In the process of financial and economic activity, enterprises strive to make financial investments, using temporarily free funds for this. Such actions are taken in order to prevent inefficient use of available resources and maximize company profits.

Within the framework of this topic, we will talk about the concept and types of securities, about the work of position 59, consider the correspondence of accounts, standard accounting entries, and also focus on one of the practical examples.

Definition and classification of documents giving the right to a share in capital

By this category, experts mean monetary documents that confirm the right to own capital or indicate the nature of the relationship between the owner of the document and its issuer.

The functions of such monetary documents as an object of market relations are as follows:

- mobilization of savings of individuals and free resources of enterprises to cover expenses;

- regulation of money circulation;

- acting as a source of investment designed to create new companies or develop existing ones;

- fulfilling the role of a credit settlement instrument;

- redistribution of funds between industries and sectors of the economy;

- granting the right to capital;

- transfer of rights to manage the company;

- acting as a source of income.

In world practice, all existing financial instruments are divided into basic and derivative financial instruments or derivatives. In the first case, we are talking about documents based on the property right to a certain asset.

If we are talking about derivatives, then in this case we are talking about a non-documentary form of right to property that appears due to a change in the value of the financial instrument that underlies it.

If we take the form of issue as a basis, then we can distinguish issue-grade securities, for example, shares, and non-issue securities, for example, checks and bills.

If we classify documents according to the order of ownership, then we should distinguish between registered, warrant and bearer papers.

In practice, there are many other criteria by which designated monetary settlement documents can be classified.

Deposits according to the agreement

When a deposit is provided, account 58 in accounting is debited. In the recording he corresponds with the account. 51 and other articles reflecting the movement of allocated property. Accordingly, as in the previous case, upon termination of the contract, a reverse entry is made. Thus, what account 58 will be in accounting - active or passive - depends on the operation being performed.

The meaning of position 58 in accounting

The designated account is designed to provide detailed accounting of the company's cash investments.

Analytics for this account is carried out for separate sub-accounts, including:

- 1 – accounting for investments in shares and shares;

- 2 – investing in debt instruments.

Investments of a company or organization are reflected in the debit part 58 of the account and the credit part of those positions where the values that are subject to transfer on account of such investments are recorded. Thus, the company’s purchase of securities of third-party companies is recorded in the debit part of position 58 and the credit part of position 51 or 52.

If an amount is written off that exceeds the purchase price of debt obligations over their nominal price, then the accounting department reflects these funds as a debit of 76 and a credit of 58 positions.

If the company decides to sell existing securities or pay off their value, then these funds are recorded in debit 91 and credit 58 positions.

Examples of postings to account 58

When reflecting investment entries on account 58, it is necessary to take into account all production factors and conditions of the organization’s industry, as well as the cost of securities in fact and at par.

You can carry out operations when purchasing shares as follows:

- Dt 58-1 Kt 76 (purchase of c/w);

- Dt 91-2 Kt 76 (accounting for the amount of the commission fee in other costs);

- Dt 76 Kt 51 (accounting for the value of shares, including intermediary commission).

When revaluing securities, the following action must be taken: Dt 51-1 Kt 91-1 (bringing the value of shares in accordance with their market value).

The sale of securities is formalized as follows:

- Dt 58-1 Kt 76 (share value in rubles in accordance with the contract);

- Dt 91 Kt 58-1 (writing off the cost of c/w on the balance sheet);

- Dt 62 Kt 91 (negotiable value of shares);

- Dt 91 Kt 99 (profit from sales is reflected).

Maintaining subaccount 58-4

Subaccount 58-4 is intended for analyzing contributions to the partnership. For example, a cash investment is reflected by an entry in the debit of the 58th account and in the K-t of the 51st account or other account corresponding to the type of material assets or assets provided. If the partnership agreement is terminated, the tangible assets are returned to the firm. The accountant makes reverse entries to the original entries.

58 “Financial investments” is used by legal entities to display information about the organization’s invested funds in securities (shares, bonds, etc.), shares in the authorized capital of other companies (including interdependent ones), as well as summarizing information about loans provided.

Account 58 in accounting is a collective account that reflects data on the enterprise’s invested assets in securities (public and private), authorized capital of other companies, and the provision of loans to individuals and legal entities (with the exception of company employees).

In addition to account 58, sub-accounts are opened:

58.1 - information is summarized on purchased shares of the joint-stock company, shares in the authorized capital of other companies

58.2 - information about investments in government or private debt securities (bonds, etc.) is displayed;

Account 58 - active. The debit displays financial investments in securities in correspondence with the corresponding accounts for recording valuables transferred as investments (for example, money from accounts 50,51,52). Repayment or sale is carried out in accounting according to Kt58 in correspondence with the account. 91 (90).

