To be able to carry out its activities, the organization uses fixed assets. This property is at the disposal of the company for more than one operating cycle. These are buildings, equipment, machines, vehicles, etc. To account for them, natural and monetary valuations are used.

The first group represents fixed assets in physical units, for example, square meters (buildings), capacity (machines). But in a market economy, each element of property has its own value. This is the price that the consumer is willing to pay, and the manufacturer to offer for this or that asset.

To calculate the cost of equipment, certain methods are used. It is this characteristic that is used to find the wear coefficient. On its basis, a decision is made on the rational renewal of fixed assets.

Types of valuation

In financial and economic analysis, the depreciation rate of fixed assets is studied precisely from the position of valuation. It is expressed in national monetary units. This allows you to compare and study the dynamics of all groups of funds.

The same units represent the degree of use of fixed assets. When purchasing one or another unit of the presented funds, it is characterized as the initial cost. Every year, equipment and other objects lose their former qualities and age. Therefore, with each operating period, the amount of depreciation accumulates.

It is subtracted from the original value. This results in the real value of the object on the date of the analysis. During operation, fixed assets may wear out more or less than expected. In this case, a revaluation is carried out, and the actual wear and tear as of the date of analysis is determined.

How to calculate depreciation of fixed assets

During this entire period, depreciation is charged to expenses, reducing the initial cost of the object. Thanks to depreciation charges, there is a return on investment in fixed assets. This indicator in the total value for the entire period of use of the fixed assets at any time allows you to establish the residual cost indicator for each fixed asset item.

This process can be either natural, natural, or depend on storage conditions, rules of operation of fixed assets and the pace of technical progress.

The provisions of this paragraph do not apply to organizations changing their legal form.

When revaluing fixed assets, data from the original and residual values are used to calculate the degree of depreciation of equipment at the enterprise.

Initial cost

In accounting, an object is initially taken onto the balance sheet at its original cost. This is the amount of money that an organization paid for the right to own property. This also includes the costs of delivery, installation and commissioning.

When calculating the wear rate in the first year of operation, this value is taken as the basis for the calculation. At the time of purchasing an object, its service life is determined. Such information is obtained from the relevant documentation with technical characteristics.

Based on this, depreciation is charged on the original cost. It corresponds to the full operational amount of wear and tear of the object. When it is 100%, depreciation savings allow the funds to be renewed.

Replacement cost

Depreciation of fixed assets does not always correspond to the planned level. In conditions of inflation, this allows you to bring the book value (initial) value as close as possible to the market value. To determine the depreciation rate of fixed assets that were purchased in different years, it is necessary to bring all objects to modern market conditions.

Therefore, in the event of a significant difference between real and book prices, the organization carries out a revaluation. This cost is called replacement cost. It is also subject to depreciation and amortization with each operating period. This is a labor-intensive process, but in certain cases necessary.

To correctly determine the wear rate, as well as an adequate amount of production costs, this action simply cannot be ignored. Replacement cost makes it possible to calculate the real market value of products and depreciation.

How to determine it

Now, having decided what OS wear is and what types it comes in, you can move on to how to calculate it.

Coefficient and percentage of depreciation of fixed assets

The following options are available for calculating the percentage of OS wear.

- Linear

. This implies writing off the cost in equal parts (or depreciation) over the entire period of use of the OS. This method is always applied to buildings that belong to the following groups: objects that have been in use for 20-25 years, those that have been in use for 25-30 years, and those that have been in use for more than 30 years. For other objects, it is possible to use some other method. The advantages of the linear method include ease of calculation, accuracy in writing off the cost of objects and uniformity. The disadvantages of this method include the fact that it is not suitable for organizations that plan to update production assets quickly enough and for property to which the non-linear method will be applied, the total tax amount will be less. - Reducing balance

. This is a non-linear method in which depreciation of fixed assets is accrued unevenly over the entire period of its use. To use this calculation, you must assign an acceleration factor and a salvage value write-off option. The advantages of this method include the fact that the performance of almost all operating systems is initially higher. And this method assumes precisely that the usefulness of using equipment decreases every year. The disadvantages include difficult calculations and the need for additional values for this calculation. - Write-off of cost based on the sum of the numbers of years of the useful life period

