How is advance payment reflected in Form 6-NDFL?

First, let us recall the provisions of Part 6 of Art.

136 of the Labor Code of the Russian Federation, according to which wages are paid at least every half month. The specific date for payment of wages is established by internal labor regulations, a collective agreement or an employment contract no later than 15 calendar days from the end of the period for which it was accrued. Please note that in this edition, this part has been in effect since October 3, 2020 (clause 1, article 2, article 4 of the Federal Law of July 3, 2016 No. 272-FZ). The seemingly insignificant changes required many employers to make amendments to local regulations and employment contracts.

In Letter No. 14-1/OOG-8532 dated September 23, 2016, the Ministry of Labor noted that the documents that can establish wage payment days in Art. 136 of the Labor Code of the Russian Federation are listed separated by commas, that is, the legislator emphasizes the equivalence of these documents, in any of which the issue of days of payment of wages can be resolved.

The Information of Rostrud “On the application of Article 2 of the Federal Law of July 3, 2020 No. 272-FZ “On amendments to certain legislative acts of the Russian Federation in terms of remuneration” (posted on the official website of the department on December 20, 2016) states that This law does not change the procedure for paying wages.

At the same time, taking into account the new wording of Art. 136 of the Labor Code of the Russian Federation, wages must be paid:

- for the first half of the month - on the established day from the 16th to the 30th (31st) day of the current period;

- for the second half of the month – from the 1st to the 15th of the next month.

As for setting the date for payment of the advance, according to the explanations of the Ministry of Labor given in Letter No. 14-1/10/B-660 dated 02/03/2016 “On the amount and timing of payment of wages, including for half a month”, the Labor Code establishes a requirement for the maximum the permissible period of time between payments of parts of wages with regulation regarding the issue of specific terms for its payment at the employer level.

At the same time, it is unacceptable to establish, instead of a specific day of salary payment, a period during which it can be paid (for example, from the 16th to the 18th). This conclusion is contained in the Letter of the Ministry of Labor of the Russian Federation dated November 28, 2013 No. 14-2-242.

Recently, both the Ministry of Finance and the Federal Tax Service have received many clarifications, according to which there is no need to withhold personal income tax from the advance payment (letters of the Federal Tax Service of the Russian Federation dated 04.29.2016 No. BS-4-11/7893, dated 03.24.2016 No. BS-4-11 /4999, Ministry of Finance of the Russian Federation dated October 27, 2015 No. 03-04-07/61550).

Let us recall that by virtue of clause 3 of Art. 226 of the Tax Code of the Russian Federation, tax amounts are calculated by tax agents on the date of actual receipt of income, determined in accordance with Art. 223 of the Tax Code of the Russian Federation, on a cumulative basis from the beginning of the tax period in relation to all income (except for income from equity participation in the activities of the organization), in respect of which the tax rate established by paragraph 1 of Art. 224 of the Tax Code of the Russian Federation, accrued to the taxpayer for a given period, with the offset of the amount of tax withheld in previous months of the current tax period.

The Letter of the Ministry of Finance of the Russian Federation dated 01.02.2016 No. 03-04-06/4321 noted that before the end of the month, income in the form of wages cannot be considered received by the taxpayer. Accordingly, the tax cannot be calculated until the end of the month. Consequently, the tax agent deducts the amount of tax calculated at the end of the month from the taxpayer only when it is actually paid after the end of the month for which this amount of tax was calculated. A similar opinion is contained in the Ruling of the Supreme Court of the Russian Federation dated May 11, 2016 No. 309-KG16-1804.

At the same time, you need to pay attention to the situation when the advance is paid on the last day of the month.

The Ministry of Finance believes (see Letter No. 03-04-06/69181 dated November 23, 2016) that if the tax agent manages to pay the advance before the end of the month, then personal income tax does not need to be transferred to the budget. This is due to the fact that, as a general rule, the institution calculates personal income tax on the last day of the month, and the tax must be withheld once - when paying income after the end of the month.

As for the arbitrators, they are also of the opinion that when paying an advance on the last day of the month, personal income tax on its amount does not need to be transferred to the budget (Resolution of the AS UO of February 24, 2016 No. F09-11987/15 in case No. A76-10562/2015).

