Retained earnings: asset or liability?

Retained earnings (uncovered loss) on the balance sheet is, of course, a liability, since it represents a share of the owners’ capital - profit generated and not yet directed to various needs. Being an internal source of finance, the company's profit in terms of economic content relates to a free reserve, which is distributed at the discretion of the founders and shareholders. This is what retained earnings (RE) means. Traditionally it is directed to:

- Investing in production development;

- Acquisition of assets;

- Payment of dividends;

- Creation (replenishment) of reserves.

The company can dispose of this liability only after a decision on the allocation of funds is made at a general meeting of owners, recorded in the minutes. Retained earnings are reflected in the balance sheet in line 1370 of the “Capital” section. The uncovered loss is also recorded there (if costs are higher than income), enclosing it in parentheses, and the overall result for the section is reduced by the amount of the loss.

So, NP is the share of profit remaining at the disposal of the company after making all necessary payments. This concept is very close to the definition of net profit (NP). It is such if the company does not have deferred tax liabilities and has not accrued dividends during the year.

The difference between them is that NP is the combined result of work for the reporting year and the period of operation of the company, and PE is only for the reporting period. Therefore, an accountant and an economist interpret them in different ways. In accounting, NP is the result of work recorded in the reporting on account 84. However, profit at the time of drawing up the report has not yet been distributed, since the decision on its direction is made by the owners in the period from March 1 to June 30 of the next year. As a result, the economist considers and analyzes the profit for the past year after the reporting date, that is, when the accountant has carried out all the operations corresponding to the decision made.

Features of account 84

The peculiarities of conducting operations on account 84 consist of several points:

- Correspondence on account 99 is reflected in the general ledger in December of the current financial year. This is the last posting, all accounts are closed.

- Correspondence with other accounts is reflected on the date of the decision on the distribution of profits and methods of covering losses. This can happen in the new financial year, it all depends on the company’s statutory documents and its accounting policies.

- Transactions involving the authorized capital of the company are reflected after state registration of the relevant changes.

How is retained earnings calculated on the balance sheet?

Retained earnings increase the liabilities of the balance sheet, and, consequently, the equity capital of the enterprise. Let's look at how to calculate retained earnings (RP) using an example:

Stroika LLC operated in 2020 with a profit of 1 million rubles, income tax (PIT) amounted to 200 thousand rubles. After paying the income tax, the profit amounted to 800 thousand rubles. It is this amount, as retained earnings, that is reflected in line 1370 of the balance sheet for 2017. If at the beginning of the year the NP value already appeared in the balance sheet, then at the end of the year it will be increased by 800 thousand rubles.

The indicator on page 1370 of the balance sheet will correspond to the value on page 2400 of report No. 2 “On financial results” if the company did not have an NP at the beginning of the year, and subsequently did not pay interim (for example, quarterly) dividends.

Balance sheet entries made on account 84

The first question that may arise is: is retained earnings on the balance sheet an asset or a liability? As noted above, this indicator is reflected in the 84th liability account of the balance sheet.

The postings made at the end of the relevant periods are shown below.

In accordance with these transactions, correspondent accounts are credited and debited, as a result of which the balance sheet value of the enterprise's retained earnings is calculated.

It is obvious that as a result of the above entries, both profit and loss from the activities of the enterprise for the reporting period are taken into account; accordingly, the numerical value of account 84 can either increase or decrease.

What is included in retained earnings on the balance sheet: calculation using the formula

So, summarizing the accounting data, the accountant calculates the amount of retained earnings in the balance sheet (line 1370), which the owners of the company have the right to distribute. Taking into account the previous values of this indicator, already appearing in the balance sheet, it can be calculated using the formula:

- NPk = NPn + PP – D, where: NPn and NPk – NP at the beginning and end of the reporting period;

- PE – net profit, ;

- D – dividends due to owners, paid from NP of previous periods in the reporting year.

Why do you need an account?

