Hello, Vasily Zhdanov is here, in this article we will look at the formula for calculating EBITDA. The abbreviation EBITDA in English means: “earnings before interest, taxes, depreciation and amortization.” From this it is clear that it is composed of the first letters of the English term. If we literally translate the entire phrase into Russian, we get the following: “earnings before interest, taxes, depreciation and amortization.”

Abbreviations in the proposed block diagram: MA – tangible assets, NA – intangible assets.

The abbreviation EBITDA is most often used and encountered in practice. Its frequent use is completely justified: this English-language term has no other names, and using a long abbreviation is not very convenient.

Meanwhile, this analytical indicator has a very clear, commonly used Russian-language definition. It is commonly said that EBITDA is the amount of earnings before interest expenses, taxes, and accrued depreciation and amortization. That is, this is one of the indicators of the financial results of the enterprise.

In simpler terms, EBITDA is a specific amount of cash earned by an enterprise, from which it will subsequently be necessary to pay taxes, pay off debts, and make depreciation charges. This is the income received by the enterprise in the current period, which can be used to assess the profitability of its main activities, which is significant for potential investors. With the help of EBITDA, they find out how much the company is able to cover its own debts, as well as reinvest existing funds for the future.

General characteristics of the English-language EBITDA indicator

EBITDA is not a completely standard indicator for Russian accounting. accounting. In the domestic book. it does not appear on the balance sheet and for many remains “an unknown term in a foreign language.” What is noteworthy is that it is not even included in international reporting standards. But, despite all this, the “rare” English-language indicator has found quite noticeable application in Russian economic practice.

EBITDA is indeed a very ambiguous indicator, because along with a number of advantages it also has disadvantages. Yes, it affects depreciation and is used in the calculation of many economic coefficients. Yes, with its help you can get more detailed information about cash flow and financial performance. And all this is considered a plus for EBITDA.

Meanwhile, the indicator does not take into account many significant factors and produces a mostly distorted calculated value. So, for example, EBITDA does not take into account changes in its working capital. Therefore, if their value increases, then the estimate of cash flow including EBITDA will already be overestimated, i.e., not entirely “in tune”. For example, an enterprise can purchase as much equipment as it wants, but these expenses will not be reflected in EBITDA, which will lead to a distortion of the calculated result.

In general, the indicator is extremely dependent on accounting policies, and does not characterize such essential components of the enterprise’s activities as risks of non-repayment of accounts receivable, quality, and sources of income. Nevertheless, it is customary to use EBITDA as an interim indicator of the enterprise’s activity to assess its profit, without taking into account the influence of investments, debt obligations, and the applied tax regime.

Thus, the important benefit and purpose of EBITDA is as follows. With his participation, through comparison, it is possible to evaluate different enterprises, companies operating in the same industry, in different countries, with different accounting policies, and different credit levels. For example, one Russian company with another, similar, foreign one. In practice, all this is done quite simply. Thus, to compare EBITDA volumes when comparing different companies, the following are excluded:

- taxes;

- interest on loans;

- depreciation.

Thus, the difference in taxation, the actual debt load of companies, and discrepancies in their accounting policies are “omitted.” And only after this the necessary data comparisons are carried out. But there is one more “but” here. Such a comparison is actually not enough to complete the picture and therefore, in addition to EBITDA analysis, comparisons of other indicators are also carried out. At a minimum, the net profit values of two companies.

Important! It should be remembered that net profit is always less than EBITDA, which in calculations overestimates the efficiency of companies.

EBITDA calculation and profitability analysis

Let's start with a definition: the abbreviation EBITDA should be read as Earnings before Interest, Taxes, Depreciation and Amortization, which translated means earnings before interest, taxes and depreciation.

Historically, this indicator was used to analyze a company's ability to pay off its debts, as well as to assess the attractiveness of investment in an enterprise or the feasibility of its merger or division.

In addition, today EBITDA is extremely often used as a tool for assessing the performance of a company and as a way to compare two or more firms in the same industry with different capital structures and tax systems.

This is due to the fact that EBITDA can be considered a relatively “pure” profit indicator, taking into account only the results of the enterprise’s operation, without taking into account debt obligations, taxes and depreciation.

But these advantages also give rise to a “trap” for which EBITDA is often criticized - it is very difficult for an outsider, such as a potential investor, to assess without depreciation the need for an enterprise to invest in the expansion or improvement of fixed assets.

In addition, EBITDA can sometimes be used as a means of "inflating" a firm's profitability and increasing its attractiveness to investors.

