Future businessmen are interested in how to open an individual entrepreneur in another city without registration? Please note that registration is a mandatory procedure for every citizen of the Russian Federation. The term in fact does not exist since the end of the USSR. Today, registration at the place of residence is called registration, the absence of which threatens with administrative punishment. However, it is just as impossible to open an individual entrepreneur in another city without registration as in your native locality. This is clearly stated in Article 8 of Federal Law No. 129-FZ - registration of individual entrepreneurs is tied to the citizen’s place of residence.

Taxes for hired employees of individual entrepreneurs in another city

Regardless of the city in which the individual entrepreneur works, all reporting and payment of all taxes was made at the place of registration of the individual entrepreneur (the exception is the personal income tax on UTII and PSN, it is paid at the place of business on the basis of Federal Law dated May 2, 2015 N 113-FZ )

Taxes payable for an individual entrepreneur:

- PFR (Pension Fund of Russia);

- MHIF (health insurance fund);

- FSS (social insurance fund);

- Personal income tax (personal income tax 13%).

Moving to another region: what to do with individual entrepreneurs, the military registration and enlistment office and registration?

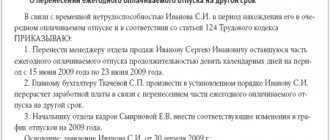

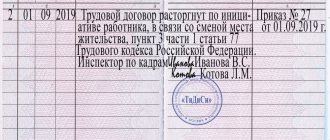

I give answers to your questions: 1. If we talk about registration, then the entrepreneur is assigned to it at the tax office at his place of residence. At the same time, an individual entrepreneur does not have the concept of a legal address and can work throughout Russia. If he has changed his registration, he does not need to report this to his Federal Tax Service. According to Article 85 of the Tax Code of the Russian Federation in 2020, information about a change in the place of residence of an entrepreneur within 10 days is transferred to the FMS, and not by an individual (i.e., you). 2. In order to register at a new place of residence, you will need to register at the old one address.

The law allows 2 methods of deregistration at the place of residence:

It is necessary to submit 3 documents to the territorial body of the Federal Migration Service (FMS) or the regional branch of the multifunctional center (MFC):

passport;

application for deregistration in any form;

completed departure address sheet

The form will be provided by the registrar or it can be prepared in advance (form No. 7 at the bottom of the page of the Russian Federal Migration Service website).

After 3 working days, you can pick up your passport with the changes made and a second copy of the departure slip.

Deregistration at your previous place of residence will occur automatically if you submit registration documents at your new address.

There may be situations when a resident of a country can be deregistered without personally applying for such a service:

in case of death, recognition as dead or missing;

in case of loss of rights to the place of residence, cancellation of registration due to its erroneous registration or evidence of fictitious registration.

In case of registration at a new place of residence, you must provide the following to the regional department of the Federal Migration Service of Russia or the MFC:

application for registration (form No. 6 at the bottom of the page of the Russian Federal Migration Service website);

passport;

a document that gives the right to live at a new address (certificate of ownership, rental agreement or warrant);

a departure slip if the discharge procedure was completed in advance (form No. 7 at the bottom of the page of the Russian Federal Migration Service website);

statement of consent from the owners, if the person registering is not the owner of the place of residence.

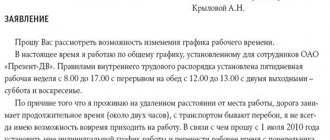

The unified form application can be completed in two ways:

Electronically. If the resident registering is registered on the State Services portal, then in the Federal Migration Service section you should select “Registration at the place of residence” and follow the instructions on the page.

Personally. The form can be filled out at the MFC, FMS offices or at home by downloading form No. 6 at the bottom of the page of the Russian FMS website.

The statement states:

personal data (passport, full name and date of birth) and data of the owner of the property (if it is another person);

information about the old and new registration address, as well as about the document providing the basis for registration.

When changing the registration address, it is recommended to make changes to the following documents:

Vehicle registration certificate (if available). To make changes, you should contact the state traffic inspectorate.

Military ID. Men of any age are required to notify the district military registration and enlistment office and receive a mark on their military ID.

The service of changing registration at the place of residence is provided free of charge. To do this, you need to contact the regional department of the Federal Migration Service or the MFC.

In order not to spend several hours in queues, it is advisable to make an appointment with the registrar in advance through the MFC or Gosuslugi portals. The duration of registration for a change of registration does not exceed 20 minutes.