Account 84 in accounting is an account that is used:

- To reflect operations on the formation and expenditure of retained earnings (formation and compensation of uncovered losses) of an economic entity. Such profit (loss) is determined at the end of the year based on the ratio of all income received and expenses.

Subsequently, profits can be used for dividends, transfers to reserve capital, increasing the authorized capital and capital investments. The loss can be compensated by reserves, additional capital, and additional contributions from owners.

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

- Reflections of a decrease in the value of fixed assets due to a markdown (below the level of the initial assessment at the time of registration of the fixed assets).

A writedown of fixed assets below the level of the original book value can be immediately taken into account as a loss, even if there is a lot of time before the end of the year.

- Reflections of the reduction of the authorized capital to the level of net assets (in accordance with paragraph 4 of Article 30 of the Law “On LLC” dated 02/08/1998 No. 14-FZ).

The account in question is two-sided. The profit of the company is reflected in the CT account, while the losses are reflected in the Dt account. Internal correspondence between subaccounts of register 84 for various purposes is also possible.

Conventionally, operations in register 84 can be divided into 2 types:

- those that generate profit (loss);

- those that reflect the expenditure of profits (covering losses).

Let's look at examples of postings for them.

Let's start with transactions that show the formation of profit (or loss).

Uncovered loss: definition and reasons for its occurrence

If there is a loss for the current year, the calculation formula will look like this:

- NPk = NPn – U – D, where U is the loss of the current year.

The NPK indicator may be negative if the resulting current loss exceeds the NP value at the beginning of the year. It is in this case that the loss becomes uncovered. Those. uncovered means a loss that occurs when the enterprise receives an actual loss and is unable to cover it with reserve funds (including when funding reserves were not created). The main causes of PE are considered to be:

- Excess of company costs over income due to various reasons;

- Radical changes in accounting policies that significantly affected the financial position of the company;

- Errors discovered in the reporting period from previous years, etc.

If there is a loss, the company carefully analyzes the causes of the phenomenon, since it may be a consequence of a drop in the competitiveness of the products being manufactured, which will require a change in the sales strategy or re-profiling of production, or may be a temporary phenomenon with the infusion of impressive, but slowly recouping investments into production.

Let's look at it with an example.

Let’s say that income from the company’s core activities amounted to 500 thousand rubles, non-operating income – 60 thousand rubles. Production costs – 490 thousand rubles, other non-taxable costs – 85 thousand rubles. NNP – 14 thousand rubles. The company did not create a reserve fund.

After calculating the NU, the amount of loss of 29 thousand rubles will appear in the balance sheet. ((500 + 60) – 490 – 85 – 14).

If a positive amount of NP appears on page 1370 at the beginning of the year, then the resulting loss will reduce it. If there is an existing negative result, the amount of the loss will increase the NL.

Reduction of authorized capital

The decision to reduce the authorized capital is made at the general meeting of shareholders, which is its exclusive competence (subclause 7, clause 1, clause 2, article 48 of the Law on Joint Stock Companies).

The issue of reducing the authorized capital is within the competence of the general meeting of participants of the limited liability company (subclause 2, clause 2, article 33 of the LLC Law).

In a joint stock company, the reduction of the authorized capital is carried out by reducing the par value of the shares (without paying cash to shareholders or transferring issue-grade securities to them) (Clause 1, Article 29 of the Law on Joint Stock Companies). The total number of outstanding shares does not change.

In an LLC, the reduction of the authorized capital is carried out by reducing the nominal value of the shares of all participants in the company in the authorized capital of the company. At the same time, the size of the shares of all participants in the company does not change (Clause 1, Article 20 of the LLC Law).

The decision to reduce the authorized capital to the net asset value must be made no later than six months after the end of the relevant financial year. After making such a decision, the company must, within three working days, report this to the body that carries out state registration of legal entities - the tax inspectorate (Article 30 of the Law on Joint Stock Companies, paragraph 3 of Article 20 of the Law on LLCs).