It gave rise to several derived indicators, the main of which is profitability without taxes, depreciation and amortization (in English literature it is known as EBITDA margin). It must be calculated like this:

EBITDA margin = EBITDA / Sales revenue

The meaning of this indicator is to demonstrate the “net” percentage of profit from the sale of goods and services without taking into account taxes, interest on loans and depreciation costs of fixed assets.

The minimum sufficient profitability value is considered to be 12%, but this figure may vary depending on the general situation in the economy and the characteristics of a particular industry.

The minimum sufficient profitability value is considered to be 12%, but this figure may vary depending on the general situation in the economy and the characteristics of a particular industry.

Simplified EBITDA calculation according to International Financial Reporting Standards (IFRS)

This method is the simplest and most commonly used, and is also considered the most understandable and optimal. The formula for calculation according to IFRS is as follows:

For calculation purposes, it is necessary to take the specified data from the accounting records. balance. That is, find the line that corresponds to profit before taxes and take the required value from it. Next, find the line that corresponds to the interest paid with the required value, etc.

It should be noted once again that the EBITDA indicator itself in accounting. There is no balance sheet, but for its calculation you will need exactly “balance sheet” data. In general, this information concerns:

- Net profit.

- Extraordinary expenses and incomes.

- Reimbursable amount of income tax and its costs.

- Deductions for depreciation.

- Interest paid (as well as received).

- Revaluation of assets in accounting. balance.

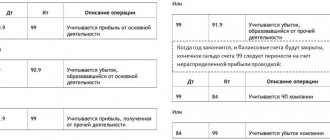

New indicators have appeared in this list, for which brief background information is provided in the table.

| Emergency or emergency | Extraordinary spending | Extraordinary Income | Revaluation of assets in accounting. balance sheet |

| The part of balance sheet profit that remains after payment of generally obligatory budget payments (tax amounts, fees and similar deductions). | Expenses incurred due to unforeseen circumstances (for example, expenses associated with liquidation of the consequences of an emergency situation) | Insurance compensation for damage in the event of an insured event (in case of a natural disaster, accident, etc.), as well as the cost of the MC, which remained after the write-off of unusable assets, etc. | The amount of increase in the value of assets that appeared as a result of the revaluation |

Abbreviations used in the table: MTs - material assets, PE - net profit, BH - net income, EC - emergency circumstances.

Typically, almost all indicators from the above list, except for the revaluation of assets, are involved in the calculation of EBIT. And EBIT, in turn, can be used in calculating EBITDA.

Formula for calculating EBITDA on balance sheet

There are two methods for determining this indicator:

- Based on data that complies with the requirements of IFRS (International Financial Reporting System) and US GAAP (translated as Generally Accepted Accounting Principles of the United States).

- For balance sheet items that comply with Russian Accounting Standards (RAS for short).

Both methods, understandably, have different formulas, and each of them has its own advantages and disadvantages. Let's take a closer look at them.

When calculating EBITDA according to the requirements of US GAAP and IFRS, the calculation formula will look like this:

EBITDA= PE + NP – GNP + CR – PE + UP – PP + JSC – PA

Let's now decipher the set of these abbreviations:

- PE is net profit, and NP and GNP are taxes imposed on profits and tax refunds, respectively.

- CR are extraordinary expenses that are associated with the non-core activities of the company (such income is also called non-operating income).

- Accordingly, BH is extraordinary income.

- UP is the interest paid, and PP is the interest received, if your company not only took out loans, but also issued them itself.

- And finally, AO - depreciation charges, transferring in shares the cost of production equipment to the cost of manufactured goods.

- PA – revaluation of assets.

The advantage of calculating EBTIDA according to foreign accounting standards is the accuracy of the resulting indicator. The downside is that you will have to calculate new data that differs from the balance sheet items that comply with RAS. But this problem can be solved by calculating EBITDA using the second method.

To do this, you will need a “Profit and Loss Statement”, also better known as Form No. 2 and a balance sheet, or rather appendices to it, from which we need data on the depreciation of your company’s fixed assets, both tangible and intangible. The formula will eventually look like this:

EBITDA = B – C + N + P + JSC

You have already seen one of the abbreviations given in the formula above. Yes, AO here also means depreciation.

As for the remaining parts of the formula, B is revenue from sales of products, it is located in line 2110 in the report, C is the cost of production, indicated in line 2120, N is tax deductions (in form No. 2 these are lines 2410, 2421 and 2450) . And finally, P – interest on loans and borrowings, line 2330.

