Any transactions with funds at the cash desk of an enterprise are accompanied by relevant documents: cash receipt and debit order, payroll, invoice, etc. Moreover, both when receiving and issuing money.

The issuance of money from the company's cash desk is regulated by special instructions.

According to the procedure, you can arrange the withdrawal of money from the cash register in several ways, each of which has its own document.

It could be:

- payroll,

- payment statement

- expense cash order (RKO).

Where and how to use an expense cash order, filling rules

So, when issuing money from the cash register, you should fill out an expense cash order, which is represented by form No. KO-2 and approved by the Ministry of Statistics.

An expense cash order is issued only in cases where cash is issued to a person who is or is not an employee of the enterprise.

Also, an expense cash order is issued for the cashier, who takes money from the cash register for the purpose of further transfer to a bank employee for depositing it into the company’s account.

Calculation of solvency and liquidity ratios. What characterizes the analysis of the financial independence of an enterprise?

Another case when registration of cash settlement is required is the issuance of the total amount of funds to employees or managers, according to the payroll or payroll.

As with any bank or cash document, strict requirements are imposed on cash registers.

There should be no corrections, blots, or ink stains on the cash receipt.

It is allowed to fill out the order with a pen with dark ink, using a typewriter, printer and other mechanical devices.

In this case, records made on these devices should be stored for as long as these documents will be stored.

How to fill out an advertisement for a cash contribution?

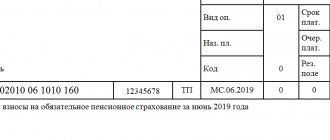

To draw up an announcement for a cash contribution, use the form according to OKUD 0402001. The following information is entered into the form:

- Number and date of the announcement.

- Payer's name.

- Name, current account number, INN, KPP, OKATO code of the recipient of the funds.

- Names and BIC of the depositing bank and receiving bank.

- Amount in numbers and words.

- Source of income (receipt of revenue, receipt of utility bills, etc.).

In addition to the announcement itself, a receipt and an order with similar information are also drawn up. The documents are certified by the signature and seal of the client, the signature of the accountant and the bank's cashier.

Stop wasting time filling out templates and forms

The KUB service helps you issue invoices in 20 seconds and prepare other documents without a single error, due to the complete automation of filling out templates.

KUB is a new standard for issuing and sending invoices to customers.

Start using the CUBE right now 14 days FREE ACCESS

Sample of filling out an announcement form for a cash contribution

Images of completed forms, which are available for free download in different formats, will help you correctly fill out an announcement for a cash contribution in 2020.

Fill out announcement forms for cash contributions and other primary documents automatically - register in the KUB service.

Stop wasting time filling out templates and forms

The KUB service helps you issue invoices in 20 seconds and prepare other documents without a single error, due to the complete automation of filling out templates.

KUB is a new standard for issuing and sending invoices to customers.

Start using CUBE right now

14 days

FREE ACCESS

Details of the cash order form

You can download a free sample form for a cash receipt and debit order on the Internet.

The cash receipt order form, being a banking document, has details that must be filled out without fail.

- details – name of the enterprise. This RKO line requires entering the full or abbreviated name of the enterprise or organization from whose cash desk cash is issued. This information can be found in the company's charter or any other document.

- requisite - identification code. When opening, the enterprise is entered into the Unified State Register, receiving its own identification code. Those companies and organizations that have their own stamp, with the name and enterprise code indicated on it, can put an imprint on this line.

- details – document number. Here the accountant must indicate the serial number under which cash settlements are registered in the journal for recording incoming and outgoing cash documents. This cash journal of form No. KO-3 shows the movement of cash in the cash register for one purpose or another.

- details – date of document preparation. This prop is one of the main ones. It is worth noting that the date of compilation of the RKO must coincide with the date that appears in the registration journal.

- details – corresponding account. Corresponding accounts may be different depending on the purpose for which money is issued from the cash register. This line in RKO shows information about correspondence, which allows you to keep accounting records in general registers.

- details – codes for intended purpose and analytical accounting. In some cases, when an enterprise has introduced special codes for any business transactions, registration of cash and register management requires filling out these details. In other cases, when the company does not provide coding, you need to put a dash.

- details - amount. The amount of cash that is issued to the recipient from the company's cash desk must be deposited in the cash register. This must be done twice: first in numbers, then in words, in the appropriate columns.

- details – recipient of funds. This line indicates the name of the person receiving money from the cash register. In some cases, when money is transferred through an intermediary, the name of the trustee, that is, the actual recipient, is indicated after the name of the person to whom the money is addressed.

- details – the basis for issuing money. This column indicates the reason why you need to issue funds from the company's cash desk. The basis can be either an oral or written order from the manager, or other reasons.

Entries for accounts receivable on the balance sheet. Is there a difference between a certificate of services rendered and a certificate of work performed? Filling out the lines of assets and liabilities in the balance sheet:

10. details – the amount of funds issued by cash settlement. This line shows how much cash was issued according to the issued cash order. This information is entered into the document exclusively in words, with a capital letter.

