflected in the asset balance, while the credit balance is included in the liability.

Account 68 in accounting

Tax liabilities based on the results of economic activity are calculated using account 68. Each type of tax that an organization must transfer has its own subaccount.

According to the methods of calculation, the following types of taxes are distinguished:

- Property. They are paid for the ownership of any object - transport, land, property on the organization’s balance sheet. Taxes are calculated based on the value of the taxable base and do not depend on the results of the company’s activities.

- Indirect taxes are included in the cost of goods or services provided (VAT, excise taxes, customs duties). The final payer is considered to be the direct consumer.

- Taxes based on the results of economic activity. Calculated based on the profit received.

The credit of account 68 shows the accrued amounts that must be transferred to the budget. The data must coincide with the results of tax reporting - declarations, calculations. Debit 68 of account shows transactions to pay off debt or reduce the amount of tax liabilities.

Postings to account 68

Analytical accounting is carried out for all types of taxes. The correspondence of account 68 depends on the nature of the operation, as in some cases account 68 is characterized - active or passive. So, debit account. 68 is formed in the following cases:

- When paying to the budget - Dt 68 - Kt 51.

- If there is “input” VAT - Dt 68 - Kt 19 - deduct VAT for goods and services received.

For a loan, account 68 in accounting entries can generate the following:

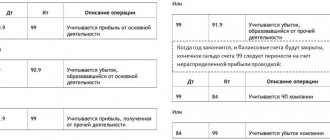

- Dt 99 - Kt 68 - calculation of income tax;

- Dt 91 - Kt 68 - reflected VAT on sales for other (non-core) activities;

- Dt 90 - Kt 68 - VAT is included in the cost of the goods;

- Dt 70 - Kt 68 - personal income tax is charged when calculating wages, account 68 is used. 1.

When offsetting tax liabilities, the posting will look like this:

- Dt 68 ― Kt 68, according to count. 68 subaccounts will correspond to the types of taxes that are involved in the transaction. Tax crediting is carried out if there is confirmation from the tax inspectorate within the budgets of one type (federal, regional, local).

Example 1

Salary accrued in the amount of 45,000 rubles. Withheld and transferred to the personal income tax budget in the amount of 5850 rubles. To reflect personal income tax in transactions, account 68 1 is used:

- Dt 26 - Kt 70 - 45,000 rubles - wages accrued;

- Dt 70 - Kt 68 1 - 5850 rubles - personal income tax withheld;

- Dt 68 1 - Kt 51 - 5850 rubles - personal income tax is transferred to the budget.

Example 2

Goods were purchased for the amount of 47,200 rubles, including VAT 18% 7,200 rubles. Products worth 88,500 rubles were manufactured for sale, including 18% VAT of 13,500 rubles. It is necessary to transfer tax in the amount of 6,300 rubles to the budget. VAT is reflected as 68 subaccounts 2.

- Dt 26 - Kt 60 - 40,000 rubles - goods from the supplier have been received;

- Dt 19 - Kt 60 - 7200 rubles - “input” VAT is reflected;

- Dt 62 - Kt 90 - 88,500 rubles - sales of products to the buyer;

- Dt 90 - Kt 26 - 75,000 rubles - reflects the cost of goods sold excluding VAT;

- Dt 90 - Kt 68 2 - 13,500 rubles - VAT is charged when selling goods to customers;

- Kt 68 2 - Dt 19 - 6300 rubles - the amount of VAT payable.

Analysis of account 68

The status of tax payments for an enterprise can be seen in more detail by analyzing the subaccounts to account 68. Each tax or fee corresponds to a separate subaccount, and calculations are also carried out separately from each other. The current list is fixed in the accounting policy of the subject; the chart of accounts 68 account can be divided as follows:

- 68 01 accounting account reflects the status of personal income tax payments for employees;

- 68 02 - invoice reflecting accrued VAT;

- 68 03 - excise taxes;

- 68 04 - income tax;

- 68 06 - land tax;

- 68 07 - transport tax;

- 68 08 - tax on property of organizations;

- 68 10 - other payments to the budget;

- 68 11 - UTII;

- 68 12 - tax paid in connection with the application of the simplified tax system.

Subaccounts 68 of the accounting account are used depending on the type and nature of the activity of the economic entity. The presented list can be expanded or shortened.