. The total amount of depreciation for the year depends on the original cost, the sum of the numbers of years of the useful life period and the number of years remaining until its completion. The advantage is that this method works well in situations where the OS is used most intensively at the beginning. Another advantage is the simplicity of calculations. The method has no significant disadvantages. - Write-off of the original price of the object is proportional to the quantity of products

. With this method, depreciation depends on the number of products that were produced during the reporting period, and also depends on the expected number of products over the entire duration of use. The advantage of this method is that it shows the wear and tear of the OS more than other methods. The downside is the difficulty in calculations, since you need to initially decide how to calculate depreciation, annually or monthly.

To analyze the state of the OS, the wear coefficient of the OS is used. It shows how much the OS has been depreciated. This ratio is the ratio of depreciation to the original cost of the asset. All operating systems are subject to moral and physical wear and tear during their operation. To determine the level of wear, this coefficient is calculated.

A lot of useful information on calculating wear and tear on operating systems is given in this video:

Cost calculation

The cost of wear and tear can be calculated as follows:

- With method 1: A = * depreciation rate.

- At 2: A = * coefficient. acceleration * depreciation rate.

- With method 3: A = initial cost of the asset * number of years remaining until the end of the effective use period / sum of the numbers of years of the effective use period

- With method 4: A = ratio of the product actual volume of production * initial cost / / approximate volume of production for the entire period of use.

Wear type

There are two main types of wear. The first type is called physical. The depreciation rate of fixed assets is calculated in accordance with this indicator. During operation, components, materials of components and systems become obsolete. Equipment and other units of non-current assets gradually lose their ability to perform the functions assigned to them at the same level.

Over time, the number of repairs and downtime increases. This is physical wear and tear. But there is another variety. In this case, the fixed assets are working properly, but the principle of their operation or market value is already outdated.

If new technological equipment appears, which is characterized by greater productivity and quality of finished products, against its background the previous facilities seem less profitable. This is obsolescence. It must also be taken into account in the depreciation process. A re-evaluation is needed.

Fixed assets are produced assets used repeatedly or continuously over a long period, but not less than one year, for the production of goods, provision of market and non-market services. Fixed assets are divided into tangible and intangible.

Material fixed assets (fixed assets) include buildings, structures, machinery and equipment, measuring and control instruments and devices, housing, computer and office equipment, vehicles, tools, production and household equipment, working, productive and breeding livestock, perennial plantings and other types of tangible fixed assets.

Intangible fixed assets (intangible assets) include computer software, databases, original works of entertainment, literature or art, high-tech industrial technologies, and other intangible fixed assets that are objects of intellectual property, the use of which is limited by the ownership rights established on them.

Depreciation is the gradual loss of fixed assets of their use value. It is necessary to distinguish between moral and physical wear and tear.

Physical wear and tear is the loss of fixed assets of their consumer value as a result of wear of parts, exposure to natural factors and aggressive environments. Physical wear and tear can be of two types: productive and unproductive. Productive physical wear and tear is a loss of value during operation; non-productive wear and tear is typical for fixed assets that are under conservation due to natural aging processes.

A number of indicators are used to characterize physical wear and tear.

The coefficient of physical wear and tear is calculated using the formula

Ki = I/FIRST *100 where I

– the amount of depreciation accrued over the entire period of operation;

First

, the initial (replacement) cost of the fixed asset.

For objects whose service life is below the standard, the wear coefficient can be calculated using the formula

Ki = Tf /T n *100 where Tf

– actual service life of this object;

Tn

is the standard service life of this object.

For objects whose service life has exceeded the standard, the wear coefficient is found using the formula

KI = TF /TN +TV *100 where TF

– actual service life of this object;

Tn

– standard service life of this object;

TV is

the possible remaining service life of a given object in excess of what is actually achieved.

The coefficient of physical deterioration of buildings and structures can be determined by the formula

where di

– the share of the i-th structural element in the cost of the object;

ai

is the percentage of wear of the i-th structural element.

