In the preferential period of service, does an employee-teacher have a code for early assignment of pension 27-PD or 28-PD?

Answer to the question:

For teachers, when filling out the SZV-STAZH form for 2020, you must indicate code 27-PD.

This code is valid for teachers from 01/01/2015.

Code 28-PD applies to activities from 01/01/2002 to 31/12/2008

Details in the materials of the Personnel System:

Situation: How to fill out a report using the SZV-STAZH form

Nina Kovyazina, Deputy Director of the Department of Medical Education and Personnel Policy in Healthcare, Ministry of Health of Russia

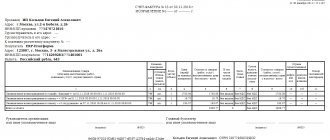

The SZV-STAZH form consists of five sections: – section 1 “Information about the policyholder”; – Section 2 “Reporting period”; – Section 3 “Information about the period of work of the insured persons”; – Section 4 “Information on accrued (paid) insurance contributions for compulsory pension insurance”; – Section 5 “Information on paid pension contributions in accordance with pension agreements for early non-state pension provision.”

The paper form SZV-STAZH can be filled out on a computer or by hand. In the latter case, use ink or a ballpoint pen of any color except red and green. Fill out the report in block letters. Erasures and corrections are prohibited.

Number the pages of the report in continuous order. Number indicator in the “Page” field fill in like this: 00001 – first page, 00002 – second page, etc.

In the header of the form, enter: – registration number in the Pension Fund, it was assigned to the organization or individual entrepreneur when registering as an insurer in the Pension Fund. Take this number from the notice of registration of an organization or notice of registration of an individual issued by the Pension Fund of the Russian Federation. You can also view the registration number in an extract from the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs - you can download them for free from the website of the Federal Tax Service of Russia; – Taxpayer Identification Number. Look for it in the certificate of registration of an organization or the certificate of registration of an individual, which was issued by the tax office upon registration. For organizations, the TIN consists of 10 characters, so put dashes in the last cells; - Checkpoint. You can also see it in the organization’s registration certificate. Entrepreneurs do not fill out this information.

These are the requirements of paragraphs 2.1–2.1.3 of the Procedure approved by Resolution of the Board of the Pension Fund of the Russian Federation dated January 11, 2020 No. 3p.

From the answer “How to compose and pass the SZV-STAZH”

With respect and wishes for comfortable work, Tatyana Kozlova,

HR System expert

>Systematization of accounting

09.21.2018 | no comments

Contributions at additional rates for employees with early retirement

One of the changes introduced by Federal Law No. 243-FZ1 dated December 3, 2012 is the introduction, from January 1, 2013, of additional insurance tariffs to finance the insurance part of the labor pension in relation to payments and other remuneration in favor of persons employed in the types of work specified in paragraphs. 1-18 paragraph 1 art. 27 of the Federal Law of December 17, 2001 No. 173-FZ.

The amount of the additional tariff depends on whether the work is classified as, relatively speaking, “harmful” (clause 1, clause 1, article 27 No. 173-FZ) or “heavy” (clauses 2-18, clause 1, article 27 No. 173-FZ). It is also envisaged that additional tariffs will increase in future years.

When calculating insurance premiums for these tariffs, there is no limitation on the base by a maximum value (in 2013 - 568,000 rubles).

Let us remind you that these persons have the right to early assignment of a labor pension and personalized accounting information for them is submitted with the appropriate notes regarding information about their length of service. To automatically generate such information in the program, it is (and was) possible to indicate the appropriate grounds in the staffing table or in information about the position.

However, these signs cannot be used when the program decides whether to accrue contributions at an additional rate to employees employed in such positions or staffing positions, since, in particular, the law provides for an exemption from the payment of such contributions “based on the results of a special assessment of the conditions labor."

In connection with these changes, in version 2.5.59 it is possible to indicate in the information about a position whether contributions at an additional rate should be charged to employees employed in it, and also to clarify which category (harmful or heavy) this position belongs to , since contribution rates vary for different conditions.

Picture 1

To enable this feature, you need to set the appropriate flag “Works with early retirement are used” in the form for setting up accounting parameters on the “Calculation of insurance premiums” tab.