The advance amount is not subject to separate reflection in form 6-NDFL: in section. 2 of this form shows the amount of wages recognized on the last day of the month. As already noted, personal income tax is withheld during the final settlement with employees and is also indicated in one amount.

We suggest you familiarize yourself with If you haven’t formalized your inheritance and died

In practice, a situation is possible when an employee receives an advance in the amount of 40%, but at the end of the month he will not have income from which personal income tax can be withheld.

This happens if for the second half of the month the employee was not accrued income (for example, he was granted unpaid leave), and in the first half of the month, due to non-working holidays, the employee actually did not work half of the working time and income was received, including for unworked time.

In section 2 of form 6-NDFL, the accountant will reflect the indicators as follows:

- on the last day of the month the amount of income actually received in the form of an advance will be recognized;

- the date of tax withholding will be indicated, which does not coincide with the date of payment of the final payment amount for the corresponding month.

Since the tax was not withheld in a timely manner, the accountant will need to provide the tax office with an appropriate explanation, which will relieve the institution from liability for providing false information.

* * *

Summarize:

- wages for the first half of the month (from the 1st to the 15th) must be paid on the appointed day from the 16th to the 30th (31st) day;

- the payment date is established in any of the documents listed in Art. 136 of the Labor Code of the Russian Federation (internal labor regulations, collective or labor agreements), while it is unacceptable, instead of a specific day for payment of wages, to establish a period during which it can be paid;

- When determining the amount of the advance, controllers recommend taking into account the time actually worked by the employee (the work actually performed by him). At the same time, there is no direct prohibition on setting an advance as a percentage of the salary;

- When paying an advance, there is no need to transfer personal income tax to the budget: calculation, withholding and payment of tax (including for the first half of the month) are carried out during the final settlement.

Is it allowed if a person had a vacation during the billing period?

Let's consider several situations:

- when the first vacation day falls in the first part of the month;

- when vacation starts in the second half;

- when the employee rests for the entire month.

In the first half

To understand this issue, let's look at two cases.

The person is on vacation throughout the entire period for calculation, namely from the 1st to the 15th. On the 15th, the accounting department must pay an advance to the employees.

For the first 15 days, this employee has a no-show note with the OT (vacation) code on his report card.

Obviously, the employee does not have any time worked during this period, which means he is not entitled to an advance.

The employee went on another vacation on the 5th. The employee’s timesheet shows 4 days, from the 1st to the 4th inclusive.

This means that on the 15th the employee must be given an advance in proportion to the days worked, that is, based on 4 days worked.

Thus, we can conclude that if an employee’s vacation begins in the first half, then he will be entitled to an advance if there are days worked in the first 15 days.

If this period falls entirely on vacation, then no payment is due. If there are working days, then funds must be paid for them.

In the second

Let's look at another example.

The employee went on another vacation on the 16th. He will be on another vacation until the end of the month.

The employee's workdays are marked on the working time sheet from the 1st to the 15th. Obviously, the advance must be paid to the employee in accordance with the time worked, that is, in full as usual.

Vacation pay will be issued to the employee separately, no later than three days before the start of the vacation (13th). The amount of vacation pay will be included in the calculation at the end of the month, minus the amounts issued (vacation pay + advance payment).

Thus, if the start of the vacation falls on any day of the second half of the month, then the money for the current month must be paid in full.

As for the advance for the next month, you need to look at what day the employee goes to work and accrue funds in accordance with the days worked.

The entire month

Since the employee does not have any time worked during vacation, he is not accrued or paid wages.

Accordingly, in this situation the employee does not receive any money.

Moreover, he will not receive a salary for either the first or the second part of the month, since there will be no days worked.

But he will be paid vacation pay for the entire period.

How is it calculated - calculation example

Employee T.V. Makarov returned from his next paid leave on February 5th.

The employee's salary is 40,000 rubles. The employee receives an additional payment for a partner who has gone on vacation in the amount of 50%.

The standard working time in February is 19 days. According to the production calendar, the hours worked, including weekends and holidays, includes 9 days.