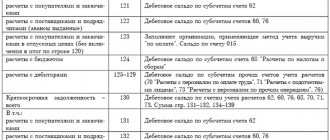

The balance sheet for account 68 contains summary information and can be considered both as a whole for the organization’s obligations, and separately for each type.

Source: https://spmag.ru/articles/schet-68-aktivnyy-ili-passivnyy

Assets and liabilities of the enterprise

Analyze the operation carefully. Active accounts include those that generate income; passive - something that entails the consumption of some resources. Let's say you are depreciating a fixed asset. In accounting, reflect this by posting: D20-K02. Account 20 “Main production” is an active account; in the balance sheet it is taken into account in the second section “Current assets” in the line “Inventories”. Account 02 “Depreciation of fixed assets” is passive. The amount of depreciation charges is indicated in the appendix to the balance sheet and profit and loss statement.

If you doubt the passivity or activity of an account, you can use the chart of accounts. In some publications or programs (for example, 1C), the type of account is indicated next to the name.

To check whether you have reflected business transactions correctly, create a balance sheet. Assets and liabilities must be equal; if your totals differ, you have reflected something incorrectly. The principle of double entry, on which all accounting is based, applies here. Check again that the transactions are reflected correctly and create the balance sheet again.

Liabilities of the enterprise

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

They characterize the obligations, responsibilities and debts of the enterprise and show where the assets come from.

All the assets that an enterprise owns do not come out of nowhere and do not appear out of nowhere; they arise from certain sources. These sources are liabilities.

Assets are closely interconnected with liabilities; any enterprise simultaneously possesses both. After all, if the organization does not have a liability, then the asset will have nowhere to come from. How to determine what a particular property of an enterprise is? To better understand the difference between a liability and an asset, let's look at a few examples.

Example #1 of the interaction of assets and liabilities

The company purchases a packaging production machine. The machine becomes his asset, that is, the organization’s assets have increased. But the machine did not come out of thin air; it was purchased from a supplier for a certain amount of money. As a result of this purchase, the company incurred a debt to the supplier; this debt will be a liability of this organization.

Purchase of a machine → assets ↑ Debt has arisen to the supplier → liabilities ↑

Moreover, note that assets increased by the same amount as liabilities.

Let's look further. The company paid the supplier money for the machine, how did the ratio of liabilities and assets change?

Debt repaid → liabilities ↓ Cash in the company's current account decreased by the amount of repaid debt → assets ↓

As we can see, as a result of this operation, both liabilities and assets decreased. Moreover, they decreased again by the same amount.

Assets and liabilities in reporting

The key form of accounting is the balance sheet, the unified form of which was approved by Order of the Ministry of Finance No. 66n. Please note that other forms of reports apply to public sector institutions: Orders of the Ministry of Finance No. 33n and 191n. However, regardless of the type of organization, the structure of the balance sheet is practically the same, that is, the forms include the assets and liabilities of the balance sheet.

Let us reflect the structure of the balance sheet indicators (balance sheet assets and liabilities) in the table:

| Active part | Passive part |

| Non-negotiable Negotiable | Capital and reserves long term duties Short-term liabilities of the company |

This grouping of indicators is defined for reporting forms according to Order of the Ministry of Finance No. 66n, which regulates forms for commercial firms and non-profit organizations. Now let's look at the balance sheet indicators in more detail:

What is included in the active part of reporting

This is any property of the institution. For example, cash on hand, inventories, fixed assets, buildings, machines and other material and financial assets that directly belong to the company.

The assets of the balance sheet group the current and non-current assets of the enterprise.

When preparing reports, it should be taken into account that a balance sheet asset is a grouping of assets according to their useful life, as well as according to the speed (time) of their turnover, that is, liquidity.

In the balance sheet form, values are grouped according to their degrees of liquidity. The resources of the enterprise that are the least liquid are indicated first, and then in ascending order. In other words, a balance sheet asset is a grouping of economic resources according to the speed of their circulation into means of payment.

Let us note that the most liquid assets are, of course, cash: cash in the cash register and in the company’s current accounts. And the least liquid include the institution’s fixed assets, intangible assets and long-term financial investments, which cannot be realized quickly and without losses.

The assets of the balance sheet present in grouped form the accounting indicators as of the reporting date. Analysis of these accounting indicators allows us to draw a conclusion about the solvency of the enterprise.

What is it for

Reflection of debt obligations and financial receipts in the financial statements is necessary:

- To track the performance of the enterprise.