In addition, the company is obliged to publish a notice of the decision twice (once a month) in the media, where data on state registration of legal entities is published (the dates of publication of these messages are indicated in the application for state registration of changes made to the constituent documents).

Then you need to submit a package of documents to the tax office. It includes, in particular:

- application for state registration of changes made to the constituent documents (form R13001, approved by Order of the Federal Tax Service of Russia dated January 25, 2012 No. ММВ-7-6/ [email protected] );

- decision of the meeting of owners (participants, shareholders) to reduce the authorized capital;

- changes made to the constituent documents, or constituent documents in a new edition in two copies;

- document confirming payment of the state duty (according to subparagraph 3, paragraph 1, article 333.33 of the Tax Code of the Russian Federation, its amount is 800 rubles).

The registration authority is obliged to carry out state registration of changes in the authorized capital of the company within five working days from the date of submission of documents.

The date of reduction of the authorized capital will be considered the day of making changes to the Unified State Register of Legal Entities. In the accounting registers, the decrease in the authorized capital should be reflected by posting on this date:

DEBIT 80 “Authorized capital” CREDIT 84 “Retained earnings from previous years”

As a result, society acquires a more stable financial position.

Let us also dwell on the fact that when registering a decrease in the authorized capital, the company incurs certain expenses. This:

- payment of state duty;

- payment for publications in the media;

- notarization of documents if necessary, etc.

All these expenses in accounting are classified as other expenses and are accrued by postings:

DEBIT 91-2 “Other expenses” CREDIT 68 subaccount “State duty”

– a state fee has been charged for registering a decrease in the authorized capital;

DEBIT 91-2 “Other expenses” CREDIT 76 “Settlements with various debtors and creditors”

– costs associated with registering a decrease in the authorized capital are reflected.

EXAMPLE.

REDUCTION OF AUTHORIZED CAPITAL TO THE VALUE OF NET ASSETS At the end of the reporting year, the uncovered loss of Passive LLC amounted to 200,000 rubles.

The value of net assets as of December 31 of the reporting year amounted to 70,000 rubles. The authorized capital of the company is 300,000 rubles. An extraordinary meeting of the company's participants decided to reduce the authorized capital by 230,000 rubles. (from 300,000 rubles to a net asset value of 70,000 rubles) by reducing the nominal value of the shares of all participants. Registration of changes in the charter was made on May 15 of the following year. On this date, the accountant made the following entry: DEBIT 80 “Authorized capital” CREDIT 84 “Retained earnings of previous years”

- 230,000 rubles. – the authorized capital was reduced. As a result, the resulting loss was completely covered, and an indicator of retained earnings in the amount of 30,000 rubles was formed in the accounting. (RUB 230,000 – RUB 200,000).

Account 84 - accounting entries and examples

Using standard postings and illustrative examples, we will help you understand the specifics of using account 84 and the features of recording transactions with retained earnings.

There are many postings to account 84 retained earnings, it all depends on what transaction is reflected. Read about this in Table 1.

Table 1. How account 84 is formed in accounting

| Debit 84 | Credit 84 |

| Transfer of net profit for the development of the company | Formation of net profit |

| Direction of net profit to the reserve | Coverage of past losses |

| Transfer of net profit to the authorized capital | Correction of a past significant error |

| Transfer of net profit to owners | |

| Formation of the current loss | |

| Coverage of past losses | |

| Correction of a past significant error |

Let's consider these operations in detail - using numerical examples with postings.

Operation 1. Formation of net profit.

If the accountant correctly closed the periods during the year, then on December 31, account 99 “Profits and losses” shows the net financial result of the year. It is added to the results of previous years - in accordance with Table 2.

Table 2. How account 84 is closed at the end of the year

| Dt | CT | Explanation |

| 99 | 84 | The annual net profit is written off |

| 84 | 99 | The annual net loss is reflected |

Operation 2. Transfer of net profit to the owners.