Advance = (40,000 +20,000) / 19 * 9 = 28,421.05 rubles.

https://youtu.be/ZPzPs_Gx1As

Advance payments

Advance payments are an obligation imposed on each employer by the Labor Code of the Russian Federation. It is enshrined in Article 136 of the Labor Code, which stipulates that wages must be paid twice a month, with an interval of no more than 15 days between payments. This procedure must be observed by every employer, unless federal legislation provides for other terms for settlements with employees. Certain categories of employees are subject to a different type of payment due to the special nature of their work.

The accrual of an advance is a measure aimed at supporting hired persons. Therefore, if an employer arbitrarily refuses to pay an advance payment, this is a gross violation of the law and entails administrative liability.

Several legislative acts regulate the issue of calculating advance funds:

- Article 136 of the Labor Code of the Russian Federation, which regulates when, where and within what timeframes wages must be paid to employees.

- The Code of the Russian Federation on bringing to administrative liability, which specifies the extent of the employer’s material and other liability for violation of norms.

- Explanatory letter of the Ministry of Labor No. 1557-6 of 2006.

Ideally, the employer just needs to adhere to the norms of Article 136 of the Labor Code of the Russian Federation and there will be no problems with the law.

Online magazine for accountants

After all, he can write a letter of resignation of his own free will at any time, including while on vacation or immediately after returning to work from vacation (clause 3 of article 77, article 80 of the Labor Code of the Russian Federation).

And then what to do? In such a situation, the employer is given the right to withhold from the employee’s salary the resulting debt for unworked vacation days (Article 137 of the Labor Code of the Russian Federation, clause 2 of the Rules on regular and additional vacations, approved by the People's Commissariat of Labor of the USSR on April 30, 1930 N 169).

138 Labor Code of the Russian Federation). Of course, in some cases this money may not be enough to pay off the entire debt. Then the employer can try to negotiate with the employee so that he will repay the debt voluntarily. If the employee agrees, he can deposit money into the organization’s cash desk or transfer it to an account.

138

What liability will the employer be held accountable for failure to pay the advance?

It is worth noting that the norm of Part 6 of Art. 136 of the Labor Code of the Russian Federation is imperative in nature, therefore, its application does not depend on the will of employees. The fact is that in practice there are still situations where employers pay wages once a month based on the relevant statements of employees. For such amateur performances in accordance with Part 6 of Art. 5.27 of the Administrative Code of the Russian Federation they face a fine:

- for officials (manager and accountant) - in the amount of 10,000 to 20,000 rubles;

- for legal entities - in the amount of 30,000 to 50,000 rubles.

Repeated violation entails the imposition of an administrative fine in a larger amount (for officials - from 20,000 to 30,000 rubles, for legal entities - from 50,000 to 100,000 rubles). This is provided for in Part 7 of Art. 5.27 Code of Administrative Offenses of the Russian Federation. Instead of a fine, another measure of liability is possible - disqualification of an official for a period of one to three years.

Please note that the arbitrators side with labor inspectors when imposing fines (resolutions of Judicial District No. 33 of the Orichevsky Judicial District of the Kirov Region dated 02.02.2017 No. 5-78/2017, Judicial District No. 1 of the Nizhny Novgorod District of Nizhny Novgorod, Nizhny Novgorod Region from 31.01.

In practice, another situation is possible - when the advance payment is provided for by local regulations, but is made with a delay.

In this case, the employer faces financial liability in accordance with Art. 236 of the Labor Code of the Russian Federation (as amended by Federal Law No. 272-FZ). Unlike an administrative fine, payments are made in favor of employees whose rights have been violated.

We invite you to familiarize yourself with Salary and salary: what they are, their similarities and differences

If the payment deadlines are violated, the employer must pay the employee compensation for each day of delay. The amount of such compensation is not less than 1/150 of the key rate of the Central Bank of the Russian Federation in force at that time of the amounts not paid on time for each day of delay, starting from the next day after the established payment deadline up to and including the day of actual settlement. The amount of monetary compensation is calculated from the amounts actually not paid on time.

We pay an advance taking into account the latest clarifications from controllers

Section 2 of form 6-NDFL. The discrepancy is in lines 100 (the date is 01/31/2020) and 110 (the date is 02/17/2020). The difference in dates is due to the fact that after receiving an advance payment for January, the employee fell ill. Within the prescribed period – 02/03/2020 – personal income tax was not withheld due to the employee’s lack of other income taxed at a rate of 13%. Personal income tax was not withheld from the advance due to clause 2 of Art. 223, paragraph 3, 4 art. 226 of the Tax Code of the Russian Federation. Personal income tax for January was withheld from the next payment in cash on February 17, 2020 (advance payment for February 2020).

