Accounting in history

As soon as people learned to write and count, they began to keep records of their economic activities. At first these were primitive records on clay tablets or papyrus of the arrival and expenditure of any things that were involved in exchange or trade. Gradually, accounting acquired new details in the form of control over funds and property, and the need arose for a chronological and documented order of records. The next stage is not only reflection, but also analysis of the data obtained, a conditional forecast of income and expenses.

The major transition to modern accounting was the emergence of double entry bookkeeping. It has been used since the Middle Ages, but for the first time in Europe it was described by Benedetto Cotrugli in the handwritten book “On Trade and the Modern Merchant” in 1458. However, this book was published only in 1573, so the founder of accounting is considered to be Luca Pacioli, whose book describing the same method was published earlier - in 1494. It is in the double entry method, in the reflection of debit and credit transactions, that the concepts of “assets” and “liabilities”, as well as the balance sheet, originate.

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Accounting for the use of funds

In order to keep track of the use of fixed assets, it is necessary to use cost indicators. They come in two types:

- Capital productivity. This indicator determines how many products are produced on the OS in value terms.

- Capital-labor ratio. This is an indicator of the ratio of the average cost per year of fixed assets to the average number of workers in the busiest shift.

Funds can be accounted for in monetary or real in kind terms. Accounting for assets is carried out in order to determine the technical equipment available on the balance sheet, the degree of its wear and tear and calculate production capacity.

Fixed assets are always calculated taking into account depreciation

In order to carry out accounting, you need passports of the enterprise, workplace and equipment. They contain all the necessary information about the initial and residual value, degree of wear and tear and year of commissioning.

Accounting is carried out according to three principles:

- Based on actual costs at the time of acquisition (creation), including transportation and other expenses.

- At replacement cost at the time of revaluation.

- At original cost with wear and tear.

It should be understood that working capital and fixed assets of an enterprise are not the same thing. Current assets are used in one production cycle, while fixed assets are permanent (subject to the deduction of depreciation cost).

https://youtu.be/hiQcdHgWZ4M

What does a balance sheet mean in simple words?

So, the source is a double entry, reflecting every fact of economic life on accounting accounts, which can be active, passive or active-passive. That is, initially assets and liabilities are formed in accounting accounts. The summary result of reflecting all the facts of economic life is the balance sheet, which consists of assets and liabilities.

What does a balance sheet mean in simple terms?

Balance is when there is equal weight on both sides of the scale. The balance sheet consists of assets and liabilities, which are the two sides of these scales. And to maintain balance, it is necessary that the bowls be balanced, that is, balance in accounting is the equality of assets and liabilities.

We can say that liabilities and assets in accounting are a check for the correct reflection of account transactions. Their inequality indicates an accounting error.

Let us describe in more detail what an asset and a liability mean, and give examples of what applies to them.

The concept of fixed assets of an enterprise. Composition of fixed assets.

Types of valuation of fixed assets. Physical and moral wear and tear of fixed assets. Indicators of the efficiency of using fixed assets at enterprises.

Fixed assets are the fixed assets of an organization reflected in accounting or tax accounting in monetary terms.

Fixed assets are means of labor that are repeatedly involved in the production process, while maintaining their natural form. Intended for the needs of the organization's core activities and must have a useful life of more than a year. As they wear out, the value of fixed assets decreases and is transferred to cost through depreciation.

To account for fixed assets, determine their composition and structure, their classification is necessary. There are the following groups of fixed production assets (including according to Russian PBU 6/01):

- Buildings (shop buildings, warehouses, production laboratories, etc.);

- Structures (engineering and construction facilities that create conditions for the production process: overpasses, highways, tunnels);

- On-farm roads;

- Transmission devices (electricity networks, heating networks, gas networks);

- Machinery and equipment, including:

- Power machines and equipment (generators, electric motors, steam engines, turbines, etc.).

- Working machines and equipment (metal-cutting machines, presses, electric furnaces, etc.).

- Measuring and regulating instruments and devices, laboratory equipment.

- Computer Engineering.

- Automatic machines, equipment and lines (automatic machines, automatic production lines).

- Other machinery and equipment.

as part of fixed assets: capital investments for radical improvement of land (drainage, irrigation and other reclamation works); capital investments in leased fixed assets; land plots, environmental management objects (water, subsoil and other natural resources).

Working capital, which includes such items of labor as raw materials, basic and auxiliary materials, fuel, containers, and so on, should be distinguished from fixed assets. Working capital is consumed in one production cycle, materially enters the product and completely transfers its value to it.