It should be provided in advance that the responsible employee will take the passport for registration for a period of 3 days. On the 4th day, the document with the changes made can be picked up without an appointment or queues.

The State Services portal makes it possible to electronically submit an application for a change of registration.

The first thing you need to do is find the “Registration at Place of Residence” section.

Next, passport data, personal and contact information, old and new registration addresses, information on the owner (if not registered) and documents certifying the right to housing are entered into the form.

If completed successfully, the system will assign a number to the application. Within 3 days, the application will be accepted for processing and the person registering will be invited to an appointment with the registrar, indicating the date, time and list of original documents.

How long before you need to register after discharge?

The law establishes a seven-day period for registration at a new address. In order not to fall within such a short period of time, lawyers recommend not checking out of the apartment separately, but going through the procedure automatically when registering at a new address.

When moving to another city you can:

Register immediately. To do this, you should appear at the Federal Migration Service or MFC at your new place of residence and submit a standard package of documents. However, it is not necessary to register at your old address in advance.

Get temporary registration. In case of long-term departure, each person has the right to obtain temporary registration within 90 days of stay in the new place.

For temporary registration, you do not need to be discharged from your permanent place of residence. 3. Conscripts were required to be registered with the military at their place of actual residence. What does it mean?

On February 6, 2020, the President of the Russian Federation signed a law according to which conscripts will be required to register for military service at the military commissariat at their actual place of residence, regardless of whether they are registered.

The provisions of Federal Law No. 54-FZ of March 28, 1998 “On Military Duty and Military Service” provide that a citizen is required to be registered with the military at the place of his actual residence, regardless of whether he has the appropriate registration. The law directly establishes that a citizen’s lack of registration at his place of residence and place of stay does not exempt him from the obligation to be registered with the military and cannot serve as a basis for refusal to register with the military.

When is a citizen required to register for military service at his place of actual residence?

Such an obligation arises when moving to a new place of residence or place of stay for a period of more than 3 months (clause 50 of the Regulations on Military Registration, approved by Decree of the Government of the Russian Federation of November 27, 2006 No. 719).

For example, if a conscript studying by correspondence temporarily leaves for another city in order to take a test that lasts two months, then in this case there is no need to register for military service at the new place of residence

However, if the move is associated with full-time (full-time) training and the young man will live in the new city for more than three months, then in such a situation, military registration at the new place of residence will be mandatory.

The law imposes on employees of organizations responsible for military registration work the obligation to send to military commissariats, within two days, information about cases of identifying conscripts who are not registered with the military, but are required to be registered. In addition, they are required to serve citizens with summonses for military registration.

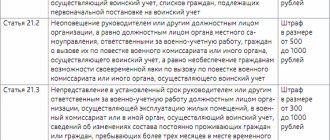

If an employer or university employee evades fulfilling his duties, then he will face a fine.

How to register for military service at your place of actual residence?

A citizen must come to the military commissariat and provide information about the place of stay (study), including those not confirmed by registration, after which the conscript will be registered with the military.

What liability is provided for failure to register for military service at the place of actual residence?

First of all, administrative – in accordance with Article 21.5. Failure to appear at the military commissariat within the prescribed period for military registration and making changes to military registration documents when moving to a new place of residence shall entail a warning or the imposition of an administrative fine in the amount of one hundred to five hundred rubles.

However, under certain circumstances, a conscript may also be brought to criminal liability - the Supreme Court of Russia has already explained that if a citizen, having the intent to evade conscription for military service, arrives at a new place of residence without registering for military service in order to avoid being handed over to him against the personal signature of the summons of the military commissariat, then what he did should be qualified under Part 1 of Article 328 of the Criminal Code of the Russian Federation (clause 6 of the Resolution of the Plenum of the Supreme Court of the Russian Federation of April 3, 2008 No. 3).

At the same time, citizens who violated the rules of military registration, but were not subject to conscription for military service, for example, due to the presence of a deferment for study (see paragraph 3 of the above-mentioned Resolution of the Plenum of the Supreme Court), will not be able to be held criminally liable.

When will the new rules on military registration come into effect?

The law was published on February 6, 2020. Since the text of the document does not provide for the procedure for entering into legal force, as a general rule this happened after 10 days.

