Insurance premiums direct payments or offset system?

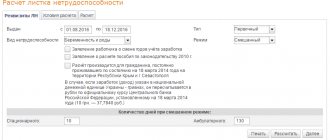

The line “Payment attribute” is an innovation in Appendix 2 of the calculation of insurance premiums.

Initially, its appearance was associated with the transfer of reporting on insurance premiums to the jurisdiction of the Federal Tax Service. Until now, many employees of companies responsible for reporting have difficulty deciding which indicator of payments to put in the calculation of insurance premiums: 1 or 2.

Let's look at what this parameter means and how to fill out this column.

What is a “Payment Sign”

Before deciding to fill out this line, you need to understand what the “Payment Sign” is: this indicator refers to the system by which payments are made when an employee becomes incapacitated or goes on maternity leave. Today there are 2 main mechanisms.

The first option is the offset type of payments. In this case, the disability benefit is paid in full by the company, and after the payment is made, the Social Insurance Fund compensates the employer for these costs in full.

The second option is direct payment (regions of the FSS pilot project). In this case, the source of finance for payments for temporary disability or maternity is directly the Social Insurance Fund, and the company’s finances are not involved.

Direct payments are available in the following cases:

- payment is based on sick leave (this also includes all cases of disability associated with pregnancy and childbirth);

- payments in connection with the registration of a woman during early pregnancy;

- child care allowance up to 1.5 years;

- payment of 4-day leave to care for a disabled child to either parent.

Thus, in Appendix 2 of the calculation of insurance premiums, the payment attribute is filled in with the number “1” for direct payments and “2” when using the credit system.

Last changes

Traditionally, Russia used an offset system of insurance payments. In this case, the employing organization was responsible to the employee for the fulfillment of social security obligations. All sick leave was paid from the company’s funds, and only then the state, represented by the Social Insurance Fund, compensated for these expenses.

The difficult financial situation often led to the company being unable to fulfill its payment obligations in full. To compensate for these difficulties, a pilot project “Direct Payment” was launched. This happened in 2011.

Since this year, systematically, more and more new regions have been connected to the program through additions to the Decree of the Government of the Russian Federation No. 294 of April 21, 2011.

REFERENCE Initially, the master plan of the campaign provided for the transfer by 2021 of all regions of the country exclusively to the production of direct payments. However, based on Resolution No. 1514, the expansion of the pilot project for direct payments from the Social Insurance Fund has been suspended.

Also see “Participants in the FSS pilot project.”

Today, you can put the code “1” in the “Payment Attribute” column only in the region that participates in the Social Insurance Fund program. A complete list of them participating in the program for 2020 can be found on our website at the link above.

Also see “Which regions will not participate in the FSS pilot project.”

As a result, policyholders can fill out the payment indicator in the calculation of insurance premiums for 2020 with the number “1” in 33 regions.

Appendix 2 is part of the ERSV, filled out for submission to the Federal Tax Service. It is worth emphasizing that an error in filling out the “Payment attribute” field will not cause a fine for the company or employee.

However, incorrectly completed items will need to be redone and resubmitted.

To avoid this, you need to clarify in advance whether your region is a participant in the Direct Payment project and how to fill out this column.

Also see “FSS pilot project in 2020.”

, please select a piece of text and press Ctrl+Enter.

What is the difference between an offset scheme and a direct payment system?

In the first case, the employer serves as an intermediary between the state and the citizen, who receives temporary disability benefits while officially employed by him.

This happens as follows - social benefits are initially paid by the employer, who can then reimburse their expenses by contacting the Social Insurance Fund.

Among the advantages of such a system is its familiarity to the population and the absence of the need to control the issuance of benefits separately, but there are also disadvantages:

- benefits depend on the employer (if he does not have money for payments, the incapacitated employee will be left with nothing and will be forced to go to court);

- the offset scheme creates problems for employers, which makes them even more diligent in hiding income and the number of employees;

- the presence of an intermediary extends the payment process.

As an alternative, there is a direct payment system, according to which the employer does not participate in the distribution of benefits. Money for socially vulnerable categories of the population comes directly from the state, which is beneficial for all parties:

- the employer will not be able to appropriate the benefits to himself;

- those who are unable to work will receive their money faster, regardless of the profitability of their place of work;

- the employer will be less biased towards employees on benefits (for example, pregnant women on maternity leave).