Obsolescence is a loss of value due to a decrease in the cost of reproduction of similar fixed assets due to improvements in technology and organization of the production process. There are two types of obsolescence:

- fixed assets depreciate in value, since similar fixed assets are produced at lower costs and become cheaper;

— as a result of scientific and technological progress, more modern and more productive equipment appears.

The relative value of obsolescence of the first type can be calculated using the formula

KMI = FIRST - SVOST / FIRST *100 where First

– the initial cost of the means of labor;

Svost

is the replacement cost of the means of labor.

Obsolescence of the second type can be established by determining the replacement cost using the formula

SUST = SSOVR * EMPTY / PSOVR where Ssovr, Sust

– replacement cost of a modern and outdated machine;

Psovr, Pust

– the performance of an outdated and modern machine.

Obsolescence of the second type - can be partial or complete.

Partial - partial loss of consumer value and value of the machine. Its constantly increasing size may lead to the use of this machine in other operations.

Complete – complete depreciation of the machine, in which its further use is unprofitable.

The essence of obsolescence is that the means of labor depreciate and lose value before the end of their physical service life.

Depreciation of fixed assets reflected in accounting accumulates throughout their service life in the form of depreciation charges in depreciation accounts

Depreciation is a systematic process of transferring the cost of means of labor as they wear out to the product produced with their help. Depreciation is the monetary expression of physical and moral wear and tear of fixed assets. The amount of depreciation accrued during the operation of fixed assets must be equal to their original (replacement) cost.

Objects for calculating depreciation are fixed assets that are in the organization under the right of ownership, economic management, and operational management.

Depreciation policy is an integral part of the economic policy of any state. By establishing the depreciation rate or useful life, the procedure for calculating and using depreciation charges, the state regulates the pace and nature of reproduction in industries.

Useful life is the average service life of objects of this type.

The depreciation rate is the annual percentage of reimbursement of the cost of fixed assets established by the state.

The depreciation rate is determined for each type of fixed assets.

The depreciation rate for complete restoration is calculated using the expression

ON = C FIRST – L+D / FIRST *TA where Nv

– annual depreciation rate for complete restoration;

First

, the initial cost of fixed assets;

L

– liquidation value of fixed production assets;

D

– cost of dismantling liquidated fixed assets and other costs associated with liquidation;

Ta

– useful life.

Depreciation rates are differentiated by groups and types of fixed assets. They also depend on the conditions in which fixed assets are operated.

The depreciation rate is related to the useful life of the fixed asset. We can assume that the useful life is the reciprocal of the depreciation rate.

During the useful life of an object of fixed assets, the accrual of depreciation charges is not suspended, except when they are under reconstruction or modernization by decision of the head of the organization. The accrual of depreciation is also suspended for fixed assets transferred by decision of the head of the organization to conservation for a period of more than three months.

Depreciation on the cost of newly received fixed assets begins on the first day of the month following the month of their receipt. For retired fixed assets, depreciation ceases on the first day of the month following the month of their disposal.

Residual value

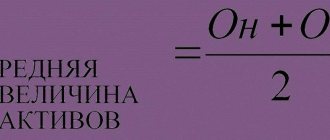

The amount of depreciation must be taken into account by the financial service of the organization. It allows you to determine the real book value of funds on the date the analysis is performed. The calculation of the depreciation rate of fixed assets is carried out precisely at the residual value. To determine it, the actual amount of wear and tear is subtracted from the original or replacement cost.

Analysis of this indicator allows us to draw conclusions about the structure of fixed assets and what equipment (old or new) the company uses to manufacture its products. If funds are characterized by a high degree of depreciation, management is simply obliged to develop measures to update non-current assets. Otherwise, the products will not be competitive, and sales revenue will decrease.

Only new, modern equipment can help increase the scale of production and commercial activities. Therefore, assessing the level of depreciation is mandatory when analyzing non-current assets.

The concept of "wear and tear"

In the process of accounting for the state of fixed assets (assets), various methods of calculating depreciation are used; for each method, a special intermediate depreciation coefficient must be used.

Over time, all fixed assets are subject to wear and tear, even if they are not used, but are simply kept idle. In the process of wear and tear, the residual value of the fixed asset decreases.