Investments in securities, the current value of which is determined, are subject to monthly or quarterly revaluation in order to include assets in the annual financial statements. The adjustment amount is applied to the company’s financial results (91.01, 91.02)

For debt securities that are not traded on the market, the difference between the original price and the nominal price is applied to the financial results of the organization’s activities evenly over the period of their circulation and receipt of income.

58.3 - mutual settlements for borrowed amounts presented to legal entities and individuals are displayed. An exception is loans issued to employees of the enterprise.

Information about the loans provided is entered in Dt58 (in case of partial or full repayment, the amount is taken into account in Kt58).

58.4 - information about the presence of a share in the common property of a simple partnership is taken into account.

Analytical monitoring of financial investments is carried out by objects of deposits (the company's counterparties - issuers, organizations whose share in the authorized capital belongs to the company and borrowers), as well as separately by type of investment.

Attention!

Investments in interdependent companies are shown separately on account 58

Typical correspondence for debit and credit

Analytical analysis is carried out based on the standard plan of the organization . To provide a complete picture of the financial position of the enterprise, the analysis reflects short-term and long-term cash deposits. Financial investments correspond with the following accounts of the enterprise's balance sheet.

In relation to debit:

- 50 – Treasury;

- 51 – Nominal accounts;

- 52 – Monetary account standards;

- 75 – Settlement with the founders of the enterprise;

- 76 – Payments to debtors and creditors;

- 80 – Property fund of the enterprise;

- 91 – Other income and expenses;

- 98 - Revenue of the future periods.

In relation to the loan:

- 51 – Current accounts;

- 52 – Monetary account standards;

- 76 – Payments to debtors and creditors;

- 80 – Property fund of the enterprise;

- 90 - Revenue from sales;

- 91 – Other income and expenses;

- 99 - P & L.

For the company to operate effectively, it is necessary to combine all corresponding accounts efficiently and correctly. This will help control and analyze the receipt of profit or loss from financial investments, and, accordingly, will show the feasibility and return on investment of such investments.

Accounts

Accounting accounts are an effective tool that allows you to register collected and summarized information about the state of property (capital, liabilities) in monetary terms. The accounting chart of accounts and the Instructions for its application were approved by the Ministry of Finance of the Russian Federation in order 94n dated October 31, 2000 (last edition - November 8, 2010).

Scope of application

The chart of accounts is a list systematized on the basis of the economic content of each position included in it. The current list is a mandatory basis for drawing up a working chart of accounts for all organizations operating on the territory of the Russian Federation and maintaining accounting using the double entry method. The exception is banks and government agencies.

The double entry method is a registration system that involves simultaneous reflection of a transaction on two accounts: withdrawal ( credit ) of a certain amount of money from one and receipt ( debit ) of the same amount to another account .

Structure

The chart of accounts is characterized by a strict structural hierarchy, which is based on:

- synthetic accounts

– designed to record generalized information about transactions, types of property, liabilities; - subaccounts

– used to obtain detailed data.

Subaccounts can be combined or excluded from the organization's working chart of accounts. Company specialists can introduce additional subaccounts. However, changing the names and purposes of synthetic accounts is unacceptable. Based on the division of the balance sheet into assets and liabilities, the following types of accounts are distinguished:

- active

– accounting for the movement of funds at the disposal of the enterprise; - passive

- accounting for sources of funds, displaying information about profits, types of capital, and obligations of the organization; - active-passive

– cumulative accounting of property and sources of its formation.

Off-balance sheet accounts

Off-balance sheet accounts are classified as auxiliary accounts. They are used in cases where an accountant needs to systematize information that is not stored on the company’s balance sheet. These accounts record information about the movement of property that does not belong to the organization, but is temporarily in its use, or assets of the enterprise written off as expenses.

Important: Off-balance sheet account data is not reflected in the financial statements.

The chart of accounts provides for 12 off-balance sheet accounts:

- 001 - leased fixed assets (fixed assets);

- 002 - inventory items accepted for safekeeping;

- 003 - materials accepted for processing;

- 004 - goods accepted for commission;

- 005 - equipment accepted for installation;

- 006 - strict reporting forms;

- 007 - debt of insolvent debtors written off at a loss;

- 008 - security for obligations and payments received;

- 009 - security for obligations and payments issued;

- 010 - OS wear;

- 011 - fixed assets leased;

- 012 - land.

