Repair of fixed assets - what is it?

Repair of fixed assets (Fixed Assets) is a process that relates to both own and leased property. It is carried out in order to support or restore the functionality of the OS. The repair procedure consists of eliminating faults that have arisen, replacing worn parts or individual components of the object. Depending on the frequency and volume of work performed, repairs can be:

- current,

- average,

- capital.

However, in no case should the repair process lead to a change in the basic technical characteristics or purpose of the object being repaired, since such a change will already be regarded as modernization (reconstruction), which must be taken into account according to completely different rules (clause 2 of Article 257 of the Tax Code of the Russian Federation).

Carrying out repairs, unlike modernization (reconstruction), does not in any way affect either the initial or residual value of the object. All repair costs, whatever their value, are taken into account during the period of its completion. However, such expenses require economic justification and documentary evidence (letters of the Ministry of Finance of the Russian Federation dated March 24, 2010 No. 03-03-06/4/29, dated February 25, 2009 No. 03-03-06/1/87).

Repairs can be carried out:

- attracted counterparty,

- on our own,

- in a mixed way.

What are depreciation deductions and why are they needed?

Depreciation charges for non-residential properties represent a monthly transfer of the cost of a fixed asset in parts (in this case, non-residential premises) in cash equivalent to account 02 (depreciation).

According to federal legislation (Article No. 259 of the Tax Code of the Russian Federation), it is carried out by all organizations in accordance with established standards and taking into account the book value of fixed assets. An exception may be those objects that are under conservation.

As the premises are used, their value gradually decreases due to physical and moral wear and tear. Based on this fact, depreciation may have the purpose of :

- direct cash flows to restore and repair the premises in the future;

- gradually distribute large expenses (for writing off premises that have fallen into disrepair) over several periods on an accrual basis;

- create the appearance of the absence of large losses for shareholders (if you do not depreciate a fixed asset, but simply write it off at the end of its useful life, a large loss for the organization will be reflected in the reporting period, which may alienate potential shareholders or frighten existing ones);

- payment of less income tax (the amount of depreciation does not always exactly match the actual depreciation; if it is greater, then the income tax will be significantly less).

Documentation of repairs

Repairs are preceded by drawing up:

- a defective statement reflecting the condition of the object, which can be made in 1 copy if the repairs are carried out on their own or in a mixed way, and drawn up in 2 copies if the repairs are carried out by a third-party contractor;

Read about what form a defective statement can take in the material “Drawing up a correctly defective report - sample.”

- estimates for repair work drawn up either by a third-party contractor or by its own department carrying out repairs;

- an order from the manager to carry out repairs, which reflects the timing of the repair work, the forces carrying it out, and, if necessary, decisions to replace temporarily absent OS;

- agreement for repairs, if it will be done by a third party;

- invoice for the internal movement of fixed assets, if the object is being repaired in its own department.

Read about the rules for issuing such an invoice in the article “Unified form No. OS-2 - form and sample.”

Upon completion of the repair work, the following is drawn up:

- certificate of acceptance of the object from repair;

For information on how to fill out such an act, read the material “Unified Form No. OS-3 - Form and Sample.”

- invoice for internal movement of fixed assets, if the object was repaired in its own department;

- a record of the repair performed in the OS inventory card.

For an example of making such a record, see the sample to the article “Unified Form No. OS-6 - Form and Sample”.

What does the tenant pay for?

Anything related to mechanical wear and tear is the responsibility of the tenant. This includes: chips/scratches on walls, floors, doors, furniture, appliances, stains everywhere, etc. If you spill coffee on the sofa or carpet, you pay, if because of your cat the door frames are scratched or the wallpaper is torn off, you pay. If you put a hot frying pan on the table and a stain remains, you pay.

Also, if repairs are solely your desire: you decide to redo/improve something yourself and want the landlord to pay for it, be sure to discuss it with him first! It often happens that residents don’t like the wallpaper or some furniture, they repaint, re-glue and think that they will be reimbursed for this money. No! If you haven't discussed this in advance, the landlord doesn't owe you anything! He was completely satisfied with this wallpaper. Moreover, if in the process of wallpapering you stained the parquet with glue, you will also have to pay for the repair of the parquet.

When renting an apartment, you must understand that all the property here does not belong to you and handle it carefully.

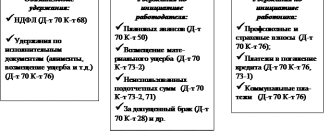

Reflection of repairs in accounting

Accounting for the cost of repairing fixed assets in accounting varies depending on how the repair work is carried out.

When carried out on their own (i.e., by one of the auxiliary departments), an order is opened for such work in the relevant department, for which direct costs associated with it are collected during the entire time the repair is in progress:

Dt 23 Kt 10, 69, 70.

