Regulatory regulations regarding timesheets

Federal Law dated December 6, 2011 N 402-FZ defines the requirements for maintaining primary documentation

Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 N 1 developed forms of primary documentation

Order of the Ministry of Finance of Russia dated March 30, 2015 N 52n determines the form of the report card for government organizations

Article 22.1. Federal Law of October 22, 2004 N 125-FZ determines the storage periods for documents on personnel

Order of the Ministry of Culture of Russia dated August 25, 2010 N 558 determines the storage period for archival documents of the organization

Basis for keeping timesheets

Today there are 22 unified report forms: T-12 and T-13. Also, the organization may not use these forms from 01/01/2013, but develop a convenient one for use depending on the specifics of the activity. But before using it, the enterprise must formalize its own forms with local documents: an order (instruction) and attach the developed form as an appendix.

Important! State and government institutions are required to use a unified report card form (Form according to OKUD 0504421). Commercial organizations have the right to develop and accept for use independently developed forms.

The employee appointed responsible for maintaining the timesheet records in this document attendances or absences from work, their reasons, overtime, etc. At the end of the month (15th - for advance payment), based on the time sheet, the accountant calculates wages and other payments.

https://youtu.be/Xec81EXlYKI

What is a time sheet?

The time sheet is a list of employees by name in a structural unit and reflects attendance for the reporting period .

The presence of the document in the company is mandatory. Maintenance is carried out in paper or electronic form. Doing this only in electronic format is prohibited.

There is no approved form of the form. The State Statistics Committee of the Russian Federation has developed two options for recommendations: T-12 and T-13. Each company reserves the right to choose the form:

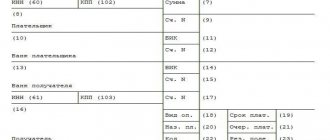

- T-12 is used if accounting is done manually. Filled out in one copy on two sheets of 2/3 A3 format. At the end of each month, after the manager’s signature, it is transferred to the accountant for calculating payments.

- To maintain timesheets in electronic form, form T-13 is used . Most timekeepers these days use this form.

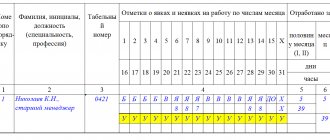

This is what the timesheet looks like (clickable):

When hired, each employee is assigned a personnel number, which is subsequently used in all documents regarding the calculation of remuneration. The numbers of new or dismissed employees should be added or deleted only on the basis of orders issued by the manager .

In this article you can read about what working hours are.

Information reflected in the report card

The report card is the primary document that is subject to the following general requirements for details:

| Props | The timesheet reflects |

| Name | time sheet |

| date | the date of the last day for payment or advance must be indicated |

| name of company | full or abbreviated |

| content of the fact of the organization's activities | marks of attendance and absence from work on specific dates of the month |

| fact measurement value indicating units of measurement | hours, days |

| names of positions (signing the timesheet) | person responsible for drawing up the time sheet, head of a structural unit, HR employee |

| signatures of persons, indicating last names and initials, to identify these persons | signed by the relevant person |

The timesheet records the hours worked for each employee directly:

- reporting period

- Full name, his position

- Personnel Number

- number of hours worked (not worked) for each calendar day

- total hours and days worked during the reporting period

- correspondent account for wages

- number and reasons for absenteeism

- number of weekends and holidays

How long should you keep a timesheet?

A time sheet is a mandatory form that must be kept at the enterprise and may be required by the following categories of persons:

- primarily to accountants for calculating wages, vacation pay and other benefits due to the employee;

- tax authorities have the right to check the availability and correctness of information; if documents are missing or filled out improperly, the company will have to pay fines;

- employees of the social insurance fund when checking the correct reflection of taxes when calculating wages;

- During the inspection, labor inspectors will ensure that the rights of all employees are respected.

The time sheet must be kept at the company for 1 year ; after this period, the documents are handed over to the archive, where they are subject to storage for a period of 5 years .

If work activity at a company is associated with dangerous or harmful conditions, then documents on hours worked are stored for 75 years. In certain cases, internal documents can be used to increase storage periods.

The importance of maintaining - the time sheet determines and days are worked by each employee of the enterprise This document is filled out in a single copy and signed by the head of the enterprise and the responsible person.

According to the law, if paperwork at an enterprise is impossible without the use of specific documents, then these documents must be stored in the archive for a certain time.

Retention periods vary depending on their need for inspections; clear retention periods are not specified in the law .