- To analyze the success or failure of a particular transaction, innovation or any other action of the company’s management.

- To formulate an enterprise development strategy, etc.

All movements in the account must be reflected in the accounting report

There are many reasons why we have to divide all material movements into active and passive. This is done by qualified accounting department personnel. They make entries for all transactions, thus identifying arrears or account balances. All data is entered into the appropriate lines of the balance sheet.

A clear distribution of all financial transactions allows not only to track and analyze the real state of affairs in the company, but also contributes to the adjustment of actions, identifying all the gaps and weaknesses of the current management of the enterprise. Strategically, this is extremely useful and effective. However, it is important that all indicators and calculations are made correctly, so allowing amateurs to fill out reports would be a reckless mistake.

What are liabilities and their classification

Liabilities include all the obligations of the organization that were accepted by it in the reporting period, as well as the sources of the formation of material assets and resources of the institution. In other words, the liability side of the balance sheet is a grouping of assets according to the sources of their formation, that is, liabilities are the sources of formation of material assets, cash, and intangible assets.

The main classification of the passive part of the balance sheet is the division of liabilities into capital and liabilities.

Capital is recognized as funds allocated by the founders to carry out activities, for example, to purchase property, to provide guarantees to creditors, and to create reserve funds.

Types of liabilities

This definition includes all the company’s sources of income and financial obligations. These include:

- interest and dividends on securities;

- wages for workers and employees at different levels;

- tax payments, etc.

All liabilities of the enterprise are grouped in reporting documents by type, purpose and affiliation. This simplifies the collection of information and helps determine where funds are going and for what purpose.

If the transaction involves making an advance payment, then transactions, depending on the timing of the transfer of funds and delivery of products, are entered into the passive part of the BB, which is why they are often called active-passive transactions.

Property of the organization - assets and liabilities

Capital can be own or borrowed. Own funds are capital that belongs to the founders, the creators of the company. And borrowed capital is funds received from third-party organizations and individuals for temporary use.

Liabilities are debts a company owes to third parties to fulfill certain financial or property requirements. In turn, liabilities are divided into long-term (more than 12 months) and short-term debts, which must be fulfilled 12 months or earlier.

| Home » Accountant » Account assets and liabilities |

Account assets and liabilities

Return to Assets and Liabilities

First of all, you should know what an asset and a liability are. An asset is property that belongs to a legal entity. This includes fixed assets (buildings, transport, equipment, etc.), finished products, materials, financial investments and more. Liabilities are those sources through which the organization’s assets are formed. This may include trade margins, depreciation of fixed assets and intangible assets, borrowed funds and more. Please note that some accounts can be active-passive, that is, they can produce both profit and loss. Such accounts include “Settlements with suppliers”, “Tax calculations” and others.

Analyze the operation carefully. Active accounts include those that generate income; passive - something that entails the consumption of some resources. Let's say you are depreciating a fixed asset. In accounting, reflect this by posting: D20-K02. Account 20 “Main production” is an active account; in the balance sheet it is taken into account in the second section “Current assets” in the line “Inventories”. Account 02 “Depreciation of fixed assets” is passive. The amount of depreciation charges is indicated in the appendix to the balance sheet and profit and loss statement.

If you doubt the passivity or activity of an account, you can use the chart of accounts. In some publications or programs (for example, 1C), the type of account is indicated next to the name.

Asset and liability - two basic concepts of accounting

Accounting is a kind of information system, the main task of which is to display information about the economic activities of an enterprise for the purpose of its further analysis and management decision-making. Asset and liability are basic accounting concepts. In this article we will explain what these terms mean and why they are so important.

As you know, one of the main accounting documents of an enterprise is the balance sheet, which has sections “asset” and “liability”. The “asset” section displays all the property owned by the company - fixed assets, means of production, low-value items, money in accounts and on hand, accounts receivable, etc. All assets are the property of the enterprise and are recorded on the balance sheet after they undergo an assessment procedure that differs for each type of property.

Obviously, no property can be acquired free of charge, without the use of any funds. That is why the “liabilities” section includes all sources of formation of the company’s assets. These sources can be divided into two large groups: the capital of the enterprise (amounts of money and the value of property provided by the founders as initial contributions) and its liabilities - accounts payable, debts for settlements with suppliers, authorities and hired employees.

