Any organization, even the most “modest” one at first glance, spends some of the money from its current account on all kinds of events, expensive furniture, cars and other attributes of a “comfortable life.” They are called “representation expenses” and they are the ones that are under the close attention of the inspection authorities. Why? Actually, today we will try to answer this question, as well as outline the basic principles of their accounting, because These are precisely the mistakes that allow tax officials to “let their hands go.” To make things more informative, we turned to the stories of our clients, where together we put emphasis on generally accepted practice. Let's see what comes of it...

Official reception and service

First of all, it is necessary to determine what exactly can be considered official reception and service; the Tax Code does not disclose these concepts. Therefore, only in accordance with the order of the manager, the meeting plan or other documents can it be proven that the meeting was of an official and business nature.

For example, a chance meeting between two executives and their dinner together will not be official. But if this meeting was planned, and certain funds were allocated for its holding by order of the manager, and after the meeting the manager presented a report on the negotiations held and the amounts spent, we can talk about an official meeting.

Place and time of negotiations

Tax authorities often try to refuse to recognize entertainment expenses due to the location of the negotiations. The disagreement here is caused by this: on the one hand, the Tax Code of the Russian Federation directly states that the location of entertainment events does not matter. But, at the same time, there is a restriction according to which expenses for organizing entertainment and recreation are not representative (paragraph 2, paragraph 2, article 264 of the Tax Code of the Russian Federation). Therefore, very often, according to inspectors, meetings in bars, cafes or restaurants are personal and unofficial.

However, in disputes of this kind, arbitration courts often side with taxpayers and recognize the legality of accounting for the costs of renting premises for a business meeting. If the organization has submitted documents indicating that it does not have premises suitable for receiving delegations of potential clients, conducting negotiations and concluding transactions.

The time for reception and negotiations of the Tax Code of the Russian Federation is not limited. This means that, subject to other conditions, the concept of an official reception will also correspond to a dinner organized for representatives of other organizations outside working hours.

What's not included?

At first glance, the above definitions of the Tax Code seem clear and understandable. But when you start using them in practice, questions arise. Let's try to deal with them. What is important here is the position of the tax authorities on what specific expenses they are willing to recognize as representative expenses, and what they will not agree to under any circumstances.

Renting premises

To organize an official reception or meeting, they often rent a room (for example, a meeting room in a business center or a larger hall). But in paragraph 2 of Art. 264 of the Tax Code of the Russian Federation, which contains an exhaustive list of expenses, there is no rent. This is where all the fuss comes from about the costs of renting premises - the tax authorities do not recognize them as representative.

Entertainment organization

Entertainment expenses do not include expenses for organizing entertainment, recreation, prevention or treatment of diseases (paragraph 2, paragraph 2, article 264 of the Tax Code of the Russian Federation). At the same time, the costs of organizing entertainment, in particular, include the costs of a buffet table, a ship and artists as part of the entertainment program organized after the official part of the entertainment event (letter of the Ministry of Finance of Russia dated December 1, 2011 No. 03-03-06/1/796).

What about individuals?

In paragraph 2 of Art. 264 of the Tax Code of the Russian Federation specifically talks about the possibility of accounting for expenses as entertainment expenses only if they were spent on preparing the official reception and service of representatives of other organizations. Those. This does not apply to individuals!

An exception is the cost of negotiations with individuals who are clients of the organization (letter of the Ministry of Finance of Russia dated March 27, 2009 No. 03-03-06/2/64), as well as with individual entrepreneurs.

Transport services and accommodation

The Tax Code of the Russian Federation in the concept of servicing representatives of other organizations includes their transportation support - delivery of event participants to the venue and back (paragraph 1, clause 2, Article 264 of the Tax Code of the Russian Federation).

And often the host party assumes the responsibility to pay for air and train tickets for invited persons, the costs of delivering them to the event from the station to the hotel, paying for accommodation, etc.

But at the same time, in practice, tax authorities refuse to take into account as part of entertainment expenses the costs of visa support, as well as payment for air and railway tickets for representatives of foreign states, the costs of delivering arriving foreigners to the event from the station to the hotel (or to specially rented premises), as well as expenses for their living (see letter of the Federal Tax Service of Russia dated 04/18/2007 No. 04-1-02/306, a similar position was expressed by the Ministry of Finance of Russia in letter dated 04/16/2007 No. 03-03-06/1/235).

At the same time, the costs of delivering foreign representatives to the venue of the entertainment event are considered entertainment expenses (letter of the Federal Tax Service for Moscow dated July 14, 2006 No. 28-11/62271).

Supervisory authorities believe that the costs of the host party to pay for the accommodation of arriving persons, if negotiations last several days, are not representative (letter of the Ministry of Finance of Russia dated December 1, 2011 No. 03-03-06/1/796, Federal Tax Service of Russia for Moscow dated December 6, 2011 .2007 No. 21-11/116748).

But some courts allow travel and accommodation expenses of the arriving party to be taken into account as representative expenses. They believe that such costs for the purposes of paragraph 2 of Art. 264 of the Tax Code of the Russian Federation relate to “service of representatives” (see resolution of the Federal Antimonopoly Service of the West Siberian District dated March 1, 2007 No. F04-9370/2006(30552-A81-27)).