Each enterprise has at its disposal fixed and working capital. The totality of fixed production assets and working capital of enterprises forms their production assets.

Fixed assets are divided into production and non-production assets. Production assets are involved in the process of manufacturing products or providing services. These include: machines, machines, instruments, etc.

Non-production fixed assets are not involved in the process of creating products. These include: residential buildings, kindergartens, clubs, stadiums, hospitals, etc. Despite the fact that non-productive fixed assets do not have any direct impact on production volume or labor productivity growth, a constant increase in these assets is associated with improvement the well-being of the enterprise’s employees, increasing the material and cultural standard of their lives, which ultimately affects the results of the enterprise’s activities.

The initial cost of the acquired fixed asset is composed of:

a) from the amount of actual costs of acquiring an item of fixed assets without value added tax (VAT), if it was acquired for the production of products that are not exempt from VAT;

b) from the amount of actual costs for the acquisition of fixed assets plus value added tax, if in accordance with Art. 170-172 of the Tax Code, VAT is not refundable and is included in the initial cost of fixed assets:

♦ when using fixed assets in the production and (or) sale of goods (work, services), operations for the sale of which are not subject to taxation in accordance with clauses 1-3 of Art. 149 Tax Code of the Russian Federation; in the production of goods (work, services) for one’s own needs, which are exempt from taxation in accordance with paragraphs 2 and 3 of Art. 149; when selling goods (performing work, providing services), the place of sale of which is not recognized as the territory of the Russian Federation (clause 2 of Article 170 of the Tax Code of the Russian Federation);

♦ when using fixed assets for non-production purposes;

♦ when accepting fixed assets for accounting by organizations and individual entrepreneurs who are not taxpayers or are exempt from taxpayer obligations for calculating and paying taxes in accordance with Art. 145 Tax Code of the Russian Federation. In the case of the acquisition of fixed assets for the production and (or) sale of goods (works, services), operations for the sale of which are not recognized as sales in accordance with clause 2 of Art. 146 of the Tax Code of the Russian Federation.

After the objects are put into operation, the amount of value added tax included in their initial cost is written off to the cost of products (works, services) through depreciation amounts in the prescribed manner.

In the production and economic activities of an enterprise, the same equipment can be used to produce products (works, services) both exempt and not exempt from value added tax. In this case, the VAT tax deduction on acquired fixed assets is carried out in an amount corresponding to the volume of products (works, services) taxed in the total volume of revenue from the sale of products (works, services) for the reporting period (Article 170 of the Tax Code of the Russian Federation).

The cost of fixed assets in which they are accepted for accounting is not subject to change, except in cases established by the legislation of the Russian Federation and PBU 6/01. A change in the initial cost of fixed assets occurs in the following cases:

♦ completions;

♦ additional equipment;

♦ reconstruction;

♦ partial liquidation;

♦ revaluation.

By modernization and reconstruction it is customary to understand the improvement of the qualitative characteristics of a fixed asset: an increase in its capacity, service life, etc. To define these concepts for accounting purposes, it is necessary to be guided by the letter of the Ministry of Finance of the RSFSR dated May 29, 1984 No. 80 “On the definition of the concepts of new construction , expansion, reconstruction and technical re-equipment of existing enterprises" (as amended by the letter of the USSR Ministry of Finance dated February 11, 1986 No. 30), Methodological guidelines for determining the cost of construction products, approved by the Decree of the State Construction Committee of Russia dated April 26, 1999 No. 31.

Replacement cost is the cost of an enterprise to reproduce an item of fixed assets in specific economic conditions. Fixed assets are valued at replacement cost as a result of their revaluation. According to PBU 6/01, an enterprise has the right to revalue groups of fixed assets at current replacement cost no more than once a year (at the beginning of the reporting year).

When making a decision on revaluation of such fixed assets, it should be taken into account that subsequently they are revalued regularly so that the cost of fixed assets at which they are reflected in accounting and reporting does not differ significantly from the current (replacement) cost.

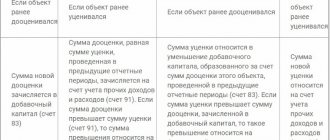

Due to revaluation, an item of fixed assets can be either overvalued or discounted. As a result, either positive or negative differences are formed between the old and revalued residual value of fixed assets.

The results of the revaluation of fixed assets carried out by the enterprise are subject to reflection in accounting separately and are included in the balance sheet data at the beginning of the reporting year. They are taken into account in the financial statements when generating data at the beginning of the reporting year (and not at the reporting date of the previous year - December 31).