In all respects, the direct issuance system is more beneficial for everyone - therefore, the FSS plans to transfer all subjects of the Russian Federation to it.

Sign of payments in the calculation of insurance premiums

The attribute of payments in the context of insurance premiums is noted in column 001 of the DAM form document. The characteristic in question has only two designations: 1 and 2. Other marks are unacceptable

Field 001 is entered as 1 if the employer makes direct payments of disability benefits.

Other employers - enter the value 2 in the specified field

If the company has more than 25 employees, the form must be submitted electronically.

Pilot Project Report

Introduction

Goals and objectives

The purpose of the pilot project was to demonstrate the possibilities of consumer influence on the quality of government services.

The results of government government services for the consumer are unchanged and are determined by regulations, so the degree of consumer satisfaction depends solely on the conditions for the provision of services. The conducted research of consumer preferences made it possible to identify a number of key service indicators: work schedule, waiting conditions for an appointment, methods of providing information, etc.

As part of the project, it was necessary to identify possible technologies for influencing individual consumers and non-profit organizations on the conditions for the provision of public government services. The applicability of different technologies and their effectiveness in different situations had to be assessed.

The result of the project in Perm was supposed to be an increase in consumer satisfaction with those government services that were included in the project.

Government services

For pilot implementation, three services with completely different characteristics, activity and interest of consumers, population coverage, and frequency of use were selected. Based on these criteria, three government services were selected: obtaining a passport, passing a medical and social examination, and conscription into the army.

Obtaining a passport covers the entire adult population, but consumers always act alone and there are no associations that could represent their interests and protect their rights.

A citizen receives a passport at least 3 times in his life, but due to losses, changes of surnames, and mandatory exchanges for new citizens, they apply for a new passport somewhat more often. The accumulation of individual experience in these conditions is impossible, because

By the time the need to obtain a passport arises, the regulatory framework has completely changed and the old experience, if it has not yet been forgotten, loses its relevance. But a citizen can quite easily find among his acquaintances a person who recently received a passport.

Passing a medical and social examination, unlike obtaining a passport, affects a small but organized group - people with disabilities. This service is required by disabled people quite often: those who have not reached retirement age must undergo it once a year or once every two years.

Disabled people are united in organizations of disabled people that protect their interests. Organizations of people with disabilities have already done a lot to take into account the special needs of people with disabilities, and government agencies are usually friendly and attentive to the proposals of societies of people with disabilities.

Conscription into the army concerns young men and is carried out once in a lifetime, but due to the importance of this event, which affects the rest of life, and the constant media coverage of army problems, conscription is always in the focus of public attention.

Quite a lot of non-profit organizations deal with the problems of conscription, but their activity is aimed mainly not at increasing the level of consumer satisfaction, but at eliminating the service itself or at providing the opportunity to avoid conscription.

Region of implementation

The project was implemented in Perm, a city with a population of just over 1 million people, divided into 7 districts. Each district has its own institutions (departments, branches) to provide selected government services.

The city stretches along the Kama for 70 kilometers, cut by a network of ravines, so transport accessibility is a serious problem.

There are quite a lot of non-profit organizations in Perm and they cover a wide range of activities: from human rights to entrepreneurial ones.

Introductory public event

On February 21, a problem seminar was held “Citizen as a consumer of government services. Technologies for consumer protection." Representatives of non-profit organizations (20 people) and journalists were invited to the seminar.

The participants were presented with the results of a study of the preferences of consumers of government services, conducted in Perm in the summer of 2004. A new approach to interaction between a citizen and the state as a consumer and performer of government government services was described. The possibilities of NGOs and citizens to improve the quality of public services are presented.

An exchange of views took place on possible joint actions of NGOs, in particular, territorial public self-government bodies acted as a possible actor of influence on the implementing government agencies.

Sign of payments in the calculation of insurance premiums in 2020

Labor laws oblige employers to pay their employees wages on a regular basis. At the same time, certain deductions must also be made regularly from the income of employed citizens.

In addition to these calculations, employees often issue sick leave certificates indicating their temporary disability. In this regard, the manager needs to complete a number of papers.

As part of the preparation of such documentation, it also becomes necessary to indicate the payment attribute.