Now let's try to figure out why the main document is called “balance sheet”? Why is the balance sheet of assets and liabilities so important? To understand this, oddly enough, the physical law of conservation of matter will help, the main essence of which can be conveyed by the phrase “nothing appears from nowhere and nothing disappears into nowhere.” In relation to accounting, the acquisition of any property as an asset should entail a corresponding change in liability. Let's say that a company receives money as a loan, on the one hand, it will appear in the asset item “cash on account”, but also in the liability item “accounts payable”. If other assets are then purchased for this money, for example, shares, then there will be a transfer between the items “money in the account” and “financial investments”, but the asset and liability of the balance sheet will still be equivalent. It is this equivalence that shows that all reporting is drawn up correctly and there are no errors in displaying the business activities of the company.

Thus, an asset and a liability are, in fact, two sides of the same coin, only the asset shows the side that concerns only the acquisition and ownership of property, and the liability shows the side that is associated with the source through which the company receives new property. Maintaining equality of assets and liabilities is an important task for any accountant, since the discrepancy between the two sections of the balance sheet shows that it was compiled with an error. Finding an error in the balance sheet is quite simple - just find the difference between an asset and a liability, and divide this amount by two. The resulting figure will be the sum of the error, mistakenly entered in the wrong section. True, this method is effective only if only one mistake is made - otherwise the search for inconsistencies can take a long time, and the preparation of the document may have to start all over again.

We hope that we have provided readers with comprehensive information about what an asset and a liability are. Remember, the equality of the two sections of the balance sheet is the basic principle of accounting and the main sign of proper accounting in an enterprise. We wish you that the asset and liability in your balance sheets always match penny to penny!!!

ABC of Accounting

d. - are his assets. These are all things that can be converted into cash.

Assets are divided into:

- Non-negotiable

- Intangible assets

- Fixed assets

- Construction in progress

- Profitable investments in material assets

- Long-term financial investments

- Deferred tax assets

- Other noncurrent assets

Negotiable

- Reserves

- Value added tax on purchased assets

- Accounts receivable (payments for which are expected more than 12 months after the reporting date)

- Accounts receivable (payments for which are expected within 12 months after the reporting date)

- Short-term financial investments

- Cash

- Other current assets

Liability balance

An organization's liabilities are the sources of its assets. These include capital, reserves, as well as accounts payable obligations that the organization has incurred in the process of conducting business activities.

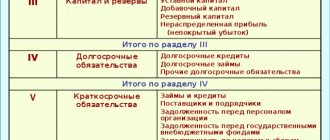

Liabilities are divided into:

- Capital and reserves

- Authorized capital

- Own shares purchased from shareholders

- Extra capital

- Reserve capital

- Retained earnings (uncovered loss)

long term duties

- Loans and credits

- Deferred tax liabilities

- Other long-term liabilities

Short-term liabilities

- Loans and credits

- Accounts payable

- Debt to participants (founders) for payment of income

- revenue of the future periods

- Reserves for future expenses

- Other current liabilities

Balance sheet asset

Intangible assets

- a non-monetary asset that has no physical form.

Fixed Assets (Fixed Assets)

(or

Fixed Production Assets

(FPF)) - fixed assets of an organization reflected in accounting or tax accounting in monetary terms.

"Construction in progress"

is the amount of unfinished capital investments.

Profitable investments in material assets

- investments of an organization in part of the property, buildings, premises, equipment and other valuables that have a tangible form, provided by the organization for a fee for temporary use (temporary possession and use) in order to generate income

Long-term financial investments

- investment of free funds of the enterprise, the maturity of which exceeds one year: - funds allocated to the authorized capital of other enterprises; — funds used to purchase securities of other enterprises; — long-term loans issued to other enterprises; and so on.

Deferred tax assets

represent a part of deferred income tax, the purpose of which is to reduce the amount of tax that must be paid to the budget in the reporting period.

Fixed assets

— assets with a useful life of more than one year: long-term financial investments, intangible assets, fixed assets, other long-term assets.

Material and production

Inventories are assets used as raw materials, materials, etc. in the production of products intended for sale (performing work, providing services), purchased directly for resale, and also used for the management needs of the organization.

Value added tax on purchased assets

- an account intended to summarize information about the amounts of value added tax paid (due to payment) by the enterprise on acquired assets.