If third-party contractors are involved for part of the work (i.e., a mixed method of repair), then account 60 will be added to the list of accounts reflected in this loan entry. In this case, a VAT entry may also arise if the services of a third-party contractor are subject to this tax:

Dt 19 Kt 60.

The overhead costs of the auxiliary department performing the repairs, distributed at the end of each month, will also be added to the total cost of the repair order:

Dt 23 Kt 25.

Upon completion of the repair, which will be recorded in the acceptance certificate of the object, the costs collected in account 23 for the corresponding order will be written off as overhead costs for the maintenance of the department in which the repaired OS is used:

Dt 25 (26, 44) Kt 23.

When repairs are carried out only by a third-party contractor, the costs for it will appear in accounting only on the date of signing the act of acceptance of the object from repair and will immediately be charged to overhead costs for the maintenance of the department in which the OS that has been repaired is used, with the allocation of VAT indicated in the documents :

Dt 25 (26, 44) Kt 60;

Dt 19 Kt 60.

In the posting for accounting for completed repair costs for both options (in-house or third-party), the list of accounts indicated by debit may also include accounts 23 and 29, if the accounting of overhead costs for them is organized using the boiler method or in separate subaccounts of these accounts. OS repair costs cannot be included in direct costs, since the objects are not involved in production during repairs.

According to the current accounting rules, a reserve for OS repairs is not created in the accounting department. Previously, this could be done, but since 2011, this possibility has been excluded from the Guidelines for fixed assets accounting, approved by Order of the Ministry of Finance of the Russian Federation dated October 13, 2003 No. 91n (Order of the Ministry of Finance of the Russian Federation dated December 24, 2010 No. 186n).

How to calculate in accounting?

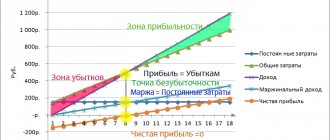

To calculate depreciation for a fixed asset whose useful life has already been determined, a predominantly linear method is used, which provides for the uniform write-off of the original cost through wear and tear. The formula consists of calculating the depreciation rate (RA) and then multiplying it by the cost of the object to determine the monthly amount of charges.

NA = 1 / SPI x 100%.

Example

Depreciation of a building is the transfer of the value of a property into expenses. The amount of depreciation depends on the useful life established for the premises.

There are no strict requirements or restrictions on the duration of the useful life, therefore, in each case, the enterprise can independently analyze the condition of the structure or premises, the degree of its wear and tear, the rate of obsolescence, factors influencing this, and existing restrictions.

Based on a combination of factors, a period is determined during which the initial cost of the premises is completely transferred to expenses, and the property can be written off as a depreciated fixed asset.

When determining SPI, you can be guided by the Classification of fixed assets by depreciation groups for tax accounting purposes.

After the period during which it is planned to use the building with the required return has been determined, a depreciation method is selected that will be used throughout the entire period of operation of the building.

https://youtu.be/jePHG16zBUY

Depreciation must be calculated for the building; this is required by PBU 6/01. Therefore, even in the case where the property has been owned for more than 30 years, you still need to calculate deductions every month.

Methods for calculating depreciation charges:

- Linear – the cost is written off in equal parts over the entire period of investment.

- The declining balance method is an accelerated non-linear method in which depreciation is calculated from the residual value and the acceleration factor.

- Based on the sum of the number of years of SPI - the calculation is carried out at the initial cost when summing up the number of years of service life.

- Proportional to the products produced.

In the vast majority of cases, for buildings, non-residential and residential premises, and structures, the linear method of calculating depreciation is chosen.

It is the uniform write-off of value throughout the entire period of use that is appropriate for real estate objects.

Accounting for repairs in tax accounting

In NU, accounting for the costs of repairing fixed assets is possible in 2 ways (Article 260 of the Tax Code of the Russian Federation):

- The same as in accounting, i.e. by including costs in expenses during the period of completion of repairs (clause 1).

- Through the creation of a reserve (clause 3). The amount of contributions to it is determined in a special manner established by clause 2 of Art. 324 Tax Code of the Russian Federation. The total amount of the reserve is subject to limits, but can accumulate over several tax periods. If a reserve is created, then all repair costs are taken into account and attributed to the reduction of this reserve. And only if its amount is exceeded, repair costs can be taken into account directly in the costs.

For more information on creating and using a reserve for repairs of operating systems at NU, read the material “Creating a reserve for repairs of fixed assets (nuances).”

The decision to create or not create a reserve in NU must be fixed in the accounting policy. If you decide to create it, the algorithm for calculating the amount of the reserve and the period for which it is formed are also written down.

Since the current accounting rules do not provide for the possibility of creating a reserve for repairs of fixed assets, differences will arise between the accounting and accounting data in terms of the reserve formed for the purposes of the accounting system.