The amounts of additional valuation of fixed assets are reflected in the debit of account 01 “Fixed assets” and the credit of account 83 “Additional capital” of the organization; the amounts of markdown in the absence of previously formed additional capital for fixed assets for which a markdown has been identified are subject to reflection in the debit of account 84 “Retained earnings” (uncovered loss)" and the credit of account 01 "Fixed assets".

The assessment of an item of fixed assets, the cost of which upon acquisition is expressed in foreign currency, is made in rubles by recalculating the amount in foreign currency at the exchange rate of the Central Bank of the Russian Federation effective on the date the item was accepted for accounting. If, for the recalculation of the value of an asset or liability expressed in foreign currency and payable in rubles, a different rate is established by law or by agreement of the parties, then the recalculation is made at such rate.

If the amount of actual costs for the acquisition and construction of fixed assets is determined in foreign currency, the foreign currency is recalculated into rubles at the rate of the Central Bank of the Russian Federation effective on the date of acceptance of these costs for accounting. If, for the recalculation of the value of an asset or liability expressed in foreign currency and payable in rubles, a different rate is established by law or by agreement of the parties, then the recalculation is made at such rate.

If the date of payment and the date of acceptance of costs for the acquisition and construction of fixed assets for accounting do not coincide, then the organization may experience exchange rate differences. Exchange differences are the differences between the ruble valuation of an asset or liability, the value of which is expressed in a foreign currency, on the date of fulfillment of payment obligations or the reporting date of a given reporting period, and the ruble valuation of the same asset or liability on the date of its acceptance for accounting in the reporting period or reporting date of the previous reporting period. Exchange differences arising as a result of the acquisition and construction of fixed assets are subject to credit to the financial results of the organization as other income or other expenses.

The residual value of fixed assets is the difference between the original (replacement) cost of fixed assets and the amount of accrued depreciation.

Depreciation of fixed assets is the loss of fixed assets of consumer properties and value during operation.

The rate of wear depends on the type of fixed assets, the features of their design, the quality of workmanship, the nature and operating conditions, the state of maintenance and other factors.

Obsolescence of fixed assets is the partial loss of use value of fixed assets due to the reduction in the cost of their reproduction or due to lower productivity compared to new ones.

Physical wear and tear of fixed assets is the partial or complete loss of fixed assets of their original or nominal technical and operational properties and qualities.

In the financial statements, the amount of physical depreciation is reflected by the amount of accumulated deductions for the complete restoration (renovation) of fixed assets, for which depreciation is calculated.

The efficiency of use of fixed assets determines the need of a trading enterprise for fixed assets. The higher the efficiency of use, the relatively smaller the volume of fixed assets required for the normal production of goods and services.

When analyzing fixed assets, one should study their composition, structure, dynamics; assess the technical condition, degree of renewal and technical improvement; identify the provision of fixed assets, the level of intensive and extensive load; determine existing reserves for the best use of funds.

In this case, it is necessary to determine the number of incoming and outgoing funds, their average annual value, balances at the beginning and end of the year.

In a market economy, there is increasing interest in the cost characteristics of fixed assets, analysis of their condition, the need for timely replacement of obsolete assets and the real financial possibilities for such a replacement.

The change in fixed assets over time is characterized by the following indicators: the coefficient of renewal of funds, the coefficient of retirement of funds, the coefficient of growth of funds, the coefficient of depreciation of funds, the coefficient of serviceability of funds.

To determine the efficiency of use of fixed assets, a certain system of indicators is used:

— general indicators: capital profitability, capital productivity and capital intensity;

- differentiated indicators of the use of the active part of fixed assets: coefficient of extensive load of equipment, coefficient of intensive load of equipment, integral coefficient of utilization of equipment, return on the active part of fixed assets, profitability of the active part of fixed assets, shift ratio of equipment;

— differentiated indicators of the use of the passive part of fixed assets: production removal from 1 m2 of production area, profit per 1 m2 of production area.

There are general and specific indicators of the use of fixed assets. General indicators include capital productivity, capital intensity, and return on funds. Among the private ones are indicators of equipment use: coefficient of extensive use of equipment, coefficient of intensive use of equipment, integral coefficient of equipment utilization, shift coefficient of equipment operation; production area indicators: product removal per 1 m2 of production area and profit indicator per 1 m2 of production area.

Each indicator characterizes individual aspects of the use of fixed assets.

To characterize the processes affecting the structure of fixed assets, the following indicators are used: renewal coefficient, retirement coefficient, growth coefficient, depreciation coefficient, serviceability coefficient.

