Advance report per diem

Return back to Advance report

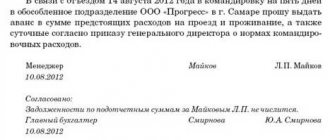

Among the travel expenses paid to the employee in advance, there is also such an item as daily allowance. This is a kind of “pocket money” for the business traveler, which he spends on food and other little things that are quite difficult or impossible to document. Indeed, daily allowances are the only type of travel expenses that the employee is not required to confirm with primary documents.

An advance report is a form that is jointly filled out by the posted employee and the company’s accountant. It serves to justify the write-off of business trip expenses in the accounting and tax accounting of the organization. The front of the form states the total amount of the advance received (including per diem) and the balance or overdraft, if any.

The reverse side of form No. AO-1 is a table and is intended to list documents confirming expenses that are attached to the expense report. It is filled out by the employee.

Advance report for a business trip: rules for registration, nuances of filling out, accounting entries

In this case, the form must bear the signature (resolution) of the person who accepted the document. The latter's autograph will indicate that the report has been accepted for consideration.

To ensure that there are no difficulties when compiling a report, before going on a business trip, you should carefully familiarize yourself with the tasks set by management.

It is necessary that the tasks of the business trip be formalized in writing - in the form of a job assignment (if any incomprehensible issues are identified, they need to be resolved on the spot).

Thus, the responsibilities of the traveler are limited solely to the performance of those functions that will be specified in this document. It is the results of resolving these issues that should be reflected in the report first of all. If possible, they should be supported by additional supporting documents.

If during the trip the employer suddenly considers it necessary to assign some additional tasks to a subordinate, he will definitely have to agree with him on the possibility of completing them. At the same time, the employee has every right to refuse them.

The deadline for submitting a business trip report is determined individually and depends on the characteristics of the enterprise. On average, this is three working days, but in any case, this period should not exceed one month from the moment the employee returns from a business trip.

In addition to the report, the traveler must submit to the accounting department:

• advance report (on expenses incurred on a business trip);

• receipts, checks, travel tickets, etc. confirming payment papers;

• travel certificate (if issued).

Before moving on to a detailed description of the document, let's give some general information. Let's start with the fact that this report can be written either in any form, or in a unified form, or, if the organization has its own document template approved in the accounting policy, according to its type. The method for generating the report must be specified in the company’s local regulations.

The report can be written on a regular sheet of paper of any suitable format (preferably A4) or on letterhead - if this requirement is in the internal regulatory documents of the enterprise. You can write it either by hand or type it on a computer (with mandatory subsequent printing).

Only one rule must be unconditionally followed - the report must contain the autograph of the traveler, the person who accepted the report (usually the head of a structural unit), as well as the director of the enterprise (in addition to the signature, he must put his resolution on the report).

It is best to write the report in two identical copies (if by hand, then you can use a carbon copy), one of which should be given to management, the second, just in case, should be kept with you (after making a note to accept the copy from the employer’s representative).

First, a short explanation of the structure. If you are writing a report in any form (and this practice is now widespread), then mentally divide the form into three parts: the beginning, the main section and the ending.

Beginning – information about the document itself (number, place, date of preparation).

The main block is the report itself, which includes:

• its period (start and end date);

• basis (here you must indicate the document on the basis of which you were sent on a business trip - this could be an invitation from another organization, an order from the director, etc.);

• purpose of the trip (indicate the actual tasks that management has assigned to you);

• trip results: the more detailed, the better. If, as a result of the business trip, any agreements were concluded, certificates were received, etc. documents, you need to indicate their number and date.

If necessary, you can attach additional papers to the form, documenting their presence in the report as a separate item. At the end, the document must be signed and dated to the current date.

Questions answered: Confirmation of travel expenses

Since the amount in the “Total” column of this table must correspond to the total amount of the report written off by the enterprise, the daily allowance should also be mentioned here. But since the employee is not required to submit any documents confirming daily expenses, the columns of the table intended for the details of supporting documents remain empty.