Depreciation of fixed assets and accounting for their repair, modernization and reconstruction

homeABSTRACT

Depreciation of fixed assets and accounting for their repair, modernization and reconstruction

Content

1. Depreciation of fixed assets

2. Accounting for depreciation

3. Repair of fixed assets

4. Modernization and reconstruction of fixed assets

List of used literature

1 .

Depreciation of fixed assets

According to paragraph 17 of PBU 6/01, the cost of fixed assets is repaid through depreciation.

Objects for calculating depreciation are fixed assets that are in the organization under the right of ownership, economic management, and operational management.

Objects of fixed assets whose consumer properties do not change over time (land plots and environmental management facilities) are not subject to depreciation.

Depreciation is not charged for the following fixed assets:

— housing facilities (residential buildings, dormitories, apartments and others);

— external improvement facilities and other similar forestry and road facilities, specialized navigation facilities and others;

- productive livestock, buffaloes, oxen and deer;

- perennial plantings that have not reached operational age.

For the above listed fixed assets, as well as for fixed assets of non-profit organizations, at the end of the reporting period, not depreciation, but depreciation is accrued according to the established depreciation rates. Accounting for accrued depreciation amounts is reflected in off-balance sheet account 010 “Depreciation of fixed assets.”

In accordance with paragraph 63 of Methodological Instructions No. 91n, during the useful life of a fixed asset, depreciation is not suspended except in the following cases:

- transfer of fixed assets by decision of the head of the organization for conservation for a period of more than 3 months;

- during the restoration period of the facility, the duration of which exceeds 12 months.

Paragraphs 21-25 of PBU 6/01 establish the following rules for calculating depreciation charges:

- the accrual of depreciation charges for an object of fixed assets begins on the first day of the month following the month in which this object was accepted for accounting, and is carried out until the cost of this object is fully repaid or this object is written off from accounting;

- the accrual of depreciation charges for an object of fixed assets ceases from the first day of the month following the month of full repayment of the cost of this object or the write-off of this object from accounting;

- during the useful life of an object of fixed assets, the accrual of depreciation charges is not suspended, except in cases where it is transferred by decision of the head of the organization to conservation for a period of more than three months, as well as during the period of restoration of the object, the duration of which exceeds 12 months;

-accrual of depreciation charges on fixed assets is carried out regardless of the results of the organization’s activities in the reporting period and is reflected in the accounting records of the reporting period to which it relates;

- the amounts of accrued depreciation on fixed assets are reflected in accounting by accumulating the corresponding amounts in a separate account.

Methods for calculating depreciation

Clause 18 of PBU 6/01 establishes four methods for calculating depreciation:

1. Linear method;

2. Reducing balance method;

3. The method of writing off the cost by the sum of the numbers of years of useful use;

4. The method of writing off the cost in proportion to the volume of products (works).

The use of one of the methods of calculating depreciation for a group of homogeneous fixed assets is carried out throughout the entire useful life of the objects included in this group.

Regardless of which method of calculating depreciation charges an organization chooses, it must determine the annual and monthly rates of depreciation charges.

Linear method of calculating depreciation

With the linear method, the annual amount of depreciation is determined using the linear method - based on the original cost or current (replacement) cost (in case of revaluation) of the fixed asset object and the depreciation rate calculated based on the useful life of this object.

The useful life of objects is determined by the organization independently when accepting the object for accounting.

The useful life of a fixed asset item is determined based on:

- the expected period of use of this object in accordance with the expected productivity or capacity;

- expected physical wear and tear, depending on the operating mode (number of shifts), natural conditions and the influence of an aggressive environment, the repair system;

- regulatory and other restrictions on the use of this object (for example, rental period).

In cases of improvement (increase) in the initially adopted standard indicators of the functioning of a fixed asset object as a result of reconstruction or modernization, the organization revises the useful life of this object.

Example.

The cost of the fixed asset is 260,000 rubles. In accordance with the classification of fixed assets included in depreciation groups, approved by Decree of the Government of the Russian Federation dated January 1, 2002 No. 1, the object is classified in the third depreciation group with a useful life of over 3 years to 5 years inclusive. The useful life is set at 5 years. The annual depreciation rate is 20% (100%: 5 years), the annual depreciation amount is 52,000 rubles (260,000 x 20/100), the monthly depreciation amount is 4,333.33 rubles (52,000/12).

Reducing balance method

The reducing balance method for determining the useful life is established in the case when the efficiency of using an item of fixed assets decreases with each subsequent year.

The annual amount of depreciation charges is determined based on the residual value of the fixed asset item at the beginning of the reporting year and the depreciation rate calculated based on the useful life of this item and the acceleration factor established in accordance with the legislation of the Russian Federation.