Figure 2

Please note that when updating an information base in which records are already kept to version 2.5.59, the flag in the settings will be set automatically if at least one of the conditions is met:

| Code of length of service | Subclause 1 of Art. 27 No. 173-FZ |

| 27-11GR, 27-11VP | 11 |

| 27-12 | 12 |

| AIRCRAFT, SPECAV, SPASAV, UCHLET, VYSHSPIL, NORMAPR, NORMSP, REACTIVN, LETRAB, ITSISP, ITSMAV, INSPEKT | 13 |

| 27-14 | 14 |

| 27-15 | 15 |

| 27-SP (28-SP - until 2011) | 16 |

| Code of special working conditions | Subclause 1 of Art. 27 No. 173-FZ |

| 27-1 | 1 |

| 27-2 | 2 |

| 27-3 | 3 |

| 27-4 | 4 |

| 27-5 | 5 |

| 27-6 | 6 |

| 27-7 | 7 |

| 27-8 | 8 |

| 27-9 | 9 |

| 27-10 | 10 |

| 27-OS (28-OS - until 2011) | 17 |

| 27-PZh (28-PZh – until 2011) | 18 |

- Contributions are paid to finance pension supplements in the coal industry or flight crew members, i.e. in the settings for calculating insurance premiums (Figure 2), the flag “Using the labor of those employed in mining operations for coal and shale extraction” or “Using the labor of flight crew members” is set.

However, regardless of whether these characteristics have already been indicated in the staffing table or information about the position, the indicator itself for the imposition of additional contributions to the position should be entered independently; it is not automatically entered when updating.

To decide whether a particular position should be subject to additional contributions, as well as which of the two additional contribution rates to choose, you can analyze the previously filled in values of the “Bases of length of service” for the position and the “working conditions” indicated in the staffing table "

| Sign of imposition of additional contributions, established in the information about the position | The basis of length of service specified for the position | Working conditions specified in the staffing table |

| Work with hazardous working conditions, subparagraph 1 of paragraph 1 of Article 27 of the Law “On Labor Pensions in the Russian Federation” Figure 3 | Not specified | |

| Work with difficult working conditions, subparagraphs 2 - 18 of paragraph 1 of Article 27 of the Law “On Labor Pensions in the Russian Federation” Figure 4 | 27-11GR 27-11VP 27-12 AIRPLANE SPETSAV SPASAV UCHET VYSSHPIL NORMAPR NORMSP REACTIVE LETRAB ITSISP ITSMAV INSPEKT 27-14 27-15 27(28)-SP | 27-2 27-3 27-4 27-5 27-6 27-7 27-8 27-9 27-10 27(28)-OS 27(28)-RV |

| Not specified Figure 5 Note. It is also not indicated for all positions in which work is not related to the right to early assignment of a labor pension | 27(28). | 28-SEV |

Please note that if the same position appears in the staffing table in different departments, and for one of such positions special working conditions are indicated from those listed in lines 1-2 of the table (i.e. for this position, the attribute of additional contributions should be set ), and for the other are not indicated, then you should highlight separate elements for these jobs in the “Positions” directory and indicate for them different signs of additional contributions.

Thus, to calculate additional contributions, it is only necessary to set the appropriate attribute for “harmful” positions. Contribution rates do not need to be configured; they are filled in automatically in the “technological” information register “Contribution rates for those employed in jobs with early retirement”

Figure 6

When calculating insurance premiums using the document “Calculation of insurance premiums”, all employee income is recorded indicating the relationship to the assessment of additional contributions (with the exception of the document “Piece work order for work performed”, which itself registers its income for the purposes of calculating insurance premiums).

Figure 7

Insurance premiums are calculated taking into account the value of this characteristic. Additional contributions are placed in a separate column depending on their type.

Figure 8

Separate accounting of “harmful” and “heavy” additional contributions is associated with their separate payment (each type has its own BCC). The document “Calculations for insurance premiums” registers the payment of accrued additional contributions.

Figure 9

In accounting, accrued additional contributions are recorded in subaccounts 69.02.5 and 69.02.6

Figure 10

In the document “Adjustment of accounting for personal income tax, insurance contributions and unified social tax” it is possible to indicate the ratio of income to taxation with additional contributions, as well as the amount of accrued additional contributions

Figure 11

Changes have also been made to analytical reporting. The report “Analysis of accrued taxes and contributions” implements an additional option “PFR, contributions for employees with early retirement” for the analysis of additional contributions

Figure 12

An additional section has been added to the “Insurance Contributions Accounting Card” report, shown for employees who have been accrued additional contributions

Figure 13

Changes to the regulated reporting of contributions will be made as the relevant regulations are published.