The employee simply writes in the column “Name of document (expense)”: “Daily allowance from such and such to such and such a date,” and in the column “Amount of expense” - the amount issued as daily allowance. There is no need to write anything more about per diem. The legitimacy of accounting for these costs as production costs is confirmed by documents proving the production nature of the business trip itself, as well as the order to send on a business trip and travel documents.

Daily allowances are taken into account by the organization in the amount of actual costs. The legislation does not contain limits on the amount of daily allowance; their monetary value is regulated by the internal acts of the organization. In the Tax Code there is a daily allowance standard only for the purpose of calculating personal income tax, but it is not a limitation on the amount of daily allowance itself. However, taking into account the existence of this standard, the advance report must indicate the dates/number of days for which daily allowances are issued.

Legal regulation

Article 166 of the Labor Code of the Russian Federation defines a business trip as a trip by an employee by order of the employer for a certain period of time to carry out an official assignment outside the place of permanent work. Business trips of employees whose permanent work is carried out on the road or has a traveling nature are not recognized as business trips.

The specifics of sending employees on business trips are established in the manner determined by the Government of the Russian Federation. Since October 25, 2008, the Regulation on the specifics of sending employees on business trips, approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749 (hereinafter referred to as Regulation No. 749), has been in effect.

Employees of any categories (managerial personnel, technical and service workers, workers) and professions can be sent on business trips. Most often, business travelers are representatives of management services, but under certain conditions workers and service personnel can be sent on business trips.

For some groups of workers, labor legislation establishes restrictions regarding the possibility of being sent on business trips.

In any case, the following cannot be sent on a business trip:

— pregnant women (Article 259 of the Labor Code of the Russian Federation);

- workers under the age of 18 (Article 268 of the Labor Code of the Russian Federation (except for some groups of employees of sports and cultural organizations);

- employees during the period of validity of the apprenticeship contract - on business trips not related to apprenticeship (Article 203 of the Labor Code of the Russian Federation).

Only with written consent can you send on a business trip:

- women with children under three years of age. At the same time, women with children under the age of three must be informed in writing of their right to refuse to be sent on a business trip;

- mothers and fathers raising children under the age of five without a spouse;

— workers with disabled children. In accordance with Art. 264 of the Labor Code of the Russian Federation, guarantees and benefits provided to women in connection with motherhood (in particular, assignments on business trips) apply to fathers raising children without a mother, as well as to guardians (trustees) of minors;

— workers caring for sick members of their families in accordance with a medical report (Article 259 of the Labor Code of the Russian Federation).

The right to send employees on business trips is granted to the heads of organizations. The list of documents that are the basis for sending an employee on a business trip may be established by order or other internal regulatory act of the organization.

Issues of reimbursement of expenses related to business trips are regulated by Art. 168 of the Labor Code of the Russian Federation, according to which, in the event of being sent on a business trip, the employer is obliged to compensate the employee for:

— travel expenses;

- expenses for renting residential premises;

— additional expenses associated with living outside the place of permanent residence (per diem);

- other expenses incurred by the employee with the permission or knowledge of the employer.

To calculate the amount of daily allowance, the procedure for determining the duration of a business trip is essential. Individual paragraphs of Regulation No. 749 resolve these issues as follows:

— the duration of the business trip is determined by the employer, taking into account the volume, complexity and other features of the official assignment;

— the day of departure on a business trip is the date of departure of a train, plane, bus or other vehicle from the place of permanent work of the business traveler, and the day of arrival from a business trip is the date of arrival of the specified vehicle at the place of permanent work;

- when a vehicle is sent before 24 hours inclusive, the current day is considered the day of departure on a business trip, and from 00 hours and later - the next day;

— if the station, pier or airport is located outside the boundaries of a populated area, the time required to travel to the station, pier or airport is taken into account. That is, in the general case, the moment an employee leaves for a business trip should be determined not by the time of departure of the train or plane, but by the time of departure of public transport from the place of residence or place of work of the business traveler (depending on where he is leaving from on the business trip). In cases where public transport does not run according to schedule, as well as when a posted worker uses personal transport or a taxi, the travel time to the station or airport, in our opinion, should be determined based on the average speed of movement of the corresponding type of transport in the corresponding conditions;

— the day of the employee’s arrival at his place of permanent work is determined similarly;

