Kontur.Accounting is a web service for small businesses!

Quick establishment of primary accounts, automatic tax calculation, online reporting, electronic document management, free updates and technical support.

Try it

The main form of accounting is annual, but there are also interim reporting. It is compiled once a month, quarter, six months or nine months, that is, for a period of less than a year. Interim reporting is not mandatory for all organizations, and it is not necessary to submit it to the tax authorities. In this article we will tell you what interim reporting includes, for whom it is mandatory and what is the procedure for its preparation.

Interim financial statements 2020

From May 7, 2020, the preparation of interim reporting officially ceased to be mandatory for all organizations on the basis of Order of the Ministry of Finance dated April 11, 2018 No. 74n. The order canceled clause 29 of the Regulations on Accounting and Reporting, which required the preparation of interim reporting by everyone who is not exempt from it by law. Similarly, the decision of the Supreme Court of the Russian Federation canceled paragraph 48 of PBU 4/99. Currently, it is necessary to prepare and submit interim reporting only in cases where this obligation is provided for:

- legislation;

- regulatory legal acts;

- contracts;

- constituent documents.

For example, quarterly reporting is required for insurance organizations and securities issuers. If your organization does not fall under these conditions, it is obligatory to prepare only annual reports, but it is possible and useful to prepare interim reports on your own initiative.

Submission of interim reporting to tax authorities and statistical authorities is not required. But interim reporting may be required when concluding agreements with counterparties, obtaining a bank loan, or at the request of the founder. In addition, interim reporting helps to monitor the situation, forecast financial results and verify the reliability of accounting data.

What is the State Information Resource for Accounting Reports (GIR BO)?

GIR BO is a state information resource for accounting reporting. It is an online service on which company financial statements will be stored, as well as audit reports on these statements.

Reporting to the Federal Tax Service must be submitted by all business entities with the exception of:

- state-owned enterprises;

- Bank of Russia;

- religious organizations;

- organizations submitting financial statements to the Bank of Russia;

- organizations whose financial statements contain information related to state secrets.

Important! If a company is reorganized or liquidated, then it does not have to send its latest accounting reports to the State Inspectorate.

All users will be able to use the GIR BO Internet service from May 2020. It will provide the opportunity to receive information about the financial statements of any business entity. This service will be provided free of charge. In addition, the company will be able to receive a copy of the financial statements signed with the digital signature of the Federal Tax Service of the Russian Federation.

Interim reporting period and submission deadlines

Interim reporting reflects all aspects of the organization's activities and includes summary data on the organization's property and finances and their current state. It is formed on a cumulative basis for a reporting period of less than a year, starting from January 1.

The reporting period is not established by law. Experts believe that the optimal period for interim reporting is a quarter. Monthly formation is too labor-intensive, and six months is a long period, and the information may not be timely. But when determining the period, be guided by the needs of owners, management and potential investors.

The deadlines for submitting reports at the end of the reporting period are also determined by the owners themselves; they depend on the goals of the company. The decision on the reporting period and filing deadlines should be reflected in the accounting policy.

Control ratios

The correctness of financial statements can and should be checked using control ratios. They are given in the letter of the Federal Tax Service dated July 31, 2019 No. BA-4-1/ [email protected]

In November, a letter from the Federal Tax Service No. VD-4-1/ [email protected] dated November 25, 2019 was issued with the recommended forms:

- simplified financial statements during reorganization or liquidation form: forms KND 0710094 and KND 0710095,

- simplified financial statements form KND 0710096,

- accounting reporting form KND 0710099.

These forms must be submitted to the tax office starting with reporting for 2019.

Many reporting systems have built-in verification. Control ratios are already “built into” the programs. If the data you enter does not match the reference ratios, you will see a warning.

If the financial statements do not pass the test for control ratios, you will receive a notification with an error code through the electronic document management operator. The accountant needs to correct the error and submit adjusted reports.

Composition of accounting records for a period of less than a year

Unlike annual reporting, interim reporting includes fewer forms. It is mandatory to prepare an interim balance sheet and a financial performance report. If necessary, supplement interim reporting with a cash flow statement, explanatory notes and other forms.

The balance sheet contains information about the financial condition of the organization as of the current date. Assets provide information about property and liabilities to the organization. Liabilities reflect own and borrowed funds, allowing you to form an idea of the sources of property formation and the financial stability of the company.