Example.

The cost of the fixed asset is 260,000 rubles. Useful life is 5 years. Acceleration factor 2. Annual depreciation rate 20%. The annual depreciation rate taking into account the acceleration factor is 40%.

In the first year of operation:

The annual amount of depreciation charges will be determined based on the initial cost formed when capitalizing the fixed asset item and will amount to 104,000 rubles (260,000 x 40% = 104,000).

In the second year of operation:

Depreciation will be determined based on the residual value of the object at the end of the first year of operation and will be 62,400 rubles ((260,000 - 104,000) = 156,000 x 40%).

In the third year of operation:

Depreciation will be determined based on the residual value of the object at the end of the second year of operation and will be 37,440 rubles ((156,000 - 62,400) = 93,600 x 40%).

In the fourth year of operation:

Depreciation will be determined based on the residual value of the object at the end of the third year of operation and will be 22,464 rubles ((93,600 - 37,440) = 56,160 x 40%).

During the fifth year of operation:

Depreciation will be determined based on the residual value of the object at the end of the fourth year of operation and will be 13,478.40 rubles ((56,160 - 22,464) = 33,696 x 40%).

The accumulated depreciation over five years will be 239,782.40 rubles. The difference between the original cost of the object and the amount of accrued depreciation in the amount of 20,217.60 rubles represents the liquidation value of the object, which is not taken into account when calculating depreciation for years other than the last year of operation. In the last year of operation, depreciation is calculated by subtracting the salvage value from the residual value of the object at the beginning of the last year.

Method of writing off cost based on the sum of the numbers of years of useful use

With this method, the annual depreciation rate is determined based on the original cost of the fixed asset object and the annual ratio, where the numerator is the number of years remaining until the end of the asset’s service life, and the denominator is the sum of the numbers of years of the useful life of the object.

Example.

The cost of the fixed asset is 260,000 rubles. Useful life is 5 years. The sum of the numbers of useful years will be 1 + 2 + 3 + 4 + 5 = 15.

In the first year of operation, the ratio will be 5/15, the amount of accrued depreciation will be 86,666.67 rubles (260,000 x 5/15).

In the second year of operation, the ratio is 4/15, the amount of accrued depreciation is 69,333.33 rubles (260,000 x 5/15).

In the third year of operation, the ratio is 3/15, the amount of accrued depreciation is 52,000 rubles (260,000 x 3/15).

In the fourth year of operation, the ratio is 2/15, the amount of accrued depreciation is 34,666.67 rubles (260,000 x 2/15).

In the last, fifth year of operation, the ratio is 1/15, the amount of accrued depreciation is 17,333.33 rubles (260,000 x 1/15).

The method of writing off the cost in proportion to the volume of products (works, services)

When writing off the cost of a fixed asset in proportion to the volume of products (work, services), depreciation charges are calculated based on the natural indicator of the volume of production (work) in the reporting period and the ratio of the initial cost of the fixed asset item and the estimated volume of products (work) for the entire useful life of the object fixed assets.

Example. The cost of the car is 65,000 rubles, the estimated mileage of the car is 400,000 km. In the reporting period, the car's mileage was 8,000 km, the amount of depreciation for this period will be 1,300 rubles (8,000 km x (65,000 rubles: 400,000 km)). The amount of depreciation for the entire mileage period is 65,000 rubles (400,000 km x 65,000 rubles: 400,000 km).

Having analyzed various methods of calculating depreciation, we can conclude that when using the reducing balance methods and writing off the cost by the sum of the numbers of years of the useful life, the amount of depreciation charges decreases over the years. When choosing one of these methods for calculating depreciation, accountants must remember that the accrued amount of depreciation affects the cost of products, work performed, services rendered.

In organizations with a seasonal nature of production, the annual amount of depreciation charges on fixed assets is accrued evenly throughout the period of operation of the organization in the reporting year.

The monthly depreciation rate in all cases will be 1/12 of the annual depreciation rate.

Write-off of the cost of fixed assets as they are released into production

Clause 18 of PBU 6/01 provides that fixed assets costing no more than 10,000 rubles per unit or another limit established in the accounting policy based on technological features, as well as purchased books, brochures and similar publications, are allowed to be written off as production costs ( selling expenses) as they are released into production or operation. In order to ensure the safety of these objects in production or during operation in an organization, it is necessary to organize control of their movement.

2 .