Instructions for the Chart of Accounts

The instructions help to simplify and systematize work with the Chart of Accounts. Its use allows:

- obtain basic information about the methodological principles of accounting;

- get acquainted with a brief description of synthetic and subaccounts;

- understand the accounting procedures for typical transactions.

Drawing up a working chart of accounts for an organization in accordance with the provisions of the Instructions makes it possible to organize a unified standardized approach to accounting and preparation of financial statements.

Accounting table

Below is a table with an approved list of accounting accounts. Each position contains a link to a page with reference information that provides answers to the most common questions and allows you to study in detail the specifics of working with a specific account.

| Accounting account | Account name |

| 01. | Fixed assets |

| 02. | Depreciation of fixed assets |

| 03. | Profitable investments in material assets |

| 04. | Intangible assets |

| 05. | Amortization of intangible assets |

| 07. | Equipment for installation |

| 08. | Investments in non-current assets |

| 09. | Deferred tax assets |

| 10. | Materials |

| 11. | Animals being raised and fattened |

| 14. | Reserves for reduction in the value of material assets |

| 15. | Procurement and acquisition of material assets |

| 16. | Deviation in the cost of material assets |

| 19. | Value added tax on purchased assets |

| 20. | Primary production |

| 21. | Semi-finished products of our own production |

| 23. | Auxiliary production |

| 25. | General production expenses |

| 26. | General running costs |

| 28. | Defects in production |

| 29. | Service industries and farms |

| 40. | Release of products (works, services) |

| 41. | Goods |

| 42. | Trade margin |

| 43. | Finished products |

| 44. | Selling expenses |

| 45. | Goods shipped |

| 46. | Completed stages of unfinished work |

| 50. | Cash register |

| 51. | Current accounts |

| 52. | Currency accounts |

| 55. | Special bank accounts |

| 57. | Transfers on the way |

| 58. | Financial investments |

| 59. | Provisions for impairment of financial investments |

| 60. | Settlements with suppliers and contractors |

| 62. | Settlements with buyers and customers |

| 63. | Provisions for doubtful debts |

| 66. | Calculations for short-term loans and borrowings |

| 67. | Calculations for long-term loans and borrowings |

| 68. | Calculations for taxes and fees |

| 69. | Calculations for social insurance and security |

| 70. | Payments to personnel regarding wages |

| 71. | Calculations with accountable persons |

| 73. | Settlements with personnel for other operations |

| 75. | Settlements with founders |

| 76. | Settlements with various debtors and creditors |

| 77. | Deferred tax liabilities |

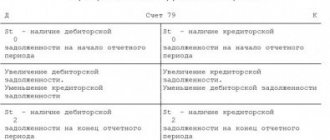

| 79. | On-farm settlements |

| 80. | Authorized capital |

| 81. | Own shares (shares) |

| 82. | Reserve capital |

| 83. | Extra capital |

| 84. | Retained earnings (uncovered loss) |

| 86. | Special-purpose financing |

| 90. | Sales |

| 91. | Other income and expenses |

| 94. | Shortages and losses from damage to valuables |

| 96. | Reserves for future expenses |

| 97. | Future expenses |

| 98. | revenue of the future periods |

| 99. | Profit and loss |

You can download the table with the chart of accounts here.

Sources: https://saldovka.com/plan-schetov/passivnyie-i-aktivnyie-scheta-buhgalterskogo-ucheta.html https://www.audit-it.ru/terms/accounting/aktivnyy_schet.html https:// nalog-nalog.ru/buhgalterskij_uchet/vedenie_buhgalterskogo_ucheta/aktivnye_i_passivnye_scheta_buhgalterskogo_ucheta_otlichiya/ https://spmag.ru/articles/schet-58-finansovye-vlozheniya https://znaybiz.ru/buh/plan-schetov/scheta/58.html https: //assistentus.ru/buhgalterskie-scheta/ https://buhspravka46.ru/buhgalterskiy-plan-schetov/schet-62-v-buhgalterskom-uchete-provodki-primeryi-subscheta.html

Concept and accounting of financial investments

According to clause 43 of the Regulations on accounting and financial reporting in the Russian Federation dated July 20, 1998 (as amended and supplemented) (hereinafter referred to as PBU), financial investments are:

- investments of a business entity in shares (bonds, other securities) issued by various joint-stock enterprises and the state;

- borrowed funds provided to other enterprises.

Registration of financial investments is carried out on the basis of documents confirming the right to own them.

- receiving income (in the form of interest, dividends);

- resale;

- other benefits.

https://www.youtube.com/watch?v=bsEuXbirEsc

Along with the benefits, the company also transfers all financial risks associated with financial investments.