The financial results report gives an idea of the organization's profits and losses for the period, allows you to assess the structure and dynamics of profits and identify problem areas and prospects.

Interim reporting forms are not approved by law; an organization can develop them itself, based on annual reporting forms. The reporting forms and its composition must be reflected in the accounting policies.

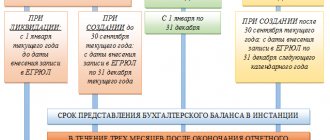

Deadline for submitting financial statements for 2020

Accounting statements must be submitted no later than March 31, 2020.

Errors in reporting can be corrected, but before it is approved. If errors or inaccuracies in the reporting are discovered after its approval, take into account all corrections in the financial statements of the next period.

If you discover an error, you have 10 working days to correct your financial statements from the day following the day the correction itself was made or the day the annual statements were approved.

Deadlines for approval of financial statements:

- for LLC reporting - April 30;

- for JSC reporting - June 30.

Deadlines for submitting revised reports:

- for LLC - no later than May 20, 2020 (10 working days after April 30);

- for JSC - no later than July 14, 2020 (10 working days after June 30).

Preparation of interim reporting

Like annual reporting, interim reporting must meet the requirements of reliability, timeliness, verifiability, integrity, simplicity and relevance. Preparation of interim reporting has its own characteristics.

- In the interim reporting there is no balance sheet reformation - write-off of profit or loss received for the previous financial year. At the end of a quarter or half a year, profit (loss) remains in account 99 and must be written off to account 84 only at the end of the reporting year.

- When preparing interim reporting, inventory is not required.

- Income tax is calculated using the tax rate that will be applied to annual earnings.

- Planned but not incurred expenses do not need to be recognized, just like income not received. As in the annual accounts, they should only be recognized when the recognition criteria are met.

- Assets are valued without the involvement of appraisers by extrapolation of data or independent calculation by the financial department of the organization.

- In interim reporting, employee bonuses can only be recognized early if, at the reporting date, the amount of the payment can be reliably measured or if the company has a legal obligation to pay that cannot be avoided.

Types of reporting

Since financial statements are based on data from primary accounting documents, it is necessary to comply with the established requirements for their maintenance. First of all, we mean continuity, reliability and timeliness. The information must be presented clearly and objectively and in such a way that data for, for example, July 2020 can be easily compared with data for July 2020 and 2020. Of course, you cannot provide false information or deliberately distort facts and data.

Accounting statements are classified according to their intended purpose, the degree of generalization of data and the frequency of preparation. Depending on the frequency of preparation, there are interim and annual financial statements.

Annual reporting

It is clear that annual financial statements are prepared for the period from January to December of the current year. Then it is sent for verification to the tax service.

This is interesting: Where to find the UIN on the receipt

According to the requirements of the Law “On Accounting”, the annual reporting should include:

- balance sheet and appendices thereto;

- financial results report with attachments;

- explanatory note.

If an enterprise is subject to mandatory audit, an auditor's report must be attached to the annual financial statements, which confirms the accuracy of the statements. The balance sheet and other documents can be signed only after an audit has been carried out and an appropriate conclusion has been made.

Preparing for interim reporting

The preparation of interim reporting includes several stages. First of all, you should prepare for its preparation. At the preparation stage, summarize all available data from primary and other documents, study the rules for drawing up forms and prepare the necessary data.

Interim reporting is prepared according to the same rules as annual reporting. It must be compiled in Russian, reflect numerical data in thousands of rubles or millions, negative indicators must be indicated in parentheses. Completed reports must be signed by the manager.

When compiling, the following data is required: full name of the documents, name of the organization, meters used, positions of persons responsible for accounting and reporting, and their personal signatures.

Complete accounting transactions at the end of the reporting period, check all entries in the accounting accounts and correct any errors found. Close accounts for cost accounting and formation of product costs on an accrual basis from the beginning of the year. Also, the preparation stage includes tax calculation.

Compliance with the rules governing the income statement

When registering it, the following rules must be observed:

- It is necessary to separate income received through the direct activities of the organization from income not related to direct activities.

- Revenue must be shown net of taxes, excise duties and VAT.

- The cost must be reflected in the correct way, while management and selling costs are not taken into account.

