Home / Collections

Back

Published: 02/28/2020

Reading time: 11 min

0

8

- 1 How to get back wages in case of bankruptcy of an enterprise? 1.1 Deadline

- 1.2 Certificate requirements

Certificates of arrears of wages and absence of arrears of wages

The purpose of the certificate of arrears of wages is to certify on the part of the employing organization the fact of the existence of arrears to the employee, as well as to confirm the specific amount of such arrears.

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

This certificate may be required:

- An employee of a bankrupt company. In this case, the certificate is submitted to the arbitration manager to include the employee in the register of creditors.

- An employee of a company that is delaying or not paying wages - to present it to the court, and then to the bailiffs in order to collect the accumulated debt. On this topic, our articles on the links Peculiarities of consideration of labor disputes regarding wages and What is the statute of limitations for wages?

- The organization itself filing for bankruptcy. In this case, the certificate serves to take into account the total debt of the organization to creditors and is taken into account when assessing the volume of property intended to satisfy the claims of creditors of such an organization (for example, the decision of the Vologda Region AS dated June 14, 2017 in case No. A13-4034/2017).

Thus, the mentioned certificates, properly executed, play in court the role of one of the proofs of the fact of debt, along with, for example, protocols, inspection reports, certificates of the labor dispute commission (for more details about this document and the procedure for issuing it, read our article at the link Certificate of the labor dispute commission - sample), balance sheets, etc.

When can you sue?

If the above measures do not work, you should take legal action. Before filing a claim, it is worth addressing the employer with a demand to pay the debt and compensation. In accordance with Article 236 of the Labor Code of the Russian Federation, it is 1/150 of the current key rate.

The statute of limitations for wage arrears is one year (see Article 392 of the Labor Code of the Russian Federation). It is counted from the day following the last possible payday. In the example above, this is October 15th. Therefore, from October 16 of the current year until October 16 of the next year, you can go to court.

In accordance with Article 11 of Federal Law No. 229-FZ of October 2, 2007, demands for the collection of wages are executed by bailiffs in the second place.

We invite you to familiarize yourself with How an advance is paid - new rules and payment procedures

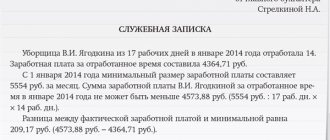

Certificate of arrears of wages: sample

A unified/standard form of such a certificate has not been developed, therefore it is compiled in free form, provided that all necessary attributes are included in its structure. For example, the structure of a certificate of arrears of wages may be as follows:

- Registration details of the document (date of issue and registration number according to the internal nomenclature of the organization).

- Information about the debtor, i.e. the employer. If the text of the certificate is placed on the organization’s letterhead, then it is quite enough to provide its name. Otherwise, in addition to the name, you must indicate the registration details and the address of the company, which would allow it to be uniquely identified.

- Information about the creditor, i.e. the employee to whom there is a wage arrears. In addition to the employee’s last name, first name and patronymic, it is recommended to indicate his passport details.

- The amount of debt, including a breakdown by type of payment (for example, salary, bonus, severance pay, compensation for unused vacation, etc.) and indicating the period for which such debt arose. If there are no debts, the employer may indicate in the certificate that it has no debt to the employee.

- Signature of the head of the organization and the chief accountant, seal of the organization (if available).

We recommend using the template we have developed for issuing a certificate of debt / absence of wage arrears, which can be downloaded from the link: Certificate of arrears of wages - sample.

Basic information

The Labor Code regulates the relationship between employees and employer. It states here that the company undertakes to transfer payment to staff for work performed at least twice a month.

However, due to the instability of the country's economy or internal reasons, the organization reduces costs through such payments. In this situation, employees have the right to defend their own rights in court by filing a statement of claim.

Let us note that the opposite situations, when the employer transfers the required funds to the staff on time and in the amount established by the contract, do not exclude inspections of the enterprise by regulatory organizations.

Accordingly, in these circumstances, documents are required confirming the legality of the actions of the company manager. Moreover, one of the required documents is a certificate of absence of wage arrears to employees.

Note! Legal regulations do not establish a single unified form for the cases under consideration. For this reason, the form is compiled in free form.

True, here it is advisable to take into account the norms of business correspondence, which establish the basic requirements for such documentation.

Thus, a certificate of absence of salary arrears becomes evidence of the good faith and timely fulfillment of the employer’s obligations to employees.

Please note that this paper is issued exclusively at the request of an employee or official.