Under the previous legislation, the time sheet had to be kept for a year, but partly this remains the case, because the accountant needs this document during the reporting year to reconcile data and verify the correctness of the reflection of transactions.

The order of the Ministry of Culture states that the shelf life of the report card must be at least 5 years, and for harmful and dangerous industries - 75 years.

The manager, by order, appoints a person responsible for filling out the time sheet ; as a rule, he is an employee of the human resources department. But there may be several people responsible for performing this work if the enterprise is large and contains many divisions.

Shelf life of the report card

The accounting sheet, on the one hand, belongs to the group of labor organization documents as part of personnel documents. In general, all such documents should be kept:

- 75 years before January 1, 2003

- 50 years if issued after January 1, 2003

But these requirements do not directly apply to the report card and it must be stored (in accordance with the lists of archival documents) for 5 years.

Time sheets at enterprises where there are difficult, harmful and dangerous working conditions must be stored for 75 years.

Economic entities may, but are not obligated to, transfer documents for storage to state and municipal archives by concluding appropriate reimbursable agreements with them.

Expert of the Legal Consulting Service GARANT, professional accountant E. Lazukova

Which employee is appointed responsible?

A special employee must maintain documentation on the basis of which employees’ wages are calculated, as well as the number of days and hours worked by them.

The latter is appointed by the head of the organization.

The specialist is obliged to promptly transmit the necessary data to the accounting department, and also bear responsibility for the accuracy of the data present in the report card.

In most cases, the person responsible for filling out the document is an employee of the human resources department or an accountant himself who specializes in calculating workers' salaries.

In addition, a timekeeper - an employee whose activities are directly related to the preparation of this paper - can keep track of working hours.

The time sheet does not necessarily need to be maintained for the entire enterprise as a whole. In companies with a large number of employees, this is often simply not possible. In such cases, a separate time sheet is created for each structural unit, and, accordingly, a person responsible for its maintenance in a specific department is appointed.

In such a situation, after submitting the timesheet to the accounting department, all received documents are combined into one. It should be noted that this accounting document can also be issued for each specialist separately.

How to lead?

To maintain documentation for recording working hours, 2 unified forms were provided - T-12 and T-13. The employer has the right to use any of the above.

The differences between both forms are not significant. They consist only in the fact that one form is intended exclusively for entering data on the time worked by specialists, and in the other, in addition, you can enter data for calculating wages of workers.

Each of these forms has a title page. It should reflect the following information:

- full name of the employing organization;

- initials, position and personal signature of the chief executive of the company;

- forms – OKUD, OKPO;

- name of the documentation;

- date of initial registration;

- validity period (reporting month);

- a structural unit in which records of employees’ working time will be kept;

- symbols used in this table.

Next there should be a table. It contains information about workers. There should be a separate line for each of them. The following data is entered in the appropriate columns:

- serial number assigned to the worker;

- Full name of the specialist;

- employee personnel number;

- mark on attendance/absence (in accordance with the symbols);

- the total number of days/hours worked for half of the reporting period;

- the total number of days/hours worked for the full reporting period.

If the enterprise uses a time sheet form on the basis of which employees’ salaries are calculated, then columns with the following information are filled in:

- code corresponding to the type of income - salary or vacation pay;

- accounting (corresponding account) from which funds intended for payment of salaries, vacation pay, sick leave benefits, etc. will be written off;

- the total number of days/hours worked for each type of income.

If an employee was absent during the reporting month, a note is placed on the timesheet indicating the reason for his absence. In this case, it is also necessary to use symbols.

For example, the abbreviation “OT” means that the specialist is on vacation. “B” indicates the fact that he is on his day off.

At the end of the reporting period, the report card is signed by the responsible persons. Among these, it is necessary to note the head of the department, the personnel officer and the specialist who filled out the document.

How long is it stored - storage periods in the organization

The shelf life of the report card is influenced by certain factors. The key ones are the working conditions established in the company.

Under standard conditions, when the working conditions of employees are not associated with any hazardous factors, the time sheet is stored for 5 years.

If production conditions are characterized as severe, dangerous or harmful, the document is stored for 75 years.

These rules are established at the legislative level.

At any time, specialists from inspection bodies, if necessary, can contact the head of the institution with a request to provide a report card.

An employee of the organization can also apply for an extract from the timesheet.

Retention periods must be observed even in relation to the electronic version of the document.

After the time sheet is completely filled out and its validity period comes to an end, it is transferred to the accounting department.

Responsible employees calculate workers' salaries.

Subsequently, the document is placed in a special folder or transferred to the archive. The transfer procedure must be regulated by the company’s internal regulations.

