Accounting statements 2020: answers to questions

Approval of reporting

Who, instead of the head of the organization, can sign the financial statements?

This can be done by any employee authorized by the head of the organization. The manager can delegate part of his powers, including the right to sign financial statements, to other employees. For example, to your deputy, financial or commercial director. What you need to do for this, read the recommendations.

Is it possible to put a facsimile signature of the head of the organization on accounting forms?

No you can not. The Accounting Law requires that the manager or an authorized employee sign the financial statements personally on paper. For information on how to prepare and present financial statements, read the recommendations.

Do I need to stamp financial reporting forms?

No no need. The financial statements are certified by the manager or an authorized employee with his signature. For other documents that do not require a seal, see the table.

How to approve annual reports?

Annual financial statements must be approved. The decision on this is made by the general meeting of shareholders (participants). Such a decision must be formalized in the minutes of the general meeting. How to draw up a protocol, read the recommendations.

Submitting reports

In what ways can you submit financial statements?

Accounting statements can be submitted to the inspectorate in the following ways:

- personally to the tax inspector (to the Rosstat branch);

- by mail;

- via telecommunication channels (Internet).

Is it necessary to submit accounting reports electronically if the organization has more than 100 employees?

Not necessarily, you can do it on paper. Unlike tax reporting, accounting reports for 2020 can be submitted both electronically and in paper form. The number of employees in the organization does not matter. Reports must be submitted no later than March 31 of the current year. If the organization reported via the Internet, then there is no need to send paper reporting forms. How to submit financial statements electronically using the TKS, read the recommendations.

Responsibility

What happens if you don’t submit accounting reports to Rosstat?

If you fail to submit your financial statements to Rosstat on time or submit them incompletely, you will be charged an administrative fine. An official of an organization faces a fine of 300 to 500 rubles. (to the manager). The organization itself can be punished in the amount of 3,000 to 5,000 rubles.

Find out in the recommendation whether the organization will be fined if it does not submit an audit report to Rosstat.

What happens if you don’t submit your financial statements to the tax office on time?

For each accounting form submitted late, the organization faces a fine of 200 rubles. Inspectors calculate the amount of the fine based on the complete list of documents that a specific organization must submit. For example, for 2020 you need to submit the following forms: Balance Sheet, Statement of Income, Statement of Changes in Equity, Statement of Cash Flows, explanations in tabular and text form. If you do not submit your reports on time, the fine will be 1000 rubles. (200 × 5). And the chief accountant faces an administrative fine in the amount of 300 to 500 rubles. What documents need to be submitted as part of the financial statements, read the recommendations.

Balance

How to reflect issued interest-free loans on the balance sheet?

Interest-free loans are reflected in the balance sheet on line 1230 “Accounts receivable”. Such loans are not financial investments because they do not generate income for the organization. Also, the information on line 1230 can be detailed, for example, depending on who the debtor is - an organization or a citizen.

There is no need to print on financial statements

See the table for line-by-line filling of the balance.

Do I need to submit an updated balance sheet if accounting errors are found?

If the submitted financial statements have already been approved by the founders, then there is no need to submit updated ones. Errors that were found after the founders signed the minutes of the general meeting must be corrected in the current period. That is, in the reporting for 2016. In this case, you will not have to adjust previously submitted reports. If errors are found in reporting that has not yet been approved (and this is possible), then the updated balance must be submitted. Read the recommendations on how to correct errors in accounting and financial reporting.

How to reflect information on advances issued (received) in the Balance Sheet - including VAT or minus VAT?

Reflect information about advances in the Balance Sheet minus VAT. At the same time, remember two important rules.

Income statement

Who is required to prepare Notes to the Statement of Financial Results?

All organizations that conduct accounting must draw up Explanations. An exception is organizations that have the right to use simplified forms of accounting and reporting. For example, these are small businesses that are not subject to mandatory audit, as well as most non-profit organizations. But in some situations, even small organizations must draw up Explanations.

How to show advertising expenses in the Financial Results Report?

The answer to this question depends on the order in which you account for business expenses (which includes advertising expenses). If such costs are attributed entirely to the current period, then advertising costs should be reflected in line 2210 “Commercial expenses” of the Report. And if you distribute between the cost of individual types of products, then reflect them on line 2120 “Cost of sales”. The procedure for accounting for business expenses must be specified in the accounting policy. See the table for line-by-line completion of the financial results report.

On which line of the Financial Results Report should the simplified single tax or UTII be reflected?

The answer to the question depends on the form in which the organization prepares the report. If the organization uses a generally established form, then reflect the tax on line 2410 “Current income tax.” If it is a simplified form, then on the line “Taxes on profit (income)”. Read the recommendations on how to fill out the Financial Results Report.

Simplified reporting option

With a simplified version of reporting, the required forms are a balance sheet, a statement of financial results and a report on the intended use of funds, and explanations for them should be drawn up only if absolutely necessary.

Since the report on the intended use of funds (Form 6) is intended for use when there is a movement of funds for a very specific purpose, it is not always used.