Please note:

- If the organization pays contributions to finance additional pension payments in the coal industry or flight crew members, i.e. in the settings for calculating insurance premiums, the flag “Uses the labor of those employed in mining operations for coal and shale extraction” or “Uses the labor of flight crew members” is set, and the corresponding flags are set in the job information, then these contributions will continue to be calculated regardless of the “new” additional contributions

Figure 14

- Additional insurance premiums are registered without dividing into UTII and non-UTII parts

note

2.1. If you have two “identical” positions with different working conditions, then from the point of view of the program, these are two different positions. You need to create two elements of the “Positions” directory, fill in the different working conditions and assign each employee a position in accordance with his working conditions.

In addition, all changes in working conditions for the same employee should be reflected in personnel movements from one position to another. We would like to remind you that, according to letters from the Ministry of Labor of Russia, if an employee is part-time for a month in work with harmful, difficult and dangerous working conditions, the calculation of insurance premiums at an additional rate is proportional to the time worked in the relevant types of work under special conditions. If you carefully reflect all changes in special working conditions, the program itself will calculate the taxable and non-taxable portions of the accruals under the additional tariff.

More details on ITS in the section “Information on updates to 1C:Enterprise software products”: https://its.1c.ru/db/updinfo#content:88:1:IssOgl1_1

In this article on ITS you will find answers to the questions:

1) how contributions are calculated from the accrual relating to a specific period of time (from the main accrual) if the working conditions change in this period;

2) how contributions are calculated from a one-time accrual that does not relate to any specific period of time;

3) how contributions are calculated from the additional accrual for the last month made after the payment of wages;

4) the procedure for additional accruals for the previous period for already dismissed employees.

2.2. If for two “identical” positions a special assessment of working conditions was carried out in different months (for example, for each of the two legal entities in your database the procedure was carried out at different times), then we again need to create two positions in the directory. It seems to us convenient to have two positions in the directory: “not certified” and “certified.” And as the assessment is carried out and a class is assigned, the employee is transferred from a “non-certified” position to a “certified” one.

An error occurred.

10 of the Federal Law of December 3, 2012 No. 216-FZ, the indexation of state benefits for citizens with children provided for in Article 4.2 of the Federal Law of May 19, 1995 No. 81-FZ was carried out, from January 1, 2013 by 5.5%.

Also in accordance with the Decree of the Government of the Russian Federation of October 12, 2010 No. 813 and Part 1 of Art. 1 of Law No. 216-FZ, the maximum amount of social benefits for funerals provided for by Federal Law No. 8-FZ of January 12, 1996 was indexed.

New benefits and restrictions are set automatically when upgrading to version 2.5.59.

Figure 16

Please note that since 2011, the maximum amount of benefits for child care up to one and a half years is not limited, and the maximum amount is limited to the earnings on the basis of which the benefits are calculated. No recalculation of such previously recorded benefits is required.

The maximum value of the base for calculating insurance premiums has been increased in accordance with Decree of the Government of the Russian Federation of December 10, 2012 No. 1276

Figure 17

In accordance with Federal Law dated December 3, 2012 No. 232-FZ, from January 1, 2013, the minimum wage (minimum wage) was established in the amount of 5,205 rubles. per month. Let us remind you that this value in the program is used exclusively for calculating benefits. If accruals with arbitrary formulas are used, in which your own minimum wage indicator appears (for example, “Additional payment to the minimum wage”), then the new value of the indicator, if necessary, should be entered independently.

Figure 18

No. 28-GD dated 02/09/2005

LAW of the Samara Region

On state support for human resources in the agro-industrial complex of the Samara Region

Adopted by the Samara Provincial Duma on January 25, 2005

This Law was developed in order to implement measures of state support for the human resources potential of the agro-industrial complex of the Samara region.

Article 1. State support for human resources in the agro-industrial complex of the Samara region

1. Measures of state support for the human resources potential of the agro-industrial complex of the Samara region include:

1) targeted contract training of specialists for the agro-industrial complex of the Samara region;

2) professional retraining and advanced training of managers and specialists of agricultural organizations;

3) material incentives for young specialists when joining an agricultural organization in the form of providing them with one-time cash payments;

4) material incentives for the heads of agricultural organizations in the form of paying them monthly wage supplements and monthly additional payments to their labor pension.