Read also: Payments for children due to coronavirus: list of all child benefits due to coronavirus

In addition, current legislation requires compliance with established rules when preparing and issuing such documentation.

To understand these aspects in more detail, let’s consider the most important nuances that should be taken into account when writing such forms. Such knowledge will be useful to both employers and employees.

Sample certificate of salary payment deadlines

A certificate of this type may be required, for example, by an employer to submit to the labor inspectorate in case of disputes with an employee regarding delayed wages or to draw up an agreement with a bank on making payments to employees’ card accounts, etc. Such a certificate can be issued by the employer and employee at the latter's request.

The content of the certificate must indicate:

- timing of receipt of funds for wages, broken down for the first (advance) and second half of the month;

- a link to regulations (for example, the Labor Code of the Russian Federation) and local documentation (for example, regulations on remuneration of an organization, a collective agreement, an employment contract, etc.).

It is also recommended to indicate the fact that the employer is the payer of insurance contributions to extra-budgetary funds.

There is no standard/unified form developed, so the employer can draw it up in any form. The text of the document is placed either on the employer’s letterhead or includes the registration details of the organization, allowing it to be clearly identified.

For example, you can issue such a certificate in accordance with our template, which can be downloaded from the link: Certificate on the timing of payment of wages - sample.

Sample certificate of lack of wages

Such a document confirming the fact of lack of income in the presence of official employment may be required, for example, by a citizen applying for a subsidy, or for submission to the court to calculate the amount of alimony or deferment of debt payment, deferment or installment plan for payment of state duty and other purposes.

The form of such a certificate is not regulated at the legislative level, so it can be drawn up in free form indicating the required attributes. In this case, it can either simply indicate the period during which the employee does not have a salary (for example, due to being on leave without pay), or a monthly breakdown can be provided. Including such information can be presented in form 2-NDFL (see order of the Federal Tax Service of Russia dated October 30, 2015 No. ММВ-7-11 / [email protected] ) with zeros entered in the columns for the corresponding months.

A sample certificate in free form can be downloaded from the link: Certificate of lack of wages - sample.

Certificate of timely payment of wages

This certificate can be compiled using any of the certificate templates proposed above, including by combining them, depending on the purpose of its execution. The simplest option is to indicate the deadlines established by the organization for the payment of remuneration to employees and at the same time payments and deductions for the period of interest in relation to a specific employee.

An alternative to such a certificate in certain circumstances may be, for example, a certificate of no arrears in payment of wages.

Thus, a certificate of arrears of wages, the absence of such, the timing of payment of wages and the timeliness of its payment are drawn up in free form. It is recommended to place the text of each of these documents on the employer’s letterhead - one way or another, the employer’s details must be clearly defined. The certificate is signed by the head of the organization and, if available, the organization's seal is affixed.

Additional documents that may be requested from the employer

- indicate the generalized amount of debt to the employee as of a certain date;

- provide a calculation of wage arrears with a monthly breakdown of debt by type of income.

One or another version of a salary arrears certificate is selected depending on where and why it is required.

A 2-NDFL certificate with zeros entered in the appropriate lines may be suitable as confirmation of the lack of income. This material tells you how to design it.

A certificate of arrears of wages (or, conversely, of the absence of debt) is a document that can substantiate your claims or confirm insolvency. The legislation does not impose any specific requirements for this document. However, such a certificate must be drawn up taking into account the circumstances in connection with which it was needed, and include information that will help solve the problems of its bearer.

- on the timing of payment of wages;

- timely accrual and payment for a certain period;

- the presence or absence of a salary in relation to a specific person.

These documents can be prepared in exactly the same way as those given above. The only difference is that instead of information about the presence or absence of debt, the requested information is indicated, for example, about the timing of salary payments.

Thus, regulatory authorities may be required to provide a certificate of absence of wage arrears to employees when conducting an inspection. Such a document confirms that the employer properly fulfills its obligations to employees. If there is a debt, a certificate of debt obligations can be prepared. It can be used in court as evidence in a case of collecting arrears of wages and in other cases.

We invite you to read Dismissal of a temporary employee due to the main one returning from maternity leave

This form can become a necessary document for an employee to present to the bank for a loan, for personal reconciliation of accrued and paid amounts, or upon dismissal.

In this case, the certificate is issued upon prior request within 3 working days from the date of submission of the application in writing.

An application for a certificate may be drawn up in any form.

A document confirming the absence of salary debt is filled out by an accounting employee.