Taxes and reporting of individual entrepreneurs in another city

Now let's look at where to register and pay taxes for the very activities carried out by an individual entrepreneur in another city (region):

UTII tax in another city

It is necessary to register the UTII tax in the city where you are going to conduct your business; you must also pay the UTII tax at the place where the activity is carried out, but there are several exceptions: (motor transport services, advertising on transport and delivery (delivery) retail trade is registered and is paid at the place of registration of the individual entrepreneur).

Application of the simplified tax system in another city

With this taxation everything is extremely simple.

Regardless of the city in which you are opening a business and want to apply the simplified tax system:

- All reports are submitted at the place of registration of the individual entrepreneur;

- All taxes are paid at the place of registration of the individual entrepreneur;

- The cash register (in case of trade) is registered with the tax office at the place of registration of the individual entrepreneur.

Patent system in another region

As for the patent taxation system, a patent is obtained in the region in which you intend to conduct your business and its effect does not extend to other regions.

All other payments are made at the place of registration of the individual entrepreneur.

Entering information into the state register of individual entrepreneurs - list of documents

To replace old information with new information in the Unified State Register of Enterprises, you need to fill out an application (form P24001). The individual entrepreneur must draw up this application on the computer, print it and several additional sheets to it. The number of such sheets depends on what specific information was updated:

- when changing the full name or birth information, a citizen of the Russian Federation must fill out an application and attach sheet “A” to it;

- if the data in the passport has been changed, then you should fill out sheet “D”;

- when changing the place of permanent residence, an individual entrepreneur must enter the relevant information into sheet “B”.

Also, when changing registration, an individual entrepreneur must submit a copy of his passport to the tax office. In this case, he must make a copy of those pages of the passport on which there are entries, connect them with threads and put numbers on each sheet.

In addition to the application, he must submit to the inspection a photocopy of the Certificate, which indicates the TIN, and the document on state registration of the individual entrepreneur.

The individual entrepreneur’s signature on the application, as well as copies of the businessman’s passport, must be certified by a notary. Every entrepreneur can carry out this procedure and pay 1000 rubles.

After accepting all the necessary documents from the individual entrepreneur, the tax officer issues a receipt indicating the entire list of submitted business papers, and sets a time for receiving an extract from the state register of the individual entrepreneur.

Registration of the changes made is done within 5 calendar days, then the extract and TIN Certificate are issued to the citizen of the Russian Federation in person.

Activities of UTII in different regions and payment of taxes

Be careful with personal income tax - you should transfer this tax for employees engaged in “imputed activities”, as well as submit information about the income of individuals to the inspectorate at the place of registration as a UTII payer. Officials made this conclusion in letters from the Ministry of Finance of Russia dated January 21, 2013 No. 030405/347, dated March 10, 2010 No. 03-04-08/3-50 and the Federal Tax Service of Russia dated April 7, 2010 No. ShS-17-3 / But insurance premiums for employees, just as with the “simplified” system, must be paid to the funds at your place of residence.

Since there is no need to register with other funds (clause 21 of the Procedure for registration and deregistration in the territorial bodies of the Pension Fund of the Russian Federation, approved by the resolution of the Board of the Pension Fund of October 13, 2008 No. 296p and clause 6 of the Procedure for registration and deregistration of policyholders, approved by order Ministry of Health and Social Development of Russia dated December 7, 2009 No. 959n).

OKATO code is the same

The first situation is that the activity transferred to UTII is carried out in one municipality (OKATO code is the same), but at different addresses. When these addresses belong to the same tax office, then the situation is simplest: registration takes place at this office.

If the types of activities are the same (for example, there are several retail outlets), then when starting to conduct the same activity, but at a new address (a new retail outlet is opened), the UTII-2 application does not need to be submitted. This follows from the instructions for filling out UTII-2 forms: they are used to deregister or register a UTII payer. This document is not a notice of change of area, change of address, etc.

If a company or individual entrepreneur has several points with the same activities on the territory of the same municipality and with the same OKATO, the physical indicators must be summed up for all points and this amount must be included in the “imputed tax” declaration. You should submit your reports to the tax office where you are registered as a UTII payer (letter from the Ministry of Finance dated July 22, 2013 No. 03-11-11/28613).

If a company opens the next location in the same tax territory, but with a different type of activity, then a UTII-2 application is submitted for the new type of activity, and reporting is provided in one declaration, but with a second sheet of Section 2, where the indicators for each type of activity will be indicated. separately.