- when traveling to an area from where the employee, based on transport conditions and the nature of the work performed on a business trip, has the opportunity to return daily to his place of permanent residence, daily allowances are not paid;

— the question of the advisability of the daily return of an employee from the place of business trip to the place of permanent residence in each specific case is decided by the head of the organization, taking into account the distance, transport conditions, the nature of the task being performed, as well as the need to create conditions for the employee to rest. In our opinion, in the same order (or other internal regulatory act) that sets the maximum duration of business trips, it is advisable to establish the conditions when an employee may not return daily to his place of permanent residence. Of course, it makes sense to do this only in relation to those settlements whose transport links provide the possibility of daily travel. In this case, it is advisable to stipulate the possibility of returning to the place of permanent residence on weekends (if the working hours of the organization to which the employee is sent coincide with the schedule of the organization from which he is sent). Payment of daily allowances and payment of expenses for renting premises for these days obviously seems economically unjustified;

- if the employee, at the end of the working day, in agreement with the head of the organization, remains at the place of business trip, then the costs of renting accommodation, upon provision of the relevant documents, are reimbursed to the employee in the amounts determined in accordance with Art. 168 Labor Code of the Russian Federation.

The issue of an employee’s attendance at work on the day of departure on a business trip and on the day of arrival from a business trip is resolved by agreement with the employer. As already noted:

— the day of departure on a business trip is the day of departure of a train, plane, bus or other vehicle from the place of permanent work of the business traveler, and the day of arrival is the day of arrival of the specified vehicle at the place of permanent work;

— when a vehicle is sent before 24 hours inclusive, the current day is considered the day of departure on a business trip, and from 0 o’clock and later - the next day. If a station, pier, or airport is located outside a populated area, the time required to travel to the station, pier, or airport is taken into account;

— the day the employee arrives at his place of permanent work is determined in a similar way.

When traveling to an area from which the business traveler has the opportunity to return daily to his place of permanent residence, daily allowances (allowances in lieu of daily allowances) are not paid. If a posted employee, at the end of the working day, voluntarily remains in the place of business trip, then upon presentation of documents on the rental of residential premises, the rental costs will be reimbursed in accordance with the general procedure.

The question of whether an employee can return daily from a business trip to his place of permanent residence is decided in each specific case by the head of the organization in which the business traveler works, taking into account the distance, transport conditions, the nature of the task being performed, as well as the need to create conditions for the employee for relax.

Decree of the Government of the Russian Federation dated July 29, 2015 No. 771 “On amendments to the Regulations on the specifics of sending workers on business trips and invalidating subparagraph “b” of paragraph 72 of the changes that are made to acts of the Government of the Russian Federation on the activities of the Ministry of Labor and Social Protection of the Russian Federation Federation, approved by Decree of the Government of the Russian Federation of March 25, 2013 No. 257" (hereinafter referred to as Resolution No. 771) from August 8, 2020, a number of significant changes were made to Regulation No. 749. Let us recall that by Decree of the Government of the Russian Federation of December 29, 2014 No. 1595, which entered into force on January 8, 2015, official assignments, travel certificates and business trip reports were canceled. The changes introduced by Resolution No. 771 clarify some of the wording amended by Resolution No. 1595.

Firstly, the new edition contains paragraph. 2 clause 3. At the same time, it is clarified that the employee must be sent on a business trip on the basis of a written decision of the employer (and not an order, as was previously the case). Thus, now, in order to send an employee on a business trip, an internal act signed by the head of the organization is required (as a rule, an order or a separate paragraph of the order on personnel matters).

Secondly, the new edition contains clause 7. At the same time, the procedure for confirming the fact and length of stay of a posted worker at the business trip point is detailed (as a general rule, the actual length of stay of an employee on a business trip is determined by travel documents):

- when going on a business trip and back on the organization's official transport - the actual length of stay at the point of business trip is confirmed in the same way as when going on a business trip on personal transport (the procedure is established by Resolution No. 1595) - on the basis of a service note, which is submitted by the employee upon return from business trips to the employer with the attachment of documents confirming the use of the specified transport for travel to the place of business trip and back (waybill, route sheet, invoices, receipts, cash receipts and other documents confirming the transport route);

— in the absence of any travel documents, the actual length of stay on a business trip is confirmed by documents for renting residential premises at the place of business trip;

— in the absence of travel documents, documents for the rental of residential premises or other documents confirming the conclusion of an agreement for the provision of hotel services at the place of business trip, the actual length of stay can be confirmed in a memo and (or) other document on the actual length of stay of the employee on a business trip containing confirmation of the party receiving the employee (organization or official) about the date of arrival (departure) of the employee to the place of business trip (from the place of business trip). That is, in this case, it actually requires the affixing of marks from the receiving party, which were previously affixed on travel certificates.

