A non-cash transfer involves several ways of making transfers - remotely or during a personal visit to the bank. The most common of them is the execution of a standard payment form indicating the purpose of the payment. Despite the relevance of the method, many entrepreneurs have a misunderstanding regarding how field 110 is filled in in the payment order from 2020. After all, changes regarding the specifics of providing information that came into force in 2020 did not add clarity to this issue.

Explanation in field 110

For the beneficiary's bank, column code 110 will indicate the purpose and type of payment. It is used to decipher banking transactions for non-cash transfers of mandatory insurance and tax contributions to the budget. Subject to the new rules, each individual entrepreneur, legal entity or individual entrepreneur must leave field cell 110 in the payment form empty. Based on the regulations of the Central Bank of the Russian Federation - enter “0”. The double explanation does not add to the understanding of how to proceed when paying taxes and filling out a financial order. Read on to find out where to find the required line and how to fill it out.

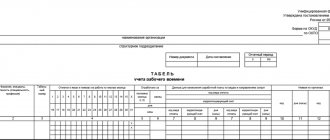

Codes by type of remuneration in the working time sheet

The list of wage codes that should be used in timesheets at the legislative level has not been approved, and in the Resolution of the State Statistics Committee “On approval of unified forms of primary accounting documentation for the accounting of labor and its payment” dated January 5, 2004 No. 1, such details as payment code, only mentioned and only in relation to the T-13 form. Nevertheless, columns for entering this designation are provided in both forms of timesheets.

This is important to know: Piece-bonus wages: calculation example

A time sheet is a supporting document on the basis of which employees’ salaries are calculated. A Russian organization has the right to independently develop a form for recording the working hours of its personnel or use forms approved by the State Statistics Committee in the form T-12 or T-13.

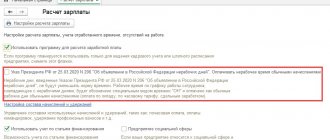

Where to find field 110 on the sample form

Payment of taxes and insurance contributions to the budget system of the Russian Federation through a non-cash transaction obliges tax agents to fill out payment orders. They indicate the required details - type and type of payment. By order of the Bank of Russia, in accordance with the order of the Ministry of Finance of Russia, a separate column is allocated for these purposes.

Attention! Cell 110 is located in field 110 at the bottom of the payment document, where information about the recipient is reflected.

In the example below you can see that field 110 in the payment slip is in the lower right corner.

How to fill out payment slips when paying taxes for third parties

Tax officials provide the following explanations for filling out payment slips when paying taxes for third parties:

- “TIN” of the payer is the value of the TIN of the payer, whose obligation to pay tax payments, insurance premiums and other payments to the budget system of the Russian Federation is fulfilled.

If the payer, an individual, does not have a tax identification number (TIN), zero (“0”) is indicated in the payer’s “TIN” details. In this case, it is necessary to indicate the Unique accrual identifier (document index) in the “Code” field;

- “KPP” of the payer - the value of the KPP of the payer, whose obligation to pay tax payments, insurance premiums and other payments to the budget system of the Russian Federation is fulfilled. When fulfilling the obligation to pay payments for individuals, the payer’s “KPP” details indicate zero (“0”);

- “Payer” - information about the payer making the payment:

- for legal entities - the name of the legal entity fulfilling the payer’s obligation to make payments to the budget system of the Russian Federation;

- for individual entrepreneurs - last name, first name, patronymic (if any) and in brackets - “IP”; for notaries engaged in private practice - last name, first name, patronymic (if any) and in brackets - “notary”; for lawyers who have established law offices - last name, first name, patronymic (if any) and in brackets - “lawyer”; for heads of peasant (farm) households - last name, first name, patronymic (if any) and in brackets - “peasant farm”;

- for individuals - last name, first name, patronymic (if any) of the individual fulfilling the payer’s obligation to make payments to the budget system of the Russian Federation.

- "Purpose of payment":

This is interesting: How to find the opening balance

— TIN and KPP of the person (for individual entrepreneurs, notaries engaged in private practice, lawyers who have established law offices, heads of peasant (farm) households, individuals only TIN) making the payment. This information is indicated first in the “Purpose of payment” details. To separate information about TIN and checkpoint, the sign “//” is used; To separate information about the payer from other information indicated in the “Purpose of payment” detail, the “//” sign is used;

- the name of the taxpayer, payer of fees, insurance premiums and other payments, whose duty is fulfilled (for an individual entrepreneur - last name, first name, patronymic (if any) and in brackets - “IP”; for notaries engaged in private practice - last name, first name , patronymic (if any) and in brackets - “notary”; for lawyers who have established law offices - last name, first name, patronymic (if available) and in brackets - “lawyer”; for heads of peasant (farm) farms - last name , first name, patronymic (if any) and in brackets - “peasant farm”), for individuals - last name, first name, patronymic (if available) and registration address at the place of residence or registration address at the place of stay (if there is no place of residence) .

- In field “101” - “Payer status”, write the status of the person whose obligation to pay tax payments, insurance premiums and other payments to the budget system of the Russian Federation is fulfilled.

