Taxi travel expenses for a posted worker

An employee sent on a business trip can use a taxi service to travel to the station, airport, place of residence, as well as to the place of his permanent work during the period of the business trip. Clause 12 art. 264 of the Tax Code of the Russian Federation allows you to include business travel expenses, including employee travel to and from work, as other expenses related to production and sales. The type of transport that can be used is not specified.

In this regard, the question arises: is it possible to take into account taxi travel for an employee on a business trip as part of other expenses? Explanations on it are provided by the Ministry of Finance (see letters dated 03/02/2017 No. 03-03-07/11901, dated 06/10/2016 No. 03-03-06/1/34183, dated 06/14/2013 No. 03-03-06/1/ 22223). And the conclusion from them follows that it is possible - subject to documentary evidence and economic justification of the costs.

What documents can confirm payment for taxi fares? This could be a cash register receipt or a receipt for payment for using taxi services. In Government Decree No. 112 dated February 14, 2009, you can find the mandatory details approved for such receipts.

If at least one of the above details is missing, the document is considered unsuitable for confirming the expenses of an employee of the organization for taxi travel.

To make an economic justification for traveling by taxi while on a business trip, it is worth getting a service note from the employee explaining the choice of this particular type of transport: a work schedule that makes it difficult to travel by public transport, the distance of the place of work or temporary residence from public transport stops. Otherwise, it is better to refuse taxi rides or recognize fees for them as expenses for profit.

Is it possible to take into account the costs of car sharing for employees in tax accounting? What documents can be used to confirm such expenses? Answers to these and other questions are in ConsultantPlus. If you don't have access to the system, get a free trial online.

You can find out what expenses are reimbursed to a posted worker and whether they are subject to personal income tax in this article.

Taxi costs to and from work

Is it possible to take into account the cost of a taxi to take an employee to work and return him home? This issue causes a lot of controversy among accountants. And inspectors are sensitive to such expenses. On accounting for the costs of transporting employees to and from work, including using a taxi, the Ministry of Finance of the Russian Federation provided an explanation in letters dated March 16, 2017 No. 03-04-06/15198, dated November 27, 2015 No. 03-03-06/ 1/69181. Based on the letters, we draw conclusions: taxi costs for transporting an employee to work and back can be taken into account as tax-reducing expenses if one of two conditions is met:

- The use of a taxi is justified by the inconvenient geographical location of the place of work in relation to public transport stops or the production work schedule, which makes it difficult to travel by public transport. These grounds must be justified in the order of the manager, which establishes the procedure for using a taxi for official purposes.

- The delivery of an employee to and (or) from work using a taxi is provided for by the employment contract and (or) collective agreement as a remuneration system, and at the same time it is possible to determine the amount of income of each employee.

To accept expenses, they must be documented. The mandatory details on documents confirming the use of a taxi service have already been discussed.

Read more about the withholding of personal income tax from travel compensation in the article “Transport to work and back - a tax aspect.”

Personal income tax and insurance premiums

When paying for a taxi to transport employees home is due to production needs, the employees do not have an economic benefit, and accordingly, there is no need to withhold personal income tax. Such trips are driven by the interests of the organization, not the employees.

It should be remembered that the organization must have supporting documents about the use of a rented car or taxi by employees for business purposes. If there are no such documents, this indicates that the persons used by the taxi have an economic benefit. And such income should be subject to personal income tax.

As for insurance premiums, the object of their taxation is such payments and rewards made to individuals in employment relationships or under civil contracts, the subject of which is the performance of certain works or the provision of services.

When an organization pays for taxi services, the benefit accrues to it, and not to the employees. In this regard, there is no object for taxation of insurance premiums.

Taxi expenses under an agreement with a transport company can be taken into account for tax purposes only if these expenses are justified (for example, for production purposes) and also documented. Such services are recognized as provided in the interests of the company, which means that employees do not generate taxable income. Accordingly, there is no need to withhold personal income tax from the amount paid by the taxi for transporting the employee home. In addition, insurance premiums for this amount are also not charged.

Important! The amount paid for taxi services to transport employees home is not subject to personal income tax. Also, insurance premiums are not charged for this amount, since the employee does not generate income in this case.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

https://youtu.be/7n54PHPmTdg

Taxi expenses for employees for business purposes

To expand the client base, in order to improve the quality of services and increase sales, organizations send employees to their clients (customers). A production necessity may be caused by an employee’s taxi ride to the counterparty with whom the company cooperates, which is not recognized as a business trip. Can these expenses be taken into account when taxing profits?

It is possible, if the employee used taxi rides specifically for official purposes, these trips are documented and their official purpose is justified in writing. The manager should issue an order indicating the employees who can use taxi services to perform their job duties. And employees must provide memos justifying the need for a taxi ride.

See also: “[INCOME TAX]: When is it permissible to write off taxi expenses?” .

If the employee’s job responsibilities, in principle, include regular travel, the organization must indicate the traveling nature of his work in the employment contract or local regulations. And documented taxi expenses should be taken into account for tax purposes.

If employees of an organization in the course of their work are forced to often resort to taxi services, in order to painlessly accept such expenses for tax accounting, it is advisable for the organization to enter into an agreement for the provision of taxi services with the appropriate company. Taxi payments should be made to the bank based on issued invoices or according to the terms of the agreement. In this case, to confirm expenses, the organization will have a bank statement with the amounts written off for payment of services, as well as primary documents provided by the taxi service confirming the implementation of these trips.