2. State support for the human resources potential of the agro-industrial complex of the Samara region can be carried out with the help of measures other than those specified in part 1 of this article, provided for by federal legislation and the legislation of the Samara region in the field of social, housing, budget and tax policy, as well as the regulation of land relations.

Article 2. Targeted contract training of specialists for the agro-industrial complex of the Samara region

The scope and procedure for organizing targeted contract training of specialists for the agro-industrial complex of the Samara region from among those studying at the expense of the budget of the Samara region are established by the Ministry of Agriculture and Food of the Samara region in agreement with educational institutions.

Article 3. Professional retraining and advanced training of managers and specialists of agricultural organizations

The Ministry of Agriculture and Food of the Samara Region organizes, on the basis of agricultural educational institutions, retraining and advanced training of managers and specialists of agricultural organizations, taking into account the requirements of federal legislation and the legislation of the Samara Region.

Article 4. One-time cash payment to young specialists

1. A citizen hired after graduating from a higher or secondary educational institution to work in an agricultural organization is given a one-time cash payment in the amount of 30 times the minimum wage if he has a higher education, or in the amount of 15 times the minimum wage if he has a secondary education. (hereinafter referred to as payment).

2. When determining the amount of payment, the minimum wage established by federal law to regulate wages is applied.

3. The basis for the appointment and provision of payment is an employment contract concluded between the citizen specified in part 1 of this article and the agricultural organization for a period of at least three years.

4. To receive the payment, citizens entitled to receive it apply to the Ministry of Agriculture and Food of the Samara Region with an application to provide them with the specified payment, to which is attached a copy of the employment contract specified in part 3 of this article, as well as a copy of the certificate (document ) about education.

5. The decision to provide a payment is made by the Ministry of Agriculture and Food of the Samara Region.

6. The procedure for assigning and providing payments is determined by the Ministry of Agriculture and Food of the Samara Region in accordance with the requirements of federal legislation, this Law and other regulatory legal acts of the Samara Region.

7. In the event of termination of the employment contract specified in part 3 of this article, on the grounds provided for in paragraphs 1, 3-6 of Article 77 of the Labor Code of the Russian Federation, with the exception of cases provided for in paragraphs 1 and 2 of Article 81 of the Labor Code of the Russian Federation, payment is subject to return to the regional budget.

Article 5. Monthly salary bonus for heads of agricultural organizations

1. A manager elected (appointed) to a corresponding position in an unprofitable agricultural organization that is of socio-economic importance for the development of the agro-industrial complex of the Samara region is given a monthly salary increase in the amount of 5 times the minimum wage for three years from the date of election (appointment). (hereinafter referred to as the allowance).

2. The list of agricultural organizations specified in part 1 of this article is approved annually by the Ministry of Agriculture and Food of the Samara Region based on the results of their work for the previous year.

3. When determining the amount of the bonus, the minimum wage established by federal law to regulate wages is applied.

4. The basis for the appointment, payment and termination of payment of the bonus is an agreement concluded between the citizen specified in part 1 of this article and the Ministry of Agriculture and Food of the Samara Region for a period of at least three years.

5. To receive a bonus, citizens entitled to receive it apply to the Ministry of Agriculture and Food of the Samara Region with an application for the provision of the specified bonus, to which is attached a copy of the relevant employment contract.

6. The procedure for paying the premium is determined by the parties to the agreement specified in part 4 of this article.

Article 6. Monthly supplement to pensions for heads of agricultural organizations

1. The head of an agricultural organization, who has worked in this position for at least 15 years (in total) and has ensured the stable socio-economic development of the agricultural organization (agricultural organizations), is entitled to a monthly supplement to the labor pension for old age or disability in the amount of 2 times the minimum wage (hereinafter - surcharge).

2. When determining the amount of additional payment, the minimum wage established by federal law to regulate wages is applied.

Z. To receive an additional payment, citizens entitled to receive it apply to the Ministry of Labor and Social Development of the Samara Region with an application to provide them with the specified additional payment, to which is attached a certificate of an assigned (early issued) pension, copies of documents confirming the relevant work experience, as well as documents testifying to the applicant’s merits provided for in Part 1 of this article.