Peculiarities of adding the payment attribute in the calculation of insurance premiums: 1 or 2

The attribute of payments in the context of insurance premiums is noted in column 001, which is located at the top of the DAM form document. This form was approved by Order of the Federal Tax Service of the Russian Federation No. ММВ/7/11/ [email protected] dated 10.10.2016. Moreover, the attribute in question has only two designations: 1 and 2. Other marks in the line in question are unacceptable.

Value 1 is appropriate to register in the documentation in those circumstances when the employer operates in Russia, in the region that is participating in the pilot project of the Federal Social Insurance Fund of the Russian Federation. The FSS pilot project means establishing a system of direct payments for temporary disability. All other companies that are located outside such regions must indicate the number 2 in their reporting.

Those enterprises that put the number 2 in their reporting are characterized by a standard procedure for making payments of disability benefits.

It is understood that the employer initially pays these amounts to the employee, after which, having prepared the appropriate documents, he can apply for compensation from the social insurance fund, or has the right to offset the costs incurred for the agreed payments and upcoming social contributions.

The list of regions that are participating in the pilot project is given in the RF Government Decree No. 294 dated April 21, 2011.

In accordance with this standard, disability payments under the direct system must be made by all employers who are located in one of the relevant cities.

In those circumstances, if the employer is a separate division of a company whose legal address is fixed in another region, then, based on the level of independence of this branch, the division may or may not be recognized as a participant in the pilot project.

Features of determining the attribute of payments in the calculation of insurance premiums for separate divisions

There are such nuances in determining the attribute of payments in the context of separate divisions:

- In circumstances where the branch operates in an area taking part in the pilot project, while the head office is located in a city not taking part in it. The indicator of payments in such circumstances will be related to whether the branch has its own bank account, as well as to the procedure for paying wages to staff. Two options are implied: either the division pays its employees itself, or the head office accountant deals with these issues. In the case where the department itself carries out all the calculations, it must register as a payer of social contributions. After this procedure, the branch will be recognized as a participant in the project. In the opposite situation, if the department does not have the necessary autonomy, then it is inappropriate to recognize it as a participant in the direct payment system under consideration.

- Conditions in which the division operates in an area that is not a participant in the pilot project, and the head office is located in a region where this is relevant. As in the first option, the indicator of payments will depend on the degree of independence of the department. If the branch has its own account and decides on its own issues with the payment of salaries to staff, then it will not be a participant in the project. In turn, if these issues are resolved by the head office, then the unit will be considered taking part in the FSS project.

Nuances of payment attribute 1 in the calculation of insurance premiums in 2019

An employer who is characterized by payment characteristic 1, upon the onset of a period of temporary disability for a subordinate, must:

Source: https://minakovajulia.ru/strahovye-vznosy-pryamye-vyplaty-ili-zachetnaya-sistema/

What indicator of payments should be indicated in the calculation of insurance premiums - Kontur.Accounting

The form for a single calculation of contributions, which employers have submitted to the tax service since the beginning of 2020, contains sections with the amounts of deductions for compulsory medical insurance, compulsory health insurance and VniM. Let's look at the nuances of filling out the second appendix of the report: how to select a payment attribute in the calculation of insurance premiums and indicate the correct code.

What is a payout sign?

Before filling out the column of the report reserved for the payment indicator, let’s figure out what this indicator means. There are rules by which insured persons receive disability or maternity benefits. In the Procedure for filling out the calculation of contributions (hereinafter referred to as the Procedure), two mechanisms for these rules are highlighted:

- direct payments - benefits are paid directly by the Social Insurance Fund - code “1”;

- offset system - benefits are paid by the organization, and the Social Insurance Fund reimburses its expenses - code “2”.

The employee receives directly the following benefits from the social insurance fund:

- sick leave, including disability due to pregnancy and childbirth;

- benefits for a woman who registered for early pregnancy;

- child care up to 1.5 years old;

- payment of four days of leave to a parent to care for a disabled child.

If an organization operates under a direct system, then in column 001 of Appendix 2 it will indicate code “1”.

When using the scoring system - code “2”.

What does the payout attribute code depend on?

The attribute of payments in the calculation of insurance premiums is indicated depending on whether your region is included in the Social Insurance Fund “Direct Payment” project, launched in 2011.

Before this, only the credit system worked; it placed the responsibility on employers for the social protection of employees. But the financial condition of the employer does not always allow paying benefits in full and then returning them from Social Security.

To eliminate problems with the timeliness and completeness of social payments, the project was created.