Accounting for depreciation of fixed assets

In synthetic accounting, depreciation is reflected in passive account 02 “Depreciation of fixed assets.” The credit balance on account 02 reflects the amount of accumulated depreciation of fixed assets, which are listed in accounts 01 “Fixed assets” and 03 “Long-term leased fixed assets”. Turnover on the debit of account 02 is the amount of depreciation on disposed objects, regardless of the reasons for disposal. Loan turnover is the amount of accrued depreciation for the reporting period. Account 02 has two sub-accounts:

02/1 “Depreciation of own fixed assets”

02/2 “Depreciation of long-term leased fixed assets”

Analytical accounting for account 02 “Depreciation of fixed assets” is carried out by type and individual inventory items of fixed assets; when using the journal order form of accounting, depreciation amounts are reflected in journal order No. 1 and statements No. 12, 15.

For the amount of depreciation accrued for the reporting month based on the total development table, accounting entries are drawn up:

Debit accounts 20 “Main production”

25 “General production expenses”

26 “General business expenses”

Account credit 02 “Depreciation of fixed assets”

The amount of depreciation also increases if the lessee buys out the property, if it was taken into account on the lessor’s balance sheet:

Debit account 01 “Fixed assets”

Credit to account 02 “Depreciation of fixed assets”

Subaccount 1 “Depreciation of own fixed assets”

Since January 1, 1998, organizations have the right to use depreciation charges accrued for full restoration using the accelerated method for any purpose, which creates a legal basis for the transfer of capital to other areas of application and reduces the risk of investment.

At the same time, it should be borne in mind that when applying any option for calculating depreciation on fixed assets, chosen by the organization as an accounting policy option, it must be based on accounting purposes. For tax purposes, the organization must adjust the amount of depreciation charges accrued based on the linear (uniform) method.

The execution of a property trust management agreement, when the subject of the agreement is fixed assets, requires, along with the acceptance of such objects on the balance sheet, the amount of accrued depreciation for the period of operation of these objects from the previous party to be reflected in the accounting of the receiving party.

An entry is made for the amount of accepted depreciation:

Debit of account 79 “Intra-business expenses”

Subaccount 3 “Settlements under a property trust management agreement”

Account credit 02 “Depreciation of fixed assets”

The write-off of accrued depreciation amounts is reflected in accounting as the debit of account 02 “Depreciation of fixed assets” in correspondence with the credit of account 01 “Fixed assets”. Such an entry is made in accounting regardless of the reasons for disposal.

3 .

Repair of fixed assets

During operation, fixed assets lose their technical properties and qualities - they wear out. Any objects included in fixed assets, except land, are subject to physical and moral wear and tear, that is, under the influence of physical forces, technical and economic factors, they gradually lose their properties and become unusable. This means that they cannot perform their functions due to technical reasons or economic disadvantage. Physical wear and tear can be partially restored by repairing, reconstructing and modernizing fixed assets.

Depending on the frequency and complexity, repairs can be current, medium and major.

Routine maintenance consists of daily maintenance of machinery and equipment in order to maintain them in working order. The amount of work on current repairs is insignificant.

Current repairs should be considered from two perspectives:

frequency;

nature of the work.

According to the frequency, current repairs of individual objects are carried out within one year.

The nature of the work involves ongoing maintenance of the facility, associated with changing individual components without disassembling the unit, adjusting mechanisms, and lubricating them, which ensures the facility is always ready for operation.

Average repairs in terms of complexity and frequency are between current and major. Its purpose is to extend the turnaround period until the next major overhaul.

Major repairs involve replacing main components and assemblies, supporting structures, etc.

When the period of repair of a fixed asset object exceeds 12 months, the accrual of depreciation charges for this object in accounting is suspended. For tax purposes, depreciation in this case continues to be calculated as before.

Regulatory documents governing the accounting of fixed assets allow organizations to choose one of three possible options for accounting for expenses for repairs of fixed assets:

the amount of actual repair costs can be fully included in current expenses (as a rule, expenses for ordinary activities) for the period in which they were incurred;

the organization can create a reserve for OS repairs;

accounting for repair costs can be carried out using a deferred expense account.

Repair work is carried out by contract and housekeeping methods.

Since repair work differs in complexity and volume, in practice various options for accounting for repair costs are used, regardless of how it is carried out. An organization can choose for accounting purposes any of the above methods of accounting for expenses for repairs of fixed assets based on the specifics of its activities, the structure and number of fixed assets, and the frequency of repairs. The chosen method of accounting for repair costs must be recorded in the accounting policy governing the accounting procedures in this organization.

When calculating income tax, one should proceed from the fact that Chapter 25 of the Tax Code of the Russian Federation (as amended by Federal Law No. 57-FZ of May 29, 2002) provides for two options for accounting for expenses for the repair of fixed assets for tax purposes (see Art. .260 Tax Code of the Russian Federation):

expenses for repairs of fixed assets may be included in other expenses in the reporting (tax) period in which they were incurred in the amount of actual costs;

taxpayers can form a reserve for upcoming repairs of fixed assets to ensure equal inclusion of costs for repairs of fixed assets over two or more tax periods.