When performing duties:

- legal entity - “01”;

- individual entrepreneur - “09”;

- notary engaged in private practice - “10”;

- lawyer who established a law office - “11”;

- head of a peasant (farm) enterprise - “12”;

- individual - “13”.

Filling out field 110 - legal explanation

The generally accepted type of payment order used when transferring tax payments was developed on the basis of the regulation of the Central Bank of the Russian Federation dated June 19, 2012 No. 383-P. The document described in detail the specifics of entering information into its columns, including line 110. The field was filled in only in case of transfer of funds to budgetary areas. The instructions for entering data in the “type of payment” column were as follows:

- “PE” - when transferring late payments and penalties for mandatory payments;

- “PC” - when transferring interest;

- “0” – tax payments coming from the Federal Tax Service.

The instructions for drawing up payment order columns change frequently. Therefore, you need to monitor the release of updated instructions. It often happens that legislation issued by different departments contradicts each other. By Order of the Ministry of Finance of October 30, 2014 No. 126n, the need to fill out line 110 of the payment order was abolished. Based on this document, it should remain empty. It was recommended to move information about the type of payment to field 109.

The response to this was the letter of the Central Bank of the Russian Federation dated December 30, 2014 No. 234-T, which explained that in column 110 the number “0” should be entered. A year later, on November 6, 2020, by decree No. 3844-U of the above-mentioned government agency, this decision was canceled. It feels like everything is back to normal. Disagreements regarding the formation of payment order lines have been eliminated.

Important! If filling out field 110 has become optional, this does not mean that entering information about the type of non-cash transfer has also been abolished.

In July 2020, a new resolution of the Central Bank of the Russian Federation No. 4449-U was issued, which makes adjustments to the previous provision on making non-cash transfers and the formation of orders. The changes took effect on August 8, 2020. They were justified by the restructuring of the general payment system of the Russian Federation and the country's transition to its own independent settlement system MIR.

Important! The innovations did not affect all payments, but only government payments in favor of individuals based on their account number.

Currently, the mandatory fields for filling out the payment order are cells 101 to 109, 110 is empty. State institutions receive information about the purpose of the payment on the basis of the KBK, for which line 104 is reserved. An erroneous code in this section of the payment will not allow the payment to be processed correctly. The funds may simply get stuck in the bank's system. The sample for filling out field 110 in a payment order will not be any different from 2020. The latest innovations regarding filling out line 110 are dated August 2020.

When is it necessary to fill out field 110

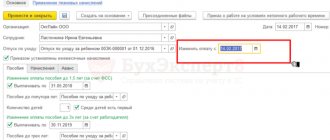

Filling out detail 110 in the payment order depends on the type of payments, the transfer of which is formalized by such a financial document. It is necessary to enter information in field 104 together with cell 110 of the payment order when:

- Wages and remuneration are paid to employees of enterprises owned by the state.

- Payments are being made to government employees.

- Beneficiaries receive pensions, benefits or compensation from the Pension Fund.

- Scholarships are provided to young promising specialists.

- Documents are being drawn up to pay the lifelong salaries of judges.

Important! When making such transfers, field 110 should be filled in, indicating the payment code - “1”.

For all other payments, including transfers of legal entities and individual entrepreneurs by bank transfer and payment of mandatory contributions to the budget, the method of entering information in column 110 does not change. The field must remain empty, without dashes or numbers.

Code “1” in field 110 when making non-cash transfers from budgetary structures means that money can only be credited to accounts to which a MIR debit card is attached. If the bank client does not have such a means of payment, his actions should be as follows:

- After the money arrives at the bank, it will be detained in the company’s accounts until the circumstances of the transfer are clarified.

- The next day, the recipient will be sent a notification with a requirement to visit a bank branch within 10 business days to receive the transfer amount in cash using their passport.

- If the client has another account through which it is possible to carry out monetary transactions using the MIR card, information on its details must be provided to the bank employee.

- After the ten-day period, if the recipient specified in the financial order has not visited the bank and provided new account information, the funds will be transferred back to the sender.

Important! The requirements for filling out payment slips in 2020 are relevant both for electronic document management and for the generation of financial orders on paper.

Accountant's Directory

At the same time, you need to understand that the employee must be aware of the decoding of the corresponding codes. After all, the Labor Code requires the employee to be notified specifically about the components of wages, i.e.

e. the type of income should be visible and understandable, not its code. At the moment, quite a lot of cases of violation of the labor code are being registered.

This is important to know: Pay discrimination

At the same time, almost all employees know that something irreparable is happening and the law is on their side. However, they do nothing. Info

What is a pay slip According to the official definition,

What payments do banks accept?

Not only are tax agents confused with the method of filling out field 110, but bank employees also do not have clear instructions on which payments to accept. Some employees make payments using documents with “0” in field 110. Others, citing the law, require that the field be left blank or have a space in it. But for some there is no difference.

Attention! Even if there is insufficient funds in the tax agent’s current account, the bank employee must accept the payment with zero or completely blank line 110, but it will be executed only after the account has been replenished with a sufficient amount.

In order for the execution of a financial order to be carried out in accordance with all the rules, and for the money to reach the recipient on time, you should adapt to the requirements for payment documents and field 110 established by the bank servicing the enterprise.