Documentation that is stored for 75 years can be transferred for storage to specialized archival companies.

Procedure for storing time sheets

Creating conditions for the protection of documents is the responsibility of an economic entity in an organization . In the office work of any organization, a nomenclature of files of the appropriate form must be drawn up, drawn up in accordance with the specifics of the organization (structural divisions), the documentation used, where the storage periods are indicated for each document. The specification of the conditions and procedure for storing documents is established by the accounting policy of the organization (since the time sheet refers to primary documentation).

Documents of temporary storage (more than 10 years) are stored in the archive of the organization (creating an archive in the organization is not an obligation, documents can be stored in structural divisions), time sheets refer to documents of temporary storage (less than 10 years - 5 years), with the exception of time sheets at enterprises with harsh working conditions (permanently stored - 75 years).

Thus, the formation of a case based on timesheets that are constantly stored requires the following requirements:

- binder (binding)

- pagination

- certification sheet

- internal inventory of documents

- making clarifications on the cover (name of organization, index, dates, title).

Temporary storage cases (5-year storage records) may not be completed in full:

- documents are not organized

- do not number sheets

- do not write statements of assurance

In case of temporary (up to 10 years) storage at the end of the storage period, documents must be destroyed only after an annual examination of the values of the documents is mandatory (Order of the Ministry of Culture of the Russian Federation dated March 31, 2020 N 526).

How and where to organize storage space

Each enterprise must develop its own document flow schedule , which specifies how and where to store each document, indicating the number of copies and accountable persons.

But not only the storage period is important, but also the timing of submission to the accounting department ; there must be a clear framework for the possibility of entering information. As a rule, the accounting department calculates salaries for the previous period by the 10th day of the month, and by the 15th the accountant is obliged to pay all taxes.

If there is a delay in transmitting the time sheet to the accounting department, then there may be delays in paying taxes, which will immediately lead to the accrual of penalties.

After the reporting period, documents for the previous year can be gradually transferred to the archive . The law does not regulate the mandatory storage of time sheets in the archive; management has the right to independently decide where and how to store documents. But this does not mean that the forms can be disposed of; they must be kept safe and access to them must be organized in the event of an audit.

The accountant is responsible for storing the timesheets , since he is the final authority for receiving these documents. When submitting to the archive, an inventory must be drawn up so that when searching for documents it is possible to immediately find the necessary information. The archivist will now be responsible for safety and transportation. If the time sheet must be stored for 75 years, then after the expiration of the 5-year period, these documents can be transferred to archival warehouses, if an agreement has been concluded with them or such warehouses are owned by the enterprise.

https://youtu.be/wtlE2TIFp6c

Storage of documents in electronic document management

In the case of electronic document management in an organization, the conditions for storing electronic documents include:

- 2 copies – archived on different devices

- Availability of tools and software for reading and monitoring their status

- provision of storage

- Electronic documents are transferred to the archive – in PDF/A format.

- To ensure storage, it is necessary to rewrite documents onto new media and formats

- When storing such documents in the archive, control must be carried out once every 5 years

Question

New FSBU 25/2018 “Accounting for leases” is mandatory for reporting for 2022. When would you like to read a detailed commentary on it in our magazine?

And the accountant will organize storage. Usually they remain in the department, but if there is no space there, then after 3 years or less, these papers can be transferred to the company archive, if there is one. The timing and procedure for transferring time sheets and other primary documents to the archive are regulated by the company’s local act, so there are no uniform conditions here.

Even if labor inspectors consider this a violation, the fine is only 300–500 rubles (Article 13.20 of the Code of Administrative Offenses of the Russian Federation) and it is unlikely.

The system of additional pay and labor incentives, including the amount of increased pay for work at night, weekends and non-working holidays, overtime work, and other types of work, is established by the employer taking into account the opinion of the elected trade union body of the organization.

Answers to common questions

Question No. 1 : What document will confirm the fact that the time sheets were stored for 5 years?

Answer : The expert commission annually organizes an examination of the value of documents and draws up a standard act that reflects the affairs of the organization with an expired storage period as of January 1 of the year of the examination and the acts are approved by the director. Documents are sent for destruction using the delivery note.

Question No. 2 : Is there a need to follow the procedure for the current storage of documents that are still in the paperwork cycle?

Answer : Storage of documents in progress is carried out in cabinets or safes in the personnel department (at the discretion of management, they can be stored in the accounting department on the basis of local documents of the organization). These documents contain confidential employee data, so you need to ensure they are protected.