If you have access to ConsultantPlus, check whether you have correctly taken into account the cost of a taxi for a business trip employee. If you don't have access, get a free trial of online legal access.

Business trip 2020: new registration rules, tax and accounting

So whether to conduct it remains entirely at the discretion of the organization.

If the employer chooses to use this document, he must adhere to the standards for filling it out. The business trip log must contain the following information for each business trip: The following information must be placed on the title page of the journal:

- The end date of its maintenance (filled in when there are no empty pages left in the journal).

- Full name of the employer.

- Logging start date.

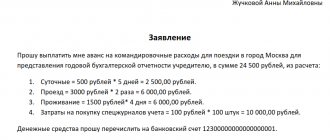

Sample of a business trip log A form and a sample form (download) will help you create and maintain a business trip log. The advance report (), as already mentioned, is the second mandatory travel document after the order to go on a business trip, which is of key importance for accounting and tax accounting.

This is interesting: Regulations on tenders

Green-eyed taxi: how to take into account travel expenses for employees (when you can recognize travel costs and how to confirm them) (Elina L

.A.) Date of publication of the article: 08/16/2016 “Expense” tax accounting We tell the manager The local regulatory act of the organization may establish special conditions for the use of a taxi, which must be familiarized to the employee when sent on a business trip.

Attention to supporting documents Personal income tax and insurance premiums Whether taxi costs reimbursed to the employee should be subject to personal income tax and insurance premiums depends on the situation.

A situation in which an employee used a taxi

Taxi expenses as entertainment expenses

It is rare that any organization in the course of its activities can do without organizing official receptions and negotiations. The costs of transporting officials of the taxpayer organization to the venue of the entertainment event and back are expressly mentioned as entertainment expenses in paragraph 2 of Art. 264 Tax Code of the Russian Federation. To accept them for accounting, they must be documented. To do this, the organization must have:

- order from the manager to carry out this event and incur related expenses;

- estimate of entertainment expenses;

- a report on entertainment expenses, which should include: the purpose and results of the event, date and location, program of the event, list of participants and amount of expenses confirmed by primary documents.

For more information about hospitality expenses and the peculiarities of their design, read the article “Representation expenses - what are these expenses?”

If the costs of delivery using a taxi are mentioned in the report and there are supporting documents, then such costs are taken into account in other costs associated with sales and production.

IMPORTANT! Representation expenses during the reporting (tax) period are included in other expenses in an amount not exceeding 4% of the taxpayer's expenses for wages for this reporting (tax) period.

Read more about rationing entertainment expenses in this article.

Taxi expenses in accounting

The procedure for using taxis by employees of an organization for official purposes is determined by its head. By his decision, with the issuance of an appropriate order or the development of a local regulatory act regulating the use of a taxi service on business trips, taxi fares for employees may be subject to payment.

Such expenses, confirmed by relevant documents, are taken into account in accounting in accordance with paragraphs. 5, 7 PBU 10/99 “Expenses of the organization” (Order of the Ministry of Finance dated 05/06/1999 No. 33n), as expenses for ordinary activities.

Reflection in the accounting of these expenses made in cash occurs on the basis of the employee's advance report with supporting documents attached.

The accounting entries are as follows:

Dt 26 Kt 71 - entertainment expenses for a taxi are reflected;

Dt 20 (26, 44) Kt 71 - reflects the employee’s expenses for a taxi during a business trip.

Taxi expenses incurred by employees in connection with the performance of official duties are calculated in the same way:

Dt 71 Kt 50 - the employee’s expenses were compensated.

To reflect taxi costs in accounting, as well as in tax records, the employee must provide supporting documents, as well as a service note explaining the route.

If an organization has entered into an agreement with a taxi service, the costs associated with the movement of employees by taxi are reflected by posting:

Dt 20 (26, 44) Kt 60 - expenses associated with employees’ work trips by taxi are reflected.

What supporting documents are needed?

It is important for an organization to remember that if it is necessary to pay an employee the cost of hiring a taxi, the latter must correctly prepare supporting documents and submit an advance report.

In order to confirm the costs of using a taxi, the employee must provide a document for payment for services.

It is usually:

- Cash receipt that the taximeter prints;

- BSO receipt, which is issued by the driver himself (quite rare).

The Government Decree establishes a list of details that the receipt must contain - name, series and number, etc.

These rules are mandatory, and it is impossible to replace the receipt with any other document, since this possibility is not provided for by law. This is especially true for electronic taxi systems (Yandex.Taxi, GetTaxi or Uber).

If the company has entered into a direct agreement with the specified services and all transactions are paid non-cash from a bank account, then a printout from the electronic taxi system and an extract from the organization’s bank account will be sufficient to confirm expenses.

However, most often the company does not have a direct contract with the taxi service, and the employee is registered in the system in his own name and pays for services from a personal bank card.

In this case, a regular printout from the electronic system will not be enough, since it most likely will not contain all the required details, and first of all, the series and number of the receipt. However, there is an opinion of the Ministry of Finance, which is as follows.

Attention! Following the results of the trip, the citizen should receive a letter with trip data via email (if indicated in his personal account). If you provide a document confirming payment for services (bank card statement), as well as a printout of this letter, expenses can be taken into account

.

Results

Taxi costs associated with the business activities of an organization attract special attention from accountants and inspectors. To be able to take them into account when calculating income tax, as well as to avoid the accrual of personal income tax and contributions on compensation amounts for taxi expenses for employees, the organization must develop regulations for the use of a taxi service on work trips. All employees must be familiar with these regulations to avoid having to pay for taxi fares at their own expense.