Why registration is important for individual entrepreneurs

Registration is important for any citizen of the country. Before registering an individual entrepreneur, a future individual entrepreneur must sort out his registration: it is desirable that it be at the address at which it is planned to carry out commercial activities. Individual entrepreneurs do not have a legal address according to Law N 129-FZ.

Individual entrepreneur registration

Lack of registration means the inability to register an individual entrepreneur. Registration of the entrepreneur’s place of residence is important due to the need to register an individual entrepreneur. Any type of residential premises is suitable for registration:

- House;

- Apartment;

- Dormitory;

- Residential premises for office purposes.

It is not at all necessary to be the legal owner of the housing space - it is enough to simply have a legal basis for residence. In the absence of permanent registration, temporary registration is allowed, but with the condition that the individual entrepreneur must actually live there for at least 6 months. For this purpose, a special verification procedure is carried out, which is chosen by the tax office.

Reference ! If an entrepreneur has simultaneous registration at two addresses, then reporting is still provided to the tax service at the official registration address.

How to register an “imputed outlet”

If a company opens a new outlet in a municipality where there are “imputed stores”, or in another, but subordinate to the same Federal Tax Service, then it is not obliged to submit an application again in form No. UTII-1. But he can send this form with a completed attachment to the tax authorities to inform them about the new address for conducting “imputed activities”, which was not previously reported. The inspectorate will consider such a statement precisely as a source of information about the new facility for which the company intends to pay UTII. True, the Ministry of Finance and the Federal Tax Service believe that a company can only be fined 200 rubles for failure to submit a notification about the opening of an OP. clause 1 art. 126 Tax Code of the Russian Federation; Letters of the Federal Tax Service dated February 27, 2014 No. SA-4-14/3404; Ministry of Finance dated April 17, 2013 No. 03-02-07/1/12946 But local tax authorities hold organizations accountable precisely for “non-accounting activities.

The fine can be challenged in court, especially if the person charged regularly calculated and paid UTII for the new store. After all, this means that the tax authorities were somehow aware of the retail facility and had the opportunity to control it. Resolution of the AS UO dated March 26, 2020 No. F09-1034/15. If stores are located in different city districts or municipal areas under the jurisdiction of different Federal Tax Service Inspectors, an application for registration as a UTII payer must be submitted to each inspectorate. And if the stores are located in different territories of the same municipal district, city district or federal city, which are serviced by different Federal Tax Service Inspectors, then the application is submitted to only one of them.

In this case, there is no need to register for UTII-registration with each inspection regarding clause 2 of Art. 346.28 Tax Code of the Russian Federation; Letters of the Ministry of Finance dated 08.28.2020 No. 03-11-11/49675, dated 07.24.2013 No. 03-11-11/29241. At the same time, nothing will happen for failure to submit an application in form No. UTII-1 in such a situation.

But if tax authorities find out (for example, during a desk audit of a UTII declaration) that the company did not report the creation of an OP, then for conducting activities without registration they may try to fine it in the amount of 10% of the income received for “unaccounted period, but not less than 40,000 rubles. clause 2 art. 116 of the Tax Code of the Russian Federation Individual Entrepreneur on UTII Where to Pay if Retail Outlets in Different Areas of the City

The need to register at the place of business depends on the tax regime

Let us remember that an individual entrepreneur can operate under one of the five tax regimes existing in the Russian Federation:

- General taxation system (GTS)

- Simplified taxation system (STS)

- Unified Agricultural Tax (USAT)

- Unified tax on imputed income (UTII)

- Patent tax system (PTS)

If the new business is intended to be conducted under a simplified, general regime or agricultural tax, then there is no need to register with the territorial tax office at the place of activity. As for UTII and patents, they are under the jurisdiction of local authorities, have their own regional characteristics, and will need to be registered at the place of activity.

Do individual entrepreneurs on UTII pay personal income tax at their place of residence or at their place of registration?

If the types of activities are the same (for example, there are several retail outlets), then when starting to conduct the same activity, but at a new address (a new retail outlet is opened), the UTII-2 application does not need to be submitted. This follows from the instructions for filling out UTII-2 forms: they are used to deregister or register a UTII payer. This document is not a notice of change of area, change of address, etc. If a company or individual entrepreneur has several points with the same activities on the territory of the same municipality and with the same OKATO, the physical indicators must be summed up for all points and this amount must be included in the “imputed tax” declaration. You should submit your reports to the tax office where you are registered as a UTII payer (letter from the Ministry of Finance dated July 22, 2013 No. 03-11-11/28613).