We recommend reading: Payment for Soybeans MKD Under Direct Agreements with RSO

Accrual procedure

The procedure for calculating material compensation for volumes of labor produced establishes that:

- first, the employee receives an advance, that is, he is actually given an amount that has not yet been worked out or has not been fully earned;

- at the end of the reporting period, namely the calendar month, accurate calculations of hours worked are made and final wage calculations are made.

There are two different formulas for calculating the down payment:

- A salary is taken, which increases by the amount of mandatory additional payments. The resulting amount is divided in half. Half of the monthly norm is paid to the employee without withholding taxes or other payments.

- The second formula also calculates the salary and all permanent bonuses, but is not divided in half, but multiplied by the accepted percentage. In some organizations, the advance may be equal to 70% of all accruals.

Of course, an accountant should take into account a lot of nuances. For employees who have alimony or other permanent deductions from their wages, smaller accruals should be made in order to ultimately be able to deduct not only taxes, but also alimony, and also accrue the amount to be transferred.

In addition, you should always keep your finger on the pulse and monitor whether this or that employee was at work or took leave at his own expense or was on sick leave. At large enterprises, by the day of the advance, all structural units submit time sheets of time already worked so that the accountant can check the actual presence of the employee and, if necessary, adjust the amount of the advance.

How to correctly determine the amount of the advance?

In Letter No. 14-4-1702 dated 08/05/2013, when considering the issue of determining the amount of an employee’s salary for the first half of the month, the Ministry of Labor confirmed that the Labor Code of the Russian Federation does not regulate the size of the advance.

At the same time, officials made a reference to Resolution No. 566, according to which the amount of the advance on workers' wages for the first half of the month is determined by an agreement between the administration of the enterprise (organization) and the trade union organization when concluding a collective agreement, however, the minimum amount of this advance must not be lower than the worker's tariff rate for the time worked.

What methods of calculating advance payments are used in practice? Let's look at the diagram.

- Proportional to time worked;

- As a percentage of salary;

- In a fixed amount (in rubles);

- The most preferred methods.

This method is not convenient for the employer, since it imposes on him the obligation to pay wages even in situations where the employee was sick or was on a business trip.

Salary calculation is proportional to time worked. In addition to the formal fulfillment of the requirements of Art. 136 of the Labor Code of the Russian Federation on the payment of wages at least twice a month, when determining the amount of wage payment for half a month, the employer must take into account the time actually worked by the employee (the work actually performed by him) (Letter of the Ministry of Labor of the Russian Federation dated 02/03/2016 No. 14-1/10/ B-660). The same conclusion follows from letters from the Ministry of Labor of the Russian Federation dated September 21, 2016 No. 14-1/B-911 and Rostrud dated September 26, 2016 No. T3/5802-6-1.

A similar position was given in an earlier Letter of the Ministry of Labor of the Russian Federation dated 08/05/2013 No. 14-4-1702. Moreover, it emphasizes that these standards apply to all employees of the organization and do not have specific application to certain categories of employees.

In addition to the fact that this method of calculating the advance is recommended by regulatory authorities as the main one, it is also convenient for the employer: when paying wages for the first half of the month in proportion to the time actually worked by the employee in this period, in practice the risk of overpayment and non-withholding of personal income tax during the final payment is eliminated.

Controlling authorities have repeatedly indicated that personal income tax is not withheld from advances. In the example considered, reducing the advance amount by the amount of tax does not provide for the transfer of personal income tax to the budget.

Calculation of wages for the first half of the month as a percentage of the salary. According to the explanations of the Ministry of Health and Social Development, given in Letter No. 22-2-709 dated February 25, 2009, with the advance method of calculating wages for each half of the month, wages should be accrued in approximately equal amounts (excluding bonus payments).

What percentage should I set? If you follow the recommendations given in the letter to the letter, this is 50%. However, historically, the advance was set at 40% of the salary. There is a completely logical explanation for this: during the final settlement, personal income tax will be withheld from employees’ salaries, and if 50% of the salary is paid in advance, then the salary for the second half of the month will be significantly less.