The distribution of profits to the owners of the company is actually the payment of dividends. For the transferred amounts, the company acts as a tax agent for personal income tax (if it pays dividends to individual participants) or for income tax (if it pays and transfers net profit to a legal entity). Read about this in Table 3.

Moreover, a company must withhold income tax on dividends regardless of what tax regime it applies - the main one or a special one, for example, the simplified tax system, UTII or Unified Agricultural Tax.

Table 3. Account 84: retained earnings

| Dt | CT | Explanation |

| 84 | 75-2 | Dividends are accrued to a legal entity or individual who does not work for the company |

| 84 | 70 | Dividends are accrued to an individual - an employee of the company |

| 75-2 | 68 subaccount “Calculations for income tax” | “Profitable” tax on payments to a legal entity |

| 75-2 (70) | 68 subaccount “Personal Income Tax Payments” | Personal income tax is withheld from dividends to an individual - an employee of the company or an individual who does not work for the company |

| 75-2 | 51 (50) | Dividends are paid to a legal entity or individual who does not work in the company in cash after tax is withheld |

| 70 | 51 (50) | Dividends are paid to an individual who is an employee of a company in cash after tax is withheld. |

Operation 3. Correction of a significant past error.

If in the reporting year, but after the approval of last year’s statements, the accountant discovered a significant error, then it must be corrected using account 84 retained earnings.

Table 4. Which accounts does account 84 correspond to?

| Dt | CT | Explanation |

| 76 (62, 02, …) | 84 | Correction of a significant error - unrecorded income or excessive expenses were found |

| 84 | 76 (60, 02, …) | Correction of a significant error - an unrecorded expense or excess income was found |

The exact correspondence of invoices depends on what kind of error is detected.

Typical bookkeeping

The following accounting entries can be used for transactions (see Table 1).

| Operation | Dt | CT |

| To eliminate unprofitability through finance reserve capital | 82 | 84 |

| To pay off unprofitability from the funds remaining from retained earnings for previous years | 84 | 84 |

| When reimbursed from the authorized capital | 80 | 84 |

| Elimination through owner contributions | 75 | 84 |

| Increasing NP through additional capital | 83 | 84 |

Everything on the topic in the video:

What is reflected in the 84th loan account?

The loan takes into account an increase in net profit or a decrease in a previous loss.

The credit balance of account 84 is net profit, that is, a positive financial result that remains after the transfer of tax and other obligatory payments and has not yet been used - not aimed at the development of the company, not put aside in reserve and not divided among its owners.

The debit takes into account the distribution of net profit or an increase in loss. The debit balance of account 84 is an uncovered loss, that is, a negative financial result of the period for which the statements were compiled and previous periods.

Retained earnings (uncovered loss). Retained earnings (uncovered loss)

- The balance of retained earnings of the reporting year is used to cover losses of previous years;

- The balance of unused profits from previous years is used to cover the losses of the reporting year;

- The balance of unused profit is directed, according to the company's charter, to the formation of target reserves that are not related to reserves, which are accounted for in account 82;

- The same posting (according to the subaccounts, it is actually the opposite) reflects the use of the target reserve. It is carried out on the basis of an accounting certificate with the corresponding calculations attached.

Scheme of transactions reflecting the operations of formation and expenditure of the target reserve,

84.1 – unused profit;

84.2 – reserve for major repairs.

- Dt 84.1 Kt 84.2 – a reserve has been created for major repairs of the building;

- Dt 84.2 Kt 02, 10, 60, 68, 69, 70, 76, etc. - the actual costs incurred for major repairs are covered by the target reserve;

- Dt 84.2 Kt 84.1 – the balance of the unused reserve is written off back to the retained earnings account.

In this case, there is no need to account for capital expenses on account 08. However, upon completion of major work and signing of the relevant act, it would be reasonable to re-evaluate the building. For details on how the revaluation of fixed assets is reflected, see the comments to the postings: Dt 01 Kt 83, Dt 01 Kt 84.

Account 84 “Retained earnings (uncovered loss)” is intended to summarize information about the presence and movement of amounts of retained earnings or uncovered losses of the organization.