4. The decision to provide a payment is made by the Governor of the Samara Region, taking into account the conclusion of the Commission on Social Guarantees for persons who have special merits to the Samara Region, and is formalized by order.

5. The procedure for assigning and providing additional payments is determined by the Government of the Samara Region in accordance with the requirements of federal legislation, this Law and other regulatory legal acts of the Samara Region.

Article 7. Financing of expenses related to the implementation of this Law

1. Financing of expenses associated with the provision of payments, allowances and additional payments provided for in Articles 4-6 of this Law is carried out from the regional budget.

2. The recipient of regional budget funds to finance payments and allowances provided for in Articles 4 and 5 of this Law is the Ministry of Agriculture and Food of the Samara Region.

The recipient of regional budget funds to finance additional payments provided for in Article 6 of this Law is the Ministry of Labor and Social Development of the Samara Region.

Article 8. Entry into force of this Law

This Law comes into force on July 1, 2005.

| Acting Governor of the Samara Region | S.A. Sychev |

Hint when choosing an insurance premium rate for organizations using the simplified tax system

In the general case, an organization using the simplified tax system calculates insurance premiums at the “general” rate, and accordingly forms section 2 in the RSV-1 report with code “52” and the category of insured persons “NR” in the personalized accounting information.

However, if the organization meets the conditions specified in clause 8, part 1, art. 58 of Law No. 212-FZ of July 24, 2009, then it has the right to apply a “preferential” rate of insurance premiums and must report with code “07” in section 2 of the RSV-1 report and with the category of insured persons “PNED” in the personalized accounting information.

The program provides for the calculation of contributions at such a “preferential” rate and the generation of appropriate reporting. To do this, in the accounting parameters settings, you should select the tariff type “Organizations using the simplified tax system, engaged in production and equivalent types of activities”

Figure 19

With this choice, contributions will be calculated at reduced rates, and reporting will be generated with the appropriate codes.

However, a situation may arise when a user who wants to establish the use of a “preferential” tariff selects the “general” insurance premium rate for the simplified tax system in the accounting settings and edits the rates in the tariff table in accordance with the “preferential” tariff, which is not correct.

Figure 20

As a result of such editing, contributions will be calculated in the expected amount, but problems will inevitably arise when generating reports. For example, personalized reporting will be generated with the “wrong” category and will not pass the ratio test.

To minimize the likelihood of such situations occurring, in version 2.5.59 the name of the “regular” tariff has been clarified: “Organizations using the simplified tax system, except for those specified in paragraph 8 of part 1 of Article 58 of the Federal Law of July 24, 2009 No. 212-FZ”, and also an additional one has been added to the form clue.

Figure 21

For the “preferential” tariff, the name remained the same: “Organizations using the simplified tax system, engaged in production and equivalent types of activities”

Figure 22

Personnel page

Early retirement The first and second lists of preferential professions allow you to retire early. These lists take into account the hard work of a person, the danger of work. The law approved by the government of the Russian Federation provides for early rest, or the possibility of changing activities to an easier and safer one.

Info

In the latter case, benefits and payment of a monthly pension are retained. The conditions for retirement are reflected in the new program. The list of preferential professions provides for the definition of conditions that must be met for early retirement.

Men whose activities are included in the first list of professions for a preferential pension must have at least ten years of experience in hazardous work. According to the second list, men are required to have two and a half years longer experience. After this, everyone gets the opportunity to retire on a preferential pension in advance.

Appointment on a part-time basis Part-time work is included in the total teaching experience for the purpose of assigning a preferential pension.

The table contains not only current codes, but also those that have already been canceled, and the period of their application is indicated. This is necessary to identify work when analyzing reporting from old periods.

In addition to the 2 codes discussed above, the table contains a large number of second ones. They also break down positions (professions) into separate categories.

Then we will briefly look at the characteristics of each of the codes.

Dear readers!

We describe typical ways to resolve legal issues, but each case is unique and requires individual legal assistance.

To quickly resolve your problem, we recommend contacting qualified lawyers on our website .

On the provision of “Lists of preferential professions” for teaching staff

26-11-2012 | |

According to Federal Law No. 27-FZ dated April 1, 1996 “On individual (personalized) accounting in the compulsory pension insurance system,” employers must submit, within the established time frame, to the territorial body of the Pension Fund at the place of registration reliable information about accrued and paid insurance contributions, as well as about the work experience of each insured person working for him.

Policyholders submit Lists and IPs quarterly.