Depreciation is the process of reducing value when it is transferred to manufactured products. Depreciation can occur at different rates, depending on the depreciation group, as well as on the period for calculation.

Wear is a negative change in properties and qualities:

- if we are talking about equipment, then these are changes that worsen the performance of the equipment - an increase in energy consumption and consumption of other resources (lubricating oils, consumables, etc.), the rate of defects when working with such equipment, corrosion, grinding of parts, an increase in the frequency of repairs and cost of maintenance, increased risk of injury;

- If we are talking about buildings, then we are also talking about the deterioration of the consumer properties of the premises - cracks and changes in the geometry of the foundation, damage and defects of the facade and roof, failure of ceilings and staircases, an increase in the number of unscheduled replacement or repair activities inside the building. For the consumer, these are drafts and leaks, sloped floors, mold in corners, uncomfortable temperature conditions and damage to furniture, equipment and other property.

It is also possible that it is not a physical deterioration in consumer properties, but their inconsistency with the current level of technological needs, for example, when it comes to computer technology - the power of a computer purchased two years ago may not be enough for a new graphics editor, or the image quality of a working kinescope monitor does not correspond to similar TFT monitors and no longer satisfies the designer.

Calculation of coefficient

The wear coefficient, the formula of which is used in the analysis, is quite simple. But its result is important information. It shows how outdated the equipment is. The formula looks like this:

— Keys = A / PS, where A is the amount of depreciation, PS is the initial valuation of the property.

The data for calculation is taken from Form No. 1 of the accounting report “Balance”. This indicator depends on the chosen method of calculating depreciation. Therefore, to obtain an adequate research result, this information must be taken into account.

The standard value is below the line below 50%. But in order to draw correct conclusions about the state of the funds, it is necessary to compare it with analogues of competing enterprises.

Wear factor value

The formula for the depreciation rate of fixed assets is used in analytical accounting, but it does not always reflect the actual state of a particular fund. An asset that is not actually completely worn out may have a zero residual value.

The reason for the conventionality of the depreciation coefficient is its dependence on the method used for determining depreciation charges, therefore it characterizes only the degree of depreciation of fixed assets, and not the degree of their depreciation.

We suggest you read: Banks in which bailiffs do not seize accounts

When assessing the value of the wear coefficient, it is compared with certain data for enterprises in a similar industry or competitors.

The formula for the depreciation rate of fixed assets can be calculated in relation to the following indicators:

- physical depreciation of fixed assets;

- obsolescence of tools and equipment;

- the ratio of the residual value of funds and their market prices, etc.

It is advisable to consider the depreciation coefficient with the serviceability coefficient of fixed assets.

Since these indicators are often used to characterize the condition of fixed assets, we note that these indicators are conditional. The reason is the dependence of the indicator and serviceability coefficient on the method of calculating depreciation. In other words, the depreciation coefficient does not reflect the actual depreciation of fixed assets, just as the serviceability coefficient does not provide an accurate assessment of their current condition.

Calculation of physical wear and tear

The depreciation coefficient, the formula of which was discussed earlier, may be slightly changed depending on the actual rate of aging of funds. If the wear rate in the accompanying documentation turns out to be overestimated, the equipment and buildings will lose their performance characteristics faster. The wear coefficient in this case is determined as follows:

— Keys = If / In, where If is the actual wear, In is the standard value.

If the result is multiplied by 100, the result is a percentage. Sometimes it happens that an object is operated for a longer period than stated in the accompanying documentation. In this case, the coefficient calculation looks like this:

— Keys = If / (In + Iv), where Iv is wear and tear, which can still be transferred to the cost price in the future.

This approach allows us to calculate the physical obsolescence of funds. But it is also necessary to take into account the level of obsolescence.

Calculation of obsolescence

The depreciation rate of fixed assets, the formula of which was presented earlier, should also take into account the moral type of obsolescence of property. It can be of two types. The first type of obsolescence occurs when the cost of manufacturing fixed assets by the companies producing them becomes cheaper.

For example, new equipment recently introduced to consumers is quite expensive. This segment of the market alone is filled with numerous manufacturers, and competition is growing. The price of such properties is reduced. The market value of funds falls. The coefficient in this case is calculated as follows:

— K1 = (1 – VS / PS) * 100, where VS is the replacement cost.