Thirdly, clause 8, which gave the Russian Ministry of Health and Social Development the right to determine the procedure and forms for recording workers leaving the sending organization on business trips and arriving at the organization to which they were sent, was declared invalid.

Why do you need an advance report?

An advance report is a prerequisite for the procedure for issuing money. The employee must report expenses made in this way.

This document relates to the mandatory reporting of the institution, and, therefore, must be completed. Its main goal is complete control over financial expenses in a budget organization. With the help of such a document, you can not only check the movement of spent funds issued to fulfill the needs of the institution, but also write off the expenses incurred.

Deadline for reporting travel expenses 2017

========================

deadline for reporting travel expenses 2017

Go to download

========================

How is the duration of a business trip determined? Any business trip is limited in time; the duration of the trip is established in the order of the manager. A business trip is a business trip for a certain period of time, on which an employee is sent for performance. It turned out that the report on travel expenses was not good. Actual length of stay on a business trip.

Advance report per diem

An accountant can maintain advance reporting using the unified form No. AO-1 or independently develop a format by issuing an appropriate order.

Documentation can be maintained both in paper and electronic form. If the institution provides for completion in electronic form, then the JSC is signed electronically by each of the participants in the accountable process.

There are a number of generally accepted rules for filling out (Decree of the State Statistics Committee No. 55 of 08/01/2001):

- Reporting is generated within a three-day period from the expiration of the period for which accountable funds were issued (it must be determined by order or regulation), the employee’s return from a business trip, or the employee’s departure from sick leave, provided that the specified day of return of the accountable account occurred during the period of incapacity for work.

- If the deadline for returning the advance money is violated, the employer may apply sanctions to the employee, including financial ones.

- The accountant provides full assistance to the accountable person in filling out.

- The document, completed and executed in accordance with all rules, is signed by the head of the organization.

- The reporting is accompanied by primary documentation confirming the expenses incurred (receipts, tickets, statements, invoices).

How to fill out an advance report for a business trip 2020?

The business trip report is the final stage of the entire procedure: from drawing up the departure order to the return of the employee.

A properly compiled report should confirm financial expenses, which, in turn, affect taxes.

An advance report must be prepared by an employee sent on a business trip. Once completed, it is sent to the accounting department for verification.

At the final stage, the document is signed by the manager. The funds spent (in the absence of an advance) or the difference if the expense is greater than the advance are listed.

Document requirements

How to prepare an advance report correctly so that it is accepted during a tax audit?

The report is a strictly reporting document. It is filled out according to form No. AO-1 and is used to account for funds that were issued to the traveler.

Advance report-ao-1

The document is drawn up in one copy on paper or filled out electronically.

Note that in the new form of the form, only the lines appeared: a receipt from the accountant that he received the report from the employee. The rest of the document has not undergone any changes.

Form and sections

How to fill it out correctly:

- Front side: personal data of the employee, a document confirming the issuance of money, information on the previous advance are filled in.

- Reverse side: dates of expenses, document number, name, amounts, documents confirming transactions are indicated (columns 1-6).

All expenses must be documented. The list of documents is given below. They must be stored and glued to a separate A4 piece of paper upon arrival.

The amount payable will directly depend on the receipts and checks provided.

Is a log book prepared for employees leaving on business trips? Is it required? Find out from our article. Does an employee have the right to refuse a business trip? See here.

Sample filling (example)

An example of preparing an advance report for a business trip 2020:

Example of filling out an advance report

Who signs and agrees?

Each document must be signed by the person completing it. Only after this is it possible to transfer the report to the accounting department. She checks that it is filled out correctly.