Thus, Forms 3, 4 and 6 may not be prepared by persons reporting under the simplified form.

Answer

Organizations are required to prepare financial statements based on synthetic and analytical accounting data and submit them to the tax authority at their location (subclause 5, clause 1, article 23 of the Tax Code of the Russian Federation). The reporting must be signed by the head and chief accountant (accountant) of the organization (Clause 5, Article 13 of Federal Law No. 129-FZ). The balance sheet and the Profit and Loss Statement are part of the financial statements, as well as instructions on the procedure for preparation and presentation are approved by Order of the Ministry of Finance of Russia dated July 22, 2003 No. 67n “On Forms of Financial Statements”. At the same time, the unified form of these reports does not provide a place for printing (MP), therefore, this detail is optional and tax inspectors do not have the right to require the organization to put it down.

And if the organization does not have a seal, then the document form will need to be approved without a place for a seal. All questions regarding the presence or absence of a seal disappeared when the Ministry of Finance of the Russian Federation gave clarifications in letter No. BS-4-17/ Referring to the law that allows one to refuse to use a seal in the work of an organization and amending the orders of the Federal Tax Service, the tax authority is obliged to accept declarations regardless whether there is a stamp on them or not.

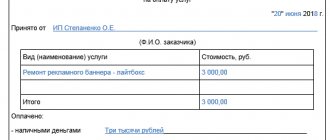

What is BSO?

BSO stands for strict reporting form. The basic rules for the use of forms and requirements for their execution are given in 2 regulatory legal acts:

- Law “On the use of cash register systems when making cash payments and (or) payments using electronic means of payment” dated May 25, 2003 No. 54-FZ;

- Regulations “On making cash payments and (or) settlements using payment cards without using cash registers”, approved by Decree of the Government of the Russian Federation dated May 6, 2008 No. 359.

BSOs are issued to customers for cash and non-cash payments instead of cash register receipts. However, the forms are allowed to be used only by legal entities and businessmen who provide services to individuals (Clause 2, Article 2 of Law No. 54-FZ).

To use BSO in calculations, you need to take into account 3 important aspects.

Firstly, only individuals are allowed to issue forms instead of cashier's checks. According to para. 4 clause 4 of the resolution of the plenum of the Supreme Arbitration Court of the Russian Federation dated July 31, 2003 No. 16, entrepreneurs are treated as individuals, so BSO can be issued to individual entrepreneurs. If the buyer is an accountable person of your counterparty, issuing a form instead of a check is risky: since you have a contractual relationship with the buyer, tax inspectors may regard the issuance of a BSO as an evasion of the use of cash registers.

Secondly, BSO is applied only when providing services to citizens. The main regulatory legal act that you should focus on is the OKUN classifier (OK 002-93), approved by Decree of the State Standard of the Russian Federation dated June 28, 1993 No. 163.

NOTE! From 01/01/2017 OKUN becomes irrelevant due to the entry into force of Rosstandart order No. 14-st dated 01/31/2014 (see also letter of the Federal Tax Service of Russia dated 11/26/2015 No. SD-4-3 / [email protected] ).

The list of services in OKUN is open. If your service is not directly named in it, but you provide it to the public (for example, you repair e-books), then you can issue BSO to customers. Judicial practice is developing in favor of taxpayers (decision of the Arbitration Court of the Moscow Region dated May 31, 2006 No. A41-K2-8056/06). If you want to be on the safe side, you can contact the Rosstandart branch in your city for clarification (letter from the Ministry of Finance of Russia dated October 21, 2013 No. 03-11-11/43794).

Thirdly, BSO can be used in calculations only if the document complies with legal requirements.

Stamping on tax reports: to put it on or not

Legislative framework when compiling reports It is recommended to study the following laws: Legislative act Contents Law No. 82-FZ dated 04/06/2015 “On amendments to certain legislative acts of the Russian Federation regarding the abolition of the mandatory seal of business companies” Letter of the Ministry of Finance No. 03-01-10/45390 dated 08/06/2015 “On affixing a seal when preparing primary accounting documents, as well as on tax returns, if the LLC does not have a seal” Letter of the Ministry of Finance No. BS-4-17/dated 08/05/2015 “On the presence of LLC and JSC seals in documents” Answers to common questions Question No. 1. Do I need a stamp on the power of attorney for the tax office? Firstly, it depends on whether a seal is provided for by the Charter of your organization. Even if available, you don’t have to install it.

Stamp on the 2-NDFL certificate

For example, an act of acceptance of work performed (form KS-2), a certificate of the cost of work performed and expenses (form KS-3), a general journal of work (form KS-6), an act of acceptance of a completed construction project (form KS-11) Instructions for filling out this category of documents, they require a stamp only for the general work log (form KS-6)* Instructions approved by Resolution of the State Statistics Committee of Russia dated November 11, 1999 No. 100 Instructions approved by Resolution of the State Statistics Committee of Russia dated October 30, 1997 No. 71a Documents on accounting for the work of construction machines and mechanisms Mandatory: in the report on the work of the tower crane (form ESM-1) and the work order report on the work of the construction machine (mechanism) (form ESM-4), as well as in the certificate for payments for work performed (services) (Form ESM-7) the stamp is placed by the customer* Section 1 of the instructions approved by the Decree of the State Statistics Committee of Russia dated November 28, 1997.