The problem stems from the fact that travel and accommodation costs are recognized as travel expenses by the sending party. Therefore, in order to avoid problems on the part of the inspection authorities, it is advisable to distribute such costs among the negotiating parties.

Souvenirs

During negotiations, the parties, as a rule, exchange souvenirs with the symbols of their enterprise. These can be notepads, pens, diaries, etc. According to the tax authorities, this kind of expense cannot be recognized as advertising due to a certain circle of people, at the same time, the cost of this type of product can be taken into account as entertainment expenses (according to letters of the Ministry of Taxes and Taxes of Russia dated August 16, 2004 No. 02-5- 10/51, Federal Tax Service of Russia for Moscow dated April 30, 2008 No. 20-12/041966.2). But the Russian Ministry of Finance refuses to include this kind of expenses in entertainment expenses, because they are not named in paragraph 2 of Art. 264 of the Tax Code of the Russian Federation (see letter dated August 16, 2006 No. 03-03-04/4/136). In such situations, the organization itself must decide which explanations to follow, and understand that it may have to prove its case.

Representative meals

Often the host party bears the costs of holding dinners, for example, in a restaurant, which can also take place at late times. How to determine these types of costs?

The official position of the regulatory authorities is that the organization must draw up a number of documents that serve to confirm entertainment expenses. These may be:

- order from the manager to confirm expenses for these purposes,

- estimate and report on the entertainment event, reflecting the purpose,

- as well as primary supporting documents.

If the event held (dinner in a restaurant) is not of an official nature or there are no documents confirming the conduct of business negotiations at it, the costs of its holding cannot be taken into account for profit tax purposes (letter of the Ministry of Finance of Russia dated November 1, 2010 No. 03-03-06/ 1/675).

And if you have completed all the necessary supporting documents, then you can take into account the expenses for breakfasts, lunches and dinners of participants in business negotiations as entertainment only within the established limit, namely, within 4% of the organization’s expenses for wages for this reporting (tax) period (according to the letter of the Ministry of Finance of Russia dated March 22, 2010 No. 03-03-06/4/26; the same letter contains a list of documents justifying entertainment expenses; the same list is given in the letter of the Ministry of Finance of Russia dated November 13, 2007 No. 03-03-06 /1/807; we will discuss these documents in detail below).

Alcohol

It is rarely possible to do without alcoholic beverages during business meetings.

Previously, the explanations of the Ministry of Finance regarding expenses for alcohol were vague (see letters of the Ministry of Finance of Russia dated November 19, 2004 No. 03-03-01-04/2/30, dated June 9, 2004 No. 03-02-051/49), but more in a later letter it was directly stated that the costs of organizing an official meeting with clients to discuss issues related to concluding contracts also take into account the costs of purchasing alcoholic beverages (letter of the Ministry of Finance of Russia dated March 25, 2010 No. 03-03-06/1/176).

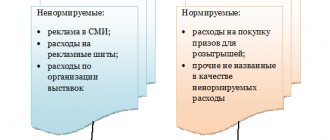

Hall decoration

In the above letter No. 03-03-06/1/176, the financial department raised another important issue: the costs of purchasing prizes, issuing diplomas, and decorating the hall, clause 2 of Art. 264 of the Tax Code of the Russian Federation is not provided for, therefore, they cannot be taken into account as part of entertainment expenses for profit tax purposes.

This means that such costs can be fully covered only from the net profit of the enterprise, even if they are properly documented, which, in principle, is not profitable: you will have to pay 20% of these amounts to the budget.

Formal nature of the reception

Once again we draw your attention to the fact that in paragraph 2 of Art. 264 of the Tax Code of the Russian Federation talks about official reception. This means that when a meeting of two organizations takes place, but it is not of an official nature, or if you have not collected documentary evidence of the formality of business negotiations, then your organization will not be able to take into account the costs of conducting them as representative expenses for income tax purposes.

When conducting negotiations within the framework of business trips, a similar procedure for recognizing such costs should be applied1.

It should be noted that to confirm the official status of the representative event, the organization will need to issue additional documents:

- program (plan) of the event (here it is important to indicate the purpose, place and timing of it);

- a list of officials taking part in the event, both from invited partners and from the organization itself (such a list may be included in the order for the event and/or in the program of this event);

- a report (act) on the results of the event, approved by the head of the organization (indicating the amounts of actual expenses incurred).

If negotiations are unsuccessful

During inspections, the tax authorities require, in order to justify representation expenses, to submit some document indicating a positive result of negotiations: an agreement, a protocol of intent, etc. And if there are no such documents, then the tax authorities believe that the entertainment expenses are unreasonable.

Meanwhile, the Tax Code of the Russian Federation does not put forward such conditions and does not in any way link the recognition of entertainment expenses with the positive result of the meeting.

If a business meeting does not bring the expected results, for example, a long-awaited contract for the organization is not signed, then, in our opinion, it is also possible to recognize expenses for profit tax purposes. After all, the goal of negotiations may simply be to establish good relations with partners. In addition, the Tax Code does not contain a direct requirement for positive results of the meeting.

To avoid disagreements with the tax authorities, it is advisable to draw up a report or protocol indicating that the issues were discussed, but no agreement was reached.