Advance for an employee: is it necessary to pay?

The concept of an advance as such does not exist in Labor Law. This name is accepted in everyday life, which means half of the earnings received in the first half of the month worked.

The rules of the standard provided for in paragraph 6 of Art. 136 of the Labor Code of the Russian Federation, employers were obliged to pay wages to staff twice a month at least. The timing of advance payments is determined by the company’s internal local regulations, in which the period for settlements with personnel must be at least 15 calendar days after the end of the period in which salaries are accrued.

Important! If local acts establish a different procedure for settlements with personnel, then they have no legal force.

So, the Labor Code has established a procedure for paying advances at least every half month, which is worked by the company’s employees. The Ministry of Labor of the Russian Federation speaks about this in its commentary No. 14-1/OOG-8532 dated September 23, 2016, and also requires observing the maximum reasonable period of time between the first and second half of earnings. It also follows from this norm that the timing of settlements for the first half of earnings must be clearly specified. For example, on the 15th of the current period, and not from the 15th to the 25th of the month.

https://youtu.be/EuaZU_tGdK0

Nuances

There are specifics about how to transfer personal income tax when transferring other payments. For example, there are specifics when sick leave or vacation is paid.

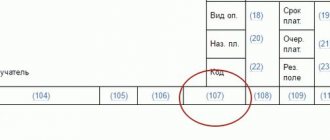

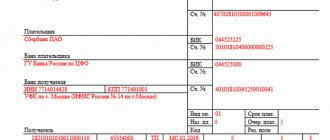

The company must pay personal income tax when the last day of the month arrives.

It is considered that the company has fulfilled its obligation if the payment is made and the treasury code is correctly written in the financial documents.

What is the procedure for calculating advance payments for staff?

The earnings due for the first half of the month (advance) are paid in any way provided by the company:

- Cash from the cash register (based on payroll);

- By bank transfer to the employee’s bank account (based on the payment register).

Labor legislation does not establish a special method for calculating the advance, in contrast to the timing of its payment. But some regulations of the Ministry of Labor (dated 09/08/2006 No. 1557-6, dated 02/03/2016 No. 14-1/10/B-660) specifically indicate that the amount of the advance should be equated to the actual amount of earnings for the period of time worked. Therefore, the calculation must be based on the information recorded in the staff time sheet. This is also indicated by the comments of the Ministry of Health and Social Development in its information letter dated February 25, 2009 No. 22-2-709.

In some cases, the company’s internal regulations establish a fixed advance amount of 30-40% of the salary, a fixed ruble amount . In both cases, using these methods, there is a risk of overpayment of earnings if the employee is absent (vacation, business trip, days of temporary disability, absenteeism).

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

What if the personal income tax from the advance payment is transferred before the payday for the month?

If you transfer 13% to the treasury before the deadline established by law, you may encounter the following problem. The Tax Service does not recognize the transferred amount as tax, and will consider the obligation of the tax agent - employer not fulfilled in accordance with paragraph 9 of Article 226 of the Tax Code of the Russian Federation. Such an explanation is given in the Letter of the Ministry of Finance dated September 16, 2014 N 03-04-06/46268, the Federal Tax Service dated September 29, 2014 N BS-4-11 / [email protected] Ministry officials also point out that the amount of tax paid in advance should be taken into account future payments will not work - you will have to issue a refund. After all, the interest will be paid not from the employee’s income, but from the employer’s own funds. Personal income tax in full will need to be paid again - on time. As a general rule, interest is transferred to the budget on the day of actual payment of the second half of the salary (the day of final payment) or the next day after it (no later). Otherwise, debt will form with all the ensuing consequences.

Responsibility of an employer who does not pay an advance

The procedure for calculating and paying an advance (as well as full earnings) should not be violated. Otherwise, the company cannot avoid penalties. Often, employees themselves insist on paying their earnings in one lump sum. This position is extremely dangerous. The norms of the Labor Code of the Russian Federation clearly define the number of payments per month: at least two. This means that all employees are given uniform rules for receiving the first and second half of their earnings for the period worked.

Violation of this rule is fined and the employer and the official responsible for such an operation suffer. The following sanctions apply to employers:

- 30,000 to 50,000 rubles (for a primary violation);

- 50,000 to 100,000 rubles (in case of repeated violation).

In relation to official representatives of the company (chief accountant or general director) it is established:

- 10,000 to 20,000 rubles (for the first time);

- 20,000 to 30,000 rubles (repeat);

- Or disqualification (removal from professional duties) from 1 to 3 years.

There are also financial penalties for employers who pay advances late. Based on Art. 236 of the Labor Code of the Russian Federation, the amount of compensation is paid to personnel for delayed wages from the day that occurs after the established deadline for payment of wages.

Personal income tax and advances: method of deduction and payment period

When paying income to individuals, the tax agent (in this case the employer) is obliged to withhold personal income tax and transfer it to the budget. The fact of receiving income when calculating earnings should be based on the norms of paragraph 2 of Art. 223 of the Tax Code of the Russian Federation, where the last day of the month is recognized as income in terms of wages. This means that the company withholds personal income tax and pays it only after paying the second part of the earnings , i.e. in the end of the month.