The head of the enterprise and the chief accountant must put their signature on the document. Only after this can the funds that the employee paid independently be transferred.

Due dates

After arriving from a business trip, the employee must draw up and submit an advance report within 3 days.

Accompanying documents

Resolution No. 749 of October 13, 2008 established a certain package of travel documents:

- Travel certificate of the established form. Issued for every business trip in the Russian Federation. The form is dated, stamped and signed upon departure from the organization. The receiving party affixes a stamp, signature and date of entry, similarly for departure. When the employee returns, the accounting department enters the date of arrival.

- Checks, receipts confirming payment for accommodation on a business trip.

- Receipts, tickets – all expenses associated with travel to and from the business trip location (train tickets, travel life insurance, toll road receipts, etc.)

- A report on the completed business trip, approved by the manager.

- Other expenses related to business travel.

Decree of the Government of the Russian Federation of October 13, 2008 N 749

All documents must be completed accordingly. When attaching them to the expense report, each document is glued to an A4 sheet with glue.

If the requirements are violated or the original documents specified in the report are missing, the accounting department has the right not to pay the expenses incurred by the employee. In cases of entry, a tax audit will reveal a violation and impose a fine.

The accounting department should carefully review the documents that the employee provides to confirm his expenses.

The most common one is a cash receipt.

If it does not indicate what product was purchased, it must be provided with a sales receipt or receipt.

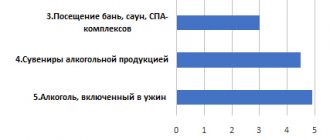

Types of documents confirming expenses incurred:

- A cash receipt is required during a tax audit; it confirms the fact of payment. When storing a check, you must follow certain rules. If you get wet or stay in the sun for a long time, the information may disappear. Such a check cannot be attached to reimbursement of expenses. Some organizations operate without a cash register or only print the total amount on the cash receipt. In these cases, you must request a sales receipt.

- Sales receipt - it indicates a detailed description of the business transaction, quantity, price, total amount, name of the organization, date, signature and position of the person filling it out. The advance report is attached along with the cash receipt. In the absence of the latter, the PM must bear the seal of the selling organization. Please note that the amount and date on the sales receipt must match the cash receipt.

- Strict reporting forms . The document must indicate the name, details of the legal entity, business transaction, price, amount, date, position and signature of the person completing it.

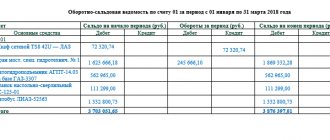

Postings

The following accounts will be used:

- 71 – “settlements with accountable persons” (applies to Active-Passive accounts);

- 70 – “settlements with personnel for wages”;

- 51 – “current account”;

- 50 – “cash desk”;

- 94 – “shortages and losses of the enterprise.”

When the report is approved, the transactions look like this:

- When issuing an advance: the accountant draws up a settlement account and funds are issued. Upon receipt, the employee signs the consumable. Dt71-Kt50

- When transferring funds from a current account to an employee's current account: entry Dt71-Kt51 is drawn up. In this case, a payment order is issued to the bank. Confirmation of receipt of funds is a bank statement.

- The funds have been issued and the amount needs to be closed. This is possible after the employee arrives from a business trip and the expenses are confirmed with relevant documents. Postings: Dt10-Kt71 – purchase of materials, Dt41-Kt71 – purchase of goods, Dt20-Kt71, Dt26-Kt71, Dt44-Kt71 – trade or production activities of the enterprise.

- When the amount of funds spent is greater than the amount issued, a reverse transaction is made and the money is returned to the cash desk. The PKO is issued: Dt50-Kt71 or Dt51-Kt71 (to the current account).

- If the advance payment for a business trip is insufficient, the money is transferred to the employee from the cash desk. RKO is issued: Dt71-Kt50 or Dt71-Kt51 (from the current account).

- In the event that an employee has lost checks or spent money on personal purposes that are not related to a business trip, the following entry is drawn up: Dt94-Kt71 - funds from the reporting person are written off as the company's shortfalls. Dt70-Kt94 - the amount of the shortfall must be deducted from the salary of the employee who was unable to report on the advance payment.