As expected, the advantages and disadvantages of this method of determining EBITDA are opposite to those of the first method. Using indicators that comply with the accounting standards of the Russian Federation, you significantly simplify the process of calculating profit. But the resulting value will have some error.

If desired, instead of revenue and cost, you can use profit from sales, which can be found in the “Profit and Loss Statement” on line 2200.

EBITDA and EBIT: relationship and calculation of analytical indicators

So, EBITDA is used by economists in conjunction with other analytical indicators and, in particular, with EBIT. Despite the fact that their abbreviation is very similar, these are different indicators that have different purposes.

EBIT is a company's earnings before interest taxes, which also includes non-operating income. This is how EBIT differs from another similar indicator – operating profit (OP). If there are no income and expenses that are not related to the main activities of the enterprise, then they say that OP coincides with EBIT. The EBIT value is calculated using the formula:

Having calculated the EBIT value in this way, you can calculate EBITDA. The calculation formula will be as follows:

Both presented formulas are also well-known and are quite often found in calculations. In practice, other variations of formulas may be used. For example, with the participation of revenue and operating expenses (V - OT). All calculation options are distinguished by the simplicity and availability of data used in the calculation.

EBITDA in Russia

Some domestic companies actively use EBITDA to evaluate their financial performance. This is especially true for organizations whose shares are popular on foreign stock exchanges, or for those that have foreign investors (creditors), as well as for those who are just about to become a participant in stock markets.

Examples of the largest domestic organizations that regularly calculate their EBITDA: Gazprom, Surgutneftegaz, FGC UES, Norilsk Nickel, Sberbank, Magnit, X5 RetailGroup, VimpelCom, MTS , Gazpromneft, Rosneft, Tatneft, etc. These enterprises are guided by international standards when preparing financial statements and calculate EBITDA according to IFRS.

Owners of small businesses usually build their business without taking into account EBITDA. And even if the owner of a small or medium-sized business knows this concept, the problem arises of calculating the indicator taking into account financial documents drawn up according to Russian standards.

Reporting according to international rules in a business of this scale is quite rare. Unfortunately, few people think that maintaining financial statements in accordance with IFRS opens up additional opportunities in terms of developing international cooperation, participating in seminars, accessing foreign credit funds, as well as obtaining a more objective assessment of one’s own business.

Today, the use of EBITDA is most common among large enterprises in the raw materials sector of the domestic economy. However, the massive transition of all Russian companies to IFRS will significantly increase the influx of foreign investment into the domestic economy, improve its condition and qualitatively improve the standard of living of the population.

Formula for calculating operating profit (EBIT)

EBIT is calculated based on international accounting standards. Based on them, we can conclude that EBIT is the result of subtracting direct costs from the company's revenue. In fact, this is the company's gross profit for the period being calculated.

In Russia, this indicator is calculated taking into account domestic practice and, accordingly, the accounting standards of the Russian Federation. Categories taken into account in the calculation include interest received, tax refunds, and unexpected income and expenses of the company.

domestic EBIT indicator

- calculate the company's net profit;

- calculate the tax burden on the company's total profit, from which the tax refund has been deducted;

- determine the amount of net interest by subtracting the amount of funds received from the amount of interest paid;

- subtract unexpected income and expenses from the resulting amount.

In fact, the formula for calculating EBIT at domestic enterprises looks like this:

EBIT = Net Income + Income Tax Expense – Tax Reimbursement + Unexpected Expenses – Unexpected Earnings + Interest Paid – Interest Earned.

In general, not in detail, the formula, based on the data from the “Profit and Loss Statement”, looks like this:

EBIT = column 2300 + column 2330, i.e. “Profit before tax” + “Interest”.

Any EBIT value with a positive sign is considered to be a positive expression of this indicator.

At the moment EBITDA ; it is closely related to EBIT , differing from it in the sum of depreciation and intangible assets. With the help of EBIT, it becomes possible to calculate the EBITDA indicator, which provides the opportunity to evaluate the profit of an enterprise without relying on the volume of investments, uncalculated liabilities, and taxes.

What is Ebitda and why is it calculated?

Ebitda is an abbreviation that stands for Earnings Before Interest ,

Taxes , Depreciation and Amortization

and literally means an indicator of profit before settlement of company loans and interest on them, repayment of tax liabilities and excluding depreciation charges.

Due to the fact that the Ebitda indicator is an indicator cleared of the influence of many factors, a comparison of its value allows you to compare companies that operate under different tax regimes, have different levels of credit burden and investment cycle. This indicator allows you to compare even unprofitable enterprises.