This type of obsolescence does not cause a loss to the company, since its cost is recovered through depreciation accumulations. But the second type of wear and tear is unfavorable for the organization. It occurs when more productive equipment appears on the market.

In this case, the coefficient is calculated as follows:

K2 = (1 - Pu / Mon) * 100, where Pu is the productivity of old equipment, Mon is the production of new equipment.

In this case, they talk about the lost benefits of the organization. This is a negative trend for the company.

Depreciation

The wear and tear of equipment is compensated by the company through the creation of a special fund. At the time of acquisition of an object, its initial cost is put on the balance sheet, and its service life is also determined. During this period, depreciation is calculated using different methods.

The amount of depreciation is transferred to cost. The depreciation rate, the calculation of which was presented above, strongly depends on the method of calculating depreciation. It covers objects owned by the company (they are not planned to be sold in the future) that have been in operation for more than 12 months. A unit of such property must cost at least 20 thousand rubles.

A sinking fund is necessary for every enterprise. It allows you to gradually accumulate significant amounts of funds to renew fixed assets. Depreciation is calculated using different methods.

What is wear and tear

Wear and tear is the decrease in the value of an object during its operation or simply over time. Each asset is purchased for a specific amount, called the initial cost (IC) expressed in Russia in rubles, and is fixed at the time of commissioning or putting on the balance sheet. They also measure the amount of absolute wear.

The initial cost includes estimated commissioning and delivery costs.

Annual changes in value are subtracted from the NA, and the difference represents the real value of the object.

Determination of service life

The time during which an object retains its properties of suitability for further use is called its service life. This parameter is the most important for determining the degree of wear and is justified by the technical characteristics specified in the asset passport or other regulatory documentation.

In case of exhaustion of the service life, renewal of fixed assets is required.

What is replacement cost

The seemingly simple task of determining wear and tear is complicated by inflationary processes. The calculated price during its formal calculation may differ significantly from the market price, which necessitates revaluation and bringing it in accordance with the current situation. The result of a rather complex process, carried out taking into account many factors, is the replacement cost, which in simplified form is the real price of a similar object minus depreciation.

Types of wear

An object may lose its value for two reasons:

- Physical deterioration;

- Obsolescence.

The reasons for the first are obvious and fully correspond to the name. According to all the laws of physics, parts of technical equipment during operation are exposed to frictional forces, deformations and other factors leading to exhaustion of motor life. These destructive but inevitable processes of the reliability curve are described, which by the end of its service life falls below the permissible standard.

As for obsolescence, it is associated with the emergence of more modern means of production, which makes the operation of equipment on the balance sheet ineffective or even pointless. There are many examples.

At one time, thousands of perfectly serviceable and new (in lubricated and original packaging) mechanical adding machines became completely unnecessary after the advent of electronic calculators.

Intangible assets, for example, computer programs, deserve special mention. If their cost does not exceed one hundred thousand rubles, they can be written off “at a low price” when they become obsolete, while more expensive ones are subject to depreciation, with an acceptable minimum two-year service life.

Today, environmental and social types of wear associated with legislative changes in safety requirements and working conditions are also added to this list.

https://youtu.be/J_70bpiDbfg

Depreciation rate

When examining the depreciation rate of fixed assets, the depreciation rate must also be determined. This is the legally established level of cost accruals that an organization makes based on the amount of its permanent property. It can be considered the officially accepted depreciation amount. The depreciation rate is determined as follows:

— Na = (PS – LS) / T * PS, where LS is the liquidation value, T is the operating period.

This is an officially recognized state method of calculating depreciation on cost.

Some calculation features

When studying the wear rate, it is necessary to note several of its features. In a transitional market economy, the inflation rate is quite high. In order to be able to obtain real data on the value of fixed assets, production costs and the amount of obsolete property, its revaluation must be carried out more often.

In developed countries, this process occurs on average once every 10 years, but domestic enterprises evaluate the real market value of funds more often. Such work is carried out once every 1.5-2 years. This allows you to calculate the actual wear rate. Based on the research results, the company's management can make the right decisions about updating fixed assets.