We draw your attention to the following points.

1. The List includes all professions and positions that give the right to early retirement.

2. The reporting period since 2011 is a quarter.

3. It is important that the names of professions, structural divisions and organizations strictly comply with the names provided for in the relevant Lists and Rules.

4. If there are no changes in the number and names of positions (professions) in the previously declared List, the policyholder must submit to the territorial body of the Pension Fund a certificate signed by the head about the absence of changes, a file of the List and an updated list of names to it.

5. If the “List” was not previously presented or changes have occurred (in terms of the number of employees, the number of preferential professions, etc.), the policyholder must submit a List file and a list of names to it, as well as a List on paper, certified by the signature of the manager and seal.

6. Filling out the column “Date of retirement” is mandatory.

7. When filling out the Lists and IS, teaching staff should use codes (27-PD, 27-PDRK); program warnings can be ignored.

8. In accordance with the approved resolution of the Government of the Russian Federation dated October 29, 2002. No. 781, a prerequisite for including a period of work in teaching experience is the employee’s enrollment in a full-time position. At the same time, periods of work performed after 09/01/2000 in positions and institutions specified in the List are counted in the length of service only if the standard working time (teaching or educational load) is met (in total for the main and other places of work).

In the event that the standard working time is not met for the entire year, when assigning an early retirement pension in old age, only those months in which the standard working time established for the wage rate are included in the teaching experience are included.

At present, it is not possible to determine such months based on individual (personalized) accounting information, because

An additional education teacher has benefit 27 pdrk

Work in the positions of teacher, teacher-educator, nursery nurse is counted towards work experience for the period before January 1, 1992.

10. Work in the positions of assistant director for the regime, senior duty officer for the regime, duty officer for the regime, organizer of extracurricular and out-of-school educational work with children, teacher-methodologist, hearing room instructor, parent-educator, as well as in the positions specified in the list, in family-type orphanages are counted towards work experience for the period before November 1, 1999.

11. Work in the positions of a social teacher, educational psychologist and labor instructor is counted towards work experience in educational institutions for orphans and children left without parental care, specified in paragraph 1.3 of the section “Name of institutions” of the list, in special (correctional) educational institutions for students (pupils) with developmental disabilities, specified in paragraph 1.5 of the section “Name of institutions” of the list, in special educational institutions of open and closed type, specified in paragraph 1.6 of the section “Name of institutions” of the list, in educational institutions for children those in need of psychological, pedagogical and medical-social assistance specified in paragraph 1.11 of the “Name of Institutions” section of the list, and in social service institutions specified in paragraph 1.13 of the “Name of Institutions” section of the list.

12. Work in the positions specified in paragraph 2 of the “Name of Positions” section of the list, in the institutions specified in paragraph 2 of the “Name of Institutions” section of the list, for periods starting from January 1, 2001, is counted as length of service if the following conditions are simultaneously met:

as of January 1, 2001, the person has worked in positions in the institutions specified in the list for at least 16 years 8 months;

the person has a fact of work (regardless of its duration) in the period from November 1, 1999 to December 31, 2000.

Code 27-2: difficult working conditions

the number of hours is entered in total for the entire reporting period. Based on the above:

— Lists for each reporting quarter, starting from the 1st quarter of 2012, should be filled out indicating the rates and number of hours (without breakdown by month), with the exception of educators (they only indicate the rate, hours are not entered).

— The information system for each reporting quarter, starting from the 1st quarter of 2012, should be filled out by month, the rate (share of the rate) and hours should be entered monthly.

— In the SZV 6-1 form, in the “additional information” column, the rate at which the employee was hired and the time actually worked by him for the month are indicated, with the exception of educators (they only indicate the rate, the hours are not entered).

Example of filling out individual information:

| № pp | Beginning of period dd.mm.yy | End of period dd.mm.yy | Territorial conditions (code) | Special working conditions (code) | Calculation of insurance period | Conditions for early retirement additional base (code) information | ||

| 27PD | 1st.80h. | |||||||

| 27PD | 1 tbsp. 60 h. | |||||||

| 27PD | 1st.72h. | |||||||

For any questions, please contact the department for assessing the pension rights of insured persons at the address: Bor, st. International, 2.

S.A. AGAFONOVA Head of the OPPZL department of the State Administration - UPF of the Russian Federation of the urban district of Bor, Nizhny Novgorod region

Order of the Government of the Russian Federation No. 781 (ed.