- The structural components of net profit are clarified.

- Proper preparation of notes and explanatory inserts regarding the financial statements and balance sheets.

The following recommendations should be followed:

- notes and explanations must be prepared in accordance with the accounting policy;

- it must also attest to the fact that the accounting procedure and preparation of financial statements were carried out in accordance with current legal norms;

- information must be deciphered clearly and extensively, relating to all areas of the company’s activities and operations (for example, about accounts payable, receivable, movement of assets, working capital and fixed assets);

- explanations must contain informative data on cash flows and capital;

- There must also be information about the leading field of activity of the enterprise, the average number of workers, and the structural and organizational divisions of the company.

Important aspects

When it comes to correcting errors in accounting documentation, one should follow PBU 22/2010 “Correcting Errors in Accounting and Reporting.”

This standard has been ratified. in accordance with it, interim accounting reports are not subject to adjustment.

But when preparing financial statements for the year, it is necessary to recalculate.

However, other regulations indicate the possibility of making changes to the annual financial statements if an error is discovered in the period between the date of signing the statements and the date of its approval.

Only significant errors are subject to correction, provided that reporting users are informed. The form of informing the addressee about clarification of accounting statements is chosen by the organization independently.

You can submit updated reports to the inspection authorities and attach a written explanation of the reasons for the correction.

What it is

Accounting statements are a set of information about the financial and property status of an organization and the final consequences of its management.

Reporting is generated on the basis of accounting information using established forms.

The purpose of accounting is to summarize all accounting data for a certain period of time and present it to interested parties in a visual format.

Preparation of financial statements is the final stage of the accounting process. Reporting reflects the accruing result in the property and financial condition of the company over a certain time.

The need for accounting reporting is due to the fact that with its help a number of significant problems can be resolved. In particular:

But, despite the numerous options for using financial statements, first of all, they are prepared for controlling structures.

In particular, mandatory reporting to the Federal Tax Service and Rosstat is required. Based on the data obtained, the activities of the economic entity are checked.

The tax office verifies the compliance of the accounting and tax reporting data. Adjusted financial statements, as the name implies, are statements with amendments or changes.

It is practically no different from ordinary financial statements. The content and form remain the same.

The only difference is that some of the corrections are in the document and an accompanying explanation explaining the reason for the corrections.

It is allowed not to correct the statements, but to submit a new one. It is compiled in the usual manner, but a note is made that the reporting is updated and an explanatory note is attached.

For what purpose is it served?

Is there an obligation to submit updated financial statements? No legislative document or regulation provides for the submission of updated accounting reports to the tax service.

But you need to pay attention to PBU 7/98, which was supplemented by clause 12.

This paragraph defines the conditions for informing users about changes in reporting. The tax office can also be considered a user.

In accordance with this provision, if during the period from the date of signing the statements to the date of their approval, events occurred that could significantly affect the results of the company’s activities and its financial position, then it is necessary to notify the direct users to whom the statements were provided about these facts.

One of the facts that is recognized as distorting reporting is the presence of a significant error in the content of accounting. But it does not reveal the definition of “materiality.”

That is, the filer of the report must make a decision about the significance of the error. To do this, the degree of influence of the error on the final indicators is determined.

In this case, one must proceed from the fact that failure to disclose a certain indicator can lead to incorrect decisions.

Thus, the purpose of filing restated financial statements is to avoid misinterpretation of the financial statements by users.

If the error is not significant, then there is no need to clarify the reporting.

The legislative framework

Design rules

According to Section 2 of PBU 22/2010, if errors are detected in the financial statements, the following correction options are possible:

| Is it surrendered if an error is discovered before the end of the reporting period? | According to clause 5 of PBU 22/2010, the inaccuracy should be corrected by making an entry in the relevant accounting accounts in the month of the reporting year in which the inaccuracy was exposed |

| How to file when an oversight is discovered during the preparation of tax reports? | Clause 6 PBU 22/2010 establishes the need for adjustments in the accounting registers to reflect the entry dated December thirty-first of the reporting year |

| What to do if a miscalculation is noticed after the accounting reports have been submitted to the tax authority, but before its final approval by the founders? | According to clause 7 of PBU 22/2010, it is necessary to replace the reporting with a new one. In this case, changes in reporting are reflected in the accounting registers by an entry dated December thirty-first of the reporting year |

| Do they hand over when the presence of an error is discovered at the time of the constituent meeting before approval? | Clause 8 of PBU 22/2010 determines the need to create new reporting |

| What to do if a mistake is identified after submitting reports to the inspection authorities and after the constituent approval? | According to clause 10 of PBU 22/2010, such accounting statements do not change |

Therefore, it is necessary to submit financial statements with clarifications only before they have been approved by the meeting of founders. After this point, the reporting cannot be changed.