Short-term financial investments

- short-term (for a period of no more than one year) financial investments of an enterprise in income-generating assets (shares, bonds and other securities) of other enterprises, associations and organizations, funds in time deposit accounts of banks, interest-bearing bonds of state and local loans, etc. - are the most easily realizable assets.

Reflection of income tax. The relationship between the income statement and tax calculations

Current income tax is shown on line 150 . This line reflects the entire amount of income tax accrued for the reporting (tax) period.

This indicator should be equal to the amount of income tax accrued on the tax return for a given period, as well as the amount of income tax generated in accounting in account 68 subaccount “Income Tax Calculations”.

Accrued payments of income tax and payments for recalculation of this tax from actual profit, as well as the amount of tax penalties due, are reflected in the debit of account 99 in correspondence with account 68 “Calculations for taxes and fees”.

With the adoption of Chapter 25 of the Tax Code of the Russian Federation, the amount of income tax is determined according to the rules of tax accounting and is subject to reflection in the accounting system, like any economic fact related to the activities of an economic entity.

The Accounting Regulations “Accounting for Income Tax Calculations” (PBU 18/02), which came into force on January 1, 2003, allows you to reflect in accounting and reporting the existing differences when calculating tax according to the accounting rules from the income tax formed in the tax office. accounting It is also important to emphasize that this Regulation provides for the reflection in accounting not only of the amount of profit tax payable to the budget in the current period, but also of amounts that affect the amount of profit tax of subsequent reporting periods. In accordance with PBU 18/02, these amounts are called permanent and temporary differences.

Deferred tax assets and liabilities

The permanent difference refers to income and expenses that form the accounting profit (loss) of the reporting period, but are not taken into account for tax purposes both in the reporting period and in subsequent periods.

In accordance with PBU 18/02, the organization independently determines the procedure for generating information about permanent differences. In our opinion, to generate information about emerging income and expenses that are not taken into account for tax purposes, you should use a system of subaccounts to the income and expense accounts.

So, to the income accounts 90 “Sales”, 91 “Other income and expenses”, 99 “Profit or loss” and expenses 20 “Main production”, 23 “Auxiliary production”, 25 “General production expenses”, 26 “General expenses” , 44 “Sales expenses”, 91 “Other income and expenses”, 99 “Profits and losses” and other accounts of the Chart of Accounts for accounting financial and economic activities, it is advisable to open the following second-order subaccounts:

- “Income taken into account for tax purposes”;

- “Income not taken into account for tax purposes”;

- “Expenses taken into account for tax purposes”;

- “Expenses not taken into account for tax purposes.”

By multiplying the amount of the permanent difference by the income tax rate, the amount of the permanent liability is determined.

The permanent tax liability (PLO) is understood as the amount of tax that leads to an increase (decrease) in tax payments for income tax in the reporting period.

For the amount of the permanent tax liability, defined as the product of the permanent difference (in terms of expenses) that arose in the reporting period and the profit tax rate established by the legislation of the Russian Federation and taxes and fees and in force on the reporting date, the following entry is made in accounting:

Debit account 99 sub-account “Permanent tax liability” Credit account 68.

Features and disadvantages of PBU 18/02

Unfortunately, PBU 18/02 does not consider the situation when permanent differences in income reflected in accounting exceed the “tax” ones (in practice, this option is possible).

In this case, the identified amount, calculated as the product of the permanent difference (in terms of income) and the income tax rate, is not a permanent tax liability, but most likely a “permanent tax asset.”

In accounting, it should be reflected by the following entry: Debit account 68 Credit account 99 subaccount “Permanent tax asset”.

The difference between income and expenses, which forms profit (loss) in accounting in one reporting period, and taxable profit in another, in accordance with PBU 18/02 is called temporary.

Moreover, if income and expenses increase the tax on accounting profit in the reporting period (i.e.

the amount of accounting profit in the reporting period is less than the amount of tax profit by the amount of the indicated income and expenses), but reduce it in subsequent periods, then they are called deductible temporary vestries.

If such income and expenses reduce the tax on accounting profit in the reporting period, but increase it in subsequent periods, then they are called taxable temporary vestries.

PBU 18/02 requires that taxable and deductible differences be taken into account separately in the analytical accounting of the corresponding asset and liability account in the assessment of which the deductible or taxable temporary difference arose.

To generate information in the accounting system about income and expenses that lead to the formation of temporary differences, we consider it appropriate to organize their separate accounting in second-order subaccounts, highlighting income and expenses that have a different accounting or recognition procedure for tax purposes.