The method chosen by the organization to account for expenses for the repair of fixed assets must be recorded in the order on accounting policies for tax purposes.

In this regard, we note that there is only one way to avoid double accounting of repair costs - by choosing a single procedure for accounting for repair costs for both accounting and tax accounting purposes: either by including the amount of actual repair costs as expenses, or by formation of a reserve for the repair of fixed assets.

If the taxpayer decides to create a reserve for future expenses for the repair of fixed assets, then during the tax period (year) contributions to the reserve are evenly written off as other expenses. In this case, actual repair costs incurred are written off from the reserve funds. If the amount of actual costs for the repair of fixed assets in the reporting (tax) period exceeds the amount of the created reserve, then the excess amount is included in other expenses as of the end of the tax period.

The procedure for forming a reserve is established in Article 324 of the Tax Code of the Russian Federation. The reserve is formed by deductions made during the tax period on the last day of the corresponding reporting period.

The amount of deductions is calculated based on the total cost of fixed assets and deduction standards approved by the taxpayer independently in the accounting policy for tax purposes.

The total cost is determined as the sum of the original cost of all depreciable fixed assets put into operation as of the beginning of the tax period in which the reserve is formed.

When determining the standards for contributions to the reserve, the taxpayer must determine the maximum amount of contributions to the reserve based on the frequency of repairs of fixed assets, the frequency of replacement of elements of fixed assets (assemblies, parts, structures) and the estimated cost of repairs. At the same time, a limitation on the amount of the reserve is introduced: it cannot exceed the average amount of actual repair costs over the past three years.

Since tax legislation limits the amount of reserve accepted for tax purposes, in order to avoid double accounting, organizations should accrue reserves in accounting according to the same rules as in tax accounting.

In accordance with Article 324 of the Tax Code of the Russian Federation, as a general rule, a reserve is created for one tax period. And if at the end of the tax period there remains an unused balance of the reserve, then this amount is subject to inclusion in the non-operating income of the organization as of the last date of the current tax period.

In this regard, in accounting, the unused balance of the reserve is not included in non-operating income, but is reversed, i.e. the amount of costs is reduced by this amount. Therefore, in case of incomplete use of the reserve at the end of the year, the accounting and tax accounting data will diverge: the amount of non-operating income and the amount of expenses for production and sales in tax accounting will exceed, respectively, the amount of non-operating income (account credit 91) and the amount of expenses reflected in the accounting accounts cost accounting for the amount of unused reserve.

Carrying over the unused balance of the reserve to the next tax period is possible only if, in accordance with its accounting policies, the organization accumulates funds to finance particularly complex and expensive types of capital repairs for more than one tax period. At the same time, the accumulation of funds for such repairs must be confirmed by a schedule for major repairs.

Particular attention in Article 324 of the Tax Code of the Russian Federation was paid to the procedure for creating a reserve for carrying out particularly complex and expensive types of repairs of fixed assets. It is assumed that the organization forms such reserves over several tax periods. In the tax period in which the organization decides to create a reserve for upcoming repair expenses, the maximum amount of contributions to this reserve is calculated.

In this case, it is allowed to increase the maximum amount of deductions to the reserve for future repair expenses by the amount of deductions to finance the specified repairs in each subsequent tax period. However, the following conditions must be met:

— Repair costs in each subsequent tax period must correspond to the repair work schedule.

— The types of repair work carried out in the tax period were not carried out in previous tax periods.

It should be noted that the accounting policy for tax purposes should provide for the formation of a reserve for particularly complex and expensive types of repairs of fixed assets. In this case, it is necessary to develop criteria for particular complexity and high cost, as well as draw up an estimate and schedule for such types of major repairs.

If an organization accumulates funds to finance these types of repairs over several tax periods, then at the end of the current tax period the balance of such funds is not included in income for tax purposes.

According to clause 3 of Article 260 of the Tax Code of the Russian Federation, the creation of a reserve is provided only for the repair of fixed assets, which will last more than two tax periods. If an organization creates a reserve, it should be used to repair all fixed assets, and not individual objects. That is, during the reporting year, for tax accounting purposes, only the amounts of contributions to the reserve are recognized as expenses. Thus, repair expenses actually incurred in the reporting year should be written off against the created reserve.

When creating a reserve for repairs of fixed assets, production costs include the amount of deductions calculated based on the estimated cost of repairs. In accounting, information on the amount of the reserve for the repair of fixed assets is taken into account in account 96 “Reserves for future expenses.” Monthly contributions to the reserve are reflected by posting:

Deductions to the reserve for repairs of fixed assets are reflected.