BITEYKIN AND PARTNERS

The form of the Order for the transfer of valuables (form code according to OKUD 0402102) and the procedure for filling it out are established by the Central Bank of the Russian Federation in the instruction dated July 30, 2014 No. 3352-u “On the forms of documents used by credit institutions on the territory of the Russian Federation when carrying out cash transactions with banknotes and coins of the Bank of Russia, banknotes and coins of foreign states (groups of foreign states), transactions with bullion of precious metals, and the procedure for filling out and registering them.”

Order for the transfer of valuables 0402102 is drawn up in the form of Appendix 19 to this Directive; the fields reserved for entering each of the details in the order for the transfer of valuables 0402102 are indicated by numbers in Appendix 20 to this Directive; a description of the details (fields) of the order for the transfer of valuables 0402102 and the procedure for filling it out and registering are specified in Appendix 21 to this Directive.

The instruction comes into force on November 1, 2014 [1]. The full text of the instructions (without attachments) is on this page.

new form of Order for the transfer of valuables OKUD 0402102, the instructions of the Central Bank of Russia and the procedure for filling out the form: presented in the publication “Bulletin of the Bank of Russia” No. 91-92 dated October 7, 2014 (PDF) [Source 1]

Description of the details (fields) of the Order for the transfer of valuables 0402102 and the procedure for filling it out and registering it

(Appendix No. 21 to the instruction. Source 1). Page last updated: December 2014.

| Attribute number (field) | Name of the attribute (field) | Contents of the attribute (field) |

| 1 | 2 | 3 |

| 1 | Order for transfer of valuables | Title of the document. |

| 2 | N | The order number for the transfer of valuables 0402102 is indicated in numbers in accordance with the document numbering order established by the credit institution. |

| 3 | _____________________ Date | The date of receipt (issue) by the cashier of valuables from the depositor (recipient) is indicated. |

| 4 | Name of the bank | The full corporate (abbreviated corporate) name of the credit institution, the full (abbreviated) name of the branch, the name and (or) number of the internal structural unit (if any) or other identifying features of the internal structural unit (if there is no name and number) with an indication of its belonging to a credit institution (branch) where valuables are accepted (issued). |

| 5 | Who owns the values? | The full (abbreviated) name of the legal entity, the last name, first name and patronymic (if any) of an individual entrepreneur, an individual engaged in private practice in accordance with the legislation of the Russian Federation, the last name, first name and patronymic (if any) of an individual handing over and receiving valuables are indicated. in a credit institution, the full corporate (abbreviated corporate) name of the credit institution, the full (abbreviated) name of the branch, the name and (or) number of the internal structural unit (if any) or other identifying features of the internal structural unit (if there is no name and number) with an indication that it belongs to a credit institution (branch) (in case of transfer of valuables between employees of a credit institution). |

| 6 | Contents of operation | The type of valuables that are accepted (issued), the persons participating in the operation (employees of the credit organization, employee of the credit organization and the depositor (recipient)) are indicated. |

| 7 | DEBIT account N | The off-balance sheet account number generated in accordance with Bank of Russia Regulation N 385-P is indicated, the debit of which reflects the operation. In cases where several accounts are debited, their numbers are entered on separate lines. In this case, in the detail (field) “CREDIT account N” (8) of the order for the transfer of valuables 0402102, only one account must be indicated. |

| 8 | CREDIT account N | The number of the off-balance sheet account, generated in accordance with Bank of Russia Regulation N 385-P, on the credit of which the transaction is reflected, is indicated. In cases where several accounts are credited, their numbers are entered on separate lines. In this case, in the detail (field) “DEBIT account N” (7) of the order for the transfer of valuables 0402102, only one account must be indicated. |

| 9 | Amount in numbers | The amount of value, including dubious banknotes of the Bank of Russia, insolvent banknotes of the Bank of Russia, banknotes of the Bank of Russia having signs of counterfeit, dubious banknotes, dubious coins of foreign states (groups of foreign states), having signs of counterfeiting banknotes of foreign states is indicated in numbers. (groups of foreign countries), damaged banknotes, damaged coins of foreign countries (groups of foreign countries), precious metal are taken into account in accounting. If there are several debit (credit) accounts, the corresponding amounts in numbers are indicated on separate lines for each account. |

| 9.1 | Free field | If necessary, indicate the amount of precious metal in accounting units of pure or alloyed mass of precious metal. Filled out based on the applicable procedure for maintaining analytical accounting of transactions with precious metals, approved by the accounting policy of the credit institution in accordance with clause 1.18 of Part I of the Appendix to Bank of Russia Regulation No. 385-P. |

| 10 | Document code | A conventional digital designation of the document is affixed in accordance with the list of symbols (ciphers) of documents posted on accounts in credit institutions given in Appendix 1 to the appendix to Bank of Russia Regulation N 385-P. |

| 11 | Name of values | The names of accepted and issued values are indicated. |

| 12 | Quantity | The quantity of each item of value in pieces is indicated in numbers. |