The amount of net profit of the reporting year is written off with the final turnover of December to the credit of account 84 “Retained earnings (uncovered loss)” in correspondence with account 99 “Profits and losses”. The amount of the net loss of the reporting year is written off with the final turnover of December to the debit of account 84 “Retained earnings (uncovered loss)” in correspondence with account 99 “Profits and losses”.

The direction of part of the profit of the reporting year to pay income to the founders (participants) of the organization based on the results of approval of the annual financial statements is reflected in the debit of account 84 “Retained earnings (uncovered loss)” and the credit of accounts 75 “Settlements with founders” and 70 “Settlements with personnel for wages” " A similar entry is made when paying interim income.

The write-off of the loss of the reporting year from the balance sheet is reflected in the credit of account 84 “Retained earnings (uncovered loss)” in correspondence with accounts 80 “Authorized capital” - when the amount of the authorized capital is brought to the value of the organization’s net assets;

82 “Reserve capital” - when funds from reserve capital are used to pay off losses; 75 “Settlements with founders” - when repaying the loss of a simple partnership at the expense of targeted contributions of its participants, etc.

Analytical accounting for account 84 “Retained earnings (uncovered loss)” is organized in such a way as to ensure the generation of information on the areas of use of funds. At the same time, in analytical accounting, funds of retained earnings used as financial support for the production development of the organization and other similar activities for the acquisition (creation) of new property and not yet used can be divided.

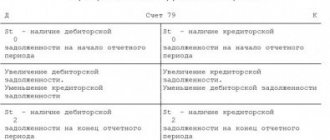

By debit

- 51 “Current accounts”

- 52 “Currency accounts”

- 55 “Special bank accounts”

- 70 “Settlements with personnel for wages”

- 75 “Settlements with founders”

- 79 “Intra-economic settlements”

- 80 “Authorized capital”

- 82 “Reserve capital”

- 83 “Additional capital”

- 84 “Retained earnings (uncovered loss)”

- 99 "Profits and losses"

By loan

- 73 “Settlements with personnel for other operations”

- 75 “Settlements with founders”

- 79 “Intra-economic settlements”

- 80 “Authorized capital”

- 82 “Reserve capital”

- 83 “Additional capital”

- 84 “Retained earnings (uncovered loss)”

- 99 "Profits and losses"

What can influence the indicator

The NU indicator, like the NP amount, may change over the year. The magnitude of the indicators depends on the management decisions made.

Table 2. Actions that may cause an increase or decrease in losses.

| Downgrade of the company's indicator | Increase in company indicator |

| If the indicators of net assets and authorized capital are equalized by reducing the amount of the latter | If the NP, by agreement of the management, was transferred to the reserve fund |

| If, based on the results of the revaluation of retired non-current assets in the current year, which increased additional capital, a decision was made to redistribute it to losses | When profits are used to increase the amount of authorized capital |

| By the amount of net profit for the reporting period | When calculating and paying dividends |

| If there are dividends that were declared but not claimed before the end of the limitation period | If there is a net loss in the reporting period |

Reflection in accounting on video:

How is it formed

Unprofitable activities of a company may occur if:

- expenses for non-operating and financial and economic operations will be more than income;

- adjustments were made to the company's accounting policies;

- During the audit, inaccuracies were discovered in the accounting system for previous reporting periods.

Factors contributing to losses:

at the end of the reporting period, negative indicators of the financial activity of the business entity were identified;- adjustments to the company’s accounting policies had a negative impact on the financial results of operations;

- Previous accounting errors may lead to negative financial results.

In the event of a disaster, it is necessary to conduct a thorough analysis of the economic and financial processes at the enterprise. A negative performance result may result from a deterioration in the competitiveness of the products produced and services provided. Management will need to make a decision on adjusting the business strategy or re-equipping production. Indicators of unprofitable activities may arise in connection with the implementation of long-term investment projects with a long payback period.