Deferred tax asset (DTA) is understood as that part of the income tax by which the tax on accounting profit of the reporting period increases and the income tax payable in subsequent reporting periods decreases.

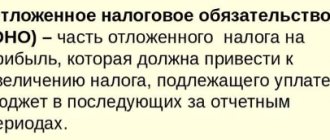

Deferred tax liability (DTL) is understood as that part of the income tax by which the tax on accounting profit of the reporting period is reduced and the income tax payable in subsequent reporting periods is increased.

The amount of the deferred tax asset and deferred tax liability is determined by multiplying the deductible and taxable temporary differences by the income tax rate.

In a manufacturing enterprise, a simplified scheme for calculating permanent and temporary differences can be represented as formulas:

Z = Mater. + Salary pl. + Report + Am. + Other + PR + Write-off of RBP

S RP (account) = (GP n – GP k) book. + (WIP n – WIP k) book. + Z inc. + Z indirect. + PR + A book. + RBP equal

S RP (cash) = (GP n – GP k)cash. + (WIP n – WIP k)cash. + Z inc. + Z indirect. + And cash. + RBP units

S RP (cash) – S RP (accounting) = D GP cash. – DGP book. + DWIP cash. – DNZP book. - ETC. + And cash. - And boom. + RBP units – RBP equal.

Unlike the balance sheet, Form No. 2 is based not on accounting account balances, but on the basis of turnover. Therefore, Form No. 2 reflects not the balances of accounts 09 “Deferred tax assets” and 77 “Deferred tax liabilities”, but the results of the turnover of these accounts for the reporting period.

The income statement reflects the difference between accrued and written off deferred tax assets and liabilities.

Namely: the line “Deferred tax assets” shows the difference between the debit turnover of account 09 and the credit turnover on this account for the reporting period, and the line “Deferred tax liabilities” shows the difference between the credit and debit turnover on account 77.

In Form No. 2 there are no brackets in the line “Deferred tax liabilities”. The fact is that the indicators of the lines “Deferred tax assets” and “Deferred tax liabilities” in form No. 2 in certain cases can change their sign.

Once accrued, deferred tax assets increase profit (reduce loss) before tax. Deferred tax liabilities, on the contrary, reduce the amount of profit or increase the loss.

When deferred tax assets or liabilities are settled, the reverse process occurs.

The write-off of deferred tax assets occurs at the expense of profits (that is, profits decrease), and the settlement of deferred tax liabilities leads to an increase in the organization's profits.

The indicator of deferred tax assets is reflected in Form No. 2 as a positive value if the debit turnover on account 09 (the amount of accrued tax assets) for the reporting period was greater than the credit turnover (the amount of repaid tax assets).

If the credit turnover on account 09 is greater than the debit turnover (that is, more deferred tax assets have been repaid than accrued), then the difference between the turnovers is reflected with a minus sign.

A negative deferred tax asset will appear on the income statement.

The opposite situation occurs with deferred tax liabilities. If the credit turnover of account 77 is greater than the debit turnover of this account, this means that during the past period more tax liabilities were accrued than were repaid.

Then in form No. 2, in the line “Deferred tax liabilities”, an indicator with a minus sign will be reflected, which will reduce profit (increase loss) before tax.

But if during the reporting period the organization repaid more deferred tax liabilities than accrued (that is, the debit turnover on account 77 exceeds the credit one), then in the profit and loss statement the indicator of the line “Deferred tax liabilities” will change its sign from minus to plus.

Calculation of income tax

According to the rules of PBU 18/02, the current income tax is calculated using the formula:

TNP = URNP + ONA – ONO + PNO – PNA + cancellation of ONO – cancellation of ONA, where: URNP – conditional income tax expense. URNP = book. profit x tax rate Debit 99 Credit 68, ONA Debit 09 Credit 68, extinguishing ONA Debit 68 Credit 09, ONO Debit 68 Credit 77, extinguishing ONA Debit 68 Credit 68, PNO Debit 99 Credit 68,

PNA Debit 68 Credit 99.

The balance on account 68 can be:

- or credit;

- or zero, since the amount of income tax cannot be negative.

When a loss occurs for tax purposes, the income tax base is considered equal to zero, and the resulting loss forms a deferred tax asset:

Debit account 09 Credit account 68.