| 13 | Amount (in numbers) | The amounts at which values are accounted for in accounting are indicated in numbers, broken down by the names of the values. |

| 14 | Suma in cuirsive | The total amount at which values are accounted for in accounting, and the name of the currency in which the amount is expressed, is indicated in words. |

| 15 | _______________________ (job title) _______________________ (personal signature) _______________________ (last name, initials) | The title of the position, signature, surname, and initials of the accounting employee of the credit institution who drew up and checked the order for the transfer of valuables 0402102 are affixed. |

| 16 | _______________________ (job title) _______________________ (personal signature) _______________________ (last name, initials) | The title of the position, signature, surname, and initials of the employee of the credit institution who accepted and issued valuables are affixed. |

| 17 | ________________________ (job title) ________________________ (personal signature) ________________________ (last name, initials) | The signature, surname, and initials of the depositor (recipient) who carried out the delivery and receipt of the valuables are affixed. When handing over or receiving valuables, an employee of a credit institution also indicates the name of his position. When the client delivers or receives valuables, the job title is not filled in. |

| 18 | An identification document has been presented, ______________ (name ________________________ document, series, number, ________________________ by whom and when issued) | When the client receives valuables from a credit institution, the name, series and number of the document identifying the individual (recipient of the organization), the name of the authority that issued the document, and the date of issue of the document are indicated. |

| 19 | Free field | Filled out if it is necessary for the credit institution to provide the details determined by the accounting policy of the credit institution. |

Note.

(Source 1) When issuing an order for the transfer of valuables 0402102 at a credit institution on the basis of the act of opening the bag and recalculating the invested cash, provided for in the statement for the bag 0402300 and the invoice for the bag 0402300, act 0402145 and the recalculation act, the details of the dubious banknote of the Bank of Russia, the insolvent A banknote of the Bank of Russia that has signs of counterfeiting a banknote of the Bank of Russia may be indicated in the requisite (field) “Name of valuables” (11) or in the free field (19) of the order for the transfer of valuables 0402102.

How to place an order?

To receive the items selected from the catalogue, order the Book of Accounting of Accepted and Issued Valuables form 0402124 or other goods, just use one of the application options. You can choose the most convenient way:

- add a product to your cart and place an online order directly on this page;

- contact our operator by phone +7 (812) 987-78-57 and dictate all the necessary information;

- send a request to our e-mail box indicating the required product names and all your wishes regarding the fulfillment of the order;

- You can personally contact our office in St. Petersburg.

| Submit your application | Our services | Connect with us |

In any case, the application will be promptly processed in order to prepare the order as quickly as possible. Favorable prices, constant updating of the product catalog, discounts and special offers - this is what we can offer our clients. The company also provides detailed expert advice on all issues of fire safety of objects of any scale and purpose: private houses, apartments, industrial and industrial buildings, office and retail premises, and so on.

Our specialists provide comprehensive solutions to issues related to fire safety. In addition to supplying high-quality equipment, we offer auxiliary equipment, fire extinguishing equipment, and testing services.

We help you quickly bring a new building into compliance with fire codes and requirements, update the corresponding components in existing buildings, prepare for inspections, and ensure maximum protection of life and health of people, as well as property.

Certified materials, modern proven technologies - all this allows you to prevent fires, avoid damage to valuable property and your own health.

Why is it necessary?

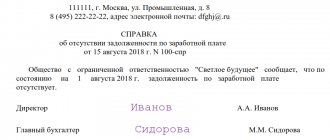

To obtain a certificate about the absence of debts on the current account, a letter is issued - a request for the absence of a card index.

A bank card file is unexecuted payment documents that are under the control of the bank where the payer’s current account is opened. The list of accounts is created only for legal entities and individual entrepreneurs; this information is not provided for individuals.

There are two types of lists:

- card file No. 1 (or queue No. 1) is information about the credit institution’s off-balance sheet account No. 90901, which reflects payment documents awaiting acceptance for payment;

- card file No. 2 (or queue No. 2) - off-balance sheet account of a credit organization No. 90902, which shows payment documents that were not paid on time. Intended for requests whose execution is not possible due to the organization’s lack of finances.

The presence of file cabinet 2 is one of the factors showing that the financial position of the company is unstable, since it does not fulfill its obligations on time. To confirm a stable financial condition, if the company wants to receive additional financing or take out a loan, a certificate confirming the absence of a card file on the current account will be required.

Information about the absence of debts must also be presented to the Social Insurance Fund in order to transfer the amount of compensation to a legal entity in the event that the benefits that are due to the organization’s employees have not yet been transferred to them. The document serves as proof that the funds transferred to the Social Insurance Fund will not be written off to pay off other debts, but will be sent specifically for the necessary payments.

A certificate from the bank about the absence of a file cabinet 2 is also needed in other cases: when participating in tenders or government procurement, to inform investors, during a merger of companies, when requested from inspection authorities, for example the prosecutor's office, that is, where confirmation of the stability of the financial position of the organization is necessary.