The idea of direct payments is simple - employees receive benefits directly from the Social Insurance Fund, without affecting company budgets, while:

- employees are guaranteed the transfer of benefits in full, regardless of the financial capabilities of the employer;

- employers retain only the obligation to timely transfer contributions to compulsory social insurance;

- companies do not withdraw funds from economic circulation;

- the number of lawsuits between employers and employees is reduced.

To receive benefits, the employee submits the required list of documents to the territorial social insurance fund and within ten days receives the amount due to him.

How to find out if a region is included in the FSS pilot project

To determine whether an organization falls under the FSS project, you need to refer to the Government Resolution dated April 21, 2011.

No. 294, which lists the regions included in the project: the Republics of Karachay-Cherkessia, Crimea, Mordovia, Tatarstan, Astrakhan, Bryansk, Belgorod, Kaluga, Kaliningrad, Kurgan, Lipetsk, Novgorod, Novosibirsk, Nizhny Novgorod, Rostov, Tambov, Samara and Ulyanovsk regions, as well as Khabarovsk, Altai and Primorsky Territories, and others. The list of pilot regions should be updated by 2021.

Separate divisions determine their participation in the FSS project in the same way as parent organizations, depending on the region of activity.

Filling out Appendix 2 of the report

Before filling out Appendix 2 of the calculation of insurance premiums, check which system - direct or credit - you are working on. This can be done on the page of the “Federal Portal of Draft Regulatory Legal Acts”, where all changes to the Resolution on Payment Systems are posted.

Example. In 2020, in the second quarter, the company transferred sick leave benefits to three employees: in April 2,000 rubles, in May 5,000 rubles and in June 3,000 rubles. The indicated amounts include sick leave paid at the expense of the employer - 1,000 rubles per month. In May, one employee was paid a lump sum benefit for the birth of a child in the amount of 17,479.73 rubles.

No benefits were transferred in the first quarter. The company employs 4 people, who received 600,000 rubles over the past six months, incl. 90,000 rubles in April, 118,000 rubles in May and 110,000 rubles in June. The rate of deductions for VNiM is set at 2.9%. The organization operates in the Tomsk region, and accordingly, uses a credit system.

Let's fill out Appendix 2 of the report:

- In column 001 the credit system code “2” is entered.

- Lines 020 and 030 indicate payments accrued to employees and non-contributory amounts, respectively.

- Line 050 records the base for determining deductions for VNiM, which does not include sick leave, including payments from the employer’s funds and a one-time benefit.

- Field 060 indicates the accrued amounts of insurance payments from the beginning of the year, and separately for the months of the second quarter, and field 070 indicates benefits paid at the expense of the Social Insurance Fund minus amounts paid from the employer’s funds.

- If during the reporting period the company received compensation from the Social Insurance Fund, they are indicated in field 080.

- Deductions (column 060) minus expenses (column 070) are contributions with code “1” that are payable (column 090). If expenses are greater than deductions, code “2” is entered in column 090; the FSS will reimburse this difference to the organization.

An incorrectly specified payment attribute code will not entail sanctions from regulatory authorities, since this field does not affect the amount of insurance payments. But the employer will have to correct the error and submit an updated report.

Irina Smirnova

Send calculations for insurance premiums in the Kontur.Accounting web service. The service is suitable for small businesses: it is easy to keep records, pay taxes, calculate salaries, and send reports via the Internet. The system itself will calculate taxes and generate reports, remind you of the dates of payment and sending. Check out the capabilities of the service - work for free for the first 14 days.

Try for free

Tax laws are updated frequently. Property taxes in 2020 were no exception. We will tell you what innovations have appeared and how to calculate property tax.

Statistical form 57-T is a report that is submitted to the statistical authorities every two years. It conveys information about employees’ salaries, indicating positions and professions. The report includes data for only one month.

Source: https://www.B-Kontur.ru/enquiry/534-priznak-vyplat-v-rsv

Who should transmit documents electronically?

Ksenia Somova,

Head of the Insurance Premium Administration Department of Branch No. 13 of the State Institution - regional branch of the Federal Insurance Fund of the Russian Federation in the Republic of Tatarstan

Companies with an average workforce of more than 25 people are required to transmit information electronically.