- home

- Question answer

- 09/16/2010 Question Do the tax authorities have the right to require stamping on the balance sheet and the Profit and Loss Statement? A. Makeeva, accountant, Kashira Answer Organizations are required to prepare financial statements based on synthetic and analytical accounting data and submit them to the tax authority at their location (subclause 5, clause 1, article 23 of the Tax Code of the Russian Federation). The reporting must be signed by the head and chief accountant (accountant) of the organization (clause 5 of Article 13 of Federal Law No. 129-FZ). The balance sheet and the Profit and Loss Statement are part of the financial statements, as well as instructions on the procedure for preparation and presentation are approved by order of the Ministry of Finance Russia dated July 22, 2003 No. 67n “On forms of financial statements.” At the same time, the unified form of these reports does not provide space for printing (M.

Is there a stamp on the balance sheet in 2018?

In addition, the accounting reporting forms do not provide for affixing a stamp on the accounting (financial) reporting Forms of the accounting (budget) reporting of state and municipal institutions Optional: no space is provided for printing on the accounting (budget) reporting forms Accounting (financial) reporting is considered prepared after signing its copy on paper by the head of the economic entity (Part 8 of Article 13 of the Law of December 6, 2011 No. 402-FZ). The instructions for submitting reports (both accounting and budget) also do not contain a requirement for a seal on the reporting forms - the signatures of the responsible persons are sufficient (clause 5 of the Instructions, approved by order of the Ministry of Finance of Russia dated March 25, 2011 No. 33n, clause 6 of the Instructions , approved by order of the Ministry of Finance of Russia dated December 28, 2010. Therefore, it is not necessary to put a stamp, in particular, in the list of goods accepted for commission (form KOMIS-1) and a certificate of sale of goods accepted for commission (form KOMIS-4) Documents for accounting of operations in public catering Optional: there is no space for printing in these documents. Therefore, it is not necessary to put a stamp, in particular, in the menu plan (form OP-2), invoice for goods release (form OP-4), purchasing act (form OP-5), order-invoice (form OP-20) Instructions approved by Decree of the State Statistics Committee of Russia dated December 25, 1998 No. 132 Documents for accounting for work in capital construction and repair and construction work Mandatory: On document forms that provide place for printing. Accounting document Availability of a seal Declarations for tax and accounting reporting Not provided for Other documents submitted to the tax office Not provided for Reports and other documents submitted to the Social Insurance Fund A seal is provided for when used by a company Negative impact on the environment A seal is provided for when used by a company Sales book, book of expenses and income A seal is required when used by the company Documents submitted for verification by non-tax authorities A seal is provided when used by the company Customs documents Almost all of them require a seal Also, a seal can not be placed on employment contracts, orders manager, as well as civil contracts, unless the contract specifies that the contract itself and all amendments to it are signed and sealed. The form of the primary document “Certificate of Acceptance of Completed Work” (Form N KS-2) is contained in the album of unified forms of primary accounting documentation approved by Resolution of the State Statistics Committee of Russia N 100 and indeed includes the field “Place for printing (MP)”, which, in in principle, implies the presence of such details as a seal. However, it should be noted that among the mandatory details that the form of the primary document used by the organization must contain in accordance with clause 2 of Art. 9 of Law No. 129-FZ, sealing is not indicated. From this we can conclude that the seal impression is an optional requisite of the act of acceptance of completed work. Optional: on documents on internal movement and accounting of goods and materials (forms M-8, M-11, M-15, M-17) and the act of acceptance of materials (form M-7), which is drawn up if there is a discrepancy between the actual data and the data specified in the accompanying documents Section 3 of the instructions approved by Resolution of the State Statistics Committee of Russia dated October 30, 1997 No. 71a Documents for accounting of fixed assets and intangible assets Mandatory: on all acceptance certificates (delivery) of fixed assets (forms OS-1, OS-1a, OS-1b, OS-3), act on acceptance and transfer of equipment for installation (form OS-15) and act on identified equipment defects (form OS-16)* Instructions approved by the resolution of the State Statistics Committee of Russia dated January 21, 2003.

SBiS technical support forum

From January 1 of the year, unified forms of primary documents ceased to be mandatory for use. Entrepreneurial organizations can document all their business transactions using independently developed forms of documents, which are approved by an order on accounting policies. Thus, a seal impression is not a mandatory document requisite. A stamp is needed only if it is expressly provided for by the legislation of the Russian Federation or the form of the document. The payment invoice must include the details used to transfer money from the customer to the supplier for goods or services. The seller issues an invoice and the buyer must pay it.