How to arrange a business trip while on vacation? Read our article. Can the advance be more than the salary? Find out here.

How to issue an order for employment? Information is here.

Procedure for compilation

Information required:

- information about the institution, number and date of the document being drawn up;

- about the employee who received an advance;

- the amount of funds issued and their intended purpose;

- actual expenses (all supporting primary documents are attached).

The front part also contains data on the movement and write-off of advance payments and on analytical accounts reflecting the accounting of funds in the organization. All completed information is certified by the signatures of the responsible accountant who issued the money and accepted the return of the accountable amounts for the advance report, as well as the chief accountant and the person who received the required amount for the report.

The accountant fills out a tear-off receipt confirming the verification of the primary documents. After registration and tearing off, it remains with the accountable person.

On the reverse side, the employee enters a detailed breakdown of the expenses for the report, and the responsible accounting employee indicates the amount to be recorded and the accounting account through which the expenses will be posted.

Advance reporting is generated in a single original copy. Since it is included in the nomenclature internal document flow of the institution, it is not necessary to affix a seal.

Corrections excluded! If you make any mistakes, or even more so, you will have to fill out a new form.

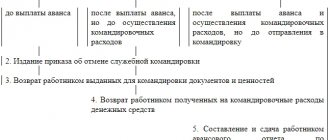

Paying the employee

So, the advance report is approved by the manager. And you see that the posted employee did not fully spend the advance payment given to him or did not confirm some expenses with primary documents. In this case, he must return the unspent amount to the cashier according to the cash receipt order.

If the employee does not return the unused balance within the time allotted for the final payment of the advance payment issued to him (3 working days (Clause 11 of the Procedure)), you can withhold this amount from his salary (Article 137 of the Labor Code of the Russian Federation). To do this, it is necessary that (Article 248 of the Labor Code of the Russian Federation):

- within a month from the end of the 3-day period, the manager issued a written order to recover the unspent amount from the employee;

- the employee has given written consent to deduct this amount from his salary if it exceeds his average monthly earnings.

In the event that an employee spends more money on a business trip than was given to him, the amount of overexpenditure must be reimbursed to him. It is advisable to do this no later than the next payment of his salary.

Nuances

In different situations, the preparation of an expense report has its own characteristics. Below are some of such cases.

When traveling abroad

A line-by-line translation of supporting documents written in a foreign language is required. It can be carried out by an invited professional or a company employee.

Decree of the Government of the Russian Federation 749 of October 3, 2008 regulates the reimbursement of expenses for travel registration, mandatory fees and medical insurance.

As a basis, you can submit documents containing the following data:

- about the amount of actual costs;

- names of paid services.

From business trip to vacation

In this case, the procedure for submitting the report differs only in that the employee must fill out and submit the paperwork to the accounting department within three days after the end of the next rest period.

For how long is sick leave paid? Read our article.

You will find information about the main accounting registers.

How to write an application for financial assistance? Find out .

In a budget institution

The advance report is drawn up in the form approved by Order of the Ministry of Finance of the Russian Federation 52N.

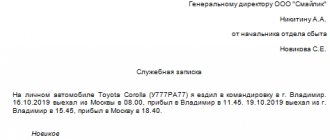

By personal car

If the trip is made in your own car, then the following documents must be presented as proof of expenses:

- waybill;

- cash receipt for fuel payment.

If you were fired during the trip. When to close a report?

In this situation, you will need to recall the employee to the place of work. Thus, all paperwork must be completed upon return, but no later than the date of termination of the employment contract.

Is one reporting document allowed for several work trips?

If we are talking about a business trip, then the following norm should be adhered to: the report must be submitted within the time limits specified by regulations, after the end of the trip.

In cases where permanent work is carried out on the road, you must report the expenditure of funds in the period for which they were issued.

Is it possible to issue one document for two employees?

This procedure is acceptable when money for a trip is given to one of the traveling employees.

Otherwise, each accountable person is obliged to draw up papers in relation to the amount received by him.

An advance report for a business trip is confirmation of the expenditure of funds that are provided to the employee to cover business expenses during the trip. It must be issued upon return within the prescribed interval and supported by supporting papers.