Appendix 2 calculation of insurance premiums and payment indicator. What to set for payments in the RSV in 2020. From July 2020, the pilot project “Direct Payments” will operate in 20 regions. In them, benefits are paid directly from the Social Insurance Fund, and the employer’s responsibilities only include submitting the relevant documents to the Fund’s branch. Let’s figure out how the payment procedure works in these regions, what questions accountants have, and what will help make their work easier.

What is the sign of payments in the RSV - 1 or 2?

This indicator appeared in the form relatively recently and is intended to reflect the system of payment of benefits to individuals. The need to add a new parameter to the report is associated with the transfer of the function of administering insurance premiums for VNIM (temporary disability and maternity) under the control of tax authorities. Let us recall that previously such functions were performed by the FSS of the Russian Federation.

The current report form is approved in the Order of the Federal Tax Service of Russia dated October 10, 2016 No. ММВ-7-11/ [email protected] The procedure for entering information is also given here. In accordance with the rules on p.

001 Appendix 2 of the RSV provides a sign of payment of social compulsory insurance for employees. That is, the accepted system for receiving benefits is indicated here.

Currently, there are 2 types of it: credit and direct:

| Type of payment attribute on OSS | The procedure for issuing benefits for VNIM |

| Straight | Funds are paid to the insured individual directly through the social insurance authorities (territorial division of the Social Insurance Fund) without the participation of the employer in the calculations |

| Credit | Funds are paid to the citizen from the employer’s finances with subsequent reimbursement by the fund based on the results of checking the eligibility of accrual and issuance |

Direct payments are not made for all types of social security. But only those that are provided for at the legislative level. These are the following payments:

- Benefits for sick leave, including for pregnancy and childbirth.

- Benefits for pregnant women for early registration at the antenatal clinic.

- Children's leave amounts for caring for children under 1.5 years of age.

- 4 additional days dedicated to the vacation of a parent who is caring for a child with a disability.

In the RSV form, Appendix 2, the payment indicator is not entered at the request of the employer. This parameter depends on whether the region where the policyholder is located is included in the FSS pilot project or not.

Previously, an exclusively offset system operated, that is, first the employer gave the staff amounts for social security, and then (after verification) the fund reimbursed the funds.

But the financial state of affairs in organizations did not always make it possible to pay staff on time. This project was created to eliminate inconsistencies.

Read: How to fill out the RSV with compensation from the Social Insurance Fund - sample

Fill out the RSV – payment sign 1 or 2

In RSV-1, the payment attribute can take one of two possible values. Which ones are specified in the rules for filling out the report. Today there are 2 types of code:

- 1 – denotes a direct system of settlements with insured persons. This value is entered in the case when funds are paid to the employee directly from the Social Insurance Fund. The employer must provide the fund with documents for assigning payments and information for transferring funds.

- 2 – indicates the credit system for issuing compulsory insurance funds. First, the benefit is calculated and issued by the individual's employer (based on the bulletin received from the employee and documents confirming the occurrence of the insured event). Then the FSS reimburses the money to the employer or offsets are made between the amount of the benefit and the accrued contributions.

The employer does not have the right to decide which indicator code to indicate. The payment option depends on the payment system adopted in the region.

To check whether your region is included in the pilot project or not, you need to study Government Resolution No. 294 of 04/21/11. The list of subjects of the Russian Federation included in the project is approved here.

The Crimea, Novosibirsk, Bryansk, Rostov regions, Primorsky, Khabarovsk territories, etc. have already switched to a direct payment system. The list is regularly updated.

Note! If the parameter value is reflected incorrectly, this will not result in penalties. After all, this line does not affect the calculation of the amount of contributions and does not underestimate the amount to be paid. But the employer will still have to submit a clarification with corrections in order to eliminate the inconsistencies.

Read: Maximum base for contributions to the Social Insurance Fund and Pension Fund for 2020

Direct system or credit system - what is the difference

The main purpose of introducing a pilot project is to improve the financial situation of both employers and staff.

The advantages of the direct system for employees are, first of all, the speed and convenience of payments.

Money is transferred promptly, in any way convenient for an individual (to a card, by postal transfer, to a bank account) and in full. The fact that the employer has available funds does not matter.

It is also more profitable for the employer if the payments are made by the Social Insurance Fund. There is no need to withdraw your own funds from circulation, waste time on calculating benefits, or bear responsibility for the correctness and completeness of calculations.

After all, when an employee brings in sick leave, it is necessary to accrue benefits to him and then pay him. If the employer is conscientious, problems usually do not arise. However, cases of delay or even complete non-payment of money are not uncommon. This led to labor disputes and conflicts.