There is a blank line after line 150. It includes expenses attributable to financial results, for example, economic sanctions for violation of tax laws (penalties, fines), etc. are shown in brackets.

If you liked the article, you may also be interested in the material “Collectors are calling and threatening – what to do”

Source: https://Status643.ru/status/otrazhenie-naloga-na-pribyl-vzaimos

Liability balance

Authorized capital

- this is the amount of funds initially invested by the owners to ensure the statutory activities of the organization; The authorized capital determines the minimum amount of property of a legal entity that guarantees the interests of its creditors

Extra capital

— a liability item on the balance sheet, consisting of the following elements:

- share premium

- the difference between the sale and par value of the company's shares; - exchange rate differences

- differences when paying for a share of the authorized capital in foreign currency; - the difference when revaluing fixed assets

is the difference when the value of fixed assets changes.

Reserve capital

- the size of the enterprise’s property, which is intended to place undistributed profits in it, to cover losses, repay bonds and repurchase shares of the enterprise, as well as for other purposes.

- Short-term liabilities

Accounts payable

- the debt of a subject (enterprise, organization, individual) to other persons, which this subject is obliged to repay.

Reserves for future expenses

In order to evenly include upcoming expenses in production or distribution costs, the organization can create reserves for: upcoming payment of vacations to employees; payment of annual remuneration for long service; payment of remuneration based on the results of work for the year; repair of fixed assets; production costs for preparatory work due to the seasonal nature of production; upcoming costs for land reclamation and other environmental measures; upcoming costs of repairing items intended for rental under a rental agreement; warranty repairs and warranty service; covering other anticipated costs and other purposes provided for by the legislation of the Russian Federation, regulations of the Ministry of Finance of the Russian Federation.

Download abstract

QUESTION:

Assets and liabilities of the enterprise

ANSWER:

The assets and liabilities of an enterprise are objects of accounting. Assets are resources controlled by an enterprise as a result of past events, the use of which is expected to lead to future economic benefits. Assets are classified according to their composition and location and functional participation in the activity process. Assets are divided into non-current and current. Current assets are cash and cash equivalents that are not restricted in use, as well as other assets intended for sale or consumption during the operating cycle or within 12 months from the balance sheet date. The following current assets are distinguished: cash on hand and in bank accounts; productive reserves; short-term financial investments; accounts receivable - current debt due within one year (debt of accountable persons, debt of customers); deferred expenses - expenses that occurred in the current or previous periods, but relate to the next reporting periods. Non-current assets - their useful life is more than one year or one operating cycle that exceeds a year. They are divided into: fixed assets; intangible assets; long-term financial investments; other irreversible assets. Liabilities are the sources of formation of economic assets (assets).

Other debts

In the balance sheet there is such a term as “other debt”. It applies to both the debtor and the creditor. For remote control it will consist of various items of a material or intangible nature.

This may include:

- Planned settlements of payments and contributions with buyers or contractors.

- Reporting on financial resources and property issued to responsible persons for the implementation of work activities (travel budget, business expenses, etc.).

- Debt for housing and communal services, social payments, etc.

Other debts include travel allowances

An important factor in optimizing receivables is the analysis of solvency and selectivity of potential partners, as well as the clear formation of terms of cooperation, payment, etc.

Other accounts payable are in many ways similar to accounts payable, but it includes such quantities as:

- Unclaimed amounts for salaries, vacation pay, scholarships, revenues from the state budget, etc.

- Claims, etc.

To analyze it, one should consider the composition, timing and reasons why it arose. It is recommended that payment calendars be created to provide a more accurate picture of a business's ability to repay funds.

How to determine liabilities and assets of a balance sheet

Sources are divided into: - own; -— attracted. Own capital includes equity, provision for future expenses and payments, and future income. Those involved are divided into long-term and current liabilities. A liability is a debt of an enterprise that arose as a result of past events and the repayment of which will lead to a decrease in the enterprise's resources, which embody economic benefits. Long-term loans include long-term bank loans; long-term financial obligations; other long-term liabilities. Current liabilities include: short-term bank loans; accounts payable for goods, works, services; current settlement obligations; other current liabilities.

TEACHER:

N.V.

GODOPOLOVA Candidate of Economics, Associate Professor, Head of the Department of Accounting and Auditing, Vinnitsa Institute of Economics, Ternopil National Economic University