The deadline for transferring the tax depends on the conditions stipulated by the company’s regulations for remuneration, but without violating the rules established by clause 6 of Art. 226 NK. Namely:

- The day of receiving money from the bank to pay wages is no later than the day of receipt;

- The day of settlement (payment) to staff bank cards is no later than the day of settlement;

- Payments for wages in kind - no later than the day when personal income tax was withheld in cash settlements with the employee.

Difficulties may arise if an employee received an advance and went on vacation without saving wages in the second half of the month. Withholding personal income tax from the advance means violating the norms of clause 6 of Art. 226 NK. In such a case, the company can do the following:

- pay the due funds minus tax;

- at the end of the month, reflect the withheld personal income tax on account 68 (sub-account for personal income tax calculations);

- pay into the budget when paying wages to all company employees.

In this case, you will not have to dispute fines with the Federal Tax Service and pay penalties for being late when paying taxes.

Advance payments for personal income tax

| For January - June - no later than July 15 of the current year, in the amount of 50% of the annual amount of advance payments |

| For July - September - no later than October 15 of the current year, in the amount of 25% of the annual amount of advance payments |

| For October - December - no later than January 15 of the following year, in the amount of 25% of the annual amount of advance payments |

If income from business activities arose during the year and the declaration is submitted after the expiration of the first or second deadlines for payment of advance payments, then the personal income tax amount is divided accordingly not into three, but into two parts or not at all.

Individual entrepreneurs who have been operating for more than a year pay one-third of the annual personal income tax amount calculated on income for the previous tax period, taking into account tax deductions provided for in Articles 218 and 221 of the Tax Code of the Russian Federation, within the same deadlines.

In the event of a significant (more than 50 percent) increase or decrease in income during the tax period, an individual entrepreneur is required to submit a new tax return to the tax authority indicating the amount of expected income for the current year. In this case, the tax authority recalculates the amounts of advance payments for the current year based on unfulfilled payment deadlines.

Recalculation of the amounts of advance payments is carried out by the tax authority no later than five days from the date of receipt of the new tax return ( clause 10 of Article 227 of the Tax Code of the Russian Federation

).

Recalculation can be made specifically for unfulfilled payment deadlines, i.e. the new tax return must be submitted to the tax authority within the time limits indicated in the table above. If the declaration is not submitted before the due date of the next payment, then the established amount of personal income tax must be paid into the budget, regardless of whether at that moment the income was received in the amount as expected or not.

In case of termination of activity and (or) termination of the existence of a source of other income before the end of the current year, a tax return must be submitted to the tax authority within five days ( Article 229 of the Tax Code of the Russian Federation

).

In other words, if there is no activity and there is no income, a tax return must be filed on time, otherwise you will have to bear financial responsibility in the form of tax sanctions (Article 119 of the Tax Code of the Russian Federation).

So, the certificate has been received, no later than a month and five days after the source of income arises, a declaration has been filed, the personal income tax amounts and payment terms for the current year are known...

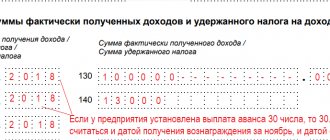

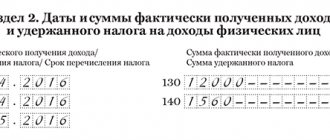

Reflection of the advance in form 6-NDFL

In the new form of the 6-NDFL report, reflection of the advance payment is not provided for by the filling rules. Earnings at the end of the month are indicated in section 2 of the form, indicating the date of payment of income to staff. All calculations are entered into the report as a total amount. The personal income tax payment deadline in the report must comply with tax legislation.

If income was paid to employees only in the first part of the month (as an advance), then the amount of payment is recognized as income in terms of wages on the last day of the month for which the calculation is made. The amount of personal income tax, which is calculated from income, but is not withheld because Tax is not withheld from the advance payment; you will need to deduct it from the employee’s next salary payment.

In such a situation, settlements with personnel are reflected in Form 6-NDFL as follows:

- an advance that is recognized as wage income is reflected in the total amount of income received;

- tax withholding date – taking into account the actual personal income tax withheld.

Important! When checking the report, tax officials may recognize untimely withholding of income tax.

An explanatory note to the report on Form 6-NDFL will help protect the company from quibbles and fiscal sanctions from tax authorities. It should indicate the reason for such a discrepancy in the timing of income payment and tax withholding.

Common Questions

Question 1: The HR service of the employing company has fixed the terms for payment of the advance payment amount and the final payment of wages in the collective agreement. Should changes be made to the document when indicating the timing of payment of bonuses and allowances?

To record calculations for employees' wages in clause 6 of Art. 136 of the Labor Code of the Russian Federation clearly states the conditions for earnings/advance payments and the dates of their payment. With regard to increasing/stimulating payments, the following should be noted. The source of the bonus is usually the company's profit. Its assessment requires some time, which deviates from the deadlines fixed in Art. 136 TK.

Having assessed the financial results that form the basis for calculating bonuses and other incentive accruals, payments are made separately. The rules for such accruals are specified in Part 2 of Art. 135 of the Labor Code of the Russian Federation, which contains requirements that indicate that bonus (incentive) accruals for successful labor results are fixed in:

- local acts of the company;

- collective agreement;

- wage regulations.

These documents should provide for the timing and frequency of payment of these accruals.