Clause 44 of the PBU prescribes taking into account financial investments (investments) in the amount of expenses actually incurred for their acquisition.

A commercial enterprise can charge to the accounts of financial results (a non-commercial enterprise - to increase expenses) the amount of the difference between the actual costs of acquiring debt securities (bills) and their nominal value (in equal shares during the period of circulation of the securities after accrual of the income provided for by them).

Professional participants in the securities market have the right to revaluate investments in securities acquired for the purpose of subsequent sale, according to stock exchange quotations.

Objects of financial investments can be:

- shares of other organizations,

- bonds of state and municipal loans,

- other debt securities,

- contributions to the authorized capital of organizations (including affiliates and subsidiaries),

- bank deposits,

- receivables received as assignments of claims.

Financial investments are divided into:

- short-term (up to 1 year),

- long-term (tenure period exceeds 1 year).

Analysis of long-term financial investments

Before purchasing a financial asset and making an investment, it is necessary to analyze long-term financial investments. This will help evaluate the effectiveness and rationality of the solution used.

The objectives of investment analysis are as follows:

- Analysis of existing options for financial investments, assessment of their strengths and weaknesses, possible acquisition requirements;

- Selection of the most optimal investment portfolio;

- Provide analysis of the effectiveness of a financial asset, that is, calculation of its profitability.

As a rule, multifactor analysis is used to carry out the analysis, which is carried out using special software products. In addition to the fact that the analysis of financial investments is carried out before direct investment, retrospective analysis is also carried out periodically. The company looks at which types of financial assets have increased, which have decreased, etc.

This makes it possible to track negative or positive trends in the company. For example, an increase in long-term financial investments indicates that the company has enough free cash, it does not worry about the liquidity of its assets and can easily invest resources in long-term assets that will yield profit only after a year.

The transferred property is valued by agreement of the parties, i.e. at the agreed cost (estimate).

D 58/1 K 51.52 – for the amount of the deposit;

D 58/1 K 01/в, 04/в, 10, 20, 23, 41, 43 – for the value of the property;

D 58/1 K 91/1 – for the difference if the agreed valuation is greater than the value of the property;

D 91/2 K 58/1 – for the difference if the agreed valuation is less than the value of the property;

D 76 K 91/1 – for the amount of interest;

D 51, 52 K 76 – for the amount of interest;

Accounting for debt securities is maintained on account No. 58/2 “Debt securities”. Debt securities include: bills, bonds, checks, savings and time deposits. However, checks, savings and time deposits, according to the instructions of the Central Bank of the Russian Federation, are accounted for in active account No. 55 “Special accounts in banks”.

When purchasing these securities, their purchase price may differ from their nominal value. However, by the end of the security's circulation period, the above values in the accounting accounts are compared. The difference between the purchase and face value of a security is written off to account No. 91 “Other income and expenses” as operating income or expense.

D 58/3 K 50,51,52 – for the loan amount;

D 58/3 K 01/в, 04/в, 10, 41, 43 – for the accounting value of the property;

D 76 K 91/1 – for the amount of accrued interest;

D 51.52 K 76 – for the amount of interest received;

D 76/2 K 91/1 – for the amount of fines;

D 50,51,52,08/4,08/5,10,41,43 K 58/3 – for the amount of the repaid loan;

⇐ Previous12

Cash in transitAccount 58. Short-term financial investmentsAccount 59. Provisions for impairment of short-term financial investments

A share (German Aktie, from Latin actio - action, claim) is an issue-grade security that secures the rights of its owner (shareholder) to receive part of the profit of the joint-stock company in the form of dividends, to participate in the management of the joint-stock company and to part of the property remaining after its liquidation. A share is usually understood as a security that is issued by a joint-stock company during its creation (establishment), during the transformation of an enterprise or organization into a joint-stock company, during the merger (absorption) of two or more joint-stock companies, as well as to raise funds when increasing the existing authorized capital. An investor in shares is attracted by the following: 1. Voting rights in exchange for capital invested in shares.

The shareholder gets the opportunity to take part in management. 2. The right to income, i.e. to receive part of the net profit of the joint-stock company in the form of dividends. 3. Capital gains associated with a possible increase in the price of shares on the market. As such, this is the main motive for acquiring shares, especially in Russia at present. 4.

Go How to remove a seizure from a credit account

Additional benefits that a joint stock company can provide to its shareholders. They take the form of discounts when purchasing products produced by a joint-stock company or using services (preferential travel, preferential prices for hotel accommodation, etc.). 5. Right of first refusal to purchase new issues of shares. 6.