FOR EARLY ASSIGNMENT OF OLD-AGE LABOR PENSION

C) persons who carried out creative activities on stage in theaters or theatrical and entertainment organizations (depending on the nature of such activities) - a list of positions and professions of workers in theaters and other theater groups and entertainment enterprises, approved by the Order of the Council of Ministers of the RSFSR of August 28, 1991 No. 447 (Collection of acts of the Government and President of the Russian Federation, 1993, No. 39, Art. 3625).

3.

Important

List 2 The second list of preferential professions includes:

- healthcare workers;

- professions related to metal and coal processing;

- food industry workers;

- railway employees.

List 2 also includes social security specialists and some other professions.

What specific hours are included in the list of preferential professions for preschool teaching staff?

- Statement;

- Identity document (passport);

- SNILS;

- Certificate of average income;

- Clarifying information;

- Army ID (for men);

- Marriage certificate (for ladies who have changed their maiden name indicated in the documents);

- Documents that indicate the presence of special experience (work book, certificates from work, etc.).

- 07/23/1998 – 08/12/2011 – teacher of Russian at the MBOU Gorskaya Secondary School;

- 01.08.2011 – 01.09.2013 – teacher of Russian at Municipal Educational Institution Secondary School No. 57 in Moscow.

The payment amount will be determined by various factors. In any case, this amount must be no less than the minimum subsistence level, which applies in the region where the pensioner lives.

Clause 20 of Part 1 of Article 30 of the Law of December 28, 2013 N 400-FZ “On Insurance Pensions”.

Work as part of an aircraft flight crew in emergency rescue (search and rescue) units

Work as a test pilot, test parachutist and test navigator, for whom 2/3 of the required length of service is spent testing skilled aircraft or parachute equipment

Preferential length of service (27PD)

Teacher-defectologist; head of physical education;

Teacher-organizer of life safety bases (pre-conscription training);

LIST OF INSTITUTIONS AND POSITIONS IN WHICH WORK IS COUNTED INTO THE WORK EXPERIENCE GIVING THE RIGHT TO EARLY ASSIGNMENT OF AN OLD-AGE LABOR PENSION FOR PERSONS WHO PERFORMED TEACHING ACTIVITIES IN INSTITUTIONS FOR CHILDREN, ACCORDINGLY II WITH SUBPARAGRAPH 19 OF POINT 1 OF ARTICLE 27 OF THE LAW “ON LABOR PENSIONS IN THE RF”

FREE CONSULTATIONS ARE AVAILABLE TO ALL CITIZENS AT THE SPECIFIED PHONE NUMBERS OR VIA CHAT MODE

Codes indicating special working conditions for an employee are noted in column 5 of subsection 6.8 “Special working conditions (code)”. What if there are no special conditions, then the count is deserted. Thus, column 5 must be filled out only if contributions at additional tariffs were calculated from the employee’s payments (clause 37.6 of the Procedure for filling out the RSV-1).

Certain categories of workers who work in hard and hazardous work have the right to receive an early retirement pension. From their payments, contributions are calculated at additional tariffs (Part 1-2.1, Article 58.3 of the Law of July 24, 2009 N 212-FZ). The employer is obliged to transfer data on the types of work and these contributions in which employees are employed to the Pension Fund of the Russian Federation as part of the personalized information for each employee shown in section 6 of the RSV-1 calculation (Appendix No. 1 to Order of the Board of the Pension Fund of the Russian Federation dated January 16, 2014 No. 2p) .

For RSV-1, there are many working conditions codes and they are all listed in Appendix No. 2 to the Procedure for filling out RSV-1 (table “Special working conditions”). An excerpt from the code table is given below.

Order of the Government of the Russian Federation of October 29, 2002

By order of the Government of the Russian Federation of May 26, 2009 N 449, transformations were introduced into this order

C) persons who carried out creative activities on the stage of theaters or theatrical and entertainment organizations (depending on the nature of such activities) - a list of positions and professions of workers in theaters and other theater groups and entertainment enterprises, approved by decree of the Council of Ministers of the RSFSR dated August 28, 1991 No. 447 (Collection of acts of the Government and President of the Russian Federation, 1993, No. 39, Art. 3625).

3.

Recognize the response of the Government of the Russian Federation as invalid in accordance with the attached list.