Procedure for filing with the tax office

There are no fields for adjustments in the established forms for accounting reports. This means you need to draw up new reports, but on paper.

The fact of the error should be recorded in . A covering letter must be submitted along with the corrected statements.

It should explain in detail the reason for the correction and its implications for the perception of the reporting.

Submitting corrected financial statements is required both to the tax authorities and to the statistics service. Provided that the reporting has not yet been approved.

Video: accounting and financial reporting

It should indicate the presence of an error and ask you to correct such and such a line with the correct data.” According to experts, this will help avoid sanctions for distorting reporting data.

Do I need to take the simplified exam?

According to these standards, all organizations using the simplified taxation regime were exempted from mandatory accounting, and, consequently, from the provision of financial statements.

And since there is no reporting, then there is nothing to clarify. In 2013, an adjusted version came into force.

From this moment on, the obligation to maintain accounting became applicable to any organizations, including those using the simplified tax system.

Accounting became the reason for the formation of financial statements as the final stage of the process.

But organizations do not provide annual financial statements only to statistical authorities. In this case, if an error is detected, notification of the tax authorities is not required.

As for Rosstat, the organization itself has the right to notify this body of the presence of an error and provide updated reporting.

Or you can not submit a “clarification” at all, if the statistical authorities have not received a request to provide an explanation for the identified error.

Deadlines

Article 34 of Federal Law No. 14 establishes that the meeting of the founders, at which the annual financial statements must be approved, should be held no earlier than two months after the end of the reporting period, but no later than four months.

That is, the time for holding the meeting is no earlier than the first of March and no later than the thirtieth of April.

At the same time, it determines the need to submit annual accounting reports to the tax service within ninety days after the end of the reporting year, that is, no later than March thirtieth.

It follows from this that the day of approval of the financial statements may occur later than the date of signing it.

Composition of interim reporting

What forms are required by users as part of interim reporting are also discussed directly with the company’s management. Basically, to analyze a company’s activities, the first two forms are needed. Other forms may also be requested by information users.

When is the balance sheet due?

With what regularity and in what time frame should this be done, what are the consequences of failure to meet the deadlines for its delivery - this will be discussed in the article.

Goals and conditions for maintaining documentation

Accounting statements are a set of documents that reflect all the nuances of an enterprise’s economic activity for a certain period, the final stage of work, which gives the most complete picture of the economic situation at the enterprise. The statements are compiled according to accounting, operational and statistical data.

Reporting documentation is not only a tribute to the current legislation, it also allows the head of an enterprise to analyze production results, make important decisions on planning business activities, navigate future plans, calculate unnecessary costs, and so on.

In addition, regulatory authorities - audit organizations, tax authorities - through data analysis can give a comprehensive assessment of the organization’s success and determine whether the necessary legal requirements are met. If the head of an enterprise needs an expert opinion or an economic analysis of the organization, the specialist will also need to study the financial statements.

Back to contents

The concept of interim reporting

Interim accounting forms are compiled for a period of less than a calendar year; it is necessary to reflect the current activities of the company. The legislation does not define the periods for which indicators are collected in the forms, so the organization independently sets them, this could be:

- Month;

- Quarter;

- Or other periods.

Interim reporting, depending on which user it is provided to and what information he needs, can be compiled in a condensed form or, on the contrary, added with the necessary lines.

Interim reporting is prepared at the request of the company's managers, for example for:

- For owners (founders), the data may be necessary to make the right decisions aimed at stabilizing the company’s activities;

- Banking institutions, if the company took out a loan secured in the form of collateral, to track the required balance on the pledged property;

- Internal divisions of the company, for drawing up plans;

- For other users.

Submit quarterly accounting forms to regulatory authorities, from

the first quarter. 2013 is not necessary, since this provision is not in the law.