We suggest you read: When opening a private enterprise, how much money they give

As can be seen from the example, if an advance payment is set at 50%, upon final payment the employee will receive a salary lower than for the first half of the month, which does not meet the requirements for approximately equal parts of the salary.

At the same time, it should be noted that, unlike an advance payment set in a fixed amount, it is not necessary to pay an advance payment as a percentage of the salary in cases where the employee did not work (was on sick leave, on a business trip, on vacation, etc. ).

Taxation

A controversial situation arises in determining the taxation of an advance payment. Today, even judicial practice is not able to fully determine this issue.

Turning to the Tax Code of the Russian Federation, you can see that the employee is obliged to pay tax on the profit he receives for the work done.

In this case, each employer acting as a tax agent is obliged to calculate the amount of tax along with the amount of salary. With the advance part, the situation turns out to be somewhat more complicated, since there is no clear definition of whether the advance should be considered an income item.

Most experts believe that taxes should be calculated and deducted directly from the second part of the profit received, the payment of which most often occurs in the second half of the month. Since the advance is paid in the first half, it is not taken into account in calculating the tax, which is withheld by the employer for further payment.

It is important to note that personal income tax is also calculated once a month, when it is accrued.

As for non-standard situations in which an advance is calculated after a vacation, each case must be calculated individually, also based on the provisions of the established legislative framework.

In this video you will learn how to retain overpaid vacation pay.

Payment term

Please note that there are no clear dates specified in any legislative act when advance payments or wages must be paid. Article 136 of the Labor Code of the Russian Federation only states that the period between payments cannot be more than 15 days, and the rest is at the discretion of the employer. Each organization sets payment dates independently.

Specific dates for payments, both advance payments and wages, should not only be thought out by the employer based on his own convenience, but also agreed upon with the banking structure.

The final agreed dates are written in:

- Collective agreement.

- Regulations on wages in the organization.

In addition, when hiring a new employee, an employment contract is concluded with each employee, in which specific payment dates are also written down as a separate line.

The employee goes on vacation in the middle of the month when the salary is paid

The employee did not return the money to the company. Now consider a situation where an employee refused to return the overpayment of vacation pay to the company. At the time of dismissal At the time of dismissal, there is no need to reverse the amount of overpaid vacation pay, because the company still has these expenses. Accordingly, there will be no overpayment of personal income tax here either, because the employee did not return the money. This means that he still has income from which you have already withheld personal income tax (see the official’s comment below). Example Let's use the conditions of example 1. But suppose that on the day of dismissal the company does not owe the employee anything, and therefore cannot withhold from Ivanov the entire debt for unearned vacation pay in the amount of 5655.5 rubles. (6500.5 – 845). The former employee refused to deposit money into the cash register. Consequently, Ivanov’s debt remained outstanding. The accountant did not reverse either the excessively accrued vacation pay or the personal income tax calculated from them.

On payment of an advance in a fixed amount.

The issue of calculating a fixed amount for paying wages by the advance method to an employee of a public sector organization was considered by the Ministry of Finance in Letter No. 02-07-05/17670 dated March 29, 2016. Department officials indicated that such an issue is within the competence of the Ministry of Labor, and not the Ministry of Finance. At the same time, financiers recalled that, according to Art.

91 of the Labor Code of the Russian Federation, wages are calculated for the actual time worked, determined within the framework of accounting organized by the employer. At the same time, the procedure for paying wages (terms, amount and components), established by local acts of the institution, should not contradict the provisions of the Labor Code of the Russian Federation.

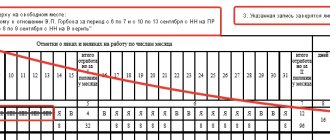

As for the accounting of actually worked time, Order of the Ministry of Finance of the Russian Federation No. 52n[2] approved the form of a sheet of accounting for the use of working time, on the basis of which a fixed amount is calculated for actually worked time for the first half of the month (including adjustment of the fixed amount), and methodological recommendations for it formation.

Taking into account these clarifications from the Ministry of Finance, the above position of the Ministry of Labor, as well as the risks associated with paying an advance in a fixed amount, we consider this method of paying salaries for the first half of the month unacceptable for public sector institutions.