Debit account 20 “Main production”

23 “Auxiliary production” and other accounts,

Credit to account 96 “Reserves for future expenses”;

Actual costs for repairs of fixed assets during the year are written off from the created reserve:

The cost of repairs performed by the contractor is reflected

Debit account 96 “Reserves for future expenses”,

Credit to account 60 “Settlements with suppliers and contractors”;

VAT on repairs performed is reflected

Debit of account 19 “Value added tax on acquired assets”,

Credit to account 60 “Settlements with suppliers and contractors”;

The cost of the repairs performed was paid to the contractor.

Debit of account 60 “Settlements with suppliers and contractors”,

Credit account 51 “Current accounts”;

INST for the repair of fixed assets is presented for deduction in the generally established manner.

Debit of account 68 “Calculations for taxes and fees”,

Credit to account 19 “Value added tax on acquired assets.”

If the amount of actual repair costs exceeds the reserve amount, then the excess amount is written off as expenses (Debit of accounts 20, 23, etc.). When inventorying the reserve for repairs of fixed assets (including leased facilities), excess reserved amounts are reversed at the end of the year.

If the work on repairing fixed assets is carried out unevenly throughout the year, then preliminary accounting of repair costs can be carried out using account 97 “Deferred expenses”. Next, the costs of repair work accumulated on account 97 (to which a separate sub-account is opened) are written off as costs associated with ordinary activities in the manner established by the organization during the period to which they relate.

If an organization takes into account repair costs using account 97 “Deferred expenses”, the amounts of “input” VAT on goods (work, services) purchased for repairs are taken for deduction in the generally established manner as the goods (work, services) are received and their payment. In accounting, repair expenses using account 97 “Deferred expenses” are reflected in the following entries:

The cost of repairs is reflected as part of deferred expenses. Debit of account 97 “Deferred expenses”,

Credit to account 60 “Settlements with suppliers and contractors”;

VAT on repairs is reflected Debit of account 19 “Value added tax on acquired assets”,

Credit to account 60 “Settlements with suppliers and contractors”;

— payment was made to the contractor for the work performed

Debit of account 60 “Settlements with suppliers and contractors”,

Credit account 51 “Current accounts”;

— the amount of VAT on repair work is claimed for deduction based on the contractor’s invoice

Debit of account 68 “Calculations for taxes and fees”,

Credit to account 19 “Value added tax on acquired assets.”

Recorded monthly

The cost of repairs throughout the year is written off evenly as expenses.

Debit account 20 “Main production”,

Credit to account 97 “Deferred expenses”.

With this accounting option, “equalization” of product costs between individual months is achieved, which simplifies accounting procedures and cost and profit management.

However, it is most convenient to use this method only if repairs are carried out at the beginning of the reporting period (for example, in the first quarter or in the first half of the year). Then you can write off the actual repair costs evenly over the remaining months of the current year.

4. Modernization and reconstruction of fixed assets

Modernization and reconstruction can be carried out both by contract and in-house.

According to PBU 6/01, these costs should increase the initial cost. However, the latter is possible only if, as a result of the work carried out, the initially accepted standard indicators of the functioning of the fixed asset (useful life, power, quality of products) are improved.

The concepts of “modernization” and “reconstruction” are defined both in accounting and tax accounting.

The concept of “modernization”, used for accounting purposes, is deciphered in the Guidelines for Accounting for Fixed Assets. According to this document, modernization includes work on the restoration of fixed assets, which lead to an improvement in previously adopted standard performance indicators. As for the Tax Code of the Russian Federation, paragraph 2 of Article 257 states that work on completion, retrofitting, and modernization includes work caused by a change in the technological purpose of equipment, a building, a structure and other depreciable object, increased loads and other new qualities. Having analyzed the above, we can conclude that the concepts of “modernization” and “reconstruction” for accounting purposes and for tax accounting purposes are identical.

In practice, quite often disputes arise with the tax inspector regarding the qualification of expenses incurred - whether these expenses are considered expenses for repairs or for modernization (reconstruction). The position of the inspectors is clear. They are looking for any opportunities to attribute expenses incurred by the organization to modernization (reconstruction). Numerous arbitration practice allows us to give some recommendations to taxpayers:

carefully study industry instructions for carrying out routine and major repairs. They must contain a list of works included in the concept of “repair”;

do not indicate in the primary documents that the object was modernized (reconstructed). This especially applies to contract agreements;

invite an expert who will give a qualified opinion;

prove that the purpose of the object has not changed.

According to paragraph 27 of PBU 6/01, upon completion of reconstruction or modernization of fixed assets, the issue of revising their useful life should be resolved.