Formulas for calculating EBITDA

To calculate EBITDA, you will need only 2 documents: Form 2 and 5 of the balance sheet (or only one Form 1 of the balance sheet).

EBITDA is calculated using financial statements that comply with IFRS (International Financial Reporting Standards) or the American GAAP standard.

EBITDA formula according to IFRS

EBITDA = [Net profit] + [Income tax expense] - [Tax deductions] + [Non-operating income and expenses] + [Interest payments] + [Depreciation] - [Revaluation of assets]

EBITDA formula according to RAS

EBITDA = [Revenue] – [Cost] + [Tax deductions] + [Interest payments] + [Depreciation] or otherwise: EBITDA = [Profit before tax] (2300) + [Interest paid] (2330) – [Interest received ] (2320) + [Depreciation]

When calculating the EBITDA indicator, the following income items are not taken into account:

- Exchange rate difference

- Extraordinary income and expenses

- Losses from impairment of various asset groups

- Accrual of reserves for various needs

- Remuneration based on shares and other securities

Advantages and disadvantages of EBITDA

EBIT is an intermediate parameter, EBITDA is an adjusted parameter that allows you to evaluate the company’s profit regardless of the influence of:

- investment amounts (depreciation added);

- debt burden (interest on obligations added);

- tax regime (adjustment for income tax).

The indicator allows you to compare companies with different internal policies regarding the period of depreciation and revaluation of assets. Only the type of activity and the amount of operating profit are important. But this is also a disadvantage of EBITDA. First, it allows you to compare only companies within the same industry. Secondly, it does not give investors an idea of how much additional investment needs to be made, that is, pour money into the company. This is often used by companies with a high depreciation load (large production, mining industries), where adding depreciation significantly improves profit data.

I also recommend reading:

Eternal portfolio from Tinkoff Capital: investor review

Tinkoff offers investors an Eternal Portfolio, my opinion on it

EBITDA and supporting indicators are also often criticized for their bias and unclear interpretation. For example, what does a 1.2 interest coverage ratio mean? Theoretically, the company has a good margin of safety for interest-bearing debts. In practice, if a company had large investments in fixed assets in the current period, then the real profit may not be enough to pay interest. That is, the value 1.2 can be misleading.

The disadvantages of EBITDA can be characterized as follows - this indicator does not make it possible to analyze a number of parameters to assess the solvency of the company:

- sustainability and stability of financial flows;

- level of adequacy of own working capital;

- level of asset liquidity (the company’s ability to withstand a crisis);

- the company's dependence on lending;

- the influence of seasonality and other external factors on the company’s profit.

The following example well illustrates the need for comprehensive analysis:

All 3 companies have the same EBITDA value, although company 2 received a loss at the end of the year due to debt and tax burden. The EBIT parameter is the same for companies 1 and 2 due to the same method of calculating depreciation.

What is operating profit (EBIT)

EBIT is the amount of profit that a company generates before deducting tax liabilities. EBIT is the midpoint between gross and net profit. The absence of a tax burden in the indicator makes it possible not to take into account the overall capital structure of the company and allows you to compare two different enterprises based on one indicator.

note

EBIT is often confused with operating profit, which, unlike EBIT, does not take other operations into account.

EBIT parameter is expressed as the basis for the evaluative perception of the business, the cost offered by the buyer for a certain mechanism of economic activity, multiplied EBIT with the necessary multiplier.

Understanding the importance and weight of this indicator, most Western enterprises take its data into account when assessing a particular case. In domestic practice, the EBIT indicator is rare. It is often used by large enterprises or enterprises that sell goods or provide services to foreign counterparties. However, for Russian reporting, EBIT does not have a decisive meaning, and the legislator does not oblige the accountant to reflect the calculation results in the submitted reports.

Formation of operating profit

If the reliability of the calculated operating profit , then it is paramount for the company’s management to understand the main factors influencing its formation.

In addition, profitability analysis is an effective tool for analyzing the activities of an enterprise. Read more about this in the material “How to conduct a cost-benefit analysis?”

operating profit growth sooner or later arises in every developing company seeking to attract large investment resources.

In such conditions, the organization’s management can use 3 main levers of influence on the indicator:

- increase sales revenue (pricing policy, expansion of assortment);

- optimize variable costs (new production technologies, logistics system, etc.);

- reduce overhead costs.

It is important to remember that financial and investment flows do not participate in the formation of operating profit . Therefore, it makes no sense to issue loans at interest or use income from participation in other organizations in order to increase the value of the indicator.