Changing the credit system to a direct one at the legislative level makes it possible to directly issue money to employees without affecting the budget of employers.

Read: How to make an adjustment according to the RSV

, please select a piece of text and press Ctrl+Enter.

Source: https://raszp.ru/otchet/priznak-vyplat-v-rsv-1-ili-2.html

Direct payments or credit system in the calculation of insurance premiums

The government of our state is systematically carrying out various reforms, including in the social sphere. One of the pressing problems facing social insurance benefits is the method of their payment. Back in 2011, a number of regions began an experiment with the payment of benefits, calling the project “Direct Payments”.

Subsequently, several more joined them, and from July 2017, there will be 33 entities that switched to direct payments of benefits from the Social Insurance Fund. Direct payments or the FSS credit system, which method is preferable for certain social groups and what benefits can be received directly, about this Our review will tell you.

What is “direct payment” and the types of benefits available to receive from the Social Insurance Fund

During the “Direct Payment” project, the system of payment of compulsory social insurance benefits is being improved.

If in the past the system worked as an “offset scheme”, that is, the employer himself calculated the benefit, paid it, and subsequently returned the money by offset from the Social Insurance Fund.

The new program involves the calculation and payment of benefits from the funds of the Social Insurance Fund itself; you can receive money there without contacting the employer. Thus, enterprises do not withdraw funds from circulation, increasing their financial stability.

Employees of enterprises also benefit; in their case, they do not need to wait for the date of payment of wages to receive benefits; the Social Insurance Fund is obliged to pay the citizen within 10 days after the application. And there can be no cases of evasion of benefits by the employer in this option.

Types of benefits paid directly to the Social Insurance Fund:

- maternity and pregnancy benefits;

- temporary disability;

- a one-time payment upon registration at an antenatal clinic in early pregnancy;

- a benefit paid monthly while the mother takes care of her offspring until he reaches one and a half years old;

- compensation for an additional four days of leave to care for a disabled child for a parent.

When receiving money by direct payment, the citizen indicates the delivery method:

- Postal transfer;

- crediting to a bank account.

As already mentioned, the Social Insurance Fund is obliged to transfer benefits within 10 days from the date of the first application, and each subsequent monthly payment is made from the 1st to the 15th of the current month.

Disadvantages of the “credit system”

Our state inherited the credit system of benefit payments from the Soviet Union. But in those days it was effective and could not include the disadvantages that arise in modern realities.

The irresponsible approach of many employers to the payment of state-guaranteed benefits forced the Social Insurance Fund to come up with direct payments.

The rights of citizens to receive cash payments through an employer may be violated in the following cases:

- stopping the functioning of the organization in case of bankruptcy;

- lack of sufficient money in the account for payment (relevant for small enterprises when several employees go on maternity leave at once);

- hiding the leader from law enforcement agencies;

- refusal of the company for any reason;

- there is a court decision on payment, but there is a lack of funds in the accounts.

Therefore, the new system of direct payments is superior to the old one, since in this case the benefit will definitely be issued, and the risks of being left without money are eliminated. It should be remembered that if the employer refuses to pay, the right to receive it can only be obtained through the court, and this is a labor-intensive and time-consuming process.

Advantages and disadvantages of the new benefit payment scheme

Elena Krivosheeva,

Deputy Head of the Insurance Department in Case of Temporary Disability and in Connection with Maternity of the State Institution - Samara Regional Branch of the Federal Social Insurance Fund of the Russian Federation

The transition to a new benefit payment system is intended to reduce the likelihood of insurance fraud and eliminate non-payment of benefits when the company's accounts are frozen or it is in the process of bankruptcy or liquidation. Because, firstly, the financial condition of a number of organizations does not allow payments for temporary disability to be made on time. And secondly, there are common cases when enterprises are liquidated during the period of maternity leave of employees. In addition, we expect that as a result of the implementation of this project, the document flow between the Fund, policyholders and medical institutions will be simplified.

Table 1. Advantages and disadvantages of the mutual benefit payment scheme and the “direct payment” scheme for all participants in the process*

* The editors of the magazine would like to thank the regional offices and branches of the FSS of the Russian Federation in the cities of Nizhny Novgorod, Naberezhnye Chelny, Elabuga and Samara for the information provided.