According to clause 20 of PBU 6/01, the organization is obliged to revise the useful life if there is an improvement in the performance of a fixed asset item. However, the useful life based on the results of the modernization (reconstruction) may not change. For example, an organization decided to retrofit a fixed asset item in order to improve its technical characteristics. But such improvements did not lead to an increase in useful life. Therefore, the useful life of the upgraded facility should not be revised.

According to clause 1.1. Article 259 of the Tax Code of the Russian Federation, an organization can exercise the right to a one-time write-off of 10% of the amounts spent on modernization, completion, additional equipment, technical re-equipment and partial liquidation of fixed assets (i.e. the right to a depreciation bonus).

The organization has the right to such write-off only after completion of modernization, completion, additional equipment, technical re-equipment and partial liquidation of fixed assets.

In accordance with clause 27 of the accounting regulations “Accounting for fixed assets” (Order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n), the costs of modernizing a fixed asset object after its completion may increase the initial cost of such an object if, as a result of modernization, they improve (increase) initially adopted standard performance indicators (useful life, power, quality of use, etc.) of a fixed asset item. Likewise, in accordance with paragraph 2 of Art. 257 modernization increases the initial cost of fixed assets for tax purposes.

Upon completion of the modernization, an acceptance certificate for the modernized facilities is drawn up (Form No. OS-3). Based on this act, the accounting department makes changes to the inventory card for recording fixed assets (form No. OS-6).

When modernizing a fixed asset, the enterprise makes the following entries:

Debit 08 Credit 60, 10, 71, …

— expenses for modernization of fixed assets are reflected;

Debit 01 Credit 08

— the initial cost of a fixed asset item has been increased due to modernization.

From the month following the month in which the modernization of the fixed asset object was carried out, the amount of depreciation charges for the above object will change according to the increase in the original cost.

Depreciation will be calculated as follows:

Debit 20, 26, … Credit 02

- depreciation is accrued (with the linear method of accrual - 1/12 of the annual depreciation amount, calculated based on the remaining useful life of the fixed asset and the changed initial cost).

Bibliography

1. Accounting Regulations “Accounting for Fixed Assets” PBU 6/01 (Order of the Ministry of Finance dated March 30, 2001 No. 26n)

2.Tax Code of the Russian Federation dated July 31. 1998 No. 146-FZ (adopted by the State Duma of the Federal Assembly of the Russian Federation on July 16, 1998) (as amended on November 26, 2008)

3. Order of the Ministry of Finance of the Russian Federation dated July 29. 1998 No. 34n (as amended on March 26, 2007) “On approval of the regulations on accounting and financial reporting in the Russian Federation” (Registered with the Ministry of Justice of the Russian Federation on August 27, 1998 N 1598)

4. Resolution of the State Statistics Committee of the Russian Federation dated January 21. 2003 No. 7 “On approval of unified forms of primary accounting documentation for accounting of fixed assets”

5. Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 N 34-N “On approval of the Chart of Accounts for accounting of financial and economic activities of organizations and instructions for its application” (as amended on September 18, 2006)

6. Chart of Accounts for Financial and Economic Activities of Organizations (as amended by Order of the Ministry of Finance of the Russian Federation dated May 7, 2003 N 38n)

7. Agabegyan O.V. Fixed assets: from acceptance to disposal. Regulatory regulation, accounting and tax accounting / O.V. Agabegyan, K.S. Makarova // Economic and legal bulletin. - 2007. - No. 3

8. A. Sokolov. Consequences of modernization of fixed assets/A. Sokolov // Practical accounting. - 2007. - No. 3

9. A.I. Samonin. Recommendations for the revaluation of fixed assets and intangible assets in 2007/A.I. Samonin // Your budget accounting. - 2007. - No. 4

10. Bezrukikh P.S. Accounting - M.: Accounting, 2004-525 p.

11. Kozlova E.P., Baichenko T.N., Galanina E.N. Accounting in organizations. M.; 2006.

12. Kondrakov N.P. Accounting: Textbook. allowance. — 4th ed., revised. and additional - M.: INFRA-M, 2006. - 640 p. — (Series “Higher Education”).

13. Paliy V.F., Paliy V.V., Financial accounting: Textbook - 2nd ed. reworked and additional - M.: Publishing House FBK-Press, 2006, 664 p.

14. Sokolova. I.N. Accounting for costs of modernization and reconstruction of fixed assets/I.N. Sokolova, A.L. Ilyina // Tax Bulletin. - 2007. - No. 3

Results

OS repair consists of implementing measures aimed at maintaining the operability of fixed assets, but it should not lead to a change in the technical characteristics or purpose of the OS.

Repair costs are taken into account in expenses in the amount of actual amounts upon completion of repair work, regardless of whose forces the repair is carried out: in-house or outsourced. Documented justification for the need for repairs is required. In the NU it is permissible to create a reserve for repairs, but this leads to differences between the BU and the NU. You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.