The right to part of the property of a joint-stock company remaining after its liquidation and settlements with all other creditors. Shares have the following properties: • a share is a title of ownership, i.e. the holder of a share is a co-owner of the joint stock company with the ensuing rights; • it has no lifespan, i.e.

the rights of the shareholder are retained as long as the joint stock company exists; • it is characterized by limited liability, since the shareholder is not liable for the obligations of the joint-stock company. Therefore, in case of bankruptcy, the investor will not lose more than what he invested in the stock; • the share is characterized by indivisibility, i.e.

joint ownership of shares is not associated with the division of rights between the owners, all of them together act as one person; • shares can be split and consolidated. When splitting, one share turns into several. The issuer can use this property of shares to reduce the supply of shares of this type.

When splitting, the amount of the authorized capital does not change. An investment unit is a registered security certifying its owner’s share in the ownership of the property that makes up the mutual investment fund, the right to demand from the management company proper fiduciary management of the mutual investment fund, the right to receive monetary compensation upon termination of the mutual investment fund.

An individual or legal entity that owns investment shares of the fund is called a shareholder; after depositing a certain amount of financial or material resources into the fund, it becomes the owner of investment shares of the fund - a shareholder. To purchase shares of a mutual investment fund, you must submit an application for purchase and transfer the invested amount to the fund account.

The number of investment units in the owner’s personal account is determined by dividing the amount received in payment for the shares by the placement price of one investment unit. The income, dividends received by the shareholder, and that part of the property or cash that he receives upon liquidation of the company depend on the value of the shareholder.

Share contributions form a mutual fund of a company or cooperative. P. is recorded in the share certificate. A mutual investment fund (UIF) is the pooled funds of shareholders, which the management company invests in securities or other assets permitted for mutual funds by current Russian legislation, in order to generate income.

Contradictions in norms

In accordance with the account plan, accounting of funds invested in bank deposits is carried out according to subaccounts. “Deposit accounts” (55.3). Another indication is contained in clause 3 of PBU 19/02. This paragraph states that such deposits are recorded by account 58. In accounting, the deposit, according to current legislation, is reflected in the way that the enterprise chooses. In this case, the preferred option may be fixed in the financial policy and disclosed in the explanatory note attached to the financial statements.

Task: document transactions with transactions

Hello) Please help with the wiring.

I’m a correspondence student...trying to get the hang of it, a mess is already forming in my head (((help me “put everything in its place”))) Check my postings, please. 1. Funds from the founders are deposited into the cash desk to account for their contribution to the authorized capital of the organization. D 50 K 75-1 2. Materials were purchased for the amount in the report. D 10 K 71 3. The account received revenue for the sale of fixed assets. D 51 K 20 4. Money was deposited from the cash register to the bank. D 51 K 50 5. Receipts from claims (on account) D 51 K 76-2 6. Taxes transferred (income, property, VAT, etc.) D 68 K 51 7. Transferred for social needs. D 69 K 51 8. Short-term loan repaid. D 66 K 51 9. Repayment of accounts payable. D 76 K 51 10. S/s paid off with suppliers and contractors. D 60 K 51 11. Receipt of fixed assets from other enterprises and persons free of charge. D 01 K 98-2 12. Commissioning. D 01 K 08 13. Write-off of materials for production based on requirements. D 20 K 10 14. As a result of the audit, excess materials were identified. (I can’t figure out which wiring to install) 15. Receipt of materials free of charge. D 10 K 98-2 16. Actual receipt of founders’ contributions to the management company in the form of intangible assets. D 04 K 75-1 17. Actual receipt of founders’ contributions to the management company in the form of securities. D 58-2 K 75-1 18. The actual receipt of the founders’ contributions to the management company in the form of cash at the cash desk. D 50 K 75-1 19. Compensation for personal income tax has been accrued from budgetary funds. (I can’t figure out what kind of posting) 20. Bonuses, financial assistance, dividends have been awarded. D 91-2 K 70(73) 21. Income tax withheld. D 70 K 68 22. Entering the shortage into the cash register from MOL. D 50 K 94 23. Salary, vacation pay, etc. issued. D 70 K 50 24. Not issued (deposited) salary reflected. D 70 K 76-4 25. Contributions to the TFOMS have been accrued. D 69-3 K 51. THANK YOU to ALL who responded in advance))))) Account 58 “Financial investments” is intended for detailed accounting of an enterprise’s investments. What is a financial investment? In what order is accounting kept? 58? Let's look at typical examples and wiring.