Examples of assets and liabilities of a business

In simple terms, assets are what a company owns and uses to generate income. And the company's liabilities are what it has assets from.

Examples of assets that a company may own:

- Enterprise OS;

- goods and finished products;

- accounts receivable;

- financial investments;

- cash in accounts and in the cash register.

Liabilities can be divided into 2 groups: liabilities and capital (which, strictly speaking, is also a liability to the participants of the enterprise). Liabilities include accounts payable to counterparties, employees, the state, as well as loans and borrowings.

Subscribe to our newsletter

Read us on Yandex.Zen Read us on Telegram

Let's give a sample balance sheet to see that all assets and liabilities are listed there.

Assets can be grouped as follows:

- intangible (trademarks, patents, websites);

- material (fixed assets, inventories, products);

- financial (investments, accounts receivable, cash).

Both assets and liabilities can be divided into groups depending on the period of use or payment:

- assets are either current or non-current;

- Liabilities are divided into short-term and long-term.

What is OS

Fixed assets (abbreviated as fixed assets) are a certain part of the company’s property that is used to provide services or produce products as a means of labor for more than one calendar year.

Fixed assets must be separated from current assets

This definition may include the following types of property:

- Industrial and commercial buildings.

- Technical and utility rooms (structures).

- A variety of production tools (working tools).

- Power mechanisms, working equipment, machine tools, etc.

- A variety of office and computer equipment.

- Regulating and measuring instruments (instruments), other devices.

- All kinds of vehicles involved in the work process.

- Household equipment.

What are the fixed assets of an enterprise? In short, this concept includes everything that is not consumed in the production cycle. But the OS wears out during use, so it cannot be considered eternal.

Note:

There is a concept of useful life. They express the period of time during which fixed assets generate income or are used for production.

Mechanism for maintaining the balance of assets and liabilities

Let us illustrate the fact of the relationship between assets and liabilities, as well as the mechanism for maintaining balance sheet equality, using several examples:

As can be seen from the diagram:

- As the amount of the authorized capital (liability) increases, the amount of fixed assets (asset) increases.

- We increase the quantity of goods (asset) - we increase accounts payable (liability). Here: we reduce funds when paying for this product (asset) - we reduce accounts payable to the supplier (liability).

- We increase the quantity of finished products (asset) - we increase the debt to the employees producing them in the form of salaries (liability). Here: we reduce the amount of money when paying salaries (asset) - we reduce accounts payable to employees (liability).

Depreciation

Since fixed assets wear out during operation, their value is determined by the depreciation method. To find the current value of an object (residual value), it is necessary to subtract all annual depreciation amounts from the original cost.

Valuation of fixed assets of an enterprise is carried out in three ways

The analysis of the enterprise's fixed assets is carried out on the basis of the residual value of each object. Depreciation can be calculated using four methods:

- Linear. The initial cost is divided by the useful life, and then this factor is subtracted by the number of years worked.

- A decrease in residual value is proportional to the volume of products produced. Roughly speaking, the tool is designed to produce 1000 parts. The initial cost is divided by 1000, and then the resulting coefficient is compared with the current quantity of products produced.

- A real reduction in the balance. The residual value of the object at the beginning of the year is taken and the uniform depreciation rate for it is subtracted from it.

- The sum of years of useful life. It is calculated taking into account the initial cost and the annual ratio using the formula PO/ES, where PO is the number of years until the end of the facility’s service life, and PO is the number of years worked.

Depreciation of fixed assets

Russian legislation stipulates that depreciation is calculated over the useful life. Even if after 100% write-off of depreciation the equipment continues to operate, it is reflected in the reporting at zero cost.

Depreciation is charged only on property whose value exceeds 40 thousand rubles. If the price of fixed assets is less than 40 thousand, then the costs are written off to cost at once, on the day the equipment starts operating.

With a gradual decrease in the initial cost, by writing off depreciation, a residual value is formed, which is reflected in the organization’s reporting.

In IFRS, if an object has expired its depreciation period, but continues to be used, then the service life is revised, and the company’s profit increases. The opposite situation may also arise - the object is not used, but depreciation has not been fully accrued. In this case, the profit of previous periods is recalculated.

According to IFRS, the selected depreciation method can be changed at any time during the operation of the equipment. The justification for the changes made is reflected in the explanatory note to the reporting.

Russian legislation does not allow such changes. Depreciation is calculated over the entire period using one method, fixed in the company's accounting policy.